What is the Caustic Soda Market Size?

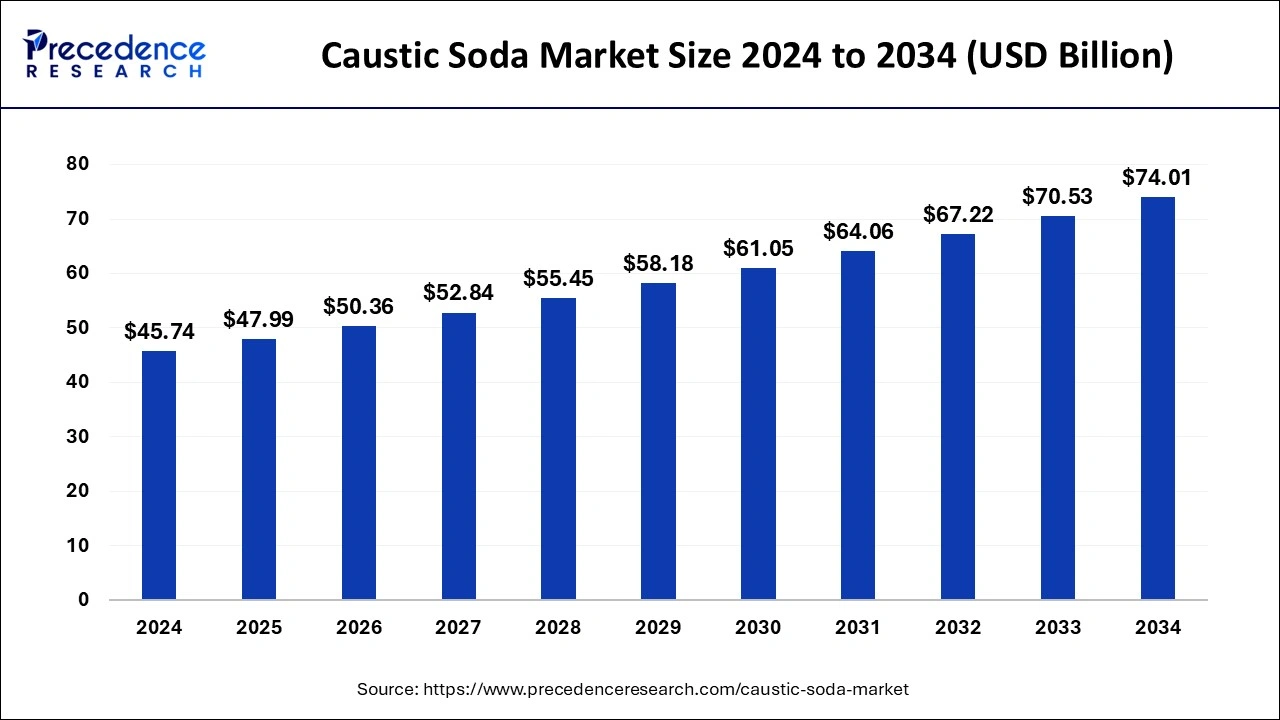

The global caustic soda market size is calculated at USD 47.99 billion in 2025 and is predicted to increase from USD 50.36 billion in 2026 to approximately USD 77.38 billion by 2035, expanding at a CAGR of 4.89% from 2026 to 2035. The caustic soda market growth is attributed to the increasing demand for caustic soda in diverse applications, such as aluminum production, water treatment, and chemical manufacturing.

Caustic Soda Market Key Takeaways

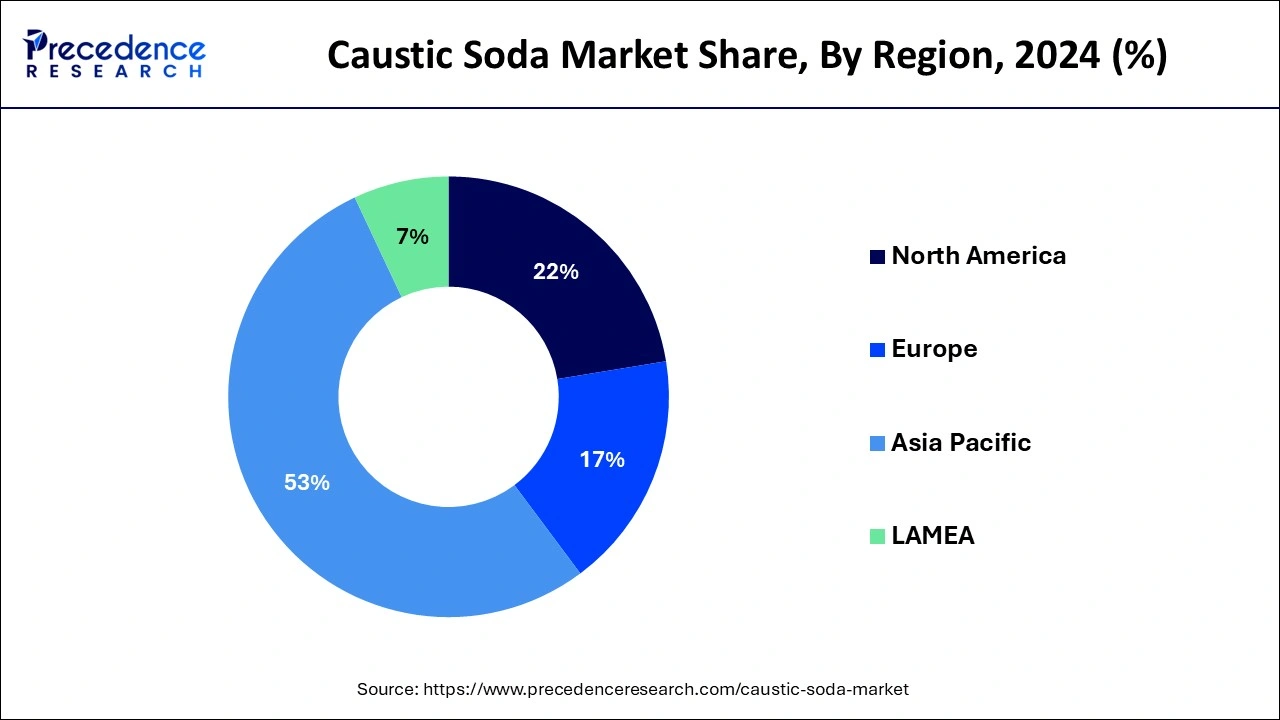

- Asia Pacific dominated the global caustic soda market with the largest market share of 53.2% in 2025.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By application, the alumina segment held a major market share in 2025.

- By application, the water treatment segment is expected to expand at a solid CAGR in the market during the forecast period.

Market Overview

The growth of caustic soda products with its high demand is going to increase across all sectors, which will further facilitate the caustic soda market. There is an increasing desire for alumina manufacturing, in which caustic soda is used to extract aluminum from bauxite. The aluminum industry and other related products are constantly growing, especially in China, India, and the rest of the world. It is anticipated that the increasing application of caustic soda in water treatment processes further drives market growth. The technological breakthroughs in caustic soda manufacturing include improved energy-efficient and eco-friendly processes that are expected to have high production capacity and quality.

- The 2024 report from the U.S. Environmental Protection Agency states that the average American uses 82 gallons of water per day at home.

Impact of Artificial Intelligence (AI) on the Caustic Soda Market

In the caustic soda market, some organizations use artificial intelligence (AI) systems in manufacturing, energy management, and increasing safety measures. Sophisticated digital programs process big data instantly to offer producers the ability to forecast equipment maintenance schedules, increase output, and reduce losses. AI also facilitates market forecasting by recognizing patterns and changes in demand, enabling stakeholders as well. Furthermore, integrating it into supply chain management also makes inventory needs and delivery more efficient, thereby enhancing customer relationships.

Technological Advancement

Technological advancement in the caustic soda market features automation, digitalization, membrane cell technology, and customized formulation. Automation and digital technologies are mainly used in food processing plants. It reduces labor work and enhances caustic soda in the food production process. Membrane cell technology replaces mercury cells and diaphragms with membrane cells. This minimizes environmental impact. The purification process ensures the product meets its advanced purity standard, mainly in popular industries such as food processing and pharmaceuticals.

The customized formulation supports modification and composition to achieve quality performance for applications. Many caustic soda companies approach sustainable production methods, which are adopted largely by manufacturers. These technologies and innovations have evolved and redesigned the market globally.

Caustic Soda Market Growth Factors

- Increasing adoption of sustainable and eco-friendly manufacturing practices across industries is driving caustic soda demand.

- Expanding the use of caustic soda in the production of biofuels and renewable energy technologies is expected to boost market growth.

- Growing demand for household cleaning and personal care products that rely on caustic soda in their formulations.

- The rising focus on wastewater treatment in industrial and municipal sectors is likely to fuel the consumption of caustic soda.

- Expansion of the construction industry and infrastructure development globally is anticipated to raise the need for aluminum and, in turn, caustic soda.

- High demand for textiles, particularly synthetic fibers, will drive caustic soda consumption in textile processing.

- Increased use of caustic soda in the pharmaceutical industry for the production of certain drugs and active ingredients is contributing to the caustic soda market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 47.99 Billion |

| Market Size in 2026 | USD 50.36 Billion |

| Market Size in 2035 | USD 77.38 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.89% |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising alumina production

Increasing demand for alumina production is expected to boost the caustic soda market growth in the coming years. The Alumina industry uses caustic soda for the Bayer process through which aluminum is obtained from bauxite using the chemical as a reagent. This dependence is due to caustic soda solubilizing power, which makes the output to be very pure. Since aluminum is used increasingly in automobiles, aerospace industries, construction, and other segments, as it is lighter and lasts longer, the demand for caustic soda increases consequently. Furthermore, these tendencies prove the role of caustic soda as the key intermediate product in the aluminum industry's value chain, together with constantly rising requirements for ecologically friendly and energy-saving production processes.

- The World Bureau of Metal Statistics also suggests that in 2023, the global aluminum production of 70.3 million metric tons is also up by 2% compared to the previous year, meaning more alumina and caustic soda are needed.

Restraint

Environmental challenge

Hamper environmental concerns surrounding caustic soda production are anticipated to limit caustic soda market expansion in the coming years. The process of production causes relative emissions of carbon dioxide and other greenhouse gases, hence contributing to climate change. The governments of countries around the world continue to put enhanced standards on pollution emissions, which has negative impacts on the cost of operations for the producers.

The most important category of production methods in the caustic soda market is also potentially problematic, as it uses mercury and asbestos in some plants, which has health and environmental consequences. Furthermore, there are global bodies like the United Nations Environment Programme (UNEP) that champion cleaner production technologies for industries that are forcing change or improvement. Such factors lead stakeholders to search for other chemicals or processes to apply.

Opportunity

Rising investments in advanced production technologies

Rising investments in advanced production technologies are likely to unlock new potential in the caustic soda market. Manufacturers prioritize the development of energy-efficient and environmentally friendly caustic soda production methods to comply with stringent regulations and reduce operational costs. Further capital expenditure on superior production technologies is opening up new opportunities in the caustic soda industry. Industry players strive to achieve efficient and sustainable production processes to meet legal requirements and cut expenses.

Membrane cell technology remains more efficient and emits less as the adoption of the technology spreads worldwide. Such innovations enhance the ability of firms to scale up production and quality standards and meet the increasing demand and need for the caustic soda market across different sectors while considering sustainability. Furthermore, the rising use of electric evaporation plants, as Nobian in 2024, has put its bet on electricity-powered evaporation plants to produce caustic soda. The facility under construction in Delfzijl decreases CO? emissions by 25,000 tonnes per year and saves 85% of the energy consumed.

Segment Insights

Application Insights

The alumina segment held a significant presence in the caustic soda market in 2025 due to the strong demand for aluminum, particularly in the automotive, aerospace, and construction sectors. Bauxite processing involves the use of caustic soda in the Bayer process, which is essential for the extraction of alumina. The global aluminum production summary of 2023 reveals that China and India have recently ramped up their capacity to produce this metal to meet the internal and export markets. Furthermore, the rising capital spending on aluminum pot lining and chromizing technologies will help drive the demand for the product further as China, India, and Brazil continue to invest in alumina refineries for higher aluminum production.

- According to the 2024 report by the Press Information Bureau (PIB), India's primary aluminum production reached 41.59 lakh tons in 2023-2024, marking a 2.1% growth compared to 2022-2023. In the first quarter of 2024-2025, production further increased by 1.2%, totaling 10.43 lakh tons.

The water treatment segment is expected to grow at the fastest rate in the caustic soda market during the forecast period of 2026 to 2035, owing to the growing interest in water and wastewater management as a necessity for growing industries and municipal needs. Sodium hydroxide is also used effectively in water treatment companies as a neutralizer of acids and for the removal of heavy metals from water. The increasing global awareness of water pollution in industrial and agricultural processes is projected to drive water treatment applications. The growth of cities in developing countries requires effluent, safe, and clean water treatment systems confined to nations such as India and sub-Saharan Africa, where water scarcity is fast becoming a cause of concern, which further boosts the demand for caustic soda in the water treatment sector.

- The United Nations UN 2022 report claims that in about three years, the world population will be 8 billion, and this is projected to put pressure on water resources.

Regional Insights

What is the Asia Pacific Caustic Soda Market Size?

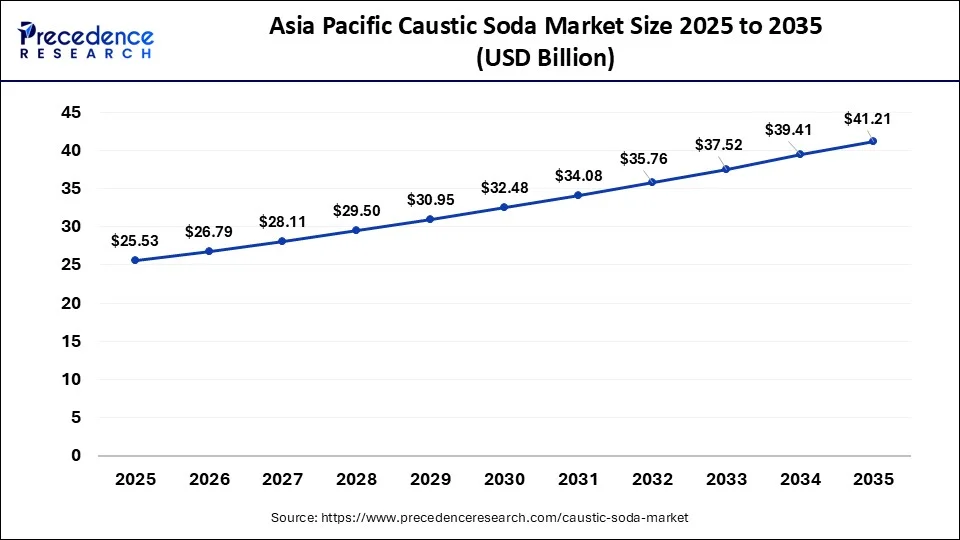

The Asia Pacific caustic soda market size is exhibited at USD 25.53 billion in 2025 and is projected to be worth around USD 41.21 billion by 2035, growing at a CAGR of 4.90% from 2026 to 2035.

Asia Pacific dominated the global caustic soda market in 2025. It remains evident that key consuming countries, including China, India, and Japan, are instrumental to the growth in end-use markets, such as aluminum production and chemicals, water treatment chemicals, and textiles. The region's domination is supported by the fact that China is the largest producer of aluminum in the world, and it uses large amounts of caustic soda in the Bayer process of alumina extraction. Furthermore, with the rising industrialization and urbanization in India, the use of chemicals in water treatment and other chemical manufacturing.

Asia Pacific is dominating the caustic soda market. Within the region, China has the highest producer and consumer rate. The government's support for the chemical industry is strengthening the growth of this market in the region. The consistent use of caustic soda in several industries, such as textiles and aluminum, is leveraging demand for the same.

- According to the International Aluminium Association, China produced approximately 3,609 thousand metric tonnes of aluminum in 2024.

North America is anticipated to grow at the fastest rate in the caustic soda market during the forecast period due to the research and development of new technologies in chemical industries, rising demand for aluminum products, and growing attention to infrastructure development. The United States remains an important market in North America where sustainability still remains a focus point; caustic soda has numerous uses, such as water treatment, production of organic and inorganic chemicals, and pulp and paper industries.

The EPA has specifically pointed to increasing stringency of water quality regulation, which compels industries to seek out and buy water treatment, in turn driving demand for caustic soda. Furthermore, the increasing demand for green technologies and the relatively recent upturn of the American manufacturing industry is expected to facilitate an increased demand for caustic soda.

- According to the 2025 report by the National Institutes of Standards and Technology, the United States ranks 9th in output per hour among 142 countries, based on data from the Conference Board.

- In 2022, manufacturing total factor productivity was 0.5% higher than its 2005 level. Within the manufacturing sector, durable goods productivity was 6.7% above the 2005 level, while nondurable goods productivity was 4.3% below the 2005 level.

What are the Advancements in the Caustic Soda Market in Europe?

Europe is witnessing significant growth in the market. This growth is driven by rising demand from the chemical, paper, and aluminum industries. The region is also witnessing increasing industrialization efforts and stringent environmental regulations, which are pushing manufacturers towards adopting more advanced and energy-efficient production technologies. There are also growing applications in water treatment and cleaning agents, further expanding market adoption.

Germany Caustic Soda Market Trends: The country is seeing an increasing emphasis on sustainable production methods. Regional government regulations are also encouraging safer handling and reduced environmental impact, thus boosting the market landscape.

What are the Key Trends in the Caustic Soda Market in Latin America?

Latin America is set to witness substantial growth in the market. This growth and development is driven by the rising demand from key industries such as pulp, paper, textiles, and chemicals. Brazil and Mexico are leading players in the region as they are the main consumption hubs, due to increasing industrialization and infrastructure development efforts. Environmental regulations and sustainability initiatives are pushing local manufacturers to adopt eco-friendly and more efficient production technologies.

Brazil Caustic Soda Market Trends: Increasing demand from the pulp and paper industry is boosting production volumes in the country. Sustainability initiatives are also seen gaining momentum, with a strong focus on energy-efficient processes.

How is the Middle East and Africa Region Growing in the Caustic Soda Market?

The Middle East and Africa region is expected to grow at a steady rate in the upcoming years. This growth is driven by expanding industrial activities and a rising demand from the chemical, pulp, and textile industries. The region is also witnessing increased investments in downstream industries, particularly in countries like Saudi Arabia and UAE. The market is also experiencing a shift towards more environmentally friendly production methods in order to comply with stringent regulations.

Saudi Arabia Caustic Soda Market Trends: Technological advancements in production processes are enhancing efficiency and reducing operational costs for local manufacturers in the country. Growing investments in the aluminum and textile domain is further helping in market expansion.

Value Chain Analysis of the Caustic Soda Market

- Raw Material Sourcing:The process begins with the sourcing of raw materials, mainly industrial-grade sodium chloride, electricity, and water.

Key Players: Tata, Cargill, Compass Minerals - Manufacturing Process:In this stage, the purified brine is subjected to electrolysis, which is an electric current in an electrolytic cell. This process splits sodium chloride to create caustic soda.

Key Players: Olin, Westlake, Covestro - Distribution Process:In this stage, caustic soda is distributed in liquid or solid form, depending on the requirements. It is distributed to a wide variety of industries such as paper, chemicals, and water.

Key Players: Brenntag, Univar, Veolia

Caustic Soda Market Companies

- Akzo Nobel N.V.

- Covestro AG

- Dow

- Formosa Plastics Corporation

- Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand) Pvt. Ltd

- Hanwha Group

- Occidental Petroleum Corporation

- Olin Corporation

- SABIC

- Shin-Etsu Chemical Co., Ltd.

- Solvay

- Tata Chemicals

- Tosoh India Pvt. Ltd

- Westlake Corporation

Latest Announcements by Industry Leaders

- April 10, 2024 – Nuberg EPC

- CMD – AK Tyagi

- Announcement - Nuberg EPC, a global leader in EPC and turnkey project management, proudly announces its involvement in India's largest Chlor-Alkali project, commissioned by Mundra Petrochemical Ltd. (MPL), a subsidiary of Adani Enterprises. Commenting on the project, Mr. AK Tyagi, CMD of Nuberg EPC, said: "This monumental Chlor-Alkali project represents more than just construction; it signifies our commitment to building a greener and more sustainable future. Our dedication to technological excellence and extensive global execution experience drives our success. Following the successful execution of the 250 TPD EPCM Caustic Soda Plant Project with Chemfab Alkalis Ltd., our role in delivering the 2200 TPD Caustic Soda Plant Project with the Adani Group highlights our relentless pursuit of engineering perfection and our significant contribution to India's industrial growth."

Recent Developments

- In April 2025, DCM Shriram announced a new caustic soda flakes plant in Gujarat. The company has expanded its chemical production capacity by introducing a caustic soda flakes plant for daily production and consumption. (Source - https://www.constructionworld.in)

- In May 2025, Iraq launched a major petrochemical plant and a new Basra industrial city with Chinese partnership. The initiative to start with a chlorine and caustic soda production plant is an effective attempt to explore and expand into the caustic soda market. (Source - https://www.iraqinews.com)

- In December 2023, Dow introduced two new caustic soda products, Caustic DEC and TRACELIGHT DEC, as part of its Decarbia portfolio of reduced-carbon solutions. These products boast up to 90% lower carbon dioxide emissions, powered by renewable energy through an electrolysis production process. This innovative method not only supports customer sustainability goals by reducing Scope 3 emissions but also maintains the same product quality.

- In October 2022, Chemdo launched a new product, Caustic Soda, a strong alkali available in flake or block form. It is highly corrosive, readily soluble in water with heat release upon dissolution, and forms an alkaline solution. Caustic soda is deliquescent, absorbing water vapor and carbon dioxide from the air, which can lead to deterioration. Its quality can be verified by adding hydrochloric acid to check for any deterioration.

- In February 2024, INEOS Inovyn unveiled its Ultra Low Carbon (ULC) range of Chlor-Alkali products, which includes caustic soda, caustic potash, and chlorine. This new range reduces the carbon footprint by up to 70% compared to industry averages, thanks to the use of renewable energy sources. The initial production sites are located in Rafnes, Norway, utilizing hydroelectric power, and Antwerp, Belgium, where energy is supplied by North Sea wind turbines.

Segments Covered in the Report

By Application

- Alumina

- Inorganic Chemicals

- Organic Chemicals

- Food

- Paper and Pulp

- Soaps and Detergents

- Textiles

- Water Treatment

- Steel/Metallurgy- Sintering

- Other

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting