What is the Medical Composites Market Size?

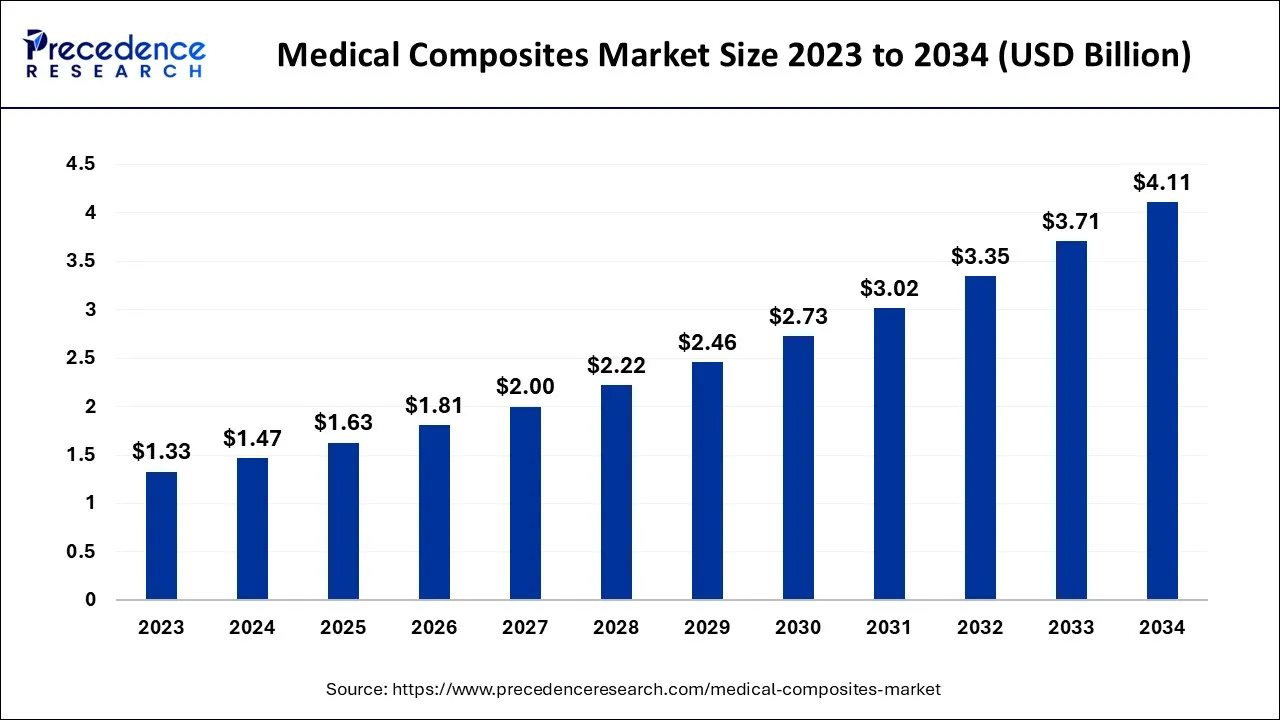

The global medical composites market is calculated at USD 1.63 billion in 2025 and is predicted to increase from USD 1.81 billion in 2026 to approximately USD 4.48 billion by 2035, expanding at a CAGR of 10.64% from 2026 to 2035.

Medical Composites Market Key Takeaways

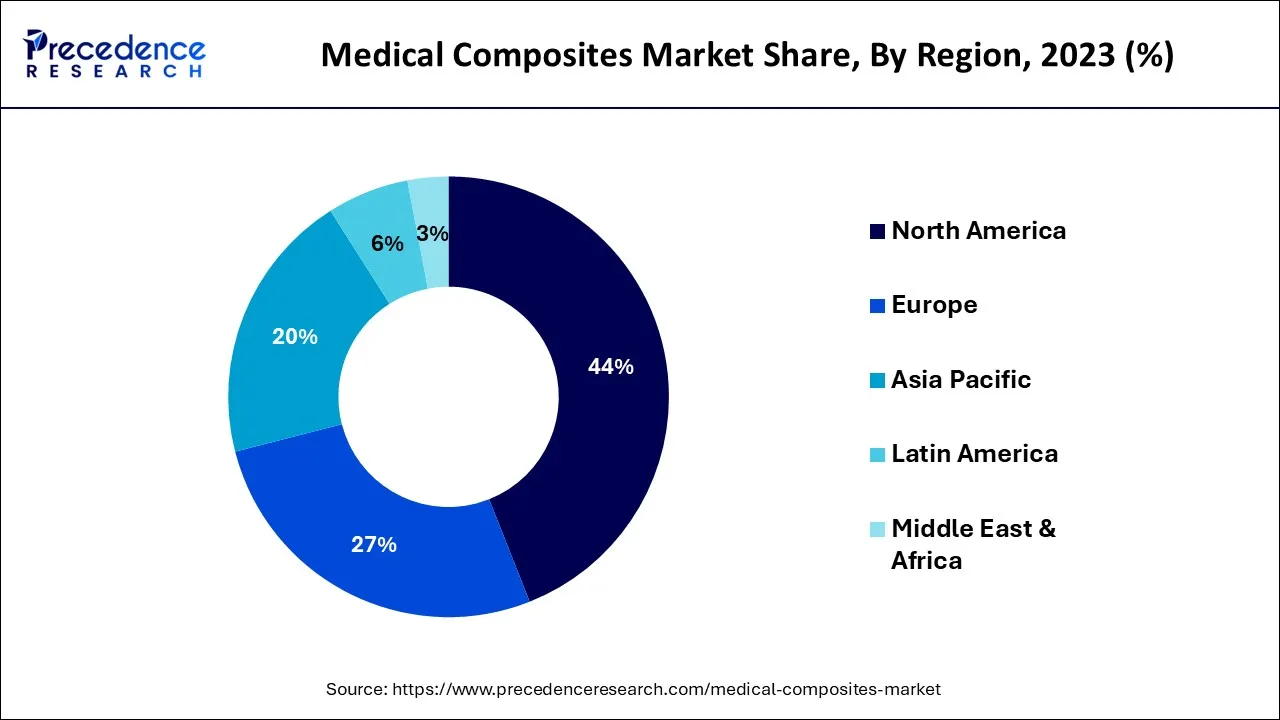

- North America led the global market with the highest market share of 44% in 2025.

- By fiber type, the carbon fiber segment residential the biggest market share in 2025.

- By application, the diagnostic imaging segment has held the highest market share in 2025.

Strategic Overview of the Global Medical Composites Industry

The composite material is a combination of two materials which possess different physical and chemical properties. Glass fiber composite are used on large scale in the healthcare sector as they have very different properties which are useful to the industry. The glass fiber can be altered into different shapes and molded in the form of aesthetic structures that provide great strength to the product and hence can be put into use in a variety of ways. The increasing development that has been observed in the healthcare sector all over the world has also boosted the market for medical composites which provides a number of materials and products to the medical industry.

The medical industry makes use of composite materials even for the surgical departments as they propose special properties of being lightweight and inert. It can be utilized as a combination material and is considered as a primary choice as compared to the metallic materials available in the market. The outbreak of the pandemic had considerable impact on the growth of the composite market Due to the rapid development of the healthcare sector which has been observed all over the world.

The increasing demand for better equipments which will provide faster results has boosted the demand for medical composites in the market. Rapid advancements have been observed in the medical sector after the outbreak of the pandemic with a view to provide maximum health care facilities of the best quality. The increasing development of the surgical department has also boosted the growth of medical composites to a great extent which facilitates faster healing of wound with the help of minimally invasive surgeries.

Artificial Intelligence: The Next Growth Catalyst in Medical Composites

AI is significantly impacting the medical composites market by revolutionizing material discovery, design optimization, and manufacturing efficiency for high-performance medical devices. Generative design powered by AI allows engineers to create complex, customized composite structures for implants, prosthetics, and surgical tools that offer enhanced strength-to-weight ratios and improved biocompatibility, often reducing the need for extensive physical prototyping.

In manufacturing, AI drives quality control through computer vision systems that detect micro-defects in composite materials in real-time, ensuring that stringent safety and regulatory standards are met.

Medical Composites Market Growth Factors

The use of medical cartilage has been widely seen in the healthcare sector due to the various advantages it provides. Biological resurfacing is a major operative procedure that is carried out for the damaged areas with the help of medical composites in the form of carbon fiber. A suitable repair of the damaged part of the body takes place with the help of medical composites that encourage cell growth within the material to heal the entire part at a faster rate. The medical composites are capable of bearing a huge amount of load and pressure which makes it quite durable and strong. These materials are made use of in manufacturing artificial limbs for the disabled people and hence provide them with mobility.

The outbreak of the pandemic had a significant positive impact on the growth of the medical composite market due to the huge demand of medical equipments and devices that was experienced all over the world. The rapidly increasing demand for minimally invasive surgeries all over the world has boosted the demand for the equipments that are made out of medical composites which are largely used for such surgical procedures. These surgical techniques help to heal a wound faster and make the process quite simple. With the help of minimally invasive surgeries the demand for high precision surgical devices has also been boosted which brings in to play the role of medical composites in the healthcare sector.

- Biological resurfacing

- Inert and lightweight materials

- Are used for making artificial limbs due to their properties

- Minimally invasive surgical procedures are boosting the demand

Market Outlook

- Market Growth Overview: The medical composites market is expected to grow significantly between 2025 and 2034, driven by a growing aging population and chronic disease, technological integration, and material innovation and diversification.

- Sustainability Trends: Sustainability trends involve bioresorbable and biodegradable materials, circular economy principles and recycling, and eco-friendly and natural fiber composites.

- Major Investors: Major investors in the market include Johnson & Johnson, Toray Industries Inc., 3M Company, Medtronic Ventures, and Dentsply Sirona.

- Startup Economy: The startup economy is focused on bioresorbable and biodegradable solutions, additive manufacturing technologies, and AI and materials informatics software.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.63 Billion |

| Market Size by 2035 | USD 4.48 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.64% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Fiber Type, Application, Process, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Manufacturing of body implants - The use of medical composites for manufacturing of body implants has emerged as a major driving force for the medical sector as these materials are extremely light in weight which becomes a major benefit for the patients. Since the weight of the implants is negligible the part of the individual does not feel excessively heavy or uncomfortable which makes it a positive point for the market.

- Medical composites can bear a huge amount of weight - As the medical composites possess the properties of flexibility, they can carry a huge amount of weight and hence proved to be durable. These materials are made use of to manufacture artificial limbs which mainly provide support to the entire body structure by carrying its weight.

Key Market Challenges

Complex procedures involved in manufacturing- Then entire procedure of manufacturing the products from composite materials emerges as a major challenge for the growth of the market as it is quite difficult and cannot be achieved easily. This imposes an additional cost on the production which reflects in the final cost of the product.

Increased cost of production- Total cost of production of artificial limbs and other products with the help of medical composite is quite high due to the complex procedures which are involved in the manufacturing process and hence the total cost of product also increases tremendously which makes it unaffordable for many people.

Medical composites are not very flexible- then direct process of restructuring a medical composite it's quite difficult and it cannot be pushed to beyond a certain level which emerges as a major restraining factor for the growth of the market. In multiple cases especially during the manufacturing of limbs for disabled people the medical composite needs to be restructured and resized which becomes a great challenge for the market which hampers the demand and supply chain to a great extent.

Key Market Opportunities

Introduction of minimally invasive surgical techniques- Increasing use of minimally invasive surgeries in the healthcare sector has emerged as a major opportunity for the growth of the medical composites market as it has emerged as the most advanced method of surgery and that is carried out. The use of this surgical procedure leads to a lesser creation of wound on the body of the individual and hence takes faster route to recovery within a shorter period of time.

Huge geriatric population all over the world- Increasing number of people belonging to the geriatric population has boosted the number of operative procedures that are being carried out all over the world and the number of people who need a device to support themselves physically in the form of implants or artificial limbs which has helped to emerge as a major opportunity for the growth of the market and is expected to provide a significant result over the period of time

Fiber Type Insights

On the basis of fiber type, the carbon fiber segment has emerged as the largest market for medical composites due to its extensive demand in the healthcare sector for making implants and other devices. The advanced capabilities of carbon fiber which helps it to carry a huge amount of load makes it very useful for the patient in the form of an implant which is able to support the entire body structure of the person by carrying its weight.

The ceramic fiber segment accounted revenue share of around 47% in 2023. The load carrying capacity of any material is a very important factor as it has a direct impact on the joint. These materials emerge as biocompatible with the body and hence can be utilized really easily for restructuring the body surface after the damage is caused by high velocity accidents. Composites also provide great stiffness and hence can be used for making body implants and artificial limbs for disabled people.

Application Insights

On the basis of application, the diagnostic imaging has emerged as the largest market go to the increasing demand of accurate diagnosis in the healthcare industry which makes it possible for the physician to choose a suitable line of treatment for the patient. The use of medical devices and equipments which help in capturing a proper image of the deformities and pathological conditions of the body emerged as the major driving force for the growth of the market.

The diagnostic imaging segment is expected to grow at a CAGR of 10.5% from 2024 to 2034. The medical composites have a property to absorb a very minimum amount of radiation which makes it very useful in the healthcare sector for the areas where imaging procedures are carried out. Attenuation of minimal signal strength emerges as another major property of medical composite which makes it a highly demanded material among the health care industries.

Regional Insights

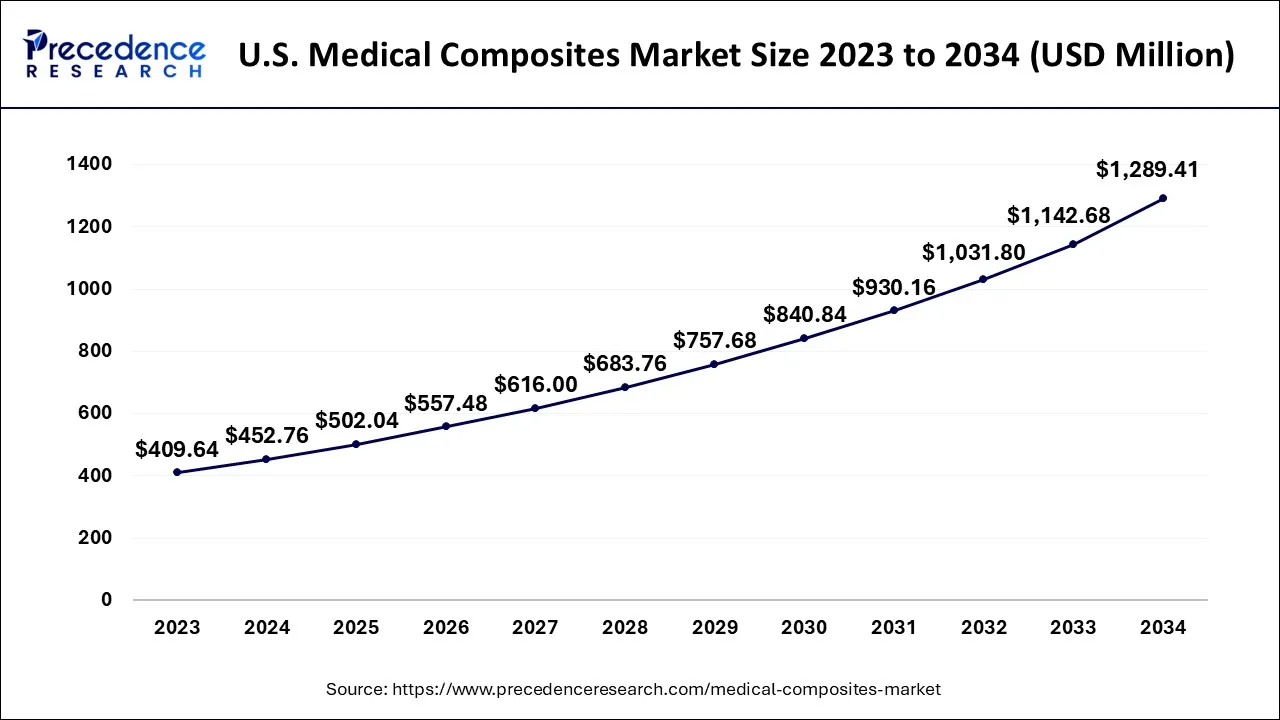

U.S. Medical Composites Market Size and Growth 2026 to 2035

The U.S. medical composites market size accounted for USD 502.04 million in 2025 and is projected to be worth around USD 1,436.14 million by 2035, poised to grow at a CAGR of 11.08% from 2026 to 2035.

The region of North America held highest revenue share 44% in 2025 owing to the huge number of healthcare industries that are existing in this sector. Back to support provided by the government to the healthcare sector has emerged as a major growth factor for this market. The European nations are also contributing significantly to the market of medical composites due to the recent advancement in technology that has taken place in the healthcare sector.

The region of Asia Pacific is expected to hit highest CAGR over the forecast period due to its maximum contribution to the global economy of this product. The huge demand of medical equipments and devices which are manufactured with the help of medical composite in this sector has boosted the growth of the market to a great extent and is expected to perform in a similar fashion during the forecast period as well. Huge number of medical equipments have been demanded by the Asia Pacific region due to the increasing number of operative procedures that are carried out in this sector. Rapid modernization of this region has emerged as a major growth factor for the medical composite market. Increasing number of road traffic accidents due to rapid modernization has boosted the size of the medical composite market to a great extent. Medical devices such as screws, implants and other products that are used for resurfacing the body structure are manufactured with the help of medical composites.

North America: U.S. Medical Composites Market Trends

The U.S. market is experiencing significant growth, driven by the superior properties and radiolucency of carbon fiber composites, primarily used in diagnostic imaging and orthopedics. The integration of advanced manufacturing technologies like 3D printing for customized solutions, and a significant focus on biocompatibility and biodegradability.

Asia Pacific: China Medical Composites Market Trends

China's market is dominated by an aging population and government-led healthcare reforms. The market is shifting towards cost-effective, high-performance materials like carbon fiber composites, driven by large-scale procurement programs.

Europe: Germany Medical Composites Market Trends

Germany's market is high demand in orthopedics and diagnostics, favoring advanced materials like carbon fiber and PEEK for their performance and compatibility. The market embraces advanced manufacturing technologies such as 3D printing for personalized medicine solutions. Strict EU MDR regulations ensure high quality and compliance, while a strong R&D ecosystem fosters continuous innovation in biomaterials and advanced manufacturing processes.

Value Chain Analysis of the Medical Composites Market

- Raw Material & Component Supply:

This foundational stage involves sourcing and processing high-grade fibers (carbon, glass, aramid) and specialty polymers (PEEK, bioresorbable polyesters, PLLA) that form the basis of medical composites.

Key Players: Toray Industries (carbon fiber), Hexcel Corporation (composites), Victrex plc (PEEK polymer), Evonik Industries AG (polymers), DSM Biomedical. - Material Design & R&D:

This crucial stage focuses on innovation, where material scientists and biomedical engineers use advanced modeling, simulation, and increasingly AI to engineer new composites with specific properties like radiolucency, strength matching human bone, and biodegradability.

Key Players: Universities and research institutions (e.g., MIT, Fraunhofer Institutes), Material science startups, R&D departments of major medical device companies, Citrine Informatics (AI for materials science). - Component Manufacturing & Fabrication:

This stage converts processed materials into final components using various methods, including compression molding, filament winding, and advanced additive manufacturing (3D printing).

Key Players: Stryker Corporation (orthopedic implants), Dentsply Sirona (dental products), GE HealthCare (imaging tables/components), EOS GmbH (3D printing solutions), and Advanced material fabrication specialists. - Assembly & Sterilization:

This stage involves the final assembly of the composite components into complete medical devices and the crucial process of sterilization (e.g., autoclaving, E-beam, gamma radiation) to ensure they are safe for clinical use.

Key Players: Major Medical Device OEMs (e.g., Medtronic plc, Johnson & Johnson), Contract Manufacturing Organizations (CMOs) specializing in medical assembly, Sterilization service providers. - Distribution, Sales, & Clinical Use:

This final stage focuses on getting the approved medical devices to hospitals, clinics, and surgical centers through specialized supply chains, distributors, and direct sales teams.

Key Players: Cardinal Health, Inc. (distribution), McKesson Corporation

Top Companies in the Medical Composites Market & Their Offerings:

- IDC Composite International Inc.: IDC Composite specializes in developing and supplying high-performance composite materials and engineered plastic solutions for various industries, including medical applications like diagnostic imaging tables and patient positioning systems.

- Kulzer GmbH: Kulzer, a part of the Mitsui Chemicals Group, is a key player in the dental segment of the medical composites market, providing a wide range of composite-based dental materials for restorative treatments and prosthetics.

- Composiflex Inc.: Composiflex is a manufacturer of highly engineered composite components, serving the medical, aerospace, and defense industries with custom-designed solutions.

- Dentsply Sirona: Dentsply Sirona is a major global player in the dental market, supplying a vast array of composite-based restorative materials, CAD/CAM blocks, and dental equipment.

- Royal DSM N.V.: DSM is a key supplier of advanced, high-performance biomedical polymers and materials used in various medical applications, including implantable devices and drug delivery systems.

- SGL Carbon SE: SGL Carbon is a leading producer of carbon fiber and composite materials, providing essential components to the medical composites market for applications like patient tables and orthopedic devices.

- Zeus Industrial Products Inc.: Zeus specializes in extruding advanced polymer tubing and related products that are essential in the medical device industry for catheters, guidewires, and other minimally invasive surgical tools.

- The 3M Company: 3M is a major contributor to the medical composites market through its vast portfolio of healthcare products, including composite materials used in dental restoratives and advanced wound care solutions.

- Toray Industries Inc.: Toray is a world leader in carbon fiber production and a key supplier to the medical composites market, providing high-performance materials for advanced medical imaging equipment and orthopedic devices.

Medical Composites Market Companies

- IDC Composite International Inc.

- Kulzer GmbH

- Composiflex Inc.

- Dentsply Sirona

- Royal DSM N.V.

- SGL Carbon SE

- Zeus Industrial Products Inc.

- The 3M Company

- Toray Industries Inc.

Recent Developments

- In April 2019- Filtek universal, which is very restorative composite product was introduced by 3M. This is a shading system that provides highly aesthetic and efficient results.

- In March 2018- TenCate advanced composites was taken over by Toray industries by offering USD 1091 million. The acuquisition was mainly carried out in order to broaden the reach of the business and maintain its position in the global market of carbon fibers. Numerous industries including the healthcare sector which existed as the end users for carbon fibers were profitted with the help of this acquisition.

Segments Covered in the Report

By Fiber Type

- Ceramic Fiber

- Carbon Fiber

- Others

By Application

- Composite body implants

- Diagnostic imaging

- Surgical instruments

- Dental instruments

- Others

By Process

- Wet Lamination

- Prepreg

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content