What is the Plastic Compounding Market Size?

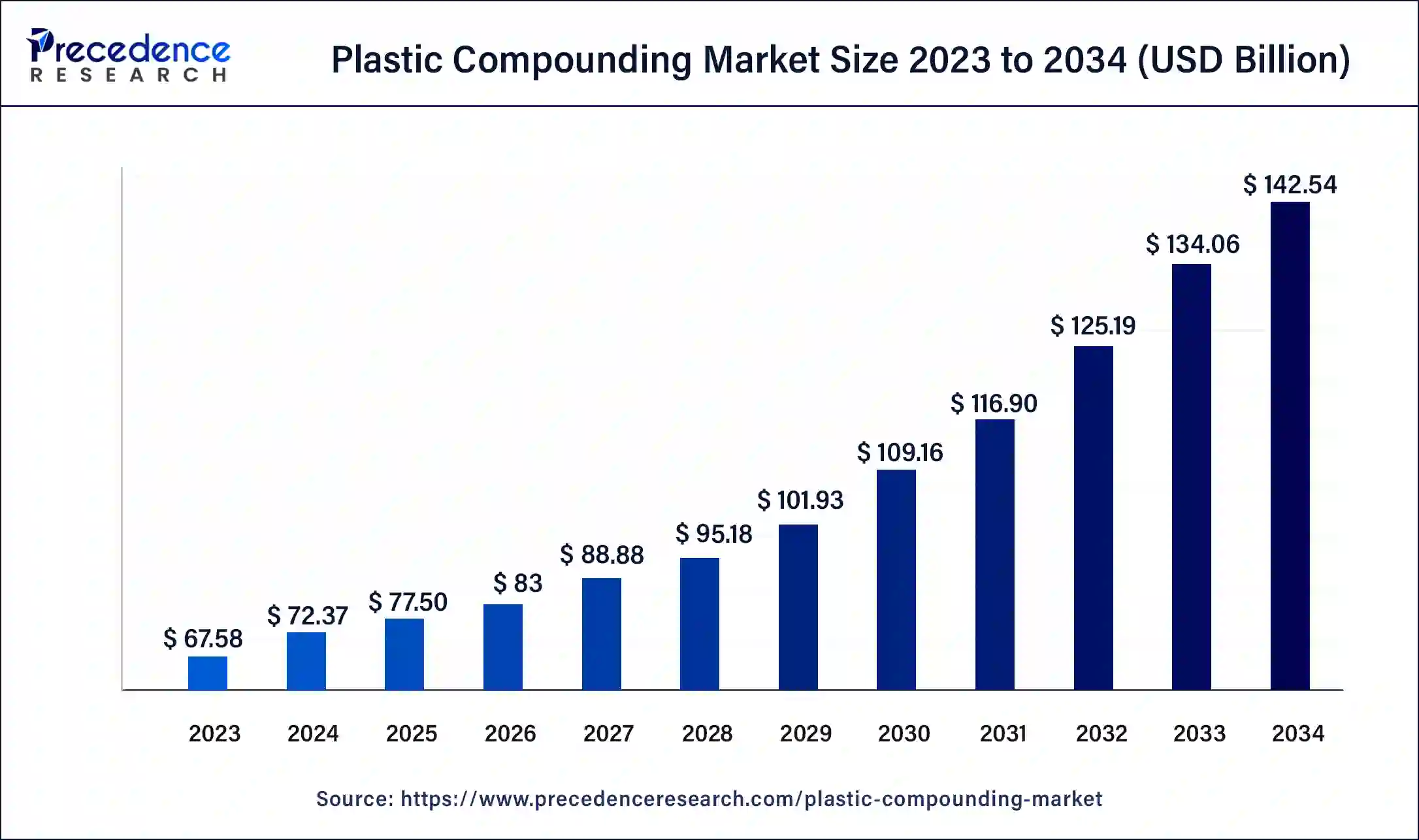

The global plastic compounding market size is calculated at USD 77.50 billion in 2025 and is predicted to increase from USD 83 billion in 2026 to approximately USD 151.28 billion by 2035, expanding at a CAGR of 6.92% from 2026 to 2035.

Market Highlights

- Asia Pacific led the global market with the highest market share of 46% in 2025.

- By Application, the automotive segment generated over 26% of revenue share in 2025.

- By Product, the Polypropylene (PP) segment is estimated to hold the highest market share of 33% in 2025.

Plastic Compounding Market Growth Factors

- The increasing demand from the end-use industries, chiefly automotive, construction, packaging, and electronics, is fueling market expansion.

- The market benefits from the excellent plastic compound properties that make them light, durable, conductive, and flame-retardant, all of which are points of attraction for their varied use.

- Among the other factors facilitating market growth for compounded plastics is the rising focus on infrastructure development worldwide.

- Environmental and regulatory issues are now beginning to cause concerns worldwide about the shift in preference toward biodegradable and sustainable polymer alternatives.

- A constant stream of innovations in additives and formulations is enhancing performance and has, in turn, assisted the growth of plastic compounding.

Market Outlook

As organizations expand their operations across different regions, they generate and access a broader and more diverse set of data. This geographic and cultural diversity enhances the richness, volume, and variety of data available for AI systems to analyze, which in turn improves the accuracy and adaptability of AI models. Major reasons behind the global expansion of AI in the data analytics market are data sovereignty, regulations, and increasing cross-border collaboration. Various regulations like the EU AI Act and the data protection bill by India are encouraging global companies to hold onto their secure data strategies to expand globally.

The AI indata analyticsmarket is poised for robust growth between 2025 and 2034, driven by its ability to go beyond basic automation to transform business areas and operational models. By 2026, nearly 80% of businesses are expected to adopt models likeGenerative AI (GenAI) and APIs. This shift enables non-technical users to interact with systems in their local languages through natural language processing (NLP), significantly fueling demand for conversational analytics.

Predictive analytics is becoming increasingly vital, particularly in energy-intensive sectors like manufacturing and data centers. By analyzing data usage patterns, AI models can forecast energy consumption and identify inefficiencies or leaks, helping organizations optimize energy usage for future operations. Additionally, AI is being used to predict weather changes and optimize energy grid performance, critical for energy management, renewable integration, and grid stability.

Industries such as finance, healthcare, and BFSI are entering a new era, leveraging real-time data processing, often through IoT sensors, to make faster decisions and enhance customer services. Much of this is powered by custom-built AI solutions designed for specific use cases.

As organizations expand their operations across different regions, they generate and access a broader and more diverse set of data. This geographic and cultural diversity enhances the richness, volume, and variety of data available for AI systems to analyze, which in turn improves the accuracy and adaptability of AI models. Major reasons behind the global expansion of AI in the data analytics market are data sovereignty, regulations, and increasing cross-border collaboration. Various regulations like the EU AI Act and the data protection bill by India are encouraging global companies to hold onto their secure data strategies to expand globally.

Market Scope

| Report Highlights | Details |

| Market Size in 2026 | USD 83 Billion |

| Market Size in 2025 | USD 77.50 Billion |

| Market Size by 2035 | USD 151.28 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.92% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Region |

Market Dynamics

Market Driver

Increasing Plastic Compounding in Infrastructure Development

As consumer awareness of appealing interiors rises, driving demand for these materials in interior designs, the frequency of residential and commercial projects in developing nations stimulates infrastructural development. The plastic compounding market is projected to benefit from the expanding construction sector. Through various products, including pipes, wires, cables, waterproofing membranes, and wood PVC composites, PVC and CPVC play a significant part in the sustainable management of this industry. The majority of developing nations, including Mexico, India, and others, are anticipated to profit from increased construction spending as well as from customers' propensity to choose sustainable and lightweight building materials over more traditional materials like metals and alloys.

Market Restraint

High Substitution Potential from its Bio-based Counterparts

The usage of bio-based polymer manufacture has been encouraged by various limits that governments have placed on the consumption of polymers made from petrochemicals in multiple sectors. Instead of using fossil fuels, these bio-compound polymers are produced from plants or other sustainable resources. Polymers derived from bio-based sources, such as Polyhydroxyalkanoate (PHA), Polylactic Acid (PLA), and Polybutylene Succinate (PBS), have demonstrated outstanding biodegradability, which their corresponding products derived from petrochemicals severely lack. As a result, these products are becoming increasingly popular, particularly for biomedical and agricultural uses.

Market Opportunity

Continued Advancement in Catalyst Technology to Boost Resin Performance and Yield

Some accelerators can boost resin yield, causing quality problems and poor product performance. The performance, adaptability, and yield of polyethylene and other resins will thus be improved by continuously developing polymerization catalyst technologies, creating a lucrative opportunity for the leading players to boost their output and compete favorably on the market.

Segment Insights

Component Insights

The software segment dominated the market while holding the largest share in 2024. This is mainly due to the ability of AIsoftwareto provide core algorithms and processing power to gain insight from data. It has become highly convenient to use simplified platforms, cloud-based solutions, and the ongoing evolution of AutoML. Software solutions are critical for data analysis, which offers real-time decision-making power across various industries.

The services segment is expected to expand at the fastest CAGR during the foreseeable period. The segment growth is driven by the increasing global demand fordigital transformation, particularly the shift to cloud-based services and the growing adoption of technologies like AI and IoT. Also, there is a growing inclination towards remote-work support and on-demand home services, fueling the segment's growth.

Type Insights

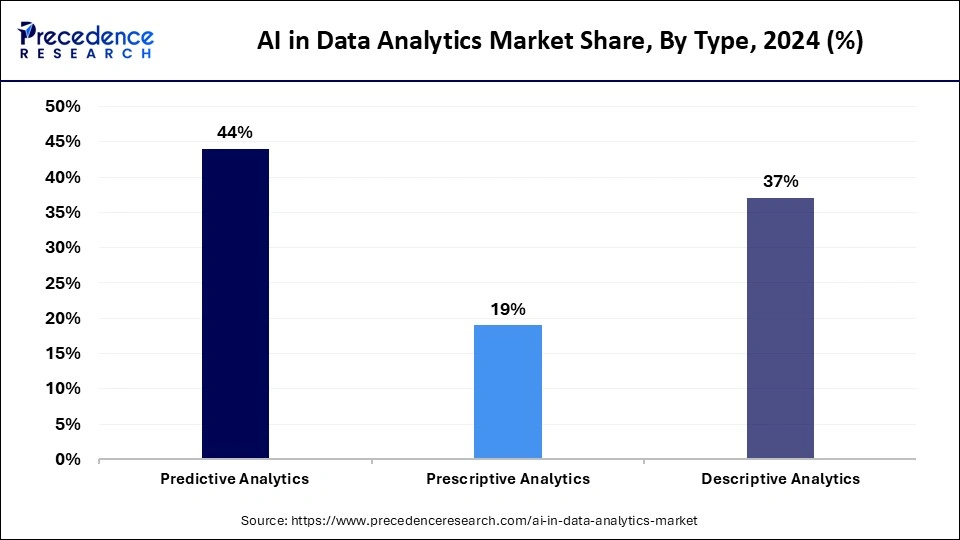

Thepredictive analyticssegment dominated the market with the largest share in 2024. The segment's dominance is attributed to its ability to process vast datasets and uncover hidden patterns, enabling highly accurate forecasts of future trends and behaviors. These insights empower organizations to make proactive, data-driven decisions across a wide range of industries. This shift marks a significant transition from traditional data analysis methods to AI-powered approaches, offering improved speed, precision, and the automation of complex tasks, making predictive analytics a critical driver of AI adoption in data analytics.

The descriptive analytics segment is expected to expand at the fastest CAGR during the foreseeable period. The segment growth is driven by widespread enterprise adoption of robust tools such as sales reports, website traffic summaries, and financial dashboards. These tools are fundamental across virtually all industries, from healthcare and finance to manufacturing, underscoring the increasing demand for clear, real-time insights into past and current performance. As a result, descriptive analytics continues to gain traction as a foundational component of data-driven decision-making.

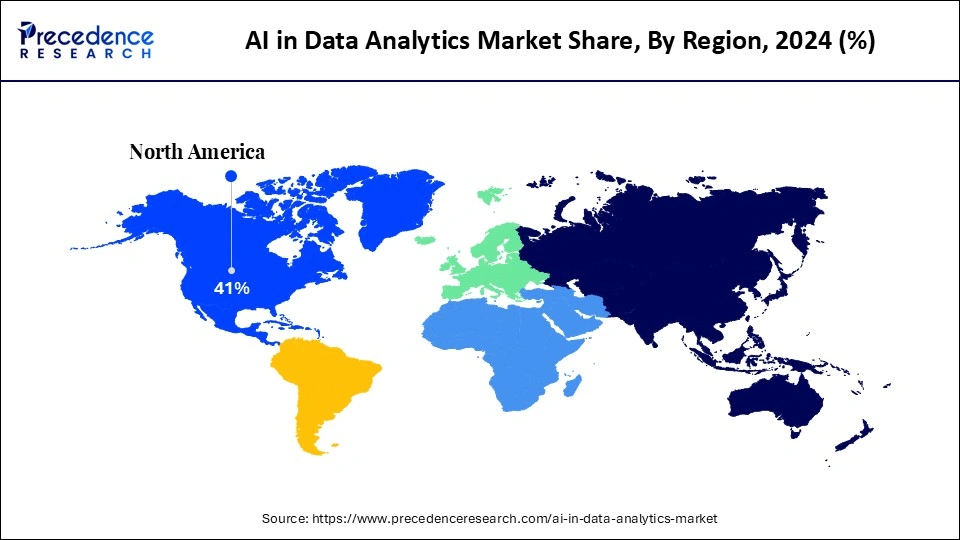

Regional Insights

North America dominated the AI in data analytics market with the largest share in 2024. The region dominance is attributed to a combination of factors, including significant financial investments by the corporate sector to leverage AI capability, early adoption of cutting-edge technologies like AI, and the presence highly skilled workforce and government-backed policies. In the first quarter of 2025, the region has gained nearly 89.3% of all AI venture capital funding across the world, highlighting their rigorous efforts to build AI-powered ecosystem.

Additionally, North America is home to some of the world's largest and most innovative tech companies, including NVIDIA, Alphabet (Google), Amazon, and Microsoft, as well as a dense network of high-growth startups, particularly in Silicon Valley and Seattle. These tech hubs play a pivotal role in driving AI market growth. World-class research institutions such as MIT and Stanford University also contribute by advancing AI research and supporting commercialization, particularly in sectors like healthcare and finance, further accelerating regional growth.

The U.S. is at the forefront of technological advancement in AI integration, which is reflected in the high adoption rate of generative AI by major U.S. tech leaders. Deep learning, a foundational AI technology, plays a critical role in this expansion, enabling the analysis of massive and complex datasets with high accuracy.

A key trend driving this growth is automation, particularly in data preparation and model selection. These processes are increasingly being handled autonomously, reducing the need for human intervention and accelerating the overall data analytics workflow. As a result, AI in data analytics has seen widespread adoption across the U.S. economy, driving innovation and operational efficiency across sectors.

Asia Pacific is expected to witness the fastest growth during the foreseeable period. The regional market growth is driven by strong government support for AI adoption in key sectors and widespread digital transformation across industries. Governments across the region are actively promoting AI through funding initiatives, national strategies, and significant investments in research and development. These efforts create a favorable environment for innovation and adoption.

Industries are evolving by integrating cutting-edge technologies to improve operational efficiency, enhance decision-making with data-driven insights, and develop new business models. Additionally, continuous advancements in machine learning (ML), natural language processing (NLP), and other AI technologies enable more sophisticated and diverse applications of AI across sectors.

Value chain analysis

This initial stage involves scraping raw data from various sources using web scraping and other data acquisition methods. AI automates the data collection process and helps generate high-quality training datasets by cleaning and organizing the raw data for further use.

Key players: Scale AI, Appen, Labelbox, Qlik

At this stage, the collected data is properly stored and processed before being analyzed by AI models. This involves building data warehouses and data lakes to manage and store diverse data types efficiently.

Key players: Microsoft Azure, AWS, Google Cloud, Databricks, Snowflake, Cloudera

This final stage focuses on visualizing data and delivering actionable insights to end-users in an easy-to-understand format, enabling data-driven decision-making to grow businesses. Visualization tools such as Power BI and Tableau are commonly used here.

Key players:Microsoft, Salesforce, Tableau, Power BI

Plastic Compounding Market Companies

- BASF SE

- Asahi Kasei Plastics

- The Dow Chemical Company

- LyondellBasell Industries N.V.

- SABIC

- Covestro (Bayer Material Science)

These companies typically focus on niche applications, industries, or regions, and while individually smaller, together they hold about 15–20% of the market.

- Cloudera

- DataRobot

- Tableau (now part of Salesforce)

- TIBCO Software

- Sisense

- ThoughtSpot

- Smaller startups and local firms

Recent Developments

- In July 2025, HydroGraph Clean Power Inc., a Canadian producer of high-purity graphene, launched the Compounding Partner Program to expedite the use of its Fractal Graphene in thermoplastics.

(Source: compositesworld.com) - In April 2025, DePoly plans to launch a PET recycling showcase plant in Monthey, Switzerland, in summer 2025, capable of converting PET and polyester waste into high-quality raw materials.

(Source: ptonline.com)

Segments Covered in the Report

By Industry Vertical

- IT & Telecommunications

- BFSI

- Healthcare & Life Sciences

- Manufacturing

- Retail & E-commerce

- Government & Public Sector

- Other Industry Verticals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting