What is the Wind Energy Market Size?

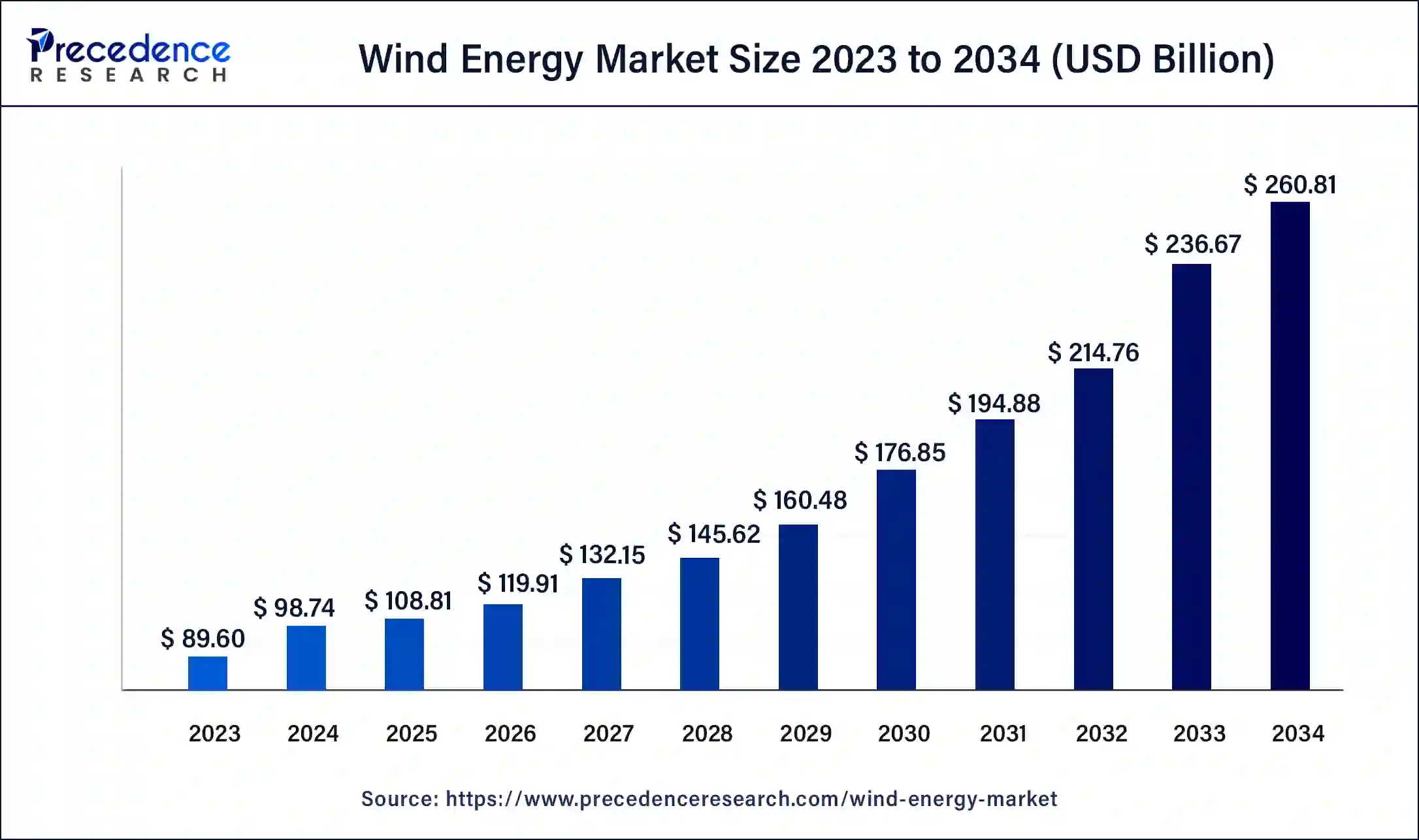

The global wind energy market size is calculated at USD 108.81 billion in 2025 and is predicted to increase from USD 119.91 billion in 2026 to approximately USD 283.46 billion by 2035, expanding at a CAGR of 10.05% from 2026 to 2035.

Wind Energy Market Key Takeaways

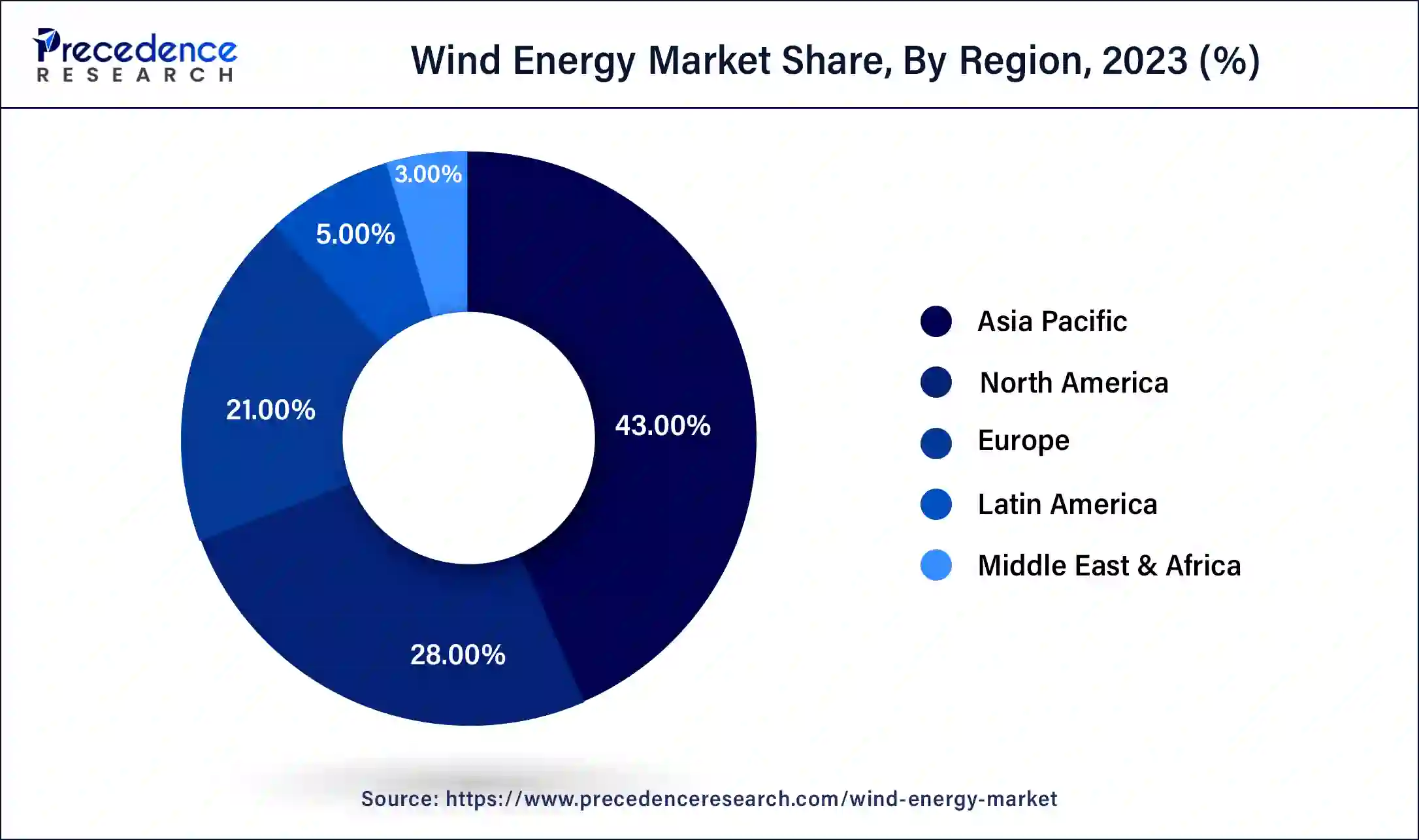

- Asia Pacific led the global market with the highest market share of 43% in 2025.

- By location, the offshore segment is estimated to capture the biggest revenue share in 2025.

- By application, the utility segment is predicted to register the maximum market share in 2025.

Wind Energy Market Growth Factors

Wind energy is a kind of renewable energy. The method of using wind to generate electricity is known as wind energy. Wind turbines are used to transform the wind's kinetic energy into mechanical energy. The mechanical power can also be used for specific purposes such as water pumping.

The offshore and onshore wind turbines can be used to generate electricity. Onshore wind energy is related with land-based turbines, whereas offshore wind energy is associated with turbines that are positioned in the sea or ocean. Offshore wind turbines, on the other hand, are more efficient and effective in producing electricity as compared to onshore wind turbines.

Due to the implementation of rigorous environmental rules, the market will continue to move away from traditional energy sources and towards renewable energy technology. The product penetration will be influenced by increasing offshore prospects along with the development of a strong industrial and commercial sector infrastructure.

The global wind energy market is predicted to rise due to a significant increase in demand for renewable energy sources. Governments all around the world are encouraging sustainable energy sources, which, unlike traditional power sources, may cut carbon emissions. In addition, offshore wind energy turbines eliminate the constraint of sea depth, making it easier to choose the ideal location for electricity generation.

Government regulatory authorities and agencies in developed and developing regions are concentrating on reducing reliance on traditional energy sources in order to reduce carbon emissions, which encourages the generation of electricity using renewable energy sources such as solar and wind. The increased need for energy in a variety of industries such as healthcare, food and beverage, and residential, has boosted the growth of the wind energy market during the forecast period.

Offshore wind farms are also becoming more popular as a source of energy among wind energy market players. Offshore wind power projects are expected to open up growth opportunities for deepwater projects, where the high speed produces a much more advantageous operating environment, driving the demand for offshore locations. Renewable energy sources have been widely supported by governments all around the globe.

Countries all over the world are concentrating their efforts on growing investment in offshore wind energy projects in order to collect energy from the environment's natural wind resources, ultimately boosting the growth of the global wind energy market. Offshore wind power installation is a difficult undertaking since it necessitates the transportation of large and heavy equipment to the project site, raising the overall cost of the wind energy projects. However, due to technological advancements for offshore installation of wind turbines, the overall cost has decreased, making offshore wind a viable renewable energy choice.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 108.81 Billion |

| Market Size in 2026 | USD 119.91 Billion |

| Market Size by 2035 | USD 283.46 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.05% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Location, Application, and Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wind Energy MarketSegment Insights

Location Insights

The offshore segment dominated the global wind energy market in 2025 due to the availability of modern technology and comprehensive solutions given by various service providers, the segment is expected to develop as demand for offshore wind installation rises.

The onshore segment is estimated to be the most opportunistic segment during the forecast period. Due to its lower cost than offshore wind power, onshore wind power has become one of the most popular renewable energy sources across the globe. Additional elements supporting category expansion are an easy installation method and a reduction in greenhouse gas emissions.

Application Insights

The utility segment dominated the global wind energy market in 2025, in terms of revenue. The utility-scale wind turbines are that are connected to the country's transmission infrastructure. Large-scale utility-scale wind generating projects necessitate a variety of building, land, and other permissions, as well as the careful management of relationships with many market players.

The non-utility segment is estimated to be the most opportunistic segment during the forecast period. Both commercial and residential wind energy projects are included in the non-utility sector. Due to the infeasibility of installing a wind turbine due to land constraints, non-utility applications had a smaller market share than utility applications.

Wind Energy Market Regional Insights

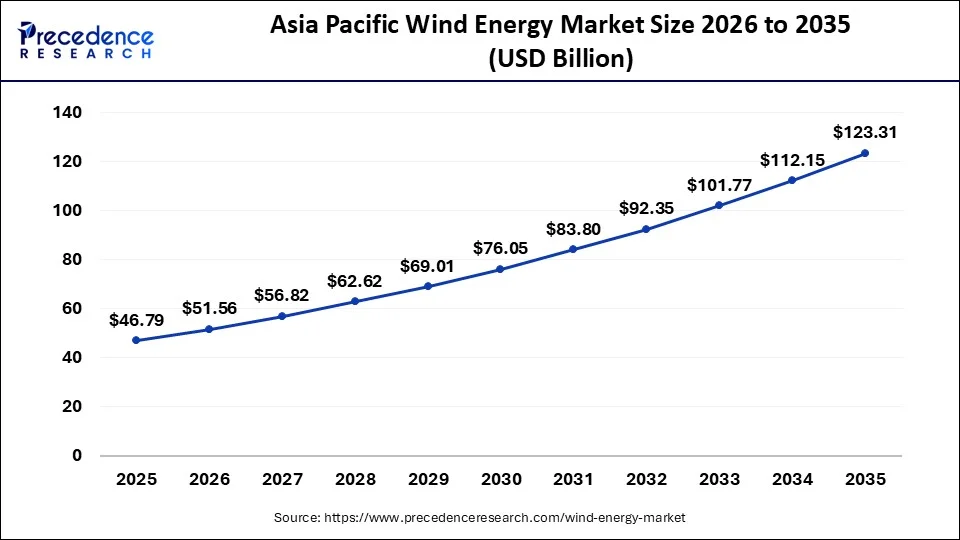

The Asia Pacific wind energy market size is estimated at USD 46.79 billion in 2025 and is predicted to be worth around USD 123.31 billion by 2035, at a CAGR of 10.18% from 2026 to 2035.

The Asia-Pacific region has accounted largest revenue share in 2025. Asia-Pacific's wind energy market is expected to grow gradually in the coming years, as governments are constantly taking action and initiatives to promote infrastructural development in the energy sector. This is likely to influence the advancement of wind energy projects in the country, which would drive the growth of the wind energy market in the Asia-Pacific region during the forecast period.

North America region is estimated to be the most opportunistic segment during the forecast period. The emerging markets in the U.S., provide a lucrative opportunity for the wind energy market, owing to increased demand for electricity. Furthermore, the immense wind power potential, along with a decrease in the cost of advanced technologies, is projected to present the industry with widespread commercial opportunities during the forecast period.

The Asia-Pacific region ranks first thanks to its excellent manufacturing base and government incentives, leading to the expansion of both onshore and offshore projects. The increasing number of installations will translate into large market growth backed by local turbine production and climate policy aimed at substantial renewable energy integration.

China is a major player in the world, helping to grow the wind power capacity and the offshore development through national planning. There are good chances of hitting the renewable targets and of expanding the turbine size and numbers. Meanwhile, the domestic ecosystem gets stronger as investments and the manufacturing technology leadership flow in.

Europe is still a mature market, but at the same time, it continues to be a source of growth; thus, it continues to be a focus for offshore power and turbine modernization processes. Existing wind farms and new installations still are an area of regulatory support, while large-scale wind farm innovations bring about modernization and signage of existing installations.

Germany outperforms other countries in the region with its strong presence in onshore wind projects, plus the offshore wind infrastructure that is being expanded. The potential market is mainly in the repowering of older wind farms, and increasing their efficiency via technology upgrades, which are all supported by the government frameworks directed at streamlining the processes of granting permits and promoting the use of environment-friendly wind turbines in the gradually developing green economy.

North America moves forward, along with the increasing electricity consumption and the acceptance of highly efficient wind turbines. Changing policies and supply bottlenecks are among the factors that affect the pace of wind power development, thus confirming the need for stable and supportive regulatory conditions as well as the upswing of innovation-based renewable energy deployment across both coastal and inland projects.

The U.S. is being viewed as a great market for offshore wind power development along the coast. There is a large area of expansion for the installation of wind farms that is always going to favor the developers who are able to cope with the changing regulatory landscape and are also able to participate effectively in the large-scale production of renewable energy through the use of incentives and the expansion of manufacturing

Wind Energy Market Value Chain Analysis

Acquisition of steel, copper, and rare earth materials for turbine parts.

Key players: BHP, Rio Tinto)

The mechanism of wind turbines transforming kinetic wind energy into electricity.

Key Players: Vestas, Siemens-Gamesa, General Electric Renewable Energy)

Controls the power flow through the substation and transmission infrastructure.

Key players: National Grid, NextEra Energy, local distribution utilities

Stores extra wind power to help balance supply and demand during windy periods.

Key players: Tesla, LG Energy Solution, CATL

Consistent inspection and performance monitoring for ensuring reliable operation.

Key Players: INOX Green, OEMs like Vestas offering O&M services

Wind Energy Market Companies

Global onshore and offshore projects are supported by the company's strong renewables solution capabilities through wind turbine design manufacture, installation, and service with an emphasis on sustainability.

Manufactures powerful wind turbines as part of the production of advanced power generation systems – the company is a strong presence in the renewable equipment manufacturing sector.

The firm concentrates on the development of revolutionary gearless wind turbine technology with the goal of energy efficiency, low maintenance, and long operation reliability in the installations.

- Goldwind

- Nordex SE

- Sinovel

- GE Renewable

- Suzlon Group

- Ming Yang Smart Energy Group Co.

- Siemens Gamesa Renewable Energy S.A.

Segments Covered in the Report

By Location

- Onshore

- Offshore

By Application

- Utility

- Non-utility

By Component

- Turbine

- Support Structure

- Electrical Infrastructure

- Others

By Rating

- ≤ 2 MW

- >2≤ 5 MW

- >5≤ 8 MW

- >8≤10 MW

- >10≤ 12 MW

- 12 MW

By Region

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

Asia-Pacific

- China

- India

- Japan

- South Korea

Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting