Methyl Methacrylate (MMA) Monomer Market Size and Forecast 2025 to 2034

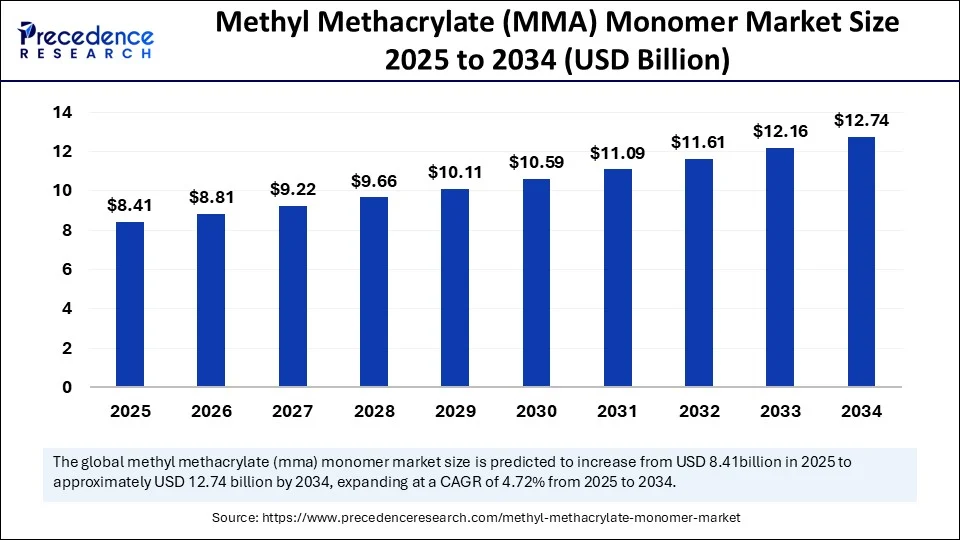

The global methyl methacrylate (MMA) monomer market size accounted for USD 8.03 billion in 2024 and is predicted to increase from USD 8.41 billion in 2025 to approximately USD 12.74 billion by 2034, expanding at a CAGR of 4.72% from 2025 to 2034.The increased industrial demand for lightweight and durable materials has increased the use of methyl methacrylate monomers. Furthermore, the growing emphasis on the adoption of bio-based MMA monomers manufacturing technologies is further contributing to the market growth.

Methyl Methacrylate (MMA) Monomer MarketKey Takeaways

- In terms of revenue, the global methacrylate (MMA) monomer market was valued at USD 8.03 billion in 2024.

- It is projected to reach USD 12.74 billion by 2034.

- The market is expected to grow at a CAGR of 4.72% from 2025 to 2034.

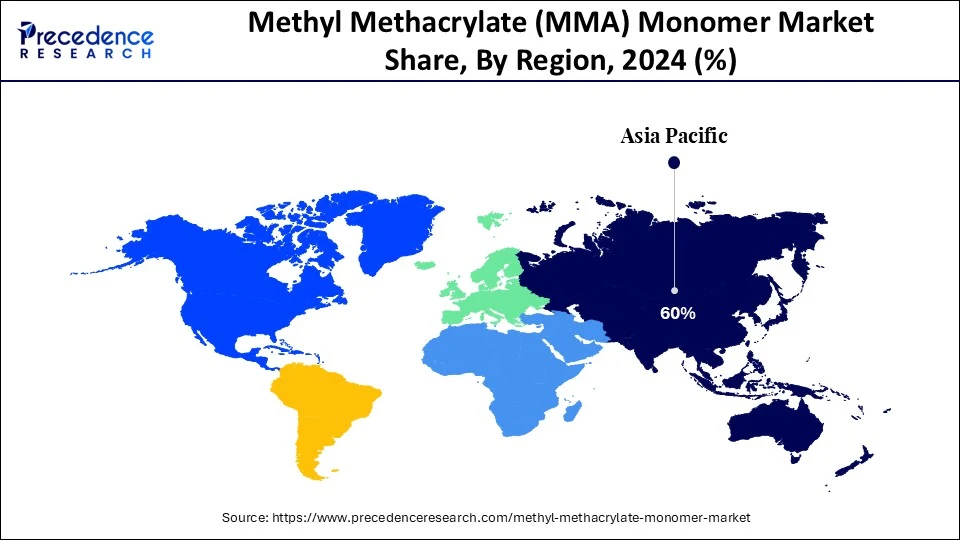

- Asia Pacific dominated the global market with the largest market share of 60% in 2024.

- The Middle East and Africa are expected to grow at a significant CAGR from 2025 to 2034.

- By production method, the acetone cyanohydrin (ACH) process segment held the biggest market share of 55% in 2024.

- By production method, the ethylene-based process segment is expected to grow at a notable CAGR between 2025 and 2034.

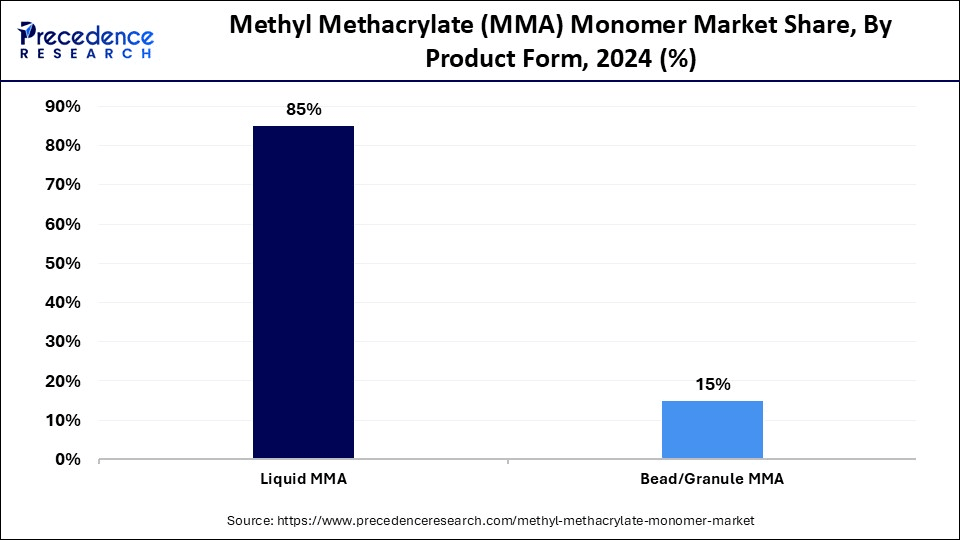

- By product form, the liquid MMA segment contributed the biggest market share of 85% in 2024.

- By product form, the bead/granule MMA segment will grow at a considerable CAGR between 2025 and 2034.

- By application, the polymethyl methacrylate (PMMA) production segment dominated the market.

- By application, the automotive parts and lighting segment will grow at a CAGR between 2025 and 2034.

- By end-user, the building and construction segment led the market with a share of approximately 35% in 2024.

- By end-user, the medical and healthcare segment will grow at a high CAGR between 2025 and 2034.

AI Role in Methyl Methacrylate Monomer Production

Artificial Intelligenceis playing a transformative role in the methyl methacrylate (MMA) monomer market by enhancing production efficiency, enabling fast R&D for novel formulations, and enhancing quality control. AI integration in manufacturing facilities helps to optimize the production process and enable real-time monitoring and enhancements. AI-driven predictive maintenance helps manufacturers to enhance the overall efficiency of the production process. Additionally, the growing emphasis on sustainable production methods has boosted acceptance of AI integration to develop bio-based methyl methacrylate monomer production.

Asia Pacific Methyl Methacrylate (MMA) Monomer Market Size and Growth 2025 to 2034

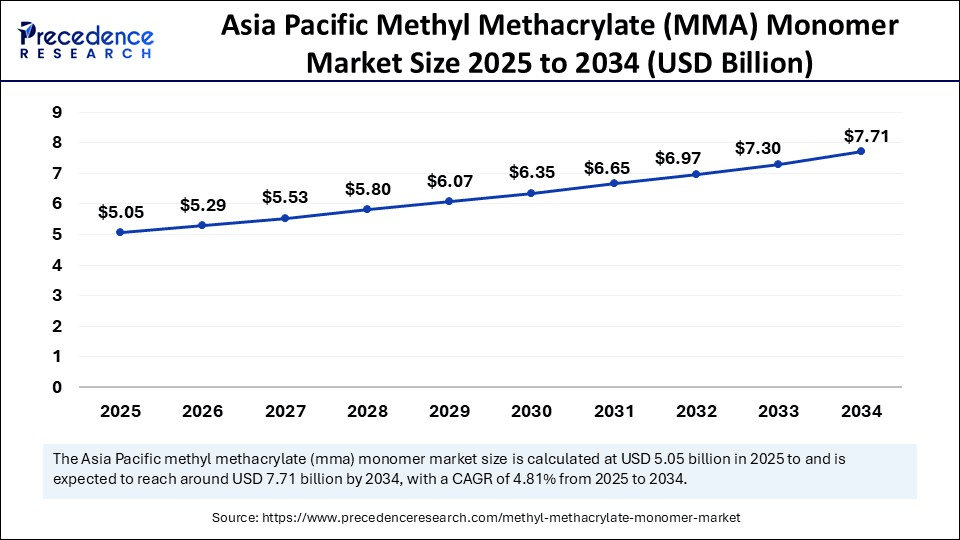

The Asia Pacific methyl methacrylate (MMA) monomer market size was exhibited at USD 4.82 billion in 2024 and is projected to be worth around USD 7.71 billion by 2034, growing at a CAGR of 4.81% from 2025 to 2034.

Asia Pacific Methyl Methacrylate (MMA) Monomer Market

Asia Pacific dominates the global methyl methacrylate (MMA) monomer market, driven by the region's robust manufacturing sector, rising building and construction activities, expanding automotive and electronic industries, and rapid urbanization and industrialization. The growing middle-class population and availability of disposable income in Asia are promoting spending on advanced products like electronics and consumer goods, driving the demand for methyl methacrylate monomers. Strong focus on technological advancements like high-performance MMA grades and demand for sustainable production methods are driving innovation and adoption of methyl methacrylate monomer in Asia.

The joint venture for optimizing MMA supply chains, government grants for low-emission R&D for MMA manufacturing, and novel regulations concerning VOCs in paints and coatings are key initiatives fostering the adoption of methyl methacrylate monomers in Asian industries. Despite robust capabilities and growing focus on sustainable practices, Asia has experienced a slight decline in the market in Q2 2025.

- In Q2 2025, the price of methyl methacrylate has decreased by 1.9% on average, settling at USD 1,740/MT by June, due to overcapacity in China and decreased demand from the sector across India and Southeast Asia.(Source: https://www.chemanalyst.com)

China is a major player in the regional market due to the country's vast PMMA production capabilities. The strong manufacturing capabilities and large-scale production facilities, especially in the plastic industry, have boosted innovation, development, and adoption of methyl methacrylate monomers in Chinese industries.

Middle East and Africa Methyl Methacrylate (MMA) Monomer Market

The Middle East and Africa are the fastest-growing regions in the global methyl methacrylate (MMA) monomer market, driven by the region's rapid industrialization and urbanization, driving demand for methyl methacrylate monomers in various industries. The growing industries like automotive, construction, consumer goods, and the growth of the packaging industry in food and pharmaceuticals are boosting the need for methyl methacrylate monomers. Additionally, robust availability of raw materials like acetone and methanol, empowering the local manufacturing capabilities and reducing import reliance of the region. The low labor and increasing energy costs are driving initiatives in MMA monomers in the Middle East and Africa.

Countries like Turkey, Saudi Arabia, and the United Arab Emirates (UAE) lead the regional market, driven by these countries' strong manufacturing and construction sectors. These countries are leading in both production and consumption of methyl methacrylate monomers. Saudi Arabia's strategic plans under Vision 2030 are implementing the integration of MMA production zones.

North America Methyl Methacrylate (MMA) Monomer Market

North America is a notable player in the global market, growth driven by strong demand for methyl methacrylate monomers in specific industries such as construction and automotives, and growing focus on sustainability. Additionally, the ongoing focus on technological advancements and the integration of cutting-edge technologies is driving significant initiatives in the regional market.

The U.S. is a major player in the regional market, driven by increasing industrial adoption and continuous innovations in various applications. The growing emphasis on sustainable and eco-friendly production methods is contributing to the market growth. Rohm is the only American-produced product in the current market using cutting-edge C2 technology. The company is a private equity backer, Advent International, and is currently evaluating future investment opportunities.

Market Overview

The methyl methacrylate (MMA) monomer market covers the global production, supply, and use of MMA, a clear, colorless liquid primarily used as a building block for acrylic-based polymers and resins. MMA is a key raw material for polymethyl methacrylate (PMMA) and is widely applied in automotive, construction, signage, paints and coatings, electronics, and medical devices due to its excellent optical clarity, weather resistance, and surface hardness. It is produced mainly through the acetone cyanohydrin (ACH) process, C4 process, and ethylene-based routes.

The superior quality and durability of methyl methacrylate monomer make it ideal for industrial use. The growing urbanization and economic developments like industrialization and infrastructure developments, the need for methyl methacrylate monomers is increasing. Moreover, the strong ongoing emphasis on advancements in manufacturing processes and technologies, along with sustainability concerns, is driving the efficiency of methyl methacrylate monomer production.

What Are the Key Trends of the Methyl Methacrylate (MMA) Monomer Market?

- Industrial Demand: The growing demand for lightweight and durable materials in various industries like automotive, construction, packaging, electronics, painting and coating, and consumer goods is driving the adoption of methyl methacrylate monomers.

- Rapid Urbanization and Industrialization: The rapid urbanization and industrialization contribute to more construction projects and industrial activity, driving demand for methyl methacrylate monomers.

- Technological Innovations: Advancements in technologies like catalytic route and polymerization techniques, and bio-based MMA, are fostering production efficiency.

- Advancements in Manufacturing Technologies: The growing enhancements in product quality and efficiency are driving the use of methyl methacrylate monomers, driving the market.

- Government Initiatives: Government support and investments in manufacturing sectors and infrastructure developments, empowering local manufacturing capabilities and production of methyl methacrylate monomers.

Market scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.74 Billion |

| Market Size in 2025 | USD 8.41 Billion |

| Market Size in 2024 | USD 8.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.72% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Production Method, Product Form, End-User Industry, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Polymethyl Methacrylate (PMMA) Applications

The use of methyl methacrylate monomers is increasing in polymethyl methacrylate applications across various industries like automotive, construction, aerospace, healthcare, and electronics. The use of polymethyl methacrylate (PMMA) is increasing in construction, automotive, electronics, aerospace, and medical devices, due to its high weather resistance, impact resistance, superior optical clarity, lightweight, durability, and biocompatibility. Rapid expansion of these industries and focus on sustainability and green certification are driving advancements in methyl methacrylate and polymethyl methacrylate production.

Restraint

Price Fluctuation of Raw Materials

The raw material price volatility is the major restraint for the global methyl methacrylate (MMA) monomers market. Price fluctuation of crude oil and natural gas leads to an increase production cost of methyl methacrylate. The price fluctuation of raw materials, including methanol and acetone, driven by supply chain distribution and demand, causes industrial crises. Additionally, the negative impact of this fluctuation on methyl methacrylate producers and disrupters leads to changes in their pricing strategies.

Opportunity

Emerging Medical and Optical Applications

The use of methyl methacrylate monomers has increased in medical and optical applications due to their high clarity, durability, and biocompatibility. Medical devices are rapidly relying on methyl methacrylate for high-quality properties. The growing use of MMA in dental applications and orthopedic implants like bone cements, driven by their durability and biocompatibility, is contributing to this growth. The rapidly growing healthcare sector and advancements in medical technologies are driving demand for innovative methyl methacrylate monomers. Additionally, the growing demand for personalized medicines is leveraging opportunities for customized medical devices, driving demand for methyl methacrylate monomers.

Production Method Insights

What Made the Acetone Cyanohydrin (ACH) Process Lead the Methyl Methacrylate (MMA) Monomer Market?

The acetone cyanohydrin (ACH) process segment led the market in 2024, due to the widespread availability of acetone and its cost-effectiveness. The strong availability of acetone and hydrogen contributes to the segment growth. The use of the acetone cyanohydrin process has increased in polymethyl methacrylate for various applications like automotive, construction, and electronics. The cost-effectiveness of the acetone cyanohydrin process, driven by regions with strong acetone production capabilities, makes it a suitable solution for methyl methacrylate manufacturers. The high demand for the acetone cyanohydrin process for methyl methacrylate monomer in applications like plastics, acrylic resins, and coatings is fueling the segment.

The ethylene-based process segment is expected to grow fastest over the forecast period, due to its increased use in high-performance plastic applications. The ethylene-based process is an ideal process to produce high-quality methyl methacrylate monomer. The use of this process is vast for large-scale productions. The ethylene-based process is versatile us in various chemical productions. The cost-effectiveness of ethylene raw materials makes it an attractive option for MMA manufacturers.

Product Form Insights

How Liquid MMA Segment Dominated the Methyl Methacrylate (MMA) Monomer Market?

The liquid MMA segment dominated the market in 2024, due to its versatility and widespread use of liquid MMA in various applications like adhesives, coatings, and sealants. The liquid MMA is used as a raw material in these applications for the production of clear and durable plastics. The wide use of liquid MMA in acrylic resins and polymer productions makes it a suitable solution for industrial applications like coating, construction, and automotive. The high performance and flexibility of liquid MMA make it ideal for numerous industrial and consumer goods.

The bead/granule MMA segment is the second-largest segment, leading the market, due to its widespread use in molding. The unique advantages of bead/granule MMA make it suitable for processing and applications such as coatings and composites. The use of bead/granule MMA is high in specialized paints and adhesives due to its ability to offer precise dosing and mixing. Molding of beads/granules of MMA in various products like electronics components, automotive components, and construction materials contributes to the growing adoption of this liquid form.

Application Insights

Which Application Dominates the Methyl Methacrylate (MMA) Monomer Market?

The polymethyl methacrylate (PMMA) production segment dominated the market, with the sheets and cast acrylic sub-segment contributing a share of approximately 40% in 2024 due to the large use of polymethyl methacrylate in various industries like automotive, construction, electronics, and healthcare. The polymethyl methacrylate production offers high transparency, lightweight, and durability. The increased demand for lightweight, high-performance, and durable materials in industrial applications is driving demand for methyl methacrylate monomers in polymethyl methacrylate production. The polymethyl methacrylate production segment involves two sub-segments, sheets and cast acrylic and extruded acrylic products, where the sheets and cast acrylic segment led the market in 2024, due to increased use of polymethyl methacrylate in the production of cast and extruded acrylic sheets.

The automotive parts and lighting segment is the fastest-growing segment in the market, growth driven by increased use of methyl methacrylate monomers in automotive applications, including parts and lighting components. The methyl methacrylate monomers are highly durable, lightweight components, and help to improve the lighting of vehicles. The external vehicle production and demand for fuel efficiency have boosted the adoption of methyl methacrylate monomers in automotive applications. The growing demand for clarity and durability of automotive parts and lighting drives the adoption of methyl methacrylate monomers.

End-User Insights

Which End-User Dominated the Methyl Methacrylate (MMA) Monomer Market?

In 2024, the building and construction segment dominated the market due to increased use of methyl methacrylate monomer in various building and construction applications, including acrylic sheets, coatings, and adhesives. Methyl methacrylate monomers are widely used in building materials like waterproofing membranes, exterior coatings, and flowing systems, due to their superior weather resistance and adhesion. The use of MMA in building and construction coatings is high due to its high durability, aesthetic appeal, and weather resistance. The use of polymethyl methacrylate has increased in construction applications due to superior durability, light transmission, and weather resistance, driving demand for methyl methacrylate monomers.

The medical and healthcare segment is expected to lead the market over the forecast period, due to increased use of methyl methacrylate monomers to create biocompatible materials in various medical and healthcare applications. The wide use of MMA materials in personalized medical devices, contact lenses, prosthetics, and dental implants contributes to the segment's growth. Additionally, the growing utilization of 3D printing in healthcare is driving the need for methyl methacrylate-based materials to produce customized medical devices and implants.

Methyl Methacrylate (MMA) Monomer Market Companies

- Arkema

- Sumitomo Chemical Company

- Kurary Group

- Dhalop Chemicals

- Saudi Methacrylates Company (SAMAC)

- Asahi Kasei Corporation

- Huntsman Corporation

- The Dow Chemical Company

- Lucite International

- Mitsubishi Chemical Corporation

New Innovation in the Industry

- In March 2025, Ohm Group introduced its new MMA plant in Bay City, Texas, for the production of 250,000 tons annually by using its proprietary LiMA process. This plan is expected to replace the old 150,000-ton operation and supply of Rohm's domestic PMMA production. (Source: https://www.echemi.com)

Recent Developments

- In March 2025, Sumitomo Chemical started selling its polymer material, polymethyl methacrylate made from methyl methacrylate monomer using chemical recycling. The company planned to supply materials to companies including LG Display Co., Ltd of South Korea and Nissan Motor Co., Ltd of Japan.

(Source: https://www.sumitomo-chem.co.jp) - In October 2024, the joint venture between Asahi Kasei and PTT Global Chemical, PTT Asahi Chemical, ceased MMA production, which ended at the end of October sale concluded by the end of December 2024. This plant is scheduled for dismantling from 2025 to 2028.(Source: https://www.echemi.com)

Segment Covered in the Report

By Production Method

- Acetone Cyanohydrin (ACH) Process

- C4 (Isobutylene) Process

- Ethylene-Based Process

By Product Form

- Liquid MMA

- Bead/Granule MMA

By Application

- Polymethyl Methacrylate (PMMA) Production

- Sheets and Cast Acrylic

- Extruded Acrylic Products

- Acrylic Emulsions and Resins

- Acrylic Sheets for Signage and Displays

- Automotive Parts and Lighting

- Paints and Coatings

- Electronics and Optical Devices

- Medical Devices

- Adhesives and Sealants

By End-User Industry

- Automotive and Transportation

- Building and Construction

- Electronics and Electrical

- Signage and Advertising

- Medical and Healthcare

- Paints, Coatings, and Adhesives

By Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting