What is the Robotic Process Automation Market Size?

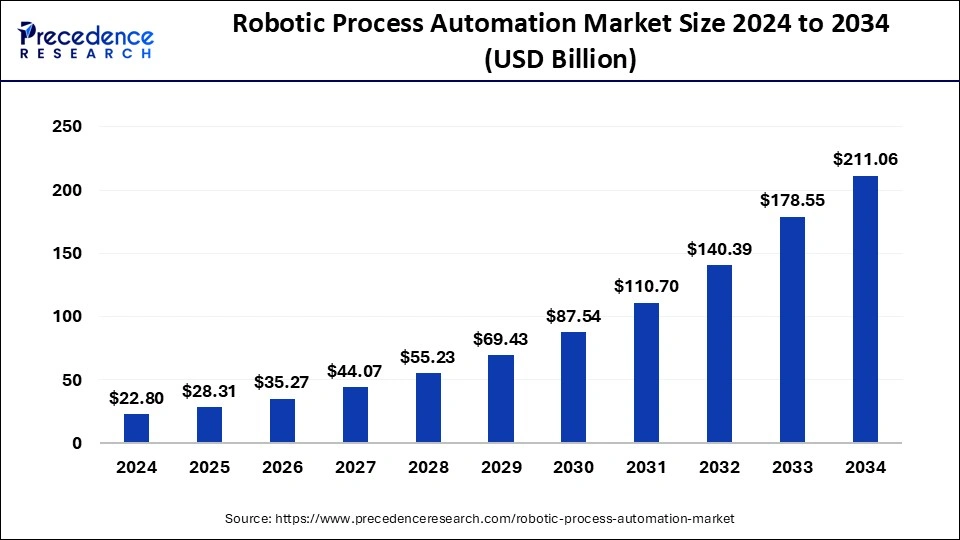

The global robotic process automation market size was estimated at USD 28.31 billion in 2025 and is predicted to increase from USD 35.27 billion in 2026 to approximately USD 247.34 billion by 2035, expanding at a CAGR of 24.20% from 2026 to 2035. The increasing adoption of automation across various industries to streamline business processes and improve operational efficiency is a major driver. Additionally, the need to reduce operational costs and enhance productivity is propelling the demand for RPA solutions.

Robotic Process Automation MarketKey Takeaways

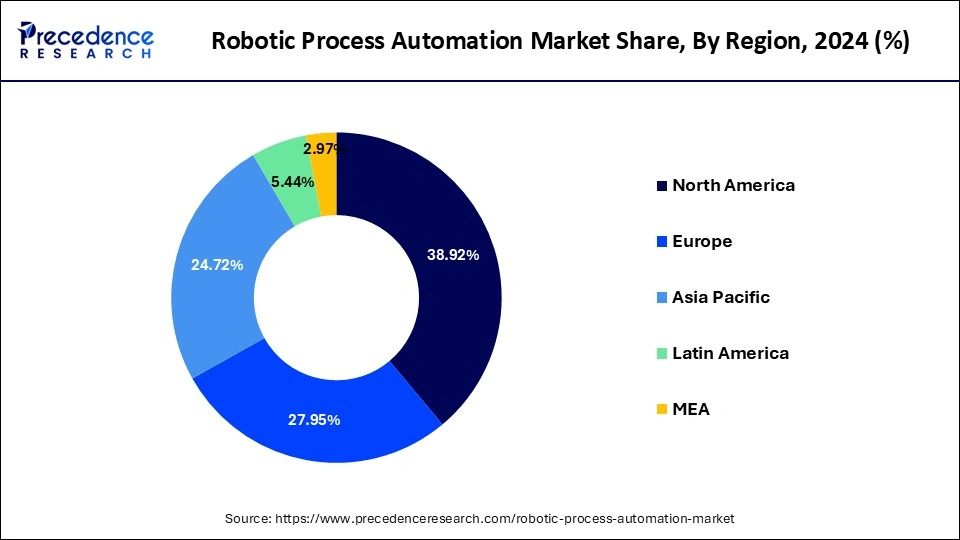

- North America accounted for 38.92% of the revenue share in 2025.

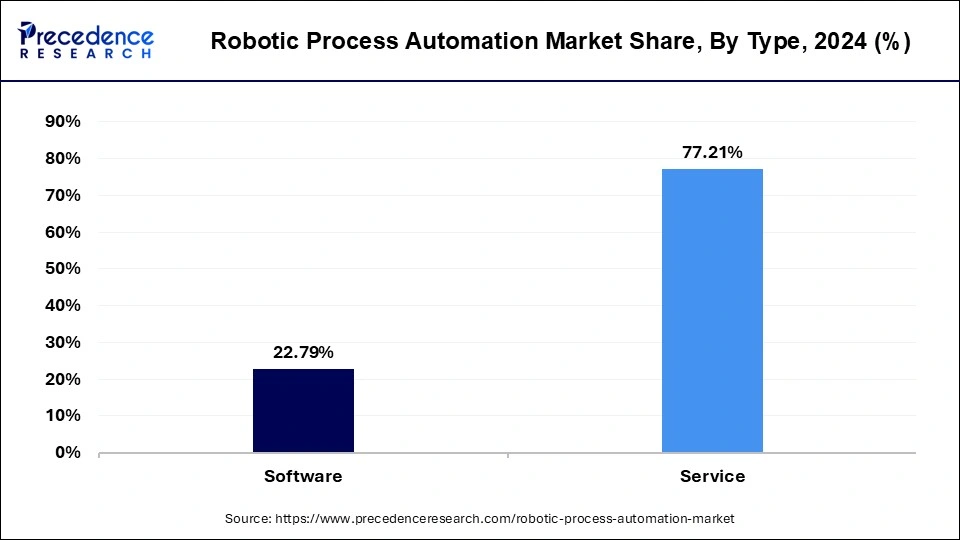

- By type, the service segment held a 77.21% revenue share in 2025.

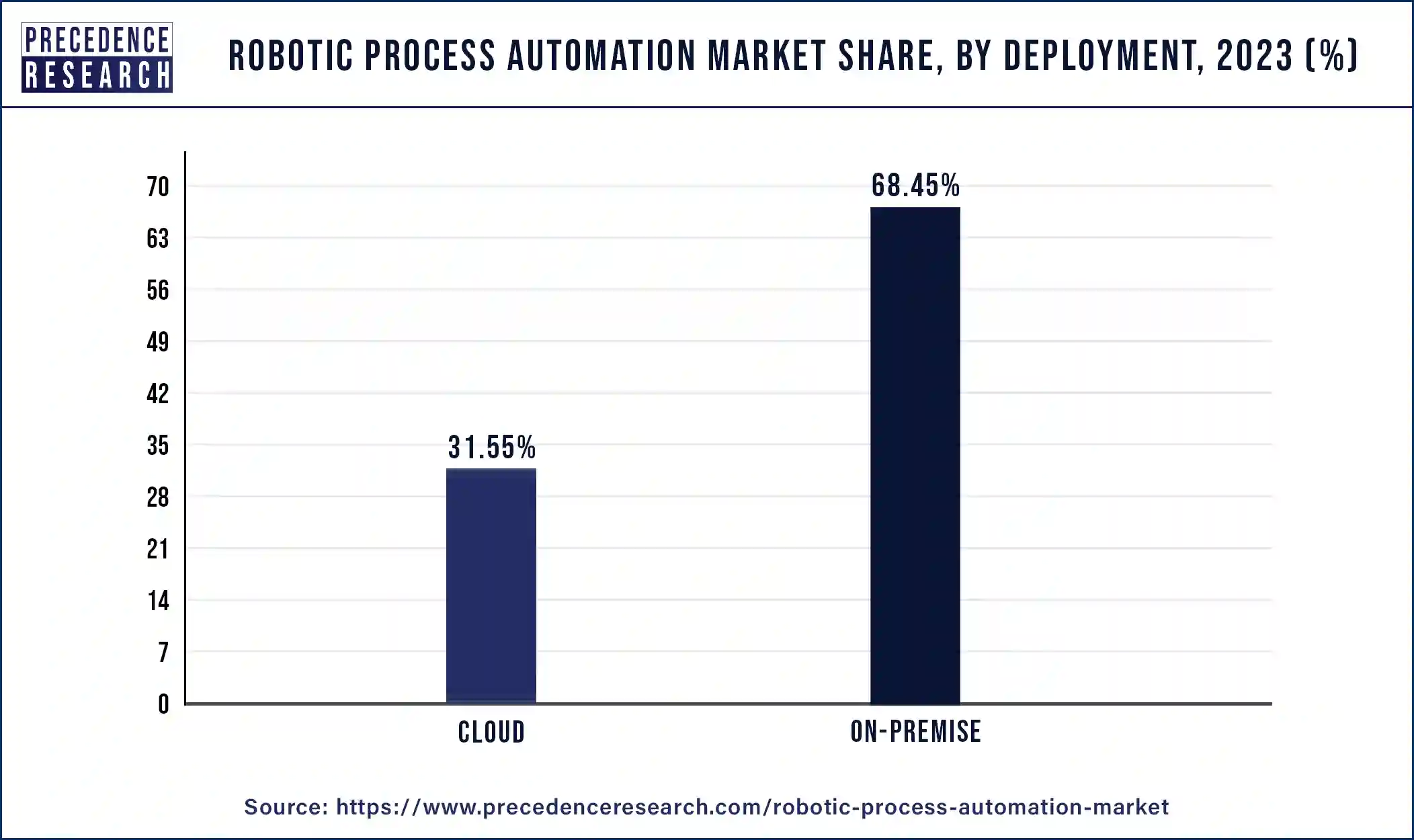

- By deployment, the on-premise segment has accounted for a revenue share of over 68.13% in 2025.

- By industry, the BFSI sector has generated a revenue share of 36.52% in 2025.

- By component, the software segment dominated the market with a 67.80% share in 2025.

- By component, the services segment is expected to grow at the highest CAGR of 17.20% over the forecast period.

- By deployment model, the on-premises segment held a 58.40% market share in 2025.

- By deployment model, the cloud / SaaS segment is expected to grow with the highest CAGR over the forecast period.

- By application, the finance & accounting segment dominated the market with a 22.80% share in 2025.

- By application, the human resources segment is expected to grow at the highest CAGR of 17.90% during the projected period.

- By end-user industry, the BFSI segment dominated the market with a 29.40% share in 2025.

- By end-user industry, the healthcare & pharmaceuticals segment is expected to grow at the highest CAGR of 18.80% over the forecast period.

What is the Role of AI in the Robotic Process Automation Market?

Artificial intelligence (AI) based robots have the ability to collect, analyze, and act on information about their surroundings in near real time to complete tasks, and may autonomously. Robots use accelerometers, cameras, and sensors for vibration, proximity, and other conditions to collect information about their environment. AI can help robotic process automation automate tasks more fully and handle more complex use cases. RPA also allows AI insights to be on more quickly instead of waiting for manual implementations.

AI business process automation is the application of artificial intelligence (AI) technologies to improve business processes, reducing human intervention and improving efficiency across various operational aspects. By using cognitive technologies, these new automation solutions can do more than just follow set rules. AI-based test automation improves accuracy, efficiency, and scalability by reducing manual efforts, improving test precision, and allowing faster releases. AI analyses requirements and historical data to generate improved test cases, improving test coverage, and reducing redundant testing efforts.

Robotic Process Automation Market Growth Factors

Organizations want robotic process automation to manage complicated unstructured data and automate any business operation from start to finish. Companies are integrating RPA with artificial intelligence and cognitive technologies to broaden the scope of business process automation. These technologies monitor work activities, identify ideal processes, and recommend an automation path to organizations. AntWork, for example, introduced ANTstein, an AI, RPA, and machine learning integrated platform in May 2020. This intelligent automation maximizes bot use while also providing insights into all sorts of data, data curation, and building.

The reduction of paperwork is one of the most discussed RPA future trends. Intelligent bots for online data extraction, filing, and processing are becoming popular in RPA. Pre-programmed bots can reduce paperwork while improving efficiency for mundane paperwork chores.Such trends will act as a growth factor in the global robotic process automation market.

Market Trends

- Rising BPO industry.

- Rising demand for automation in the oil & gas industries in MEA.

- Increasing collaboration and partnership with the government to develop the public sector.

- Rising demand for RPA across BFSI and IT & telecom industries.

- Increasing demand for compliance and data security.

Future Trends in Robotic Process Automation

Hyper automation: Hyper-automation is a key driver for companies looking to expand their business in the highly evolving technological landscape. By integrating RPA, AI, and ML along with process mining, automation can be seamlessly possible to operated. According to Gartner data, hyper-automation has affected one-fifth of all business processes and has helped with greater efficiency and offered cost savings as well.

Expansion of new sectors with RPA: Robotic process automation is witnessing a transforming phase while extending its applications beyond conventional sectors like IT and finance. Robotic process automation holds the potential to offer advanced experience in various sectors like healthcare, education, agriculture, and others. Its continuously broadening applications have shown remarkable progress and future potential to expand further on a large scale.

Market Scope

| Report Highlights | Details |

| Growth Rate From 2026 to 2035 | CAGR of 24.20% |

| Market Size in 2025 | USD 28.31 Billion |

| Market Size in 2026 | USD 35.27 Billion |

| Market Size by 2035 | USD 247.34 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Deployment, Industry, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Automation Across Sectors

The increasing demand for automation across sectors is a major driver of the Robotic Process Automation (RPA) market. Organizations globally are increasingly recognizing the need to improve their operations, increase efficiency, and reduce costs to remain competitive in the modern business environment. RPA emerges as an innovative technology that helps firms fulfill these objectives efficiently.

One of the most significant reasons for the growing need for RPA is its ability to automate repetitive and rule-based operations. There are several repetitive operations in many industries, including banking and finance, healthcare, manufacturing, telecommunications, and others, that are time-consuming and prone to human error when conducted manually. These activities include data entry, invoice processing, customer onboarding, and claims processing. Organizations that use RPA technologies may automate these routine processes, enabling human workers to focus on more strategic and value-added activities. Furthermore, RPA improves accuracy and compliance by lowering the possibility of human error. Software robots' complete tasks with precision and consistency, following established guidelines and limitations. This is crucial in highly regulated industries such as finance and healthcare, where strict compliance is required.

The healthcare sector is witnessing a surge in automation adoption due to its seamless integration with applications, enhanced flexibility, clearly defined operational processes, workforce optimization initiatives, budgetary reductions, and numerous other advantages. About 80% of healthcare professionals have observed substantial cost reduction and time savings by using electronic prescriptions. A reduction in labor expenses by 50-60% can be achieved through the automation of manual tasks. Organizations can improve accuracy and redirect substantial sections of their labor-related costs, up to 60%, towards core operations by automating demanding tasks that were previously performed by humans. Furthermore, automation improves quality by reducing the possibility of human error. Automation tools operate consistently without being affected by fatigue or lapses in concentration, ensuring a reliable basis for care activities.

According to research conducted at a Texas hospital, increased automation in areas such as medical records management, order entry, and decision support resulted in fewer deaths, complications, and overall expenses for the healthcare facility. Furthermore, “A survey conducted in 2022 revealed that nearly 90% of healthcare organizations have embraced AI and automation strategies."

Moreover, in the logistics industry, Real-time fleet tracking and task streamlining result in significant labor and inventory cost savings. In the United States, logistics companies profit $12 to $20 for every $100 in e-commerce sales due to automation, compared to $3 to $5 in brick-and-mortar retail. Logistics automation eliminates errors through electronic data input and enhances customer service by enabling real-time supply chain monitoring, such as inventory tracking, accounting, and document generation.

In the Finance Industry, according to an EY report, 65% of surveyed organizations anticipate that financial process automation will receive substantial attention in the coming years. According to the study, 79% automation delivered time-savings, 69% improved business productivity and 61% cost savings.

Rising Focus on Digital Transformation

Process automation is an integral component in accelerating digital transformation initiatives by discovering a wide range of advantages that propel organizational advancement and competitiveness. At its foundation, automation improves operational efficiency by eliminating human operations and replacing them with automated ones. This optimization not only accelerates procedures, but also eliminates bottlenecks and reduces errors. Employees can divert their focus to higher-value activities when typical and time-consuming processes are automated, boosting productivity and efficiency throughout the firm. Moreover, process automation contributes significantly to cost savings by eliminating the need for manual labor, reducing errors, and lowering operational costs. Organizations can save money in the future by improving workflows and automating jobs. The excess allows for the shift of resources to strategic projects that drive business development and innovation, creating an environment appropriate to digital transformation.

Furthermore, automation improves flexibility within organizations, allowing businesses to react rapidly to market developments and evolving client expectations. Businesses that automate their processes may respond rapidly to new requirements, scale operations efficiently, and capitalize on possibilities in changing market conditions. This adaptability is critical for maintaining a competitive advantage in the current fast-changing digital market. In addition, process automation leads to a better customer experience by accelerating service delivery, reducing errors, and maintaining consistency. Automated procedures ensure that client queries are responded to rapidly, orders are completed effectively, and personalized interactions are frequently supplied at a scale. Such enhancements in customer service translate into improved satisfaction and loyalty, which leads to growth in the digital age. Another key advantage of process automation is that it reduces the time required to bring products and services to market. Organizations can streamline their product lifecycle by automating operations such as product design, development, testing, and deployment. This reduction in the introduction allows organizations to rapidly capitalize on market opportunities, establishing them as market leaders.

Rising Labor Cost

In response to the rising price of manual labor, businesses are increasingly turning to Robotic Process Automation (RPA) as a viable solution to streamline operations and contain expenses. With rising labor costs, businesses are under pressure to find cost-effective alternatives to recurrent jobs. RPA emerges as a compelling option by automating these tasks, thereby reducing labor expenses, and ultimately improving Return on Investment (ROI). This shift towards automation not only addresses immediate financial concerns but also sets the stage for long-term efficiency gains. One of the primary benefits of RPA is its capacity to significantly decrease labor costs over time. RPA eliminates the need for additional hiring by automating labor-intensive tasks, while also increasing task completion speed and accuracy. Furthermore, RPA's unparalleled capacity to manage massive amounts of data helps to increase operational efficiency. Studies have shown that RPA adoption has enormous benefits, including possible savings of thousands of hours in rework within individual departments and large labor hour reductions across a variety of industries, including medical technology.

Furthermore, the cost-effectiveness of RPA grows apparent when comparing it to conventional labor models. RPA solutions cost a fraction of the cost of offshore and onshore labor, resulting in significant savings for enterprises. Depending on the deployment approach, the ROI for RPA adoption can range from 30% to 200% in the first year alone, with a total potential ROI of 300%. Strategic decision-making about the scope and scale of RPA implementation is essential for maximizing profits, whether by focusing on specific worker operations or executing company-wide automation efforts.

However, the benefits of RPA extend beyond mere financial gains. While cost reduction is the major incentive, RPA also provides several business benefits across all aspects of organizational operations. Employees can redirect their efforts toward more strategic objectives by automating repetitive processes, which promotes creativity and increases overall productivity. Furthermore, RPA improves accuracy and compliance, lowering errors and decreasing the risks associated with manual procedures. Thus, RPA represents a transformative technology that not only addresses rising labor costs but also drives operational excellence and competitive advantage in the current changing business landscape.

For instance, according to a survey conducted 30% of US workers are interested in learning more about robotic process automation. 68% believe RPA increases productivity 68% believe RPA saves time, 52% believe RPA ensures a better work/life balance and 43% believe RPA empowers workers to focus on more important work.

Restraints

Lack of Standardized or Well-Defined Processes Across Industries

The lack of standardized or well-defined processes is a significant restraint on the Robotic Process Automation (RPA) market. A major challenge is the variation of procedures among sectors, as each sector has its own workflows and practices. This lack of uniformity makes it difficult for RPA solutions to be universally applicable without considerable customization or adaptation to meet individual organizational objectives. As a result, enterprises come across challenges in identifying RPA solutions that efficiently interact with their different processes, restricting scalability and widespread use of automation technology.

Furthermore, the inherent complexity of many organizational processes significantly complicates RPA implementation. Defining clear and consistent automation procedures can be difficult in varied and complicated processes. Without well-defined procedures, RPA implementations may fail to accurately duplicate human activities and decision-making, resulting in inferior outputs and lower efficiency benefits. Companies are hesitant to invest in RPA technologies as they are concerned about inefficiencies or failures caused by process uncertainty. Furthermore, not all procedures are appropriate for automation according to RPA criteria. Automation is most effective when applied to highly repeatable and rule-based tasks. Processes that are inconsistent or poorly defined might fall short of these criteria, limiting the scope of automation options within firms. The disparity between existing processes and RPA capabilities can deter companies from pursuing automation initiatives, thereby hindering the growth of the RPA market.

Failure to Consider Software Licensing Restrictions

The failure to consider software licensing restrictions presents a barrier to the effective implementation and widespread adoption of Robotic Process Automation (RPA) solutions. In many cases, critical systems like Enterprise Resource Planning (ERP) platforms, which are required for RPA capabilities, operate on a Software as a Service (SaaS) basis with per-user licensing arrangements. When RPAs connect with SaaS systems that require per-user licensing, enterprises face unexpected consequences. These may include project delays or cancellations as businesses struggle to reassess licensing requirements, distressing implementation timetables, and wasting critical resources. Furthermore, the unexpected requirement to purchase new licenses to comply with licensing agreements can strain budgets and threaten the financial viability of RPA operations. Retroactively addressing license compliance concerns faces significant mitigation and remediation expenditures, severely burdening firms. To reduce these risks, companies need to perform thorough upfront analyses of licensing agreements and potential implications for RPA deployments. Active efforts include communicating with vendors regarding licensing terms and investigating alternate licensing models that are consistent with RPA usage.

Opportunity

Increased Demand for the RPA in BPO

The growing demand for Robotic Process Automation (RPA) in the Business Process Outsourcing (BPO) sector creates a significant opportunity for the RPA market. RPA is reshaping the landscape of BPO services, offering unparalleled efficiency and accuracy, which is increasingly desirable in the highly competitive business climate. As BPO firms aim for increased productivity and cost optimization, the integration of RPA technologies emerges as an important strategic goal. Initially the BPO sector faced multiple challenges, including political shifts, rising customer demands, and budgetary limits. Political developments, particularly in regions such as Europe and America, can have a major effect on the global BPO landscape, generating uncertainty and disruption. Furthermore, continuing to strive to exceed customer expectations during increased competition remains a constant challenge for BPO providers. Meeting these expectations requires not only outstanding service quality, but also flexibility and innovation in service delivery.

Budget constraints further compound the challenges faced by BPO companies. Balancing the delivery of high-quality services with cost- effectiveness is an ongoing challenge that requires innovative solutions to optimize operating expenses. Additionally, talent scarcity presents an immense challenge, as BPO firms deal with sourcing and retaining skilled professionals to meet the diverse demands of their clients. The absence of expertise increases the requirement to maintain service excellence while dealing with professionals' constraints.

Despite these challenges, the growing demand for RPA in BPO represents a transformative potential. RPA technology provides a compelling solution by automating repetitive processes and optimizing workflows, which improves operational efficiency and accuracy. RPA's scalability and adaptability allow BPO organizations to efficiently adjust to changing project requirements and launch on novel initiatives without being limited by conventional labor-intensive methods. Furthermore, RPA ensures workflow consistency, reduces errors, and improves service delivery standards. BPO providers can achieve significant cost savings by using RPA, with returns on investment (ROI) ranging from 30% to a staggering 200% in the first year alone, according to a study. RPA implementations develop over time, lowering maintenance costs, delivering long-term returns, and reinforcing RPA's value proposition in BPO.

Segment Insights

Type Insights

The market is classified into software and service. The service segment is the most revenue generating in the market which accounted for the highest market share of over 77.21% in 2025 and is expected to be the fastest growing in the market. The rise in demand for outsourcing RPA and installing software over the cloud for automation is due to the growing demand for completing repetitive high-volume activities. Due to the fierce rivalry among businesses, service providers have been forced to improve their advising, training, and consulting services. The adoption of RPA as a service assists companies in identifying the automation possibilities to be maximized and then developing a business case by concentrating on the proper vendor selection as a first step toward pilot project deployment.

The software category is projected to hit 22.79% revenue share in 2025 and is anticipated to expand at a consistent CAGR throughout the projection period due to the requirement for companies to overcome remote working difficulties and automate operations for internal data control while decreasing company expenses on extra personnel.

- In February 2025, the launch of Nibot RPA Product, expanding automation services into the Global Market, was announced by CLPS Incorporation. This most powerful and cost-effective solution offers broad applicability and will primarily target the international market and the Hong Kong market. (Source: laotiantimes.com)

- In December 2024, the Factory of the Future Rapid Automation Assessment (RAA) service was launched by Invio Automation. RAA presents a structured approach to evaluating a factory's automation readiness. It identifies opportunities for automation and delivers a detailed report with actionable insights, including business cases, estimated costs, timelines, and recommendations for success. (Source: therobotreport.com)

Global Robotic Process Automation Market Revenue, by Type (USD Billion) 2022-2024

| By Type | 2022 | 2023 | 2024 |

| Software | 3.325 | 4.150 | 5.196 |

| Service | 11.593 | 14.262 | 17.600 |

Deployment Insights

The market is sub divided into on-premises and cloud. Because of its in-house ownership, the on-premises sector is projected to lead the market with revenue share of over 68.13% in 2025 and projected to surpass at a steady CAGR from 2026 to 2035.

The cloud sector is projected to surpass revenue share over 31.87% in 2025. The cloud sector, on the other hand, is anticipated to be the fastest-growing category in the next years due to benefits such as cheaper infrastructure costs, simplicity of deployment, and minimal upgrading, as well as lower operational costs. To gain flexibility in growing company operations, organizations are gravitating toward cloud-based solutions. Automation Anywhere, for example, will deliver Robotic process automation SaaS for its web-based and cloud-based workforce platform in May 2020. This platform allows for the adoption of a return-to-office or remote work environment.

- In January 2025, a number of advancements across artificial intelligence (AI), the Internet of Things (IoT), and smart home ecosystems that enhance privacy, scalability, and user experiences through a variety of means like edge processing, on-premises edge solutions, and seamless device interoperability were launched by Qualcomm Technologies, Inc. (Source: siliconangle.com)

- In March 2025, the launch of UiPath Test Cloud, a revolutionary new approach to software testing that uses advanced AI to amplify tester productivity across the entire testing lifecycle for exceptional efficiency and cost savings, was announced by UiPath, a leading enterprise automation and AI software company. (Source: businesswire.com)

Global Robotic Process Automation Market Revenue, by Deployment (USD Billion) 2022-2024

| By Deployment | 2022 | 2023 | 2024 |

| Cloud | 4.662 | 5.810 | 7.264 |

| On-Premise | 10.255 | 12.601 | 15.531 |

The on-premises segment held a 58.40% market share in 2025. The dominance of the segment can be attributed to the growing demand for stringent data security and privacy needs, along with its ability to tailor RPA solutions for specific business needs. Also, on-premises solutions enable organizations to align RPA to corporate policies, standards, and access control protocols.

The cloud / SaaS segment is expected to grow with the highest CAGR over the forecast period. The growth of the segment is due to benefits such as cheaper infrastructure costs, simplicity of deployment, and minimal upgrading, as well as lower operational costs. To gain flexibility in growing company operations, organizations are gravitating toward cloud-based solutions.

End-User Industry Insights

The BFSI segment holds the largest market share of 36.52% in 2025. Banking and insurance businesses use RPA for regulatory reporting and balance sheet reconciliation. This technology also assists financial services firms in monitoring and controlling multiple interfaces, ensuring transaction execution is smooth. For example, in April 2020, the United States Banks implemented the UiPath software robot to handle loan applications from small and medium-sized companies (SMB) across the country.

The healthcare industry is expected to grow at the fastest rate in the future years. RPA allows healthcare providers to track and record each process step in structured log files in order to comply with external audits. RPA in hospital management is primarily used to improve administrative processes, revenue cycle management, time for blood or organ transportation, cleaning patient areas, and coordinating schedules for operations and other medical procedures. For example, the British startup T-impact provides a frequently utilized RPA function in healthcare: helping surgeons during surgeries by offering crucial instructions, recommendations, and common cautions.

- In March 2025, “robot factory,” a project to create and implement robots in customer support processes, was launched by Russia's VTB Bank. The Bank's Employee will identify which processes can and need to be automated. They will also look to introduce digital assistance into the operation. (Source: fintechfutures.com)

- In November 2024, the commercial release of the BD OMICS-One XT WTA Assay, its first robotics-compatible high-throughput reagent kit, was announced by Becton, Dickinson, and Company, or BD. Created in partnership with Hamilton, a leader in lab automation, this new solution aims to streamline the traditionally manual and time-consuming DNA library preparation process required in single-cell discovery studies. (Source: thehealthcaretechnologyreport.com)

Global Robotic Process Automation Market Revenue, by Industry (USD Billion) 2022-2024

| Industry | 2022 | 2023 | 2024 |

| BFSI | 5.535 | 6.778 | 8.325 |

| Pharma & Healthcare | 3.036 | 3.823 | 4.827 |

| Manufacturing | 2.731 | 3.384 | 4.207 |

| Retail & Consumer Goods | 1.413 | 1.726 | 2.117 |

| Information Technology (IT) & Telecom | 1.064 | 1.297 | 1.588 |

| Communication and Media & Education | 0.408 | 0.499 | 0.612 |

| Logistics, and Energy & Utilities | 0.315 | 0.381 | 0.463 |

| Construction | 0.158 | 0.189 | 0.227 |

| Others | 0.258 | 0.334 | 0.429 |

Component Insights

The software segment dominated the market with a 67.80% share in 2025. The dominance of the segment is due to the requirement for companies to overcome remote working difficulties and automate operations for internal data control while decreasing company expenses on extra personnel.

The services segment is expected to grow at the highest CAGR of 17.20% over the forecast period. The rise in demand for outsourcing RPA and installing software over the cloud for automation is due to the growing demand for completing repetitive, high-volume activities. Due to the fierce rivalry among businesses, service providers have been forced to improve their advising, training, and consulting services. The adoption of RPA as a service assists companies in identifying the automation possibilities to be maximized and then developing a business case by concentrating on the proper vendor selection as a first step toward pilot project deployment.

Application Insights

The finance & accounting segment dominated the market with a 22.80% share in 2025. The dominance of the segment can be linked to the growing adoption of cloud-based solutions, providing cost-effectiveness and scalability. Furthermore, automating routine processes reduces human errors by ensuring consistent outcomes with higher data quality in tasks like accounts payable and invoicing.

The human resources segment is expected to grow at the highest CAGR of 17.90% during the projected period. The growth of the segment can be driven by the increasing need for skilled workers in the labor market, coupled with the growing demand for remote work options. Moreover, RPA reduces human errors in data handling, which is essential for HR departments.

Regional Insights

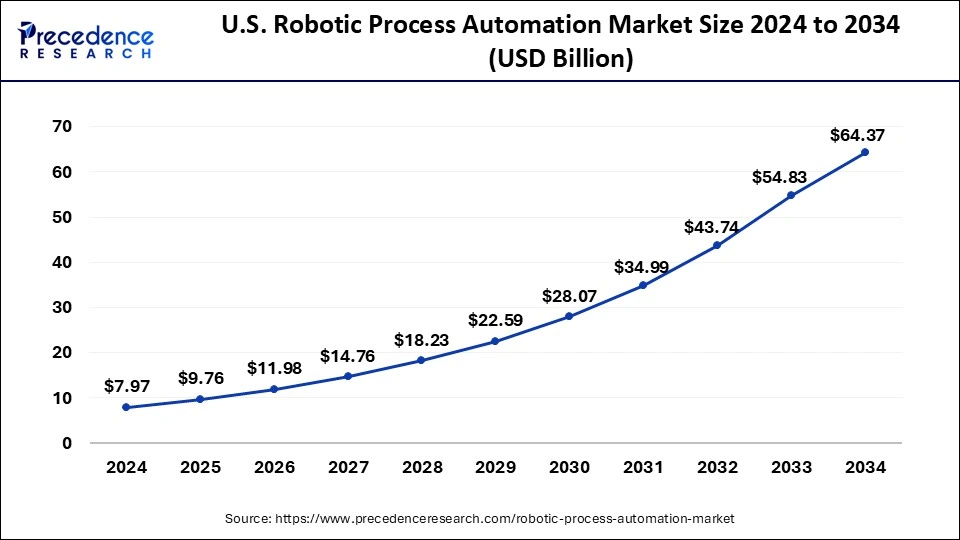

What is the U.S. Robotic Process Automation Market Size?

The U.S. robotic process automation market size is exhibited at USD 9.76 billion in 2025 and is projected to be worth around USD 74.94 billion by 2035, growing at a CAGR of 22.61% from 2026 to 2035.

North America dominated the overall market with the share of 38.92% in 2025. The United States, which is one of the primary inventors and pioneers in robotics adoption, is one of the most important markets. The region's usage of robotics is rising, making US firms more competitive and providing job possibilities, OEMs for process automation. Since 2010, over 180,000 robots have been deployed to various American companies, resulting in the creation of over 1.2 million new manufacturing jobs, according to the Association for Advancing Automation.

Asia Pacific region is expected to be the fastest growing over the forecast period due to increasing product adoption across the pharma, healthcare, IT and Telecom, retail, and manufacturing industries. Robotic process automation is growing as a result of increased demand for automation utilized for various activities in organizations, as well as advancements in machine learning and artificial intelligence. Furthermore, increasing awareness among different industries and SMEs is projected to drive market expansion. The growing need for automation in the Business Process Outsourcing (BPO) industry has also contributed to regional growth.

- Europe robotic process automation market size was valued at USD 6.37 billion in 2024 and is expected to reach at a CAGR of 25.36% from 2025 to 2034.

- Asia Pacific robotic process automation market size was valued at USD 7.14 billion in 2024 and is expanding at a CAGR of 27.52% from 2025 to 2034.

- China robotic process automation market size was valued at USD 1.89 billion in 2024 and it is anticipated to grow at a CAGR of 26.30% from 2025 to 2034.

- South Korea robotic process automation market size was valued at USD 0.49 billion in 2024 and it is growing at a CAGR of 32.43% from 2025 to 2034.

- Germany robotic process automation market size was valued at USD 2.04 billion in 2024 and it is projected to grow at a CAGR of 24.06% from 2025 to 2034.

- In June 2025, the formation of Elevate Robotics, a new, wholly owned subsidiary focused on advancing industrial automation beyond human capabilities, was announced by Apptronik, a US-based AI humanoid robotics startup. The new venture, based in the US, will operate independently under the leadership of CEO Paul Hvass, co-founder of Plus One Robotics. (Source:analyticsindiamag.com)

- Robotic Process Automation (RPA) Lab in NIELIT Gorakhpur on 16th October 2023, during the 26th All India Directors' Meet of NIELIT, was inaugurated by Secretary, Ministry of Electronics and Information Technology (MeitY), Shri S Krishnan (IAS).

Press Release: (Source:pib.gov.in)

Key Companies & Market Share Insights

The market is very competitive, with many specialties small-scale market players as well as established large-scale vendors offering sophisticated robotic process automation systems. Leading industry competitors are providing sophisticated solutions that go beyond rule-based automation. As niche competitors emerge with different solutions to compete in the global market, the main firms are concentrating on providing more enhanced solutions. To obtain a big client base, prominent players are extending their businesses through partnerships.

Robotic Process Automation Market Companies

- UiPath

- Automation Anywhere

- Blue Prism

- NICE

- Pegasytems

- Celaton Ltd.

- KOFAX, Inc.

- NTT Advanced Technology Corp.

- EdgeVerve Systems Ltd.

- FPT Software

- OnviSource, Inc.

- HelpSystems

- Xerox Corporation

Recent Developments

- In July 2025, AI+ Robotics, a comprehensive certification designed to prepare professionals to lead, build, and improve AI-powered robotic systems in the age of Industry 4.0, was launched by as industries move rapidly toward intelligent automation, AI CERTs, a global provider of specific roles and vendor-aligned AI certification programs. (Source: fox40.com)

- In April 2025, the first enterprise-grade platform ‘Ui-Path Platform' for agentic automation, a groundbreaking platform designed to unify AI agents, robots, and people on a single intelligent system, was launched by a global leader in agentic automation, UiPath. (Source: businesswire.com)

Segments Covered in the Report

By Component

- Software

- RPA Development Tools

- RPA Runtime Tools (Bot Execution Engines)

- RPA Orchestration/Control Center

- RPA Analytics & Dashboard Tools

- Pre-built Bots/Bot Marketplace Platforms

- Integration Middleware/API Gateways

- Services

- Consulting

- Process Identification & Prioritization

- ROI & Feasibility Analysis

- Implementation & Deployment

- Workflow Mapping & Bot Configuration

- Integration with Legacy & ERP Systems

- Support & Maintenance

- Bot Lifecycle Management

- Version Control & Updates

- Training

- User Training (Non-technical)

- Bot Developer Training (Low-code/No-code or Advanced)

- RPA-as-a-Service (RPAaaS)

- Fully Managed Services

- Pay-per-bot / Pay-per-process models

- Consulting

By Deployment Model

- On-Premises

- Cloud / SaaS

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Technology Type / Operation

- By Intelligence Level

- Rule-Based RPA (Traditional)

- Static rules

- Structured data

- Intelligent/Cognitive RPA

- Natural Language Processing (NLP)

- Optical Character Recognition (OCR)

- Machine Learning (ML)

- Computer Vision

- Conversational AI Integration (e.g., chatbots)

- Rule-Based RPA (Traditional)

- By Bot Type

- Attended RPA

- Desktop Assistance Bots

- Trigger-Based Execution

- Attended RPA

- Unattended RPA

- Batch Processing Bots

- Scheduled or Triggered by System Events

- Hybrid RPA

By Application / Process

- Administration & Reporting

- Data Entry & Validation

- Report Generation & Distribution

- Data Migration & Capture Extraction

- Legacy System Data Migration

- Invoice & Document Data Capture

- Customer Support

- Ticket Management

- Customer Data Update

- FAQ Automation

- Analysis & Decision Support

- Data Aggregation

- Pre-analytics Reporting

- Compliance & Risk

- Audit Trail Creation

- Regulatory Reporting

- Finance & Accounting

- AP/AR Automation

- Bank Reconciliation

- Expense Processing

- Human Resources

- Onboarding & Offboarding

- Payroll Processing

- Leave & Attendance Management

- Procurement

- PO Creation & Approval Workflows

- Vendor Contract Management

- IT Operations

- Password Resets

- Software Installations & Monitoring

- Others

- Marketing Campaign Management

- Product Catalog Updates

By End-User Industry

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecommunication

- Healthcare & Pharmaceuticals

- Manufacturing & Logistics

- Retail & Consumer Goods

- Government & Defense

- Energy & Utilities

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting