What is Electric Vehicles Engineering Plastics Market Size?

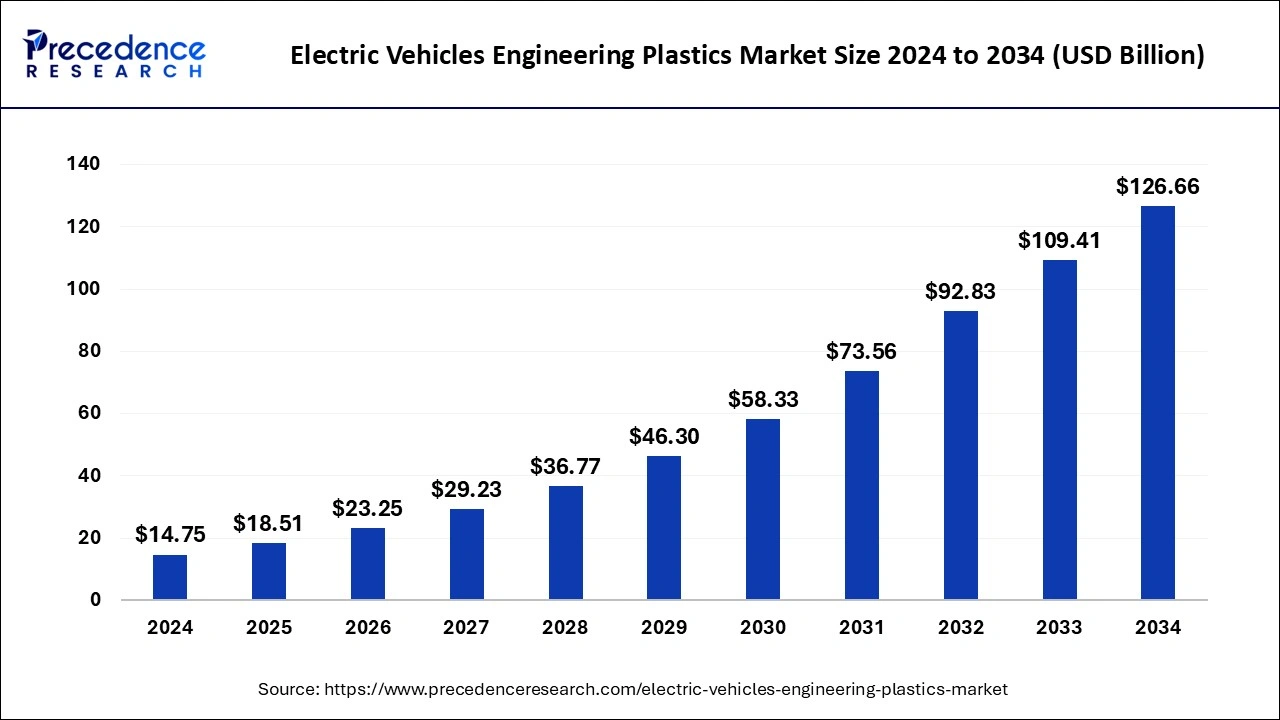

The global electric vehicles engineering plastics market size is estimated for USD 18.51 billion in 2025 and is anticipated to reach around USD 126.66 billion by 2034, growing at a CAGR of 23.98% from 2025 to 2034. The growth of the electric vehicles engineering plastics market is driven by the rising production and adoption of electric vehicles worldwide.

Market Highlights

- Asia Pacific dominated the global electric vehicles engineering plastics market in 2024.

- By Resin, the Electric Vehicle Battery (EVB) segment led the global market in 2024.

- By Component, the exterior application segment held a significant market share in 2024.

What are Electric Vehicles Engineering Plastics?

The need for plastics in the sector is anticipated to rise in response to consumer demand for lighter BEV/PHEV and HEVs and improved plastic performance in challenging environments. Growing environmental concerns, strict emission regulations that encourage electrification as well as weight reduction, greater use of anti-microbial polymers in EVs, and other reasons are important market drivers. America, the United Kingdom, India, Japan, China, Germany, and Canada are the principal nations with the greatest potential for industry expansion on a worldwide scale.

Since electric vehicles produce less heat than internal combustion engines (ICE), manufacturers may utilise polymers rather than pricey metals. Over the projection period, these elements are anticipated to fuel product demand. Plastics are appropriate for use in EVs due to their customizability, formability, affordability, performance, and organic fit. Low weight, part consolidation, moulding components which fit in non-linear areas, and noise and vibration dampening are important properties of plastics. The need for plastics in EVs is anticipated to be driven by these factors as well.

What is the Impact of AI on the Electric Vehicles Engineering Plastics Market?

Artificial intelligence (AI) positively impacts the market for electric vehicles engineering plastics. Integrating cutting-edge technologies like AI and IoT in the production processes of engineering plastics enhances the design process. AI algorithms can analyze material properties and performance metrics during production, which further helps to improve the properties of engineering plastics, leading to improved performance of EVs. Moreover, AI algorithms automate production processes, reduce errors, and minimize waste generation, enhancing production efficiency.

Electric Vehicles Engineering Plastics Market Growth Factors

- The increasing usage of engineering plastics in battery casings, connectors, and thermal management systems of EVs boosts the market.

- The rising demand for durable, heat-resistant, and lightweight materials in EVs fuels the growth of the market.

- There is a strong focus on improving vehicle performance. However, engineering plastics are used in the production of EVs to reduce weight, which further enhances battery performance and, ultimately, vehicle performance.

- The growing concern about environmental sustainability contributes to market expansion. Engineering plastics are made from recycled materials and can be recycled, aligning with the growing focus on sustainability.

- The increasing use of engineering plastics 3D printing to create vehicle models boosts market growth.

- Rising advancements in material science further contribute to market expansion.

Electric Vehicles Engineering Plastics Market Outlook

- Industry Growth Overview: The electric vehicles engineering plastics segment is anticipated to expand rapidly between 2025 and 2030 due to increasing EV production and lightweighting factors. Demand for high-performance polymers is particularly strong for battery enclosures, charging components, and interior applications, most notably in the Asia-Pacific region and Europe.

- Sustainability Trends: Car manufacturers are focused more on recyclable and bio-based alternatives to help meet emission targets and circular economy initiatives. Low-carbon polymer blends are being developed for EV components by companies such as SABIC and Covestro, as part of closed-loop recycling programs that align with worldwide green mobility legislation.

- Global Expansion: Many leading manufacturers are also expanding capacity to China, Germany, and Mexico to support regions dedicated to electric vehicle OEM clusters and to localize the supply chain. For example, LG Chem and Solvay say they are investing in the local polymer compounding plants aimed at new EV platforms.

- Significant Investors: Venture capital and private equity are taking an interest in engineering plastics start-ups that provide flame-retardant and high-heat-resistant materials. Investors such as Apollo Global Management and TPG are funding sustainable polymer-based technologies that are tailored to maximize thermal management and safety for EVs.

- Start-up Ecosystem:The start-up ecosystem in EV plastics is rapidly emerging with innovations in nanocomposite polymers, lightweight alloys, and recyclable thermoplastics. Start-ups such as Lummus Polymers (US) and PolyCycle (Germany) have secured funding to create scalable and sustainable alternatives for metal parts in EVs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.51Billion |

| Market Size in 2026 | USD 23.25 Billion |

| Market Size by 2034 | USD 126.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 23.98% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin, Components, Vehicle Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

A growing interest in electric vehicles and weight loss

- PHEVs, HEVs, and BEVs all in the civilization we live in today, transportation is significant. Fossil fuels have been utilised in vehicles for transportation since ancient times. As a result, there are growing worries about maintaining fossil resources for future generations. in particular because to the growing scarcity of resources and environmental issues. Thus, the necessity to safeguard the environment and the rise in pollution provide a significant challenge to both society and government worldwide.

- The advent of e-bikes is having revolutionary impacts as the ideal response to this problem. This is driving up demand for e-bikes, which in turn drives up demand for plastic, an essential raw material for electric vehicles. Further driving the need for electric vehicle plastics and, by extension, the market growth during the projection period is the trend of weight reduction in PHEV/ HEV and BEV vehicles.

Stringent mechanical and chemical property requirements for EV components propell innovations

- During the projection period, it is anticipated that the market for engineering plastics for electric vehicles will grow at a CAGR of 27.3%. Innovations in polyamide 6 reinforced with glass fibres, which is known for its insulation and flame-retardant qualities, make this clear. Additionally, the assembly of EV batteries is made simpler and lighter thanks to this technology.

- A battery module enclosure for electric vehicles has been created in partnership between resin supplier Lanxess and Korean auto part manufacturer Infac. Glass-fiber reinforced polyamide 6 is highly processable and enables the integration of complicated functionalities necessary for housing components, therefore manufacturers are boosting R&D in this material due to the strict mechanical and chemical property requirements for electric car components. As a result, producing fewer parts and streamlining the battery assembly process for electric vehicles is made easier.

Key Market Challenges

- Legislation for recycling electric vehicles engineering plastics - Engineering plastic recycling is governed by a number of laws, thus some plastic does not get recycled and forms permanent chemical connections. According to a research, millions of end-of-life automobiles are improperly managed each year in Europe and cause environmental issues. For recyclers, the wide range of plastic used in EVs is a hurdle. Governments from different nations enforced rules and laws on electric car engineering and plastic recycling. The market's ability to develop in terms of revenue is constrained by the high cost of technology and information recycling facilities as well as recycling regulation that restricts the use of engineering plastic in EVs.

Key Market Opportunities

- R&D in glass-fiber-reinforced polyamide-6 boosts prospect: Due to their capacity to satisfy strict mechanical and chemical property criteria for OEMs, a number of polymer producers are observing a significant market potential for glass-fiber reinforced polyamide-6. These are distinguished by parameters for heat management, shock absorption, and insulating quality.

- OEMs look for engineering plastics for electric vehicles to meet strict emission standards: International standards, particularly the numerous ISO/IEC and LSR Standards, have a significant impact on how OEMs use EV engineering plastics. The need for polymer solutions, which aid participants in the EV sector in adhering to rigorous emission standards regarding fuel economy and the utilisation of recyclable waste and residues, is increasingly generating cash for chemical businesses.

Segment Insights

Resin Insights

In 2024, the Polyurethane (PU) sector led the industry globally and was responsible for the biggest portion of revenue—more than 27%. It has improved chemical resistance, toughness, radiation resistance, water resistance, and other properties. In EV batteries, polyurethane increases power and enhances crash safety. Additionally, it is utilised in foam seats, cushions, electrical compounds, suspension bushings, and insulation panels. Over the projection period, these elements are anticipated to fuel the need for plastics in EVs. The PP segment, on the other hand, is anticipated to develop at the quickest rate over the projection period. Different grades of polypropylene are being developed by manufacturers in order to decrease the weight of the car and increase the range of electric vehicles. Its use extends to both interior and external components as well as structural and non-structural components. Additionally, it's employed in things like carpet fibres, bumpers, tailgates, and cable insulation.

Vehicle Type Insights

In 2024, the Electric Vehicle Battery (EVB) type category led the global market and was responsible for the highest revenue share of more than 75%. The need for plastics in EVs is rising as a result of the expanding population and strict emission laws. In order to enhance the range of the EV, BEV is focused on decreasing the vehicle weight, which is made possible by the use of plastics. Vehicle safety and durability are top priorities for manufacturers, who also use economical polymers for the battery compartment. It is anticipated that these developments would increase demand for plastic over costlier metals.

The Plug-in Hybrid Vehicle (PHEV) & Hybrid Electric Vehicle are two other types of electric vehicles (EVs) in addition to BEVs (HEV). PHEVs feature an alternate fuel supply to power the ICE in addition to batteries to power the electric motor. When the battery is totally discharged, the car turns over to the ICE. However, because they are more cost-effective and efficient than PHEVs, BEVs are favoured. HEVs combine an ICE with an electric engine that draws power from batteries. A smaller ICE and less idle time while the car is stopped may be possible because to the increased power the electric motor produces. These elements improve performance while while offering superior fuel efficiency.

Components Insights

In 2024, the exterior application segment controlled the majority of the market and generated more than 30% of the total revenue. The need for plastics is rising as more plastics are used in place of metal in various components of automobiles, such as the bumper, lights, door assembly, and other sections. Utilizing plastics, which function as an absorbent body in the case of an accident, reduces danger. Plastics also improve the looks of vehicles, reduce total vehicle weight, and offer the necessary strength. Interior components are more aesthetically pleasing than practical. Their main functions are to provide the interior of the car a nice appearance and make it comfortable. Plastics offer physical and electrical characteristics that are anticipated to drive the market, including heat resistance, chemical stability, abrasion resistance, and others. Metals were previously used for the under-the-hood parts of automobiles, but plastics are gradually taking their place since they contribute to lighter vehicles.

Some of the most common plastics used in automobiles include nylon, polypropylene, and polyphenylene sulphide, which offer advantages such component consolidation, resistance to corrosion, sound dampening, cost savings, and others. Given its strong strength and ability to tolerate high temperatures, nylon is the thermoplastic that is used in engine compartments the most frequently. Polyethylene can be employed in applications wherein moisture resistance is needed because of its low density, strong impact resilience, and robust durability. It may be utilised to produce inexpensive electrical insulations. PVC is also used to manufacture the sheathing for electrical cables.

The interior component sections include things like the steering cover, seat trim, steering lining, and roof lining. The goal of interior trim is to make the interior of the car comfortable and suitable. Wheel covers, headlamp covers, fenders, and other exterior trim components give the car its aesthetic appearance. Plastics reduce the cost of battery manufacture and eventually take the place of metallic components. Plastics, like PP, offer improved shock-absorbing capabilities and shield the batteries from harm from unintentional shocks. PET also serves as a separator and an excellent insulator that guards against short-circuiting.

Regional Insights

Asia Pacific: Asia's EV Plastics Surge: Powering the Electric Revolution

China Electric Vehicles Engineering Plastics Market Trends

China's ambitious EV production targets, widespread adoption of electric vehicles, and strong government support through incentives, subsidies, and policies promoting sustainable mobility. Demand for lightweight, high-performance engineering plastics, including polycarbonate (PC), polyamide (PA), polypropylene (PP), and reinforced thermoplastics, is rising sharply, as these materials are critical for battery enclosures, wiring harnesses, structural components, under-hood applications, and interior/exterior trims to improve vehicle efficiency, range, and safety.

Why is North America growing at the fastest rate in the electric vehicles engineering plastics market?

North America has been the region with the fastest growth, driven by widespread adoption of electric vehicles, strong sustainability goals, and rapid technological progress. Investment in polymer recycling and advanced manufacturing opened enormous prospects for plastics components used in electric cars and battery housings.

U.S. Electric Vehicles Engineering Plastics Market Trends

The U.S. has led the market with a robust electric vehicle infrastructure, advanced research & development facilities, and significant companies, such as Tesla, driving new materials innovations. In addition, government incentives and sustainability programs have created demand for advanced engineering plastics.

Greener Roads Ahead – Europe's Sustainable Shift in EV Plastics

Europe has seen steady growth in the electric vehicles engineering plastics market, based on strict emission laws, rapid electric vehicles adoption, and strong sustainability goals. Moreover, Europe's overall focus on recycling, innovation, and circular economy practices has created many new market opportunities. Simultaneously, sustainability imperatives and circular-economy targets (including greater recycled content in plastics) are pushing innovation in bio-based and recycled engineering plastics, which is reshaping supply-chains and material specifications across Europe.

Germany Electric Vehicles Engineering Plastics Market Trends

Germany led the European electric vehicles engineering plastics market for automotive manufacturing at an advanced level, requiring advanced engineering plastics in the design of electric vehicles. Moreover, supportive government policies and partnerships with chemical companies enabled material innovation with lightweight electric vehicles, thus assisting the nation's growth.

Charging Forward – Latin America's EV Plastic Awakening

Electric mobility uptake and investment in charging infrastructure continued to grow significantly in Latin America. This growth trajectory was supported by favourable polices, and the growing awareness around sustainable materials has created opportunities for engineering plastics in the manufacturing of EVs. Key drivers include rising EV adoption in countries such as Brazil and Mexico, growing investment in lightweighting technologies, and increasing use of high performance plastics in battery casings, wiring systems, and structural components.

Brazil Electric Vehicles Engineering Plastics Market Trends

Brazil led the Latin American market as a result of the increasing production of EVs, as well as increases in foreign investment into the market. Growth in Brazil's automotive industry and a strong push toward bio-based polymers have opened up opportunities for engineering plastics in the manufacture of lightweight components for EVs.

The New Wave – MEA's Entry into Electric Mobility Materials

Countries in the Middle East & Africa have seen modest but sustained growth in their markets due to government plans to diversify their economies and reduce their reliance on oil. Government investment in green transport and the EV assembly opened new opportunities for advanced engineering plastics. Key drivers include the abundant petrochemical feedstock availability in Gulf countries such as the UAE and Saudi Arabia, infrastructure investment in EV charging and mobility ecosystems, and localization efforts in polymer manufacturing.

United Arab Emirates (UAE) Electric Vehicles Engineering Plastics Market Trends

The United Arab Emirates (UAE) has led the Middle Eastern and African market as a result of its smart mobility projects, EV incentives, and partnerships with global automakers. The emphasis on innovation and clean transport has driven demand for engineering plastics in EV components. As the UAE accelerates its EV adoption and manufacturing ambitions, including government fleet conversions and strategic infrastructure build-out, the demand for high-performance engineering plastics is rising significantly in EV applications.

Electric Vehicle Engineering Plastics Market Companies

- BASF SE

- SABIC

- LyondellBasell Industries Holdings B.V.

- Evonik Industries

- Covestro AG, Dupont

- Sumitomo Chemicals Co. Ltd.

- LG Chem, Asahi Kasei

- LANXESS, INEOS Group

- Celanese Corp.

- AGC Chemicals

- EMS Chemie Holding

- Mitsubishi Engineering Plastics Corp.

Recent Developments

- In January 2025, BASF launched its flame retardant (FR) grade of Ultramid T6000 polyphthalamide (PPA). This upgraded solution replaces non-FR material, enhancing safety for the inverter and motor system in electric vehicles (EVs) with excellent thermal shock resistance and electrical isolation.

- In October 2023, Gunze Limited announced a plan to expand its Konan plant with a target completion date of March 2025 to support the growth of its engineering plastics business.

Segments Covered in the Report

By Resin

- Polypropylene (PP)

- Polyamide (PA)

- Polycarbonate (PC)

- Polyethylene (PE)

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Polyvinyl Butyral (PVB)

- Polybutylene Terephthalate (PBT)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene Terephthalate (PET)

- Others

By Components

- Steering & Dashboards

- Car Upholstery

- Bumper

- Door Assembly

- Exterior Trim

- Interior Trim

- Connector and Cables

- Battery

- Lighting

- Electric Wiring

- Others

By Vehicle Type

- Electric Vehicle Battery (EVB)

- Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting