Onshore Wind Energy Market Size and Forecast 2025 to 2034

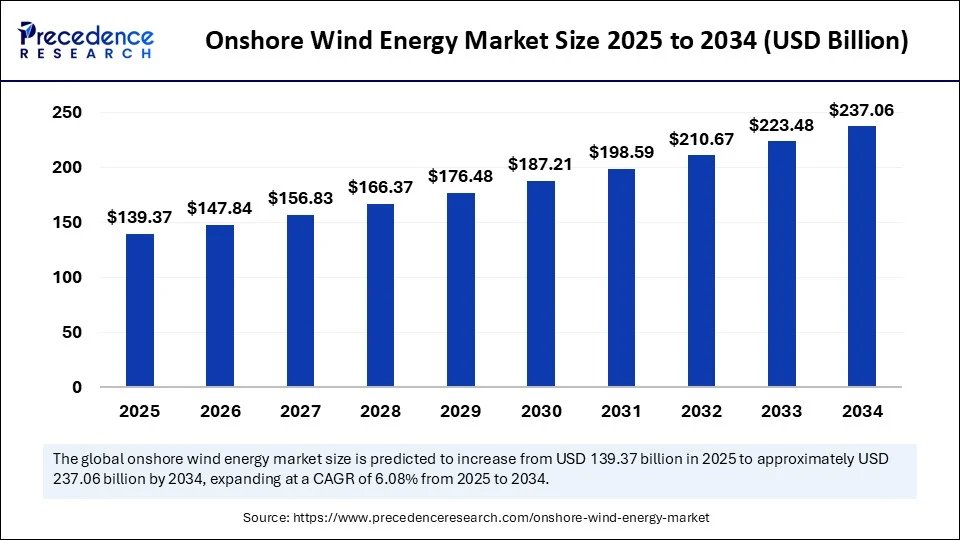

The global onshore wind energy market size accounted for USD 131.38 billion in 2024 and is predicted to increase from USD 139.37 billion in 2025 to approximately USD 237.06 billion by 2034, expanding at a CAGR of 6.08% from 2025 to 2034.The demand for renewable energy has increased, driving the global market. Government initiatives and policies are further contributing to this growth.

Onshore Wind Energy MarketKey Takeaways

- In terms of revenue, the global onshore wind energy market was valued at USD 131.38 billion in 2024.

- It is projected to reach USD 237.06 billion by 2034.

- The market is expected to grow at a CAGR of 6.08% from 2025 to 2034.

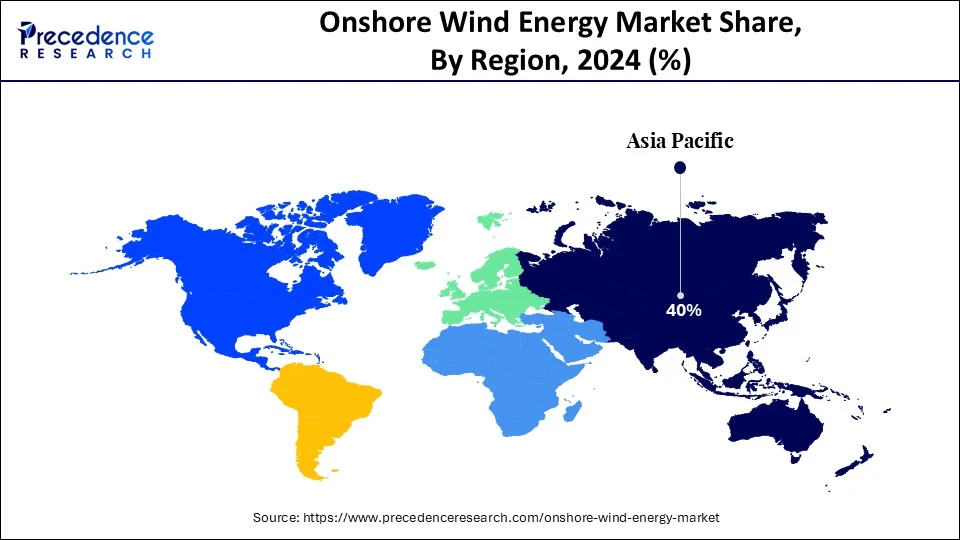

- Asia Pacific dominated the global onshore wind energy market with the largest share of 40% in 2024.

- Latin America is expected to grow at a significant CAGR from 2025 to 2034.

- By turbine configuration, the horizontal-axis wind turbines (HAWT) segment contributed the largest market share of 95% in 2024.

- By turbine configuration, the vertical-axis wind turbines (VAWT) segment is expected to grow at a notable CAGR at a CAGR between 2025 and 2034.

- By rated turbine capacity, the 3.0–5.0 MW segment captured the highest market share of 40% in 2024.

- By rated turbine capacity, the >5.0 MW segment will grow at a significant CAGR between 2025 and 2034.

- By end-user/offtaker, the utilities (vertically integrated) segment generated the major market share of 80% in 2024.

- By end-user/offtaker, the corporate/industrial (captive / PPA) segment will grow considerably between 2025 and 2034.

- By installation type, the new-build greenfield installations segment held the biggest market share of 70% in 2024.

- By installation type, the repowering/retrofit (turbine replacement & repower) segment will grow rapidly between 2025 and 2034.

- By O&M service type, the preventive maintenance (scheduled) segment generated the major market share of 50% in 2024.

- By O&M service type, the predictive/condition-based maintenance (CBM) segment will grow at a notable CAGR between 2025 and 2034.

Market Overview

The onshore wind energy market refers to the utility-scale and distributed electricity generation using wind turbines installed on land to convert wind kinetic energy into electricity for grid or off-grid use. The growing requirement of clean energy to combat climate change, government incentives, and technological advancements in turbine efficiency are the key factors driving innovations and developments of robust onshore wind energy projects across the world. The demand for >2 MW capacity based onshore wind power is high in the global market, driven by the high need for efficient and sustainable large-scale wind farms.

Electricity demand has increased due to growing urbanization, industrial growth, and reliance on cutting-edge and new technologies, leading to high adoption of onshore wind energy in utility applications. Additionally, as demand and investment in renewable energy infrastructure grow, the market is experiencing significant expansion. According to BloombergNEF's 2H 2025 Renewable Energy Investment Tracker, the global new renewable energy development investment has risen by $386 billion in the first half of 2025.(Source: https://about.bnef.com)

AI Role in Onshore Wind Energy

Artificial Intelligenceis playing a transformative role in the onshore wind energy sector by enablingpredictive maintenance, wind forecasting, turbine optimization, data analysis, and grid integration. AI is being a supportive tool in data-driven decision-making, helping to develop individual wind farms through efficient yield optimization. AI is a promising technology in project planning and designs of onshore wind projects, ensuring to meet growing clean energy demands and needs. Key offering companies in onshore wind farming are developing AI platforms to optimize farm planning and grid integration by using data to predict performance, making design and manufacturing of turbine technologies more efficient and affordable.

- In January 2025, Norwegian technology company Vind AI introduced its advanced digital platforms for supporting the design and assessment of onshore wind parks with more efficiency, smarts, and a strong focus on environmental and community impact. This launch supports European preparation for the rapid onshore wind expansion by 2030 targets.(Source:https://www.vind.ai)

Asia Pacific Onshore Wind Energy Market Size and Growth 2025 to 2034

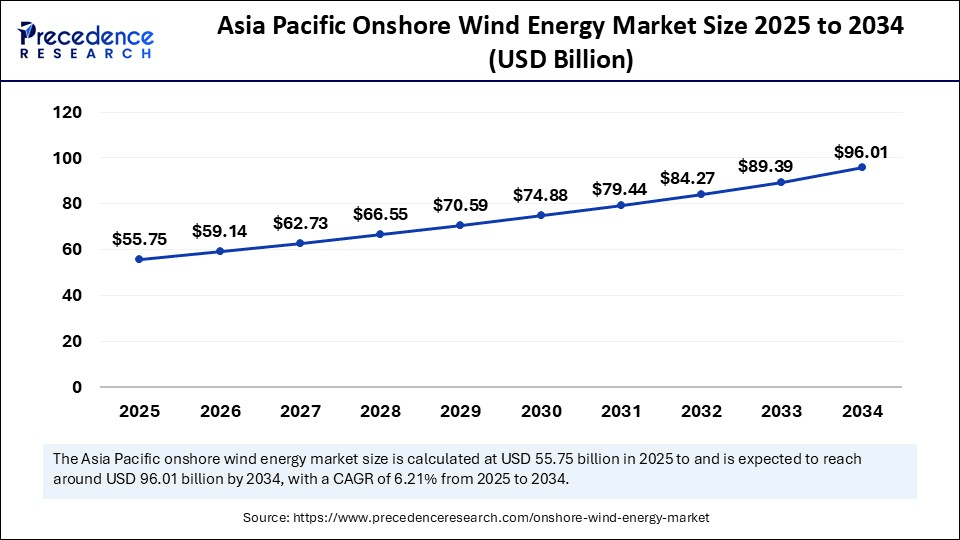

The Asia Pacific onshore wind energy market size was exhibited at USD 52.55 billion in 2024 and is projected to be worth around USD 96.01 billion by 2034, growing at a CAGR of 6.21% from 2025 to 2034.

Asia Pacific Onshore Wind Energy Market

Asia Pacific dominates the global market due to large energy demand, the presence of large-scale wind farms, government support, and the growing shift toward renewable energy sources. Regional focus on developing resilient supply chain management, such as localizing production and manufacturing, is contributing to the market growth. Rapid innovations in wind turbine technology and green energy initiatives are forcing innovations and developments in onshore wind energy projects. Countries like China, India, Vietnam, and Japan are facilitating the shift of renewable energy adoption and supportive government policy incentives, fueling the regional market.

China Market Trends

China is the major player in the regional market, contributing to growth due to the country's vast domestic wind industry, large-scale renewable energy investments, and supportive government polices. China is focusing on expanding its wind farm and manufacturing capabilities. Sophisticated supply chain distribution and energy transition are solidifying, contributing to China's market dominance.

India as an Emerging Market

India has emerged as a global leader in onshore wind power driven by the country's evolving manufacturing ecosystem, novel strides in offshore development, and supportive government polices, driving progress in both additional capacity and wind energy infrastructure. India has ranked the 4th in the world for installing wind power capacity.

Wind Energy Achievements by India from 2014-2025

Installed capacity increased to 51.3 GW by June 2025 from approximately 21 GW in 2014. The capacity added in FY 2024-25 is 4.15 GW.Electricity generation increased by wind energy to 78.21 billion units (BU) between April 2024 and February 2025, accounting for a total of 4.69% electricity generation. (Source:https://www.pib.gov.in)

Latin America Onshore Wind Energy Market

Latin America is the fastest-growing region in the global market, driven by supportive government policies and abundant resources. The strong innovations and advancements in technological infrastructure are contributing to this growth. Additionally, the rapid investments of Brazil and Chile in new project commissions due to government policies and corporate power purchase agreements are expanding this growth. The wind energy policy support provided by the Global Wind Energy Council (GWEC) and recognition of its role to meet global net-zero goals and transition toward clean energy are fueling the regional market.

What are Brazil's Market Incentives?

Brazil is the major player in the regional market, growth driven by the country's strong investment in new wind farms, including the Borborema II project and agreements for wind power to supply data centers. The large installed capacity of offshore wind power in Brazil and the robust wind energy potential further contribute to this growth. Supportive government policies, large energy demands, and the existence of major wind farms are leveraging market expansion.

Major Upcoming Onshore Wind Energy Projects and Their Capacity

| Key Projects | Capacity (MW) |

| Western Green Energy Hub wind farm in Australia | 25000 |

| Asian Renewable Energy Hub wind farm in Australia | 10220 |

| H2 Magallanes wind farm in Chile | 10000 |

| Oman Green Energy wind farm in Oman | 10000 |

| AMUN wind farm in Morocco | 7500 |

| Xinjiang Balikun new energy project wind farm in China | 7000 |

| West Sohag wind farm in Egypt | 5000 |

(Source:https://www.blackridgeresearch.com)

What are the Key Trends of the Onshore Wind Energy Market?

- Renewable Energy Demand: The demand for renewable energy has increased, driven by rising concerns about climate change and environmental sustainability, which is driving a focus on onshore wind energy.

- Environmental Concern: The growing concern over the environment and the importance of renewable energy to reduce greenhouse gas emissions has increased demand for onshore wind energy.

- Technological Advancements: The ongoing advancements in turbine technology, such as larger turbines with high capacity and efficiency, are increasing energy output.

- Increasing Electricity Demands: Rapid urbanization, industrialization, and growing dependence on technologies have increased electricity demand, making onshore wind power a vital and sustainable energy source.

- Corporate Demand and Investments:Corporate organizations are investing heavily in renewable energy sources, including onshore wind power, to meet sustainability goals and demand for green energy.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 237.06 Billion |

| Market Size in 2025 | USD 139.37 Billion |

| Market Size in 2024 | USD 131.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.08% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Authentication, Component,Deployment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Government Initiatives and Polices

Governments worldwide are implementing several policies for tract shift toward renewable energy sources. The government is increasing its investments in the onshore wind energy sector to meet its sustainability goals. Supportive government policies like power purchase agreements and feed-in-tariff are contributing to this growth. Additionally, significant financial incentives such as tax credits and accelerated depreciation are making renewable energy targets mandatory through renewable purchase obligations (RPOs). The government is facilitating investments through waivers of inter-state transmission system (ISTS) charges and competitive bidding processes.

Restraint

Grid Integration Challenges

The technical challenges in ensuring grid stability, consistent load balancing, and frequency support posed by wind energy are a major challenge for market growth. The underdeveloped and aging grid infrastructure is causing issues, making it difficult to integrate high penetration of renewable energy. The challenges associated with grid integrations hamper the operator's ability to manage power fluctuations in the onshore wind energy market.

Opportunity

Development of Green Financing Models

The ongoing developments of green financing models are increasing green technology and infrastructure initiatives. Green bonds and sustainable investment funds are leveraging investors in renewable energy projects, making affordable capital available. The green financing models, such as loans, are also accelerating significant construction and scaling of wind farms. The growing trend of a low-carbon economy and the need for more sustainable and reliable energy are accelerating the shift toward green financing models. Additionally, government incentives offering power purchase agreements and feed-in tariffs are investing in the development of these models.

Turbine Configuration Insights

Which Turbine Configuration Segment Led the Onshore Wind Energy Market in 2024?

In 2024, the horizontal-axis wind turbines (HAWT) segment led the market due to its high demand for large-scale power generation. The horizontal-axis wind turbines (HAWT) are highly scalable, efficient, and technologically mature, making them suitable for large-scale power generation. The horizontal-axis wind turbines (HAWT) with aerodynamic blade designs are highly preferred in utility-scale wind farms. This turbine captures more energy from the prevailing wind current than other turbines.

The vertical-axis wind turbines (VAWT) segment is the second-largest segment, leading the market, due to their easy maintenance and sustainability. The vertical-axis wind turbines (VAWT) are widely used in urban and residential areas. The cost-effectiveness of these turbines makes them ideal for urban areas and small-scale applications like businesses and homes. Additionally, the high wind handling capabilities of these turbines make them more suitable for residential environments.

Rated Turbine Capacity

How 3.0 – 5.0 MW Rated Turbine Capacity Dominates the Onshore Wind Energy Market?

The 3.0 – 5.0 MW segment dominated the market due to its superior efficiency and cost-effectiveness. This capacity is ideal for large-scale projects and the generation of more power with limited units. Government policies, growing investments in high turbine capacity, and technological advancements are enabling the adoption of the 3.0 – 5.0 MW capacity. The increased demand for cost-competitive renewable energy is driving a surge toward 3.0 – 5.0 MW turbine capacity. The growing adoption of large-scale deployments is creating opportunities for demand and adoption for the 3.0 – 5.0 MW turbine capacity.

The >5.0 MW segment is expected to grow fastest over the forecast period, due to its cost-effectiveness in large-scale projects. This capacity holds high power outage and energy yields. The efficiency of >5.0 MW capacity is improving due to rising advancements in turbine designs, larger rotor diameter, and improved materials. The growing focus on decarbonization targets and minimizing the need for turbines for a given capacity drives a shift toward the adoption of >5.0 MW turbine capacity.

End-User/Offtaker Insights

Which End-user/Offtaker Insights Dominated the Onshore Wind Energy Market in 2024?

The utilities (vertically integrated) segment dominated the market in 2024, due to their well-established infrastructure and grid access. The utilities (vertically integrated) have robust financial capacity for large-scale investments in wind farms. The utilities (vertically integrated) have a core business of energy generation and supply to comply with growing electricity demands. The vertical integration allows utilities' end-users to manage the overall value chain.

The corporate/industrial (captive / PPA) segment is expected to lead the market in the upcoming period, driven by increased energy demands in corporate/industrial segments. The security of long-term and stable power makes it cost-effective for the corporate and industrial sectors. Several policies, including captive models and power purchase agreements (PPAs) to leverage sustainability targets, are driving demand for renewable energy supplies across these end-users. The long-term saving and reducing price volatility through onshore wind energy projects makes it ideal for corporate/industrial environments.

Installation Type Insights

Which Installation Type Dominates the Onshore Wind Energy Market?

The new-build greenfield installations segment dominated the market in 2024, due to its key role in building new capacity expansion. The new-build greenfield installations develop entirely novel wind farms in strong and untapped wind resource areas. The rural or remote areas are the primary adoptable for new-build greenfield installations of onshore wind energy farms. The faster grind integration and lower cost effectiveness make these installations suitable for rural environments.

The repowering/retrofit (turbine replacement & repower) segment is expected to grow fastest over the forecast period, driven by its crucial role in offering increased power outputs and efficiency. Replacing older and less powerful turbines with new, modern, cutting-edge, and higher-capacity turbines enhances the efficiency of energy. The repowering/retrofit helps to reduce maintenance costs, reduce environmental impacts, and leverage with road and grid. The ability of repowering/retrofit to reduce noise and flickering makes it an essential step for community acceptance.

O&M Service Type Insights

Why O&M Service Type Dominated the Onshore Wind Energy Market in 2024?

In 2024, the preventive maintenance (scheduled) segment dominated the market, due to its crucial role in enhancing power output and turbine durability. These services help to reduce costly unscheduled downtime and provide operational efficiency through regular inspections. The lubricant and blade checkers are the major components services require preventive maintenance. To prevent sudden failures, potential issues, and costs associated with large-scale maintenance, preventive maintenance (scheduled) is essential in onshore wind energy farms.

The predictive/condition-based maintenance (CBM) segment is the fastest-growing segment in the market, growth driven by a growing focus on proactive maintenance rather than reactive maintenance. The predictive/condition-based maintenance (CBM) of wind projects helps to reduce downtime, cost, and enhance turbine lifespan. To enhance the efficiency and energy production of turbines, predictive/condition-based maintenance (CBM) is essential. The adoption of sensor and machine learning algorithms is rising for predictive/condition-based maintenance (CBM) of the onshore wind energy projects to enhance the capabilities of prediction and prevention of potential failures.

Value Chain Analysis

- Resource Extraction

Resource extraction for onshore wind energy is classified in three categories of raw materials for turbine components, including steel, iron, copper, aluminum, and fiberglass, land resources like occupation and peatlands, and operational resources, including water, wind, and lubricating oils & fluids.

Key Players: GE Vernova, Vesta, Adani Green Energy, and Suzlon Energy.

- Distribution Network Management

Network distribution management of onshore wind energy includes technologies and strategies used by utilities for integration and controlling power from wind turbines connected with local electricity grids.

Key Players: Hitachi Energy, GE Vernova (General Electric), and Schneider Electric.

- Grid Maintenance and Monitoring

Onshore wind energy grid maintenance and monitoring conduct physical upkeep and continuous surveillance for wind turbines and transmission infrastructure for connecting with the national power grid.

Key Players: Siemens Gamesa Renewable Energy (S.A.U.), GE Vernova, Nordex SE< Goldwind, and Vestas.

Onshore Wind Energy Market Companies

- Vestas

- Siemens Gamesa Renewable Energy

- GE Renewable Energy

- Goldwin

- Nordex Group

- Enercon

- Suzlon Energy

- MingYang Smart Energy

- Envision Energy

- Sany Renewable Energy

- Dongfang Electric Corporation (DEC)

- Mitsubishi Heavy Industries (MHI)

- Doosan Heavy Industries & Construction

- Acciona Energia

- Shanghai Electric Wind Power

- Sinovel Wind Group

- TPI Composites

- Vensys Energy

- Clenergy

Latest Innovations

- On August 13, 2025, the US Department of Commerce began a national security investigation into wind turbine and their components imports under section 232 of the Trade Expansion Act of 1962. The Bureau of Industry and Security was required to submit its innovations within 15 days of the notice's publication in the Federal Register on 25 August 2025. (Source: https://windtech-international.com)

Recent Developments

- In July 2025, Germany announced the launch of its third onshore wind power auction of 2025, to secure 3.44 GW of new capacity. The Federal Network Agency (BNetzA) announced that developers must submit their bids by August 1, 2025. Projects are required to gain permits under the Federal Immission Control Act (BImSchG) and should be registered in the national registry. (Source: https://balticwind.eu)

- In July 2025, Britain launched its first-ever onshore wind strategy to enhance renewable power capacity and jobs in the sector. Britain has announced its commitment to largely decarbonise its electricity sector by 2030 under the efforts to meet its climate goals and enhance energy security, and reduce the cost of power.(Source:https://www.reuters.com)

Segments Covered in the Report

By Turbine Configuration

- Horizontal-Axis Wind Turbines (HAWT)

- Vertical-Axis Wind Turbines (VAWT)

By Rated Turbine Capacity (per unit)

- < 1.5 MW

- 1.5 – 3.0 MW

- 3.0 – 5.0 MW

- >5.0 MW

By End-User / Offtaker

- Utilities (vertically integrated)

- Independent Power Producers (IPPs) / Project developers

- Corporate / Industrial (captive / PPA)

- Community / Municipal / Cooperatives

By Installation Type

- New-build greenfield installations

- Repowering / Retrofit (turbine replacement & repower)

- Expansion / Brownfield additions

By O&M Service Type

- Preventive maintenance (scheduled)

- Corrective maintenance (reactive)

- Predictive / condition-based maintenance (CBM)

- Remote monitoring & digital services

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting