What is the Electric Vehicle Polymers Market Size?

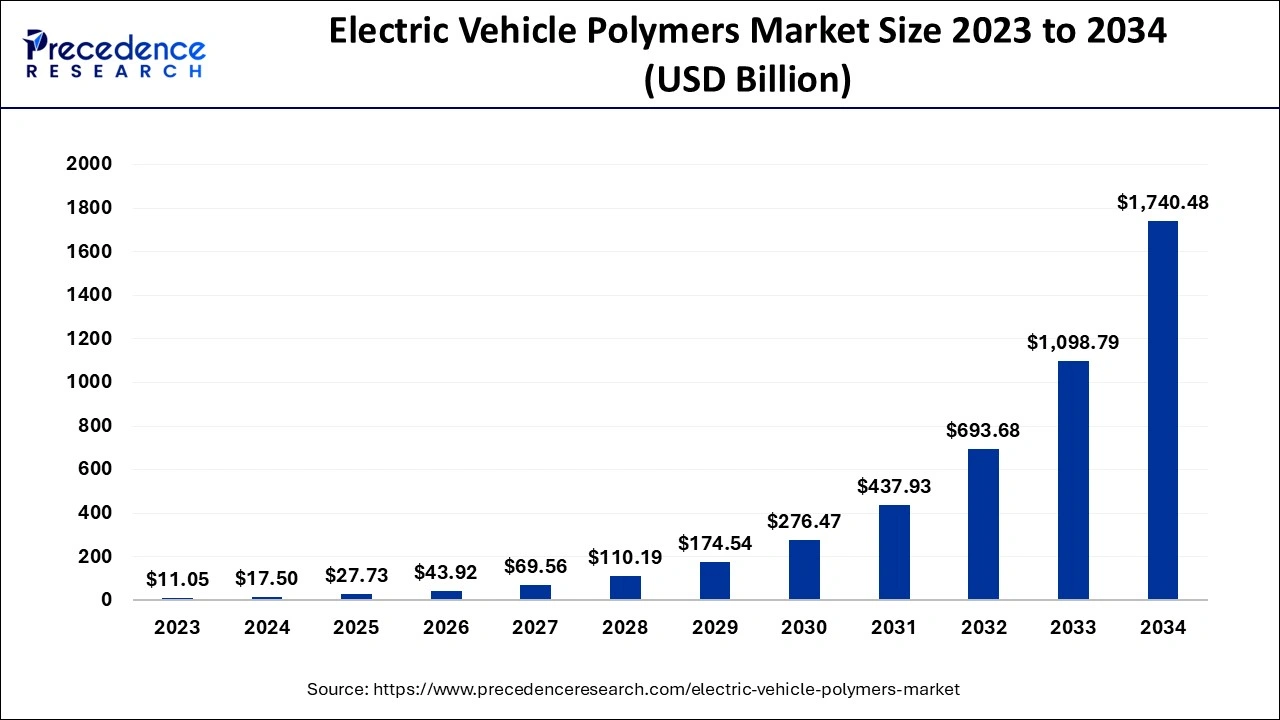

The global electric vehicle polymers market size is accounted at USD 27.73 billion in 2025 and predicted to increase from USD 43.92 billion in 2026 to approximately USD 2,382.17 billion by 2035, representing a CAGR of 56.10% from 2026 to 2035.

Electric Vehicle Polymers Market Key Takeaways

- By type, the elastomers segment accounted major market share of over 69% in 2025.

- By component, the interior segment held the highest revenue share in 2025.

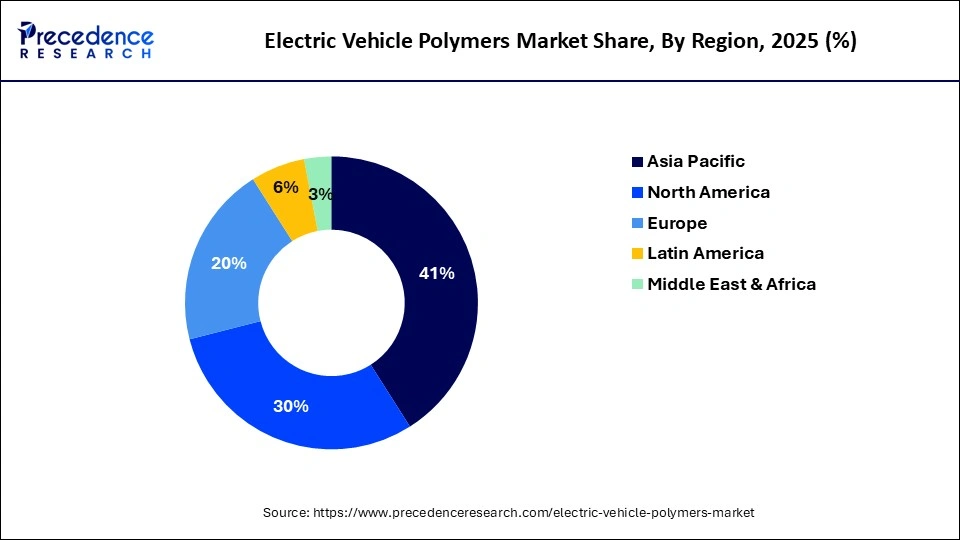

- Asia-Pacific region made up 46% of the total revenue share in 2025.

- North America and Europe regions are growing significantly over the forecast period.

What are Electric Vehicle Polymers?

Electric vehicle polymers are the types of plastics used in electric vehicles to lighten them up without sacrificing performance. Only materials that can replace metals are polymers since they share many of their characteristics, including heat resistance, abrasion resistance, stiffness, and toughness. For the makers of electric vehicles, replacing metals with polymers is a crucial strategy for reducing the total weight of the vehicles. A vehicle's heavy weight is a major obstacle to running entirely on electricity for a lengthy period of time, however some lighter materials can lower a vehicle's weight without compromising its strength and endurance. Whether a vehicle is using gasoline or electricity as fuel, its total weight may be decreased to increase fuel efficiency.

Electric vehicles (EVs) are more effective for daily use since lighter cars can go farther with fewer batteries. Long-term performance, weight reduction, and improved fuel economy are all provided by polymers. Over the past several years, polymer technology has advanced quickly, expanding the range of applications for it in the automobile industry. Over the course of the projection period, the market will see revenue growth due to strict laws aimed at reducing vehicle emissions and rising consumer demand for lightweight and fuel-efficient vehicles.

Additionally, a lithium-ion battery pack made of an innovative polymer can boost battery power, guarantee temperature stability, and expand EV range on a single charge. These battery packs help protect car batteries from any negative events. The market for electric vehicle (car) polymers is primarily driven by the rising demand for electric vehicles in the emerging economies of the Asia-Pacific region, including China and India, the rapid escalation of governmental regulations aimed at reducing CO2 emissions, and the development of EV charging infrastructure in both developing and developed countries.

Electric Vehicle Polymers Market Growth Factors

Demand for electric vehicle (car) polymers is rising as consumer taste for battery-powered, lightweight vehicles shifts, which is increasing market revenue growth. Government regulations that are encouraging and beneficial as well as incentives for EV owners have boosted the use of electric vehicles. In addition, the development of a wide range of electric automobiles with cutting-edge features and innovations is anticipated to increase demand for polymers, supporting the expansion of the worldwide electric vehicle (car) polymers market. However, changes in the price of polymer raw materials may partially restrain the market's revenue expansion for electric vehicle (car) polymers.

Market Outlook

- Industry Growth Overview:

The electric vehicle polymers market is experiencing significant growth, driven by massive EV acceptance due to environmental challenges and government support. Polymers are significant for lightweighting, thermal management, battery safety, and interiors, replacing metal to enhance range and expenses. - Global Expansion:

The Market is experiencing significant global expansion, driven by increasing EV adoption and the need for lightweight, efficient materials replacing metal in components like battery casings, interiors, and exteriors. Asia Pacific is dominant in the market due to surging demand for lightweighting and robust local supply chains. - Major investors:

Major investors in the market include large multinational chemical and materials companies that develop and supply high-performance polymer solutions to automotive original equipment manufacturers (OEMs).

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 27.73 Billion |

| Market Size by 2035 | USD 2,382.17 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 56.10% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, End User, Type, and Geography |

Market Dynamics

Key Market Drivers

- Increase in adoption of electric cars: The expansion of the electric vehicles polymer market is projected to be influenced by the rise in electric vehicle production and sales around the globe. The rise in usage to lower the weight of electric vehicles. Additionally, it is anticipated that favourable government laws and significant investments in the construction of charging infrastructure would have a good effect on the development of the polymer market for electric vehicles.

- BEV revenue share of the market is forecasted to increase constantly- The revenue of BEVs are predicted to rise at a positive rate as BEV technology advances along with battery capacity and energy density and as cars become more autonomous and networked. The use of polymers in the automotive industry is predicted to increase steadily, with growth rates dependent on the applications and types of plastic used in vehicles, regional recycling initiatives, and inter-polymer substitution.

Key Market Challenges

- Various legislations for electric vehicle polymers: Since there are many regulations and laws governing polymer recycling, certain polymers are not recycled and create irreversible chemical linkages. According to a research, millions of End-of-life Vehicles (ELVs) are improperly maintained each year in Europe and cause environmental issues. The wide range of polymers used in EVs makes recycling difficult. Governments from several nations enacted laws and rules governing the recycling of polymers. Electric vehicle polymers market growth is constrained by the high cost of technologies and sophisticated recycling facilities as well as recycling regulations that limits the use of polymers in EVs.

Key Market Opportunities

- Use of polymers in interiors: Over the projection period, the highest rise is anticipated in the usage of polymers in automotive interiors. An important element fueling the expansion of the industry is the ability of polymers to reduce the inadvertent danger and safety concerns related to the inside of the vehicle. Another reason promoting the segment's growth is the manufacturer's increased usage of polymers to reduce the total weight of the electric car.

- Increasing governmental support - The segment is expanding as a result of rising political support for favourable laws and regulations that will reduce global warming. Additionally, the manufacturing of long-range electric vehicles is receiving more attention from top manufacturers, which is promoting category growth. A totally electric model Y that can simultaneously transport seven passengers and their luggage was also introduced by Tesla in 2019. The torque of the front and rear wheels is managed by two separate electric motors in the car.

Component Insights

The interior section of components is undergoing a considerable shift as metals are being replaced by polymers, which have reduced accident risk and safety concerns. As a result, the interiors of electric cars now use polymers rather than metals, which also helps to lighten the total weight of electric vehicles. Due to its durability, aesthetic appeal, and ability to dampen noise, vibration, and harshness (NVH), polymer has proven to be the best material for automotive interior parts. During the projection period, all of these elements are anticipated to fuel the segment's expansion.

End-user Insights

Due to increased PHEV sales globally, which are fueling high demand for polymers, the plug-in hybrid electric vehicles category is anticipated to show a consistent CAGR in the global EV (car) polymers market over the forecast period. Vehicles that are plug-in hybrids provide a choice of fuels and can run on both internal combustion engines and electric motors. PHEV cars may run on conventional fuel or alternative fuel sources, such batteries and gasoline. In this market, polymers are in great demand because to the widespread use of polymer technologies, particularly carbon fibre for PHEV inside and exterior components.

Type Insights

Due to the widespread use of elastomers in different vehicle components including the braking system, chassis, tires, and interior portions of vehicles, the elastomers segment is anticipated to see a substantially quick rate of revenue growth over the projected period. The use of elastomers in the aforementioned sections improves force and impact resistance in both hot and low temperatures. The infrastructure for electric vehicles is still in its infancy, but it is driving the quick development of elastomeric materials that can survive extreme weather conditions. Additionally, the need for elastomers in electric cars is growing, which drives businesses to create new products. For instance, Freudenberg Sealing Technologies created thermally conductive elastomers for EVs in July 2020.

Due to the growing usage of engineering plastics by original equipment manufacturers to provide consumers with sophisticated EVs, the engineering plastics segment revenue is anticipated to account for the biggest revenue share in the worldwide market during the projected period. OEMs create items and sell them with some or all customised attributes such great machinability, dimensional stability, strength and safety, and design flexibility. Additionally, a few of the biggest OEM producers worldwide set an electrification objective by 2034.

Regional Insights

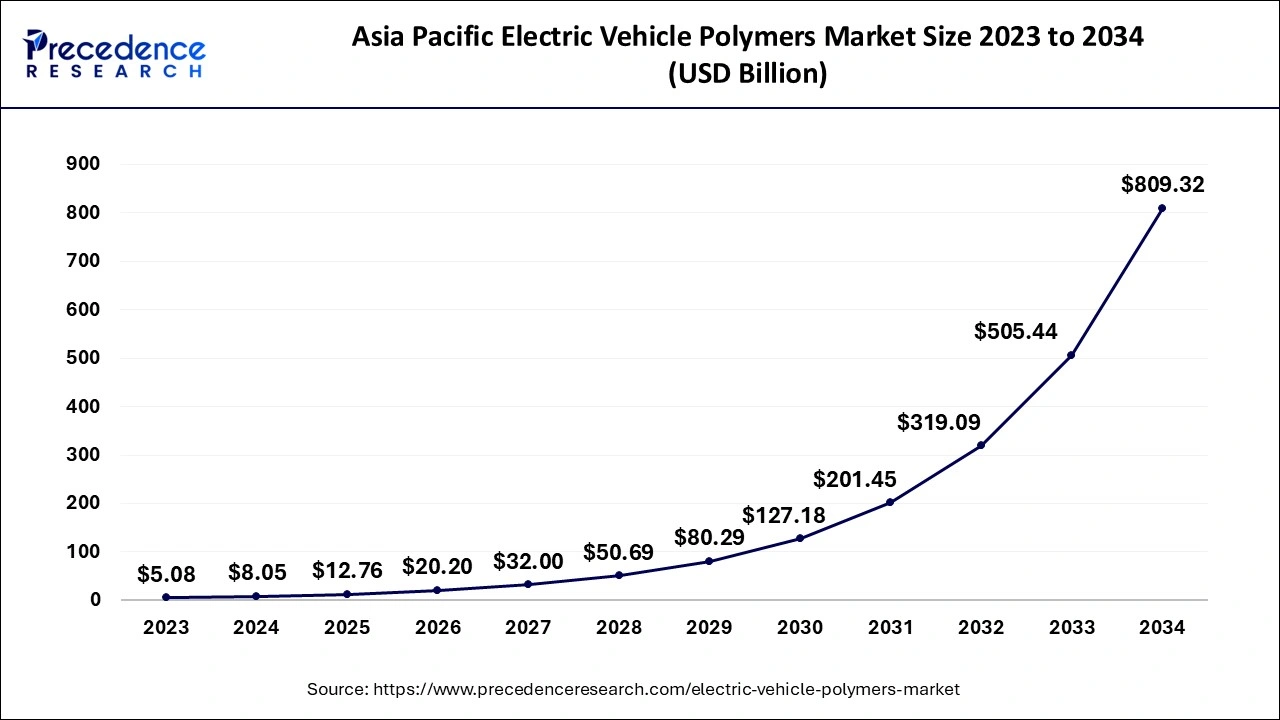

Asia Pacific Electric Vehicle Polymers Market Size and Growth 2026 to 2035

The Asia Pacific electric vehicle polymers market size is evaluated at USD 12.76 billion in 2025 and is predicted to be worth around USD 1,034.85 billion by 2035, rising at a CAGR of 55.20% from 2026 to 2035.

Asia Pacific: High EV adoption

During the projected period, the Asia-Pacific region is anticipated to lead the global market for polymers used in electric vehicle (car) manufacturing. Due to the rapid increase in the manufacture of electric automobiles in countries like China, Japan, and South Korea, among others, the area has become the largest user of electric vehicle (car) polymers. The primary drivers driving the expansion of the market for electric vehicle (car) polymers in the Asia-Pacific region are the rising concern for decreasing carbon footprints, growing government backing, and decrease in the total weight of electric automobiles. During the projection period, North America and Europe are also anticipated to present potential development possibilities.

India Electric Vehicle Polymers Market Trends

In India, polymers replace heavier metals to enhance EV range and performance, a significant factor in India's cost-sensitive environment. Growing guidelines such as PLI (Production Linked Incentive) for battery manufacturing and FAME (Faster Adoption & Manufacturing of EVs) increase overall EV manufacturing, thus growing component demand.

North America: Advanced Polymer Innovation

North America is the fastest-growing market, as growing sales, regulatory incentives (tax credits, fees), and long-term fuel/maintenance savings are speeding up the EV purchases in the U.S. and Canada. Constant tech development in polymers, such as thermal stability, electrical insulation, and fire resistance, meets EV requirements for safety and high voltage systems. Strong regulatory policies and significant investments by the main automakers in the North American EV industry bolster the entire supply chain.

U.S. Electric Vehicle Polymers Market Trends

In the U.S., strong government guidelines, incentives such as the Inflation Reduction Act, and increasing charging networks speed up EV sales, directly boosting demand for EV components. The U.S. is building huge battery production capacity, creating a parallel flow in demand for particular polymers for battery packs and components.

Europe: Rising pharmaceutical sector

Europe is significantly growing in the electric vehicle polymers market due to stringent EU regulations pushing EV acceptance, massive spending in local battery and auto production (German, French, UK makers), customer shift to green transport, and innovation in lightweight, sustainable polymers for better range and cost, all supported by charging infrastructure growth. Major European auto manufacturers are seriously investing in EV technology, including novel polymer solutions, which contribute to the growth of the market.

The UK Electric Vehicle Polymers Market Trends

The UK has high EV adoption, maintained by subsidies and guidelines pushing for net-zero, making a robust demand for EV components, including polymers. Growing government initiatives such as DRIVE35 are channeling billions into the UK EV industry, battery supply chains, and R&D, making the UK a home for innovation.

Value Chain Analysis – Electric Vehicle Polymers Market

- Raw Material Sourcing:

The raw materials for the vehicle polymers industry are primarily sourced from fossil fuels (crude oil, natural gas, and coal), with a growing shift toward renewable biomass and recycled plastics.

Key Players: BASF and Covestro - Material Processing:

The significant materials processing methods for polymers in the electric vehicle market are different molding and forming techniques, with injection molding, extrusion, and blow molding.

Key Players: SABIC and DuPont - Waste Management:

Waste management for vehicle polymers focuses on the waste hierarchy (reduce, reuse, recycle) using methods like mechanical/chemical recycling, energy recovery, and landfilling.

Key Players: Solvay and LG Chem

Top Companies in the Electric Vehicle Polymers Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Asahi Kasei Corporation |

Japan |

Diversified operations and strong emphasis on innovation and R&D |

In November 2025, Asahi Kasei licenses novel electrolyte technology to EAS Batteries for the market launch of an ultra-high power cell |

|

BASF SE |

Germany |

World's leading chemical company |

In 2024, BASF introduces an innovative 'Design-for-Recycling' polyurethane (PU) foam technology, enabling simplified and scalable recycling of PU foam. |

|

Celanese Corporation |

Texas |

Cost efficiency and strong cash flow |

Celanese's automotive chemicals and specialty polymers for the automotive industry enable the development of safer, lighter, and energy-efficient vehicles. |

|

Covestro AG |

Germany |

Advanced automotive and construction |

Covestro has introduced its next-generation Baysafe BEF flame-retardant polyurethane foam, a breakthrough in EV battery safety. |

|

DuPont de Nemours, Inc. |

USA |

Strong intellectual property portfolio and significant investment |

DuPont is a pioneering company in the field of polymers for electric vehicles, offering advanced material solutions that optimize performance, safety, and energy efficiency. |

Electric Vehicle Polymers Market Companies

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Covestro AG

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Kumho Polychem

- Lanxess AG

- LG Chem Ltd.

- Saudi Basic Industries Corporation

- Solvay

Recent Developments

- Saudi Basic Industries Corp. (SABIC), located in Riyadh, Saudi Arabia, and Heng Hiap Sdn Bhd (HHI), based in Malaysia, joined up in March 2021 to create circular polymers from improved recycling of discarded plastics that are headed for the ocean and recovered mixed plastic. According to SABIC, its clients will use circular polyolefins from the Trucircle range of the company as solutions in new products. SABIC's Trucircle portfolio consists of certified circular goods made from advanced plastic recycling, certified renewables made from bio-based feedstock, and mechanically recycled products.

- On March 22, 2022, BASF SE and Zhejian REEF Technology Co Ltd agreed into a strategic cooperation agreement to develop cutting-edge recyclate formulations for application in the packaging, automotive, and consumer industries. Through this arrangement, BASF SE will provide technical assistance and consulting for recycled polymer formulations carried out at BASF's test labs, as well as its recently announced IrgaCycle additive solutions. In a variety of end-use applications, IrgaCycle additive solutions help raise the proportion of mechanically recycled material.

- On March 8, 2022, a new sort of battery pack called a "Pure Performance Battery" was produced by Evonik Industries, which is working to provide lighter, more cost-effective, and more efficient battery EV solutions utilising composites. The novel holistic battery system concept is anticipated to be advantageous to the automobile sector. The fact that this battery pack is built on sheet moulding compound technology makes it a more affordable, secure, and lightweight alternative to metal-based options.

Segments Covered in the Report

By Component

- Powertrain System

- Exterior

- Interior

By End User

- Hybrid Electric Vehicles (HEV)

- Plug-In Hybrid Electric Vehicles (PHEV)

- Battery Electric Vehicles (BEV)

- Fuel Cell Electric Vehicle (FCEV)

By Type

- Engineering Plastics

- Acrylonitrile Butadiene Styrene (ABS)

- Polyamide

- Polycarbonate

- Polyphenylene Sulfide (PPS)

- Polyurethane

- Polypropylene

- Fluoropolymer

- Thermoplastic Polyester

- Others (Polyethylene, Polyacetal, Polyphenylene Ether, Polyphenylene Oxide, Polysulfone, Polyethersulfone, Polyetherimide, Polyphthalamide, Polyetheretherketone)

- Elastomers

- Synthetic Rubber

- Natural Rubber

- Fluoroelastomer

- Silicone Elastomer

- Others (Thermoplastic Olefin, Styrenic Block Copolymer, Thermoplastic Polyurethane, Thermoplastic Vulcanizate, Thermoplastic Copolyester, Polyether Block Amide)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content