What is the Robotic Drilling Market Size?

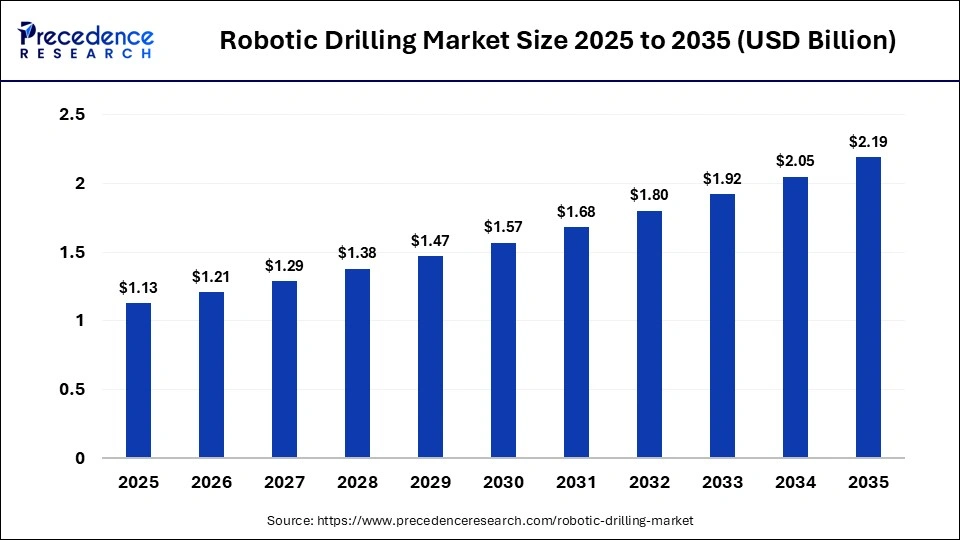

The global robotic drilling market size accounted for USD 1.13 billion in 2025 and is predicted to increase from USD 1.21 billion in 2026 to approximately USD 2.19 billion by 2035, expanding at a CAGR of 6.86% from 2026 to 2035. The market is driven by rising demand for automation, ongoing technological advancements, stringent environmental and regulatory pressures, and growing energy exploration and extraction activities.

Market Highlights

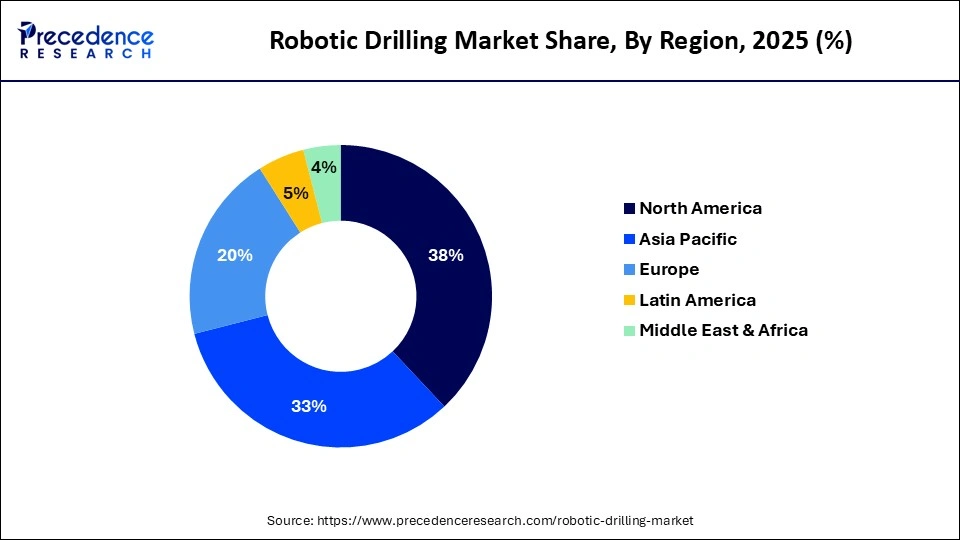

- North America led the robotic drilling market with the largest share of approximately 38% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 7.0% in the market between 2026 and 2035.

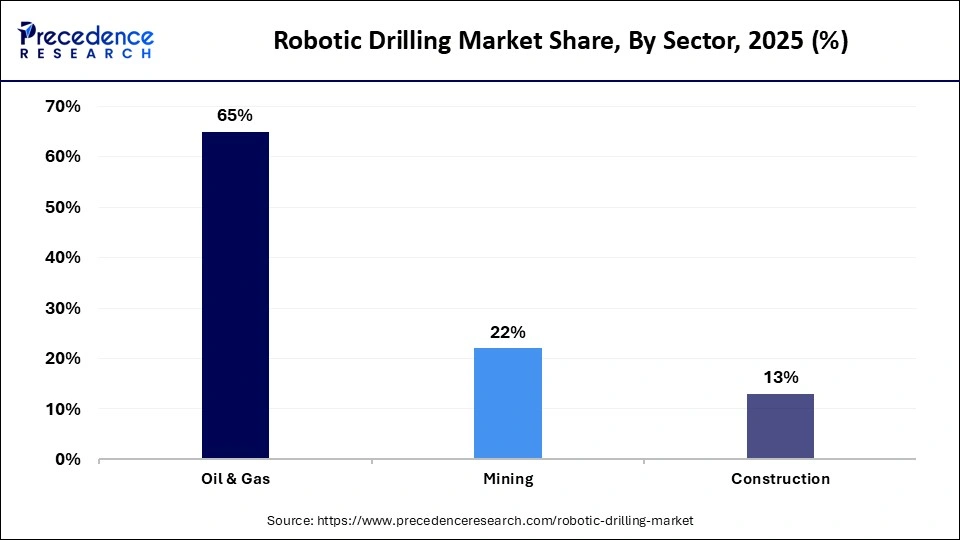

- By sector, the oil & gas segment held a dominant share of approximately 65% in the market in 2025.

- By sector, the mining segment is expected to grow at a healthy CAGR of 5.7% between 2026 and 2035.

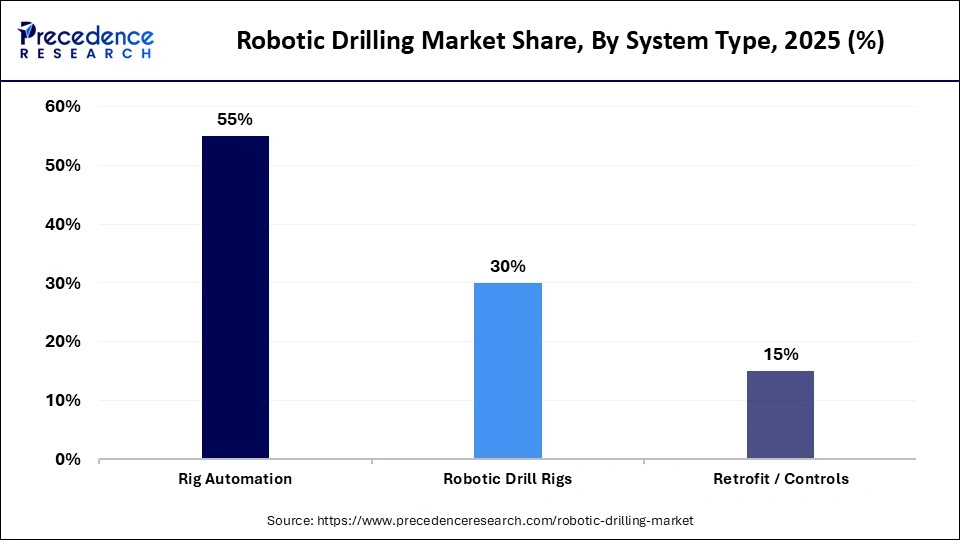

- By system type, the rig automation segment led the market with a market share of approximately 55% in 2025.

- By system type, the robotic drill rigs segment is expected to expand at a robust CAGR of 6.0% from 2026 to 2035.

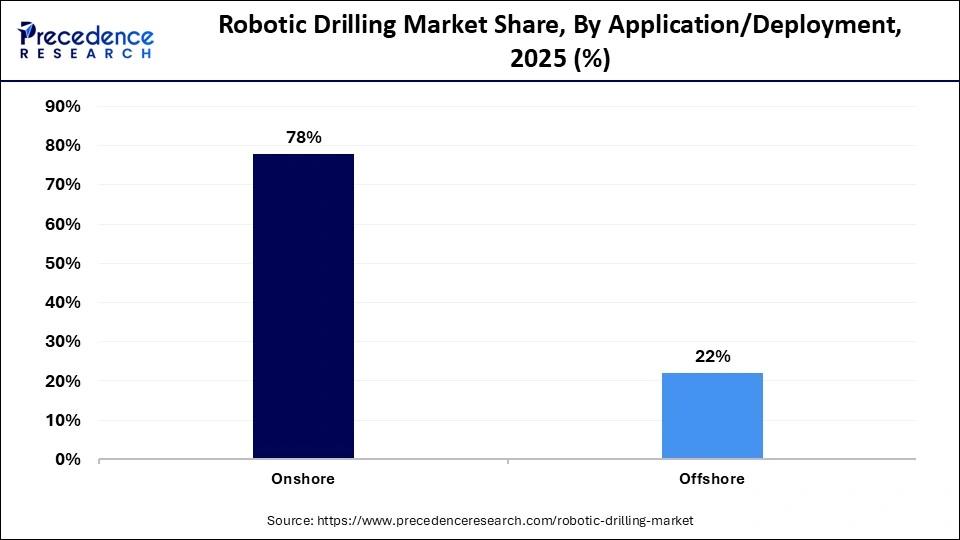

- By application / deployment, the onshore segment held a dominant market share of approximately 78% in 2025.

- By application / deployment, the offshore segment is expected to grow at a solid CAGR of 5.8% between 2026 and 2035.

- By component / technology, the hardware segment held a dominant share of approximately 65% in 2025.

- By component / technology, the software / control solutions segment is expected to grow at the highest CAGR of 6.1% between 2026 and 2035.

Market Overview

The robotic drilling market involves automated and robotic technologies used in drilling operations across sectors such as oil & gas, mining, and construction. These advanced drilling solutions enhance precision, safety, efficiency, and operational uptime by integrating robotics, automation software, and sensor-based control systems into drilling rigs and equipment. Rising energy demand, the need for reduced human exposure in hazardous environments, and digital transformation initiatives are driving adoption globally, especially in onshore and emerging drilling markets. Market growth is also driven by rising demand for high accuracy, reduced labor dependency, improved workplace safety, consistent quality output, faster production cycles, and the increasing adoption of smart manufacturing and Industry 4.0 practices.

How Does AI Reshape the Global Robotic Drilling Industry?

Artificial intelligence integration significantly reshapes the robotic drilling industry by enabling smarter, more adaptive, and highly precise operations. Through machine learning algorithms and real-time sensor data analysis, AI-powered systems can automatically adjust drilling parameters based on material type, thickness, and tool condition, minimizing errors and wear. Predictive maintenance supported by AI helps detect early signs of equipment failure, reducing unplanned downtime and extending tool life.

AI also enhances quality control by identifying defects during the drilling process, ensuring consistent output. Additionally, intelligent process optimization improves cycle times, energy efficiency, and overall productivity while supporting fully autonomous and data-driven manufacturing environments.

Major Trends Influencing the Robotic Drilling Market

- Integration of Advanced Sensors and AI: Robotic drilling systems increasingly incorporate high-precision sensors, machine vision, and artificial intelligence to enhance real-time decision-making. This enables adaptive drilling paths, automatic error correction, and predictive maintenance, ultimately improving accuracy, reducing scrap, and enabling smart, autonomous operation across complex manufacturing environments.

- Growth of Collaborative Robots (Cobots): Collaborative robots designed for safe interaction with human workers are gaining traction in drilling applications. These robots can work alongside operators in tight spaces, improve ergonomics, and handle repetitive tasks, reducing human fatigue while ensuring safe, flexible automation within small to medium enterprises.

- Customization for Industry-Specific Applications: Manufacturers are developing tailored robotic drilling solutions for specific sectors like aerospace, automotive, and shipbuilding. These customized systems address unique part geometries, material variations, and precision requirements, enabling industry-optimized performance that enhances quality and reduces cycle time for specialized components.

- Connectivity and IoT Enablement: Robotic drilling equipment is becoming more connected through Industrial Internet of Things (IIoT) platforms. Real-time data collection, remote monitoring, and cloud analytics enable better performance tracking, predictive insights, and seamless integration with overall factory automation systems, driving operational efficiency and lower downtime.

- Emphasis on Modular and Scalable Systems: Modular robotic drilling units that can be reconfigured or scaled according to production needs are emerging as a trend. This flexibility allows businesses to expand capacity, adapt to changing product lines, and manage costs by upgrading specific modules rather than entire systems, supporting agile manufacturing strategies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.13 Billion |

| Market Size in 2026 | USD 1.21 Billion |

| Market Size by 2035 | USD 2.19 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.86% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Sector, System Type, Application/Deployment, Component/Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Sector Insights

Why Did the Oil & Gas Segment Dominate the Market in 2025?

The oil & gas segment dominated the robotic drilling market with a major revenue share of approximately 65% in 2025. This is mainly due to the industry's need for high-precision, automated drilling solutions to improve operational efficiency and safety in complex and hazardous environments. Robotic drilling systems help reduce human intervention, minimize downtime, and optimize drilling accuracy, particularly in offshore and deep-well operations. Additionally, continued investments in exploration, production optimization, and digital oilfield technologies reinforced oil & gas as the leading end-use segment in the market.

The mining segment is expected to grow at the fastest CAGR of 5.7% during the projection period due to the increasing need for automation to improve safety, precision, and productivity in hazardous and labor-intensive mining operations. Robotic drilling systems enable remote operation, consistent drilling accuracy, and reduced workforce exposure to harsh underground and open-pit environments. Additionally, rising demand for critical minerals and metals, coupled with the industry's push toward digital and autonomous mining solutions, is accelerating the adoption of robotic drilling technologies in the mining sector.

System Type Insights

What Made Rig Automation the Leading Segment in the Robotic Drilling Market in 2025?

The rig automation segment dominated the market with a major revenue share of approximately 55% in 2025. This is primarily due to its high efficiency, precision, and ability to handle complex, repetitive drilling tasks with minimal human intervention. Its seamless integration with production lines enhances throughput and consistency. Additionally, ring automation systems improve safety in confined spaces, reduce labor costs, and support scalable operations, making them ideal for industries like automotive and aerospace.

The robotic drill rigs segment is expected to grow at a healthy CAGR of 5.8% in the upcoming period due to increasing demand for autonomous, flexible drilling solutions in challenging and remote environments. These rigs enhance operational safety by reducing human exposure, improving drilling accuracy, and boosting productivity with advanced navigation and automation. Growing adoption of these rigs in the mining, oil & gas, and construction sectors, driven by labor shortages and the push for cost-efficient, high-precision drilling, fuels the segmental growth.

Application / Deployment Insights

Why Did the Onshore Segment Dominate the Market?

The onshore segment dominated the robotic drilling market with the highest share of approximately 78% in 2025 due to easier accessibility, established infrastructure, and greater adoption of automation in surface drilling operations. Onshore sites benefit from lower logistical challenges, faster deployment of robotic systems, and high demand from construction, mining, and energy sectors. Improved safety, reduced labor needs, and enhanced precision further drive onshore robotic drilling preference.

The offshore segment is expected to expand at a CAGR of 5.8% over the forecast period, as energy companies increasingly rely on automation to operate in remote and technically demanding marine locations. Robotic systems support continuous drilling with minimal human presence, improving operational safety and reliability. Their ability to function under high-pressure, deepwater conditions and unpredictable environments makes them essential for offshore exploration and production efficiency.

Component / Technology Insights

Why Does the Hardware Segment Lead the Robotic Drilling Market in 2025?

The hardware segment dominated the market with a share of approximately 65% in 2025 because physical components like robotic arms, sensors, actuators, and control systems are essential for executing automated drilling tasks. Continuous advancements in durable, high-precision hardware improve performance and reliability. Strong investment in robust machinery, combined with wide application across industries, reinforces demand and solidifies hardware as the core foundation of robotic drilling solutions.

The software/control solutions segment is expected to grow at the fastest CAGR of 6.1% in the market due to its critical role in controlling, monitoring, and optimizing automated drilling operations. Advanced software enables real-time data analysis, predictive maintenance, and autonomous decision-making, improving drilling accuracy, efficiency, and equipment uptime. Additionally, the integration of AI, machine learning, and digital twin technologies is increasing the demand for sophisticated software platforms to manage complex robotic drilling systems.

Regional Insights

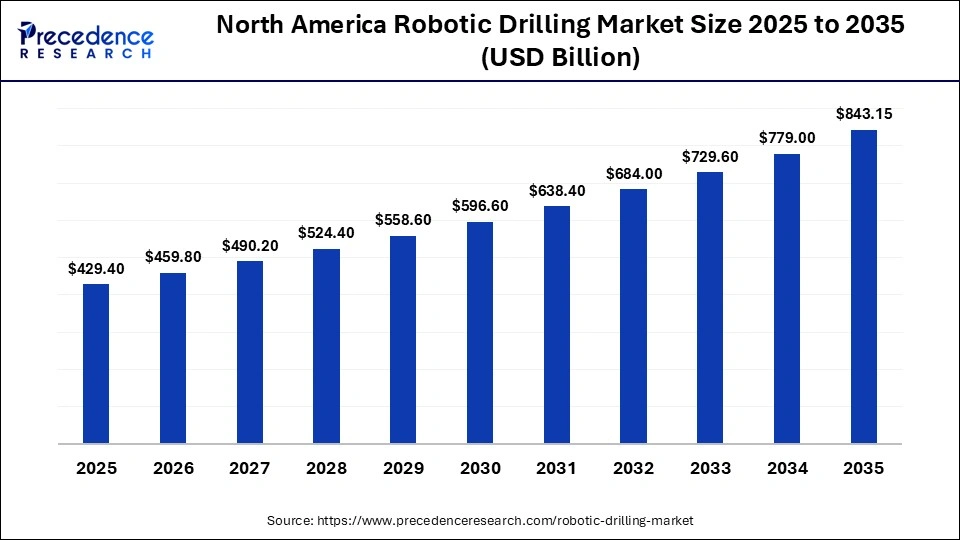

How Big is the North America Robotic Drilling Market Size?

The North America robotic drilling market size is estimated at USD 429.40 billion in 2025 and is projected to reach approximately USD 843.15 billion by 2035, with a 6.98% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Robotic Drilling Market?

North America dominated the robotic drilling market by capturing the largest share of 38% in 2025. This is mainly due to strong industrial automation adoption, significant oil & gas and mining activities, and early technology integration across manufacturing sectors. Robust infrastructure, high R&D investment, and supportive regulatory environments accelerate robotics deployment. Additionally, the local presence of major equipment manufacturers and technology innovators strengthens market leadership and drives widespread implementation of advanced drilling solutions.

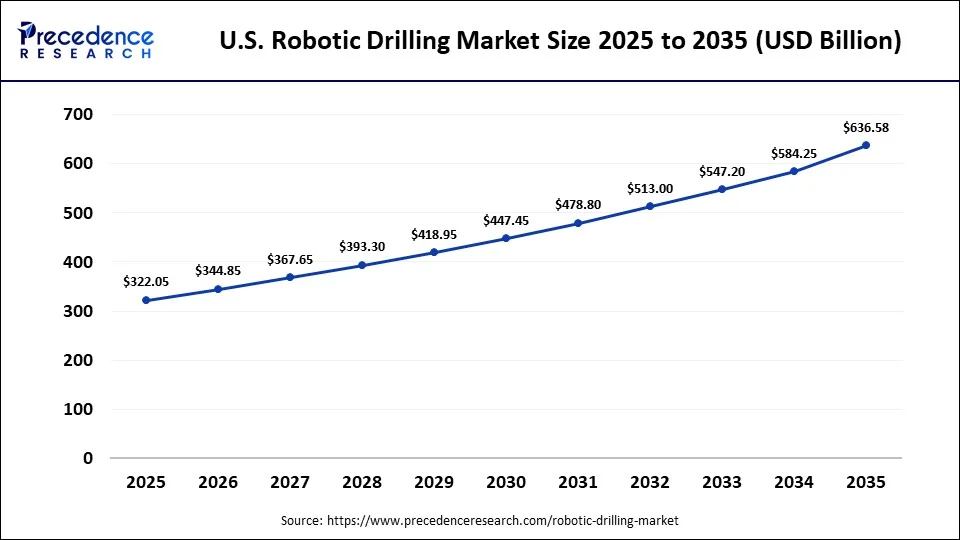

What is the Size of the U.S. Robotic Drilling Market?

The U.S. robotic drilling market size is calculated at USD 322.05 billion in 2025 and is expected to reach nearly USD 636.58 billion in 2035, accelerating at a strong CAGR of 7.05% between 2026 and 2035.

U.S. Robotic Drilling Market Trends

The U.S. leads the North American market due to its advanced industrial automation ecosystem, strong presence of key technology developers, and high adoption in oil & gas, aerospace, and manufacturing sectors. Substantial investment in R&D, supportive infrastructure, and ongoing modernization of drilling operations further accelerate the deployment of robotic drilling systems nationwide.

Why is Asia Pacific Experiencing the Fastest Growth in the Robotic Drilling Market?

Asia Pacific is expected to grow with the highest CAGR of 7.0% in the market due to rapid industrialization, expanding manufacturing and mining sectors, and increasing automation adoption to improve efficiency and safety. Rising investments in infrastructure development and energy exploration, along with growing demand for advanced drilling technologies in countries like China and India, are accelerating deployment. Additionally, supportive government initiatives and strengthening the supply chain ecosystem further boost regional growth momentum.

China Robotic Drilling Market Trends

China dominates the Asia Pacific market due to its large-scale industrial and energy infrastructure projects, widespread adoption of automation, and strong government support for advanced manufacturing technologies. The presence of leading robotics manufacturers, rapid modernization of mining and oil & gas operations, and high demand for efficient, safe, and precise drilling solutions drive China's leading position in the regional market.

Who are the Major Players in the Global Robotic Drilling Market?

The major players in the Robotic Drilling market include Nabors Industries Ltd. (Canrig Drilling Technology), NOV Inc. (National Oilwell Varco), Schlumberger Limited, Halliburton Company, Epiroc AB, Sandvik AB, Huisman Equipment B.V., Robit Plc, Herrenknecht AG, Caterpillar Inc., Komatsu Ltd., Drillmec S.p.A., Automated Rig Technologies Ltd., Drillform Technical Services Ltd., and Weatherford International plc.

Recent Developments

- In January 2026, Sandvik announced the expanded rollout of its AutoMine autonomous surface drilling systems through a collaboration with global mining major Vale. The upgraded platforms feature enhanced robotic controls, intelligent navigation, and centralized fleet management capabilities. Designed for continuous, high-precision drilling, these systems allow operators to manage drilling activities remotely from control centers. The expansion supports safer mining environments, optimized resource extraction, and improved productivity across large and geographically complex mining sites.(Source: https://www.mining.sandvik)

- In September 2025, Helmerich & Payne (H&P), in collaboration with NOV, announced the commercial deployment of its FlexRobotics drilling system in the Permian Basin. The solution features advanced robotic arms designed to automate repetitive rig-floor activities such as pipe handling and connection tasks. This development significantly improves operational consistency while reducing manual labor requirements. The system is engineered as a retrofit solution, allowing existing rigs to adopt automation without major structural changes, enhancing safety, uptime, and drilling efficiency.(Source: https://www.linkedin.com)

- In March 2025, Kongsberg Gruppen entered into a strategic partnership with Oceaneering International to accelerate the development of autonomous robotic drilling technologies for offshore operations. The collaboration focuses on combining robotics, digital twin modeling, and intelligent control systems to enable remote drilling management. This initiative aims to minimize offshore personnel exposure while improving precision and reliability in complex marine environments. The partnership highlights the industry's shift toward digitally enabled, low-touch offshore drilling operations.(Source: https://www.kongsberg.com)

- In February 2025, Halliburton, an oil and natural gas company, in partnership with Sekal AS, unveiled an automated on-bottom drilling solution that integrates advanced drilling control software with real-time downhole automation. The system enables continuous drilling optimization without manual intervention, improving drilling stability and performance. By combining intelligent algorithms with automated control mechanisms, the solution supports remote operations and consistent execution in offshore environments. This launch reflects growing demand for software-driven robotics in precision-focused drilling applications.(Source: https://www.halliburton.com)

Segments Covered in the Report

By Sector

- Oil & Gas

- Mining

- Construction

By System Type

- Rig Automation

- Robotic Drill Rigs

- Retrofit/Controls

By Application/Deployment

- Onshore

- Offshore

By Component/Technology

- Hardware

- Software/Control Solutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content