What is Metal Forging Market Size?

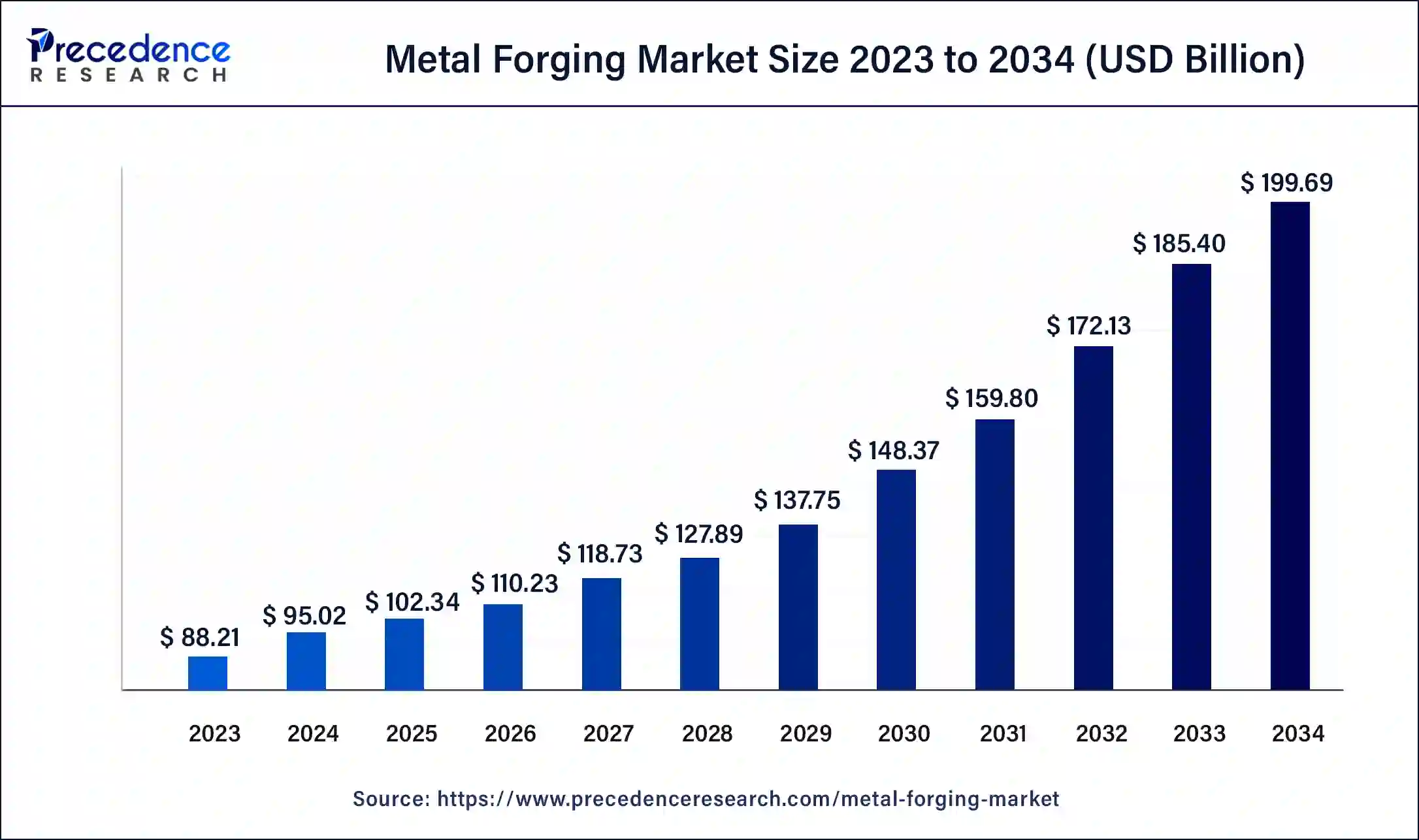

The global metal forging market size is projected to be worth around USD 213.3 billion by 2035 from USD 102.34 billion in 2025, at a CAGR of 7.62% from 2026 to 2035. The increasing demand for metal-forged parts from the aerospace industry is propelling aircraft production and benefiting the metal forging market growth.

Market Highlights

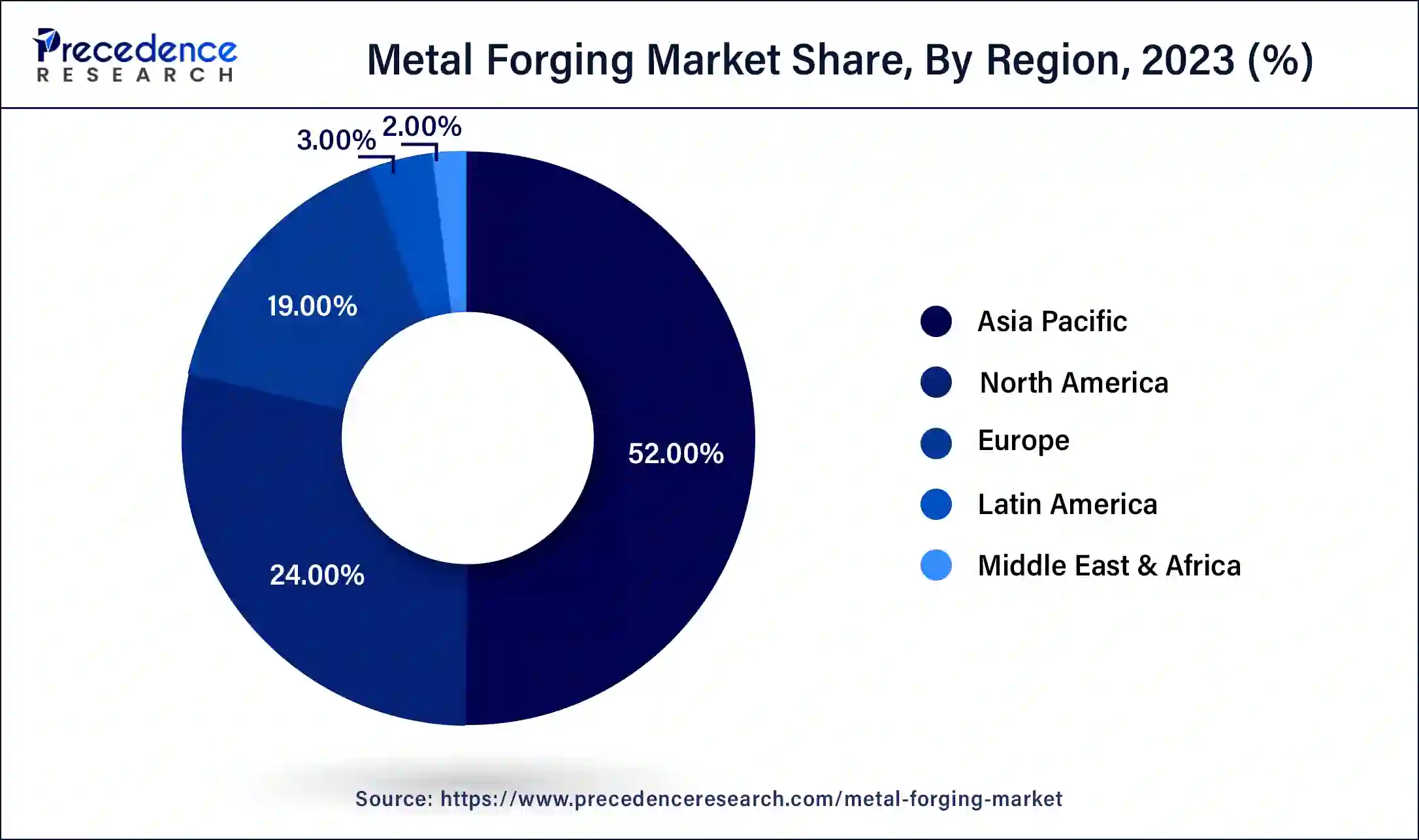

- Asia Pacific dominated the metal forging market with the largest market share of 52% in 2025.

- By raw material, the carbon steel segment captured the highest market share of 44% in 2025.

- By raw material, the aluminum forgings segment is expected to grow at a significant rate in the market over the forecast period.

- By application, the automotive segment generated the largest market share of 59% in 2025.

- By application, the power generation segment is anticipated to grow at the fastest rate in the market during the forecast period.

Market Overview

Metal forging involves shaping and forming metal through compressive forces. This process can be done at room temperature, known as cold forging, or at elevated temperatures, called hot forging. Forged metal exhibits a well-aligned grain structure, which enhances its strength, reduces brittleness, and increases durability. These characteristics make forged metal ideal for demanding applications across various industries, including automotive, aerospace, railways, marine, and industrial machinery. Forging has been a traditional method of metal forming and shaping for centuries, effectively producing components capable of withstanding high pressure, force, and temperature.

What Are the Benefits of AI in the Metal Manufacturing Industry?

Artificial intelligence is making waves in the metal forging industry in numerous ways. AI-based algorithms are being used to analyze data from metal forming processes to identify defects and opportunities for improvement. AI models are also being trained to map out production processes from input to output to improve optimization and reduce costs. AI-based predictive analytics are also being used to enhance supply chain management by predicting market movements and helping businesses improve inventory management.

- In July 2024, Trumpf and SiMa.ai partnered up to bring together their laser application expertise and software-centric AI systems to develop AI-powered laser systems for improved efficiency and precision. The partnership aims to enhance complex material processing by integrating AI chips directly into Trumpf's systems, enabling real-time monitoring of laser welding.

Metal Forging Market Growth Factors

- A rise in the expansion of the automotive industry can drive the metal forging market.

- Rise in energy sectors such as oil & gas refineries, along with thermal power plants are expected to fuel the metal forging market growth shortly.

- Increasing people's disposable income, coupled with rising urbanization, can boost the metal forging market growth further.

What are the Growth Factors in the Metal Forging Market?

- Rising automotive production - As a result of increasing consumer demand for lightweight, high-performance vehicle components, manufacturers are being forced to adopt forged parts instead of fabricated parts. Forged parts are considered stronger and perform better when subjected to stress. These increased vehicle production volumes will fuel the growth of the overall metal forging market.

- Expansion of the aerospace industry -Lightweight, high-strength, and fatigue-resistant parts are essential to the aerospace industry. Demand for forged components is being generated through increasing production levels of commercial and defense aircraft. These developments are greatly impacting the growth of the aerospace forging market.

- Industrialization in emerging economies - Emerging economies like Brazil, India, Russia, and China are experiencing rapid industrial growth, generating demand for forgings for machinery parts and tools, and infrastructure. These developments will significantly contribute to growth within the overall forgings market.

- Technological advances in forging - New developments in forging technology, such as automation and precision forging, are creating efficiencies in production and decreasing waste. These new developments are attracting more industries to forge components over fabricated components.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 102.34 Billion |

| Market Size in 2026 | USD 110.23 Billion |

| Market Size by 2035 | USD 213.3 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.62% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Raw Material, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Surging demand for both passenger as well as commercial vehicles

The growing demand for both passenger and commercial vehicles is driving the increased need for the metal forging market. Passenger vehicles, such as cars, SUVs, and other personal transport options, along with commercial vehicles like trucks, buses, and vans used for logistics and transportation, are seeing a surge in demand. Several factors contribute to this increase. Population growth, urbanization, and rising living standards are leading to greater mobility needs, which results in higher rates of car ownership and a greater number of commercial vehicles for transporting goods. Moreover, rapid economic development in the emerging metal forging market, particularly in Asia and Latin America, is fueling a rise in vehicle demand. The expansion of industrialization and infrastructure projects also boosts the need for commercial vehicles.

2023 Global Vehicle Production Statistics

| Country | Cars | Commercial Vehicles | Total |

| Argentina | 304,783 | 305,942 | 610,725 |

| Austria | 102,291 | 46,944 | 114,191 |

| Belgium | 1,781,612 | 543,226 | 332,103 |

| Brazil | 1,781,612 | 543,226 | 2,324,838 |

| Canada | 376,888 | 1,176,138 | 1,553,026 |

| China | 26,123,757 | 4,037,209 | 30,160,966 |

| Czech Republic | 1,397,816 | 6,685 | 1,404,501 |

| Finland | 30,191 | 30,191 | |

| France | 1,026,690 | 478,386 | 1,505,076 |

Restraint

The capital-intensive nature of metal

Forging, establishing, and running metal forging facilities requires substantial capital investments. The considerable expenses related to acquiring forging equipment, machinery, and skilled labor can pose challenges for new entrants or smaller manufacturers, which can potentially hinder market expansion. Additionally, the constraints of the metal forging process are expected to impede the metal forging market growth in the future.

Opportunity

High demand for advanced materials and alloys

The rising demand for high-performance materials with enhanced strength, durability, and corrosion resistance is driving the development and use of advanced alloys. These materials enable metal forging companies to produce components with improved properties created to meet specific industry requirements. Furthermore, advanced materials and alloys offer superior attributes compared to traditional ones, which makes them highly sought after for various applications across different sectors. Industries such as aerospace, automotive, and energy require components capable of withstanding extreme conditions, including exceptional strength and durability. As a result, these factors positively influence the metal forging market by leading to anticipated growth during the forecast period.

- In March 2023, the Relativity Space Terran 1 rocket launched from Cape Canaveral Space Force Station in Florida. This was the first launch of a test rocket made entirely from 3D-printed parts, measuring 100 feet tall and 7.5 feet wide. A form of additive manufacturing, 3D printing is a key technology for enhancing capabilities and reducing costs. Terran 1 included nine additively manufactured engines made of an innovative copper alloy, which experienced temperatures approaching 6,000 degrees Fahrenheit.

Segment Insights

Raw Material Insights

The carbon steel segment dominated the metal forging market in 2025. Carbon steel is divided into three grades based on carbon content: low, medium, and high. Due to its lower material cost compared to stainless steel, carbon steel forgings are frequently used in the oilfield and automotive industries. These carbon-forged parts are used in various products, including automobiles, tractors, aircraft, energy missiles, drilling equipment, and ships.

- In June 2024, Fastmarkets, one of the industry's leading cross-commodity price-reporting agencies (PRA), announces the launch of a new European reduced carbon emissions flat steel price. This new price, which is for domestically produced steel, forms part of Fastmarkets' growing suite of prices that cater to steel decarbonization and is a testament to their commitment to providing accurate and timely market information.

The aluminum forgings segment is expected to grow at a significant rate in the metal forging market over the forecast period. The growth of the segment is driven by the increasing need for lightweight materials in the automotive sector. Car manufacturers have long sought to reduce vehicle weight to enhance fuel efficiency, boost performance, and cut carbon emissions. As the new, stricter regulations come into play, automotive companies will likely be compelled to incorporate more lightweight materials, which creates new opportunities for the product throughout the forecast period. Additionally, the rising demand for new defense aircraft is anticipated to further stimulate the market expansion.

Application Insights

The automotive segment led the global metal forging market in 2025. This can be attributed to the increasing disposable income, a growing urban population, and the expanding boundaries of cities. Automotive components and parts must endure severe weather conditions, high torque, force, pressure, and temperature, which requires the use of forging in their production. Also, the segment is witnessing notable growth driven by rising demand for both commercial and passenger vehicles, as well as the growing adoption of electric vehicles (EVs). This surge in the automotive industry is expected to drive up the need for forged metal parts by contributing to market expansion.

- In June 2024, Hilton Metal Forging Ltd, a manufacturer of forged products for various industries, launched a new product line: wagon axles for railway wagons. This comes at a time when India relies on imports to meet its wagon axle needs. Hilton Metal's entry into this market aligns with the government's 'Make in India' and 'Atmanirbhar Bharat' initiatives, aiming to reduce reliance on imports and boost domestic manufacturing.

The power generation segment is anticipated to grow at the fastest rate in the metal forging market during the forecast period. In wind and hydroelectric power plants, a range of forging components, including turbine blades, sleeves, motor ends, flanges, rings, seals, locks, stators, diaphragms, impellers, covers, spacers, casings, and rotors, are utilized. As investments in the power generation sector continue to rise, this is expected to boost the growth of the segment in the coming years.

Regional Insights

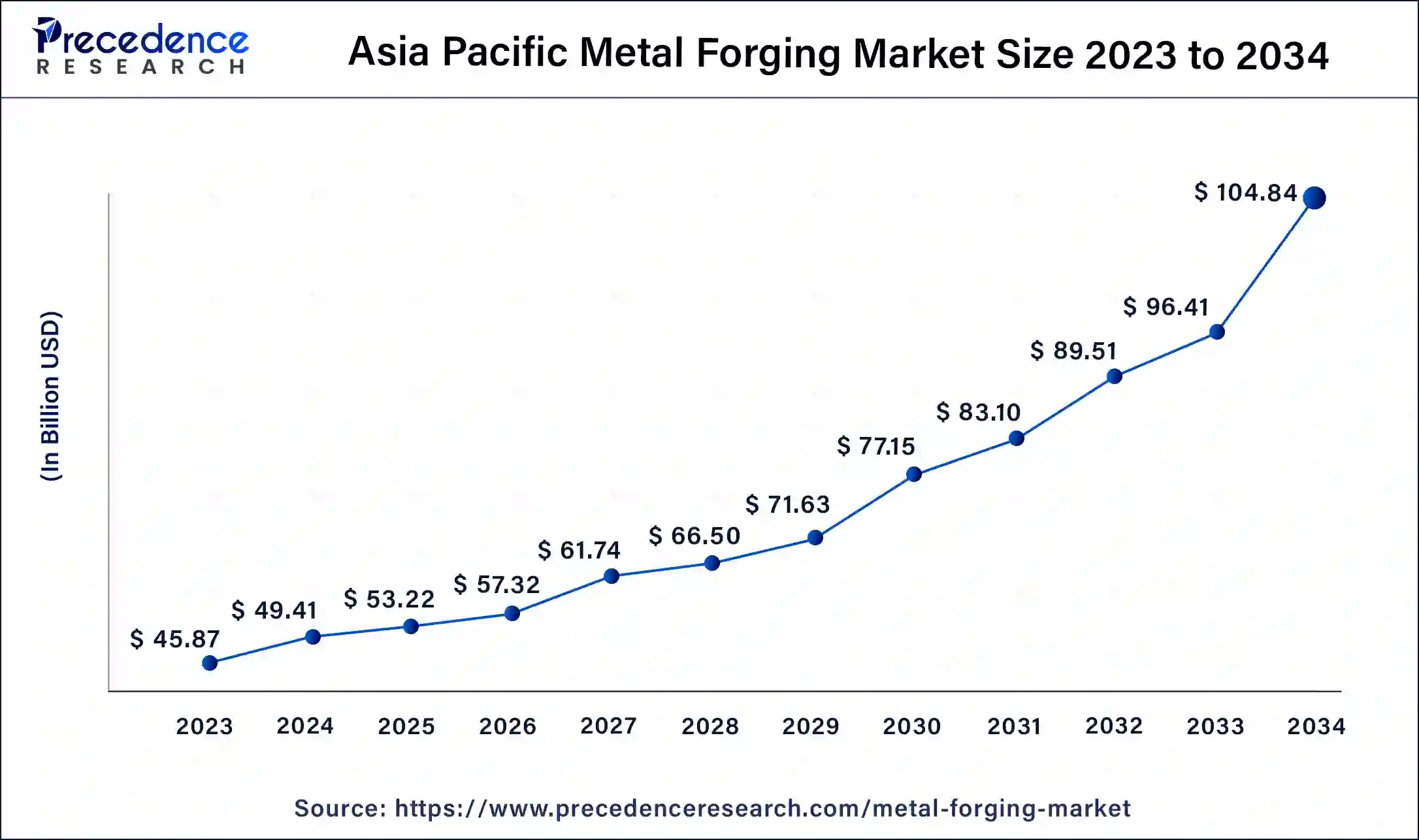

Asia Pacific Metal Forging Market Size and Growth 2026 to 2035

The Asia Pacific metal forging market size is exhibited at USD 53.22 billion in 2025 and is projected to be worth around USD 112.25 billion by 2035, poised to grow at a CAGR of 7.75% from 2026 to 2035.

Asia Pacific dominated the metal forging market in 2025. The automotive industry is a significant consumer of forged metal components, including engine parts, axles, and chassis components. Moreover, several countries in the region are experiencing rapid urbanization and infrastructure development, which includes the construction of bridges, buildings, and transportation networks. Forged steel components are important for these infrastructure projects due to their durability and strength. Also, the growing demand from the energy sector is projected to propel market growth in APAC throughout the forecast period.

North America is projected to show the fastest growth in the metal forging market over the studied period. Investment in renewable energy within the region is anticipated to drive up demand for the product. The emphasis on improving infrastructure, combined with rising investments in aerospace and defense, boosts the need for high-quality forged components.

- In December 2023, The Institute for Advanced Composites Manufacturing Innovation, in partnership with the Department of Defense's Industrial Base Analysis and Sustainment (IBAS) Program, announced a national workforce initiative to help meet essential U.S. defense needs in the casting and forging industry.

In North America, stringent regulatory standards related to emissions and safety are pushing the automotive industry towards the use of lightweight and high-strength materials, which benefits the industry significantly. Additionally, the market's growth is supported by the presence of key players in the metal forging market and advancements in forging technologies.

What are the Advancements for Metal Forging in Europe?

Europe is witnessing significant growth in the market. This growth is because the region benefits from a strong manufacturing base, particularly in countries like Germany and France, where automotive and machinery sectors are in high demand. The region also has robust, supportive regulatory frameworks that help in promoting energy efficiency and sustainability.

These aspects are encouraging investments in modern forging technologies. The regional market is also seen rapidly adapting to digital transformation trends, enhancing operational efficiencies and product quality, thus leading to a competitive advantage.

Latin America Metal Forging Market Trends

Latin America is experiencing substantial growth in the market, driven by various factors like industrial growth and technological advancements. Countries in this region are increasingly investing in infrastructure projects, which, in turn, helps to boost the demand for forged components, mainly used in construction and manufacturing. The automotive sector also plays a crucial role here as manufacturers continue to seek more enhanced vehicle performance and safety.

Furthermore, the region is also witnessing a rising emphasis on sustainability, prompting companies to adopt eco-friendly practices. Brazil remains the largest market for metal forging in the region, showcasing a steady demand across various sectors and industries.

What are the advancements in the Middle East and Africa?

The Middle East and Africa region is gradually developing in the market. The region's growth is primarily driven by the presence of resource-rich countries that are increasingly investing in infrastructure and manufacturing capabilities. The region's regulatory frameworks are also seen to be evolving, supporting industrial growth and fostering innovation, with a focus on local production and reducing import dependency.

Countries like South Africa and the UAE are leading players in the region, with local players trying to establish a strong foothold. As the region continues to diversify its economy, the metal forging market is expected to grow even more.

Metal Forging Market Companies

- Ironic

- ATI

- Bharat Forge Ltd.

- Bruck GmbH

- China First Heavy Machinery Co., Ltd.

- ELLWOOD Group, Inc.

- Jiangyin Hengrun Heavy Industries Co., Ltd.

- Nippon Steel Corp.

- Precision Castparts Corp.

- Larsen & Toubro Ltd.

Recent Developments in the Metal Forging Industry

- In October 2025, Alcoa Corporation unveiled a new aluminum forging facility in Brazil, aimed at increasing production capacity and meeting the rising demand for sustainable materials. This investment underscores Alcoa's commitment to innovation and sustainability, positioning the company to capitalize on the growing market for eco-friendly products.(Source:https://www.bing.com)

- In August 2025, Bharat Forge Limited completed the acquisition of a local forging company in Argentina, enhancing its operational capabilities and market reach. This strategic move is likely to strengthen Bharat Forge's competitive edge by providing access to new customers and expanding its product offerings in the region.(Source:https://www.bing.com)

- In May 2025, the Czech company MSV Metal Studénka officially launched the largest investment in recent years – a robotic forging line with a hydraulic press with a capacity of 4 thousand tons – into mass production. The investment project will increase the annual capacity of the enterprise to 18 thousand tons and reduce energy consumption. (Source: gmk.center)

- In November 2024, Semiconductor and fiber laser specialist, nLight launched its new Corona AFX-2000 two-kilowatt beam shaping laser at Formnext 2024. It is designed to enhance laser powder bed fusion 3D printing. nLight claims that its new laser will significantly boost the productivity of metal additive manufacturing. (Source: 3dprintingindustry.com)

- In October 2024, Cobra launched King Black Edition Tour irons. Like their chrome counterparts, the KING Black Edition Tour irons are constructed from 1025 carbon steel using Cobra's five-step forging process. COBRA utilizes a fifth forging strike to deliver unmatched soft feel and precise shaping. (Source: golfbusinessnews.com)

- In March 2024,ATI Inc. celebrated the commissioning of its state-of-the-art 12,500-ton billet forging press critical to the production of titanium for aerospace and defense.

- In February 2024, Ramkrishna Forgings announced a significant milestone as it penetrated further into the North American market by successfully securing a contract worth USD220 million. This contract will span over a decade and marks the company's foray into a new vertical within the forging sector, focusing on supplying Tier 1 customers in the Light Vehicle segment across North America.

- In August 2023,Arconic Corporation and Apollo announced today that Apollo Funds had completed the previously announced acquisition of the Company, which included a minority investment from funds managed by affiliates of Irenic Capital Management (“Irenic”). The Company will continue to operate under the Arconic name and brand.

Segment Covered in the Report

By Raw Material

- Carbon Steel

- Alloy Steel

- Aluminum

- Magnesium

- Stainless Steel

- Titanium

- Others

By Application

- Automotive

- Transportation

- Aerospace

- Oil & Gas

- Construction

- Agriculture

- Power Generation

- Marine

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content