Expanded Metal Foils Market Size and Forecast 2025 to 2034

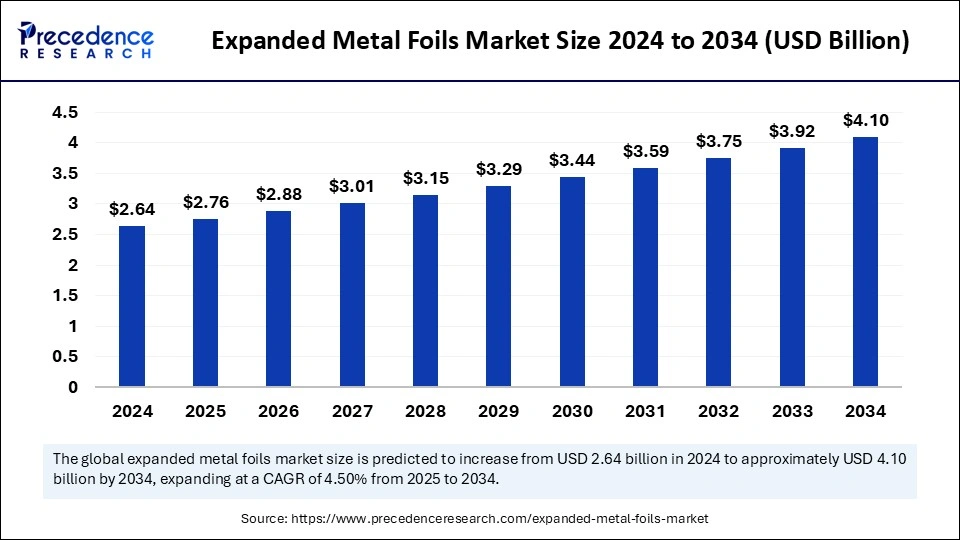

The global expanded metal foils market size was estimated at USD 2.64 billion in 2024 and is predicted to increase from USD 2.76 billion in 2025 to approximately USD 4.10 billion by 2034, expanding at a CAGR of 4.50% from 2025 to 2034. Rising demand for renewable energy, especially wind power, is the key factor driving the growth of the market. Also, technological developments in materials coupled with stringent regulatory standards can fuel market growth further.

Expanded Metal Foils Market Key Takeaways

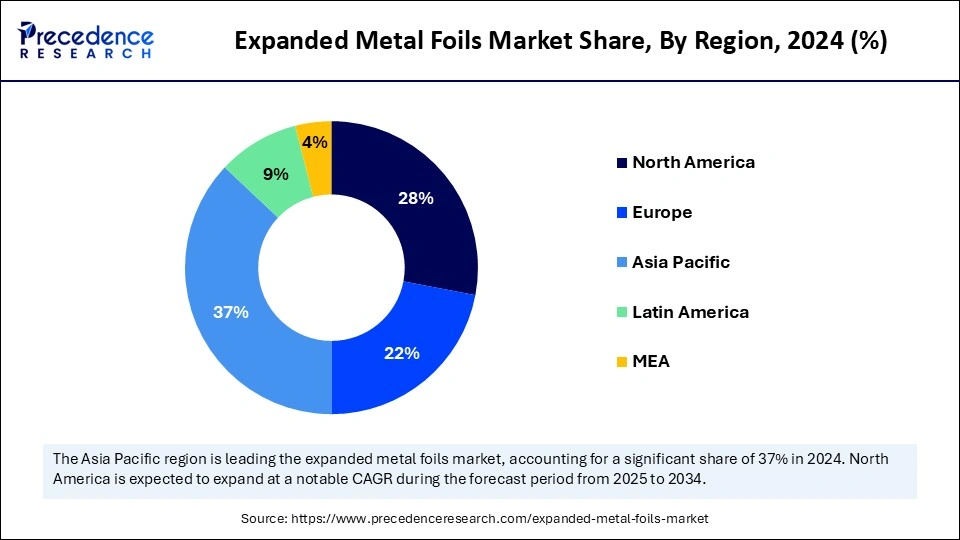

- Asia Pacific led the global expanded metal foils market with the largest market share of 37% in 2024.

- North America is expected to grow at the fastest CAGR over the studied period.

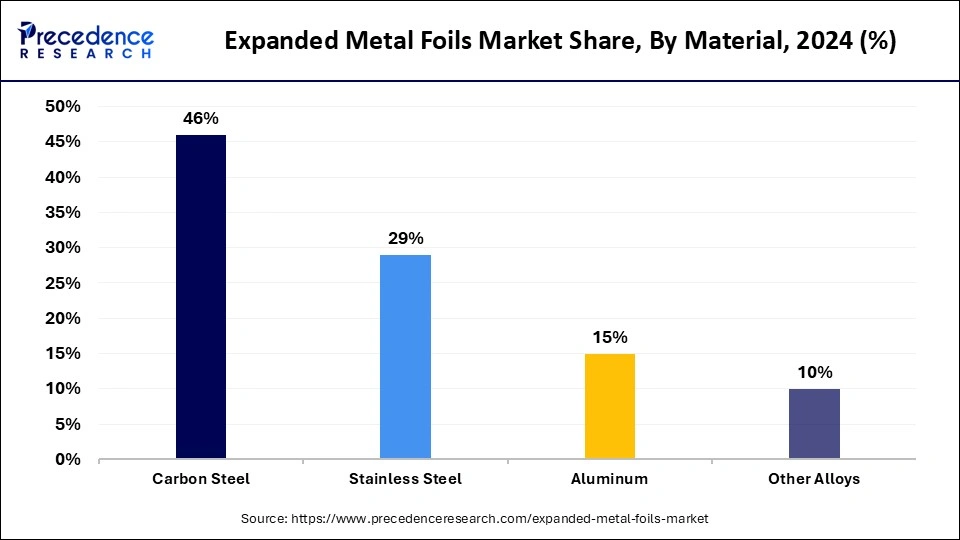

- By material, the carbon steel segment held the major market share of 46% in 2024.

- By mesh size, the 3.0 mm-4.0 mm segment dominated the market in 2024.

- By mesh size, the 1.5 mm-2.0 mm segment is expected to grow at the fastest rate over the forecast period.

- By shape, the flat-shape segment led the global market in 2024.

- By shape, the corrugated-shaped segment is projected to grow at the fastest rate over the forecast period.

- By substrate, the polypropylene segment led the market in 2024 and is expected to grow at the fastest rate over the studied period.

- By end use, the building and construction segment held the largest market share in 2024.

- By end use, the automotive segment is anticipated to grow at a significant rate during the projected period.

Impact of Artificial Intelligence (AI) on the Expanded Metal Foils Market

The advent of Artificial Intelligence and Machine Learning is substantially impacting the expanded metal foils market positively. These technologies enable organizations to optimize operations, automate processes, and gain key insights into market trends. Furthermore, companies using AI-powered analytics can detect patterns, forecast demand, and make decisions, accordingly, fuelling innovation.

- In November 2024, 1000, Kelvin, headquartered in Berlin, Germany, announced that its AI co-pilot software, AMAIZE, has expanded beyond toolpath automation to include nearly the entire metal Laser Beam Powder Bed Fusion workflow. AMAIZE 2.0 features a comprehensive suite of innovative automation tools created to tackle some of the most persistent challenges in AM.

Asia Pacific Expanded Metal Foils Market Size and Growth 2025 to 2034

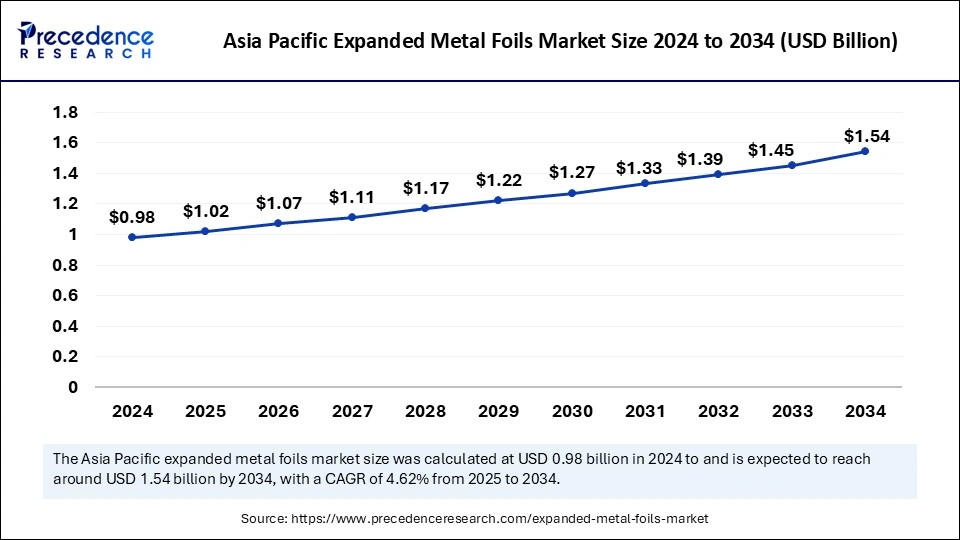

The Asia Pacific expanded metal foils market size was exhibited at USD 980 million in 2024 and is projected to be worth around USD 1.54 billion by 2034, growing at a CAGR of 4.62% from 2025 to 2034.

Asia Pacific dominated the global expanded metal foils market in 2024. The dominance of the region can be attributed to the rising demand for expanded metal foil in the automotive and construction industries. Also, the region exhibits a strong presence of key market players which facilitates the demand for this metal further. Moreover, governments are increasingly promoting food exports.

- In March 2023, LSKB Aluminium Foils Pvt Ltd. launched India's 1st Golden Embossed HOMEFOIL at the 37th AAHAR - The International Food & Hospitality Fair.

North America is expected to grow at the fastest rate in the expanded metal foils market over the studied period. The growth of the region can be credited to the rising requirement for durable and lightweight materials in the automotive and construction industries. Furthermore, this metal foil is also utilized in many applications like shielding, filtration, and EMI/RFI protection, leading to market growth in the region in the upcoming years.

Market Overview

Expanded metal is a kind of metal sheet that can be stretched and cut to form a diamond-shaped mesh-like material. It is mostly utilized for grates and fences or as a metallic lath to support stucco or plaster. This metal is used to protect devices or equipment in the home or industrial sector. Expanded metal foils are generally used for decorative use, filtration process, security purposes and screening, and ventilation.

Top 5 Steel Exporting Countries For 2024

| Top 5 Steel Exporting Countries | Steel Export Data |

| China | 88.3 billion |

| India | 12.7 billion |

| Japan | 7.2 billion |

| The United States | 6.9 billion |

| Russia | 6.6 billion |

Expanded Metal Foils Market Growth Factors

- The increasing demand for lightweight materials is expected to boost expanded metal foils market growth soon.

- The rising need for improved electrical and thermal conductivity can propel market growth shortly.

- The blending of sensor technologies into expanded metal foils will likely contribute to the market expansion over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.10 Billion |

| Market Size in 2025 | USD 2.76 Billion |

| Market Size in 2024 | USD 2.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.50% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Mesh Size, Shape, Substrate, End Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Growth in the construction and infrastructure industry

The expanded metal foils market products can be used in many building applications, especially in cladding, flooring, and roofing. The infrastructure and construction industry are huge and heavy-duty, which results in an increasing number of installations in residential and commercial buildings. In addition, these metal foils are also used in the construction sector, like tunnels, bridges, and stadiums. Also, the surging infrastructure and construction sectors in developing countries can boost market growth further.

- In August 2024, Metals major Hindalco Industries planned to manufacture copper foils, primarily used in lithium-ion batteries, as the company aims to capitalize on the booming battery materials market and strengthen its position in the rapidly growing energy storage sector.

Restraint

Complex installation procedures

Complicated installation procedures are the major factor restraining the expanded metal foils market, particularly in developing economies. Also, strict regulatory requirements associated with adverse environmental impact and safety standards can create challenges for manufacturers. Moreover, stringent certifications and testing need to fulfill industry-specific standards, which can increase overall costs.

Opportunity

The surge in global consumption of packaged and processed food products

The market is witnessing growth due to increasing consumer choices towards packaged and processed foods. Portability and convenience are important factors fuelling the demand for expanded metal foils, such as aluminum foils, in the food and beverage sector. Furthermore, the pharmaceutical industry uses metal foil for blister packaging that provides benefits like raised product shelf life and tamper-evident features.

- In December 2023, Aluminium producer Hindalco Industries announced its plan to set up a battery foil manufacturing facility at Sambalpur in Odisha with an investment of INR 800 crore to tap the fast-expanding electric vehicle market. The facility will initially produce 25,000 tonnes of aluminium foil which forms the backbone of lithium-ion and sodium-ion cells, Hindalco.

Material Insights

The carbon steel segment accounted for a considerable share of the expanded metal foils market in 2024. Carbon steel is the most widely used material due to its high strength, durability, and cost-effectiveness. It is commonly used in construction, automotive, and industrial applications. Carbon steel materials have been witnessing an upsurge in investment in recent years. The key players operating in the market are including carbon steel foils in their portfolios.

Mesh Size Insights

The 3.0 mm-4.0 mm segment dominated the expanded metal foils market in 2024. The dominance of the segment can be attributed to the increasing demand for expanded metal foils in automotive, construction, and other applications. Additionally, major market players are growing their R D expenditure to improve the quality and performance of products, propelling the market growth soon.

The 1.5 mm-2.0 mm segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rising use of this size mesh in filtration and separation processes, particularly in pharmaceutical companies where, during the manufacturing process, filtration is necessary. Also, many end-use industries use this size mesh for other industrial applications too.

Shape Insights

The flat-shape segment led the global expanded metal foils market in 2024. The dominance of the segment can be driven by increasing applications of flat-shaped metal foils in various end-user industries because of their cost-effectiveness, easy installation, and handling. The applications of this segment extend from lithium-ion batteries to photovoltaic solar modules surface finishing, fuses, and flexible printed circuit boards.

The corrugated-shaped segment is projected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to its high rigidity and strength, which makes it convenient for applications that necessitate durability and structural support. Commonly, these metal sheets are manufactured from aluminum, steel, and galvanized metal and coated for corrosion resistance.

Substrate Insights

The polypropylene segment led the expanded metal foils market in 2024 and is expected to grow at the fastest rate over the studied period. The dominance and growth of the segment can be linked to the increasing use of Polyethylene in the agricultural and packaging industry. Furthermore, Polypropylene has excellent chemical resistance and superior strength-to-weight ratio and is extensively used in the packaging, automotive, and construction sectors.

End Use Insights

In 2024, the building and construction segment held the largest expanded metal foils market share. The dominance of the segment is due to the rising demand for durable and lightweight materials in the construction industry. Moreover, the construction industry is booming in developing economies like China and India, which further necessitates the expanded metal sheets widely.

- In November 2022, Fi-Foil Company, a portfolio company of Validor Capital and a manufacturer of reflective insulation and radiant barriers, acquired Kennedy Insulation Group to significantly expand its reflective insulation product line.

The automotive segment is anticipated to grow at a significant rate during the projected period. The growth of the segment is because of the increasing demand for fuel-efficient and efficient vehicles across the globe. In addition, in the automotive sector, these foils reduce the vibration, noise, and harshness, propelling the overall segment's growth soon.

Expanded Metal Foils Market Companies

- Lippert Components

- Artistic Wire Products

- Dhamija Industries

- Neelex Inc

- Denver Expanded Metal

- AMZ Expanded Metal

- Hansheng Hardware

- Metalex Group

- Chicken Wire Fencing

- JSW Group

- Dehua Huali Metal Products

- Tangshan Jiansheng Metal Products

- Hephaestus Iron Works

- Vastu Group

- Orsimet

Latest Announcement by Market Leaders

- In December 2024, Metalex Ventures Ltd. announced a private placement ("the Offering"). The Company has closed the Offering, resulting in gross proceeds of USD 1,050,000. The Offering consisted of the issuance of 42,000,000 flow-through shares (the "FT Shares"), issued at USD 0.025/FT Share.

- In October 2024, JSW group announced a joint venture (JV) with South Korea's Posco that will collaborate in steel, battery materials, and renewable energy in India. The two groups will set up an integrated steel plant in India with an initial capacity of 5 million tonnes per annum (mtpa), according to a statement. The JV will explore collaborating on battery materials for electric vehicles (EVs) and renewable energy for the proposed steel plant.

Recent Developments

- In June 2023, Euroguss event in Nuremberg, Germany, Nemak, S.A.B. de C.V. ("Nemak," or the "Company") (BMV: NEMAK), a leading supplier of cutting-edge lightweight solutions for the global automotive industry, demonstrated its capabilities in cutting-edge electrification, body-in-white, and chassis applications.

- In April 2023, the materials and trade section of Rheinmetall received three new orders for structural components used for e-mobility cars. Nearly 200,000 of the sets, which included the two side members and front shock absorber mountings, were supplied by Rheinmetall.

Segments Covered in the Report

By Material

- Carbon Steel

- Stainless Steel

- Aluminum

- Other Alloys

By Mesh Size

- 5 mm-2.0 mm

- 0 mm-4.0 mm

- 0 mm-6.0 mm

- 0 mm-8.0 mm

- 0 mm-10.0 mm

By Shape

- Flat

- Curved

- Corrugated

- Custom

By Substrate

- Polypropylene

- Polyethylene

- Nylon

- Polystyrene

By End-Use

- Building and Construction

- Automotive

- Electronics

- Aerospace

- Medical

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting