What is Orthopedic Implants Market Size?

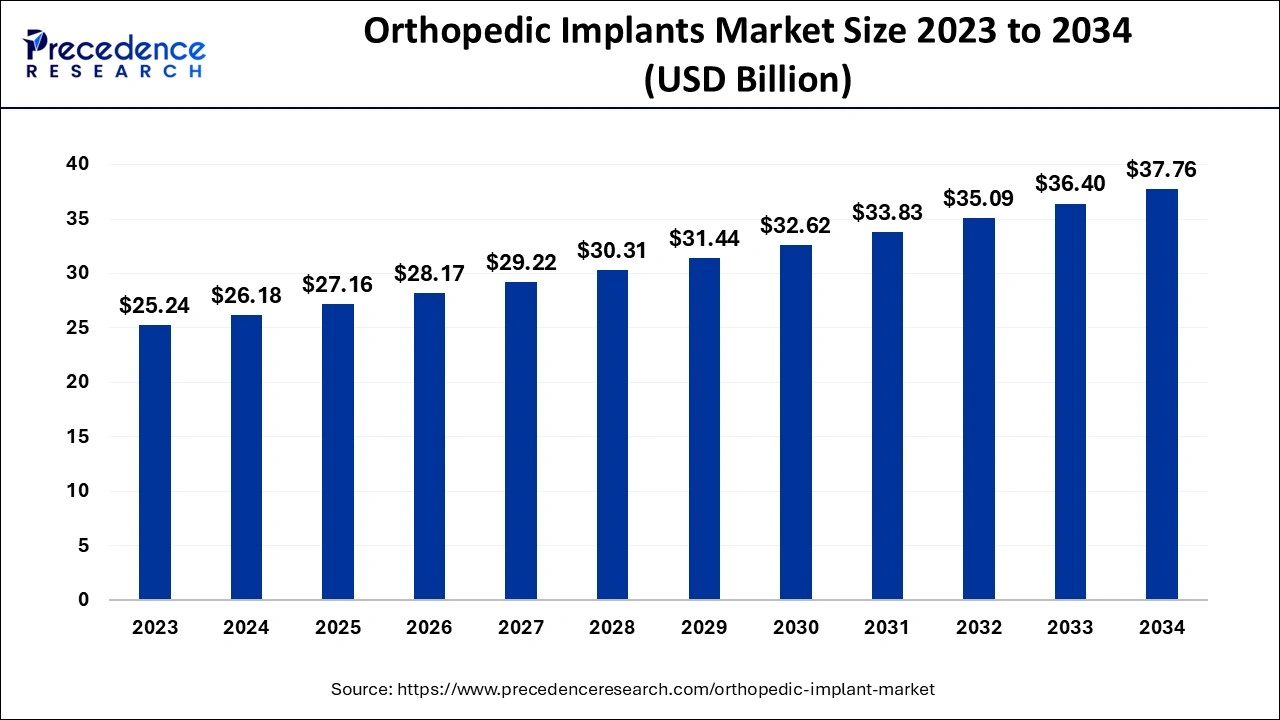

The global orthopedic implants market size is estimated at USD 27.16 billion in 2025 and is anticipated to reach around USD 39.08 billion by 2035, expanding at a CAGR of 4.09% from 2026 to 2035

Market Highlights

- By product, the reconstructive joint replacements segment has garnered market share of around 43%.

- The spinal implant product segment has accounted 19% market share in 2025.

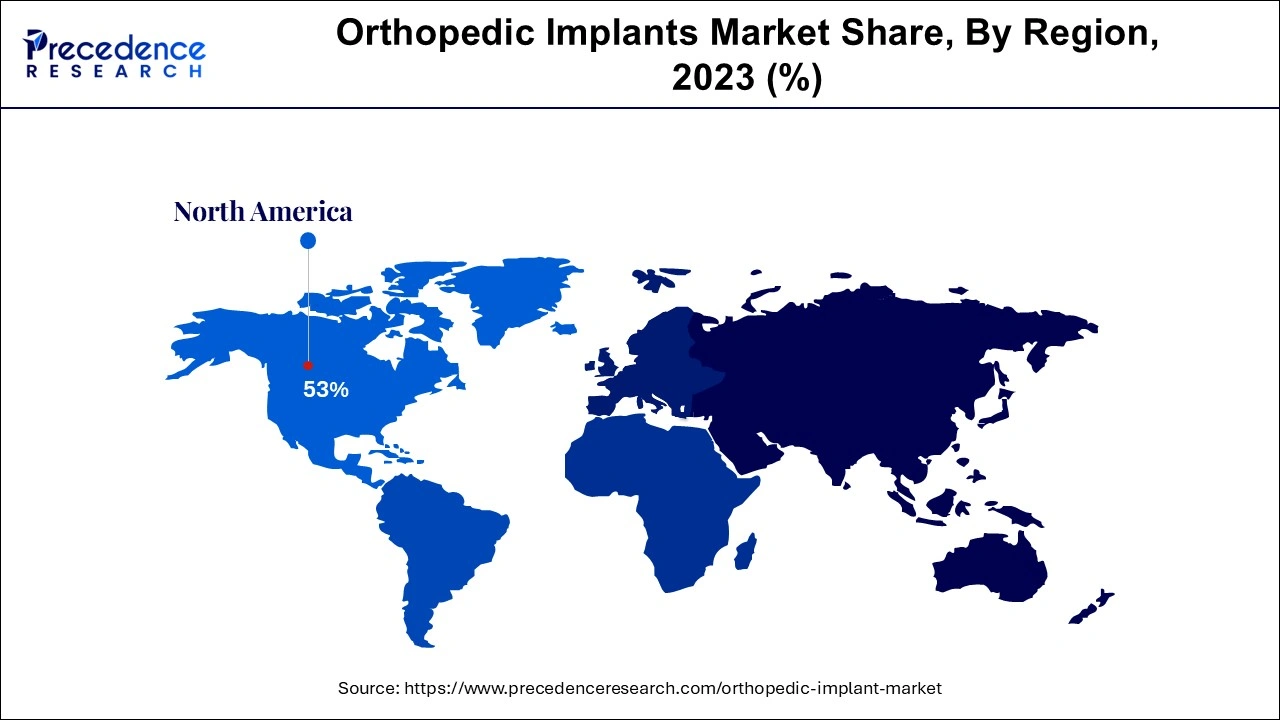

- The North American orthopedic implants market is growing at a CAGR of 3.82% from 2026 to 2035

- Metallic Biomaterials segment accounted largest revenue share of around 59% in 2025.

- North America has garnered revenue share of around 53% in 2025.

Market Overview

It is a medical equipment which is made use of when there is a missing part of the bone or a particular joint in order to support the damage is done to that particular bone with a view to prevent further damage. This artificial implant is manufactured with the help of stainless steel and alloys like titanium to obtain maximum strength and is quoted with the help of plastic which behaves as the cartilage for that particular part of the body in order to maintain the structure and functionality of the joint. The surgeries which would require minimal operative procedures mainly make use of these kind of artificial implants which are usually seen in the treatment of spinal injuries and other such related diseases like the stenosis of the lumbar spine.

Rapid surge in the number of orthopedic injuries have been noted recent years as a result of the various crawling diseases that have showing up relating to the bones. As a result of the huge geriatric population residing worldwide the number of bone injuries and fractures has seen a rise during the recent years. As the age advances the calcium level of the bones deteriorates which makes it porous and is termed as osteoporosis. Osteoporosis and osteoarthritis have become one of the most common diseases existing in the elderly population during the recent times. The prevalence of other types of local injuries due to fall among the elderly people also proved to be a driving factor for the growth of the market.

Additionally, the technological advancements and innovations like the robot assisted operative equipments, the rapid use of orthopedic implants and the acceptance of medical devices which are used for implementation and the various other modern techniques to deal with musculoskeletal injuries have helped to boost the market during the forecast. The cost which is associated with the use of these advanced technologies is very high which becomes unaffordable for the common people. The government policies are very strict regarding the orthopedic implants which make it quite difficult for the market to show a considerable growth during the forecast. On the other hand, the developing economies are offering lucrative opportunities to the market in order to show a considerable growth.

The outbreak of the pandemic had shown a considerable impact on the growth of the market negatively. In order to curtail the spread of infection strict government guidelines and rules were laid down regarding the functioning of the hospitals. The hospitals started opting for elective surgical procedures only which were unavoidable and proved to be an emergency. While the other surgical procedures which did not need emergency surgical intervention were kept on palliative treatment or on hold. This reason greatly hampered the growth of the market.

Number of startup industries hard to shut down temporarily which involves a number of sub-domains as well related to the health care industry. There was a considerable decline in the flow of patients which was noticed during the course of the pandemic in order to avoid cross infection between the patient and the medical staff. The demand and supply of orthopedic implants was hampered as a number of clinics and hospitals remained specifically reserved only for the patients affected by the pandemic. These multiple factors hampered the growth of the market and showed a decline in the revenue generation.

Orthopedic Implants Market Growth factors

A sudden boost was noticed in the compound annual growth rate of the orthopedic implant market after the restrictions were removed in the post pandemic period. The surgeries which were kept on hold and palliative treatment during the occurrence of the pandemic were opted for immediately by the hospitals which led to the high demand of orthopedic implants in the market. As a result of the sedentary lifestyle practices which were followed globally due to the changes in the work pattern of the people during the pandemic led to a number of orthopedic disorders which involved spinal disorders and other bone related disorders as a result of obesity. As per our research which was conducted by the NCBI most of the Americans who were above the age of 50 develop osteoporosis and need surgical intervention in order to deal with the disease.

The rapid increase in the cases of osteoporosis and osteoarthritis is foreseen to boost the demand for the orthopedic implants in the near future. The delays which were made regarding the surgical treatments during the period of the pandemic had hampered the demand in supply chain of the orthopedic implants market. After the removal of the restrictions during the post pandemic this same demand was seen will be on a rise. The recent technological advancements which have been made by the orthopedic implants sector have helped to boost the market tremendously. The increasing demand for joint implants which are customized as per the requirements of the patients is foreseen to boost the market growth considerably. The orthopedic implants are manufactured as per the orders which are placed by the hospital by taking into consideration the anatomical structure of each bone and joint. This helps the patient to have a unique experience and enjoy a comfortable life after the surgical procedure.

Numerous companies are striving hard to supply advanced technologies in order to manufacture customized orthopedic implants. A new technology which is known as 3D printing has also seen a great demand from the present market as a result of its high accuracy and precision regarding the structure and the anatomical setting of a particular joint or bone. Technologies which can supply a cutting-edge variety are being developed by numerous companies in order to boost the demand of orthopedic implants in the market.

A constant rise in the cases of obesity and the increasing shift to sedentary pattern of lifestyle helps to boost the market during the forecast period. A huge amount of investment has been observed by the key market players for research and development in order to produce a minimally invasive procedure for the orthopedic surgeries. Constant efforts are also being taken by the key market players in order to develop cost effective orthopedic implants in order to make it affordable for the common man. These multiple factors prove to be a driving force for the growth of the market during the forecast period.

Market Outlook:

- Industry Growth Overview: The expansion of the orthopedic implants market is driven by the use of smart implants, additive manufacturing, and increased development of cross-border collaboration between clinical research organizations (CROs).

- Sustainability Trends: The development of sustainable practices, such as the use of recycled corrosion-resistant biomaterials, eco-efficient manufacturing practices, and a life-cycle assessment approach to implant design, will provide sustainable solutions that can become competitive advantage points.

- Global Expansion: Due to the increasing prevalence of cost-effective surgical centers and localized manufacturing capabilities within emerging markets, these emerging markets are recognizing and fulfilling the need for unmet orthopedic care.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 27.16 Billion |

| Market Size in 2026 | USD 28.17 Billion |

| Market Size by 2035 | USD 39.08 Billion |

| Growth Rate from2026 to 2035 | CAGR of 4.09% |

| Dominating Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Type, Biomaterial, Procedure, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

On the basis of product, the market has been distributed under reconstructive joint replacements, dental implants, orthobiologics, spinal implants and trauma. There are numerous other types of implants which come under this category. The reconstructive joint implants segment is foreseen to dominate the market by having the largest share in the forecast period. As a result of the rapid increase in the cases of osteoarthritis and osteoporosis this segment is seen to dominate its position throughout the growth phase of the market.

A rapid research and development which is carried out by the key market players in order to develop the best implants for such cases has helped to boost the market. The increasing need for modern techniques and advanced therapies which include minimal invasive techniques has made the market players eager to develop better implants. With the increasing awareness regarding orthobiologics a steady growth in the market size has been noticed.

Biomaterial Insights

On the basis of biomaterial, the market has been divided into ceramic biomaterials, metallic biomaterials, polymers biomaterials and many other varieties. Among these the metallic biomaterials have dominated the market segment with the largest share as a result of its numerous benefits. The metallic biomaterials or cost effective and stimulate better bone healing in comparison to the other types of materials used. They are mainly used in order to manufacturer a number of orthopedic implants like plates, screws and VCF devices.

On the other hand, the other varieties of biomaterials are seen to generate a higher demand during the forecast period. The advantages of reduced toxicity and biocompatibility have also helped to boost the market for the other types of materials. The capacity to carry a specific type of binding protein helps to hasten the tissue healing process which increases the demand for these materials in the market.

Type Insights

On the basis of type, the market has been divided into hip, wrist, knee, shoulder, spine, dental and ankle implants. Among these, the knee segment has recorded the highest growth during the forecast period and is foreseen to maintain its position in the future as well figured with the increase in prevalence of road traffic accidents the number of bone injuries and joint dislocations has seen a steady rise. The number of bone injuries has also increased due to the increasing prevalence of sports injuries which is seen as a result of the increasing competition among the players. Accident re lifestyle practice which leads to obesity has also become a major factor for a number of bone injuries and joint disorders. These multiple factors have helped to boost the market for the knee segment as it bears the direct load of the body. This has also given rise to multiple spinal disorders which helps the market to grow. The rapid growth in the geriatric population has increased the number of incidences with spinal disorders.

Regional Insights

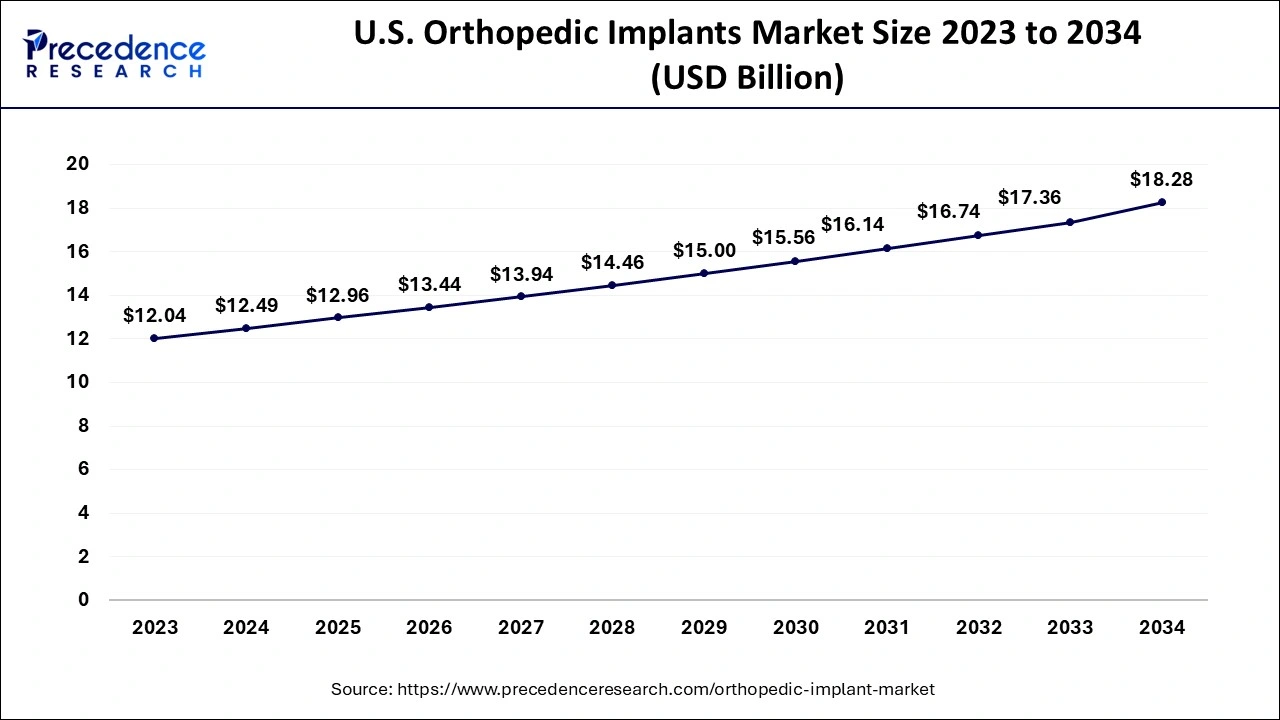

U.S. Orthopedic Implants Market Size and Growth 2026 to 2035

The U.S. orthopedic implants market size is evaluated at USD 12.96 billion in 2025 and is predicted to be worth around USD 19.00 billion by 2035, rising at a CAGR of 3.9% from 2026 to 2035

U.S. Orthopedic Implants Market Analysis

The U.S. is a major contributor to the North American orthopedic implants market, driven by its large aging population, high rates of musculoskeletal disorders, and a well-established healthcare system. The country also benefits from being home to leading orthopedic implant manufacturers and a robust demand for advanced surgical procedures, including joint replacements and spinal surgeries. Additionally, significant investments in medical technology and healthcare innovations further strengthen its position in the global market.

On the basis of geography, the North American market has dominated the segment as a result of it's high prevalence in the patients of osteoarthritis and osteoporosis. The European market has been considered to be the second in line as far as the market share is concerned. The Asia Pacific region has also registered a significant growth as a result of the groin joint replacement surgeries. The increasing sedentary lifestyle of the people has led to numerous born and joined disorders.

On the basis of geography, the North American market has dominated the segment as a result of it's high prevalence in the patients of osteoarthritis and osteoporosis. The European market has been considered to be the second in line as far as the market share is concerned. The Asia Pacific region has also registered a significant growth as a result of the groin joint replacement surgeries. The increasing sedentary lifestyle of the people has led to numerous born and joined disorders.

What Made North America the Dominant Region in the Orthopedic Implants Market?

North America dominated the orthopedic implants market with the largest share in 2025, primarily due to its advanced healthcare infrastructure, high demand for joint replacement surgeries, and increasing aging population, which drives the need for orthopedic solutions. Additionally, the region benefits from significant investments in research and development, which have led to innovative implant technologies, as well as high healthcare spending and widespread insurance coverage, making it accessible to a larger portion of the population.

Why is Europe Considered the Second-Largest Market?

Europe is considered the second-largest market for orthopedic implants due to its well-established healthcare systems, high adoption of advanced medical technologies, and an aging population that drives demand for orthopedic procedures. The region also benefits from a strong presence of key industry players, along with increasing government focus on improving healthcare infrastructure and patient access to treatment. Furthermore, the growing prevalence of conditions such as osteoarthritis and the rising trend toward minimally invasive surgeries are driving market growth across European countries.

Germany Orthopedic Implants Market Trends

Germany is a major contributor to the European market, owing to its strong healthcare infrastructure, leading medical research institutions, and a high demand for orthopedic procedures driven by an aging population. The country is home to several key players in the orthopedic implant industry and has a well-established market for joint replacement surgeries, spinal implants, and trauma-related devices. Additionally, Germany's focus on advanced healthcare technology and high healthcare expenditure further bolsters its position as a leader in the European market.

What Potentiates the Growth of the Orthopedic Implants Market in Asia Pacific?

The market in Asia Pacific is expected to grow at a notable rate over the forecast period, primarily driven by the increasing aging population, rising incidences of bone and joint disorders, and expanding healthcare infrastructure. Additionally, economic growth in key countries such as China and India, along with advances in medical technology and greater access to healthcare services, is driving higher demand for orthopedic surgeries and implants. The growing awareness of advanced treatment options and the expansion of medical tourism also play significant roles in accelerating market growth in this region.

China Orthopedic Implants Market Trends

China is a major contributor to the market, driven by its large population, rapid urbanization, and growing healthcare needs stemming from an aging population. The country's increasing prevalence of musculoskeletal disorders, along with government investments in healthcare infrastructure, has led to a rising demand for orthopedic implants. Additionally, China's expanding medical tourism sector and the presence of both domestic and international implant manufacturers further bolster its position as a key player in the region's market.

How Crucial is the Role of Latin America in the Orthopedic Implants Market?

Latin America plays a crucial role in the orthopedic implants market due to rising orthopedic disorders, an aging population, and expanding healthcare infrastructure. Growing awareness of advanced surgical procedures, government support for modern hospitals, and adoption of innovative implant technologies also support market growth. Brazil leads the market because of its large population, high rate of musculoskeletal disorders, advanced healthcare infrastructure, widespread use of modern surgical techniques, strong presence of private and public hospitals, and government initiatives that support medical technology and improve access to orthopedic treatment nationwide.

How Big is the Opportunity for the Growth of the Market in the Middle East and Africa?

The Middle East and Africa offer significant growth opportunities in the orthopedic implants market, driven by rising orthopedic disorders, an aging population, and expanding healthcare infrastructure. Adoption of advanced surgical technologies, government initiatives to improve medical facilities, the growth of private hospital networks, and rising awareness of minimally invasive procedures further support market development across the region.

The UAE leads the Middle East and Africa orthopedic implants market thanks to advanced healthcare systems, top-tier hospital networks, strong government investment in medical technology, and widespread use of minimally invasive and robotic-assisted surgeries. Its position as a regional medical hub, along with skilled specialists and quick access to innovative implants, fuels market leadership and growth.

Value Chain Analysis

The value chain for orthopedic implants extends far beyond manufacturing and distribution; it also includes advanced research and development (R&D), regulatory compliance, clinical validation and post-market surveillance. Leading companies such as DePuy Synthes, Zimmer Biomet, Stryker Corporation and Medtronic have made significant investments in all stages of the orthopedic implant value chain in order to capitalize on the value associated with each stage.

- Integrated R&D/Regulatory Function: Innovative materials (e.g., polymers, composites, bioactive ceramics) and digital technology (including artificial intelligence) will continue to require extensive clinical and pre-clinical evaluation in order to enhance market entry times while providing for greater product differentiation.

- Cost and Manufacturing: The high costs of raw materials (titanium, cobalt-chromium alloys) and the need for precision machining have led to a higher cost structure that will affect pricing strategy and margin planning.

- Data and Post-Marketing Surveillance: Real-world evidence derived from EHR (electronic health records) can be used as a data point to monitor implant performance, demonstrate safety and develop design improvements.

Key Players in Orthopedic Implants Market and Their Offerings

- Zimmer Biomet Holdings: Zimmer Biomet is a global leader in orthopedic implants, offering a wide range of products for joint replacement, trauma, spine, and dental applications, and advancing minimally invasive surgical solutions.

- Stryker Corporation: Stryker contributes to the orthopedic implants market with its comprehensive portfolio, including joint replacement systems, spine implants, and trauma products, while also pioneering robotic-assisted surgery technologies.

- Johnson & Johnson:Through its DePuy Synthes division, Johnson & Johnson provides a broad range of orthopedic implant solutions, including joint reconstruction, trauma, and spine implants, alongside innovative surgical instruments.

- Medtronic Plc: Medtronic offers a diverse selection of orthopedic implants and related technologies, focusing on spinal, musculoskeletal, and trauma solutions, while investing heavily in advanced robotic and navigation technologies for orthopedic surgeries.

- NuVasive: Specializing in spine surgery, NuVasive provides innovative spinal implant solutions and minimally invasive surgical technologies, leading advancements in vertebral fixation and interbody fusion.

- Arthrex, Inc.: Arthrex is a prominent player in the orthopedic implants market, offering a wide range of products for arthroscopic surgery, sports medicine, joint repair, and minimally invasive procedures.

- DJO Finance LLC:DJO Finance is a key provider of orthopedic implants and rehabilitation products, with a focus on joint reconstruction, bracing, and pain management solutions.

- Smith and Nephew Plc:Smith & Nephew develops orthopedic implants for joint replacement, sports medicine, and trauma, emphasizing innovation in robotic-assisted surgery and biologics for faster recovery.

- CONMED Corporation: CONMED offers advanced orthopedic implants and surgical instruments, specializing in arthroscopic, sports medicine, and minimally invasive procedures, along with trauma and reconstructive solutions.

Recent Developments

- In January 2021, GOeasy, which is a leading market player of the orthopedics implants industry which manufactures instruments and implants for joint replacement procedures has disclosed its deal with PeekMed, which is a leading software technology industry that is developing a digital planning platform which is a powerful 3D preoperative tool.

Segments covered in the report

By Product

- Reconstructive Joint Replacements

- Upper Extremity Reconstruction

- Elbow

- Shoulder

- Hand Wrist

- Lower Extremity Reconstruction

- Upper

- Lower

- Knee Replacement Implants

- Hip Replacement Implants

- Extremities

- Spinal Implants

- Thoracolumbar Devices

- Cervical Fixation Devices

- Interbody Fusion Devices

- Balloon Kyphoplasty Devices

- Vertebroplasty Devices

- Dynamic Stabilization Devices

- Artificial Disc Replacement Devices

- Annulus Repair Devices

- Nuclear Disc Prostheses

- Spinal Fusion Implants

- Vertebral Compression Fracture (VCF) Devices

- Motion Preservation Devices/Non-Fusion Devices

- Dental Implants

- Root Form Dental Implants

- Plate Form Dental Implants

- Trauma

- Orthobiologics

- Demineralized Bone Matrix (DBM)

- Allograft

- Bone Morphogenetic Protein (BMP)

- Viscosupplementation Products

- Synthetic Bone Substitutes

- Others

- Others

By Type

- Wrist & Shoulder

- Dental

- Knee

- Hip

- Spine

- Ankle

By Biomaterial

- Metallic Biomaterials

- Stainless Steel

- Titanium Alloy

- Cobalt Alloy

- Others

- Ceramic Biomaterials

- Polymers Biomaterials

- Others

By Procedure

- Open Surgery

- Minimally Invasive Surgery (MIS)

- Others

By End User

- Hospitals

- Orthopedic Clinics

- Home Cares

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting