What is Industrial Lubricants Market Size?

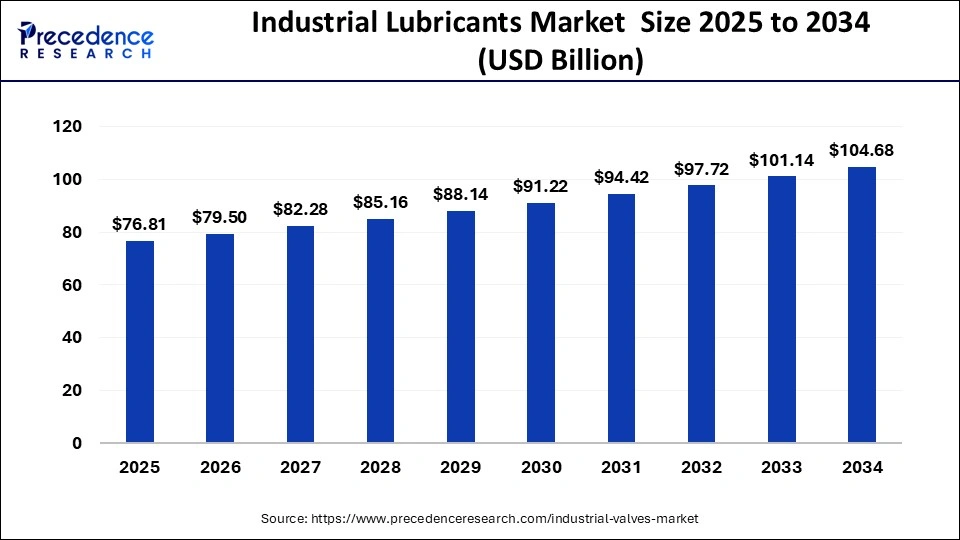

The global industrial lubricants market size is calculated for USD 76.81 billion in 2025 and is Forecasted to increase from USD 79.50 billion in 2026 to approximately USD 108.14 billion by 2034, expanding at a CAGR of 3.48% from 2026 to 2035

Market Highlights

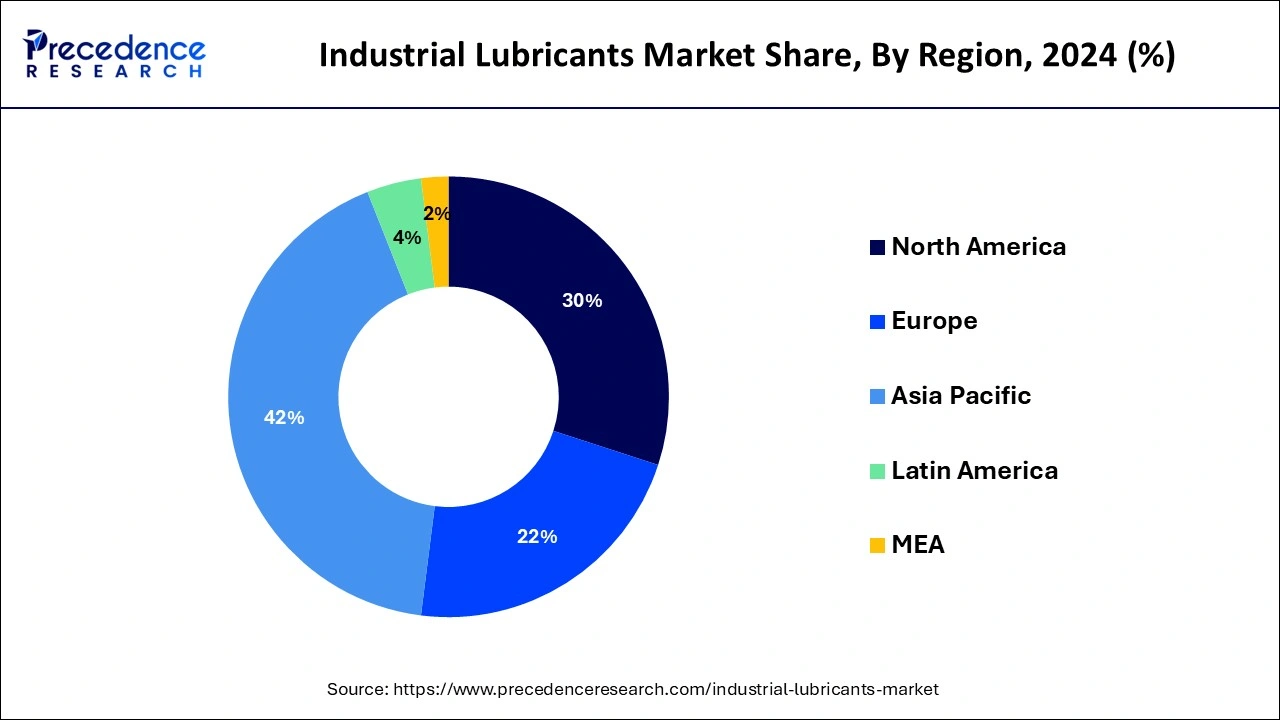

- Asia Pacific led the global market with the highest market share of 42% in 2025.

- By product, the process oil segment has held the largest market share 35% in 2025.

- By application, the chemical manufacturing segment captured the biggest revenue share in 2025.

Industrial Lubricants Market Growth Factors

- Rapid industrialization along with the significant rise in trade activities particularly in the developing countries expected to fuel the demand for industrial lubricants in the upcoming years. Increasing investments in Research & Development (R&D) sector coupled with expansion of various industrial process contributes towards the growth of these industry participants.

- Some of the industries for example mining, chemicals, and unconventional energy are analyzed to register substantial growth over the forecast timeframe. This trend is further expected to flourish the demand for industrial lubricants in hydraulics, compressors, centrifuges, industrial engines, and bearings.

- Additionally, the significant impact of Western culture on the lifestyle in developing nations has propelled the demand for frozen and processed foods over the recent past. This in turn expected to boost the growth of industrial lubricants as several packaging industries are deploying Artificial Intelligence (AI) and automation processes for increasing their productivity. Thus, increasing emphasis on automation and robotic processing is likely to foster market growth for industrial lubricants in the coming years.

Market Outlook

- Industry Outlook: The technological changes in the machinery and the acquisition of more stringent environmental regulations are the causes of a structural transformation within the industry. Lubricants with long drain life, increased thermal stability, and better wear protection are being demanded by end users. The digital monitoring, condition-based maintenance, and lubricant analytics are not only becoming a built-in service option, but they are also becoming a value-added option.

- Global Expansion: The aim of the global expansion strategies is the expansion spread in new industrial centers and protect market share in the mature market. Localization of blending plants and warehousing facilities is done by manufacturers to keep the logistics cost down and maintain supply reliability. Market access is being boosted through strategic alliances with original equipment manufacturers (OEMs) and industrial service providers.

- Startup Ecosystem: The industrial lubricants startup environment is comparatively small yet innovation-focused and is focused on specialties and bio-lubricants, as well as intelligent lubrication. Advanced chemistry, additive optimization, and AI-based predictive maintenance platforms are being exploited by startups. The latter has many of them working alongside industrial customers, in pilot deployments as opposed to mass-market distribution.

- Major Investors:The key investors are the multinational oil and gas companies, specialty chemical companies, and diversified industrial conglomerates. Interest in private equity is rising, especially in specialty and high-margin lubricants. The initiatives on bio-based lubricants are supported by the development banks and government-backed funds in line with the sustainability objectives.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 76.81 Billion |

| Market Size in 2026 | USD 79.50 Billion |

| Market Size by 2035 | USD 108.14 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.48% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Industrial Lubricants Market Segment Insights

Product Insights

In 2024, process oil holds the highest market share in the global industrial lubricants market in terms of both value and volume among other product types. The process oil segment accounted for a volume share of nearly 35% in 2024 and is estimated to retain its dominance over the forecast timeframe growing at a rate of 3.5%. The prominent growth of the segment is mainly because of its wide range of applications in different industries such as chemical, agriculture, food processing, textile production, manufacturing of leather goods, and many others. In the polymer industry, compounded polymers contain a significant amount of process oil ranging from 20% to 50% that significantly affects the properties of the polymer such as strength, hardness, and stability.

Apart from this, process oil is also prominently used in the food processing industry as an important component in the production of anti-foaming agents. Hence, the oil is effectively used in vegetable preparation as well as added as an additive in various food oils. Further, it has significant applications in the production of crop protection oils, pesticide carrier fluids, grain de-dusting agents, and fertilizers that are extensively used in agriculture.

Application Insights

Chemical manufacturing emerged as the largest application segment in the year 2024 due to increased demand for chemical oils in the production of fertilizer, pharmaceutical & cosmetics products, and industrial gas. The chemical industry seeks healthy demand for basic as well as specialty chemicals over the coming years owing to their high application in construction, pharmaceutical, agriculture, and many other industries.

Energy is the other important application segment in the global market for industrial lubricants. The equipment used in the energy sector relies prominently on their performance and lubrication plays an important role in enhancing their efficiency. Further, the shifting trend towards renewable generation also triggers the demand for gear oils as they are extensively used in wind power generation in gearboxes.

The metalworking application segment is likely to register rapid growth over the upcoming years on account of rising industrial activities along with the demand for metal products in applications such as building and machinery. Moreover, extensive demand for metalworking processes that include welding, cutting, and forming across a wide range of applications such as ships, foundries, milling, aircraft, and industrial machinery is expected to drive the growth of the segment in the coming years.

Industrial Lubricants Market Regionl Insights

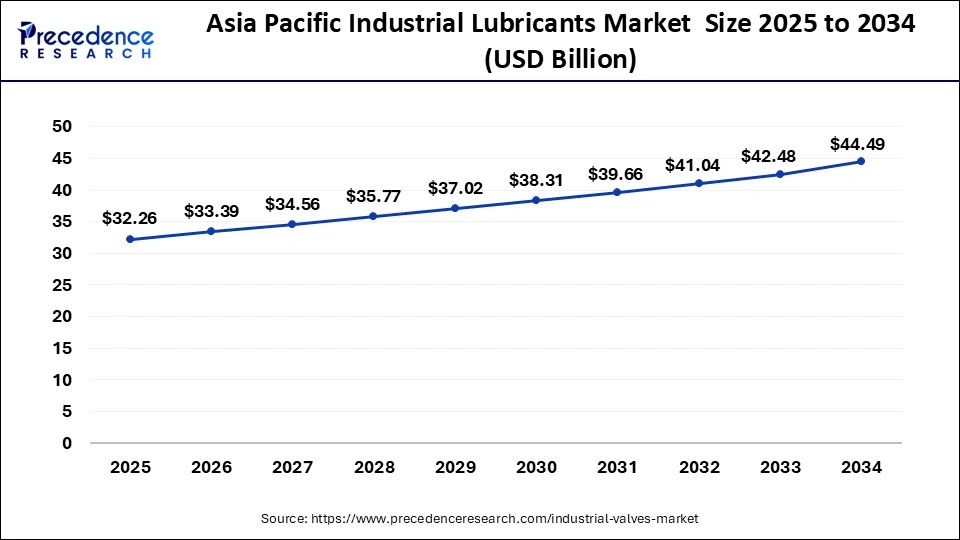

The Asia Pacific industrial lubricants market size is exhibited at USD 32.26 billion in 2025 and is predicted to be worth around USD 46.12 billion by 2035, at a CAGR of 3.62% from 2026 to 2035.

Asia Pacific led the industrial lubricants market with 42% in 2024. Asia Pacific has witnessed rapid industrialization, especially in countries like China, India, and Southeast Asian nations. The booming manufacturing sector, coupled with extensive infrastructure development, has significantly increased the demand for industrial lubricants used in machinery, automotive, construction, and other industrial applications. The automotive and manufacturing industries in Asia Pacific are among the fastest-growing in the world. As these sectors expand, the need for high-performance lubricants to ensure the efficient operation of machinery and vehicles has surged. China, in particular, is a global leader in automotive production, further driving the demand for industrial lubricants.

The Indian industrial lubricants market is witnessing consistent growth due to the expansion of the automotive sector in India, as it is a major consumer of industrial lubricants. The growth is supported by the initiatives taken by the state government to foster industrialization and manufacturing growth. The incorporation of advanced technology into the manufacturing process requires high-quality lubricant to avoid thermal damage to the machines due to overheating. Advances in lubricants and machine technology are also likely to foster the demand for specialized industrial lubricants produced for specific purposes and for particular equipment. Synthetic and bio-based lubricants have seen a surge in recent years.

Automotive energy and manufacturing are increasingly adopting lubricants, further propelling the country's growth. In April 2024, Indian Oil Corporation and Gujarat Gas Limited signed a non-binding MoU aiming to boost energy solutions required for various applications in the growing industries. Similarly, many companies are strategically partnering and collaborating to strengthen their market presence, increase product innovation and to serve evolving and update industrial demands.

Industrial Lubricants Market-Value Chain Analysis

- Raw Material Suppliers: The base oil producers are the starting point of the value chain since they provide mineral, synthetic, and bio-based base stocks. The additive manufacturers offer components that are performance-enhancing, e.g., anti-wear agent, anti-corrosion, anti-detergent, and anti-viscosity moderator.

Key Players: ExxonMobil Chemical and Chevron - Formulation and Blending: Lubricant producers develop and mix base lubricants and additives to fit a certain industrial demand. This phase demands good R&D, quality control mechanisms, and adherence to industry standards. Formulation expertise is a significant means through which product differentiation is attained.

Key Players: Shell Lubricants, TotalEnergi, and Chevron Lubricants - Packaging and Storage: Lubricating oils are finished and loaded in drums, intermediate bulk, or bulk delivery systems. The trend in packaging design is more focused on the control of contamination and sustainability. Storage facilities should be in a way that a product is stable and traceable.

Key Players: Greif, Inc., Schütz Group, and Maus - Raw Material Sourcing: The sourcing concept of raw materials combines cost, availability, and performance reliability. Base oils based on mineral sources are also usually acquired locally, whereas synthetic base stocks and specialty additives can be acquired worldwide. Long-term supply contracts are useful in reducing price volatility.

Key Players: ExxonMobil Chemical, Chevron Phillips Chemi, and Royal Dutch Shell - Testing and Certification: The performance and compliance of lubricants are vital in testing and certification. The products go through a long laboratory test on viscosity, oxidation stability, wear protection, and thermal resistance.

Key Players: Intertek Group plc, SGS S, and Bureau Veritas

Industrial Lubricants Market Companies

- Fuchs Group

- Exxonmobil Corp

- The Lubrizol Corporation

- Phillips 66

- Royal Dutch Shell

- Lucas Oil Products, Inc.

- Bel-Ray Co., Inc.

- Amsoil, Inc.

- Kluber Lubrication

- Chevron Corp.

Recent Developments

- In August 2024, Assurance Intal and Energizer collaborated to invest in the production of new car petrol products in India. The products include car filters; car lubricants and batteries used in the car. With this alliance, an innovative product range will be produced by Assurance Intl, aiming to grow by 50% than before.

- In April 2024, a biodegradable lubricant ester 5 was launched by Savsol Corp. This lubricant is majorly used for premium automotive and railway segments. It helps reduce friction and speed up mileage in the batteries of EVs and high-speed railway coaches.

- In April 2024, Castrol proposed a nationwide campaign in the United States, known as Castrol MoreCircular, to reduce the carbon footprints made by lubricants businesses and re-refining spent oil markets.

Industrial Lubricants Market Segments Covered in the Report

By Product

- General Industrial Oils

- Process Oils

- Industrial Engine Oils

- Metalworking Fluids

- Other Industrial Lubricants

By Application

- Textiles

- Non-woven Textiles

- Textile Weaving

- Textile Composites

- Textile Finishing

- Other Textile Applications

- Metalworking

- Metal Cutting

- Metal Forming

- Metal Joining

- Industrial Heat Exchangers

- Metalworking Electronics

- Other Metalworking Applications

- Energy

- Pipelines

- Transformers

- Ocean Energy

- Liquefied Natural Gas (LNG)

- Other Energy Applications

- Industrial Gases

- Polymers

- Fertilizers

- Other Chemicals Manufacturing

- Chemical Manufacturing

- Hydraulic

- Bearings

- Compressors

- Other Hydraulic Applications

- Food Processing

- Frozen Food

- Beverages

- Canned Food

- Bakery

- Processed Potatoes

- Cocoa & Chocolate

- Other Food Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content