Offshore Drilling Market Size and Growth 2025 to 2034

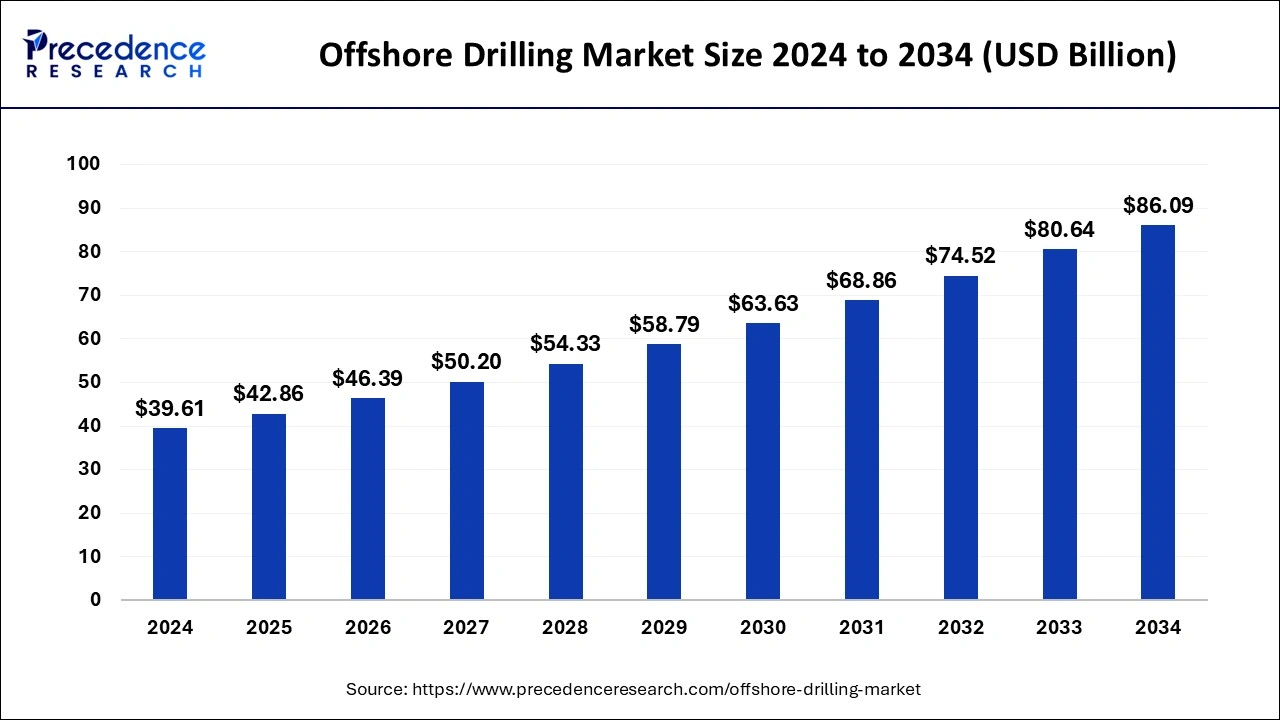

The global offshore drilling market size was estimated at USD 39.61 billion in 2024 and is predicted to increase from USD 42.86 billion in 2025 to approximately USD 86.09 billion by 2034, expanding at a CAGR of 8.07% from 2025 to 2034. The offshore drilling market is driven by the rising demand for natural gas and oil worldwide.

Offshore Drilling Market Key Takeaways

- In terms of revenue, the global offshore drilling market was valued at USD 39.61 billion in 2024.

- It is projected to reach USD 86.09 billion by 2034.

- The market is expected to grow at a CAGR of 8.07% from 2025 to 2034.

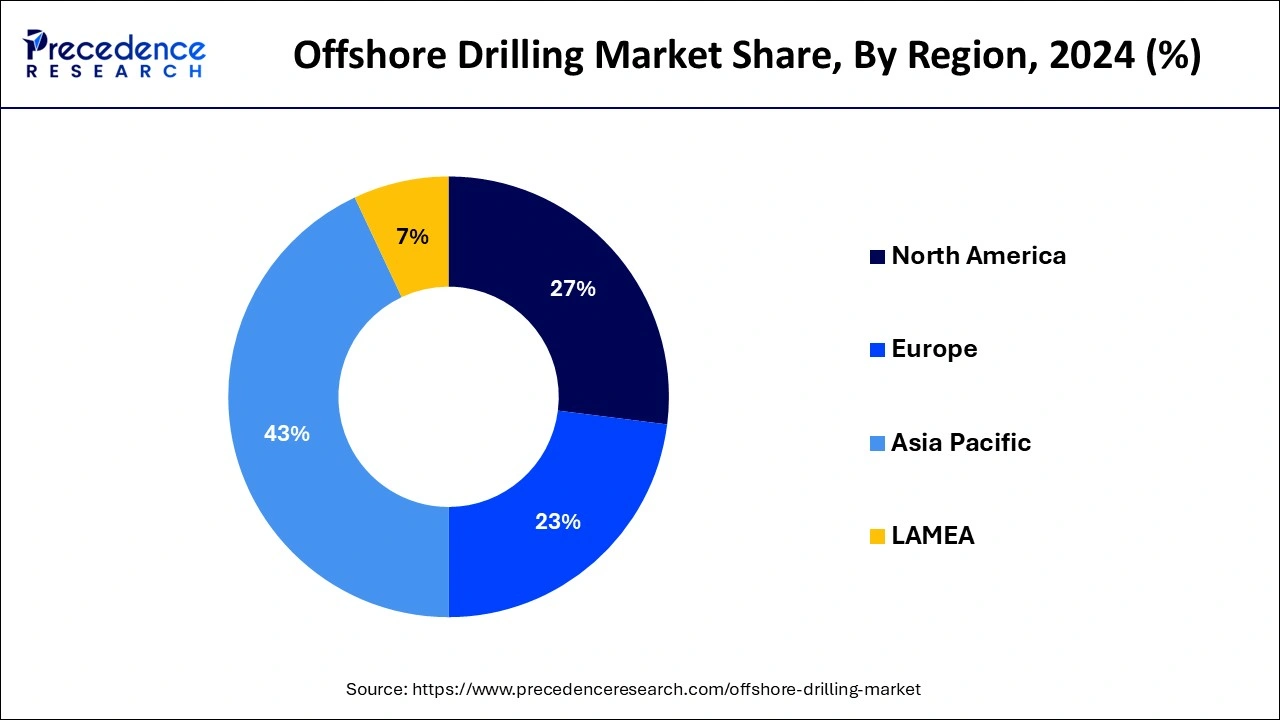

- Asia-Pacific led the market with the largest market share of 43% in 2024.

- Latin America is observed to be the fastest-growing market during the forecast period.

- By rig type, the drillships segment dominated the offshore drilling market in 2024.

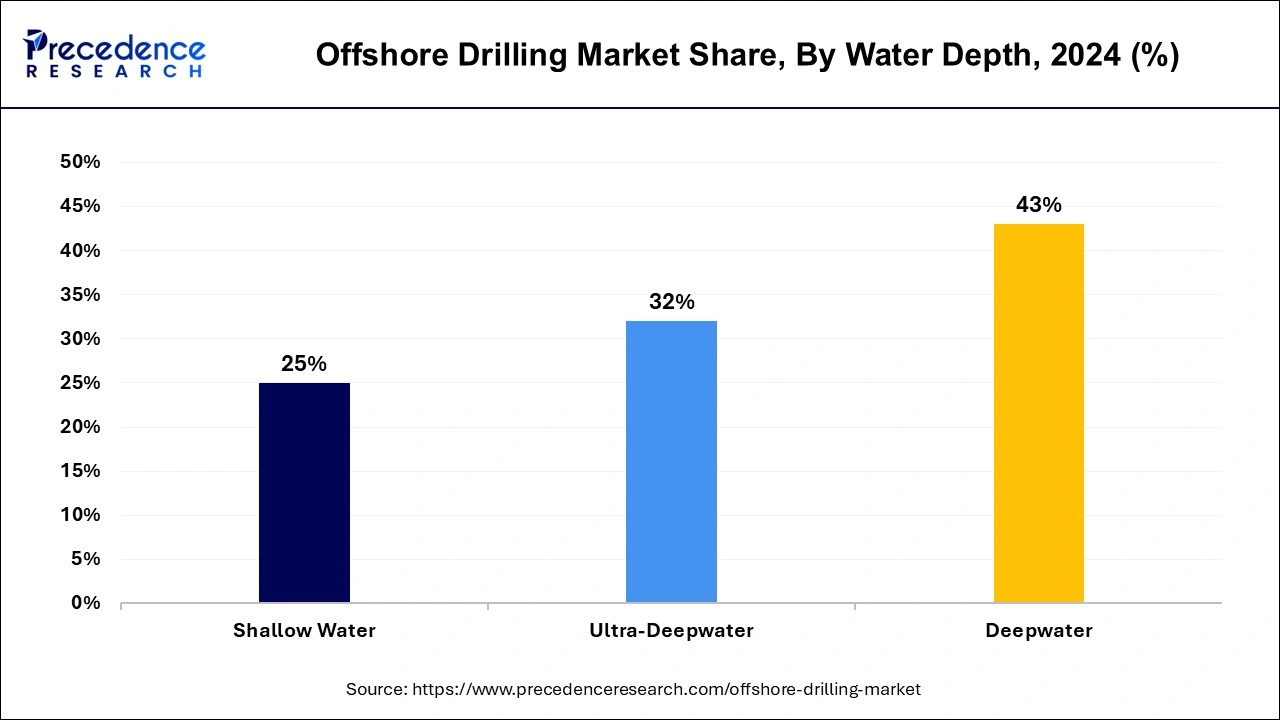

- By water depth, the deepwater segment has held the largest revenue share of 43% in 2024.

- By water depth, the shallow water segment is observed to be the fastest growing in the market during the forecast period.

Asia PacificOffshore Drilling Market Size and Growth 2025 to 2034

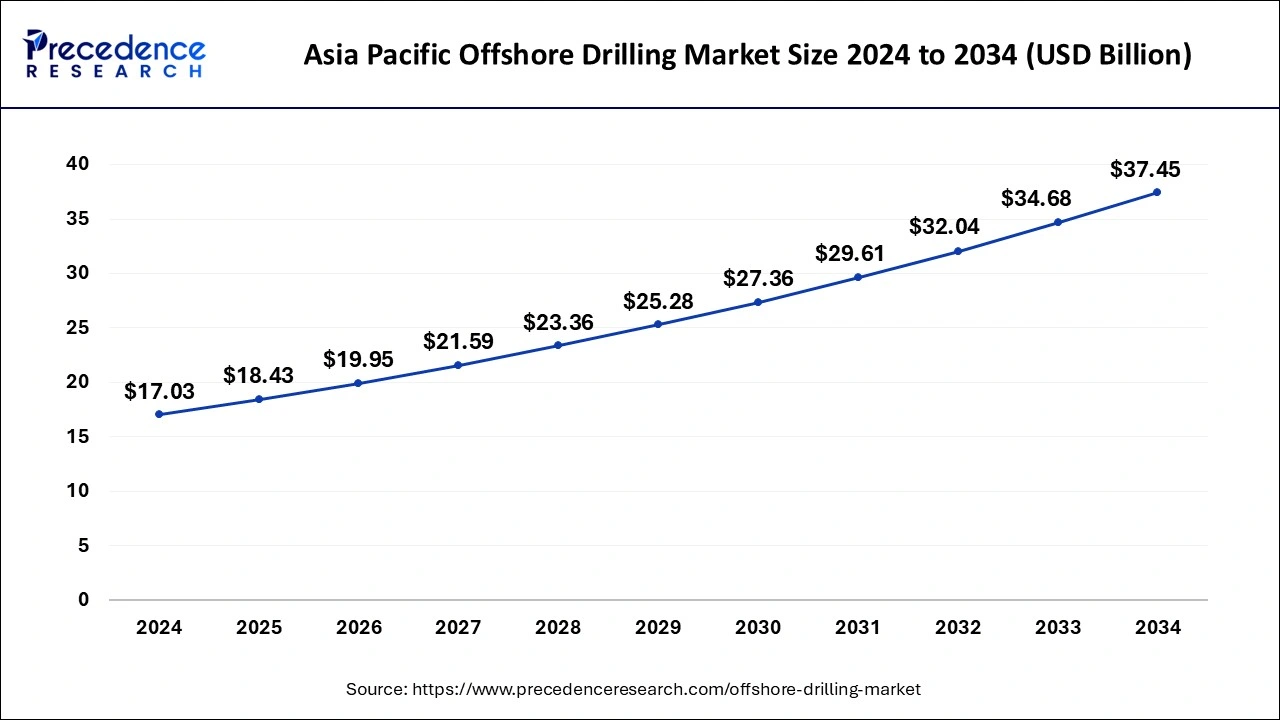

The Asia Pacific offshore drilling market size was estimated at USD 17.03 billion in 2024 and is predicted to be worth around USD 37.45 billion by 2034 at a CAGR of 8.20% from 2025 to 2034.

Asia-Pacific had the largest market share in 2024 in the offshore drilling market. Energy consumption has increased dramatically due to the Asia-Pacific region's economic expansion. Rising living standards, urbanization, and industrialization have all contributed to this increase in the need for energy. Countries in the area are spending more on offshore drilling to augment their energy sources and fulfill this growing demand. For example, China and India, whose economies are increasing, depend highly on energy imports and are eager to expand their domestic production capacity to improve energy security. The region's governments have established laws to support offshore production and exploration.

These policies include tax breaks, infrastructural development investments, and preferential production-sharing contracts (PSCs) terms. Under India's Hydrocarbon Exploration and Licensing Policy (HELP), one license is provided for both exploration and production.

- In December 2023, Due to worldwide solid demand and rising crude oil prices, Indian offshore rig operators were expected to see a 30% increase in operational income in the 2025 fiscal year.

Latin America is observed to be the fastest-growing in the offshore drilling market during the forecast period. Developments in offshore platform safety and efficiency and improvements in deepwater drilling techniques have made it possible to access and utilize previously unreachable deposits. Improvements in subsea infrastructure, seismic imaging, and drilling technology allow for more accurate and economical exploration and extraction. Relative geopolitical stability in important nations like Mexico and Brazil has created an atmosphere favorable for ongoing offshore drilling operations. Political stability promotes foreign direct investment and long-term planning in offshore industry.

- In December 2023, two tenders were held by Petrobras, the federal oil company of Brazil, to rent offshore well intervention rigs. Units with risers up to 2,400 meters in depth must be rented in one procedure.

Middle East & Africa shows significant growth in the offshore drilling market during the forecast period. Natural gas is becoming more and more significant as the globe moves toward greener energy sources since it has a smaller carbon footprint than coal and oil. An essential part of this energy shift is anticipated to be played by offshore gas fields in the MEA region. To diversify their economies and boost investment in the energy industry, particularly offshore drilling, nations like Saudi Arabia and the United Arab Emirates (UAE) are implementing strategic plans like Saudi Vision 2030 and UAE Vision 2021. Nigeria, and Ghana are a few West African nations with sizable offshore oil reserves. Because of its vast hydrocarbon potential, the Gulf of Guinea is a prevalent location for offshore drilling.

- In May 2024, Thailand's PTTEP Energy Development Company and Saudi Arabia's ADES Holding Company have agreed to a deal for offshore drilling services for 354 million Saudi riyals, or $94.39 million.

Market Overview

The industry involved in finding, extracting, and producing natural gas and oil beneath the ocean floor is known as the offshore drilling market. This industry covers a wide range of tasks, including operating offshore platforms and rigs, drilling wells, installing subsea infrastructure, and conducting geological surveys. The market offers various drilling techniques, including ultra-deepwater, deepwater, and shallow-water drilling.

Offshore drilling is an essential part of the world's energy supply since it gives access to enormous natural gas and oil deposits that are not accessible onshore. By diversifying hydrocarbon supplies and lowering reliance on imports for many countries, this promotes energy security. However, it is susceptible to shifts in laws and regulations and advancements in technology. Investment in this area varies in response to shifts in the market, which affect the world's oil supply and prices.

- In September 2023, Block 58, offshore Suriname, is the site of a massive oil project for which TotalEnergies has announced the start of development studies. Along with APA Corporation, which holds a 50% stake, TotalEnergies is the operator of Block 58.

Offshore Drilling Market Data and Statistics

- In August 2023, the government of Bulgaria announced that it has chosen to issue a call for bids for a permit to prospect and explore oil and gas in Block 1-26 Khan Tervel in the Black Sea. Following a weekly meeting, the licensing government released a statement stating that the 4,032 sq km block will be for five years, with three two-year extensions possible. The project aims to evaluate petroleum potential, drill an exploratory well, prepare a geological model to identify viable drilling sites and undertake 3D seismic surveys.

- In April 2023, the total crude oil produced was 2454.14 TMT, 2.85% less than in March 2022 and 15.57% less than the monthly objective. The total crude oil produced between April and March of 2022–2023 was 29178.56 TMT, 8.41% less than the period's goal and 1.73% less than the previous year.

Offshore Drilling Market Growth Factors

- The increasing need for energy worldwide makes offshore gas and oil extraction appealing. Market expansion is fueled by rising exploration expenditures from nations possessing gas and oil deposits.

- Companies are moving toward offshore exploration because stricter rules prohibit onshore drilling operations.

- Technological developments have made it possible to tap enormous resources into deep and ultra-deep waters, creating numerous opportunities.

- One primary growth driver is the increasing investments governments and energy firms make in offshore exploration and development projects.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.07% |

| Market Size in 2025 | USD 42.86 Billion |

| Market Size by 2034 | USD 86.09 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Rig Type, Water Depth, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing needs for energy

The world's population is still expanding, raising the energy need. An increased population means an increased need for transportation, heating, cooling, and power. The rate of urbanization is rising as more people relocate to cities, which usually have higher per capita energy consumption because of easier access to transportation, electricity, and industrial activity. Due to rising oil prices, offshore drilling is now more economically feasible. The potential profits from offshore oil extraction projects outweigh the significant costs and hazards involved when oil prices are high. Eventually, driving the offshore drilling market growth.

Discovering significant new reserves

Geologists and reservoir engineers assess the data gathered during drilling to determine the amount, quality, and commercial viability of the discovered reserves. This assessment considers various factors, including geological stability, fluid composition, and reservoir pressure. Significant financial resources must be found, and businesses must carefully consider whether it would be profitable to develop these reserves. Making decisions is heavily influenced by several factors, including market demand, production costs, oil prices, and regulatory constraints.

Restraints

Governments around the world are imposing strict regulations

Governments impose strict safety regulations on drilling technology and equipment to avoid mishaps. These requirements frequently call for significant expenditures in new technology and infrastructure modifications. For instance, the U.S. Bureau of Safety and Environmental Enforcement (BSEE) enforces stringent restrictions regarding blowout preventers, well design, and other vital equipment. Governments are stepping up their enforcement and compliance monitoring.

Businesses must now make frequent investments in audits, inspections, and reporting to comply with regulations. Noncompliance may result in heavy fines and possible shutdowns of operations. The Canadian Energy Regulator (CER) enforces severe penalties for infractions and regularly inspects. These strategies imposed by the government bodies are limiting the expansion of the offshore drilling market.

Fluctuations in oil prices

Offshore drilling projects may be postponed or canceled in response to sharp drops in oil prices. To reduce financial risk, oil companies typically must reassess their exploration and production budgets, delaying or abandoning plans for offshore drilling. Drilling contractors thus face a decline in service demand, which results in rig underutilization and lower profits. Companies involved in the offshore drilling industry may experience financial strain during extended periods of low oil prices.

Declining revenues and excessive fixed expenditures related to sustaining drilling fleets can erode profit margins and stress balance sheets. Under such conditions, businesses turn to cost-cutting strategies like layoffs, asset sales, or bankruptcy filings, which exacerbate the market's state and reduce funding for upcoming drilling operations.

Opportunities

Advances in drilling technology and subsea engineering

Current drilling technology is more economical and efficient. Drilling operations have become more efficient thanks to automation and robotics, which also minimize operational downtime and manual labor requirements. Furthermore, advancements like better drill bits, cutting-edge drilling fluids, and real-time data analytics allow operators to optimize the drilling process, which lowers total project costs and speeds up drilling. Operator profitability rises, and market competition sharpens due to these efficiency gains.

Development of technologies that minimize environmental impact

Governments and international organizations are imposing stricter environmental controls on offshore drilling operations. Technologies that reduce ecological effects can assist businesses in adhering to these rules, avoiding fines, and maintaining business continuity. Businesses that use green technologies can improve their brand image and reputation. Being regarded as an ecologically conscious business can draw partners, investors, and clients who value sustainability. Real-time monitoring systems can anticipate equipment breakdowns using IoT and AI, which lowers the risk of environmental damage and operational downtime.

Numerous governments provide financial incentives, including tax breaks, grants, and subsidies, to encourage the development and adoption of environmentally friendly technologies. Investing in these technologies can lower operating costs and boost the financial performance of offshore drilling firms.

Rig Type Insights

The drillships segment dominated the offshore drilling market in 2024. Drillships are equipped with cutting-edge technology, such as sophisticated propulsion systems, dynamic positioning capabilities, and sophisticated drilling equipment. Drillships can now function in various water depths and complex settings, including extreme deepwater and severe weather, where other drilling rigs might be unable to. Interest in discovering and exploiting deepwater reserves has grown due to the rising need for gas and oil worldwide.

These are perfect for these projects since they can drill over 10,000 feet of ultra-deepwater depths. Because of this, many oil and gas corporations want to use drillships for deepwater exploration and production, which helps them maintain their supremacy in this particular area of the offshore drilling industry.

Water Depth Insights

The deepwater segment dominated the offshore drilling market in 2024. The past few decades have seen a surge in global oil prices, which has economically increased the viability of deepwater resource development. Oil and gas corporations have significantly invested in deepwater drilling operations despite the more significant costs involved due to the potential returns from reaching massive deposits in these places. Another factor influencing investment in the deepwater segment is geopolitical concerns. Countries can diversify their energy supplies and lessen their reliance on politically unstable regions by accessing deepwater deposits. Developing offshore capabilities is a common goal for nations with abundant deepwater resources to improve energy security and boost economic growth.

The shallow water segment is observed to be the fastest growing in the offshore drilling market during the forecast period. With readily available infrastructure like ports, pipelines, and support services, many shallow water locations are very close to shore. This infrastructure lowers the expenses and logistical difficulties related to offshore operations, promoting the expansion of shallow-water drilling. Technological developments have made shallow water drilling operations much safer and more efficient. This market is growing because of improved drilling methods, including controlled pressure drilling and directed drilling, which increase the efficiency of accessing deposits in shallow water locations.

Offshore Drilling Market Companies

- Archer Well Company

- Borr Drilling

- Odfjell Drilling

- Shelf Drilling

- Maersk Drilling

- KCA Deutag

- COSL – China Oilfield Services Limited

- Diamond Offshore Drilling, Inc.

- Saipem

- Nabors Industries

- Pacific Drilling

- Noble Drilling

- Valaris plc

- Transocean

Recent Developments

- In May 2024, A pair of vessels intended for use in offshore oil fields were launched by the Indian yard. The launch of two boats at the San Marine yard in Kakinada has been confirmed by the ship classification agency, the Indian Register of Shipping (IRS).

- In December 2023, Risavika Gjenvinning, a firm founded by Geminor and its partners, will develop innovative technological solutions for treating and recovering waste from the petroleum industry.

Segments Covered in the Report

By Rig Type

- Drillships

- Semisubmersibles

- Jackups

By Water Depth

- Shallow Water

- Deepwater

- Ultra-deepwater

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting