What is the Protective Coatings Market Size?

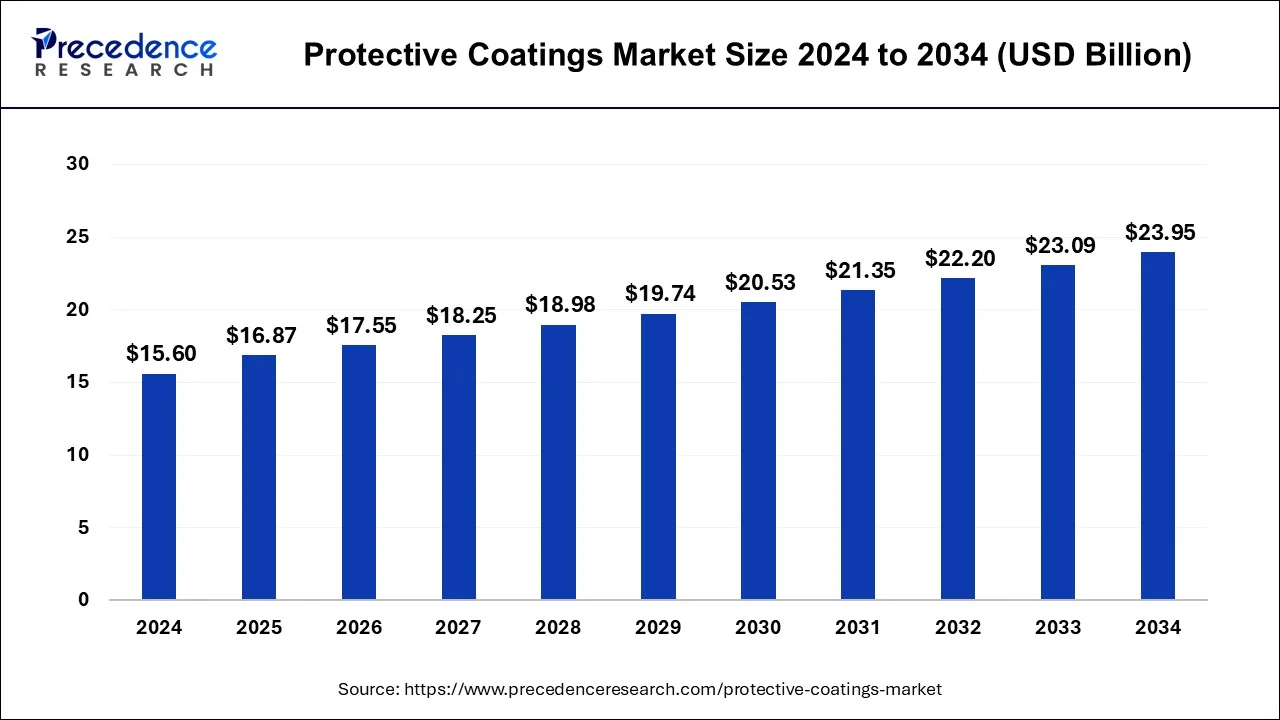

The global protective coatings market size is valued at USD 16.87 billion in 2025 and is predicted to increase from USD 17.55 billion in 2026 to approximately USD 23.95 billion by 2034, expanding at a CAGR of 4.38% from 2025 to 2034.

Protective Coatings Market Key Takeaways

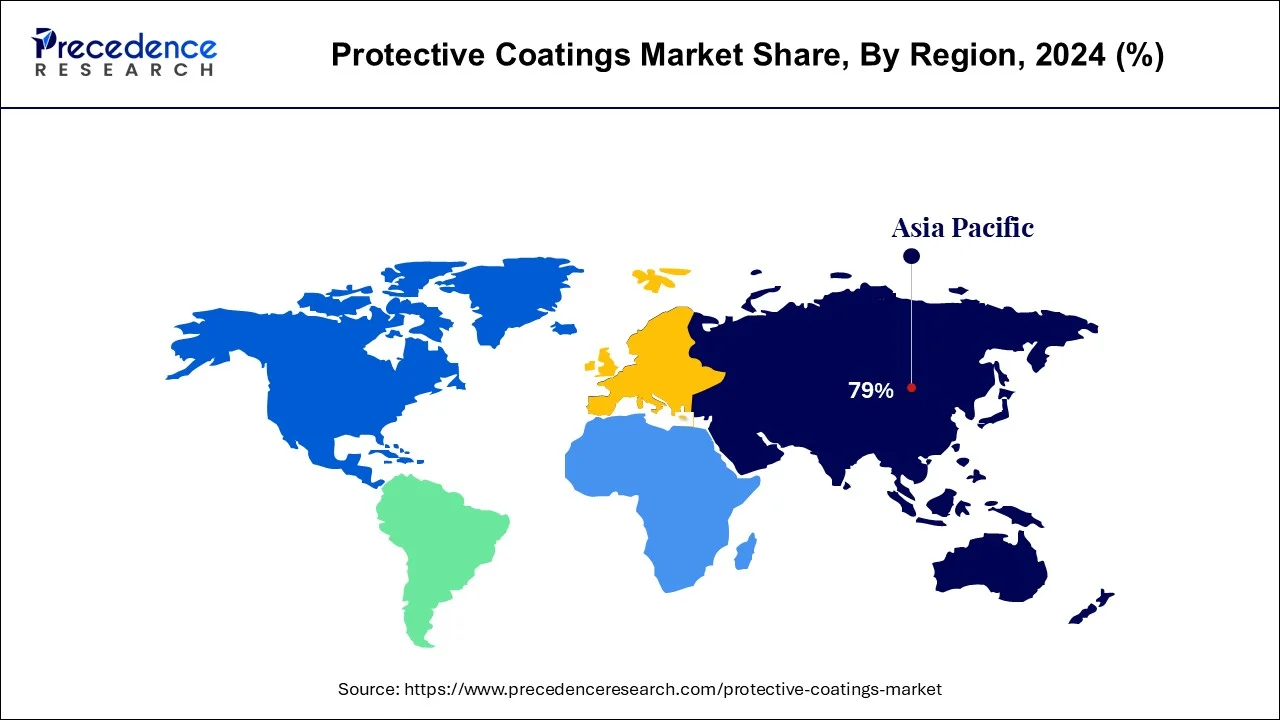

- Asia Pacific has dominated the protective coating market with a market share of 79% in 2024.

- By Technology, the solvent borne coatings segment has generated a market share of 33.7% in 2024.

- The water borne technology segment is expanding at a CAGR of 7.6% over the forecast period 2025 to 2034.

- By Application, the construction segment has held the largest market share of 23% in 2024.

- The aerospace application segment is poised to grow at a CAGR of 7.9% during the forecast period 2025 to 2034.

- By Resin, the epoxy segment has held a market share of 39.3% in 2023 and it is poised to grow at a CAGR of 7.2% during the forecast period.

What is a Protective Coating?

The purpose of a protective coating is to prevent or inhibit corrosion by adding a layer of substance to the surface of another material. A shielding layer could be metallic or non-metallic. Protective coatings are applied using a variety of techniques and have various uses besides preventing corrosion. Polymers, epoxies, and polyurethanes are often used substances in non-metallic protective coatings. Zinc, aluminum, and chromium are among the substances utilized to create metallic protective coatings.

The development of the construction industry, particularly in rising economies like Japan, China, and, India is being heavily fueled by the country's strong economic growth and growing government initiatives to build the nation's infrastructure. Over the course of the projected period, rising infrastructure spending in these countries is anticipated to support market growth for protective coatings.

Market Outlook

- Industry Growth Overview:

The protective coatings market is growing, driven by increasing infrastructure development, rising urbanization, and a shift toward more maintainable, high-performance coatings. Increasing demand for environment-friendly water-borne and UV-curable coatings, dedicated coatings for the automotive and renewable energy fields. - Global Expansion:

The protective coatings market is increasing globally, driven by growing urbanization and a rise in infrastructure projects globally, specifically in emerging economies. A flourishing in the renewable energy subdivision creates demand for protective coatings for components such as EV batteries and wind turbines. Asia Pacific is dominated in the market due to rising spending in infrastructure, including smart cities, water systems, and transportation networks. - Major Investors:

The major players and investors in the protective coatings industry are primarily large, global coatings manufacturers and specialized private equity firms. It includes AnCatt, Greenkote PLC, the Sherwin-Williams Company, Jotun A/S, and Kansai Paint Co., Ltd.

Protective Coatings Market Growth Factors

Concrete is frequently used in civil engineering structures since it is a durable and robust material. Buildings must also fulfil the owner's and architect's expectations for their aesthetic appeal. By avoiding water infiltration, sealing, and adapting surface cracks, protective coating solutions can increase the concrete's longevity as well as its appearance and color palette. Depending on where they are and what they are used for, concrete structures are exposed to a wide range of environmental conditions. The two most frequent factors contributing to concrete deterioration and reinforcing corrosion are carbonation and chloride attack.

Concrete with a coating to protect it from physical and chemical harm from the outside environment concreting coating enhances its appearance, simplicity of upkeep, and light reflectance. If coatings are applied correctly to a concrete surface that has been properly prepared, they can increase a structure's lifespan. Protective surface coatings are typically applied to protect freshly installed or repaired concrete surfaces from future chemical attack and invasion by noxious liquids and gases. impregnated with a water-repelling agent, pore-blocking elastic, and crack-bridging properties. The possibilities for this concrete surface protection include chemical resistance, abrasion and wear resistance. Hence, rising demand for corrosion protection of concrete is expected to be the driving factor.

Protective Coatings MarketScope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.87 Billion |

| Market Size in 2026 | USD 17.55 Billion |

| Market Size by 2034 | USD 23.95 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.38% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segment Covered | By Formulating Technology, By Resin Type, By End Use, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Formulating Technology Insights

Depending upon the formulating technology, the solvent-based segment is the dominant player and is anticipated to have the biggest impact on protective coatings market. Organic chemicals that resemble solvents are present in solvent-based coatings, which operate as liquefying agents and evaporate when in contact with oxygen. Additionally, the liquefying chemicals fasten the drying process by a chemical reaction with environmental oxygen. Because of their nature, solvent-based coatings are simple to apply in a humid environment and at various temperatures. Additionally, solvent-based coatings dry quickly, many businesses choose them to avoid chemical interactions. For instance, businesses like Jamestown Coating Technologies provide industrial paints that are solvent-based and more resilient than coatings that are water-based. Therefore, the quick-drying properties of solvent-based coatings enable their use in humid conditions, which supports the development of solvent based segment of coatings.

The market for products based on water is anticipated to develop the fastest. Since this coatings technology has advanced, water-based coatings are now on par with or even superior to their solvent-based equivalents. High grade water dispersed acrylic emulsions are extremely durable, dry quickly, and smell significantly less.

Resin Type Insights

During the projected period, the epoxy segment is anticipated to be the largest. The Asia Pacific region's stable economy, rising disposable income, and rising living standards in developing nations like China, India, Malaysia, and Vietnam are all contributing to the region's expanding epoxy coating market. Epoxy coatings are resilient coatings that are used in a variety of applications. These coatings are well-liked because they give metals and other materials a quick-drying, strong, and protective coating. These coatings are quick and simple to apply, unlike conventional powder coatings, which makes them perfect for a number of applications. When used in flooring applications, they create a long-lasting and resilient flooring solution. In a range of commercial and industrial settings, including commercial and retail establishments, manufacturing facilities, industrial facilities, hospitals, warehouses, showrooms, aero plane hangars, and garages, they are used on concrete floors. They feature a glossy surface and are available in a range of hues and designs.

During the forecast period, the polyurethane section is anticipated to have a strong market expansion. Polyurethane coatings have qualities including physical damage tolerance, barrier properties, and chemically inert. By generating a thin, pleasing to the eye gloss covering and shields metal surfaces from damage, these coatings can also be utilized to safeguard metal surfaces.

The epoxy segment accounted for the dominating share of 65.20% in 2024, owing to the rising investment in infrastructure development and increasing demand for high-performance & long-lasting finishes. Epoxy coatings are widely used in the construction sector for their exceptional durability, strength, chemical resistance, low VOC content, and strong adhesion. They are also used in floor toppings, crack injection, grouts, and adhesives. Moreover, the growing demand for shipbuilding and repair, petrochemicals, and steel is expected to drive the demand for epoxy resin during the forecast period.

End Use Insights

On the basis of end use industry, the infrastructure & construction category accounted for the largest market share in both volume and value. Protective coatings are applied to structures to increase their durability and to shield them from UV rays, fire, and corrosion. To increase heat resistance and minimize the impact of corrosive gases, they are used in industrial projects. the expanding construction industry and the need for these coatings to protect equipment from deterioration and to enhance its performance in affected locations. Throughout the projection period, this component is most likely to drive the market.

The offshore structure has a significant growth during the forecast period. For marine structures, whether they are submerged or located far below the surface of the water, coatings are the best form of protection. The primary factor is the steel, which is extremely susceptible to marine corrosion, makes up the majority of maritime structure, including ships, mobile or fixed drilling platforms, production platforms, bridges, pilings, and piping. To keep steel from reverting to its initial form, iron oxide, it needs to be completely protected. One, and maybe the only, way to shield every surface of a steel structure from the elements is using surface coatings.

Technology Insights

The solvent-borne segment held a dominant presence in the market in 2024, with 43.70%. The growth of the segment is attributed to the increasing demand for solvent-borne protective coating across various sectors such as industrial, oil and gas, marine, and automotive. Solvent-borne offers a durable and glossy finish, superior adhesion, and strong resistance to corrosion, weathering, and UV radiation. Moreover, increasing demand for high-quality finishes, durability, and fast drying times is likely to fuel the segment's expansion in the coming years.

Application Industry Insights

The infrastructure/construction segment held the major market share of 28.60% in 2024. The segment's growth is attributed to the rapid urbanization, increased government investment in infrastructure development, and the rising need to extend the lifespan of assets against corrosion, weathering, and chemical exposure. In the infrastructure/construction, protective coatings are extensively used to increase their durability and to shield them from UV rays, fire, and corrosion. To increase heat resistance and minimize the impact of corrosive gases, they are used in industrial projects. The expanding construction industry has led to an increasing need for these coatings to protect from deterioration and to improve their performance in affected locations.

Distribution Channel Insights

The distributors/wholesalers segment registered its dominance with 36.10% over the global protective coatings market in 2024. Distributors and wholesalers are a significant critical distribution channel in the protective coatings market, which connects manufacturers with end-users. The distributors/wholesalers purchase products in bulk, which provides efficiencies in the supply chain for large industrial projects and smaller commercial applications. Distributors/wholesalers are adept at understanding local market demands and preferences, which also offers tailored product solutions to better serve their customers.

Function Insights

The corrosion resistance segment contributed the biggest market share of 36.80% in 2024. The growth of the segment is driven by rapid urbanization and industrialization. The rising investment in infrastructure projects and increasing industrial activity, particularly in emerging nations, fuels the need for corrosion protection. Moreover, the stringent environmental regulations, along with the rising focus on safety and asset protection, are expected to spur the demand for high-performance coatings.

Regional Insights

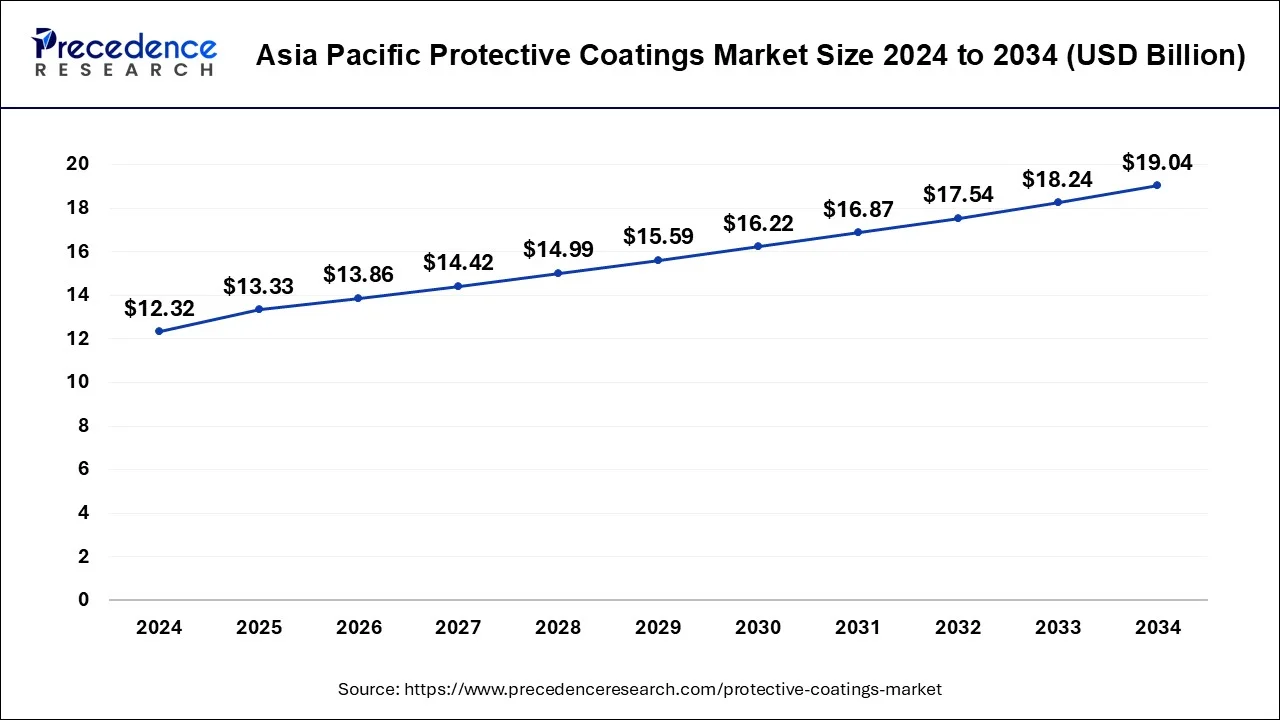

Asia Pacific Protective Coatings Market Size and Growth 2025 to 2034

The Asia Pacific protective coatings market size is estimated at USD 16.87 billion in 2025 and is predicted to be worth around USD 19.04 billion by 2034, at a CAGR of 4.45% from 2025 to 2034.

Due to a growth in demand from finished industries such as infrastructural projects, power, automobiles, oil and gas, industrial, and maritime, Asia Pacific holds the largest market share in 2024. Due to rising government spending in infrastructural projects, it is projected that infrastructure and building will increase in developing Asia Pacific countries like China and India. Among other things, these projects involve building bridges, trains, airports, and more. There is a high need for protective coatings that are used to stop and slow down corrosion brought on by severe weather patterns. These coatings are necessary to increase the durability and require no upkeep nature of the buildings and constructions. It is projected that the region's market will be fueled by rapid increase in construction sector.

India: Rapid industrialization and infrastructure growth

In India, increasing industrialization, increasing infrastructure projects, and an increasing automotive sector all need durable and high-performance coatings. It is the largest automotive producer; India's growing automotive organization fuels a massive requirement for specialized protective and decorative coatings.

North America's automotive industry will grow quickly, ultimately driving the market. As consumer interest inelectric vehicles rises, the automotive sector is anticipated to grow. Due to the US's strong economy and the excellent development of the real estate sector commercial, it is anticipated that the non-residential building industry would grow. Additionally, there has been an increase in state and federal spending on institutional and public buildings. It is projected that the market will be driven by the rising demand from the commercial building and automotive industries.

U.S.: Technological advancements

In the U.S., the strong presence of both domestic giants and international players, as well as the emergence of novel large-scale manufacturers, intensifies competition and drives market growth by innovation and expansion. The market is seeing innovation, with organizations developing advanced services such as solvent-free, anti-corrosive coatings and integrating automation in application processes.

Europe: Growing innovation in green technology

Europe is significantly growing in the market as a integration of strict environmental guidelines, high demand from major industries, and a strong focus on novelty and R&D. Regulations such as those from the European Chemicals Agency (ECHA) and the EU Green Deal are driving the market toward sustainable, low-VOC, and bio-driven coatings. European companies are at the forefront of advancing novel coating technologies, which contribute to the growth of the market.

UK: Technological and regulatory advantages

The UK is a leader in advanced high-performance, tough coatings, including advanced epoxies and other formulations that encompass the life of industrial tools. Strict government regulations for industrial production and the environment create demand for efficient and maintainable protective coatings, driving companies to develop eco-friendly standards.

Protective Coatings Market- Value Chain Analysis

Raw Material Sourcing:

Raw material sourcing for the protective coatings industry involves significant components such as resins like epoxy, polyurethane, and acrylic, pigments, solvents, and additives, which are sourced from chemical dealers and suppliers.

- Key Players: Jotun A/S, and Hempel A/S

Package Design and Prototyping:

Protective coatings are specialized materials applied to surfaces of materials such as metal or concrete to protect them from environmental conditions, like corrosion, wear, water damage, and chemical attacks.

- Key Players: The Sherwin-Williams Company and BASF SE

Recycling and Waste Management:

The protective coatings industry manages waste through various methods, including waste reduction, source reduction, and recycling and recovery of materials from waste streams such as paint sludge and overspray.

- Key Players: Akzo Nobel N.V. and PPG Industries, Inc.

Top Vendors in the Protective Coatings Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

The Sherwin-Williams Company |

United States |

Extensive distribution network |

Sherwin-Williams protective coatings are intended to shield assets from corrosion, fire, and harsh environments across significant industries. |

|

PPG Industries, Inc. |

Pittsburgh, Pennsylvania |

Global supplier of paints |

PPG spotlights metal coating innovations, design, and durability at AIA Conference 2025. |

|

Jotun |

Norway |

Strong corporate culture |

In June 2025, Jotun launched novel powder coating technologies to safeguard batteries. |

|

Akzo Nobel N.V. |

Netherlands |

Strong emphasis on sustainability |

In November 2025, AkzoNobel India inked significant agreements with the parent company in a proposed acquisition. |

|

Kansal Paint Co., Ltd. |

Osaka, Japan |

Robust financial foundation |

Kansai Paint Co. Ltd. provides a broad range of coatings solutions for various markets, including automotive, decorative, industrial, and marine coatings. |

Other Key Players

- Sika AG

- The Chemours Company

- Dulux Protective Coatings

- Oasis Paints

- Wacker Chemie AG

- Henkel AG & Co. KGaA

- NIPSEA GROUP

- Berger Paints

- Sherwin-Williams

- Hempel

Recent Developments

The FIRETEX passive fire protection coatings portfolio from Sherwin Williams Protective and Marine has included a solution that allows for precise coating thickness parameters, which enhances applications and decreases capital for onshore assets.

Market Segmentation

By Resin Type (USD/Kilotons)

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc-rich

- Fluoropolymer

- Silicone

- Vinyl Ester

- Polyaspartic

- Others (e.g., polyester, phenolic)

By Technology

- Solvent-borne

- Water-borne

- Powder coating

- High solids

- UV-cured

- Thermal spray

- Others (e.g., fusion-bonded epoxy)

By Application Industry

- Oil & Gas

- Marine

- Infrastructure / Construction

- Power (Thermal, Hydro, Renewable)

- Transportation

- Automotive

- Rail

- Aerospace

- Water & Wastewater Treatment

- Mining & Metals

- Industrial Equipment & Machinery

- Chemical & Petrochemical

- Food & Beverage Processing

- Pharmaceutical

- Pulp & Paper

- Others

By Distribution Channel

- Direct Sales (Manufacturers to End-Users)

- Distributors / Wholesalers

- Retail (B2C & B2B retail outlets)

- Online Platforms

By Function

- Corrosion Resistance

- Fire Resistance / Intumescent

- Abrasion & Wear Resistance

- Chemical Resistance

- Waterproofing

- UV Resistance / Weatherproofing

- Thermal Resistance

- Aesthetic/Decorative Protection

- Anti-Fouling / Anti-Microbial

- Others (e.g., anti-static, insulating)

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content