What ia the Medical Polymer Market Size?

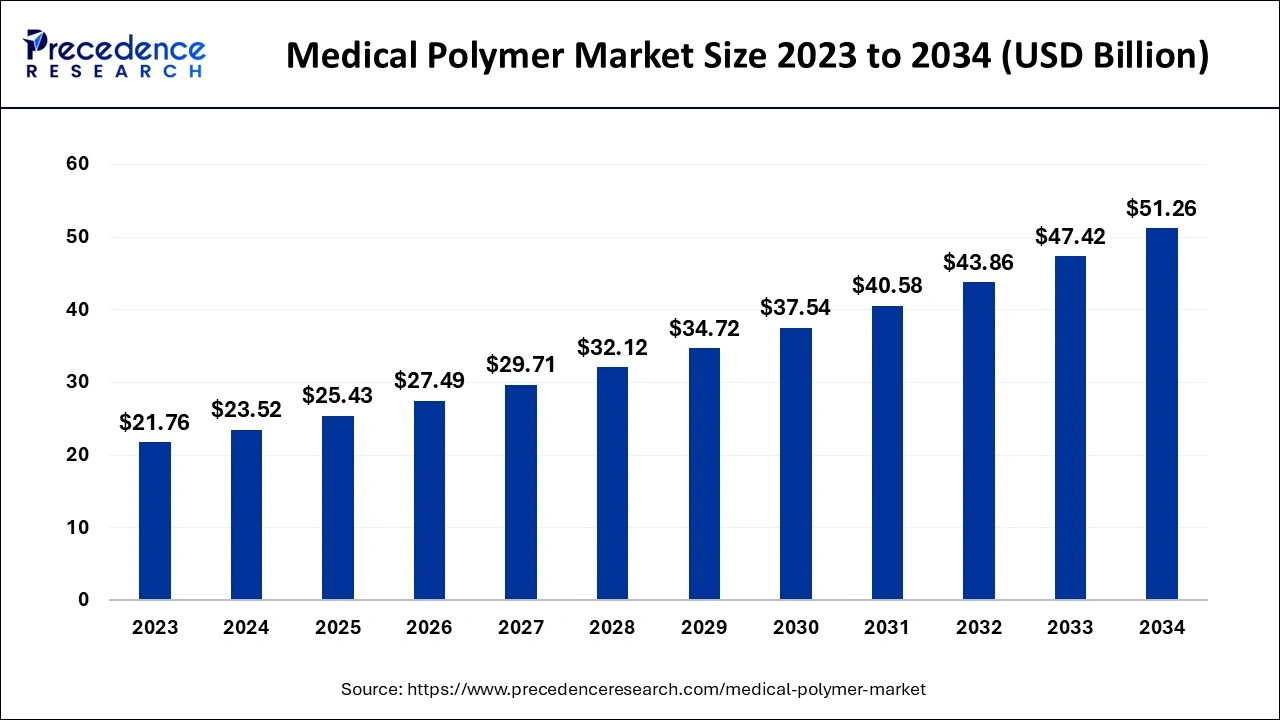

The global medical polymer market size is calculated at USD 25.43 billion in 2025 and is predicted to increase from USD 27.49 billion in 2026 to approximately USD 54.91 billion by 2035, expanding at a CAGR of 8% from 2026 to 2035.

Medical Polymer Market Key Takeaways

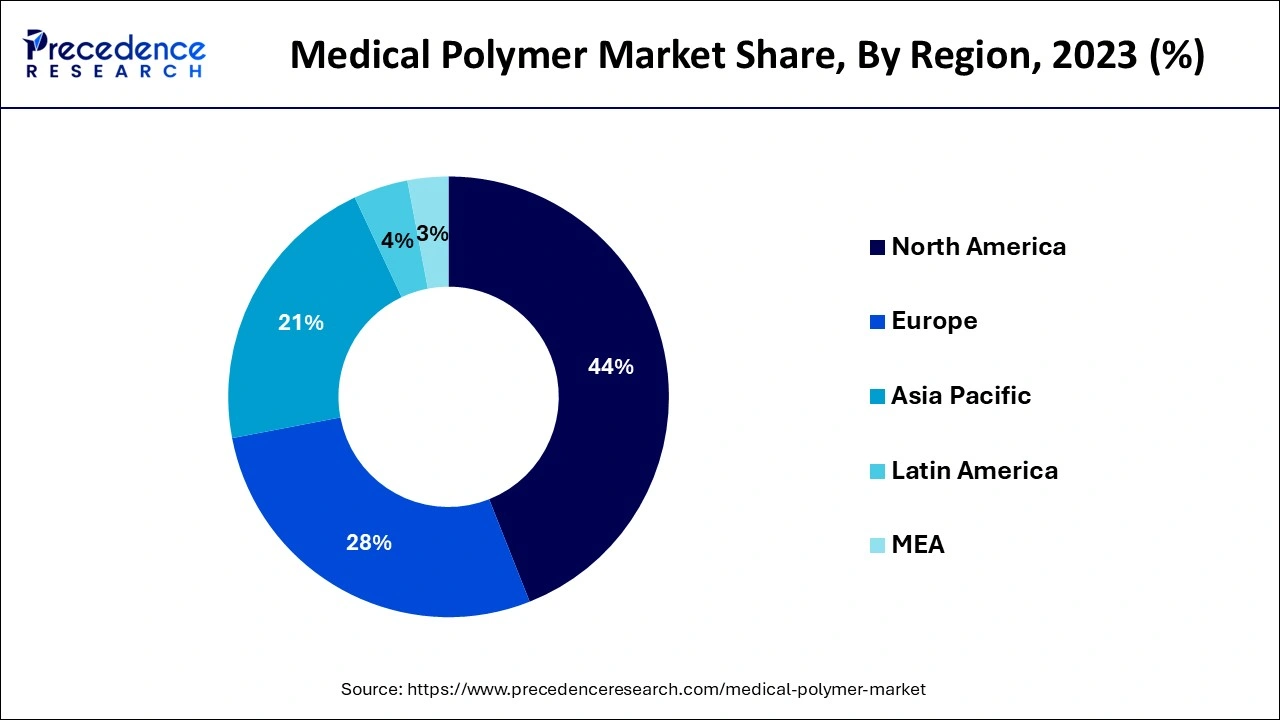

- North America region has garnered a 44% market share in 2025.

- By product, the fibers & resins segment has dominated the market with 54% market share in 2025.

- The biodegradable segment is growing at a 10.3% CAGR b from 2026 to 2035.

- By application, the medical components accounted for 41% market share in 2025.

Market Overview

Medical polymers, also known as clinical grade polymers, are synthetic materials that are often organized as elastomers, filaments, and saps. Clinical polymers are utilized as additives and fillers in clinical plastics, as well as other clinical devices and packaging. The growing interest in dealing with the COVID-19 pandemic situation throughout the world is expected to considerably increase interest. The market is expected to be significantly impacted by the consistently expanding demand in clinical bundling products for COVID-19. Because the region contains substantial medical care item makers, North America is expected to lead the expanding interest. They provide adaptability, strength, adaptability, biodegradability, biocompatibility, sanitization solidness, and tiredness, as well as heat and electrical resistance. Several manufacturers are now displaying several types of therapeutic polymers with varying molecular weights, crosslinking and crystallization levels, copolymers and blends, and further bioactive surface fictionalization. Furthermore, the growing interest in novel and inventive healthcare devices is increasing the need for clinical polymers globally to aid in device innovation and supportability. The two primary categories of biomedical polymers are naturally occurring polymers and synthetic polymers. Natural polymers include proteins, polysaccharides, and polynucleotides.

The most often hydrolytically destroyed biomedical polymers include homo-and copolymers of polyamides, polyesters, polyanhydrides, poly (orthoesters), poly (amido amines), and poly (-amino esters). These materials, which are largely employed in biotechnology and medicine, are referred to as biopolymers and smart polymers. Furthermore, therapeutic polymers are less costly than metals and polymers. Engineered plastics used as medical polymers can rival metals and polymers in structural strength, stability, inertness, durability, and formability while being less adequate and more difficult to deal with. Growing interest in clinical polymers in the assembly of clinical devices and equipment, as well as clinical bundling, is expected to fuel growth.

The global medical polymers industry study offers a comprehensive analysis of the market. The research provides a thorough examination of major segments, trends, drivers, constraints, the competitive landscape, and factors that are significant in the market. Factors such as rising medical sector demand are expected to drive demand for the medical-grade polymers. These Polymers are categorized as the synthetic or natural based on their source component. Wood, bio-base polymers and the natural rubber are some of the examples of naturally occurring polymers, whereas the synthetic polymers includes the thermosets and thermoplastic resins, elastomers, and also the fibres.

Medical Polymer Market Growth Factors

One of the primary factors impacting market expansion in North America is rising per capita healthcare expenditures in the type of health insurance coverage. This is likely to boost demand for generic medicines and medical devices in the future years, propelling the North American market during the forecast period. Medical component manufacturing and pharmaceutical packaging are two significant uses for this business. The presence of the very significant government programs such as Affordable Care Act (ACA) and Medicaid has allowed a huge proportion of the population in the United States to get the access to large healthcare facilities and the services. This has increased demand for the branded medications, the medical devices, and the healthcare services, fueling the country's demand for medical polymers, specifically in applications like as the medical components, packaging, and the wound care. Both the public and private sectors are making considerable investments in the Canadian healthcare sector.

The Canadian Institute for health Information (CIHI) estimates that the government will spend USD 308 billion on healthcare in 2021. The country is known for its high health consciousness and long life expectancy, with women living an average of 85 years and men living an average of 79 years, presenting attractive development potential for medical polymer makers in Canada.

Wide use of medical polymers in manufacturing of medical devices and packaging, substantial growth in the pharmaceutical sector in recent years has led in a growth of the market for medical polymers, which will increase the industry share by 2032. Government organizations are pushing R&D investment in the pharmaceutical business in order to build technically complex equipment that will aid in the elimination of dangerous ailments in the region. The increasing need to develop novel medical gadgets will benefit the medical polymers market growth over the forecast period. Because of its cost-effectiveness and convenience, patients' desire for homecare health treatment has led to an increase in worldwide demand for medical disposables. This will contribute greatly to gaining a higher market share within the predicted period.

Continuous product innovation by industry leaders is a prominent market trend. Clariant Plastics & Coatings Healthcare Polymer Solutions, for example, announced the development and testing of novel polymer materials in February 2020. Clariant's ‘medical grade components are covered by the new compounds offered under the MEVOPUR brand name. These items are particularly useful in applications such as medical catheters. The high demand for the medical devices, essentially driving medical polymer market growth. Biocompatible medical polymers exist in nature. Polyether ether ketone is a polymer that is widely employed in the healthcare industry for a variety of applications including neuro-devices, and robotic assistance the structural heart, infection control. As the result, mounting demand for the medical devices is moving the medical polymer market forward.

Polymer usage in the medical industry has grown over the previous decade, thanks to the development of the engineering plastics such as PEEK, ABS the PMMA, and PET. These polymers are safe for use in medical equipment and appliances. Furthermore, medical polymers are less expensive than alternatives such as ceramics, glass, and metals. Engineering plastics used as medical polymers can rival metals and ceramics in inertness, durability, structural strength, stability, and formability while being the lighter and more resource efficient. Furthermore, because to their lightweight, cheap cost, resilience, and transparency, medical polymers are employed for packaging. As a result, the numerous benefits provided by medical polymers are raising their demand in the medical sector, consequently fuelling medical polymer market expansion.

Market Trends

- Increasing Demand for Advanced Medical Devices- Rising use of disposable and minimally invasive devices is escalating demand for high-performance polymers with strong biocompatibility, flexibility, and strength, which will offer improved innovation and adoption of new applications within healthcare.

- Changes in Regulation and Compliance- More stringent regulation and emphasis on safe and sustainable choices are influencing product choices and formulations of polymers by manufacturers, ultimately driving them towards more compliant, non-toxic and recyclable alternatives.

- Technology and Developments- The continued positive shift in polymer engineering is offering groundbreaking inventions in biocompatible and bioresorbable, anti-microbial, and other innovations as it relates to surgery, wound care, and regenerative medicine to expand the use of medical polymers.

- Growth in Home Healthcare and Wearable Products- Increasing number of remote patient monitoring, and self-sort therapies are creating demand for lightweight, durable, and skin-friendly polymers in wearable medical devices that will also fuel the evolution of the market.

Market Outlook

- Industry Growth Overview: The medical polymer market is expected to grow at a significant rate from 2025 to 2034, driven by the rising use of high-performance and green medical polymers. Moreover, the need for compliance with regulations and quality assurance is contributing to the market.

- Major Investors: The main investors are large multinational chemical companies, manufacturers of specialty polymers, and medical device firms. Investments are primarily directed toward R&D, expanding production capacity, and developing advanced medical-grade polymers.

- Global Expansion: The market is expanding worldwide due to the increasing healthcare needs and the rise in medical device production. Medical device manufacturers are also expanding their production facilities into new markets, mostly in developing countries, supporting global expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.43 Billion |

| Market Size in 2026 | USD 27.49 Billion |

| Market Size by 2035 | USD 54.91 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Processing Method and Geography |

Segment Insights

Product Insights

Fibers and resins led the market in terms of both volume and revenue in 2025, owing to the excellent chemical and electrical resistance afforded by resins like polyethylene (PE) the polypropylene (PP) and (PE). Furthermore, strength, and toughness, polycarbonate polymer resins have high heat resistance, allowing them for replace the metal and the glass in a wide range of medical applications. Optical clarity is an important feature in therapeutic and diagnostic contexts where blood, tissues, and other fluids must be seen. Extrusion of the medical polymers can result in the monofilaments; those are the single threadlike synthetic fibres. These medical-grade monofilaments can be used like the alternative to metal filaments in the magnetic resonance imaging (MRI).

Furthermore, medical polymer fibres have a high the strength-to-weight ratio and making them an excellent choice for a wide range of minimally invasive devices and medical apparel. Silicone is a common medical elastomer used in medical applications. Its advantages include the capacity to function in temperatures ranging from -50 °C to +250 °C, the water repellency, great resistance to ozone, weather, and UV rays, non-allergic nature, and compatibility with steam, ETO, and the gamma radiations, making it perfect for use in medical applications.

Application Insights

Medical device packaging, mobility assistance, wound treatment, medical components, and dental implants are among the uses being examined for the North American the medical polymers sector. In the region, rising rates of lifestyle-related disorders such as heart attack and diabetes have resulted in higher healthcare spending by the population. This has been predicted to increase demand for and healthcare services, the medical equipment, the generic pharmaceuticals, affecting the worldwide medical polymer market size positively.

Propylene and polyether ether ketone (PEEK) polymers are in high demand because to increased global use of orthopedic soft products. Because of its great strength and tolerance to unfavorable environmental conditions, the PEEK polymer is chosen as it is a premium material for the manufacturing plastic casts and braces used in those medical applications. Furthermore, worldwide demand for PEEK polymers is predicted to expand because to increased attempts by orthopedic goods producers to reduce overall weight of their products through material replacement. Furthermore, worldwide demand for PEEK polymers is expected to be fueled by its simple moulding capabilities, which will result in enhanced shape of orthopedic goods.

Regional Insights

U.S. Medical Polymer Market Size and Growth 2026 to 2035

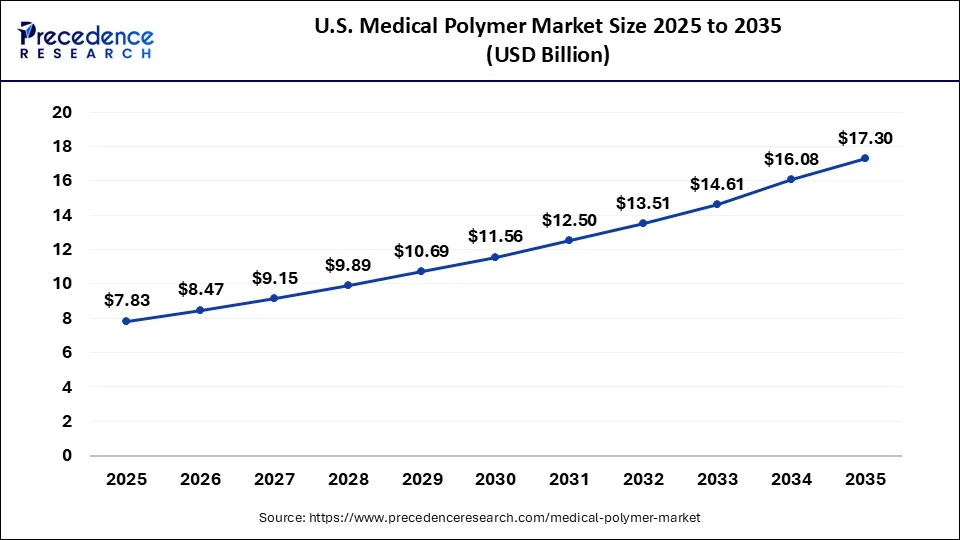

The U.S. medical polymer market size was evaluated at USD 7.83 billion in 2025 and is predicted to be worth around USD 17.30 billion by 2035, rising at a CAGR of 8.25% from 2026 to 2035.

In 2025, North America was the biggest segment, accounting highest market revenue. Medical Components lead the market in terms of both volume and revenue in 2024. Mounting he demand for the medical polymers in packaging of pharmaceutical applications as well as the fast expansion of pharmaceutical businesses in Mexico and Canada, is likely to propel growth further. For example, the Mexican government's removal of tough laws restricting the development of new manufacturing where it led in the establishment of new pharmaceutical production facilities in Mexico by large corporations like as Takeda and Astellas.

The region's growing senior population and the frequency of chronic illnesses have increased demand for medical gadgets. Over the forecast period, this is likely to increase demand for medical polymers in equipment manufacture. Increasing government investments in the healthcare sector, as well as the increasing home healthcare market, are likely to increase demand for medical devices, favourably influencing the growth of the medical polymers market throughout the forecast period.

The U.S. is the major contributor to the North America medical polymer market. This is due to its well-established healthcare infrastructure, strong presence of leading medical device and pharmaceutical manufacturers, and high investment in research and development of advanced medical materials. Additionally, a large aging population and high healthcare spending drive sustained demand for medical polymers across various applications.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. This is mainly due to the development of healthcare infrastructure and rising medical device manufacturing. The region is experiencing demand for polymer-based products due to increased healthcare spending and broader access to medical services. It also benefits from cost-efficient production and a stable supply of raw materials. Fast urbanization and population growth are putting more pressure on demand for medical consumables. Local manufacturing of syringes, IV sets, and diagnostic devices is increasing, and so is polymer consumption.

Several Asian countries are contributing to the market. China is the frontrunner in the mass production of medical devices and polymer parts. Japan is focusing on high-performance and specialty medical polymers for cutting-edge healthcare applications. India is experiencing strong growth, driven mainly by rising domestic healthcare demand and the expansion of medical device exports. South Korea is focusing on biocompatible and specialty polymers for innovation.

Why is Europe Considered a Significant Region in the Market?

Europe is considered a significant market for medical polymers. The European market is characterized by its well-developed healthcare systems and strict quality standards. The continent is increasingly opting for high-performance and specialty polymers for medical and pharmaceutical applications. The use of minimally invasive devices is becoming a major driver of polymer consumption. Strong R&D capabilities are driving innovation in bio-based and advanced polymers, contributing to regional market growth.

Germany is the leader in medical device manufacturing and polymer innovation. France energizes growth through its strong pharmaceutical and healthcare industries. The UK is focusing on polymer-based diagnostics and advanced medical equipment. Italy and Switzerland are supporting growth through the production of specialized medical devices.

What Opportunities Exist in the Middle East & Africa for the Medical Polymer Market?

The Middle East & Africa (MEA) offers significant opportunities for the market, supported by improving healthcare infrastructure and increased investment in medical facilities. As a result, governments are increasing healthcare spending to meet rising population needs. Demand for disposable medical products is rising in hospitals and clinics. Medical tourism in some countries is therefore creating demand for advanced medical devices. Infection control awareness is helping drive the use of polymer-based consumables. The region has ample room for long-term growth as healthcare systems develop.

At the country level, Saudi Arabia is at the forefront of healthcare modernization initiatives. The UAE is demonstrating strong use of advanced medical devices and consumables. South Africa is helping to increase demand for medical devices through the expansion of hospital networks and diagnostic services. Many other countries are slowly but steadily increasing their imports of medical polymer products. This growth is supported by the expansion of the healthcare sector, which is driven by policy.

Medical Polymer Market Companies

- BASF SE

- NatureWorks LLC

- Covestro AG

- Celanese Corporation

- Eastman Chemical Corporation

- Evonik Industries AG

- Dow Inc.

- Exxon Mobil Corporation

- Arkema

- Koninklijke DSM NV

- Formosa Plastics Corporation

- Foryou Medical

- KRATON CORPORATION

- SABIC

- Trinseo S.A.

Key Market Developments

- In February 2025, ALBIS has announced that it has partnered with Arkema to distribute the company's high-performance, medical-grade polymers, effective immediately. The engineering and high-performance plastics distributor will now provide Arkema's medical range of Pebax MED thermoplastic elastomers, Rilsan MED polyamide 11, Rilsamid MED polyamide 12, Rilsan Clear MED transparent polyamide, and Kynar MED PVDF.

- In November 2024, EOS introduces EOS P3 NEXT for increased productivity in polymer AM. A significant aspect of the EOS P3 NEXT is its compatibility with innovative materials that redefine efficiency and sustainability in additive manufacturing.

- In September 2024, Americhem Healthcare Launches ColorRx Medical grade polymers product line in the European market. ColorRx polymers will be produced in one of three ISO 13485 and cGMP compliant facilities throughout the world, ensuring the highest standards of quality and reliability.

- In October 2023, Ashland introduced new bioresorbable polymers technology platform, pharmaceutical products and solutions at CPHI and AAPS. Viatel™ Ultrapure high-purity bioresorbable polymers, a line extension that offers improved stability and longer, more consistent drug release profiles for long-acting injectables and implants (LAII). These low monomer polymers are better suited for sensitive drug compounds in LAII.

- SIBUR and BASF cooperated in June 2019 to create novel polymer solutions at SIBUR's PolyLab Research and Development Center in Moscow.

- In response to the COVID-19 pandemic, Celanese Corporation, the global chemical and the specialty materials company, is prioritizing its operations in April 2021 to provide with the specialty materials used in applications like ventilators, respirators, and the other critical medical equipment and supplies in support of the healthcare and medical devices industry.

- BASF intends to spend US $29.56 million in its superabsorbent polymer business in March 2021.

Segments covered in the report

By Product

- Fibers & Resins

- PVC

- PP

- PE

- PS

- Others (engineering thermoplastics such as nylon, PET, PLA, PHA, PA, PC, ABS)

- Medical Elastomers

- Styrene Block Copolymer

- Rubber latex (NR + Butyl Rubber+Silicone rubber)

- Others (TPU, TPO, TPV)

- Biodegradable Polymers

- Polyhydroxyalkanoate (PHA)

- Others

By Application

- Medical Device Packaging

- Medical Components

- Orthopedic Soft Goods

- Wound Care

- Cleanroom Supplies

- BioPharm Devices

- Mobility Aids

- Sterilization & Infection Prevention

- Tooth Implants

- Denture-based Materials

- Other Implants

- Others

By Processing Method

- Blow Fill Seal

- Extrusion Blow Molding

- Injection Stretch Blow Molding

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content