What is Industrial Alcohol Market Size?

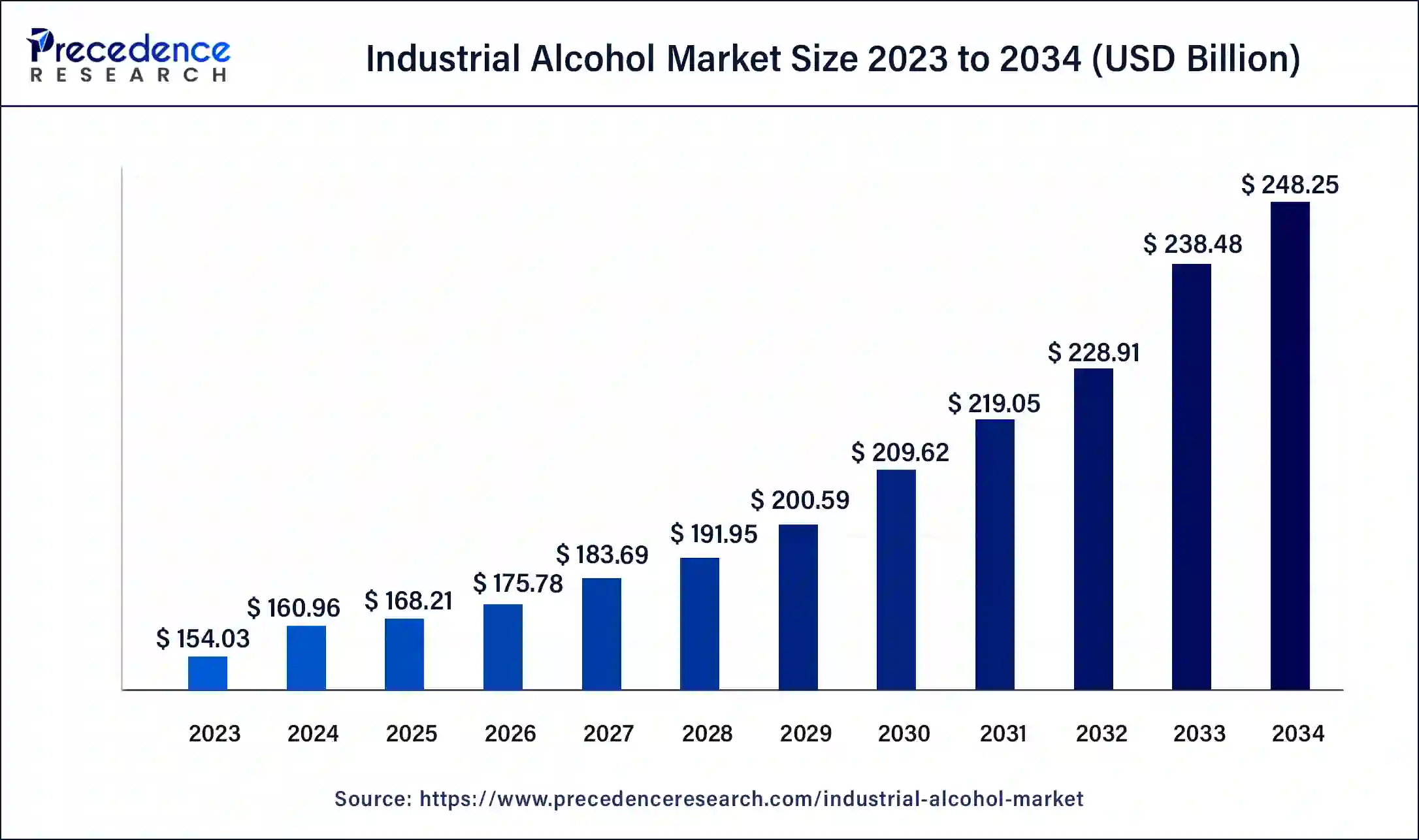

The global industrial alcohol market size is calculated at USD 168.21 billion in 2025 and is expected to reach around USD 248.25 billion by 2034, expanding at a CAGR of 4.4% from 2025 to 2034.

Market Highlights

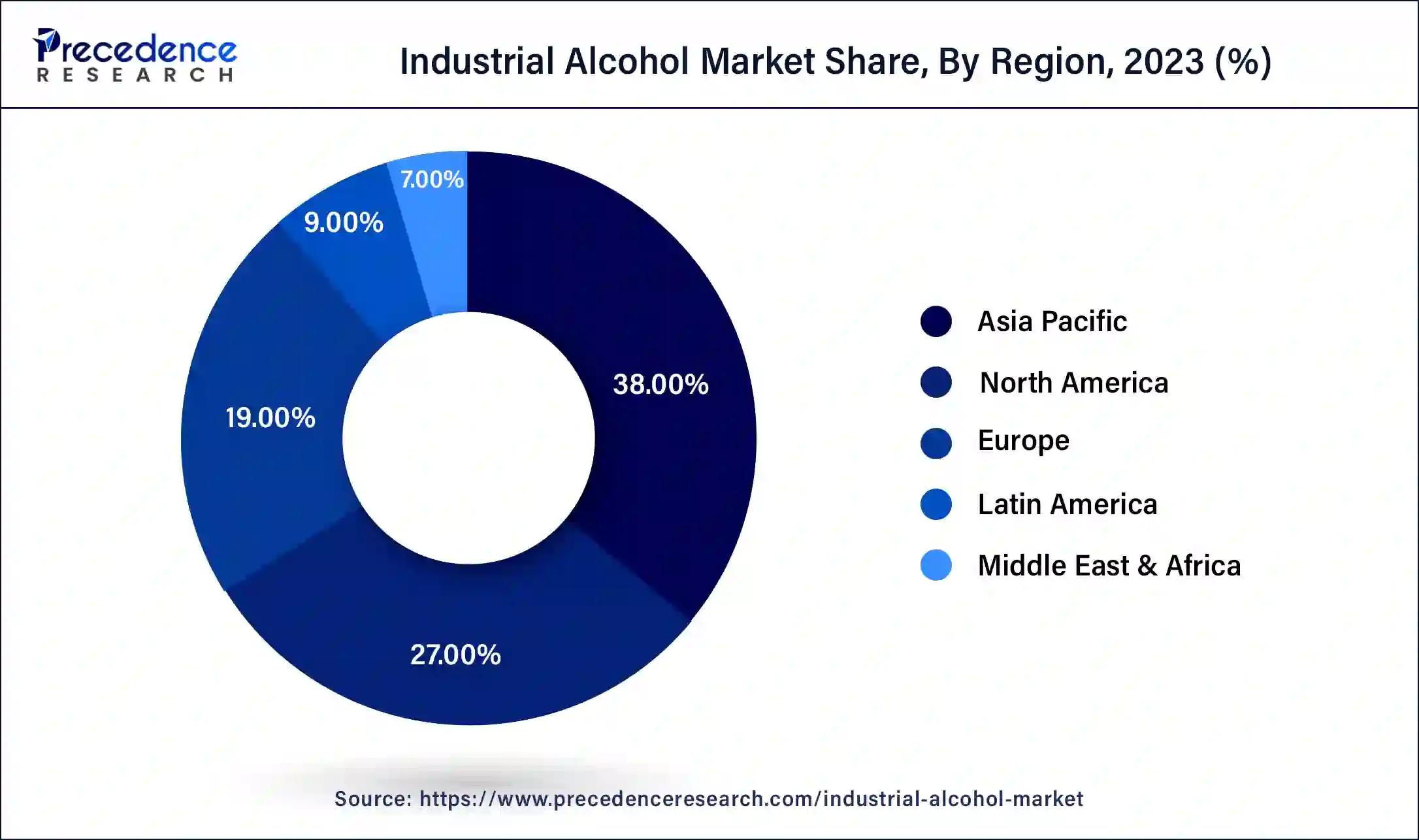

- Asia Pacific region has garnered highest market share of over 38% in 2024.

- By type, the ethyl alcohol manufacturing applications segment accounted 53% market share of around in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2034.

- By source, corn source segment contributed 32% revenue share in 2022 and is projected to grow at a CAGR of 8.8% from 2025 to 2034.

- By application, transportation fuels & fuel additives segment has contributed market share of over 43% in 2024.

What is Industrial Alcohol?

Industrial alcohol is distilled ethyl alcohol that is manufactured and sold for uses other than drinking. It is often of a high strength. It is often sold as pure ethyl alcohol, fully denatured alcohol, specifically denatured alcohol, and unique solvent blends. It is essential for producing medications like chloroform, atabrine, and barbiturates as well as antiseptics, compound tonics, syrups, tinctures, and liniments. It is used to make textiles, cosmetics, explosives, detergents, inks, hand cream, and adhesives.

The market for industrial alcohol has expanded in tandem with rising petrochemical demand and the introduction of alternative fuels. Industrial alcohols have a wide range of uses in industries like paints and coatings, pharmaceuticals, and cosmetics because of their versatility. Methanol, benzyl alcohol, and isopropyl alcohol are just a few examples of the alcohols that are utilized in the manufacturing of food items, flavorings, cosmetics, and adhesives.

Industrial Alcohol Market Growth Factors

Due to these alcohols' exceptional qualities, such as their high octane number and increased flammability features, there is an increase in demand for organic solvents, which drives the market's expansion. The energy need is another factor leading the market. Moreover, the high energy demand is a result of the expanding global population and developing industry. Over the past few years, this has led to an increase in the price of natural gas and crude oil. The creation of bioethanol is a result of both the growing concern over climate change and the rapid use of renewable resources. Renewable energy sources, such as biofuels, have helped to meet market demand for fuel that lowers global pollution levels.

Additionally, the energy crisis has worsened due to a lack of petroleum and an increase in energy prices, which has increased the use of alcohol as a fuel. Additionally, bioethanol is blended with gasoline and diesel to be used as a fuel in cars.

For many years, alcohol has been utilized in both food and medicine. Alcohol, however, has found usage in a variety of applications as technology advanced. Ethyl alcohol is the most popular and widely regarded industrial alcohol on the planet among the several commercially accessible alcohols. In present, the majority of the ethyl alcohol generated is used as biofuel in the petroleum industry. Even though ethyl alcohol is a widely utilized biofuel that has been commercialized, research into the creation of bio-butanol has gained relevance and is paving the road for its eventual commercialization.

Alcohols are used in a variety of industries besides biofuel, including medicine, food, home and personal care, the chemical industry, paints, inks, adhesives & coatings, and insecticides. In these industries, but methyl alcohol, ethyl alcohol predominates, maltitol, benzyl alcohol, sorbitol, and other alcohol are also employed in a few applications. Due to its applications and behaviors including solubility, insect repellency, antibacterial nature, preservation, and anti-freezing qualities, ethanolfinds uses in all of these industries.

Industrial Alcohol Market Outlook

- Industry Growth Overview: The industrial alcohol market is poised for strong growth from 2025 to 2034, driven by rising demand from the pharmaceutical, personal care, and chemical industries, as well as its increasing use as a biofuel and disinfectant. Expanding production capacities, government support for renewable fuels, and technological advancements in fermentation and distillation processes further drive market growth.

- Adoption of Sustainable Production Methods: A major trend is the ongoing adoption of sustainable production methods, such as using bio-based feedstocks like grains and agricultural waste, to align with circular economy practices. The growing use of industrial alcohol in sectors such as sustainable aviation fuel and the adoption of advanced distillation technologies are also notable.

- Global Expansion: The market is expanding worldwide, with significant growth opportunities across emerging regions driven by increased investments in industrialization, infrastructure, and renewable energy, accelerating market penetration.

- Major Investors: Large industrial and agricultural technology companies such as Cargill, Archer Daniels Midland, and BASF are major investors. Investment is also being driven by initiatives focused on biofuels, sustainability, and expanding production capacity, often supported by government mandates and end-user demands.

- Startup Ecosystem: A vibrant startup ecosystem focuses on niche innovations and sustainable production methods. Startups are attracting funding for developing next-generation biofuels, new applications for bio-based materials, and waste-to-alcohol technologies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 168.21 Billion |

| Market Size in 2026 | USD 175.78 Billion |

| Market Size by 2034 |

USD 248.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.4% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Source, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Depending upon the type, the ethyl alcohol segment is the dominant player and is anticipated to have the biggest impact on industrial alcohol products. Many cosmetics and beauty products contain ethanol as an ingredient primarily as an astringent to aid in the wiping of the skin. In order to ensure the binding of ingredients and the preservation of skincare products, it is also employed as a preservative in lotions and other cosmetics. It can be used in homes, as food additives, and as transportation fuel. Hence, the rising consumer preference for cosmetics products are also a leading factors which drives the ethyl segment more than any other type. It also has applications in many household products and the high demand for household products are leading to drive the industrial alcohol market.

Methyl alcohol has a significant share in the industrial alcohol market and is expected to grow. Methyl alcohol is a very adaptable substance that finds extensive use in the chemical industry for industrial applications. Methanol is a fuel that is used to generate power and is used because it is environmentally friendly and is seen as a potential source of clean energy. There are several industries that employ methyl alcohol. It is used in the production of plastics, polyesters, and other compounds as well as deicers, solvents, and other chemicals.

Isopropyl alcohol is used in drug industry mainly has a significant role in that industry. It is too used in the production of lotions and other cosmetics products. The use as solvents in drug industry is the major reason driving these type of alcohol in the market.

Source Insights

During the forecast period, corn sourced alcohol dominant the market in industrial alcohol market. The dry-milling procedure is used to turn the maize into flour, which is then fermented with other byproducts to create ethanol. Sweeteners and ethanol are typically produced at wet-mill facilities. For the purpose of producing ethanol, the met mills process corn to separate the protein, starch, and fiber. The market for industrial alcohol is dominated by corn, which is a major producer of ethanol.

Molasses is the other significant source for industrial alcohol market. Molasses is a source of microbiological energy that promotes the development of mold, yeast, and bacteria, all of which are necessary for the ethanol-producing process. A biological process called molasses fermentation transforms molasses into cellular energy, which then yields ethanol. Due to its numerous uses and practicality, ethanol is becoming more and more in demand. Market expansion is predicted to be aided by the increased demand for ethyl alcohol produced through fermentation.

Application Insights

During the projected period, the fuel segment is anticipated to be the largest in the industrial alcohol market. Due to the increasing need for gasoline from the automobile industry, the fuel segment is predicted to dominate the market. Alcohols, particularly ethanol, are widely used as transportation fuel. A number of US automakers are generating ethanol that allows cars to run on a certain sort of gasoline with a mature blend of 85% ethanol and 15% gasoline.

Due to its natural plant origins, industrial alcohol utilized in chemicals has a number of advantages, including sustainability, adaptability, and health. The demand is anticipated to increase due to the developing region's rapidly expanding manufacturing sector. The demand for industrial in the industries is anticipated to increase during the projected period as a result of a significant number of manufacturers focusing on replacing crude chemicals with bio-derived products.

Regional Insights

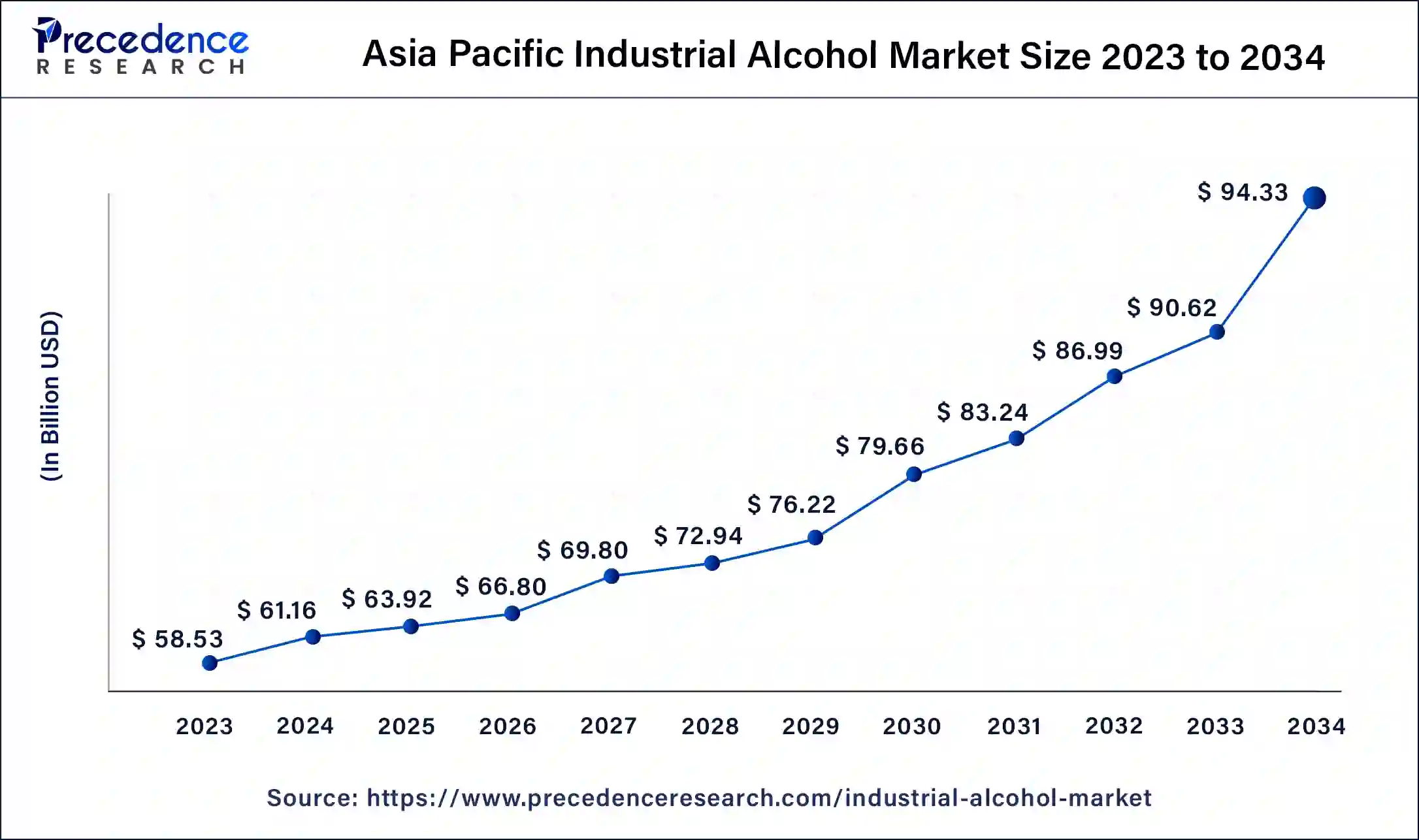

Asia Pacific Industrial Alcohol Market Size and Growth 2025 to 2034

The Asia Pacific industrial alcohol market size surpassed USD 63.92 billion in 2025 and is predicted to be worth around USD 94.33 billion by 2034 with a CAGR of 5% from 2025 to 2034.

The highest market share and dominant position in the industrial alcohol industry belongs to Asia-Pacific. Because of the rising demand from China and India, the regional market is also anticipated to expand rapidly throughout the projection period. This region mainly includes China, India and Japan. Due to numerous policy initiatives and rising foreign investments in the industrial sector, the region's nations are fast developing. China is a large producer of ethanol, supporting the demand for fuel from the automotive industry and for food additives.

Furthermore, the region is expanding rapidly as a result of economic expansion and rising urbanization in nations like China and India. These nations have the greatest potential for growth since there is a large supply of arable land and low labor costs. The rising demand for cosmetics and personal care products is one of the main reasons fueling the expansion of the industrial alcohol market. Hence, raising awareness to the importance of keeping a clean environment throughout the pandemic. These drivers are making this region more prominent.

Why is North America Considered the Second-Largest Market?

North America is considered as second largest region which shows a significant position in the industrial alcohol market. The market is expanding rapidly due to the growing use of ethanol as a fuel for transportation purposes. The Environmental Protection Agency has a number of programs in place to assist environmentally friendly and sustainable goods made using renewable energy sources. The demand for ethanol fuel, which lowers overall costs, is significantly rising as more people buy cars.

India Industrial Alcohol Market Trends

India is a rapidly growing market with substantial potential, fueled by strong domestic demand, increasing industrialization, and government initiatives to promote ethanol blending with fuel. The country mainly depends on sugarcane and molasses for ethanol production, and the government actively encourages blending ethanol with automotive fuel to cut oil dependence. Additionally, rising consumer awareness and government programs are expected to lead to significant growth in the coming years.

U.S. Industrial Alcohol Market Trends

The U.S. is a major contributor to the market in North America. The market in the U.S. is primarily driven by its advanced biofuel industry, strong agricultural base, and supportive government mandates. As the world's largest producer of corn-based ethanol, the U.S. leverages initiatives such as the Renewable Fuel Standard (RFS) to meet high demand across the pharmaceutical, personal care, and chemical industries, with a focus on sustainable, bio-based solutions.

Why is Europe Considered a Notably Growing Region in the Industrial Alcohol Market?

Europe is expected to grow at a notable rate in the coming years, with a strong emphasis on sustainability and compliance with strict environmental regulations. The market is mainly fueled by demand for ethanol as a chemical intermediate, a solvent in pharmaceuticals and cosmetics, and for use in the food and beverage industry. Leading global manufacturers dominate the sector, investing heavily in R&D to produce high-purity, environmentally friendly alcohol from various sources to meet rigorous EU standards. Additionally, government initiatives supporting renewable fuels and increasing investments in production facilities and R&D drive market expansion across the region.

Germany Industrial Alcohol Market Trends

Germany holds a dominant position in the European industrial alcohol market, supported by its sizable chemical and pharmaceutical sectors and a strong focus on Industry 4.0 and sustainable manufacturing. The country's demand spans various applications, including solvents, fuel additives, and the production of personal care products. It is home to global agrochemical and chemical giants like BASF SE and Siemens, and actively promotes the adoption of bio-based alternatives to lessen environmental impact.

How Does Latin America Contribute to the Industrial Alcohol Market?

The market in Latin America is mainly driven by the production of bioethanol from plentiful local feedstocks like sugarcane and corn. The region focuses on using industrial alcohol as a vital component for transportation fuel and as a key chemical intermediate across different industries. Although the market can be unpredictable due to economic factors and currency fluctuations, rising government mandates for biofuel use to cut emissions are a major growth catalyst.

Brazil Industrial Alcohol Market Trends

Brazil is a global leader in the industrial alcohol market, especially in producing and using sugarcane-based ethanol as a biofuel. The market also benefits from various uses in pharmaceuticals, personal care, and the chemical industry. The presence of major domestic companies and a well-established infrastructure for producing and distributing bio-based alcohol strengthen Brazil's position in both local and international markets.

What Potentiates the Middle East & Africa Industrial Alcohol Market?

In the Middle East & Africa, the market is driven by diverse demands, ranging from disinfectants and cleaning supplies in cities to industrial solvents and potential biofuel uses. Growth is driven by increased industrialization and greater awareness of health and hygiene, which boost demand for isopropanol and ethanol in personal care and healthcare sectors. Government efforts to diversify economies and attract investment in manufacturing and chemical industries are expected to foster future growth.

UAE Industrial Alcohol Market Trends

The UAE is a key contributor to the industrial alcohol market, with significant demand for products such as isopropyl alcohol for healthcare and cleaning applications, as well as ethanol for various industrial uses and as a fuel additive. The country's strategic position as a trade and logistics hub facilitates the import and re-export of industrial alcohols. Government visions and initiatives focused on sustainability, economic diversification, and the development of green hydrogen projects are accelerating the efficient chemical solutions.

Value Chain Analysis

- Feedstock Sourcing and Supply

This involves procuring raw materials like corn, sugarcane, or natural gas for alcohol production.

Key Players: Cargill, Archer Daniels Midland Company, Exxon Mobil, and BASF. - Production and Manufacturing

Raw materials are converted into various industrial alcohols (ethyl, methyl, etc.) through fermentation or chemical synthesis.

Key Players: Green Plains Inc., Raízen Energia, Cristalco SAS, MGP Ingredients Inc., and Greenfield Global Inc. - Storage, Blending, and Packaging

After production, industrial alcohols are stored, potentially denatured, blended, and packaged for specific customer needs.

Key Players: BASF and Univar Solutions. - Distribution and Supply Chain Management

This ensures efficient transportation and delivery of the final product to industrial customers globally.

Key Players: Univar Solutions and Sigma-Aldrich.

Top Companies in the Industrial Alcohol Market and Their Offerings

- Cargill Inc.: Industrial and pharmaceutical grade ethanol from corn, molasses, and grain.

- BASF SE: Industrial alcohols as part of a broad chemical portfolio for solvents, personal care, and pharmaceuticals.

- Cristalco SAS: High-purity, nature-derived alcohols from beets and wheat for pharmaceutical, cosmetic, and food industries.

- MGP Ingredients Inc.: High-quality neutral grain spirits and specialty ingredients for food and industrial applications.

- Greenfield Specialty Alcohols: Sterile and bio-friendly solvents/bioprocess solutions for the life science, food, and personal care markets.

Other Key Players

- Grain Millers Inc.

- The Andersons Inc.

- Birla Sugar

- Flint Hills Resources

- Sigma Aldrich

Segments Covered in the Report

By Type

- Ethyl Alcohol

- Methyl Alcohol

- Isopropyl Alcohol

- Others

By Source

- Molasses

- Sugar

- Grains

- Corn

By Application

- Food Ingredient

- Transportation Fuel & Fuel Additives

- Chemical Intermediates

- Pharmaceutical

- Personal Care

- Detergent & Cleaning Chemicals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting