What is Metal Recycling Market Size?

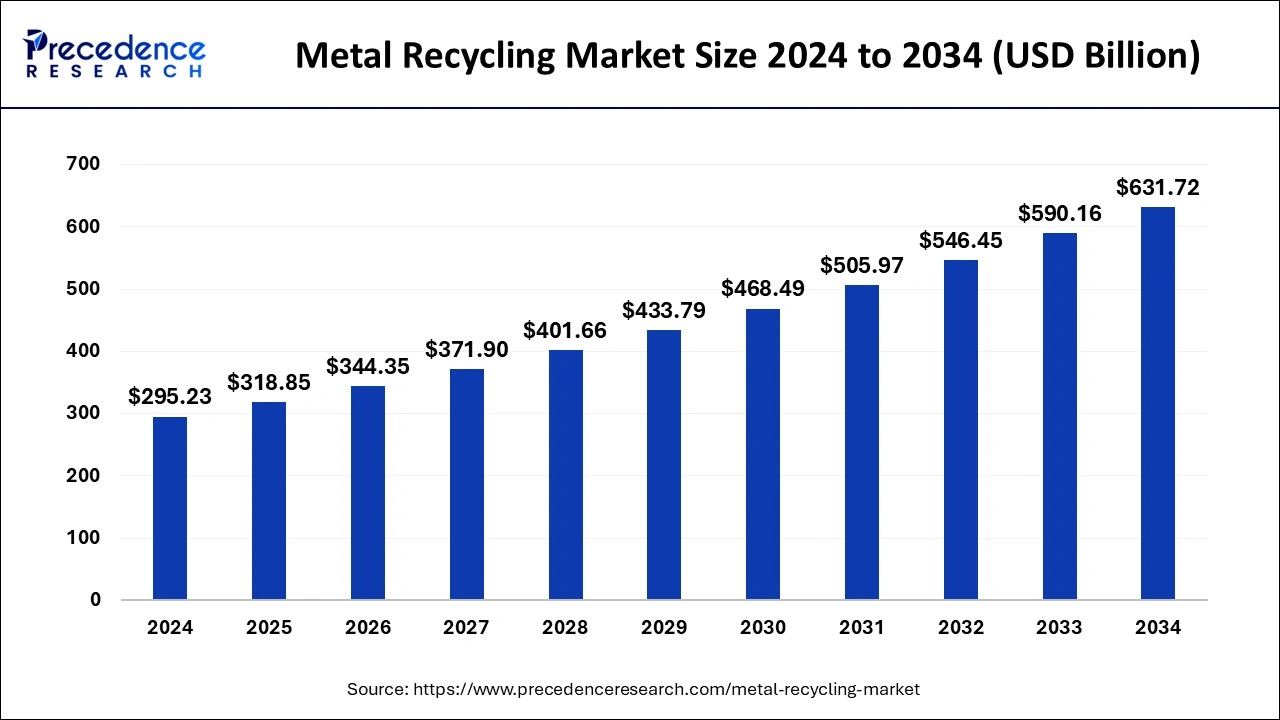

The global metal recycling market size accounted for USD 318.85 billion in 2025 and is predicted to increase from USD 344.35 billion in 2026 to approximately USD 674.71 billion by 2035, expanding at a CAGR of 7.78% from 2026 to 2035. The growing demand for environmental sustainability, the burgeoning automotive sector, and technological advancements drive the metal recycling market.

Market Highlights

- By product, steel emerged as a dominating product segment in 2025.

- By application, the construction segment dominated the global metal recycling market in 2025.

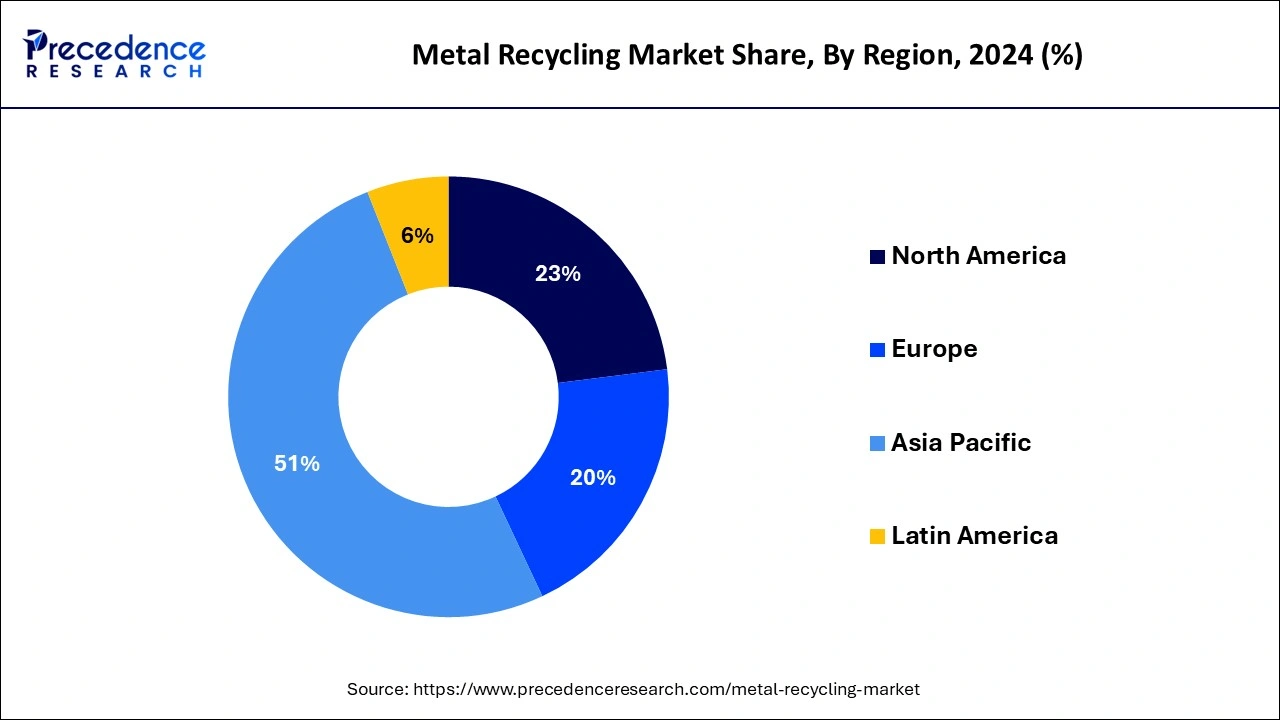

- Asia Pacific emerged as the global leader in the metal recycling market with revenue share of 51%.

Market Overview

Metal recycling permits manufacturers to procure metal wastes from various end-use industries and convert them into raw metals that are further used across those end-use industries in various applications. This process of recycling costs less compared to mining the metals as well as is an environment-friendly method that prospers the growth of the metal recycling process over the upcoming years.

Rising demand for metals across various industries, increasing focus on the conservation of natural resources, and reduction of greenhouse gas emissions are some of the crucial factors that prominently drive market growth.

Additionally, increasing demand for metals and their alloys across numerous applications in automotive, industrial, consumer electronics & goods, and other various industries is the other most significant factor that thrives the market growth. Increasing urbanization and industrialization along with government initiatives towards sustainable development again propel the industry growth.

Integration of AI in Metal Recycling

Artificial intelligence (AI) plays a vital role in the market by revolutionizing the process of recycling. The major challenge is sorting metals that can be reprocessed and reused, requiring highly intensive labor work and time. AI can simplify this process by introducing automation and optimizing the identification and segregation of different metals. This leads to increased efficiency, accuracy, and cost-effectiveness, increasing productivity. Integrating AI, machine learning (ML), and sensors in waste metal sorting significantly reduces contamination, increasing the ultimate value of recycled metals. Apart from sorting, AI can also transform the mining and waste management of metals. Thus, AI changes the operational landscape and paves the way for a more sustainable environment.

Metal Recycling Market Outlook

- Industry Growth Overview: The market is experiencing strong growth, driven by sustainability demands, cost savings (less energy use/mining), strict regulations, and technological advancements such as AI sorting. Growing concerns over industrial waste also contribute to the market.

- Major Investors:Companies such as ArcelorMittal, Tata Steel, Nucor Corp., Aurubis AG, and Dowa Holdings, along with specialized recyclers like Sims Metal Management, Commercial Metals Company (CMC), European Metal Recycling (EMR), and Schnitzer Steel, with remarkable investment coming from major players expanding through acquisitions and capacity.

- Global Expansion:The market is growing worldwide due to rising demand for sustainable raw materials, cost savings, and the reduction of environmental impact from mining and metal production. Additionally, increasing industrialization, urbanization, and stricter environmental regulations are encouraging governments and businesses to adopt efficient metal recycling practices globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 318.85 Billion |

| Market Size in 2026 | USD 344.35 Billion |

| Market Size by 2035 | USD 674.71 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.78% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Steel segment has generated highest revenue share in 2025. Further, the segment expected to maintain its dominance over the forecast timeframe owing to large-scale utilization of the product in automotive, construction, and consumer goods industries. Steel is the most recycled material across the globe and contribute around 40% of the total steel production mainly attributed to the opportunity to recover large structures along with their ease of reprocessing. In addition to this, easy process of steel separation from waste stream is other benefit that drives the steel recycling process.

Aluminum is however another product that offers tremendous benefits for recycling. As per the Aluminum Association, aluminum is among the most recyclable materials across the industry today. The statistics published by the association reveal that the aluminum industry spends approximately USD 800 Million on recycled aluminum cans every year. Major source of raw material for aluminum recycling is from automotive and building parts. Approximately, 90% of the aluminum used in automotive and building parts is recycled at their end of use.

Application Insights

The construction segment dominated the global metal recycling market in 2025. Flourishing growth in urbanization because of rise in the disposable income of consumers particularly in the developing economies is the major factor that propels the demand for recycled steel and aluminum across the construction industry.

Besides this, the automotive industry is the other important segment that uses large amount of metal product in various applications. For instance, body parts, engine components, and various other components that include mufflers, hoods, basic vehicle door frame, and fuel tanks are all made from steel. As per the World Steel Association, around 70% of the weight of an automobile is mainly because of iron and steel. In addition to this, automobile industry registered an increased sale mainly across the developing nations expected to offer lucrative growth opportunities in the forthcoming years.

Regional Insights

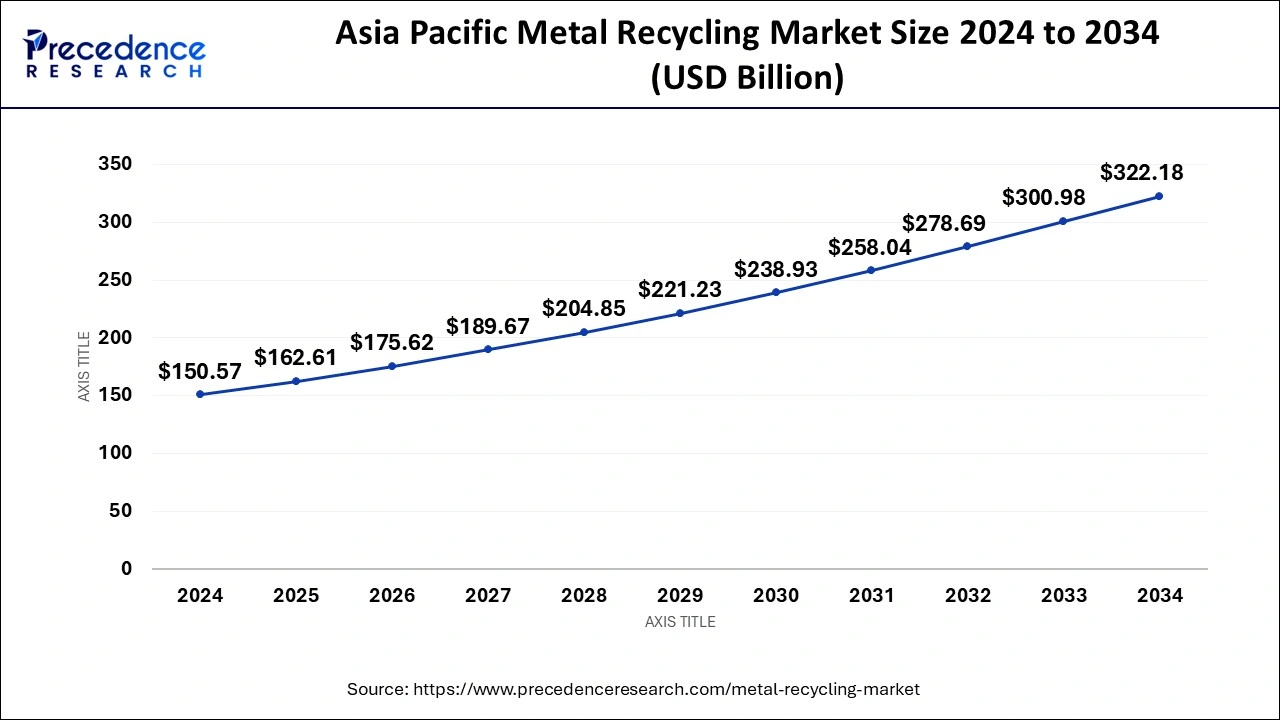

What is the Asia Pacific Metal Recycling Market Size?

The Asia Pacific metal recycling market size is valued at USD 162.61 billion in 2025 and is expected to be worth around USD 344.10 billion by 2035, at a CAGR of 7.78% from 2026 to 2035.

Asia Pacific Dominates the Global Metal Recycling Market: High Metal Production

Asia Pacific emerged as the global leader in the metal recycling market with revenue share of 51%. The dominance of the region can be attributed to the high production of metal. For instance, 66% of total primary aluminum and 72% of total steel produced across the world were contributed by the region. Among other Asian countries, China is the front-runner in the global industry in the year 2023. As per the World Steel Association, China is the major producer of steel and produced nearly 1,000 million tons of steel in the year 2023 that is roughly 53% of the total crude steel production. The country sources around 20% of the raw material for steel recycling from metal scrap.

China Metal Recycling Market Trends

- Favorable government policies to recycle metals and its focus on environmental sustainability contribute to the market growth. In August 2024, the Chinese Ministry of Industry and Information Technology released proposed industry standards to recycle used new electric vehicle (NEV) batteries, aiming to recycle more critical metals such as lithium, nickel, and rare earths.

- China is the world's largest recycled steel user. In the first quarter of 2023, recycled steel consumption in China increased by 0.2%, amounting to 57.46 million tonnes.

India Metal Recycling Market Trends

- The increasing consumption of metals in various sectors in India boosts market growth. The Government of India estimated that the steel demand will increase by 8% in 2025. Steel consumption in India touched a seven-year high at 85.7 million metric tonnes in the second and third quarters of 2024.

- The presence of key players also fuels market growth in India. CMR Green Technologies Ltd. is India's largest scrap metal recycling business with approximately 310,700 metric tonnes of combined aluminum and zinc production.

Europe Metal Recycling Market Gains Momentum: Circular Economy and Construction Demand Driving Growth

Europe follows the Asia Pacific in terms of metal production. However, the application of recycled scrap in secondary metal production is relatively higher in Europe. Growing emphasis on the circular economy in the region together with stringent government regulations related to energy usage significantly promotes the market growth in the region. Furthermore, notable growth of construction sector in the region again drives the growth of metal recycling in the region owing to high usage of recycled metals in parts and buildings.

Germany Metal Recycling Market Trends

- The German Government supports environmental sustainability through stringent regulations and investments. The government announced an investment of 1.3 billion euros in ArcelorMittal to help reduce carbon emissions from steel production using renewable energy and recycled scrap metal.

- The increasing exports of recycled metal also promote market growth. In 2023, Germany exported around 16.3 million tonnes of waste and scrap, amounting to 11.4 billion euros. Out of the total exports, 55.7% of all waste exports were base metals such as iron and steel.

What Makes North America a Significant Region in the Metal Recycling Market?

North America is a significant region in the market due to its well-established recycling infrastructure, advanced technologies, and strict environmental regulations promoting sustainable metal recovery. The presence of major industrial players and high demand from construction, automotive, and manufacturing sectors further drives metal collection and reuse. Additionally, strong government initiatives and awareness around circular economy practices support the growth of the metal recycling industry in the region.

U.S. Metal Recycling Market Trends

The U.S. is the major contributor to the North American market. The market in the country is driven by stringent environmental regulations, increasing demand for sustainable and cost-effective raw materials, and advanced recycling technologies. Additionally, high consumption of metals in construction, automotive, and manufacturing sectors fuels the collection and processing of scrap metals.

What Drives the Market in Latin America?

The metal recycling market in Latin America is driven by rapid industrialization and urbanization, which increase demand for raw materials and recycled metals. Growing environmental awareness and government policies promoting sustainable practices are encouraging businesses to adopt recycling initiatives. Additionally, the expansion of the construction, automotive, and manufacturing sectors is boosting the collection and processing of scrap metal across the region.

Brazil Metal Recycling Market Trends

Brazil's market is growing due to rising industrialization, expanding construction and automotive sectors, and increasing demand for cost-effective raw materials. Government initiatives promoting waste management and recycling, along with growing awareness of environmental sustainability, are supporting market expansion. Additionally, abundant scrap metal availability and rising energy costs are encouraging industries to adopt recycled metals over primary metal production.

What Opportunities Exist in the Middle East & Africa (MEA)?

The Middle East & Africa (MEA) offers significant opportunities in the metal recycling market through increasing government initiatives and investments in sustainable infrastructure and circular economy projects. Growing industrial and construction activities in Gulf countries and key African hubs are driving demand for recycled metals. Additionally, rising awareness of environmental sustainability and cost-effective raw-material sourcing presents opportunities for private-sector players to expand recycling operations in the region.

UAE Metal Recycling Market Trends

The UAE market is expanding due to rapid infrastructure development, strong construction activity, and growing industrial demand for recycled metals. Government initiatives promoting sustainability and circular economy practices, along with strict waste management regulations, are encouraging recycling. Rising energy costs, availability of scrap from demolition projects, and investments in modern recycling facilities further support the adoption of metal recycling across the country.

Value Chain Analysis of the Metal Recycling Market

- Raw Material Sourcing

Metal recycling sourcing involves collecting ferrous and non-ferrous scrap from industries, construction, and end-of-life products via scrap yards, B2B platforms, and partnerships, ensuring quality sorting for efficient EAF processing.

Key players: Sims Metal, Nucor, Tata Metaliks, ArcelorMittal, and EMR. - Testing and Certification

Testing and certification in metal recycling ensure material quality, safety, and regulatory compliance using techniques such as XRF testing, radiation screening, and visual checks. Standards like BIS, ISO, and R2 guide compliance, while third-party agencies issue PSICs for exports and quality marks for domestic trust.

Key players: SGS, Bureau Veritas, TUV Rheinland, Intertek, and DNV. - Product Lifecycle Management

Product Lifecycle Management in metal recycling uses a data-driven, circular approach to track metals from production to reuse. It emphasizes design for easy disassembly, material traceability through product passports, and advanced sorting technologies to reduce waste, save energy, and enable closed-loop recycling, lowering dependence on virgin materials.

Key players: Siemens, SAP, Dassault Systèmes, ArcelorMittal, and Norsk Hydro.

Key Companies & Market Share Insights

The global metal recycling industry is largely unorganized and competitive in nature. Increasing emphasis towards sustainable waste management, rising environmental concern, and high demand for recycled metals across various end-use industries encourages manufacturers to sources raw materials at a higher rate compared to past years. Furthermore, growing recycling partnerships in the aluminum industry because of supportive government programs to promote the use of recycled tins and cans expected to flourish the overall market growth.

Top Companies in the Metal Recycling Market & Their Offerings

- Tata Steel: It offers comprehensive metal recycling solutions by collecting, processing, and reusing scrap steel in its production processes to reduce environmental impact and support circular economy initiatives.

- Novelis: It specializes in aluminum recycling, producing high-quality recycled aluminum products for automotive, beverage, and industrial applications while promoting sustainability and resource efficiency.

Metal Recycling Market Companies

- GFG Alliance

- European Metal Recycling

- CMC Recycling

- Kimmel Scrap Iron & Metal Co. Inc.

- Norsk Hydro ASA

- Schnitzer Steel Industries, Inc.

- Utah Metal Works

- Sims Metal Management Limited

Latest Announcement by Industry Leaders

- Roland Harings, CEO of Aurubis AG, commented that the U.S. market has huge potential for strategic growth and the company aims to become a fully integrated copper producer that uses recycling materials in North America as well. He also said that the company will invest $1.3 million globally in eight projects by the end of the 2025-2026 fiscal year.

Recent Developments

- In November 2024, Nupur Recyclers Ltd. announced its expansion into the recycling of metal scraps and lithium-ion batteries. The expansion was made due to the growing demand for sustainable and eco-friendly industrial solutions.

- In September 2024, researchers from Rice University developed a novel method of recycling valuable metals from electronic waste using the flash Joule Heating method. The new process reduces the environmental impact and increases efficiency, decreasing cost.

Segments Covered in the Report

By Product

- Aluminum

- Steel

- Copper

- Others

By Application

- Automotive

- Construction

- Industrial Goods

- Consumer Goods

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting