Hydraulic Fracturing Dual Engine Systems Market Size and Forecast 2025 to 2034

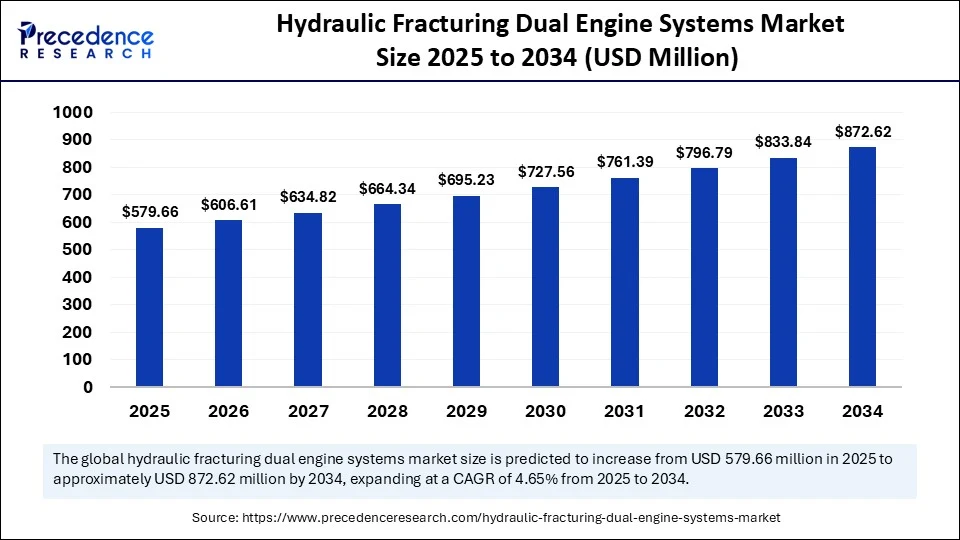

The global hydraulic fracturing dual engine systems market size accounted for USD 553.9 million in 2024 and is predicted to increase from USD 579.66 million in 2025 to approximately USD 872.62 million by 2034, expanding at a CAGR of 4.65% from 2025 to 2034. This market is growing due to the rising demand for efficient, lower-emission fracking operations in shale-rich regions.

Hydraulic Fracturing Dual Engine Systems MarketKey Takeaways

- In terms of revenue, the global hydraulic fracturing dual engine systems market was valued at USD 553.9 million in 2024.

- It is projected to reach USD 872.62 million by 2034.

- The market is expected to grow at a CAGR of 4.65% from 2025 to 2034.

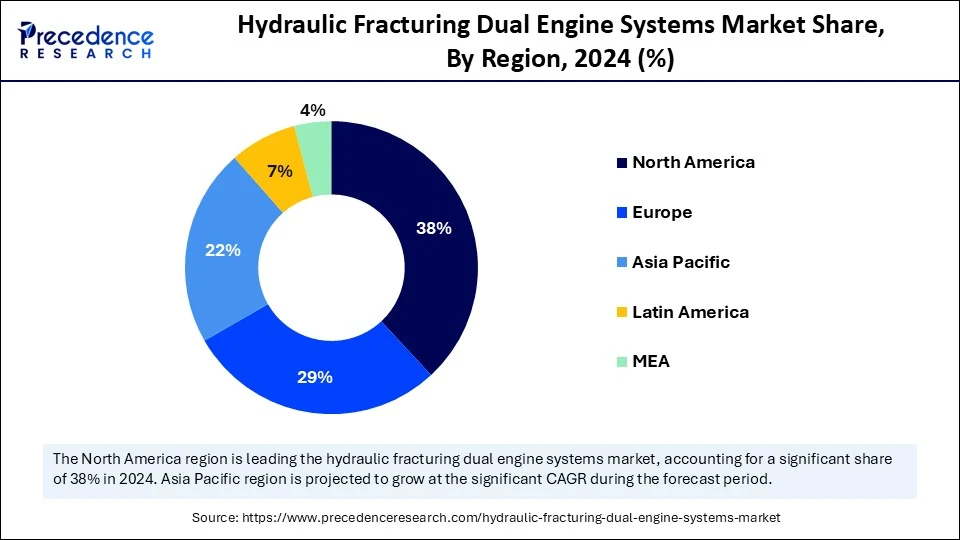

- North America dominated the hydraulic fracturing dual engine systems market with the largest share of 38.1% in 2024.

- Asia Pacific is expected to grow at a significant CAGR in the coming years.

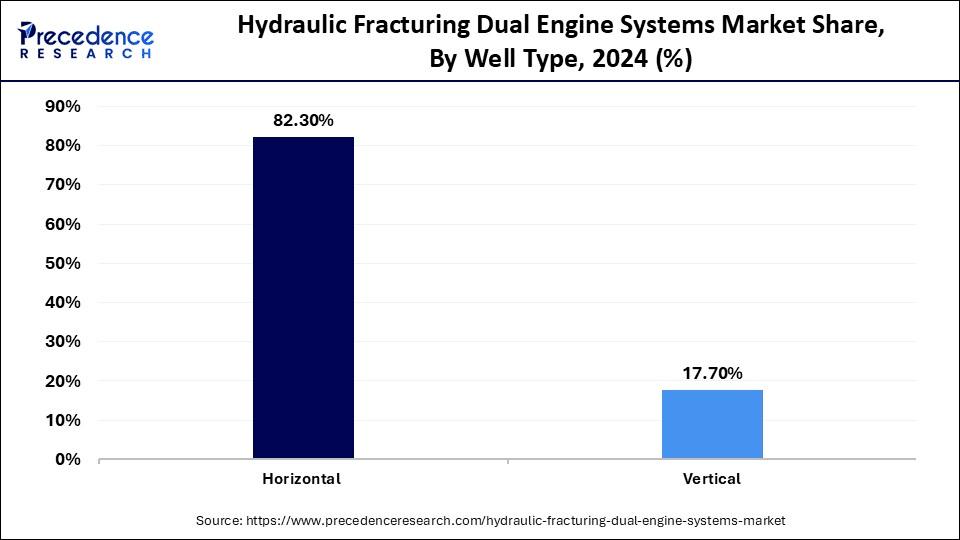

- By well type, the horizontal segment held the biggest market share of 82.3% in 2024 and is likely to grow at the fastest rate in the upcoming period.

- By unlocking mechanism, the hybrid/dual fuel systems segment contributed the largest share in 2024.

- By unlocking mechanism, the autonomous/algorithm-led control systems segment is expected to grow at the fastest CAGR in the coming years.

- By application, the shale gas segment captured the highest market share in 2024.

- By application, the tight oil & shale gas integration segment is emerging as the fastest growing.

- By technology, the manual/traditional systems segment generated the major market share in 2024.

- By technology, the autonomous systems segment is expected to grow at the fastest rate during the forecast period.

How is AI improving fuel efficiency and emission control in dual-engine systems used for hydraulic fracturing?

Artificial Intelligence is significantly improving fuel efficiency and emission control in hydraulic fracturing dual-engine systems by enabling real-time optimization of engine performance, intelligent fuel blending, and predictive emission management. The ratio of natural gas to diesel is dynamically adjusted by AI through ongoing analysis of data from engine sensors, guaranteeing optimal combustion and lower fuel consumption. To comply with environmental standards, it also predicts emissions levels and adjusts engine settings. AI also automates load distribution, reducing unnecessary idle time and lowering operating costs, which in turn reduces carbon emissions, making fracking operations more environmentally conscious and efficient.

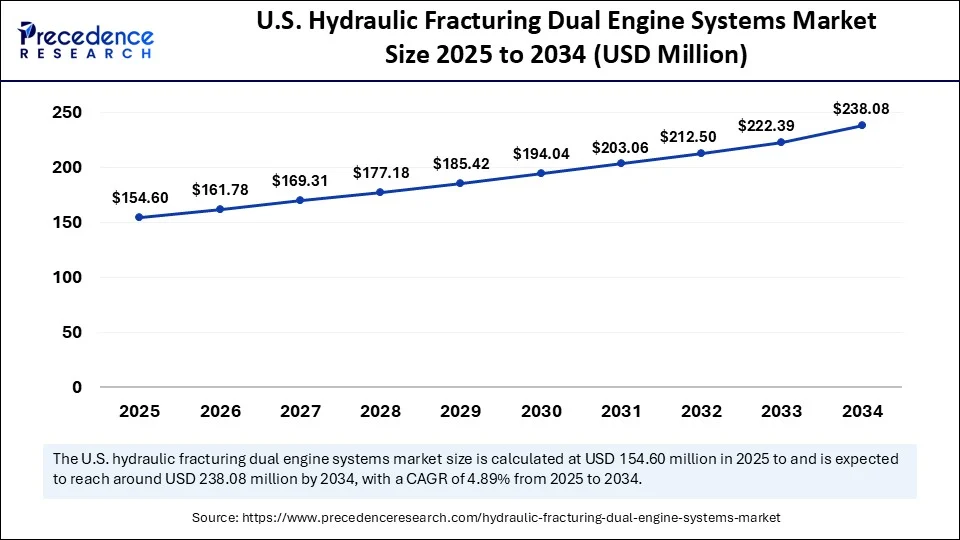

U.S. Hydraulic Fracturing Dual Engine Systems Market Size and Growth 2025 to 2034

The U.S. hydraulic fracturing dual engine systems market size was exhibited at USD 147.73 million in 2024 and is projected to be worth around USD 238.08 million by 2034, growing at a CAGR of 4.89% from 2025 to 2034.

What made North America the dominant region in the hydraulic fracturing dual engine systems market?

North America registered dominance in the market by capturing the largest share in 2024. This is primarily due to its extensive fleet of hydraulic fracturing equipment, which is highly regarded for its operational efficiency, and well-established shale exploration infrastructure. Due to the extensive use of high-volume fracturing and horizontal drilling, dual-engine systems are now necessary to meet the region's energy needs. Furthermore, the increasing use of automated and hybrid frac engines in large-scale operations is a result of the drive for reduced emissions and fuel flexibility.

Why is Asia Pacific experiencing the fastest growth?

Asia Pacific is emerging as the fastest-growing market for hydraulic fracturing dual engine systems. This is primarily due to the growing emphasis on energy independence and increased investments in unconventional oil and gas exploration. Advanced fracturing equipment, such as dual-engine systems, is increasingly being used in the area to access previously unprofitable reserves. Technological developments and policies that promote energy security are driving the market's expansion in this area.

Market Overview

The hydraulic fracturing dual engine systems market encompasses dual-powertrain systems used in hydraulic fracturing operations, typically combining diesel with electric or gas engines designed to optimize energy delivery, reduce emissions, increase pump hours, and adapt to stringent environmental regulations.

What is a dual-engine system for hydraulic fracturing?

A dual-engine system in hydraulic fracturing is a type of engine setup that uses both diesel and natural gas to power fracking equipment. These engines can run on a combination of fuels or switch between them, which lowers harmful emissions and fuel costs. High-pressure fluids are pumped into rock formations during fracturing operations to extract gas or oil. The dual-fuel system enhances process efficiency and environmental friendliness.

Hydraulic Fracturing Dual Engine Systems Market Growth Factors

- Rising Shale Production: Surge in unconventional oil& gas extraction, especially in the U.S., is boosting demand for reliable dual-engine systems.

- Technological Advancements: New hybrid systems featuring automation, real-time controls, and fuel flexibility enhance efficiency and reduce costs.

- Emission Regulations: Stricter emission norms are pushing operators to adopt cleaner, dual-fuel systems to reduce diesel consumption.

- Remote & Off-Grid Demand: Dual-engine systems provide reliable power for remote and offshore sites with limited grid access.

- Digital Integration:IoT and predictive maintenance enhance system performance and reduce downtime.

- Industry Partnerships: Mergers like NexTier & Patterson UTI accelerate the adoption of advanced dual-engine fleets.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 872.62 Million |

| Market Size in 2025 | USD 579.66 Million |

| Market Size in 2024 | USD 553.9 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Well Type, Unlocking Mechanism, Application, Technology and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Fuel Efficiency

The rising demand for fuel efficiency is a major factor driving the growth of the hydraulic fracturing dual engine systems market. Due to the rising cost of diesel, operators are switching to dual-engine systems. Businesses can improve fuel efficiency during fracking operations by combining natural gas and diesel. Profit margins rise and operational costs decrease as a result. Additionally, this gradually lessens reliance on a single fuel source, guaranteeing supply stability. Moreover, dual-fuel systems help improve thermal efficiency and reduce engine wear, resulting in fewer breakdowns and a longer equipment lifespan. As fracking becomes more competitive, fuel-saving technologies like these are key to maintaining profitability. Companies also benefit from reduced logistical efforts in fuel supply management.

Growth in Shale Gas Exploration

The booming shale industry, especially in the U.S., has significantly increased demand for efficient and reliable hydraulic fracturing equipment. Dual engine systems provide the power needed for high-pressure fracking while offering improved efficiency. They are ideal for contemporary fracking locations due to their ability to operate in harsh conditions. It is anticipated that this trend will persist as the world's energy demands continue to rise. The market for dual-engine systems is expected to grow globally as new shale reserves are discovered in parts of Eastern Europe, China, and Latin America. Durable and fuel-flexible engines are becoming increasingly necessary as exploration ventures into more challenging terrain. The adoption of dual fuel is also being aided by mounting pressure on shale operators to maintain sustainable operations.

Restraint

Limited Infrastructure for Natural Gas Supply

The necessary infrastructure, such as pipelines or CNG/LNG delivery systems, to ensure a steady supply of natural gas, is either nonexistent or insufficient at many isolated fracking sites. This restricts the viability of using dual-fuel engines, hampering the growth of the hydraulic fracturing dual engine systems market. Operators must depend more on diesel in the absence of a dependable gas supply, which lessens the advantages of dual-fuel systems. The time-consuming and costly nature of developing or expanding gas infrastructure deters adoption in off-grid areas.

Complexity in Engine Maintenance and Operations

Compared to traditional diesel engines, dual engine systems are more complicated, necessitating specific training for operators and technicians. In the absence of qualified staff, this raises maintenance expenses and downtime. Advanced technical skills are needed for troubleshooting, integrating AI systems, and balancing fuel mix. Rapid access to support services may be difficult for businesses operating in remote areas, which could reduce operational effectiveness.

Opportunities

Increasing LNG and CNG Infrastructure Development

The availability of cleaner fuels is increasing as a result of increased investments in transportation, as well as a shortage of CNG (compressed natural gas) and LNG (liquefied natural gas). This bolsters the viability and broad adoption of dual-fuel systems. Even remote fracking sites will be able to successfully use dual engines as global gas supply chains get stronger. Enhanced infrastructure also lowers the cost of fuel delivery, increasing the economic appeal of dual systems.

Expansion of Shale Reserves in Emerging Markets

The shale potential of nations like China, India, and Argentina is being explored, which is driving up demand for reliable and effective fracking equipment. Due to their affordability and fuel adaptability, dual-engine systems are well suited to satisfy this need. Early market entry can help manufacturers capitalize on unexplored opportunities as these nations develop their energy infrastructure and policies. In these areas, local alliances and customized product lines can further strengthen market presence.

Well Type Insights

Why did the horizontal segment dominate the hydraulic fracturing dual engine systems market in 2024?

The horizontal segment dominated the market with the largest share in 2024 and is expected to maintain its growth trajectory in the coming years. In comparison to vertical wells, horizontal wells are more productive and have better reservoir contact. Because dual-engine systems provide the continuous high-pressure pumping required for lengthy lateral sections in horizontal drilling, they are particularly well suited for these wells. To optimize production efficiency and reduce fuel costs during prolonged fracturing operations, operators in shale-rich areas, such as the Permian Basin, frequently employ dual-engine configurations.

Unlocking Mechanism Insights

How does the hybrid/dual-fuel systems segment dominate the market in 2024?

The hybrid/dual fuel systems segment dominated the hydraulic fracturing dual engine systems market in 2024. The dominance of this segment stems from their ability to provide flexibility, lower emissions, and cheaper fuel costs by permitting the use of both natural gas and diesel. Their versatility renders them perfect for operators who want to reduce expenses without sacrificing power output. In fracturing operations, hybrid systems provide a strategic advantage as environmental regulations become stricter and diesel prices fluctuate.The autonomous/algorithm-led control systems segment is expected to experience the fastest growth in the upcoming period, driven by their increasing adoption, as they can improve engine performance, minimize manual intervention, and enhance safety. Using algorithms to automate the fracturing process platforms, such as Halliburton's Octiv Auto Frac, is very appealing to next-generation frac fleets because they increase efficiency, reduce fuel consumption, and require low real-time system adjustments.

Application Insights

Why did the shale gas segment dominate the hydraulic fracturing dual engine systems market in 2024?

The shale gas segment dominated the market in 2024 because it requires vigorous hydraulic fracturing procedures, which often involve prolonged pumping under high pressure. Dual engine systems provide the consistent, dependable power required for these challenging areas, such as the UAE, which has witnessed a sharp increase in shale gas development, making it the primary area where autonomous and dual-fuel technologies are utilized to enhance cost-effectiveness and reduce environmental impact.

The tight oil & shale gas integration segment is expanding quickly, as companies optimize infrastructure to target multiple resource types. This trend requires highly flexible and powerful dual-engine systems to manage varying pressure, fuel, and environmental demands across sites. Hybrid engine setups and intelligent control systems are helping operators tackle both resource types in a streamlined, cost-effective manner.

Technology Insights

What made the manual/traditional systems the dominant segment in the technology segment?

The manual/traditional systems segment dominated the hydraulic fracturing dual engine systems market while holding the largest revenue share in 2024 because they have been shown to be dependable, affordable, and simple to implement. For most fracturing fleets, these systems are a viable option because they can effectively switch between natural gas and diesel without requiring complicated upgrades. Because of their compatibility with current infrastructure and low capital investment, operators favor them particularly in basins with high activity.

The autonomous systems (ZEUS/Octiv auto frac., etc.) segment is expected to grow at the fastest CAGR over the forecast period due to their rising adoption for monitoring fuel consumption, self-correcting engine performance, and minimizing human error. ZEUS and Occtiv Auto Frac are two examples of technologies that use artificial intelligence to optimize pumping schedules, reduce downtime, and guarantee safer, more reliable operations. These intelligent systems are turning into important growth engines as oilfield services undergo a rapid digital transformation.

Hydraulic Fracturing Dual Engine Systems Market Companies

- Schlumberger (SLB)

- Halliburton

- Baker Hughes

- NexTier Oilfield Solutions (now part of Patterson-UTI)

- Calfrac Well Services

- Liberty Oilfield Services

- ProPetro Holding Corp.

Recent Developments

- On 12 June 2025, Chevron U.S. & Halliburton launched a closed-loop, AI-driven hydraulic fracturing workflow in Colorado, integrating Halliburton's XEUS IQ platform to automate stage execution and real-time subsurface feedback for optimized energy delivery. (Source: https://www.stocktitan.net)

- On 14 February 2025, Caterpillar Oil and Gas introduced the Cat Dynamic Gas Blending Gen 2 Kit, enabling up to 85% diesel displacement using natural gas on 3512C tier 2 engines, improving combustion efficiency and cutting greenhouse gas emissions. (Source: https://www.oilfieldtechnology.com)

- On 8 April 2025, American Power Group highlighted its vehicular dual fuel system for class 8 trucks, which displaces 50-60% of diesel with dairy manure RNG, achieving negative carbon intensity (-104 to –145 gCO2e/ MJ) and reducing CO2 by 500-610 tons per truck annually. (Source: https://www.stocktitan.net)

- In February 2025, Halliburton Energy Services and Coterra Energy launched autonomous hydraulic fracturing in the Permian basin using Halliburton's Octive Auto Frac as a part of its ZEUS platform, yielding a 17% boost in stage efficiency and reducing human error. (Source: https://www.mrt.com)

Segments Covered in the Report

By Well Type

- Horizontal

- Vertical

By Unlocking Mechanism / Power Architecture

- Hybrid/Dual Fuel (Diesel + Gas/Electric)

- Full Electric

- Diesel-only

- Autonomous / Algorithm led control systems

By Application

- Shale Gas

- Tight Oil & shale gas integration

- Coalbed Methane (CBM)

- Others (tight gas, oil sands)

By Technology / Control Systems

- Autonomous Systems (e.g., Octiv Auto Frac / ZEUS / Sensori) subsegment

- Manual/Traditional Systems

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content