Styrene-Butadiene Rubber Market Size and Forecast 2025 to 2034

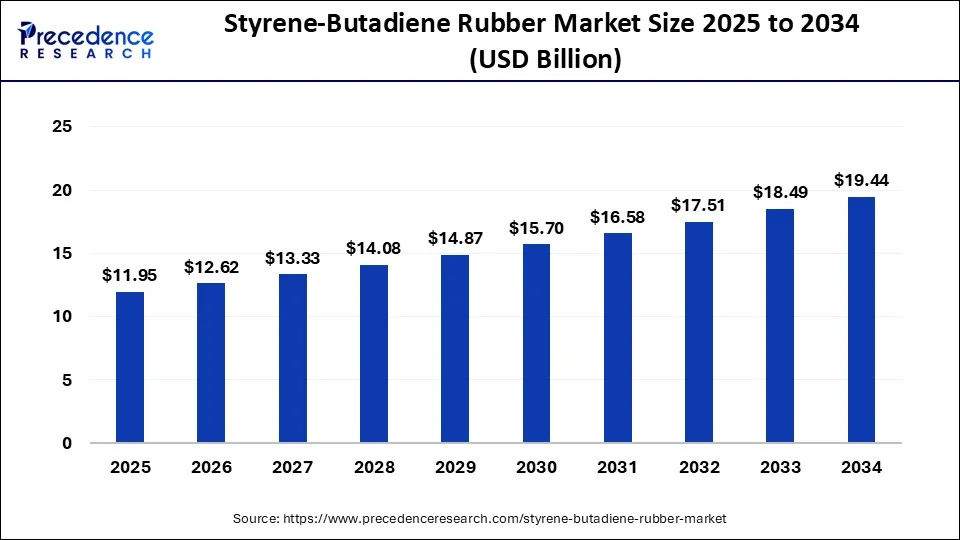

The global styrene-butadiene rubber (SBR) market size was estimated at USD 11.32 billion in 2024 and is predicted to increase from USD 11.95 billion in 2025 to approximately USD 19.44 billion by 2034, expanding at a CAGR of 5.56% from 2025 to 2034.

Styrene-Butadiene Rubber Market Key Takeaways

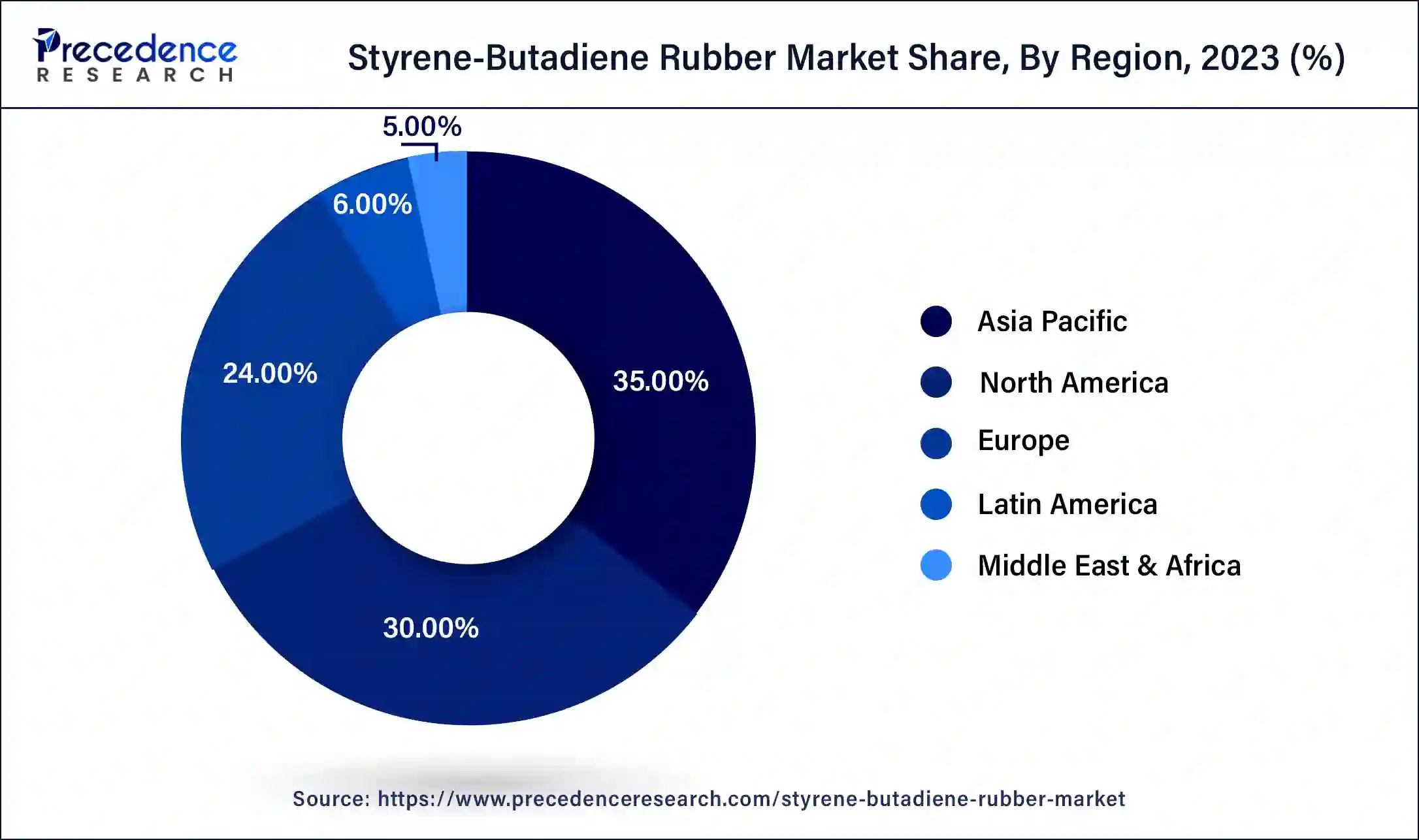

- Asia-Pacific dominated the global market with the largest market share of 33% in 2024.

- North America is estimated to expand at the fastest CAGR between 2025 and 2034.

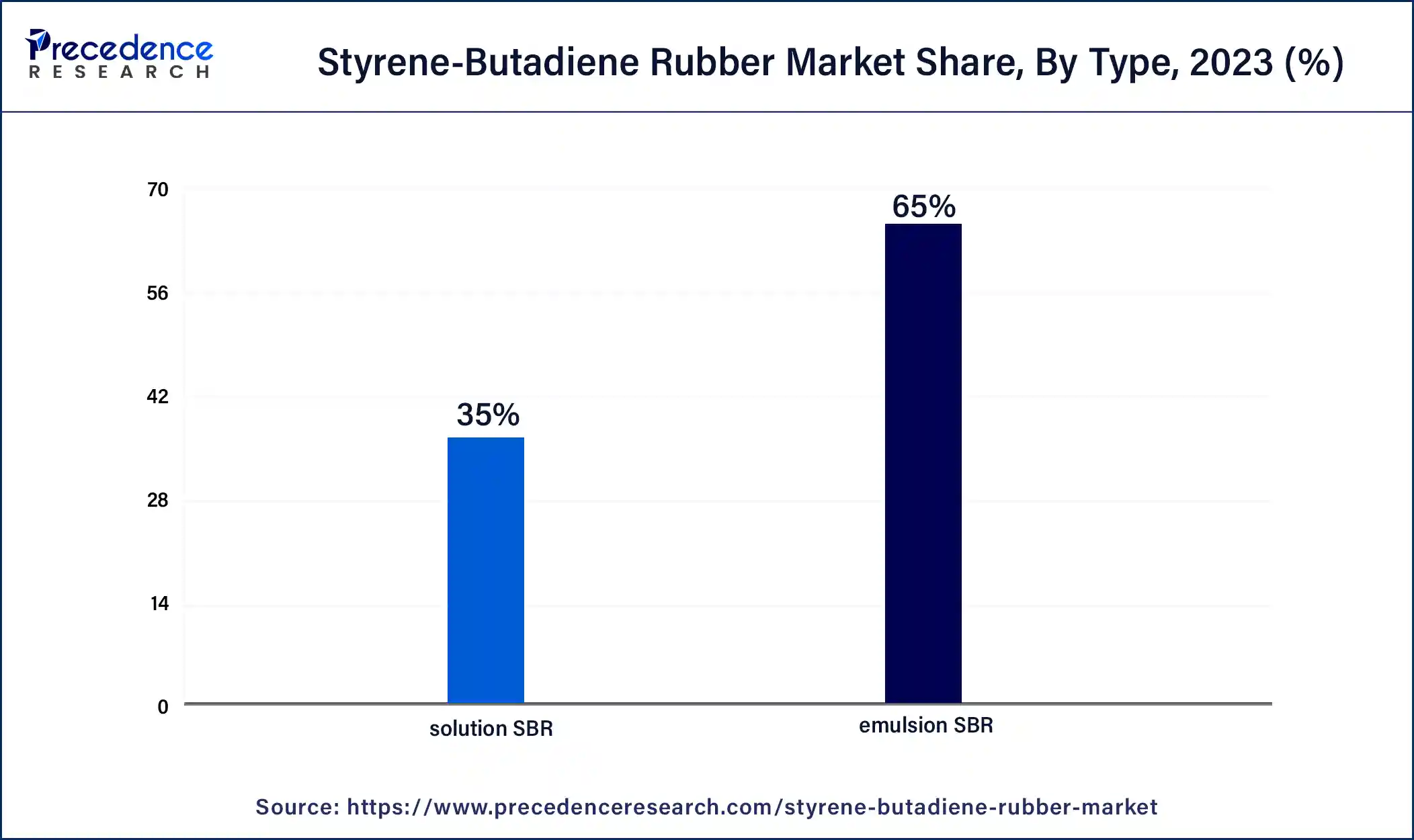

- By type, the emulsion SBR segment has held the largest market share of 65% in 2024.

- By type, the solution SBR segment is anticipated to grow at a remarkable CAGR of 6.5% between 2025 and 2034.

- By application, the tire segment generated over 31% of revenue share in 2024.

- By application, the footwear segment is expected to expand at the fastest CAGR over the projected period.

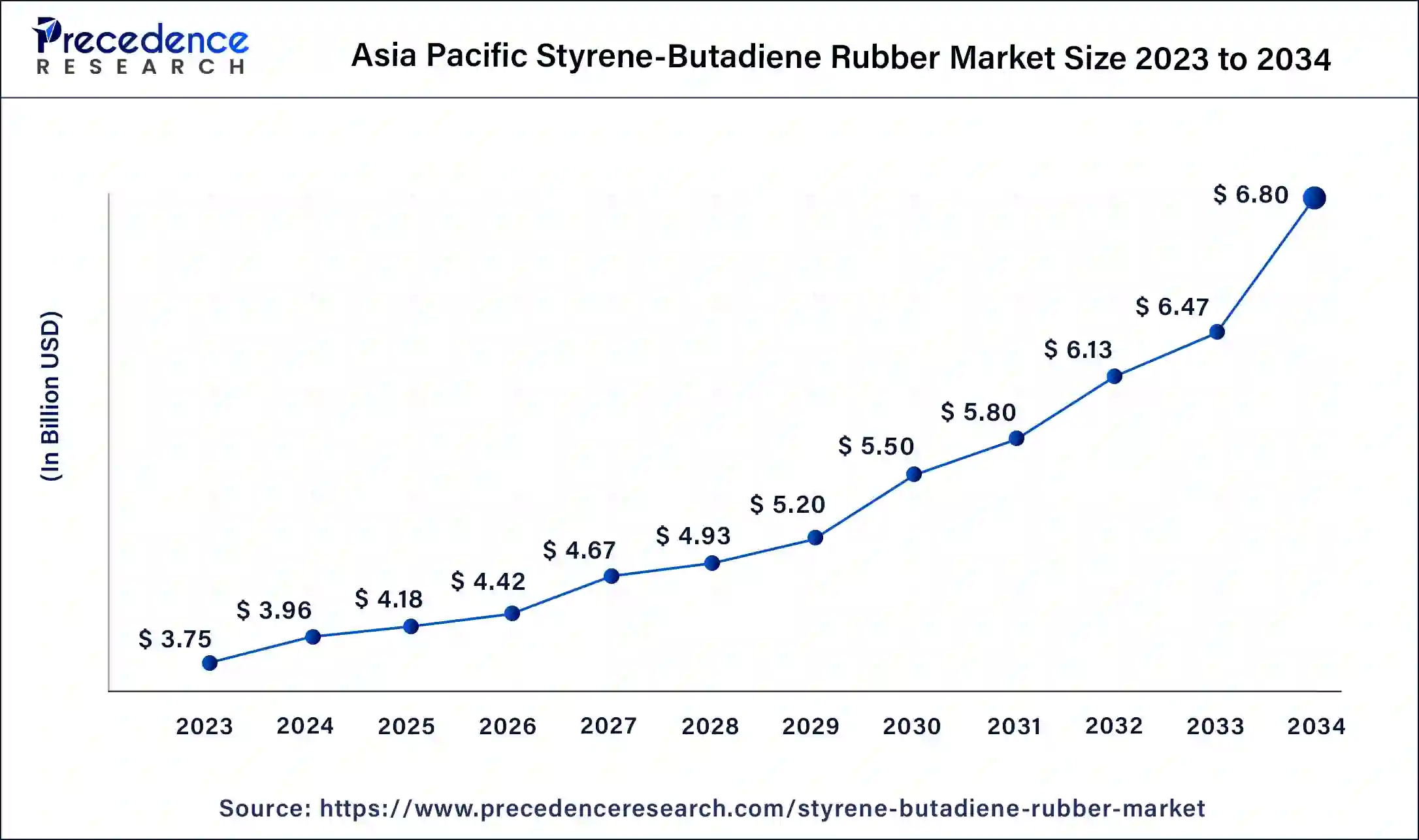

Asia Pacific Styrene-Butadiene Rubber Market Size and Growth 2025 To 2034

The Asia-Pacific styrene-butadiene rubber market size was valued at USD 3.96 billion in 2024 and is expected to be worth around USD 6.90 billion by 2034, rising at a CAGR of 5.71% from 2025 to 2034.

Asia-Pacific has held the largest revenue share of 33% in 2024. Asia Pacific is dominating the styrene-butadiene rubber (SBR) market. The increased tire and automotive industries in this region, especially in China, position the region in the first place globally. The production and consumption rate is high due to the quality demand of customers.

Additionally, the region's economic growth fosters increased consumer spending on automobiles and infrastructure projects, sustaining the demand for SBR. The strategic positioning of Asia-Pacific as a global manufacturing hub solidifies its significant share in the styrenebutadienerubber market.

North America is estimated to observe the fastest expansion. North America holds a major growth in the styrene butadiene rubber market due to robust demand across key industries. The region's well-established automotive sector, continuous infrastructure development, and the demand for consumer goods contribute to high SBR consumption.

Moreover, stringent quality and safety standards in industries such as automotive drive the preference for SBR. Additionally, ongoing research and development activities and a focus on sustainable practices enhance the competitiveness of North American SBR manufacturers, further solidifying the region's prominent position in the global market.

Market Overview

Styrene-butadiene rubber is a synthetic elastomer derived from the copolymerization of styrene and butadiene monomers. This versatile rubber is widely used in the production of tires, automotive parts, and various industrial and consumer goods. SBR exhibits excellent abrasion resistance, durability, and resilience, making it a preferred choice in tire manufacturing, where it enhances traction, tread wear, and overall tire performance. Its cost-effectiveness and ability to be blended with natural rubber further contribute to its widespread adoption in the rubber industry.

Beyond tires, SBR finds application in conveyor belts, footwear, adhesives, and coated fabrics due to its favorable balance of properties, including good aging resistance and moderate heat resistance. The copolymerization process allows for tailoring the material's characteristics, making SBR adaptable to different manufacturing requirements. However, it is important to note that SBR may not excel in extreme temperature or oil resistance compared to other synthetic rubbers, but its affordability and well-rounded performance make it a key player in various industries that rely on durable and cost-effective rubber materials.

Styrene-Butadiene Rubber Market Growth Factors

- Automotive Industry Expansion: The growing automotive sector fuels demand for Styrene Butadiene Rubber (SBR) in tire manufacturing, as it enhances tire performance and longevity.

- Construction Sector Boom: Increased construction activities worldwide drive the use of SBR in infrastructure projects, as it is employed in various construction materials for its durability and resilience.

- Rising Consumer Goods Production: SBR is a key component in the manufacture of consumer goods such as footwear and sporting equipment, contributing to market growth as consumer spending and production increase.

- Global Industrialization Trends: The ongoing industrialization in emerging economies boosts the demand for SBR in conveyor belts, hoses, and other industrial applications, driving market expansion.

- Technological Advancements: Continuous innovations in SBR production processes and formulations enhance its properties, meeting diverse industry needs and fostering market growth.

- Increasing Demand for Radial Tires: The shift towards radial tires, known for their superior performance, increases the consumption of SBR, as it is a crucial component in radial tire manufacturing.

- Green Tire Initiatives: Environmental concerns drive the development of green tires, promoting the use of SBR with bio-based or recycled content, contributing to sustainable market growth.

- Urbanization and Infrastructure Development: Urbanization projects and infrastructure development create a demand for SBR in applications like road construction, as it provides the necessary durability and resilience.

- Expanding Footwear Industry: The growing global footwear industry relies on SBR for its cost-effectiveness and desirable properties, supporting market growth.

- Increasing Disposable Income: Higher disposable incomes in developing regions lead to increased consumer spending on automobiles and consumer goods, positively impacting the SBR market.

- Stringent Tire Performance Standards: Stringent regulations and standards for tire performance and safety drive the adoption of high-performance materials like SBR in tire manufacturing.

- Growing Renewable Energy Sector: SBR is used in components for renewable energy systems, and the expanding renewable energy sector contributes to the demand for SBR in various applications.

- Infrastructure Rehabilitation: Rehabilitation and maintenance of existing infrastructure worldwide boosts the demand for SBR in construction materials and repair applications.

- Expansion of Chemical Industry: The chemical industry's growth increases the demand for SBR in various applications, including seals, gaskets, and industrial hoses.

- Increasing Demand for Adhesives: SBR's adhesive properties contribute to its use in the expanding adhesive industry, driven by demand in packaging, construction, and automotive sectors.

- E-commerce Boom: The rise of e-commerce fuels demand for SBR in packaging materials, as it provides strength and durability to packaging products.

- Focus on Lightweight Materials: SBR's lightweight properties make it a preferred choice in industries emphasizing the use of lightweight materials, such as aerospace and automotive, supporting market growth.

- Innovations in Polymer Blends: Ongoing research and development efforts in polymer blends and compound formulations lead to improved SBR products, expanding its applications and market share.

- Expansion of Industrial Manufacturing: The expansion of industrial manufacturing across diverse sectors drives the demand for SBR in the production of various industrial components and products.

- Globalization of Supply Chains: The globalization of supply chains increases the need for reliable and cost-effective materials like SBR, promoting its use in various industries worldwide.

Technological Advancement

Technological advancement in the styrene-butadiene rubber (SBR) market features product quality, additive formulations, and bio-based rubber. The sustainable and eco-friendly methods consist of recycling technologies and sustainable production methods. Industries and Applications using skilled technology in the footwear, construction, and automotive sectors. The low rolling resistance due to the development in SBR formulation increases demand for electric vehicles. The technological innovations have improved and excelled the product quality, adding enhancements in the manufacturing process.

Customers' attitude and shift towards hybrid and electric vehicles is seeking attention from SBR formulations. The eco-friendly bio-based rubber results in a reduction of petroleum-based products. SBR in construction provides asphalt modifiers and waterproofing membranes. Supporting sustainable production, popular Methanol-to-olefins (MTO) technology is used in the making process. The improvisation in properties through technology has eased the growth of the styrene-butadiene rubber (SBR) market. These technologies leverage two monomers in an integrated way is an excellent advancement strategy. The proportional rate of chemical and technology boosts the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 11.32 Billion |

| Market Size in 2025 | USD 11.95 Billion |

| Market Size by 2034 | USD 19.44 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.56% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Construction industry expansion and consumer goods manufacturing

The expansion of the construction industry and the growth in consumer goods manufacturing significantly surged the market demand for styrene butadiene rubber. In the construction sector, SBR is sought after for its durability and resilience, making it a key component in various construction materials such as sealants, adhesives, and coatings. As infrastructure projects and urbanization efforts continue globally, the demand for these construction materials rises, driving the need for SBR.

Simultaneously, the consumer goods manufacturing sector heavily relies on SBR for products like footwear, sporting equipment, and various household items. SBR's desirable properties, including abrasion resistance and flexibility, make it a preferred material for the production of these goods. As consumer spending increases and markets expand, the demand for SBR in consumer goods manufacturing experiences a considerable upswing, contributing to the overall growth and sustainability of the styrene butadiene rubber market.

Restraint

Storage and retrieval challenges

The limited heat and oil resistance of Styrene Butadiene Rubber (SBR) represents significant constraints on its market growth. In applications where high-temperature resistance is crucial, such as in the automotive and industrial sectors, SBR may face limitations compared to alternative synthetic rubbers with superior heat-resistant properties. The restricted ability of SBR to withstand exposure to certain oils also hampers its adoption in applications requiring resistance to lubricants and fuels. These limitations impact the potential applications of SBR in critical industries, limiting its use in environments with elevated temperatures and exposure to oil-based substances. As industries continually seek materials with broader performance capabilities, the constraints related to heat and oil resistance place constraints on the overall market expansion for SBR, prompting manufacturers to explore and develop alternative formulations or collaborate with end-users to find suitable substitutes for specific applications.

Opportunity

Green technology adoption

Green technology adoption is creating significant opportunities in the Styrene Butadiene Rubber (SBR) market. Manufacturers can capitalize on the growing demand for sustainable practices by developing and promoting eco-friendly SBR formulations. The incorporation of bio-based or recycled content in SBR aligns with environmental initiatives, meeting the preferences of environmentally conscious industries and consumers. This shift towards greener alternatives positions SBR as a more sustainable choice in various applications, enhancing its market appeal.

Furthermore, as regulatory pressures for environmentally friendly materials increase, the development and promotion of green SBR variants provide manufacturers with a competitive edge. Collaborations and partnerships within the industry to advance sustainable practices can foster innovation and open doors to new markets where eco-friendly solutions are increasingly prioritized, contributing to the long-term growth and viability of the styrene butadiene rubber market.

Type Insights

In 2024, the emulsion SBR segment had the highest market share of 65% on the basis of the type. Emulsion styrene butadiene rubber (ESBR) is a type of SBR produced through emulsion polymerization, resulting in apolymer with enhanced properties like improved abrasion resistance, flexibility, and heat build-up characteristics. ESBR is widely used in tire manufacturing due to its ability to improve tire performance and fuel efficiency. In the styrene butadiene rubber market, the ESBR segment is witnessing a trend towards increasing demand, driven by its advantages in tire technology. The automotive industry's focus on developing high-performance and fuel-efficient tires contributes to the growing prominence of ESBR in the market.

The solution SBR segment is anticipated to expand at a significant CAGR of 6.5% during the projected period. Solution Styrene Butadiene Rubber (S-SBR) is a type within the styrene butadiene rubber market, characterized by its production through a solution polymerization process. S-SBR exhibits superior performance characteristics, particularly in the production of high-performance tires, due to its controlled microstructure. The market trend for S-SBR includes a growing demand for high-performance tires in the automotive industry, driven by increased emphasis on fuel efficiency and tire performance. This segment's prominence is expected to continue as tire manufacturers seek materials that enhance overall tire performance and contribute to sustainability initiatives.

Application Insights

According to the application, the tire segment has held 31% revenue share in 2024. In the styrene butadiene rubber market, the tire segment refers to the use of SBR in tire manufacturing. SBR is a key component in tire formulations, enhancing tread wear, providing abrasion resistance, and contributing to overall tire performance. Trends in the SBR tire segment include a shift towards high-performance and fuel-efficient tires, driven by automotive industry advancements. Additionally, the demand for eco-friendly or "green" tires, incorporating sustainable materials like bio-based or recycled content SBR, reflects the industry's response to environmental concerns and evolving consumer preferences.

The footwear segment is anticipated to expand fastest over the projected period. In the styrene butadiene rubber market, the footwear segment refers to the application of SBR in the manufacturing of shoes and related products. SBR's widespread use in the footwear industry is driven by its desirable properties, including flexibility, abrasion resistance, and cost-effectiveness. Trends in this segment include a growing emphasis on sustainable footwear production, leading to the development of eco-friendly SBR formulations.

Additionally, innovations in SBR technologies contribute to the production of high-performance and durable footwear, meeting evolving consumer demands for both comfort and environmental responsibility.

Styrene-Butadiene Rubber Market Companies

- Lanxess AG

- Sinopec

- Kumho Petrochemical Co., Ltd.

- Asahi Kasei Corporation

- The Goodyear Tire & Rubber Company

- LG Chem

- JSR Corporation

- Trinseo

- Michelin

- Bridgestone Corporation

- Versalis S.p.A. (Eni)

- Synthos S.A.

- Zeon Corporation

- Nizhnekamskneftekhim

- Eastman Chemical Company

Recent Developments

- In May 2025, TSRC Corp started maintenance at the SBR plant. TSRC Corp is shutting down its styrene-butadiene rubber plant in Kaoshiung. It might be shutting down for maintenance.

- In December 2024, the automotive industry is heading towards new growth and opportunities because of the heavy demand for styrene-butadiene rubber solutions. The indirect opportunity for the automotive industry is benefiting both markets, increasing the heavy demand for styrene-butadiene rubber.

- In January 2025, the European automotive industry has been struggling a lot. Regarding to European styrene-butadiene rubber (SBR) market has weakened in demand.

Segments Covered in the Report

By Type

- Emulsion SBR

- Solution SBR

By Application

- Tires

- Adhesives

- Footwear

- Other Applications

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting