What is the Hydraulic Dosing Pump Market Size?

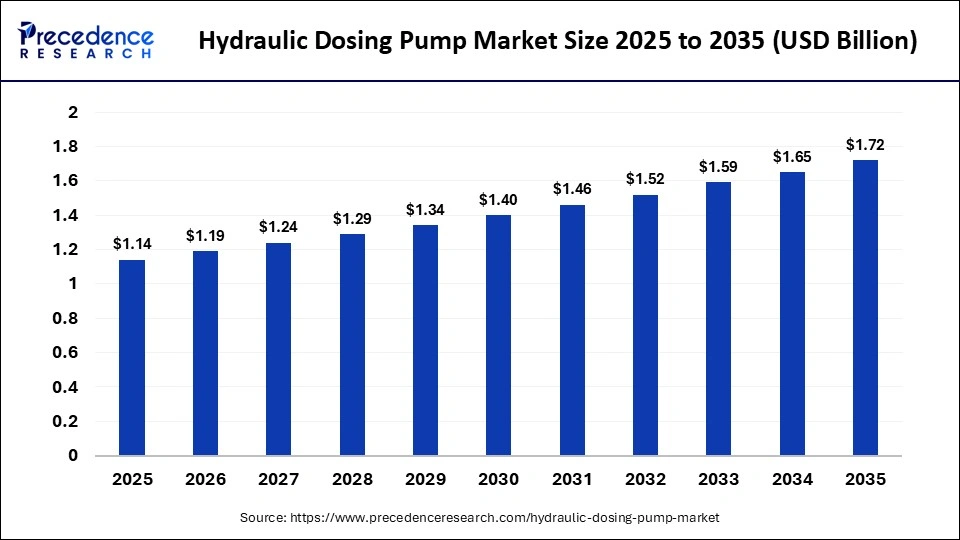

The global hydraulic dosing pump market size accounted for USD 1.14 billion in 2025 and is predicted to increase from USD 1.19 billion in 2026 to approximately USD 1.72 billion by 2035, expanding at a CAGR of 4.22% from 2026 to 2035. The hydraulic dosing pump market is driven by rising automation in fluid handling, demand for precise chemical injection, and growing adoption across water treatment and industrial processing applications.

Market Highlights

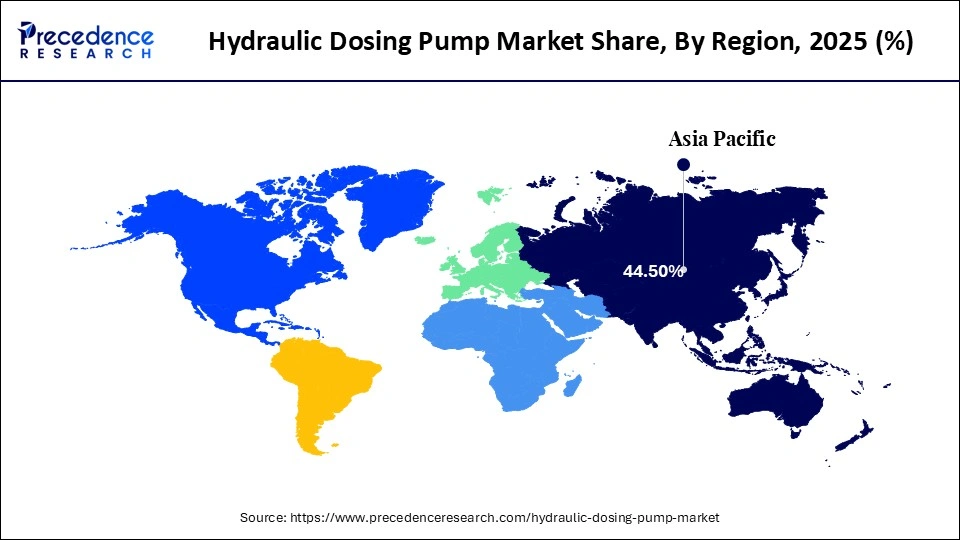

- Asia Pacific led the hydraulic dosing pump market with 44.5% of the market share in 2025.

- North America is estimated to grow at a CAGR of 7% between 2026 and 2035.

- By type, the hydraulic diaphragm dosing pump segment captured the largest market share of 58.6% in 2025.

- By type, the hydraulic double diaphragm dosing pump segment is growing at a CAGR of 5.9% from 2026 to 2035.

- By flow rate, the 101-500 LPH segment held the major market share of 54.4% in 2025.

- By flow rate, the 500 LPH segment is poised to grow at a CAGR of 6% from 2026 to 2035.

- By operation mode, the automatic segment contributed the biggest market share of 54.4% in 2025 and it is growing at CAGR of 6.4% between 2026 and 2035.

- By end-user, the pharmaceutical & biotechnology companies segment held more than 43.4% of the market share in 2024.

- By end-user, the contract development & manufacturing organizations (CDMOs) segment is expected to expand fastest with a CAGR of 6% between 2026 and 2035.

What does the Evolution of the Hydraulic Dosing Pump Market Signify?

In industrial settings, precise amounts of chemicals are injected into a process using hydraulic flow through a hydraulic dosing pump. Hydraulic dosing pumps provide high accuracy, pressure stability, and reliability when a process requires these features. The hydraulic dosing pump market continues to grow steadily. Many industries are demanding higher levels of process control, improved chemical handling and consumption, and enhanced safety measures.

Hydraulic dosing pump usage will continue to increase as more industries demand greater process control due to regulations on wastewater treatment, the oil and gas industry, and chemical processing, and as more refineries upgrade their operations to reduce the amount of corrosive materials being introduced into a system. The development of hydraulic dosing pumps with digital monitoring capabilities and energy-efficient hydraulic pump heads, along with advanced diaphragm designs, has all contributed to increasing pump reliability. Emerging economies are quickly adopting automated hydraulic dosing pump solutions, while developed countries are moving towards maintaining hydraulic dosing pumps that support longer service intervals.

AI-Driven Innovation in Hydraulic Dosing Pump Market

AI-driven innovation is reshaping the hydraulic dosing pump market by improving dosing precision, operational reliability, and real-time process control. Modern hydraulic dosing pumps integrated with AI algorithms can automatically adjust stroke length, flow rate, and pressure in response to fluctuations in viscosity, temperature, or chemical concentration, thereby maintaining consistent dosing accuracy during continuous operation. Machine learning models analyze historical pump performance, fluid-behavior patterns, and sensor data to predict seal wear, diaphragm fatigue, and cavitation risks, enabling maintenance teams to intervene before failures occur. AI-enabled monitoring platforms also support automated calibration, reducing manual adjustments and minimizing dosing deviations in industries such as water treatment, petrochemicals, food processing, and pharmaceuticals.

Which is Major Market Trends Driving Growth of the Hydraulic Dosing Pump Market?

- Digital Monitoring Adoptions: Digital Monitoring, IoT, and Real Time Monitoring will improve the accuracy of dosing and decrease the amount of manual adjustments necessary for accurate dose controls. This also increases visibility into the dosing process and enables consistent, stable fluid flow across all applications.

- Chemical-Resistant Materials: manufacturers are developing pumps using corrosion-resistant alloys and advanced polymers that allow for pumps to endure contact with corrosive &/or aggressive chemicals, thus extending the service life of equipment. In conjunction, this will reduce maintenance for pumps that meet the demands for water treatment and industrial sectors.

- Accelerated Process Automation: the use of automated hydraulic dosing pumps is increasing within process industries as businesses seek greater accuracy, consistency, and reliability in terms of flow, while also decreasing downtime within their operation. This is especially beneficial for the chemical, food, pharmaceutical, and refining industry sectors.

- Focus on Energy-Efficient Systems: pump manufacturers are designing hydraulic pumping systems with enhanced hydraulic mechanisms as well as smart controls to reduce the overall energy consumption of hydraulic pumping. This is done to help businesses lower their operating costs and support the long-term goals of sustainability & reliability.

Market Outlook

- Industry Growth Overview: The market increases steadily due to the increasing demand for specific chemical injection in water industrial usage.

- Sustainability Trends: The operational cost to the environment is minimized in the use of more efficient pump designs and biodegradable hydraulic fluids.

- Global Expansion: Asia Pacific, North America, and Europe are developing in terms of industrialization, infrastructure, and water treatment investment.

- Major Investors: Grundfos Holding, ProMinent GmbH, Dover Corporation, IDEX Corporation, LEWA GmbH, and Milton Roy are the aggressive investors.

- Startup Ecosystem: Startups are specialized in remote monitoring and precision-enhanced technologies of smart dosing automation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.14 Billion |

| Market Size in 2026 | USD 1.19 Billion |

| Market Size by 2035 | USD 1.72 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.22% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Flow Rate, Opration Mode, End-Use Industry, and Reigon |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: Precision and Efficiency Requirements

Industries are increasingly setting as a priority the accurate dosing of chemicals, which will allow them to cut down on the amount of raw materials wasted and the variations in the production processes. Pharmaceutical production requires that the same formulations are always produced, whereas food and drink producers need to strictly control the exact amount of additives.

Water treatment plants rely on precise dosing to meet legal standards. All these requirements in unison lead to the adoption of hydraulic dosing pumps, which guarantee the established accuracy, stable performance, and continuous operational efficiency even in critical applications.

Restraint: Competition from Low-Cost Alternatives

Inexpensive dosing pump options put pressure on the market, and thus, the manufacturers of hydraulic pumps will have to find ways to convince buyers about their products' advantages. Cost savings in the period of the first purchase are the most important factor for many industries, thus they are opting for electric or mechanical pumps with lower accuracy.

The substitute products consume fewer hydraulic dosing pumps even though they are likened to them in terms of reliability, accuracy, and durability under high-pressure, critical industrial environments.

Opportunity: Smart and Programmable Dosing Technologies

The development of smart dosing technologies is a significant opportunity for hydraulic dosing pump manufacturers. Automated systems allow for the precise control of flow, advanced automation, and improved process optimization. The pulp and paper industry, for instance, is realizing the benefits in terms of accurate chemical consumption and less production downtime.

Moreover, the integration with IT support systems leads to the operators enjoying the benefits of efficiency, safety, and cost savings in the long run.

Segment Insights

Type Insights

Why Hydraulic Diaphragm Dosing Pump the Leading Type in the Hydraulic Dosing Pump Market?

Hydraulic Diaphragm Dosing Pump: The segment is the leading seller in the market in 2025 with a 58.6% share due to its leak-free operation, corrosion resistance, and ability to dose aggressive chemicals. These pumps have been the preferred choice for metering applications within the water treatment, chemical processing, and industrial dosing sectors. In addition, these pumps have a long service life and maintain stable performance under varying pressures, making them a reliable pump for large-scale applications.

Hydraulic Double Diaphragm Pump: The segment is the fastest-growing category among dosing pumps with a 5.9% share, with their additional safety features, dual-chamber design for increased reliability, and lack of cross-contamination prevention making them increasingly popular in applications requiring uninterrupted dosing, zero-leakage performance, and superior diaphragm protection. These pumps are also growing in popularity in today's industrial and process operations because of their capability to pump abrasive and viscous products and to operate under high-pressure conditions.

Flow Rate Insights

Why 101-500 LPH Flow Rate Dominating the Hydraulic Dosing Pump Market?

101-500 LPH: The 101-500 LPH range is the most dominant flow rate in 2025 with a 54.4% share because it strikes a balance between sufficient throughput and accurate dosing for most mid-scale industrial processes. It is the most commonly specified flow-rate category by many large industrial operations, including chemical manufacturing, wastewater treatment, and oil and gas production, due to its flexibility, energy efficiency, and compatibility with diverse dosing tasks. The consistent output from this flow-rate category has facilitated widespread adoption.

Above 500 LPH: The segment is expected to be the fastest-growing, with a 6% CAGR, driven by increasing demand for pumps with flow rates above 500 LPH. Within this growth segment, the accelerating volume of industrial wastewater generated and the continued acceptance of higher-volume dosing systems by large industrial clients such as oil refineries, manufacturing facilities, and power generation plants are contributing to higher-capacity requirements. Continued advancements in pump design that enable high flow rates with high reliability are driving further growth in this flow rate category.

Operation Mode Insights

Why does Automatic Operation make up the Largest Percentage of the Hydraulic Dosing Pump Market Share?

Automatic: The segment dominates the hydraulic dosing pump market with a 54.5% share, because the accuracy and reliability of automatic hydraulic dosing pumps drive the industry toward reduced human intervention and greater cycle optimization through real-time adjustments. The segment is also expected to be the fastest growing in the coming years, with a 6.4% share. Modern plants utilize automatic dosing systems to provide reliable, more efficient dosing systems. The automatic operation is also expected to be the fastest-growing segment, as more and more industries embrace the use of automatic systems with smart monitoring and remote control. With the ability to increase productivity, decrease operational errors, and meet regulatory requirements, it will continue to be adopted rapidly. As digital plants and Industry 4.0 platforms become reality, the need for dosing pump solutions will move from concept to deployment faster than ever.

End Use Industry Insights

What is the Importance of Water and Wastewater Treatment in the Hydraulic Dosing Pump Market?

Water and Wastewater Treatment: The segment holds a dominant share of 32.2% share in the overall market due to the increasing needs of municipalities and industries for efficient disinfection, pH control, and chemical conditioning. The hydraulic dosing pumps provide accurate chemical dosing for safe water quality and regulatory compliance. Additionally, hydraulic dosing pumps' ability to withstand corrosive water treatment chemicals and provide consistent flow makes them critical to the water and wastewater treatment sectors.

Pharmaceuticals: Pharmaceuticals are the fastest-growing segment, with an expected 6% CAGR over the forecast period, as strict contamination-free chemical dosing during drug manufacture is critical. In high-purity applications such as those used in the pharmaceutical industry, precise dosing is critical. Additionally, the pharmaceutical segment is growing due to increased investment in advanced bioprocessing, sterile environments, and active pharmaceutical ingredient (API) manufacturing.

Regional Insights

What is the Asia Pacific Hydraulic Dosing Pump Market Size?

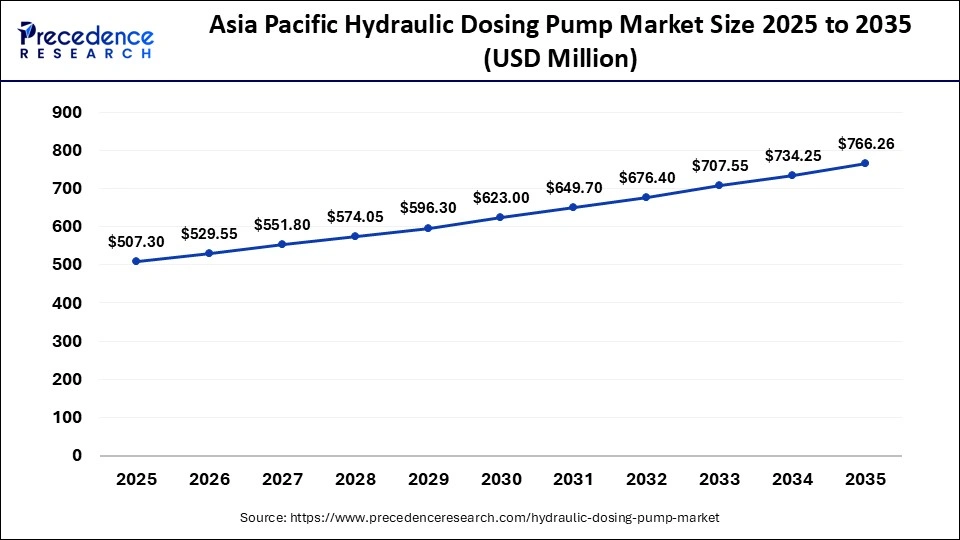

The Asia Pacific Hydraulic Dosing Pump market size is expected to be worth USD 507.30 million by 2035, increasing from USD 766.26 million by 2025, growing at a CAGR of 4.21% from 2026 to 2035.

What Factors Have Contributed To The Dominance Of The Hydraulic Dosing Pump Market In The Asia Pacific Region?

The Asia Pacific region accounts for the largest share of the global hydraulic dosing pump market for several reasons. The region has a high concentration of Industrial Manufacturing, which has increased the number of locations where hydraulic dosing can be used to serve the growing number of industrial facilities.

Asia Pacific also has a significant increase in investments in water treatment facilities, whichhase driven the increase in urbanisation. Many municipalities have been forced to improve their wastewater treatment systems and have therefore invested heavily in hydraulic dosing pumps to meet their wastewater treatment needs. The increase in industry automation creates further demand for the new generation of hydraulic dosing pumps, as they improve process stability and enhance operational safety across diverse applications.

China Hydraulic Dosing Pump Market Trends

China is the largest producer of chemicals in the region, significant upgrades have been made to municipal wastewater treatment plants, and the ongoing modernisation of industries and the need for chemical plants to replace out-of-date systems with more accurate and reliable dosing are the main drivers of demand for hydraulic dosing pumps. In addition, the growing number of hydraulic dosing pump manufacturers in China presents a great opportunity for manufacturers to continue expanding their product market.

- In December 2024, IDEX China launched the Pulsafeeder PulsaMax 8480 metering pump a hydraulically balanced diaphragm pump that meets API 675 standards, promising leak-free, precise dosing across oil & gas, chemical, water treatment, and other industries.

What makes North America the Area of Most Growth in the Hydraulic Dosing Pump Market?

The recent trend of fast growth due to extensive investments by North American manufacturers in upgrading legacy fluid-handling systems and combining those systems with automated dosing solutions that incorporate the latest technology, and increased pressure for superior precision dosing in specialty chemicals, oil & gas additives, power generation and municipal water treatment, has led to an increased demand for legacy fluid-handling systems to be upgraded.

The regulations in North America are encouraging companies to implement safer methods for handling chemicals and to increase the accuracy of dosing, which has stimulated the growth of hydraulically actuated pumps that have a longstanding reputation for reliability. The presence of technology-driven companies and the widespread use of SCADA-enabled dosing solutions have made North America an emerging leader in this market when it comes to replacing legacy fluid-handling systems in other cost-sensitive areas worldwide.

U.S. Hydraulic Dosing Pump Market Trends

The United States is driving growth through continued upgrades to municipal water-treatment facilities; continued growth in the pharmaceutical and specialty chemical sectors; and rapid technology integration within process plants. There continue to be strong supplier networks within the United States, an emphasis on system reliability, and a commitment by end-users to comply with strict environmental regulations, all of which are propelling end-users toward selecting advanced hydraulic dosing pumps that improve operational control, enhance safety, and improve maintenance predictability.

How is Europe Entering a New Era of Hydraulic Dosing Pumps?

There is considerable growth occurring in Europe as a direct result of the ongoing modernization of chemical, pharmaceutical, food processing, and municipal water treatment facilities. The continued increase in modernization is attributed to strict regulations at both the state and federal levels on wastewater discharge and air quality standards for industrial emissions; this has resulted in an increased demand for durable, accurate hydraulic dosing systems that enable continued compliance by the end user.

The emphasis on low maintenance, energy efficient and large scale equipment has led to the need for industry to continue to upgrade from existing mechanical dosing units; this is creating a need for increased demand for higher specification automation-ready pumps in western Europe and an emerging market in central and eastern europe as the region continues to upgrade its infrastructure through the use of engineering expertise and advanced manufacturing capabilities.

Germany Hydraulic Dosing Pump Market Trends

Germany is the leader in growth in Europe due to its strong and highly developed chemical industry, engineering, and manufacturing capabilities, as well as its strong environmental standards. More industries are utilising high-precision hydraulic dosing pumps integrated with automation and monitoring systems than ever before to achieve greater reliability, minimise downtime, and ensure consistent dosing performance across all complex manufacturing processes.

In January 2024, the German manufacturer of external gear pumps, Kracht GmbH, was acquired by the Atlas Copco Group, which integrated it into its Power & Flow division, thereby expanding Atlas Copco's industrial-pump portfolio.

What makes the Middle East and Africa an emerging region in the Hydraulic Dosing Pump Market?

The Middle East & Africa will have a very promising growth trajectory due to major oil & gas activities, growing desalination plants and technologies, development of infrastructure for treating water for both drinking and industrial purposes. In many countries in the region, demand for hydraulic pumping stations is on the rise as industries and companies want reliable & durable options that can withstand extreme temperatures and the high quantities of minerals used in desalination plants. Much of the growth is project-driven and linked to other mega projects and infrastructure related to the petroleum industry, as well as to projects aimed at providing water security.

UAE Hydraulic Dosing Pump Market Trends

The UAE is the largest market in this region. Continuous investment in building, upgrading, or converting desalination facilities, upgrading refinery equipment, and building infrastructure will ensure that the UAE continues to lead in this area for the foreseeable future. Companies in this region are very focused on ensuring they operate a reliable, robust operation. This will drive end-users to purchase hydraulic pumps because of their long-term service contracts and their ability to provide precise chemical dosing to maintain a reliable production level at an acceptable price, even under the extreme conditions often found in this area.

What Drives Latin America's Progressive Development in the Hydraulic Dosing Pump Market?

The increase in industrial modernization, growth in urban water treatment, and development of industries such as chemicals, mining, and food processing are driving Latin America's development at an increasing rate through increased investment. Additionally, new infrastructure projects related to water security, increased automation of industrial processes, and greater emphasis on environmental compliance provide further opportunities for these technologies to gain traction within their respective markets. Even though procurement cycles for these technologies are inconsistent, industrial expansion and government initiatives related to water will continue to drive consistent demand for these durable dosing technologies for many years to come.

Brazil Hydraulic Dosing Pump Market Trends

Brazil has been one of the largest manufacturers of hydraulic dosing pumps in Latin America and has continued to maintain a strong industrial base, especially in the chemical and mining industries, industrial pulp and paper processing, and municipal water treatment plants. The continued modernization of the nation's water treatment facilities and the need to meter amounts of chemicals into those facilities in large-scale industrial facilities has created a very large market demand for hydraulic dosing pumps that provide reliability, accuracy, and durability even when subject to the higher temperatures, pressures, and flow rates that can occur in large industrial applications.

Top Hydraulic Dosing Pump Market Companies and their Offerings

- Grundfos: Grundfos provides DMH hydraulic piston diaphragm pumps that provide high-pressure accuracy and reliability in terms of service life for industrial chemical dosing.

- Milton Roy: Milton Roy is the manufacturer of API compliant mRoy and Primeroyal hydraulic diaphragm pumps that guarantee accurate injection of chemicals and low maintenance.

- ProMinent: ProMinent offers HYDRO modular hydraulic diaphragm pumps with new safety multilayer PTFE diaphragms and constant compliance of monitoring.

Top Key Players in the Hydraulic Dosing Pump Market and their Offerings

- Grundfos

- Milton Roy

- ProMinent

- Dover Corporation (PSG)

- Seko S.p.A.

- Lewa GmbH

- IDEX Corporation

- SPX FLOW

- Nikkiso Co., Ltd.

- Blue-White Industries

- Etatron

- Groundfos Alldos

- Ingersoll Rand

- Watson-Marlow Fluid Technology Solutions

- Chem-Tech

Recent Developments

- In July 2024, Milton Roy unveiled its new chemical metering pump line Primeroyal Q series featuring eight drive sizes and nine liquid-end options, delivering up to 8,657 L/h flow and up to 1,035 bar discharge pressure ideal for heavy-duty industrial chemical dosing.(Source: https://www.azom.com)

Segments Covered in the Report

By Type

- Hydraulic Diaphragm Dosing Pump

- Hydraulic Piston Dosing Pump

- Hydraulic Double Diaphragm Pump

By Flow Rate

- Up to 100 LPH

- 101-500 LPH

- Above 500 LPH

By Operation Mode

- Manual

- Semi-Automatic

- Automatic

By End-Use Industry

- Water & Wastewater Treatment

- Oil & Gas

- Chemicals

- Food & Beverage

- Pharmaceuticals

- Power Generation

- Pulp & Paper

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content