Engineering Plastics Market Size and Forecast 2025 to 2034

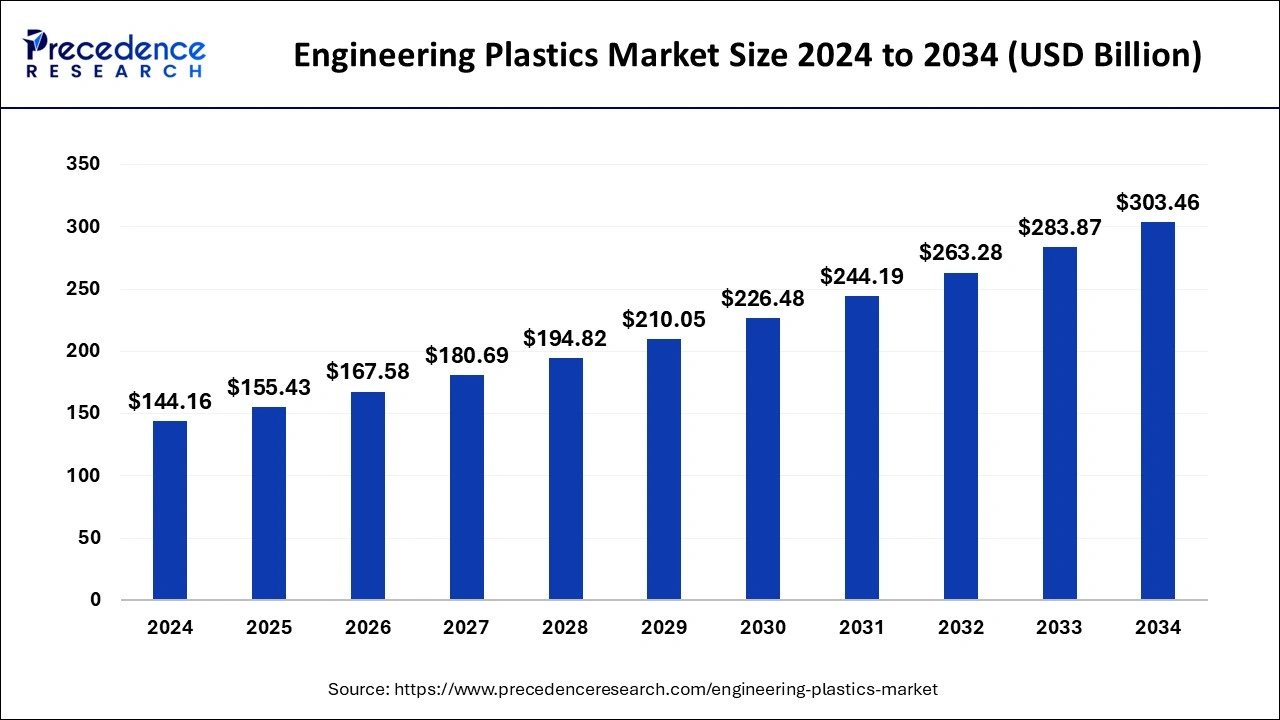

The global engineering plastics market size accounted for USD 144.16 billion in 2024 and is predicted to increase from USD 155.43 billion in 2025 to approximately USD 303.46 billion by 2034, expanding at a CAGR of 7.73% from 2025 to 2034. Rising mechanical properties may boost the market.

Engineering Plastics Market Key Takeaways

- The global engineering plastics market was valued at USD 144.16 billion in 2024.

- It is projected to reach USD 303.46 billion by 2034.

- The market is expected to grow at a CAGR of 7.73% from 2025 to 2034.

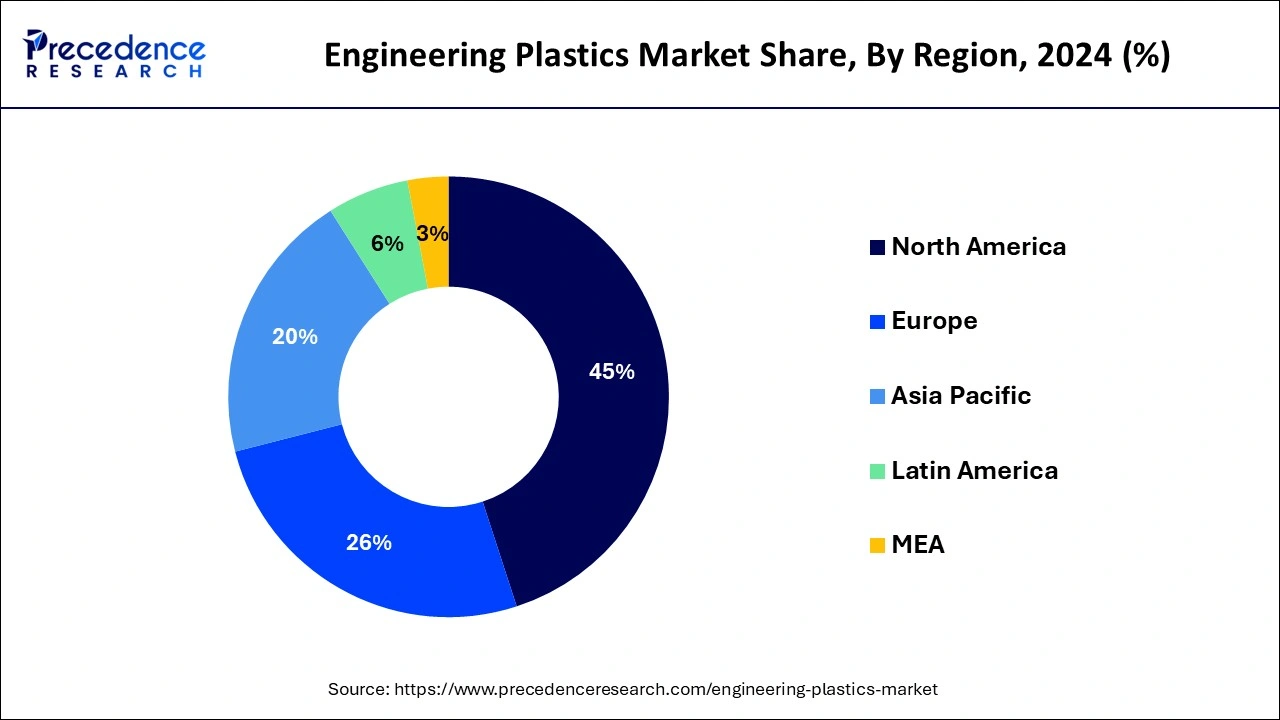

- Asia Pacific dominated the market with the highest market share of 45% in 2024.

- North America held a notable share of the market in 2024.

- By resin type, the styrene copolymers (ABS and SAN) segment has held the largest market share of 35% in 2024.

- By resin type, the polycarbonate (PC) is expected to grow at a notable CAGR during forecast period.

- By end-use, the automotive & transportation segment accounted for the major market share of 36% in 2024.

- By end-use, the electrical & electronics segment is expected to grow to the highest CAGR during forecast period.

Asia PacificEngineering Plastics Market Size and Growth 2025 to 2034

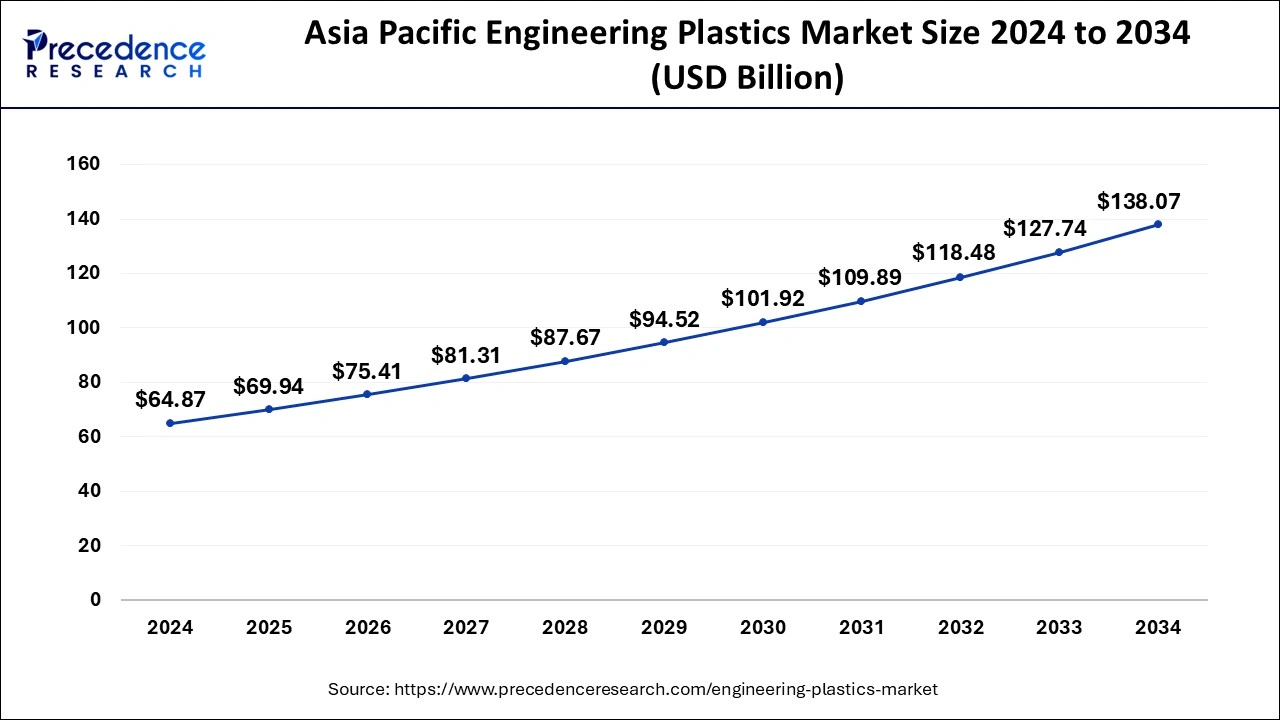

The Asia Pacific engineering plastics market size was exhibited at USD 64.87 billion in 2024 and is projected to be worth around USD 138.07 billion by 2034, growing at a CAGR of 7.85% from 2025 to 2034.

Asia Pacific dominated the engineering plastics market in 2024. The region is observed to sustain dominance over the forecast period. Rapid industrialization in Asia Pacific countries has resulted in increased demand for engineering plastics in various sectors such as automotive, electronics, packaging, and construction. Asia Pacific has been at the forefront of technological advancements in the plastics industry, including research and development of new engineering plastic materials and manufacturing processes.

North America held a notable share of the engineering plastics market by region in 2023. This occurred for several reasons, including its strong manufacturing capabilities, extensive infrastructure for research and development, strong demand from important industries like healthcare, electronics, and automotive, and emphasis on innovation and technological advancements. Additionally, the development of the engineering plastics sector in the area is frequently aided by advantageous legislative and policy frameworks.

- In 2022, the United States produced 125.5 billion pounds of resins. Of this total, thermoplastics accounted for roughly 86.5 percent of total production. On a dry weight basis, Linear low-density polyethylene (LLDPE) was the most produced resin that year, with an output of 23.3 billion pounds. High-density polyethylene (HDPE) accounted for a similar production volume, at 22.6 billion pounds.

Europe is expected to grow at a notable rate in the engineering plastics market by region, during forecast period. The area's emphasis on sustainability and environmental laws, which fuel demand for strong, lightweight, and recyclable materials like engineering plastics, is one important element. Furthermore, Europe has a robust automobile sector that uses engineering plastics more and more to reduce weight and improve fuel economy. Moreover, research and development expenditures, in conjunction with industry-academia cooperation, foster innovation and the creation of novel engineering plastic materials and applications in Europe.

More than 13 million tonnes of plastic produced in Germany found their way to export markets into 016, with around 10 million tonnes of foreign plastic making the reverse journey with almost 75% of all exports. The European single market is the biggest recipient of German plastic, followed by the remaining countries in Europe at 11%. In 2016, German plastic exports generated a turnover of almost Euro 23.5 billion.

Market Overview

The engineering plastics market refers to the class of materials known as engineering plastic, which is utilized in many different applications because of its excellent mechanical, thermal, chemical, qualities and electrical qualities. These polymers are engineered to endure extreme environments and provide exceptional functionality across multiple sectors, including automotive, aerospace, electronics, manufacturing, building & construction, consumer goods & appliances, industrial and pharmaceutical.

The engineering plastics market is fragmented with multiple small-scale and large-scale players, such as Polyplastics Co., Ltd., Mitsubishi Engineering-Plastics Corporation, Chevron Phillips Chemical Company LLC, Wittenburg Group, Ngai Hong Kong Company Ltd., Ginar Technology Co., Ltd, Grand Pacific Petrochemical Corporation, Piper Plastics Corp., Daicel Corporation, Nylon Corporation of America (NYCOA), Eastman Chemical Company, Evonik Industries AG, Ascend Performance Materials, Ravago, Teknor Apex, Trinseo LLC.

Engineering Plastics Market Growth Factors

- The engineering plastics market is driven by factors including rising mechanical properties and low risk of shock engineering plastics.

- The rising mechanical properties may boost the engineering plastics market.

- The low risk of shock engineering plastics may boost the engineering plastics market.

- The significant advancements in the production of additives can be the opportunity to grow the engineering plastics market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.73% |

| Market Size in 2025 | USD 155.43 Billion |

| Market Size in 2024 | USD 144.16 Billion |

| Market Size by 2034 | USD 303.46 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin Type and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising mechanical properties

The rising mechanical properties may boost the engineering plastics market. The rising mechanical qualities of engineering plastics increase their strength, durability, and resistance to wear and tear, which makes engineering plastics more attractive for various applications. Industries like automotive, aerospace, electronics, manufacturing, building & construction, consumer goods & appliances, and industrial and pharmaceutical seek materials that can increase their mechanical properties.

Low risk of shock

The low risk of shock engineering plastics may boost the engineering plastics market. The need for low risk of shock engineering plastics can driven by various industries like automotive, electronics, and medical devices. Additionally, the advantages of engineering plastics with increasing shock resistance include the durability of products, lower maintenance costs, and enhanced user safety.

Restraint

Environmental impact

Even while engineering plastics have advantages over other materials in terms of lightweight design and recycling, certain formulations may nevertheless be harmful to the environment. Not all engineering plastics are readily recyclable or biodegradable, and certain chemicals used to improve qualities or processing may have an ecological impact. It's crucial to weigh the benefits against any possible environmental effects.

Opportunity

Significant advancements in the production of additives

The significant advancements in the production of additives can be the opportunity to grow the engineering plastics market. The development of complex components and prototypes using engineering plastics is being revolutionized by digital manufacturing, which includes 3D printing. The aerospace industries, healthcare industries, and consumer goods industries are among those that are adopting additive manufacturing due to their capacity to customize components on demand and minimize material waste. The ongoing advancement in printing and materials technology enhances the performance and increases the variety of engineering plastics in additive manufacturing.

Resin Type Insights

The styrene copolymers (ABS and SAN) segment dominated the engineering plastics market by resin type in 2023. There are various reasons why styrene copolymers, like acrylonitrile butadiene styrene (ABS) and styrene acrylonitrile (SAN), are the industry leaders in engineering plastics. Their qualities, which include strong mechanical strength, impact resistance, heat resistance, and ease of processing, are well-balanced. They are also more affordable than a lot of other engineering polymers, which appeal to a variety of uses in markets, including consumer products, electronics, and automobiles. Their commercial appeal is further enhanced by their adaptability and availability in a range of grades.

The polycarbonate (PC) is expected to grow at a notable CAGR in the engineering plastics market by resin type, during the forecast period. Its special blend of heat resistance, transparency, and durability makes it appropriate for a variety of uses. Due to its excellent impact resistance, polycarbonate is a great material to employ in items that need to be strong and resilient, such as electronic devices and automotive components. Because it is far lighter than glass while maintaining its high strength, it is a desirable option for sectors looking to cut costs without compromising functionality. Polycarbonate is a recyclable material with possibilities for reuse, making it a desirable choice for manufacturers trying to lessen their environmental impact in light of the growing emphasis on sustainability.

End-use Insights

The automotive & transportation segment dominated the engineering plastics market by end-use in 2023. Because engineering plastics are lightweight, strong, and flexible in design, they are perfect for automotive applications where fuel economy and weight reduction are critical. Furthermore, engineering plastics can take the place of conventional materials like metal and glass, which lowers costs and improves vehicle performance. Furthermore, the usage of engineering plastics in the automotive industry has increased due to the growing demand for electric and hybrid vehicles, which depend on lightweight materials for improved energy efficiency. Because engineering polymers have superior electrical insulating qualities, they are the perfect choice for electrical and electronic components where dependability and safety are crucial.

Furthermore, engineering plastics can be made to fulfill certain specifications, which are crucial for electronic applications and include flame retardancy, chemical resistance, and thermal stability. In addition, the trend toward electronics miniaturization has raised the demand for high-performance, lightweight materials like engineering plastics, which provide dimensional stability and mechanical strength in small designs. Furthermore, there is a greater need for engineering plastics in the manufacture of electrical devices and components due to the expanding usage of cutting-edge technologies like 5G, the Internet of Things (IoT), and electric cars.

The electrical & electronics segment is expected to grow to the highest CAGR in the engineering plastics market by end-use, during the forecast period. The market for engineering plastics is anticipated to expand in the electrical and electronic sector as a result of the growing need for strong, heat-resistant, lightweight materials for a range of electronic devices and components. Excellent qualities like high strength, chemical resistance, and dimensional stability make engineering plastics perfect for use in electrical and electronic industry applications such as connectors, housings, and insulators. In addition, the need for engineering plastics in this market is fueled by the trend toward miniaturization and technical developments in electronics.

Recent Developments

- In April 2024, Nylon Corporation of America (NYCOA), a custom manufacturer of engineered nylon resins, announced the launch of NY-Clear, an amorphous 6I/6T nylon that is targeted for packaging and precision molded applications.

- In October 2023, Polyplastics launched Sarpek polyether ketone (PEK), an advanced material for metal replacement and applications requiring the highest heat resistance of any injection moldable resin without post-curing. Sarpek PEK is an engineering plastic in the upper end of the crystalline super engineering plastic hierarchy, an advancement upon polyetheretherketone (PEEK) that delivers a high crystallization rate and superior molding efficiency.

- In May 2023, Borealis launched Stelora, a new class of sustainable engineering polymer offering increased strength, durability, and a step change in heat-resistance capability. Stelora, which developed in collaboration with TOPAS Advanced Polymers, the world's leading producer of cyclic olefin copolymer (COC). It is created using a unique process that combines COCs, which are a relatively new class of clear, high-purity polymer, with polypropylene (PP).

Engineering Plastics Market Companies

- Grand Pacific Petrochemical Corporation

- Mitsubishi Engineering-Plastics Corporation

- Wittenburg Group

- Piper Plastics Corp.

- Chevron Phillips Chemical Company LLC

- Daicel Corporation

- Evonik Industries AG

- Nylon Corporation of America (NYCOA)

- Eastman Chemical Company

- Ascend Performance Materials

- Ravago

- Teknor Apex

- Trinseo LLC

- Polyplastics Co., Ltd.

- Ngai Hong Kong Company Ltd.

- Ginar Technology Co., Ltd.

Segment Covered in the Report

By Resin Type

- Styrene Copolymers (ABS and SAN)

- Fluoropolymer

- Ethylene Tetrafluoroethylene (ETFE)

- Fluorinated Ethylene-propylene (FEP)

- Polytetrafluoroethylene (PTFE)

- Polyvinyl Fluoride (PVF)

- Polyvinylidene Fluoride (PVDF)

- Liquid crystal polymer (LCP)

- Polyamide (PA)

- Aramid

- Polyamide (PA) 6

- Polyamide (PA) 66

- Polyphthalamide

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polyether Ether Ketone (PEEK)

- Polyethylene Terephthalate (PET)

- Polyimide (PI)

- Polymethyl Methacrylate (PMMA)

- Polyoxymethylene (POM)

By End-use

- Automotive & Transportation

- Electrical & Electronics

- Building & Construction

- Consumer Goods & Appliances

- Industrial

- Aerospace

- Medical

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting