What is the Powder Coating Market Size?

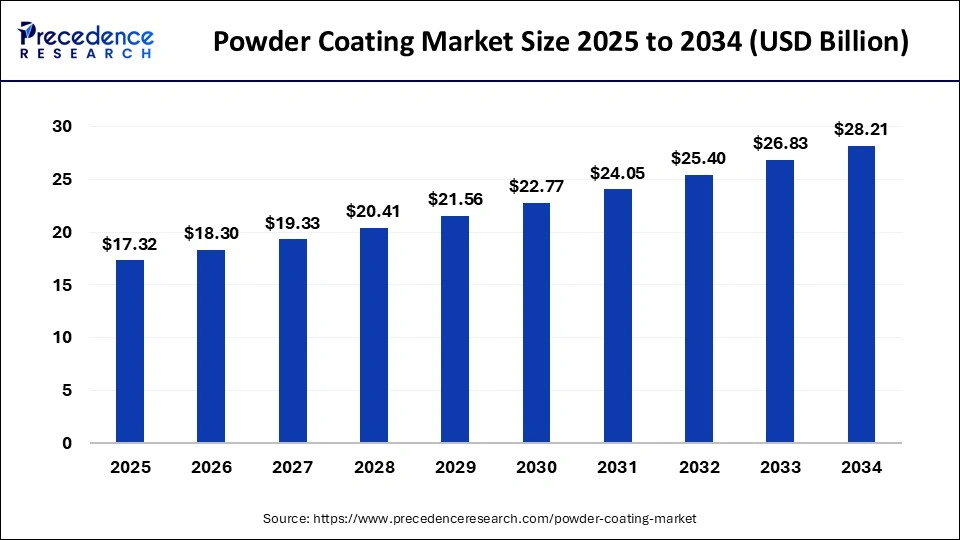

The global powder coating market size is valued at USD 17.32billion in 2025 and is predicted to increase from USD 18.30 billion in 2026 to approximately USD 29.62 billion by 2035, expanding at a CAGR of 5.51% from 2026 to 2035.

Powder Coating Market Key Takeaways

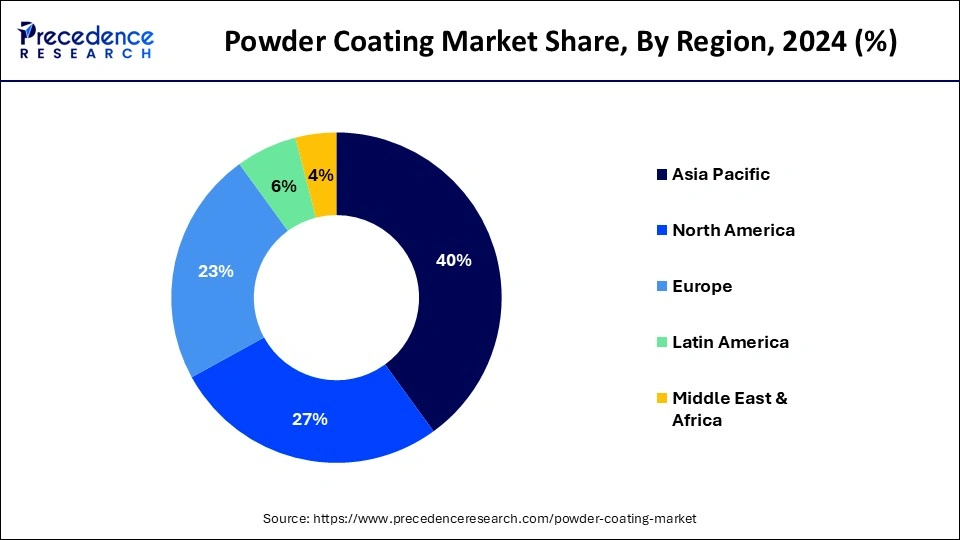

- Asia Pacific dominated the market with a revenue share of over 40% in 2025.

- By region, the market in North America is expected to grow at a solid CAGR during the forecast period.

- By application, the consumer goods segment dominated the market in 2025.

- By resin, the polyester segment held the largest market share in 2025.

- By resin, the epoxy-polyester segment is anticipated to expand fastestCAGR during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 17.32 Billion

- Market Size in 2026: USD 18.30Billion

- Forecasted Market Size by 2035: USD 29.62 Billion

- CAGR (2026 to 2035): 5.51%

- Largest Market in 2025: Asia Pacific

- Fastest Growing Market: North America

What is Powder Coating?

Powder coating is applied as a dry, free-flowing powder. It is a convenient method used to finish surfaces of different materials, including plastics, metals, and ceramics. It is a finishing process in which powder coating is applied using a spray gun that electrostatically charges the powder particles and resin onto a surface or object and then cures the coating by heat, which then forms a hard finish. This coating has a high recyclable content and better abrasion resistance and durability, making it suitable for industrial, architectural, and automotive applications. Furthermore, this coating is available in a range of textures and colors.

What is the Role of AI in the Powder Coating Market?

The powder coating industry is witnessing a sea change where AI is making everything faster, more energy-efficient, and with enhanced quality. Application, throughput, and human exposure are among those hazardous tasks minimized by AI, including in applications through adaptive AI controls. Supply chain visibility, along with intelligent tracking and forecasting, is also improved by AI to manage logistics and inventory better. This integration enhances productivity, waste reduction, safety, and greener processes in the powder coating industry.

Powder Coating Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to grow significantly due to the growing investment by painting companies for opening up new production centres along with rapid expansion of the consumer goods industry.

- Major Investors: Several coating companies and strategic investors are actively entering this market, drawn by partnerships, R&D and investments. Various market players such as the Valspar Corporation, Eastman Chemical Company, PPG Industries, Inc. and some others have started investing rapidly for developing power coatings to cater the needs of numerous end-users.

- Sustainability Trends: The coating manufacturers are using eco-friendly substances for developing powder coatings to cater the needs of end-users. Additionally, the rise in number of sustainable painting companies in different parts of the world is an ongoing trend in this sector.

- Startup Ecosystem: Several startup brands are involved in manufacturing high-quality powder coatings for the industrial sector. The crucial startup companies dealing in powder coatings consists ofLorven Metal Products Pvt Ltd, Bisco Ultimate, Rakul Metal Coating and some others.

Powder Coating Market Trends

- Shift towards eco-friendly coatings: The rising demand for low-volatile organic compound (VOC) and eco-friendly coating solutions is significantly propelling the shift towards powder coatings, which offer a more sustainable alternative to conventional liquid paints. This transition not only addresses environmental concerns but also meets the growing consumer preference for coatings that minimize harmful emissions while ensuring durability and performance.

- Increased use in architecture and construction: The increasing demand for low-volatile organic compound (VOC) and environmentally sustainable coating solutions is stimulating a notable transition from traditional liquid paints to powder coatings. These innovative coatings are not only designed to reduce harmful emissions, but they also provide a robust, resilient finish that enhances the longevity of surfaces.

- Technological advancements: Innovations such as ultra-thin film powder coatings, UV-curable powders, and high-temperature resistant formulations are significantly broadening the scope of applications across various industries. These advanced materials not only enhance surface durability and aesthetic qualities but also offer unique advantages in performance and sustainability, paving the way for new possibilities in product development and design.

- Rising demand for automotive and consumer goods: New developments in coatings are creating exciting options for many industries. Ultra-thin film powder coatings protect surfaces while looking good, as they are applied in thin layers. UV-curable powders dry quickly and are environmentally friendly. They harden under UV light, which speeds up production and reduces waste.

Powder Coating Market Growth Factors

- Increased demand for sustainable solutions drives powder coating adoption as an environmentally friendly option over liquid coating.

- Demand for durable coatings and applications from various industries is growing due to developments in the construction and manufacturing sectors.

- Changing consumer preferences and increasing disposable income are playing a positive role in the acceptance of advanced coating procedures. These procedures are better in terms of finish and durability than traditional methods.

- The advancement in raw materials and application procedures is increasing the efficiency and the finishing quality of the coatings, and at the same time increasing the possibilities for end uses.

- The emphasis on the development of long-lasting infrastructure globally, with a focus on cost-effectiveness, is augmenting the demand for better coatings, which are long-lasting and reduce waste.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 29.62Billion |

| Market Size in 2026 | USD 18.30 Billion |

| Market Size in 2025 | USD 17.32Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.51% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Resin Type, Application Type, Region Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for sustainable coating solutions

Powder coatings are environmentally friendly, as they do not contain VOCs and create less wastage than the other finishing processes, like liquid coating. Furthermore, the proper utilization of powder coating can help in eliminating waste because after the usage, the waste powder can be reused further. This type of recycling practice helps in reducing costs and minimizing environmental impacts. The rising adoption of powder coatings over liquid coatings in various industries boosts the market.

- In June 2024, Arkema launched eco-friendly powder coating with recycled PET. This new coating reduces Product Carbon Footprint by up to 20% and supports sustainable lifestyle.

Restraint

High initial investment can impede market growth

Setting up a powder coatings workshop requires a high initial investment in equipment such as spray guns, a curing oven, and a spray booth. The size of the curing oven purchased must be taken into consideration while handling the equipment effectively. The thicker, larger, and heavier parts need a more powerful oven, which might be costly, further adding to the overall equipment costs. Moreover, powder coatings typically form a thick coat on surfaces, creating challenges in obtaining thin film.

Opportunity

Increasing demand in the automotive industry

The increasing demand for powder coatings in the automotive industry creates immense opportunities in the market. These coatings can be applied to various substrates, such as plastic and metals. This versatility makes them suitable for automotive applications. These coatings are used to coat various components, such as wheels, chassis, and engine. Furthermore, advancements in powder coating technology led to the development of new formulations with enhanced durability and performance.

Segment Insights

Application Insights

The consumer goods segment dominated the market in 2024. Application of powdered enamels is a superior resource-conserving and environmental friendly process in the arena of industrial coating technology. As a result, powder coatings have recognized themselves in the numerous applications in a countless range of industries such as furniture manufacturing, household appliances, architecture, equipment and machinery manufacturing, automotive industry and consumer goods. There is constant growth in the sale of powder coatings with innovative applications being established. Among different application segments assessed in this report, furniture and appliances segment is considered to advance at a stable pace during the prediction period. Furthermore, new application market such as IT and telecom are also expected to offer lucrative growth where uses of powder coatings are broadly explored.

The emergence of powder-on-powder application which involves application of topcoat and primer with one cure step has offered novel prospects for powder coatings. Further, powder coatings have attained more extensive access in new-fangled applications. It is, precisely, lower baking temperatures that have allowed access to innovative substrates such as MDF, wood and plastic. The technology is unveiling new fangled likelihoods and novel markets. This drift is vastly reinforced by enhancements in process control and application equipment that provide a broader range of application sectors such as dry-on-dry systems.

Resin Type Insights

Out of different types of resins, polyester resin type occupied highest revenue share in 2024. This progress is credited to its advantageous characteristics including chemical resistance, quick-drying, quick-drying, temperature resistance, surface protection and abrasion resistance. Rush in demand of product in applications such radiator grills, as door handles, bumpers, wheel rims, metallic structural components and bicycle is expected to bolster growth of the market during next few years.

The epoxy-polyester segment is expected to expand at the fastest growth rate during the forecast period. The growth of the segment is attributed to exceptional hardness and corrosion resistance properties of epoxy polymers. Epoxies exhibit excellent adhesion when applied to metals. Moreover, the low costs of epoxy-polyester coatings contribute to their increased adoption.

- In August 2024, PPG introduced PPG PRIMERONTM Optimal zinc epoxy powder primer. The product is formulated with a maximum amount of zinc, offering a better transfer efficiency than standard primers.

Regional Analysis

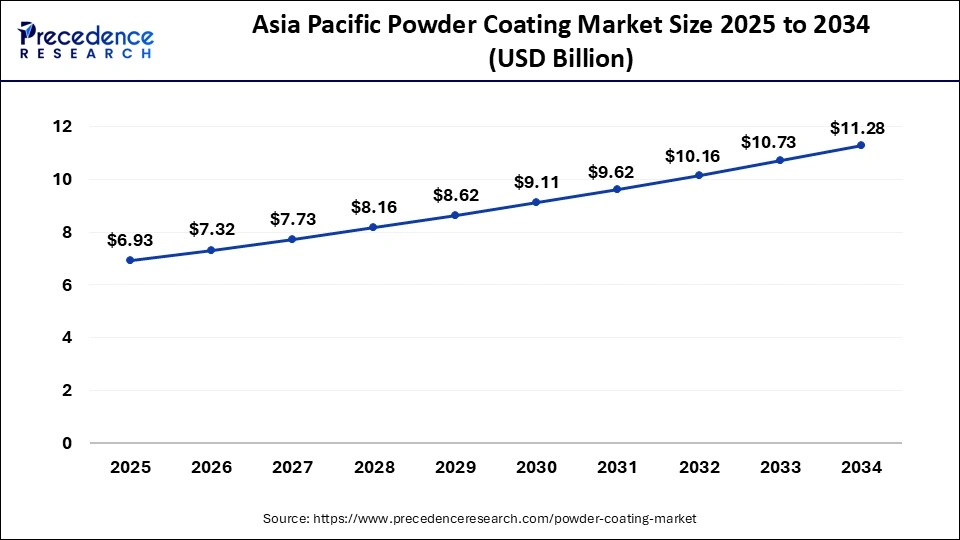

What is the Asia Pacific Powder Coating Market Size?

The Asia Pacific powder coating market size is calculated at USD 6.93 billion in 2025 and is expected to be worth around USD 11.84 billion by 2035, poised to grow at a CAGR of 5.50% from 2026 to 2035.

Asia Pacific emerged as largest market for powder coating industry in 2024. The optimistic stance towards the construction sector of South Korea, India, China, Japan, Malaysia, Indonesia and Vietnam is proposed to endorse the practice of powder coatings. Besides, promising government guidelines with an objective to create investments public-private collaborations and from FDI is further complementing the growth of the market. Automotive sector in Asia Pacific is projected to advance significantly on account progress in transportation infrastructure, increasing disposable income and shifting lifestyle. The green coatings engineering corporations and research institutions have profoundly capitalized to improve eco-friendly, cutting-edge, and harmless powder coatings.

India Market Analysis

India's powder coating market is growing due to rapid urbanization, increasing construction activities, and expansion in the automotive and infrastructure sectors. Government initiatives supporting sustainable and eco-friendly coating technologies are further boosting adoption, while rising disposable income and industrial growth are driving demand for high-quality powder coatings.

Solid protection, sleek finish: The powder-coating boom

- China boasts an expansive manufacturing sector and greater industrial equipment demand. With a stronger export and import base and increasing infrastructure investment, China remains a key global supplier.

- The Indian government initiative “made in India” focused on the growth of the middle class and increased automotive and consumer goods manufacturing, further accelerating demand.

- Japan's emphasis on precision, quality, and eco-friendly practices enhances powder coating usage in high-end applications.

Taiwan's electronics and industrial manufacturing sectors contribute to steady demand for the powder coatings market.

What Makes North America the Fastest-Growing Region in the Market?

North America is expected to grow at the fastest rate throughout the projection period. The market growth in the region is mainly attributed to the rising usage of powder coatings over liquid coatings in numerous industries, like automotive and construction. Moreover, the rapid shift toward eco-friendly coating solutions is projected to boost the market in the region.

The U.S. perceives higher powder application in the architectural sector whereas conventionally it's prominently liquid. China is sighted a huge wave of powder usage in numerous industrial areas like ACE and commercial vehicles. Powder on dissimilar substrates in the place of traditional ones is also a drift that is achieving tractions as the application competence and powder technology progresses.

The growing power of powder coatings (Major factors contributing towards growth)

- High adoption of automated and robotic coating systems, as well as innovations in ultra-durable and heat-sensitive powder.

Increasing research and development in this segment to promote more eco-friendly alternatives around the globe. The U.S. is the leading producer of green manufacturing alternatives. - The market is trying to make it cost-effective, and this has raised the demand for powder coating amongst various industries.

Consumer and industrial preference for sustainable products is boosting the popularity of recyclable and low-waste coatings.

Why Europe held a significant share of the market?

Europe held a significant share of the industry. The rapid expansion of the automotive sector in several countries such as Germany, France, Italy, UK and some others has boosted the market growth. Also, the presence of various market players such as Arkema Group, Akzo Nobel NV, Evonik Industries AG and some others is expected to propel the growth of the powder coating market in this region.

UK Market Analysis

The UK powder coating market is expanding primarily because of rising adoption in the aerospace and automotive industries. Government regulations promoting eco-friendly coatings, combined with investments in advanced manufacturing technologies, are encouraging the use of powder coatings over traditional liquid coatings, enhancing durability and sustainability in various industrial applications.

What made Latin America to hold a considerable share of the market?

Latin America held a considerable share of the market. The growing demand for high-quality powder coatings from the furniture industry in numerous countries such as Argentina, Brazil, Peru and some others has driven the market expansion. Additionally, partnerships among aerospace companies and coating manufacturers to develop a wide range of powder coatings for the aerospace sector is expected to drive the growth of the powder coating market in this region.

Brazil Market Analysis

Brazil's powder coatings market growth is driven by increasing demand from the furniture, automotive, and construction sectors. Partnerships between coating manufacturers and aerospace companies to develop specialized powders, along with infrastructure expansion and industrial refurbishment projects, are fueling market expansion in key regions like Argentina, Peru, and Brazil.

How did Middle East and Africa held a notable share of the industry?

Middle East and Africa held a notable share of the market. The rising use of advanced powder coatings in the oil and gas sector across numerous countries such as UAE, Saudi Arabia, Qatar, South Africa and some others has boosted the market growth. Also, rapid investment by market players for opening up new production centers is expected to foster the growth of the powder coating market in this region.

UAE Market Analysis

The UAE powder coating market is growing due to the rising usage of advanced powder coatings in the oil and gas, construction, and automotive sectors. Investments by market players to establish new production facilities, along with strong government support for industrial development and sustainable solutions, are further accelerating the growth of the powder coatings market in the region.

Value Chain Analysis

- Feedstock Procurement: Raw materials are considered stock for powder coating manufacturing and therefore have to be procured and purchased.

Key Players: BASF, Dow, DuPont, and Bayer

- Chemical Synthesis and Processing: These processes involve those chemical reactions used to generate or transform powder coating components and methods used to prepare or refine the materials.

Key Players: AkzoNobel, PPG Industries, Inc.

- Compound Formulation and Blending: Combining and mixing raw materials such as resins, pigments, fillers, and additives in a prescribed ratio to get the desired properties in the powder coating.

Key Players: AkzoNobel, PPG Industries, Axalta Coating Systems

- Quality Testing and Certification: Carrying out a variety of tests to ensure that the powder coating meets its performance specifications, appearance, and chemical characteristics, and is then certified to conform.

Key Players: QUALICOAT, The Powder Coating Institute

- Waste Management and Recycling: Handling the disposal of wastes generated throughout the powder coating value chain and the possible recycling and recovery of resources.

Key Players: Powder Coating Recycling LLC, Re-Coat

Key Companies & Market Share Insights

Growing stipulation to augment the outdoor and indoor air quality taking into account the health effects of VOC's, moving producers emphasis on plummeting VOC content. Nominal VOC emissions, than liquid paints would deliver robust business prospect for industry participants as they can obey economically and easily with the guidelines of U.S. environmental protection agency.

Key Players in Powder Coating Market & Their Offerings

- The Sherwin-Williams Company: The Sherwin-Williams Company is a global leader in paint, coatings, and related products, founded in 1866 and headquartered in Cleveland, Ohio. It manufactures, develops, distributes, and sells a wide range of products, including architectural paints, industrial coatings, and floor covering products, under brands such as Sherwin-Williams, Valspar, and Krylon.

- Arkema Group: Arkema Group is a global specialty materials company headquartered in France, which became a public company in 2006. It designs and produces innovative materials for various sectors such as adhesives, advanced materials, and coating solutions, with a strong focus on sustainability,

- The Valspar Corporation: The Valspar Corporation is a global manufacturer of paints and coatings, founded in 1806 and now a wholly-owned subsidiary of The Sherwin-Williams Company. Valspar provides a wide range of products for consumers (paint, stains) and industrial, packaging, and transportation markets (coatings, resins, polymers)

- Eastman Chemical Company: Eastman Chemical Company is a global specialty materials company founded in 1920 that produces a wide range of advanced materials, chemicals, and fibers for everyday products. Eastman operates with a focus on innovation and sustainability, serving markets like transportation, building and construction, and consumer goods.

- PPG Industries, Inc.: PPG Industries, Inc. is a global supplier of paints, coatings, and specialty materials headquartered in Pittsburgh, Pennsylvania. The company produces and distributes protective and decorative coatings, sealants, adhesives, and other specialty materials.

- Akzo Nobel NV: Akzo Nobel N.V. is a Dutch multinational company specializing in paints and performance coatings for consumers and industries. This company is engaged in developing numerous products that are used in various sectors including buildings and infrastructure, transportation, and consumer goods along with focusing on sustainability.

Other Companies

- Axalta Coating Systems

- The Valspar Corporation

- Evonik Industries AG

- Nippon Paint Co., Ltd.

Recent Developments

- In October 2025, PPG unveiled PPG ENVIROCRON Extreme Protection Edge Plus powder coating. This new range of coating are designed for the industrial sector.

(Source: businesswire.com) - In July 2025, Valspar launched Valspar Valde Extreme Flex Cure Coating Technology. This coating is equipped with corrosion protection technology for use in multiple industries.

(Source: coatingsworld.com) - In July 2025, Kansai Helios inaugurated a new production facility in Ohio, U.S. This new manufacturing center is opened to increase the production of powder coatings for the consumers of North America.

(Source: coatingsworld.com) - In May 2025, PPG introduced PPG EnviroLuxe Plus powder coatings, featuring up to 18% post-industrial recycled plastic and PFAS-free formulation, offering a versatile solution for various application needs. (Source:https://www.indianchemicalnews.com)

- In April 2025, Interpon D2000 Stone Effect powder coating launched for North American architects, followed by the hyperdurable D3000 variant for challenging climates and applications.

(Source:https://www.prnewswire.com)

Segments Covered in the Report

By Resin

- Epoxy-Polyester

- Epoxy

- Acrylic

- Polyester

- Polyurethane

- Others

By Application

- Automotive

- Consumer Goods

- Architectural

- Furniture

- Oil and Gas

- Pipeline

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting