Plastic Component Market Size and Forecast 2025 to 2034

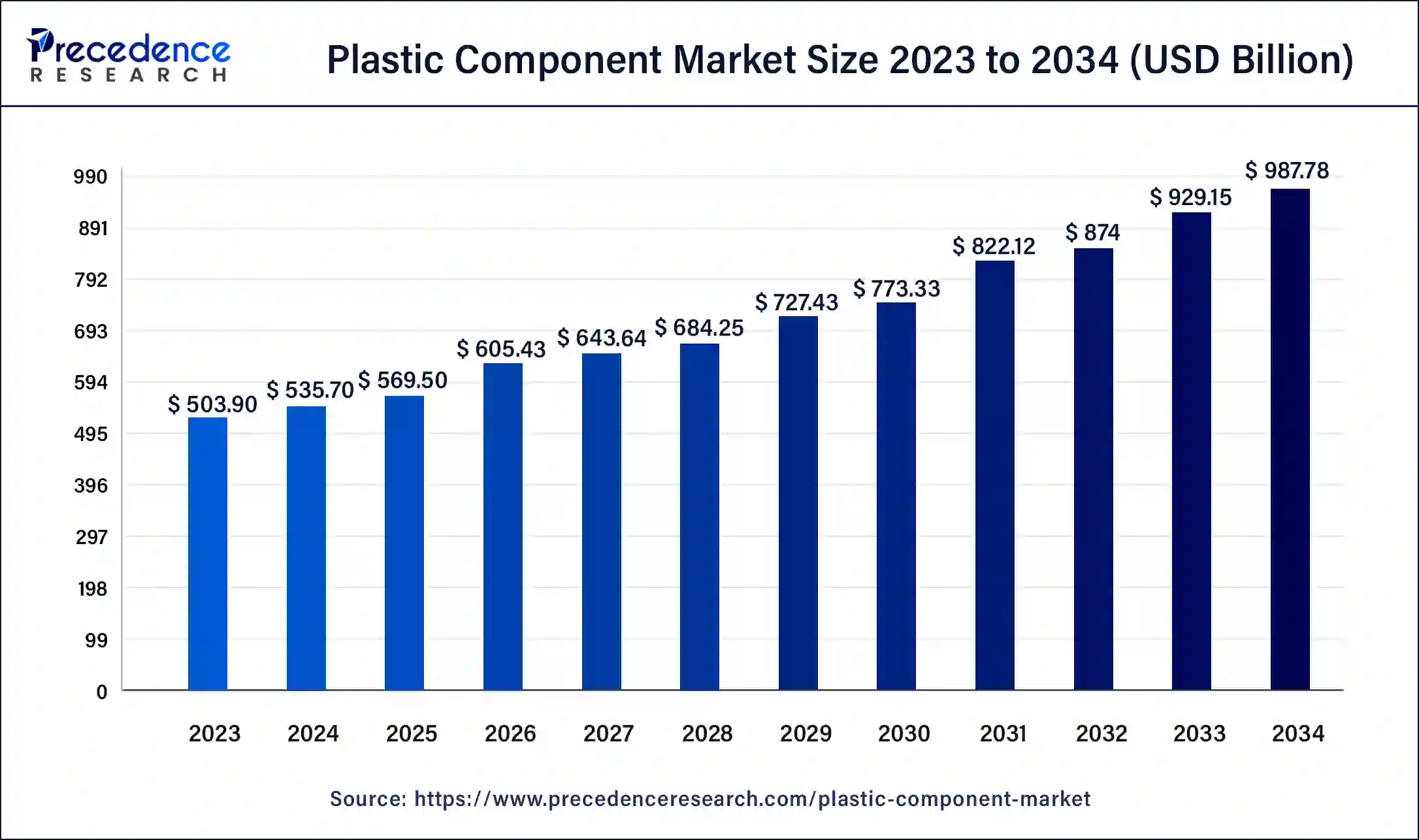

The global plastic component market size was evaluated at USD 535.70 billion in 2024 and is anticipated to reach around USD 987.78 billion by 2034, growing at a CAGR of 6.31% over the forecast period 2025 to 2034. The rising urbanization in emerging economies, which necessitates the construction of more residential & commercial buildings and improved transport infrastructure, is anticipated to accelerate the adoption of the plastic component market in the coming years.

Plastic Component Market Key Takeaways

- The global plastic component market was valued at USD 535.70 billion in 2024.

- It is projected to reach USD 987.78 billion by 2034.

- The plastic component market is expected to grow at a CAGR of 6.31% from 2025 to 2034.

- Asia Pacific held the dominant share of the plastic component market in 2024.

- North America is expected to grow at a rapid pace during the forecast period.

- By type of plastic, the Polypropylene (PP) segment held a significant presence in the market in 2024.

- By type of plastic, the Acrylonitrile Butadiene Styrene (ABS) segment will witness considerable growth in the market over the forecast period.

- By application, the automotive segment registered its dominance over the market in 2024.

- By application, the electronics segment is projected to expand rapidly in the market in the coming years.

Market Overview

Plastic is a synthetic or semi-synthetic material that contains polymers as their primary component. Plastic is generally derived from petrochemicals. Petrochemicals are chemicals that are most commonly derived from petroleum or natural gas. Plastics offer ease of fabrication and can be easily molded into solid objects in different shapes and forms using techniques such as extrusion, injection molding, and blow molding. There are several different types of plastics with unique characteristics and properties. Plastic components are widely used across various industries, from automotive to construction and medical devices, owing to their cost-effectiveness, versatility, ease of manufacture, durability, versatility, and lightweight.

- Global plastics use is projected to triple between 2019 and 2060, from 460 million tonnes (Mt) to 1,321 Mt, mainly driven by economic growth.

Plastic Component Market Growth Factors

- The rising demand for plastic components as a replacement for glass and metal, particularly in industries such as automotive and construction, is expected to contribute towards the growth of the global plastic component market during the forecast period.

- The rapid product innovation and material advancements aided by 3D printing are expected to boost the wider commercialization of plastic components during the forecast period.

- The rapid expansion of the packaging industry is expected to support the growth of the plastic component market during the forecast period.

- The increasing investments in R&D activities and modernization in production techniques are anticipated to fuel the market's expansion during the forecast period.

- The increasing demand from the electrical & electronics industry is expected to drive the market's growth in the coming years.

- The rapid urbanization, along with the rise in disposable income, is anticipated to create significant growth opportunities for the plastic component market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 987.78 Billion |

| Market Size in 2025 | USD 569.50 Billion |

| Market Size in 2024 | USD 535.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.31% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Plastic, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising demand for lightweight vehicle

The significantly increasing demand for lightweight vehicles is expected to fuel the growth of the plastic component market. Plastic is most commonly used to make a wide range of automotive components. Plastic components are generally the molded plastic parts used in automotive manufacturing. These include interior trims, exterior body panels, and under-hood components for cars, buses, and trucks. Automotive manufacturers are widely using plastic components in the manufacturing of vehicles and replacing conventional materials owing to the reduced vehicle weight and improved fuel efficiency. Therefore, these factors make plastic components ideal for use in the automotive industry.

- In November 2023, NIFCO South India injected INR 288 crore in Karnataka for an auto plastic parts plant. This transformative move stems from a memorandum of understanding (MoU) inked between the Karnataka government and NIFCO South India Manufacturing Pvt Ltd, an offshoot of Nifco Korea.

Restraint

Fluctuation in the price of raw materials

The fluctuation in the price of raw materials is anticipated to hinder the plastic component market growth. The raw material prices majorly depend on petrochemical feedstocks, such as crude oil and natural gas, which are often subjected to fluctuation. Such fluctuation in the raw material prices can adversely impact the profitability of manufacturers. Additionally, difficulties in recycling and stringent environmental regulations are observed.

Opportunity

Rise in construction activities

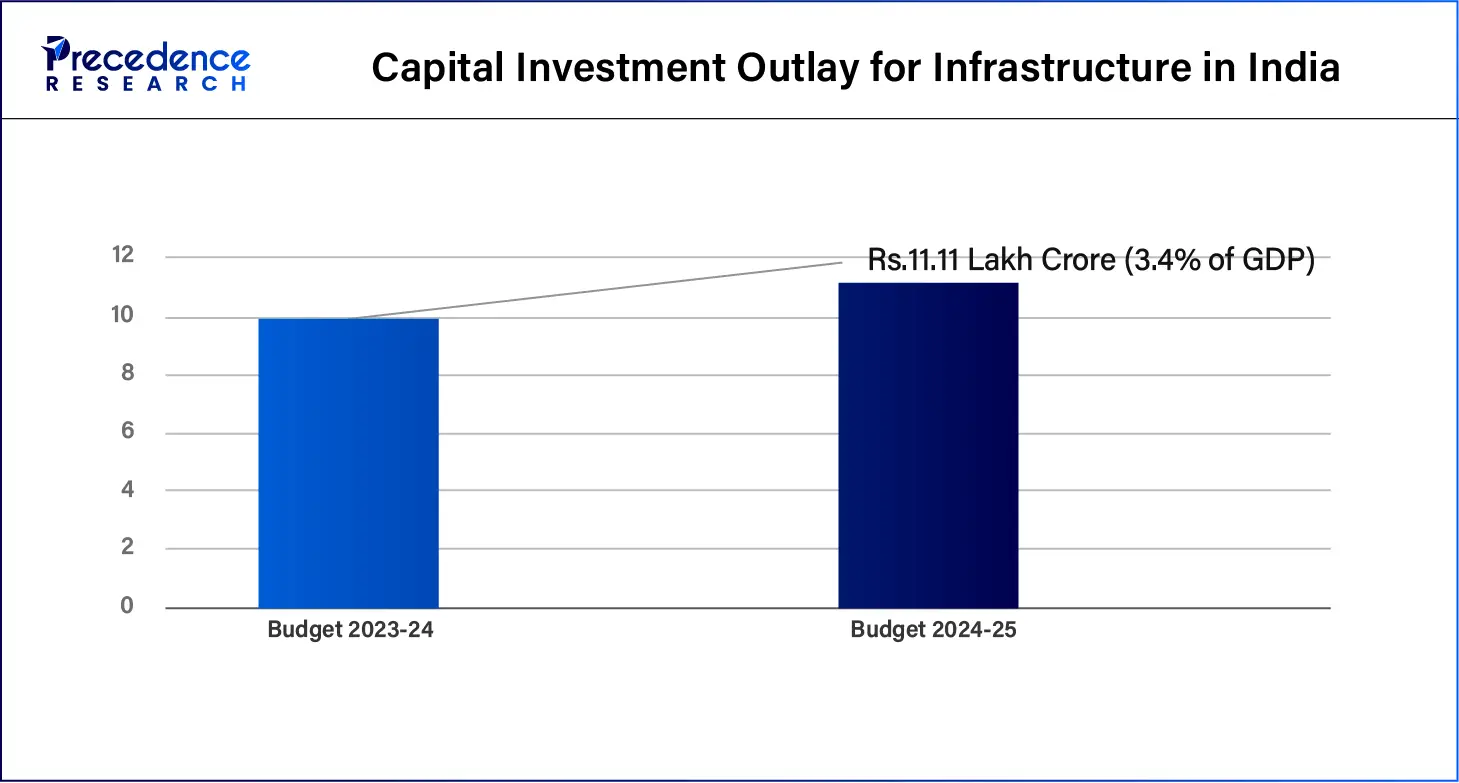

The increasing infrastructural activities and construction projects are projected to create significant growth opportunities for the growth of the plastic component market during the forecast period. The rise of plastic consumption increases with the expansion of the construction industry. Plastic components have a wide range of applications in the construction industry, such as insulation materials, pipes, films, doors, windows, flooring, roofing sheets, and others. The construction industry mainly uses plastic due to its strength-to-weight ratio, versatility, durability, and corrosion resistance. The lightweight plastic makes it easier to transport and shift around sites.

- In March 2024, Welspun Corp's Sintex-BAPL to invest INR 2355 crore to set up manufacturing units in Telangana, Odisha, Madhya Pradesh & J&K. The proposed investment is for manufacturing plastic pipes and water storage with a total capacity of ~200,000 MT and shall cater to the exponentially growing water storage and distribution segment.

Application Insights

The automotive segment registered its dominance over the plastic component market in 2024. The segment's growth is majorly driven by the increasing use of plastics in automotive manufacturing. Plastics have become the primary material for vehicles due to their lightweight and fuel efficiency. Modern heavy-duty vehicles such as excavators, loaders, tractors, combine harvesters, buses, and trucks have various plastic content in both interior and exterior. The average automotive vehicle has 30,000 parts, and about â…“ of these parts are made from plastic materials. Plastics are increasingly being used for automotive parts such as fenders, dashboards, carburetors, bumpers, splash guards, engine covers, handles, seating, interior wall panels, cable insulation, and others. In addition, the rapid technological advancement in the plastic industry has brought eco-friendly and lightweight plastics and the increasing production of electric vehicles as well as heavy-duty vehicles.

- China sold over 1 million EVs in August 2024, breaking the previous record set in December 2023 by 70,000 vehicles.

- According to the data from the China Association of Automobile Manufacturers (CAAM), from January to July of 2024, China's production of new energy vehicles (NEVs) reached 5.914 million units, a 28.8% increase from the 4.591 million units produced over the same period last year, while sales amounted to 5.934 million units, up by 31.1% year on year from 4.526 million units in the first seven months of 2023.

The electronics segment is projected to expand rapidly in the plastic component market in the coming years. The rapidly evolving electronics industry has led to increased adoption of plastics as it offers several advantages in electronics components manufacturing. Plastic materials are extensively used in the electronic industry as they have invaluable properties that make them a perfect material option. They are lightweight, durable, cost-effective, electrical insulation, heat insulation, easy to design, and others. Plastics in the electronics industry most commonly include switches, connectors, LEDs, wire and cable coating, semiconductors, and others.

- According to the Ministry of Electronics & IT Government of India (Annual Report 2022-2023), the Electronics hardware industry is the world's largest and fastest growing industry and is increasingly applications in all sectors of the economy. The domestic production of electronic items has increased from USD 49 billion in 2016-17 to USD 87.1 billion in 2021-22, growing at a CAGR of 15%. India's electronics production is expected to reach USD 300 billion by 2026.

- In July 2024, Siemens Smart Infrastructure and BASF announced the first electrical safety product to include components made from biomass-balanced plastics.

Type of Plastic Insights

The Polypropylene (PP) segment held a significant presence in the plastic component market in 2024. The market has witnessed that Polypropylene (PP) is the most widely used for various applications. Polypropylene is gaining immense popularity due to its lightweight, durability, high resistance to chemicals & corrosion, and flexibility. It can be easily molded into complex shapes without compromising its structural integrity. Polypropylene (PP) finds various applications in the automotive industry, such as interior trim, bumpers, door panels, battery cases, engine covers, and dashboard components, owing to its impact resistance, lightweight, and ease of molding. Moreover, Polypropylene (PP) has an excellent resistance to chemicals and moisture, which makes it a suitable choice for pharmaceutical packaging and chemical storage.

The Acrylonitrile Butadiene Styrene (ABS) segment will witness considerable growth in the plastic component market over the forecast period. Acrylonitrile Butadiene Styrene is widely used in manufactured products due to its durability, ease of mold, good insulating properties, corrosive resistance, cost-effectiveness, and manufacturing simplicity. The most common uses for ABS plastic include pipes, fittings, keyboard keys, 3D building materials, vacuum parts, and refrigeration parts. ABS is the common thermoplastic polymer used for injection molding applications. In the automotive industry, steering, wheel covers, and dashboards are often made of ABS plastic.

- In July 2023, Arburg, a German manufacturer of injection molding machines opened a new subsidiary in Ho Chi Minh City, Vietnam. With this newest subsidiary, Arburg now operates 36 subsidiaries in 26 countries across the globe.

Regional Insights

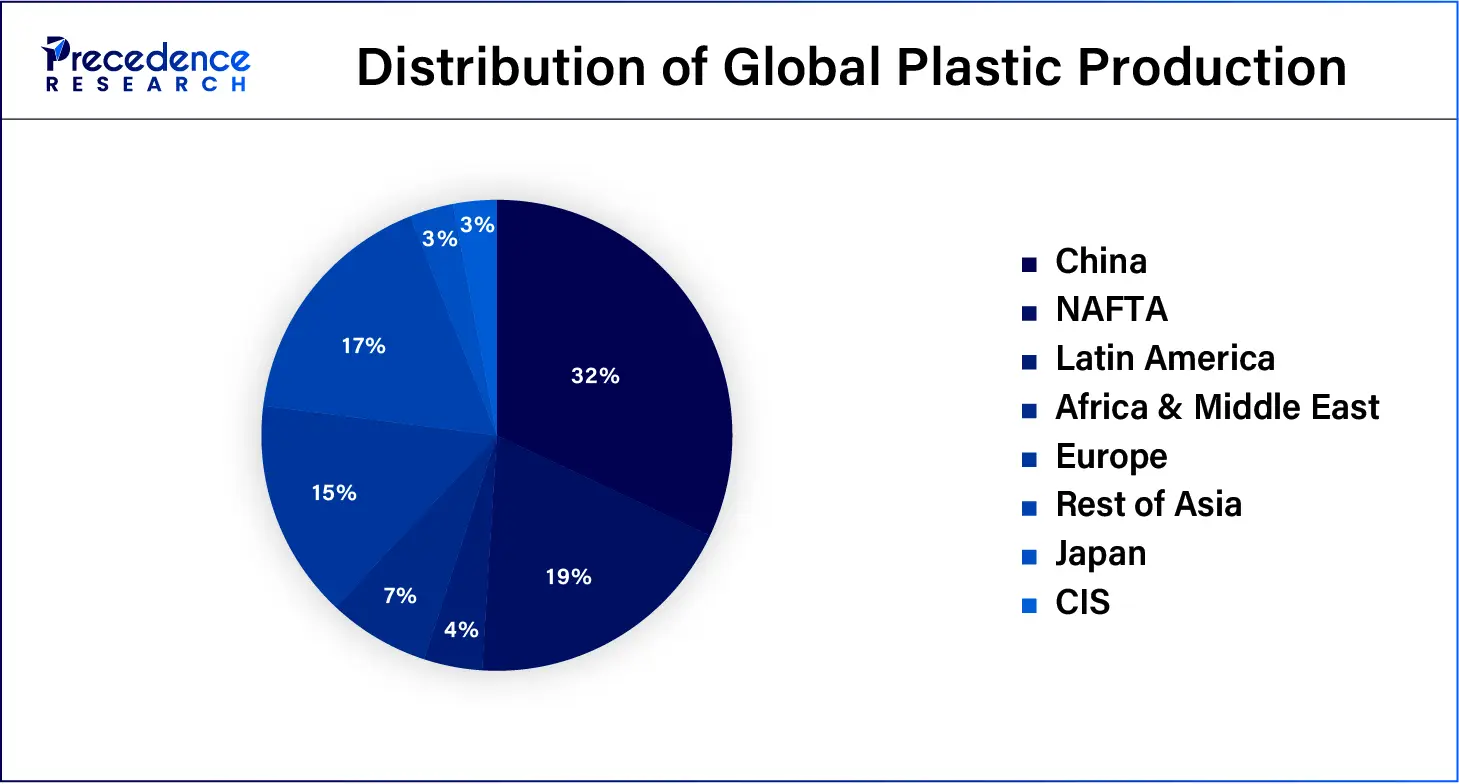

Asia Pacific held the dominant share of the plastic component market in 2024 and is observed to witness prolific growth during the forecast period. The region is expected to experience significant growth during the forecast period. This growth is due to the presence of prominent market players, rapid urbanization, improving economic conditions, increasing demand for medical devices, growing demand from the electrical & electronics industry, rising research and development activities, the increasing trend of replacing glass and metals, expansion of the packaging industries, and rising consumer spending on household products.

- In October 2023, Gunze Limited announced its investment of 5.7 billion JPY to expand the Konan Plant in Japan for the growth of the engineering plastics business, which is projected to be complete by March 2025. This investment is made to meet the increasing demand in the medical device and semiconductor markets.

Moreover, the rising demand for lightweight vehicles coupled with increasing sales of electric and hybrid vehicles are expected to positively impact the market's expansion in the coming years. India and China are the major contributors to the plastic component market owing to the significantly increasing demand for plastic components from various industries such as automotive, consumer goods, construction, healthcare, packaging, electrical & electronics, and industrial machinery.

The availability of cheap labor and raw materials in countries such as China and India is anticipated to accelerate the regional plastic component market growth during the forecast period. China has a robust presence in the plastic industry to meet the increasing consumer demand and reduce imports. India is also one of the largest producers and manufacturers of plastics.

- According to the China Association of Automobile Manufacturers (CAAM), In the first eight months of 2024, from January to July, the production and sales of passenger vehicles in China amounted to 16.141 million units and 16.157 million units, up 3% and 3.3% year on year.

- In March 2023, Saudi Aramco and its Chinese joint venture partners NORINCO Group and Panjin Xincheng Industrial Group signed an agreement to construct an oil refinery and petrochemical plant in northeastern China with an investment of USD 12.2 billion.

- In November 2023, ExxonMobil's USD 10 billion plan to boost plastics production in China.

- In May 2022, Micro Plastics India announced the set up of a toy manufacturing facility with a total investment of INR 500 crore in Tamil Nadu, India. Micro Plastics India Ltd has leased a 7,00,000 sq ft industrial space in Hosur for setting up the manufacturing plant and this investment will generate employment for over 6000 people.

North America is expected to grow at a rapid pace in the plastic component market during the forecast period. The North American plastic component market is characterized by the penetration of plastics in automotive manufacturing, rising construction & infrastructure activities, rising demand from the packaging industry, rising preference for lightweight components, increasing demand for electric and hybrid vehicles, and modernization in production techniques. In addition, rapid technological advancement, along with rising research and development activities, are expected to result in the development of innovative plastic components to cater to the evolving needs of various industries.

- In March 2024, Germany's Schott Pharma announced that it would build a facility in North Carolina to manufacture prefillable polymer syringes that can withstand the deep-cold storage and transportation conditions required by mRNA medications. The site also will have the capability to produce glass prefillable syringes used in the treatment of diabetes and obesity. The project will add 401 jobs in the Wilson, NC, region and include a total investment of USD 371 million.

Plastic Component Market Companies

- LG Chem.

- Toray Industries, Inc.

- Exxon Mobil Corporation

- DowDuPont Inc.

- Magneti Marelli S.P.A.

- FLEX-N-GATE CORPORATION

- TOYODA GOSEI Co., Ltd.

- ElringKlinger AG

- Hartford Technologies, Inc.

- Abbott Ball Company Inc.

- SMB Bearings

- BASF SE

- Continental AG

Recent Developments

- In June 2024, Sirmax collaborated with Technogym for a line of performing products in recycled plastic. Sirmax Group develops materials for Technogym's recycled plastic components in the next-generation Excite fitness line. Sirmax Group, Europe's leading manufacturer of thermoplastic granules for various applications, has developed materials for Technogym, a world leader in fitness, wellness, sports, and health products.

- In September 2022, Essentium, Inc. partnered with Braskem to offer manufacturers a fully integrated AM machine and materials solution. Combining the Essentium High-Speed Extrusion (HSETM) 280i HT 3D Printer with Braskem's Polyolefin materials will unlock affordable, sustainable, and rapid volume production of 3D-printed thermoplastic components.

- In July 2023, Omega Plastics Group plastic specialist in injection molding specialists announced the addition of a new injection molding press capacity at both Signal Plastics and Omega Plastics to enhance customer service and solutions.

- In June 2024, WIS Kunststoffe GmbH, a German company, announced its plan to invest € 100 million in plastic production in Kazakhstan.

Segments Covered in the Report

By Type of Plastic

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Engineering Plastics

By Application

- Automotive

- Consumer Goods

- Electronics

- Packaging

- Healthcare

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting