What is Sodium Hydroxide Market Size?

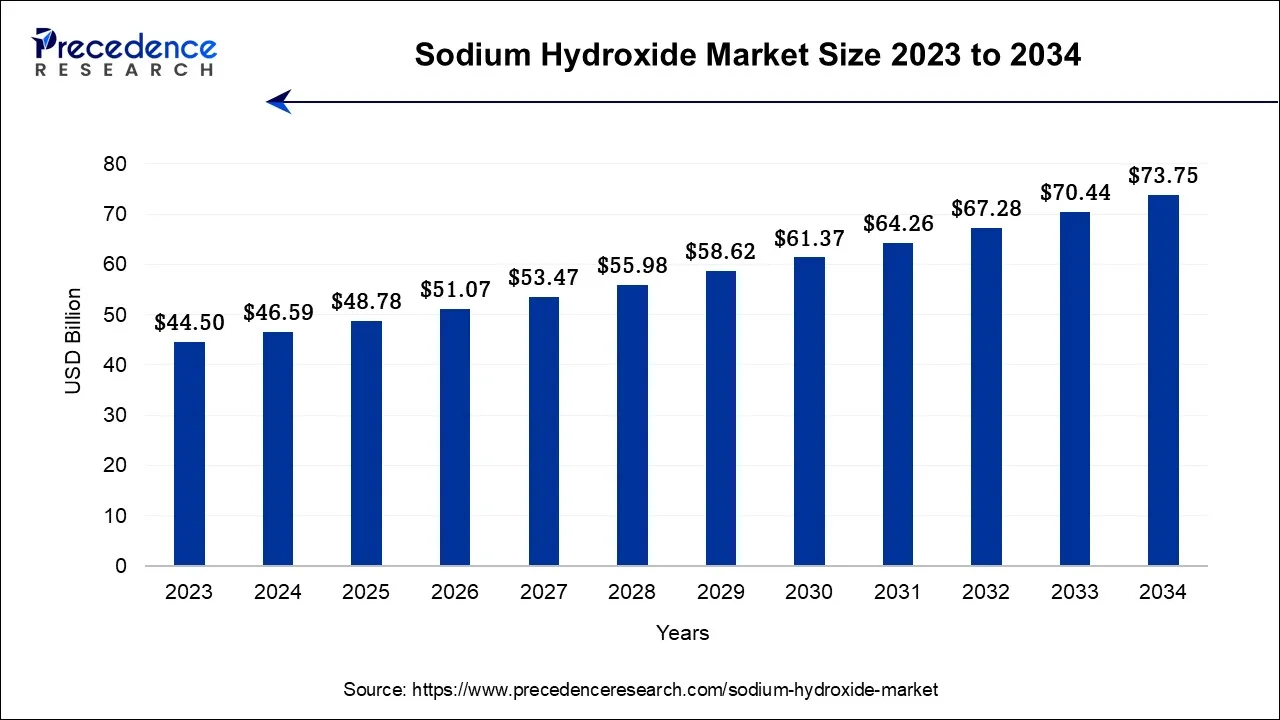

The global sodium hydroxide market size was expected to valued at USD 48.78 billion in 2025, and is projected to hit around USD 51.07 billion by 2026, and is anticipated to reach around USD 76.96 billion by 2035, expanding at a CAGR of 4.67% over the forecast period from 2026 to 2035.

Market Highlights

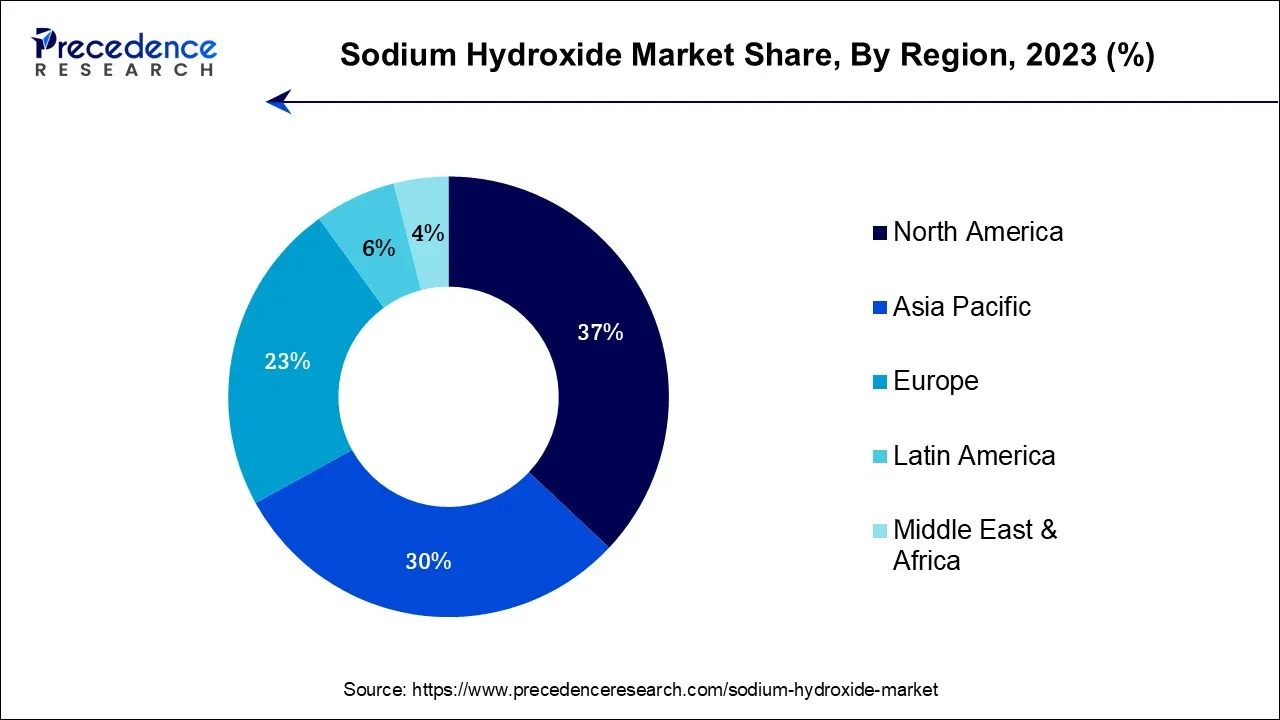

- North America generated more than 37% of revenue share in 2025.

- By Grade, the 50% aqueous solution segment contributed the largest revenue share of 43% in 2025.

- By Grade, the hardware segment is expected to expand at the fastest CAGR of 5.8% between 2026 to 2035

- By Production Process, the membrane cell segment captured the largest revenue share of 29% in 2025.

- By Production Process, the diaphragm cell segment is estimated to grow at the fastest CAGR over the projected period.

- By Application, the biodiesel segment had the largest market share of 36.8% in 2025.

- By Application, the alumina segment is anticipated to grow at the fastest CAGR over the projected period.

Market Overview

- The sodium hydroxide market refers to the global industry involved in the production, distribution, and sale of sodium hydroxide, also known as caustic soda. This market is characterized by its vital role in various sectors, including chemicals, pulp and paper, textiles, and water treatment.

- Sodium hydroxide is a versatile chemical compound used for pH regulation, industrial processes, and manufacturing, making it an essential commodity with steady demand. Market dynamics are influenced by factors like industrial growth, environmental regulations, and technological advancements, impacting both supply and pricing in this resilient and ever-evolving market.

- In 2025, the top exporters of Sodium hydroxide (caustic soda), solid are China, India, the European Union, Poland, and others.

How is AI Influencing the Sodium Hydroxide Industry?

The integration of artificial intelligence along with automation is remarkably changing production processes around the sodium hydroxide powder industry. AI-based predictive analytics are enhancing supply chain management by improving raw material sourcing and reducing operational expenses. AI algorithms can determine vast datasets from numerous sources, including online reviews, social media, and customer interactions, in real time, uncovering trends along with sentiments that would be nearly impossible to detect manually.

Sodium Hydroxide Market Growth Factors

Several industry trends and growth drivers are shaping the sodium hydroxide market, including the expanding chemicals sector, driven by increased demand for raw materials and intermediate products, which continues to boost sodium hydroxide consumption. Moreover, the rising awareness of water treatment and environmental concerns prompts the adoption of caustic soda for effective wastewater management.

Additionally, technological advancements in manufacturing processes enhance sodium hydroxide production efficiency, further propelling market growth. The market also benefits from its integral role in the pulp and paper industry, which is experiencing growth due to e-commerce packaging demands and increased paper recycling.

Moreover, the sodium hydroxide market growth is underpinned by several key factors. The increasing demand for caustic soda as a key ingredient in the manufacturing of various chemicals, including soaps, detergents, and textiles, presents lucrative business opportunities. Furthermore, the growing need for water purification and treatment, driven by urbanization and environmental regulations, creates a stable market demand for sodium hydroxide.

Technological innovations that optimize production processes and reduce energy consumption are likely to enhance market competitiveness. Additionally, the market can explore opportunities in emerging economies where industrialization and infrastructure development are on the rise, fostering greater demand for sodium hydroxide across various applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 48.78 Billion |

| Market Size in 2026 | USD 51.07 Billion |

| Market Size by 2035 | USD 76.96 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.67% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Grade, Production Process, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Chemical manufacturing and industrial demand

The surge in chemical manufacturing significantly boosts the demand for the sodium hydroxide market. As a fundamental ingredient in the production of various chemicals, including detergents, soaps, and synthetic materials, sodium hydroxide is indispensable to this sector. With chemical manufacturing expanding to meet growing consumer and industrial needs, the reliance on caustic soda as a crucial raw material escalates. This heightened demand underscores sodium hydroxide's pivotal role in the chemical industry, making it an essential and steadily sought-after commodity in the market. Moreover, Industrial demand is a primary driver for the surge in market demand for the market.

Moreover, the growth and expansion of these industries, coupled with the development of new products and applications, continuously increase the need for caustic soda. This sustained industrial demand creates a steady and robust market for sodium hydroxide, making it a fundamental and sought-after commodity in the global market.

Restraints

Environmental regulations and safety concerns

Environmental regulations impose constraints on the sodium hydroxide market by mandating stringent compliance measures and sustainability practices. The disposal of byproducts, notably chlorine gas, requires costly, eco-friendly solutions, increasing production costs. Additionally, regulations demand reduced emissions and responsible waste management, adding operational complexities and expenses. As a result, manufacturers face challenges in maintaining competitive pricing while adhering to these environmental mandates. This can potentially limit market demand for sodium hydroxide as industries seek more environmentally friendly alternatives to meet their chemical needs.

Moreover, Safety concerns pose a significant restraint on market demand for the market. The highly corrosive nature of sodium hydroxide necessitates stringent safety measures in handling, storage, and transportation, increasing operational complexity and costs. Mishandling can result in accidents, injuries, and environmental hazards, making businesses cautious about its usage. Compliance with safety regulations further adds to operational expenses. These safety-related challenges can discourage some industries from using sodium hydroxide or prompt them to explore safer alternatives, thereby impacting market demand.

Opportunity

Energy storage and water treatment

Energy storage technologies, such as flow batteries, are surging in popularity due to their role in renewable energy integration and grid stability as it is essential for batteries as an electrolyte solution as renewable energy sources expand, so does the need for large-scale energy storage solutions, consequently increasing the demand for sodium hydroxide. This demand surge positions sodium hydroxide as a critical component in the growing energy storage sector, offering substantial growth potential for manufacturers and suppliers within the market.

Moreover, water treatment processes drive market demand for sodium hydroxide. As stringent environmental regulations and increased urbanization heighten the need for effective wastewater management, sodium hydroxide is essential for pH control and neutralizing acidic or alkaline contaminants in water treatment facilities. Its versatile and reliable performance in water purification positions it as a fundamental component in addressing growing global concerns about water quality and sustainability. Hence, the escalating demand for clean water and compliance with environmental standards significantly bolster the market demand for sodium hydroxide in the water treatment sector.

Segment Insights

Grade Insights

According to the grade, the 50% Aqueous Solution segment has held 43% revenue share in 2025. A 50% Aqueous Solution of sodium hydroxide is a chemical mixture consisting of 50% sodium hydroxide and 50% water. It finds widespread application across industries due to its adaptability in regulating pH, counteracting acidic substances, and supporting various chemical operations. In the sodium hydroxide market, there is a growing trend toward the demand for 50% Aqueous Solution due to its convenience and safety compared to handling solid sodium hydroxide. Industries like water treatment, pulp and paper, and textiles increasingly favor this solution for its ease of use and precise dosing capabilities, reflecting a shift towards safer and more efficient chemical handling practices.

The hardware sector is anticipated to expand at a significant CAGR of 5.8% during the projected period solid sodium hydroxide, available in various grades, is a key chemical compound extensively used across industries. In the Sodium Hydroxide Market, trends indicate a shift towards higher-purity grades to meet stringent quality requirements, especially in the food, pharmaceutical, and electronics sectors. Additionally, advancements in production processes have led to improved solid sodium hydroxide quality and reduced impurities. Growing awareness of environmental sustainability is also prompting the development of eco-friendly solid sodium hydroxide formulations, reflecting the market's commitment to meet evolving industry demands while adhering to stringent quality standards.

Production Process Insights

Based on the production process, membrane cell segment is anticipated to hold the largest market share of 29% in 2025. Membrane cell, a production process in the sodium hydroxide industry, utilizes an ion-exchange membrane to separate chlorine gas and sodium hydroxide during electrolysis. This method offers several advantages, including improved energy efficiency and reduced environmental impact compared to the older mercury cell process. In recent trends, there's a notable shift toward membrane cell technology due to its eco-friendliness and compliance with stringent environmental regulations. This transition reflects the market's commitment to sustainability and energy-efficient manufacturing processes in the sodium hydroxide production landscape.

On the other hand, the Diaphragm Cell segment is projected to grow at the fastest rate over the projected period. A Diaphragm Cell is a production process used in the sodium hydroxide market to manufacture this essential chemical compound. This process yields sodium hydroxide, chlorine gas, and hydrogen gas, all while preserving a physical diaphragm barrier between the anode and cathode compartments. This technology is evolving to meet environmentally friendly production standards, reduce energy consumption, and enhance overall operational efficiency, reflecting the industry's growing commitment to sustainability and resource optimization.

In recent sodium hydroxide market trends, there is a growing emphasis on environmentally friendly production methods and sustainability. Diaphragm cell technology is evolving to minimize environmental impacts, reduce energy consumption, and improve overall efficiency, aligning with the industry's increasing focus on eco-friendly practices and resource optimization.

Application Insights

In 2025, the biodiesel segment had the highest market share of 36.8% on the basis of the installation. Biodiesel, a sustainable alternative to traditional fossil fuels, is produced through a chemical process called transesterification, where sodium hydroxide (caustic soda) serves as a catalyst. In the sodium hydroxide market, biodiesel production has emerged as a notable application trend. A notable trend in this sector involves the increasing global demand for biodiesel due to its lower carbon footprint and compliance with stringent emissions standards. As governments and industries worldwide prioritize sustainability, the biodiesel market continues to grow, driving the demand for sodium hydroxide as a crucial catalyst in this eco-friendly fuel production process.

- In 2023, global FAME biodiesel production neared 50 billion liters. Indonesia led with 14 billion liters (palm oil), followed by the EU at 13 billion liters (rapeseed, used cooking oil) and Brazil at 8 billion liters (soybeans).

The alumina is anticipated to expand at the fastest rate over the projected period. Alumina, derived from bauxite ore, is a primary application of sodium hydroxide. In the sodium hydroxide market, the alumina industry is witnessing significant growth trends. As global demand for aluminum continues to rise, alumina production, which relies on sodium hydroxide for refining bauxite, is increasing. The market is also impacted by technological advancements aimed at optimizing the alumina extraction process, enhancing efficiency, and reducing environmental impact. Additionally, sustainability concerns are driving efforts to recycle sodium hydroxide used in alumina refining, aligning with the broader industry shift towards eco-friendly practices.

- According to SMM statistics, China's aluminum production in December 2024 (31 days) increased by 4.13 per cent YoY, with cumulative production from January to December up 3.89 per cent YoY.

Regional Insights

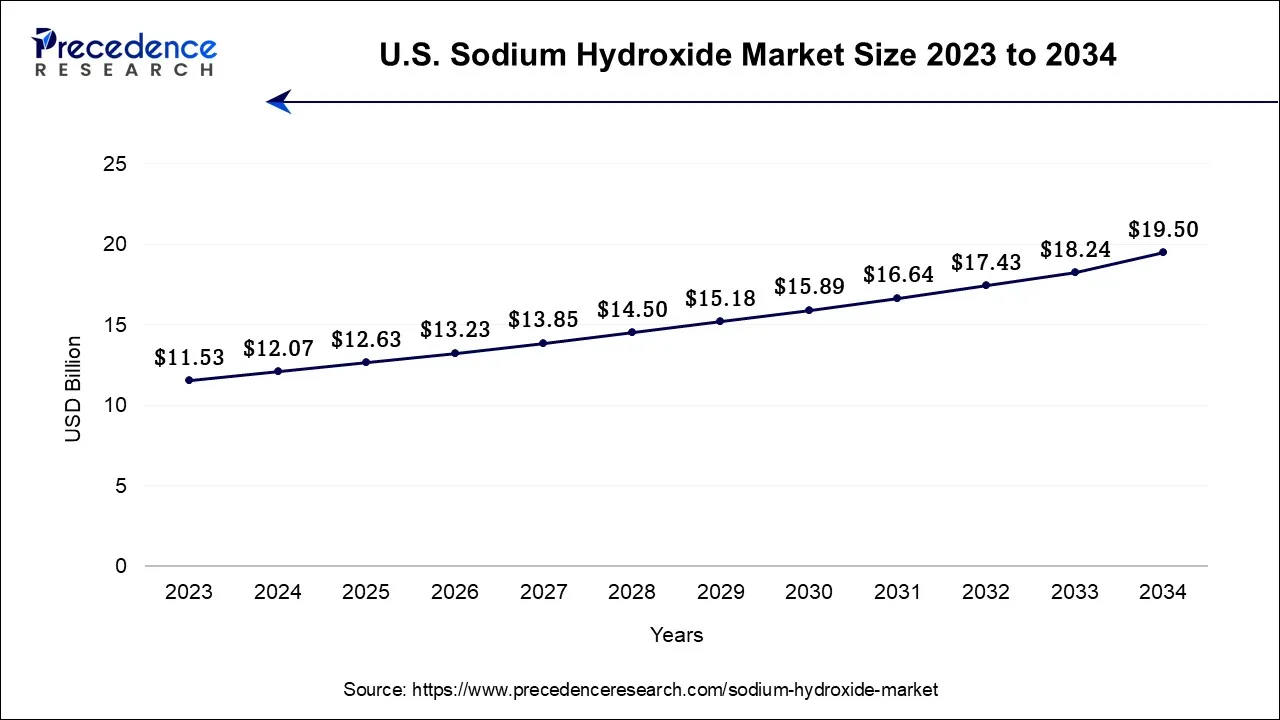

U.S. Sodium Hydroxide Market Size and Growth 2026 to 2035

The U.S. sodium hydroxide market size accounted for USD 12.63 billion in 2025 and is projected to be worth around USD 20.46 billion by 2035, poised to grow at a CAGR of 4.94% from 2026 to 2035

U.S. Sodium Hydroxide Market Trends

Rising environmental concerns, along with regulations, require improved wastewater management, where sodium hydroxide is utilized for pH adjustment, treating acidic water, and removing impurities. Expansion in the U.S. construction and automotive industries drives the need for aluminum and a few materials, indirectly boosting the demand for sodium hydroxide in processing.

North America has held the largest revenue share 37% in 2025. One key trend is the increasing emphasis on sustainable production methods and environmentally friendly processes, driven by stringent environmental regulations. Additionally, the market has seen growth in applications related to water treatment, as concerns over water quality and purification continue to rise. The region's expanding chemical and manufacturing sectors also contribute to the steady demand for sodium hydroxide. These trends reflect North America's commitment to both environmental responsibility and industrial growth in the sodium hydroxide market.

Asia-Pacific is Estimated to Observe the Fastest Expansion

In the Asia-Pacific region, the sodium hydroxide market is witnessing significant growth driven by expanding industrial sectors and infrastructure development. Countries like China and India are experiencing robust demand due to increased manufacturing activities and water treatment needs. Additionally, rising environmental awareness is encouraging the adoption of sodium hydroxide for wastewater treatment. As the region continues to urbanize and industrialize, the sodium hydroxide market in Asia-Pacific is poised for sustained expansion, making it a key player in the global sodium hydroxide landscape.

- According to the Minister of Petroleum and Natural Gas, India emerges as the world's third-largest biofuel producer. India has achieved 19.6% ethanol blending in petrol as of January and is on track to reach 20%, five years ahead of its original 2030 target.

China Sodium Hydroxide Market Trends

China acts as both the largest manufacturer and consumer, featuring a large number of producers providing low-end, competitive pricing. The main drivers are industries demanding large-scale chemical processing, including paper or pulp, textiles, soap or detergents, and water treatment.

Future Outlook of the Europe Sodium Hydroxide Market

Europe's market shows significant growth during the forecast period. It is driven by green hydrogen integration, energy-efficient chlor-alkali upgrades, along with steady demand from alumina, chemicals, and water treatment sectors. Regulatory drive for sustainability and also regional supply security funds long-term market stability and moderate growth.

The UK Sodium Hydroxide Market Trends

The UK market is driven by mergers and acquisitions targeted at improving production capacity, along with broadening the product portfolio to meet various end-user demands, particularly in electronics, pharmaceuticals, and specialty chemicals sectors. Key demand drivers include its use in chemical manufacturing, water and wastewater treatment, and ongoing needs in detergents, textiles, paper, and other industrial processes, while regulatory emphasis on water quality and environmental management also underpins sustained usage.

Chlor-Alkali Capacity and Trade Dynamics in the Latin American Sodium Hydroxide Industry

Latin America's market shows notable growth during the forecast period. It is driven by regional sodium hydroxide supply, and favorable trade dynamics decrease import dependence and stabilize expenses. Rising domestic production helps downstream industries such as pulp, paper, alumina, and chemicals, driving consistent need and overall market expansion across Latin America.

Argentina Sodium Hydroxide Market Trends

Argentina's market is driven by the country's increasing need from the petrochemical industry for refining processes, as well as from mining activities, mainly for mineral extraction. Growing urbanization and environmental knowledge are increasing the application of sodium hydroxide in water purification, along with waste management systems.

Emerging Opportunities in the MEA Sodium Hydroxide Industry

MEA's market shows fast growth during the forecast period. It is driven by the growth of alumina, water treatment, petrochemicals, and textile industries. Investments in chlor-alkali capacity, infrastructure development, along with rising industrialization across the GCC and Africa, are driving new requirements and regional market growth.

UAE Sodium Hydroxide Market Trends

UAE's market is driven by the burgeoning construction and infrastructure sector, increased need from the water treatment industry, as well as the expanding chemical production landscape within the UAE. The government's strategic initiatives targeted at economic diversification under the UAE Vision 2021, and thus, subsequent development plans have significantly led to this upward trend.

Sodium HydroxideMarket Companies

- Dow Chemical Company

- Olin Corporation

- Occidental Petroleum Corporation

- INOVYN

- BASF SE

- Solvay S.A.

- Tata Chemicals Limited

- Formosa Plastics Corporation

- Hanwha Chemical Corporation

- AkzoNobel N.V.

- PPG Industries, Inc.

- Tosoh Corporation

- Shin-Etsu Chemical Co., Ltd.

- FMC Corporation

- Westlake Chemical Corporation

Recent Developments

- In January 2025, Century Lithium Corp. announced its non-binding memorandum of understanding (MOU) with Orica Specialty Mining Chemicals (Orica). The non-binding MOU outlines the intent of Century Lithium and Orica to formalize a multi-year offtake agreement for Orica to purchase sodium hydroxide (NaOH) from Century Lithium's wholly owned Angel Island project near Silver Peak, Nevada.

- In September 2023, South Korean Petrochemical Company Hanwha Solutions announced a USD 282.3 million investment plan to expand the production of caustic soda. The investment is expected to boost caustic soda manufacturing capacity by 270,000 tons per year. The company's present petrochemical factory in the southwestern coastal city of Yeosu produces 840,000 tons of caustic soda per year.

- In March 2025, DCM Shriram commissioned a new caustic soda flakes plant of 300 tonnes per day capacity at its flagship chemicals complex at Jhagadia in Bharuch district, Gujarat. With this, the total capacity of caustic soda flakes that the Bharuch unit can produce goes up to 900 tonnes per day, making it one of the largest single-location caustic soda flakes producing units in the country.

- In 2018,Solvay and INEOS formed a joint venture named INOVYN, which focuses on the production of chlorine, caustic soda, and other chemicals, thus significantly impacting the sodium hydroxide market.

- In 2017, Occidental Petroleum and Mexichem formed a joint venture called Ingleside Ethylene, LLC, to construct and operate a new ethane cracker and ethylene production facility in Ingleside, Texas, which is linked to the production of sodium hydroxide and other chemicals.

- In 2016, Westlake Chemical acquired Axiall Corporation, which had a substantial presence in the production of chlor-alkali products, including sodium hydroxide.

Segment Covered in the Report

By Grade

- Solid

- 50% Aqueous Solution

- Others

By Production Process

- Membrane Cell

- Diaphragm Cell

- Others

By Application

- Biodiesel

- Alumina

- Inorganic Chemical

- Organic Chemical

- Food

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting