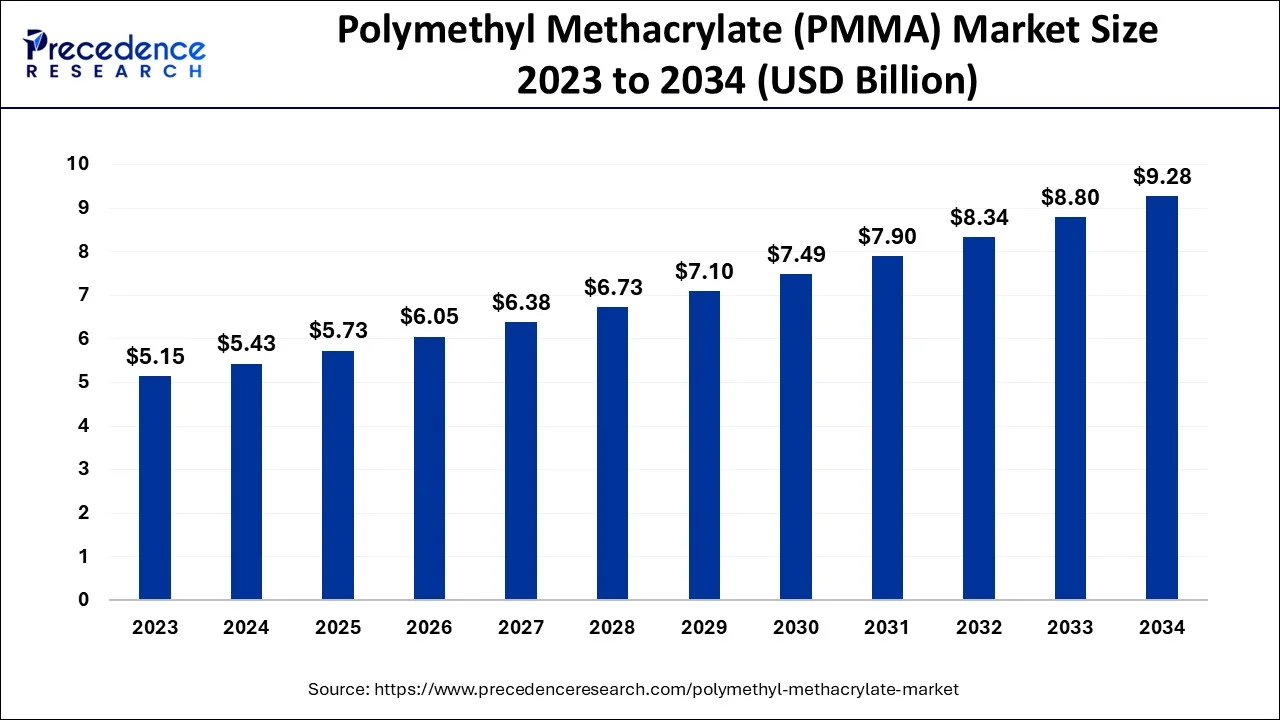

What is the Polymethyl Methacrylate (PMMA) Market Size?

The global polymethyl methacrylate (PMMA) market size is accounted at USD 5.73 billion in 2025 and predicted to increase from USD 6.05 billion in 2026 to approximately USD 9.75 billion by 2035, growing at a CAGR of 5.46% from2026 to 2035.

Polymethyl Methacrylate (PMMA) Market Key Takeaways

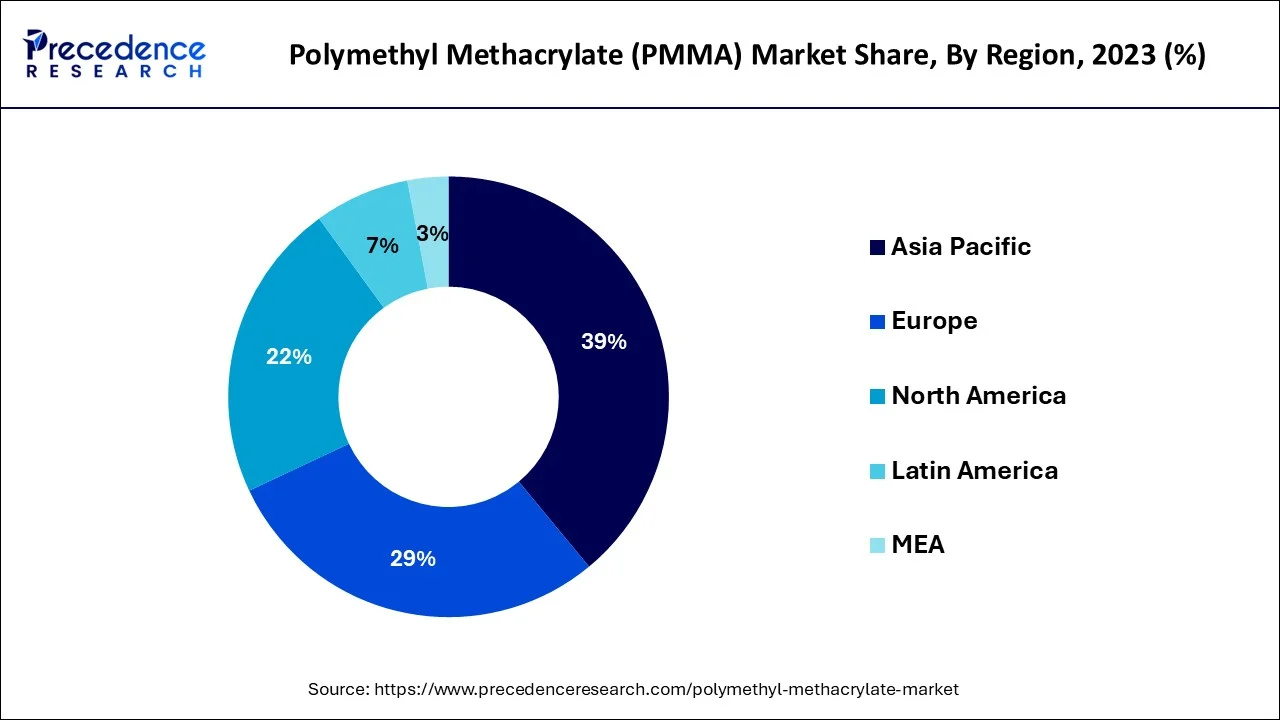

- Asia Pacific dominated polymethyl methacrylate (PMMA) market with share of about 39% in 2025.

- By form, the extruded films segment dominated the market in 2025.

Strategic Overview of the Global Polymethyl Methacrylate (PMMA) Industry

PMMA is a clear plastic with qualities that surpass those of glass. As a result, it is frequently utilized as a substitute for glasses in several sectors. Compared to comparable substances, polymethyl methacrylate was easier to create, cheaper to produce, and much more durable. It is employed to create a variety of products, including glass windows, auto glass, cell phone displays, aquariums, LCD panels, optic glasses, and lighting coverings. Due to the accelerated growth of its finished sectors, the market price for polymethyl methacrylate was rising. PMMA does have an advantage in the marketplace due to its superior eyecare qualities, including excellent transparency & Ultraviolet light protection. Additionally, because it is reusable plastics, it satisfies strict environmental safety requirements to gain commercial acceptance.

Artificial Intelligence: The Next Growth Catalyst in Polymethyl Methacrylate (PMMA)

AI is transforming the Polymethyl Methacrylate (PMMA) market by significantly enhancing operational efficiency, accelerating R&D, and driving sustainability initiatives. The integration of AI and automation into "smart factories" optimizes production processes, enabling real-time quality control, predictive maintenance, and reduced material waste.

In research and development, machine learning algorithms analyze vast datasets to predict and optimize material properties like heat resistance and impact strength, shortening the innovation cycle and enabling the design of next-generation PMMA composites. Furthermore, AI-driven supply chain analytics improve demand forecasting and inventory management, ensuring a more resilient and cost-effective supply chain.

Polymethyl Methacrylate (PMMA) Market Growth Factors

The industry for polymethyl methacrylate has been disrupted by the coronavirus epidemic. Due to widespread shutdowns and rigid social isolation policies, there was a large market for safety clothing and sterilizers worldwide. This resulted in a huge increase in the market for polymethyl methacrylate transparent plates, which were used all over the world as safety precautions to end the viruses from spreading. However, the desire for PMMA also fell as a result of the abrupt decline in sales in the transportation and automotive sectors, which hurt an adverse effect on the industry.

- In the longer term, rising prices for LED television sets and expanding utilization as a glasses replacement in different goods are the main development drivers for such polymethyl methacrylate business.

- On the other hand, it is anticipated that the cost of production will impede the expansion of the industry under consideration.

- The major segment was in the transportation and automotive sector, which is anticipated to expand significantly throughout the projection period. This is mostly caused by growing hygienic consciousness and a growing preference for cosmetics.

- Various growth possibilities are anticipated to arise during the forecast time frame as a result of the industry's transition towards PMMA, primarily as a replacement for polycarbonate.

- The Asia-Pacific area is predicted to control the international market. This is mainly because end-user sectors including electrical, automotive, construction, and electronics are demanding more products.

Market Outlook

- Market Growth Overview: The polymethyl methacrylate (PMMA) market is expected to grow significantly between 2025 and 2034, driven by growing demand from end-use industries, technological innovation, sustainability, and government initiatives and regulations.

- Sustainability Trends: Sustainability trends involve advancing circular economy principles, improving overall energy efficiency to address environmental concerns and comply with stricter regulations, and developing bio-based alternatives.

- Major Investors: Major investors in the market include Rohm GmbH, Mitsubishi Chemical Group, Arkema S.A., Chi Mei Corporation, and LG Chem.

- Startup Economy: The startup economy is focused less on new companies producing bulk virgin PMMA and more on innovators in specialized recycling technologies, bio-based materials, and niche applications like PMMA microspheres for advanced medical or cosmetic uses.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.73 Billion |

| Market Size in 2026 | USD 6.05 Billion |

| Market Size by 2035 | USD 9.75 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.46% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Form, Grade, End-use Industry, and Geography |

Market Dynamics

Key market Drivers

Market growth is anticipated to be driven by increased EV penetration and anticipated restoration from the effects of COVID-19

- The automotive sector uses poly methyl acrylate a lot because it is lightweight and weatherproof. It is used in body parts (such as lamp coverings and exterior and interior trimmings) and equipment for automobiles. It is utilized in headlights, side windows, windshield wipers, windscreens, headlights, rear lights, meter panels, wind deflectors, tail light coverings, speedometer needs to cover, and signalling lighting in addition to other external lighting fixtures. In mass transit, it is additionally utilized as an inside covering. Since 2019, decreased revenues, shifting customer preferences to EVs, altering operating framework, a trend favouring rental cars and coaster, decreasing per-capita expenditure, and economic slump in various nations have all had an impact on traditional automobile manufacturing. The market for automobiles fell in 2020 as a result of the COVID-19 outbreak and the accompanying halt of industrial activities.

Rising urbanization, industrialization, and commercial activity

- The industry for polymethyl pethacrylate was expanding due to rising urbanization, industrialization, and growing business interest worldwide. The construction and building industry has expanded as a result of growing disposable income & higher living standards, particularly in emerging economies. International design standards' implementation, rising economic expansion, and the expansion of infrastructural development are all factors promoting market expansion.

Technology development and increased construction financing

- The use of polymethyl methacrylate within the construction industry has expanded as a result of technological breakthroughs and expanding expenditures in the construction of workplaces, industries, and production facilities. The need for methacrylate first from the automobile industry has increased due to growing demands for modernized vehicles and the requirement to keep the weight down in cars for enhanced quality.

Key market challenges

- Adverse effects on the environment: PMMA is frequently used for sheets since it is affordable and highly accessible. But it also has detrimental effects on the ecosystem. Consumption should decline as a result of increased awareness of these detrimental environmental effects. These elements make the expansion of the PMMA sector difficult. According to a computed calculation, one kilogram of acrylic fiber causes the release of about 5.5 kilograms of co2 into the environment throughout manufacturing. Acrylic sheets' carbon breakdown produces carbon dioxide particles breaking when exposed to sunshine. When carbon dioxide emissions enter the ozone layer, they significantly reduce it.

- The recycling of acrylic materials is difficult: Clear acrylic sheets can be recycled. Recycling is a complicated and complicated process, though. Using perspex and reducing huge pieces of acrylic substance into tiny chunks, followed by additional stages, is the suggested way of recovering acrylic films. The difficulty in reusing acrylic substances has resulted in an excessive number of debris being dumped worldwide, which has an impact on ecosystems supporting flora and wildlife. In areas where formations of acrylic by products interfere negatively with the breakdown of co2 and o2, plants cannot develop.

Market Opportunities

- Bio-composite PMMA: Petroleum products are used to make PMMA, which produces products that are harmful to the environment and emit carbon dioxide. But because of the rising need for PMMA, alternative production techniques that make use of bioenergy and biochemical functions have been discovered. As a result, an enzyme that can create PMMA has been produced, leading to the creation of microbially PMMA remedies. In addition to having a lower environmental footprint, organic PMMA can be designed to have a variety of different properties. As an illustration, take Arkema's Plexiglas Renew organic thermoplastic polymer. Its composition incorporates more than 25% bio-renewable material, giving it better chemical characteristics than traditional thermosets.

- Outstanding impact and corrosion durability: a dramatic improvement in machinability due to better-molten matrix, high solubility producing outstanding visibility, and enhanced corrosion and thermal characteristics are only a few of the improved qualities. To achieve this, qualities including optical, resistance to abrasion, color tolerance, and material aesthetics were not significantly changed.

Segment Insights

Form Insights

Extruded films are anticipated to represent the biggest and most rapidly expanding PMMA market throughout the forecast timeframe. Optic purity, weather resistance, a lustrous finish, convenience of manufacture, and other benefits are offered by extruded sheets. Additionally, extruded sheets offer a more affordable option than other forms. Extruded sheets make up the bulk of the market. Due to the strong demand for high-quality sheets across numerous manufacturing industries, it had approximately 53.5% of the worldwide market volume in 2022. Such sheets are perfect for situations where complicated forms are needed due to their superior width flexibility. Extruded sheets also offer cost-effectiveness because they are made with affordable methods.

End User Insights

The PMMA industry's leading segment sector category is anticipated to be the automobile sector throughout the projected timeline. PMMA is employed in the automotive sector for parts of the body, headlamp coverings, and exterior and interior decoration. One of the main factors propelling the mobile industry is the increased use of EVs with a rising preference for personal mobility. Due to its high-performance qualities, PMMA is chosen among conventional polymers and other substances. It is also a lightweight material. As a result, the PMMA market is anticipated to develop throughout the projected period due to such a shifting regulatory landscape and the government effectively implementing EVs.

Regional Insights

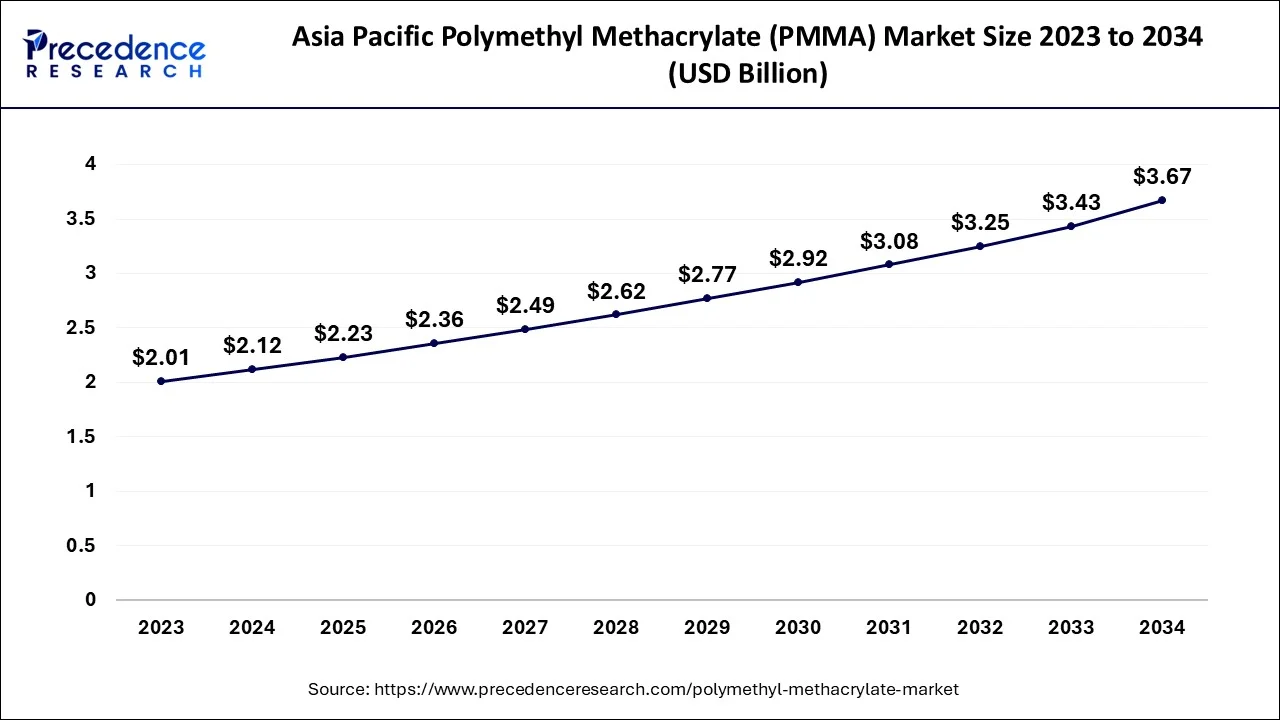

What is the Asia Pacific Polymethyl Methacrylate (PMMA) Market Size?

The Asia Pacific polymethyl methacrylate (PMMA) market size is evaluated at USD 2.12 billion in 2025 and is predicted to be worth around USD 3.87 billion by 2035, rising at a CAGR of 5.67% from 2026 to 2035.

The region with the greatest CAGR throughout the forecast period is the Asia Pacific. It is projected that rising per capita revenue in nations like China and India will drive car sales, ultimately driving up product demand. To take advantage of the attractive potential in the region, global corporations are making significant investments in the area and moving their production sites there.

In the coming years, it is anticipated that the Middle East and Africa would overtake Europe as the second-largest consumer. The combination of big industry players with local manufacturers and several ongoing projects will probably have a beneficial effect on the market dynamics. The market also has enormous potential in Central and South American developing nations, where there was a spike in sales for signage and projections during Rio Olympics throughout Brazil (2016). The 2018 Middle American & Caribbean Olympics also helped the local industry expand. This region's growth is driven by rapid urbanization, increased R&D activity, and the expansion of foreign players. PMMA is in higher demand as a result of expanding automotive adoption, industry expansion in developing nations like India, China, and Japan, and an increase in building and development operations. The market for polymethyl methacrylate in the sector has been further spurred by growing uses in the pharmaceutical and electronic businesses.

Why is the UK Polymethyl Methacrylate (PMMA) Market Growing?

The UK market is growing due to rising demand in automotive, electronics, and construction sectors, where lightweight, durable, and transparent materials are preferred. Increased use in smartphone displays, lighting, and optical applications, coupled with environmental benefits and recyclability, is driving adoption. Additionally, technological advancements in PMMA manufacturing and expanding end-use industries are further supporting market growth across the UK.

What Factors Are Driving the Expansion of the North American Polymethyl Methacrylate (PMMA) Market?

The North American market is growing due to rising demand from automotive, electronics, and construction sectors, where lightweight, durable, and transparent materials are preferred. Increasing applications in LED lighting, optical devices, displays, and consumer electronics are driving adoption. Additionally, technological advancements in PMMA production, a focus on sustainable and recyclable plastics, and strong industrial infrastructure are supporting consistent market growth across the region.

Why is the U.S. PMMA Market Experiencing Significant Growth?

The U.S. market is expanding due to growing applications in automotive components, electronics, and construction materials that require transparent, durable, and lightweight plastics. Rising demand for LED lighting, display panels, and optical devices is boosting consumption. Additionally, advancements in PMMA manufacturing, focus on recyclable and eco-friendly materials, and strong domestic industrial infrastructure are driving steady growth in the U.S. market.

What is Fueling the Rapid Growth of the Asia-Pacific Polymethyl Methacrylate (PMMA) Market?

The Asia-Pacific market is increasing due to rising demand from automotive, electronics, and construction industries, fueled by rapid urbanization and industrial growth. Expansion in applications like LED lighting, displays, and optical devices is driving adoption. Additionally, cost-effective manufacturing, government support for advanced materials, and growing awareness of lightweight, durable, and recyclable plastics are further contributing to the region's rising PMMA consumption.

Why is the China Polymethyl Methacrylate (PMMA) Market Expanding Rapidly?

The China market is growing due to increasing investments in high-tech electronics, solar panels, and advanced lighting solutions. Rising consumer demand for smartphones, tablets, and automotive components featuring transparent and durable materials is driving usage. Additionally, expansion of the domestic manufacturing base, focus on environmentally friendly plastics, and innovations in high-performance PMMA grades are further accelerating market growth across multiple industrial and consumer applications.

Value Chain Analysis

Feedstock Procurement

- Feedstock procurement for PMMA focuses on sourcing methyl methacrylate (MMA), the primary monomer.

- Selection of the production process depends on cost, raw material availability, and environmental impact.

- Efficient sourcing ensures consistent PMMA quality and supply for various industrial applications.

Key Players: Mitsubishi Chemical, Evonik Industries, LG Chem, Arkema, BASF.

Chemical Synthesis and Processing

- PMMA is produced by polymerizing methyl methacrylate (MMA) monomers, typically via free radical polymerization.

- Common production methods include bulk, suspension, and emulsion polymerization, with suspension and emulsion techniques preferred for ultra-high molecular weight PMMA.

- These methods ensure desired mechanical and optical properties for diverse industrial applications.

Key Players: Arkema, Mitsubishi Chemical, Evonik Industries, LG Chem, Sumitomo Chemical.

Quality Testing and Certification

- PMMA undergoes quality testing and certification to assess its chemical composition, physical properties, and performance.

- Tests ensure safety, purity, durability, and compliance with industry standards.

- Certification is critical for applications in automotive, electronics, construction, and medical industries.

Key Players: SGS, Intertek, TÜV SÜD, Bureau Veritas, UL Solutions.

Polymethyl Methacrylate (PMMA) Market Companies

- 3A Composites GmbH: 3A Composites supplies PMMA-based sheet materials used in signage, display, architectural glazing, and industrial applications. Their products focus on clarity, durability, and ease of fabrication for commercial and architectural uses.

- Arkema SA:Arkema offers high-quality PMMA resins and transparent polymers for automotive lighting, construction glazing, medical devices, and consumer products. Their materials emphasize optical clarity, weather resistance, and reliable mechanical performance.

- PTT Global Chemical (PTTGM): PTTGM produces PMMA resins for use in lighting, electronics, and construction applications, offering cost-effective, high-transparency materials tailored for mass production and large-volume manufacturing.

- United S.A.: United S.A. supplies PMMA sheets and custom polymer components for consumer goods, signage, and industrial applications, focusing on consistent transparency, ease of processing, and long-term durability.

- Plaskolite LLC: Plaskolite manufactures acrylic PMMA sheets and molded products for glazing, displays, automotive parts, and lighting uses. Their offerings are known for high transparency, impact resistance, and suitability for both consumer and industrial applications.

Other Major Key Players

- ALBIS Distribution GmbH & Co. KG

- Asahi Kasei Corporation (Japan)

- CHI MEI Corporation (Taiwan)

- Double Elephant Optical Material

- Evonik Industries AG (Germany)

- Gehr Plastics, Inc. (U.S.)

- Heilongjiang Zhongmeng Longxin Chemical Co., Ltd.

- Kolon Industries, Inc. (South Korea)

- Kuraray Co., Ltd (Japan),

- LG Chem Ltd. (South Korea),

- Lotte Chemical Corporation (South Korea),

- Makevale Group

- Mitsubishi Chemical Holdings Corporation (Japan),

- Nippon Shokubai Co., Ltd.

- Polycasa N.V. (Belgium)

- Röhm GmbH (Germany),

- RTP Company

- Saudi Arabia Basic Industries Corporation (Saudi Arabia)

- Shanghai Jingqi

- Sumitomo Chemical Co., Ltd. (Japan),

- The Dow Chemical Company (U.S.)

- Toray Industries, Inc. (Japan),

- Trinseo S.A. (US),

- Unigel S.A.

Recent Developments

- Trinseo accomplishes the procurement of the PMMA business sector from Arkema in 2021. With the acquisition of Trinseo, PMMA, and MMA goods, as well as technologies seven, as well as technologies up to seven were added.

- Aristech Surfaces LLC was acquired by Trinseo S.A. in 2021. The manufacturer of PMMA continuously casting and surface layer panels in North America was Aristech Technologies.

- Plazit-Polygal (Israel), a producer of engineering thermoset sheets, was bought by Plaskolite LLC in 2021. The activities and properties of Plazit-Polygal throughout South America, North America, and Europe are anticipated to be acquired by Plaskolite.

- On the United States Gulf Coast, Rohm GmbH constructed a factory in 2021 that can produce 250,000 tonnes of methyl methacrylate annually.

- In Niihama Town, Japan, Sumitomo Chemicals intended to build a trial facility for recovering acrylic resin in 2021. In 2022, the project is scheduled to be finished.

- In 2018, the Saudi Arabian production facility for polymethyl methacrylate (PMMA) and methyl methacrylate monomers will begin operations thanks to a combined venture between Mitsubishi Chemical Company and Saudi Basic Industry Organization.

- 2018 saw the acquisition of the US polycarbonate sheets production plant of Covestro by Plaskolite LLC. The company's performance in the United States is anticipated to grow as a result of the acquisition.

Segments covered in the report

By Form

- Extruded sheet

- Cast acrylic sheet

- Cell Cast

- Solid Surface

- Continuous

- Composite

- Pellets

- Beads

- Others

By Grade

- General purpose grade

- Optical grade

By End-use Industry

- Signs & displays

- Signage

- Display boards

- Point of sale boards

- Construction

- Residential

- Multi-Family

- Commercial

- Industrial

- Barriers

- Shatterproof Glass

- Noise Barriers

- Flooring

- PMMA Resin Flooring

- High-End Decorative Flooring

- Paints and Coatings

- End-use

- Type

- Automotive

- Body parts

- Lamp covers

- Interior & Exterior trim

- Passenger car

- Light Commercial

- Heavy Commercial Vehicles

- Quad/ATV & Side by side

- Snowmobile

- Recreational Vehicles

- ICE vehicles (Petrol, diesel, Other)

- Electric Vehicles

- Automotive Part and Accessories

- Vehicle Type

- Fuel Type

- Lighting Fixtures

- Light Guide Panels

- Solar Equipment

- Electronics

- Mobile Phones, Tablets, and LCD screens

- Others

- Marine

- Personal Watercraft

- Commercial

- Sport watercraft/Jet Skis

- Glazing and Windows

- Consoles

- Interior Surfacing

- Sinks

- Shower Pans

- Countertops

- Wall Cladding

- Outboard Engine Covers

- Portable Tables

- Others

- Type

- By Accessories and Parts

- Healthcare

- Healthcare Devices

- Furniture

- Wall Cladding

- Sanitary ware

- Others

- Agriculture

- Glazing/ Windows

- Agriculture Machinery & Vehicles

- Consumer Goods

- Exercise Equipment

- Homeware

- Others

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content