What is the Flow Assurance In Oil And Gas Market Size?

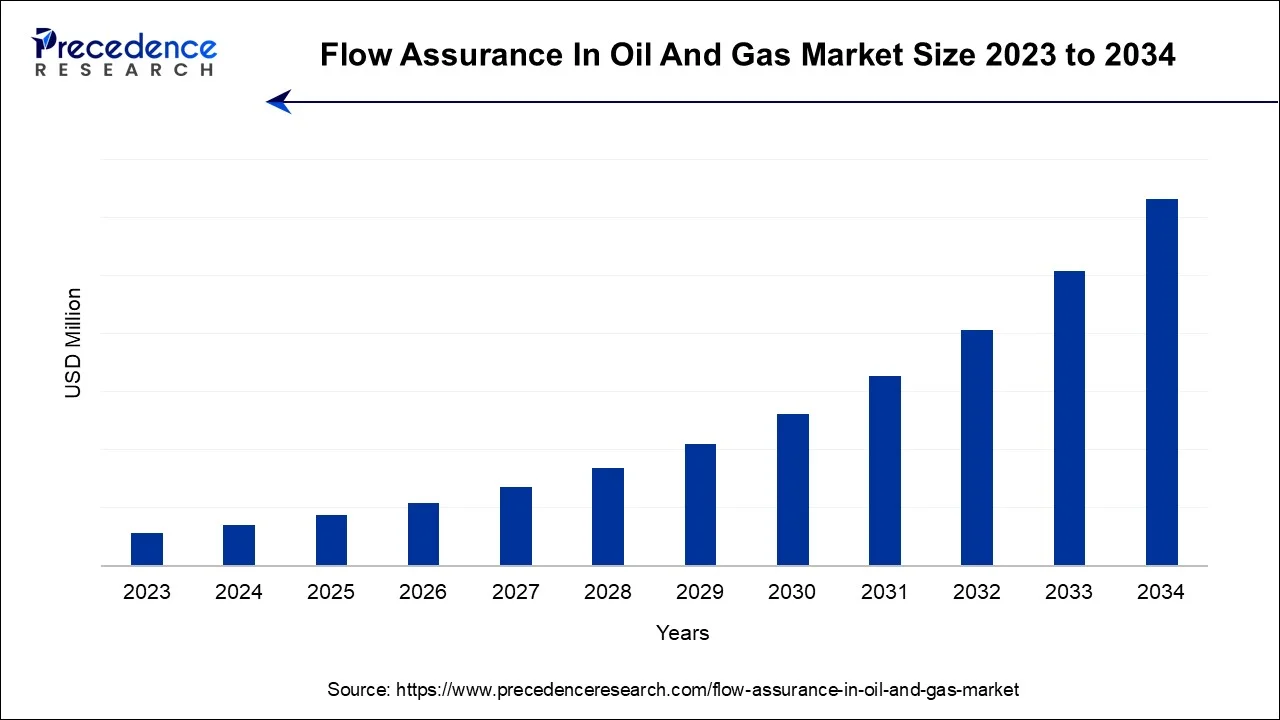

The global flow assurance in oil and gas market is surging, with an overall revenue growth expectation of hundreds of millions of dollars during the forecast period from 2026 to 2035.

Flow Assurance in Oil and Gas Market Key Takeaways

- North America is expected to dominate the market over the forecast period.

- By Type, the steady state simulation segment is expected to dominate the market during the forecast period.

- By Sector, the upstream segment is expected to capture the largest market share over the forecast period.

- By Operation, the offshore segment is expected to grow at the highest CAGR over the forecast period.

- By Application, scale management is expected to hold the largest market share over the forecast period.

What is the Flow Assurance In Oil And Gas Market?

Flow assurance is a critical aspect of the oil and gas industry and other industries involving the transportation of fluids through pipelines or different carriers. It refers to the set of measures and strategies implemented to ensure the safe, reliable, and efficient flow of fluids (usually hydrocarbons like oil and natural gas) from the reservoir to their destination, which can be a processing facility, storage tanks, or a point of export.

To avoid the development and deposition of undesirable solids (such as hydrates, wax, asphaltenes, and scales) during the production and transportation of crude oil, understanding fluid characteristics and operating conditions is essential. Methane gas hydrates may crystallize or asphaltenes may precipitate in pipelines under the condition of severe heat and pressure. The asphaltene, wax, or hydrate crystals might precipitate and clump together to the point of clogging the pipeline if they are not adequately regulated. It can be expensive and risky to remove an asphaltene or hydrate clog from a subsea pipeline.

How is AI Influencing the Flow Assurance in Oil and Gas Industry?

AI in flow assurance makes the oil and gas industry more efficient through the application of predictive analytics, real-time monitoring, and optimization. It foresees possible blockages, spots abnormal situations, and modifies the operations for maximum efficiency. AI, along with digital twins, drones, and data-driven insights, leads to proactive maintenance, less downtime, and ensures safe, uninterrupted hydrocarbon flow in the complicated production and transport systems.

Flow Assurance in Oil and Gas Market Growth Factors

- The market growth is driven by several factors including rising demand for energy, stringent environmental regulations, complex reservoirs and fields, growing automation and technological advancements.

- According to the US Energy Information Administration, worldwide output of liquid fuels will climb by 1.2 million b/d in 2023. 2024 will see a 1.7 million b/d rise in global output. The United States, Brazil, Canada, and Guyana are the top four countries leading non-OPEC production growth, which will increase by 2.0 million b/d in 2023 and 1.3 million b/d in 2024.

- According to the report published by BP “Review of World Energy 2022”, oil consumption rose by 5.3 million barrels per day (b/d) in 2021, although it still lagged behind 2019 levels by 3.7 million b/d. Gasoline (1.8 million b/d) and diesel/gasoil (1.3 million b/d) accounted for the majority of the consumption rise. Such rising demand for oil and other associated sources is observed to act as a major growth factor for the global flow assurance in oil and gas market.

- As oil and gas industries across the globe start emphasizing on the design and operation of the oil and gas system, the market is expected to accelerate in the upcoming years. In addition, the cost effective measure offered by flow assurance processes for oil and gas industry also highlights the market's potential.

Market Outlook

- Industry Growth Overview: The Market is likely to experience steady growth due to the demand for deepwater production.

- Sustainability Trends: Emphasis is on using fewer chemicals, switching to green tech, and incorporating carbon capture along with the usual carbon capture and storage methods.

- Global Expansion: The market is growing rapidly in areas where the underwater and offshore operations are complicated and require the use of advanced flow assurance to ensure the continued production.

- Major investors: Major oil and gas firms (example, Shell, TotalEnergies) are the investors who are pouring lots of money into R&D and innovative flow solutions.

- Startup Ecosystem: New companies are focusing on predictive modeling and efficient pipeline maintenance with the help of AI, big data, and IoT, thus improving the operability.

Market Scope

| Report Coverage | Details |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Sector, Operation, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising energy demand

The global energy demand continues to grow, leading to the development of more remote and unconventional oil and gas reserves. Ensuring the reliable flow of hydrocarbons from these reserves to processing facilities and markets is essential to meet the growing energy needs. For instance, according to the European Commission, the consumption of oil products increased in the industry sector both for non-energy use (+6.3 pp) and for energy use (+2.7 pp), and in some cases, the increase was significant, such as in the services sector (+11.4 pp) and the transport sector, the largest user of oil products (+9.4 pp overall for different types of transports). Thus, the growing energy demand is expected to propel the market growth during the forecast period.

Restraint

Complexity and high cost

Flow assurance solutions often require a deep understanding of fluid behavior, thermodynamics, and fluid mechanics. The complexity of these systems can make them challenging to design, implement, and maintain effectively. Moreover, implementing flow assurance measures can be expensive, particularly in remote or challenging environments. The cost associated with chemical inhibitors, insulation, heating systems, monitoring equipment, and maintenance can strain operational budgets. Thus, this is expected to limit the market growth during the forecast period.

Opportunity

Offshore and deepwater exploration

The growing offshore and deepwater exploration is expected to offer a potential opportunity for market growth during the forecast period. As offshore and deepwater exploration activities continue to expand, the demand for flow assurance solutions in these challenging environments is expected to grow. Innovation in subsea technologies and equipment will be crucial to meeting this demand.

- For instance, in August 2022, ExxonMobil, a major American energy corporation, teamed up with the Oil & Natural Gas Corporation (ONGC), a government-owned business in India, to explore for hydrocarbons in deep waters off the coast of that nation. This will increase that nation's energy security. The Krishna Godavari and Cauvery basins in the eastern offshore, as well as the Kutch-Mumbai region in the western offshore, would be the focus of this partnership, according to ONGC. Therefore, such collaboration is expected to propel revenue growth in the flow assurance market.

Segment Insights

Type Insights

The global flow assurance in the oil & gas market is segmented into steady state simulation and transient state simulation. The steady state simulation segment is expected to dominate the market during the forecast period. Steady state simulation is a crucial tool in flow assurance, as it helps engineers and operators model and analyze the behavior of fluids within pipelines and production systems under steady-state conditions. Steady state simulations are used to analyze the hydraulic behavior of pipelines and production systems.

Engineers can determine pressure drops, flow rates, and fluid velocities throughout the system. This information is essential for designing pipelines and facilities to ensure the desired flow conditions are maintained. Moreover, these simulations predict temperature distributions and identify potential areas where hydrate and wax formation might occur. This information guides the design of insulation and heating systems to prevent solid deposit formation. Thereby, driving the market growth over the forecast period.

Sector Insights

The global flow assurance in oil & gas market is segmented into upstream, midstream and downstream. The upstream segment is expected to capture the largest market share over the forecast period. The wellbore, where hydrocarbons are first generated, is where managing flow assurance starts. There are several difficulties could occur, including the potential for wax and hydrate production. To avoid obstructions and sustain flow, procedures for flow assurance include the injection of chemical inhibitors and the use of heating systems. Thus, flow assurance in the upstream oil and gas industry is critical for ensuring the economic viability and safety of production operations.

Operation Insights

The global flow assurance in oil & gas market is segmented into onshore and offshore. The offshore segment is expected to grow at the highest CAGR over the forecast period. Offshore environments often involve low temperatures and high pressures, which increase the risk of hydrate and wax formation. These deposits can block pipelines and equipment, causing flow disruptions, which in turn, drive the flow assurance industry. Moreover, the growing offshore oil & gas project investments further drive the market growth over the projection period.

- According to the US Energy Information Administration, in 2022, wells in the Federal Offshore Gulf of Mexico produced roughly 14.5% of the nation's crude oil, while those in the Federal Offshore Pacific (California) generated around 0.1%. Thus, the aforementioned facts support the market expansion during the projected period.

Application Insights

The global flow assurance in oil & gas market is segmented into scale management, asphaltene management, hydrate prevention and others. The scale management is expected to hold the largest market share over the forecast period. Flow assurance experts use analytical tools and modelling techniques to identify the potential for scale formation in pipelines and equipment. They predict when and where scaling is likely to occur based on factors such as fluid composition, temperature, pressure, and flow rate. Thus, this is expected to propel the segment's growth.

Regional Insights

North America is expected to dominate the market during the forecast period. The market growth in the region is attributed to the growing shale gas production. The region is known for its extensive shale oil and gas resources, particularly in the Permian Basin in Texas and New Mexico. Flow assurance is essential in these areas to manage the production of unconventional hydrocarbons and transport them efficiently. The overall technological innovation and rapid adoption of the same also promote the market's growth.

- For instance, according to the US Energy Information Administration, Shale formations contributed roughly 28.5 trillion cubic feet (Tcf) or 80% of all dry natural gas produced in the United States in 2022.

Moreover, the increasing offshore production in the region is also the main contributor to the market expansion. The Gulf of Mexico is a major hub for offshore oil and gas production in North America. Deepwater and subsea operations in this region require specialized flow assurance measures to address the challenges posed by high pressures, low temperatures, and the risk of hydrate and wax formation.

- For instance, in June 2023, BP announced that oil production at its Argos offshore platform had begun smoothly, supplying extra energy at a crucial moment and enhancing its position as a major producer in the deepwater US Gulf of Mexico. Argos is BP's sixth platform in the Gulf of Mexico and the first newly constructed production facility the company has run in the area since 2008. It has a gross production capacity of up to 140,000 barrels of oil per day. Therefore, this kind of project in the region is expected to propel the growth of the market in the region.

How is Asia-Pacific leading in the Flow Assurance In Oil And Gas Market?

The region is undergoing a rapid expansion, which is mainly attributed to increased energy demand and industrial activities. The government initiatives to digitalize the industry, along with the rise in offshore exploration and refining projects, are creating the perfect environment for advanced flow assurance technologies being absorbed into the market.

China Flow Assurance In Oil And Gas Market Trends:

With its well-established oil and gas infrastructure, China is the forerunner in the regional market. The country's substantial energy consumption, combined with its drive for technological innovation, leads to heavy investment in AI-powered predictive maintenance and efficient flow systems.

How is North America performing in the Flow Assurance In Oil And Gas Market?

This region is still the principal area of technological innovation in energy operations. The advanced shale exploration and digitalization of oilfields maintain the necessity for predictive flow assurance systems, which are capable of making the production faster and easier.

United States Flow Assurance In Oil And Gas Market Trends:

The United States is a major market that mainly revolves around smart operations and the use of data analytics. Utilization of AI in supervising and managing pipelines guarantees production safety, operational resilience, and efficiency in the energy sector.

What are the driving factors of the Flow Assurance In Oil And Gas Market in Europe?

Europe is on the way to achieving growth that may be referred to as steady; more and more people are focusing on safety, efficiency, and sustainability in the oil and gas industry. The digital flow assurance is increasingly taking over due to the combination of renewable systems and carbon management strategies.

Norway Flow Assurance In Oil And Gas Market Trends:

The North Sea sector continues to be the area where Norway is able to advance technologically. The country is so committed to operational safety, efficiency, and sustainability that it is willing to adopt high-performance monitoring and predictive systems just to maximize offshore production.

Managing Flow Risks: Flow Assurance in Oil and Gas Industry in Latin America

Latin America's market shows notable growth during the forecast period. With significant operations in deepwater Brazil, along with offshore Guyana, high-pressure, low-temperature, and even long-distance tie-backs raise the risk of solid deposition and blockages. It addresses corrosion together with scaling, protecting pipeline infrastructure, which is vital for reducing environmental risks and handling production levels.

Brazil Flow Assurance in Oil and Gas Market Trends

Over 95% of Brazil's oil is manufactured offshore, with significant, rising operations in the deepwater pre-salt basins. These depths create extreme conditions, such as high pressure and low temperature, which create flow assurance, like preventing blockages in pipes, absolutely critical for continuous operation. Flow assurance, which involves managing hydrates, wax, and asphaltenes, is vital in Brazil to avoid the enormous expense of offshore, maintenance, and production shutdowns.

Deepwater and Offshore Developments Fueling the Oil and Gas Flow Assurance Market in MEA

MEA's market shows fast growth during the forecast period. It is mainly due to the extreme technical difficulties of operating in deep water, high pressure, and low temperatures, which cause severe blockages such as hydrate wax. Increasing use of digital tools like real-time monitoring, simulation, and predictive analytics is enhancing operational reliability, and environmental and safety regulations are pushing adoption of eco-friendly solutions.

UAE Flow Assurance in Oil and Gas Market Trends

The UAE is investing billions to drive production capacity, creating a significant need for advanced flow assurance to handle operational efficiency in both existing and new, complex, or aging assets. The market is boosted by the acceptance of digital technologies, smart monitoring, and even advanced chemical solutions for flow assurance to improve production and reduce downtime.

Value Chain Analysis

- Resource Extraction: The procurement of raw fossil fuels or minerals obtained through safe and sustainable means.

Key Players: Shell, BP, and ExxonMobil - Power Generation: The transformation of extracted resources into electricity for industrial and domestic use.

Key players: Siemens Energy - Distribution Network Management: The movement and delivery of hydrocarbons to end-users is managed in an efficient manner.

Key Players: Enbridge Inc. - Energy Storage Systems: The energy that has been extracted is stored to ensure a constant supply and to minimize disruptions in operations.

Key Players: Tesla - Grid Maintenance and Monitoring: Disabled, safe, and efficient hydrocarbon flow is achieved through the application of proactive measures.

Key Players: ROSEN Group

Key Players' Offering

- Oceaneering International, Inc.: Delivers a full set of advanced systems for deepwater intervention, subsea robots, as well as testing directed at pipeline integrity and performance.

- Baker Hughes Company: Provision of technology-based solutions for production enhancement, with predictive flow management and chemical optimization being the primary focus.

- Intertek Group plc: Offering of quality assurance, testing, and certification services in order to confirm the safety and reliability of flow assurance processes.

- ROSEN Group: Technologies for inline inspection and monitoring are developed that are advanced enough so that the pipeline can be kept healthy, and no interruptions occur.

- Oceaneering International, Inc.: Oceaneering International, Inc. offers specialized flow assurance services to guarantee subsea infrastructure efficiency, aiming to remediate blockages such as wax, hydrates, and asphalts in deepwater flowlines.

- Baker Hughes Company: Baker Hughes provides a comprehensive portfolio for flow assurance in the oil and gas market, aiming to prevent, mitigate, and handle production blockages over the entire lifecycle of a well, from subsea to surface.

- Intertek Group plc: Intertek Group plc offers comprehensive Flow Assurance and Total Quality Assurance services , thus, for the oil and gas industry, aiming to optimize production along with preventing blockages in deepwater and challenging environments.

Other Major Players

- SLB

- GATE Energy

- AMOG CONSULTING

- ESSS

- SGS

- Exxon Mobil Corporation

- METTLER TOLEDO

Recent Developments

- In November 2025, BP agreed to sell non-controlling interests in Permian and Eagle Ford midstream assets to Sixth Street-managed funds for $1.5 billion, with BP remaining the operator and phased payments.

- (Source: https://www.bp.com)

- In June 2025, Baker Hughes and Repsol announced an agreement to deploy next-generation digital capabilities, including a generative AI-powered virtual assistant, via the Leucipa™ solution.

(Source:https://www.bakerhughes.com)

Segments Covered in the Report

By Type

- Steady State Simulation

- Transient State Simulation

By Sector

- Upstream

- Midstream

- Downstream

By Operation

- Onshore

- Offshore

By Application

- Scale Management

- Asphaltene Management

- Hydrate Prevention

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content