Robotic Flexible Part Feeding Systems Market Size and Forecast 2025 to 2034

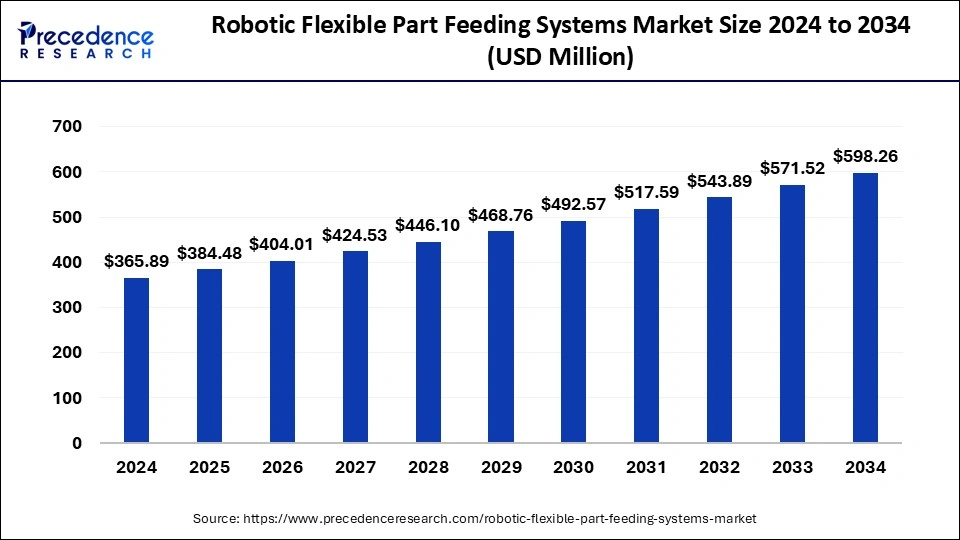

The global robotic flexible part feeding systems market size accounted at USD 365.89 million in 2024 and is predicted to increase from USD 384.48 million in 2025 to approximately USD 598.26 million by 2034, expanding at a CAGR of 5.04% from 2025 to 2034. The increasing need for automation globally, combined with developed cutting-edge technological integration, ensures seamless operations, fueling the robotic flexible part feeding systems market on a wider scale.

Robotic Flexible Part Feeding Systems Market Key Takeaways

- The global robotic flexible part feeding systems market was valued at USD 365.89 million in 2024.

- It is projected to reach USD 598.26 million by 2034.

- The robotic flexible part feeding systems market is expected to grow at a CAGR of 5.04% from 2025 to 2034.

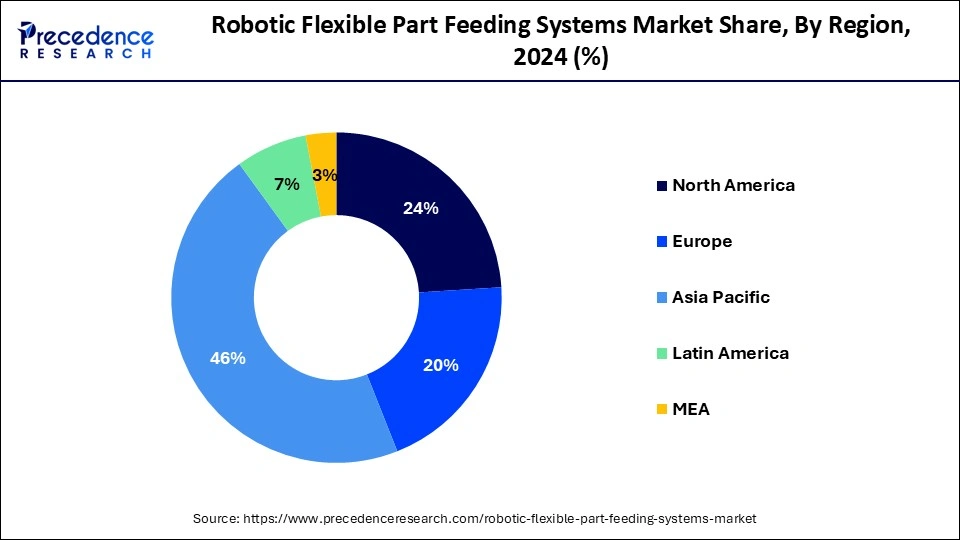

- Asia Pacific dominated the robotic flexible part feeding systems market with the largest revenue share of 46% in 2024.

- By component, the part feeding mechanism segment has contributed more than 51% of revenue share in 2024.

- By application, the assembly segment has held the major revenue share of 42% in 2024.

- By application, in 2024, the material handling equipment segment led the global market.

- By application, the material handling equipment segment is expected to grow rapidly in the market over the forecasted years.

- By end use, the automotive segment held the largest share of the global market in 2024.

Asia Pacific Robotic Flexible Part Feeding Systems Market Size and Growth 2025 to 2034

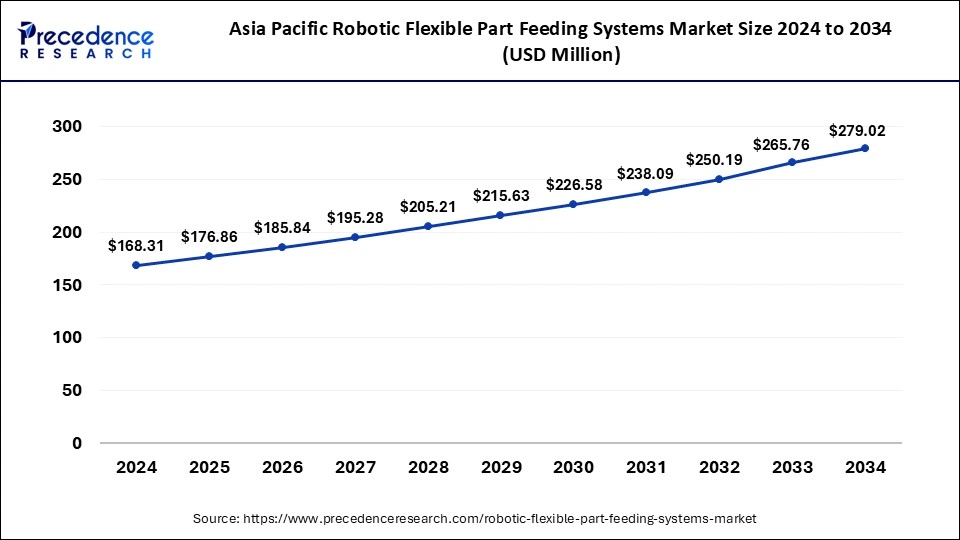

The Asia Pacific robotic flexible part feeding systems market size was exhibited at USD 168.31 million in 2024 and is projected to be worth around USD 279.02 million by 2034, growing at a CAGR of 5.18% from 2025 to 2034.

Asia Pacific dominated the robotic flexible part feeding systems market in 2024 due to its rapid industrialization and economic growth. Countries like China, Japan, South Korea, and India are at the forefront of this expansion, driven by their robust manufacturing sectors and increasing adoption of automation technologies. These nations are investing heavily in advanced manufacturing solutions to enhance productivity, quality, and global competitiveness.

The demand for the robotic flexible part feeding systems market in Asia Pacific is further fuelled by the region's electronics, automotive, and pharmaceutical industries, which require high precision and efficiency. The presence of numerous manufacturing plants and the trend toward Industry 4.0 adoption are driving the need for flexible and adaptable feeding systems. Additionally, the growing middle-class population and increasing consumer demand in these countries are pushing manufacturers to adopt automation to meet higher production standards and volumes.

China is a significant player in the robotic flexible part feeding systems market, with its large-scale manufacturing capabilities and government initiatives such as ‘Made in China 2025' aimed at upgrading its industrial base. Japan and South Korea are also key contributors, and they are known for their technological advancements and innovations in robotics and automation.

Market Overview

The robotic flexible part feeding systems market is experiencing significant growth, driven by increasing automation across industries such as automotive, electronics, and pharmaceuticals. These systems, known for their adaptability and efficiency in handling diverse parts, are becoming essential in manufacturing processes to enhance productivity and reduce downtime.

Technological advancements in robotics and artificial intelligence are further propelling market expansion. Key players are investing in innovative solutions to meet the rising demand for customizable and high-speed feeding systems. Additionally, the trend towards Industry 4.0 and smart manufacturing is expected to boost market growth.

Robotic Flexible Part Feeding Systems Market Growth Factors

- Increasing adoption of automation in manufacturing processes across various industries.

- Advancements in robotics and artificial intelligence enhancing system capabilities along with the rising demand for customizable and high-speed part-feeding solutions aids the growth of the robotic flexible part feeding systems market.

- Expansion of Industry 4.0 and smart manufacturing initiatives are opening new opportunities for players in the robotic flexible part feeding systems market.

- Need for efficient, flexible systems to handle diverse parts and reduce downtime.

- Investments by key players in the robotic flexible part feeding systems market in innovative and adaptive feeding technologies create lucrative opportunities.

- Rapid industrialization and economic growth in emerging regions, particularly Asia Pacific.

- Growing emphasis on improving productivity and operational efficiency in production lines.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 598.26 Million |

| Market Size in 2025 | USD 384.48 Million |

| Market Size in 2024 | USD 365.89 Million |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.04% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing adoption of automation in manufacturing processes

One of the primary drivers of the robotic flexible part feeding systems market is the growing adoption of automation in manufacturing processes. As industries strive to enhance productivity, efficiency, and accuracy, the need for advanced automated systems becomes crucial. Flexible part-feeding systems play a vital role in this transformation by providing versatile solutions capable of handling a wide range of parts without the need for constant reconfiguration or manual intervention.

Automation reduces human error, speeds up production lines, and ensures consistent quality, all of which are essential in today's competitive industrial landscape. In sectors such as automotive, electronics, and pharmaceuticals, the demand for precision and high-speed assembly is particularly high, making flexible part-feeding systems indispensable. These systems can adapt to different part geometries and sizes, thereby offering significant advantages over traditional, fixed feeding mechanisms.

Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning allows these systems to become smarter and more efficient, contributing to the overall optimization of manufacturing processes. As more companies recognize the benefits of automation, the robotic flexible part feeding systems market is expected to continue its robust growth trajectory.

Restraint

High initial investment costs

A significant restraint for the robotic flexible part feeding systems market is the high initial investment costs associated with implementing these advanced systems. The development, purchase, and installation of robotic flexible part feeders require substantial financial outlay, which can be a barrier for small and medium-sized enterprises (SMEs). These businesses often operate with limited budgets and may find it challenging to allocate funds for such capital-intensive equipment.

Rapid technological advancements can make earlier investments seem obsolete, adding to the financial risk. This cost sensitivity can slow the robotic flexible part feeding systems market as companies weigh the benefits against the substantial upfront expenses, particularly in industries with narrow profit margins. Additionally, the costs extend beyond just the acquisition; they also encompass integration with existing manufacturing systems, employee training, and potential downtime during the transition period. For some companies, especially those in regions with lower labor costs, the return on investment (ROI) may not justify the initial expenditure, leading to hesitation in adopting these technologies.

Opportunity

Expansion in emerging markets

One of the key opportunities for the robotic flexible part feeding systems market lies in the expansion into emerging markets, particularly in Asia Pacific. Countries such as China, India, and Southeast Asian nations are experiencing rapid industrialization and economic growth. These regions are becoming manufacturing hubs due to their cost-effective labor and favorable government policies that encourage foreign direct investments and the adoption of advanced technologies.

As these countries continue to develop their manufacturing sectors, there is a growing need for automation to enhance production efficiency, quality, and competitiveness on the global stage. The increasing adoption of Industry 4.0 practices in these markets is driving demand for sophisticated manufacturing solutions, including flexible part-feeding systems. The robotic flexible part feeding systems market offers the agility and efficiency needed to handle diverse and complex production requirements, making them ideal for dynamic industrial environments in emerging markets.

Moreover, the rise of local manufacturing companies striving to meet international standards presents a significant market opportunity. These firms are more likely to invest in modern automation technologies to improve their operational capabilities and reduce dependency on manual labor, which can be inconsistent and error-prone. By tapping into the potential of emerging markets, manufacturers and suppliers of robotic flexible part feeding systems can expand their customer base, increase market share, and drive growth. This geographical diversification also helps mitigate risks associated with the robotic flexible part feeding systems market saturation in developed regions.

Component Insights

The part feeding mechanism dominated the robotic flexible part feeding systems market in 2024 and is expected to maintain its position throughout the studied period due to its critical role in ensuring smooth, efficient, and accurate delivery of parts to the production line. These mechanisms are essential for maintaining the flow of varied components without manual intervention, significantly reducing downtime and enhancing productivity.

Advanced part-feeding systems offer high flexibility, accommodating different part sizes and shapes, which is crucial for industries with diverse product lines. Their ability to adapt to changing manufacturing needs makes them indispensable, leading to higher demand and dominance in the robotic flexible part feeding systems market. Additionally, continuous innovations and technological advancements in part feeding mechanisms further bolster their market position.

Application Insights

The assembly segment dominated the robotic flexible part feeding systems market in 2024 due to its integral role in diverse manufacturing industries such as automotive, electronics, and consumer goods. These industries require precise, efficient, and high-speed assembly processes to meet production demands and maintain product quality.

Robotic flexible part-feeding systems offer significant advantages in assembly operations, including the ability to handle various part sizes and shapes without frequent reconfiguration. This adaptability is crucial for modern assembly lines that produce multiple product variants. Additionally, the increased focus on automation to reduce labor costs and enhance operational efficiency drives the adoption of these systems in assembly applications, solidifying the segment's leading position in the robotic flexible part feeding systems market.

The material handling equipment segment is expected to grow rapidly in the robotic flexible part feeding systems market over the forecasted years. It is essential for efficient movement, storage, control, and protection of materials throughout the manufacturing process. These systems enhance productivity by automating tasks such as sorting, picking, and placing parts, thereby reducing manual labor and minimizing errors. The demand for advanced material handling solutions is growing as industries seek to optimize their operations and integrate smart technologies into their production lines.

End-use Insights

The automotive segment held the largest share of the global robotic flexible part feeding systems market in 2024. The automotive segment dominates due to its high demand for automation and precision in manufacturing processes. Automakers are increasingly adopting these systems to enhance productivity, reduce labor costs, and improve the quality of assembly lines. The need for efficient handling of a variety of parts, quick changeovers, and minimizing downtime makes flexible part feeders particularly valuable in automotive production. As the industry continues to evolve with advancements in electric vehicles and autonomous driving technologies, the reliance on sophisticated, adaptable robotic systems is expected to grow further, solidifying the segment's dominance.

Robotic Flexible Part Feeding Systems Market Companies

- ABB Ltd.

- ARS Srl Socio Unico

- Daifuku Co. Ltd.

- FANUC Corp.

- ISRA VISION AG

- Keyence Corp.

- OMRON Corp.

- RNA Automation Ltd.

- Seiko Epson Corp.

- Teradyne Inc.

Recent Development

- In March 2023, plus one robotics and bowe intralogistics collaborated with proMat 2023. This collaboration offers a consumer a cutting-edge parcel induction system with a different range of parcel sorting solutions. These solutions are extensively utilized across e-commerce for parcel delivery and ensure seamless operations with improved efficiency.

Segments Covered in the Report

By Component

- Part Feeding Mechanisms

- Vision Systems

- Grippers & End Effectors

- Software & Programming

By Application

- Assembly

- Material Handling

- Inspection & Quality Control

- Packaging

- Welding & Joining

By End-use

- Automotive

- Electronics

- Aerospace

- Food & Beverage

- Pharmaceuticals

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting