What is the Specialty Alumina Market Size?

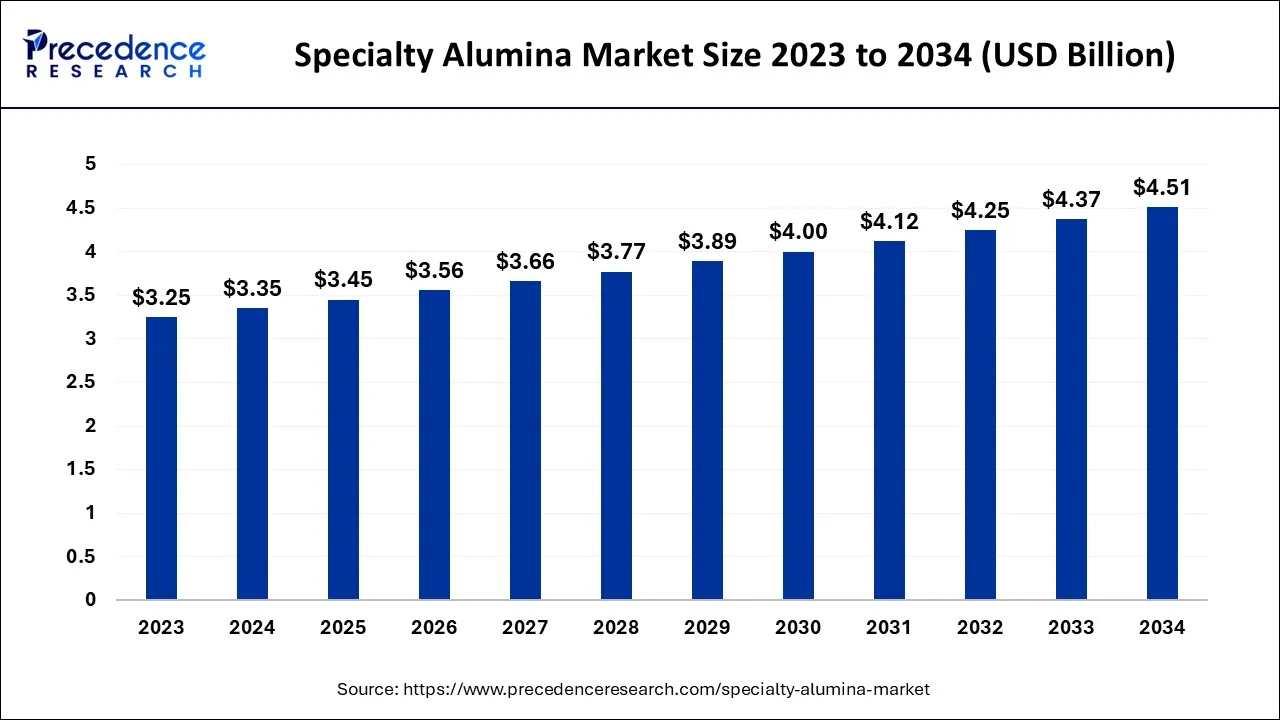

The global specialty alumina market size is expected to be valued at USD 3.45 billion in 2025and is predicted to increase from USD 3.56 billion in 2026 to approximately USD 4.64 billion by 2035, expanding at a CAGR of 3.01% over the forecast period 2026 to 2035.

Specialty Alumina Market Key Takeaways

- North America has generated the maximum market share in 2025.

- By Product Type, the standard calcined alumina has captured the largest market share in 2025.

- By Application, the ceramics sector has recorded the highest market share in 2025.

What is Specialty Alumina?

Due to its exceptional mix of physical, thermal, and electrical qualities, alumina is the material utilized in technical ceramic applications the most frequently. Catalytic substrates, mechanical wear components, electronic substrates, spark plugs, and thermal interface management are examples of typical applications. Technical ceramics applications and processes range substantially from one another due to the specific requirements each requires for the alumina powder. For each application, it is essential to comprehend how raw materials' physical and chemical properties affect product performance. For instance, although some applications are very sensitive to surface area or particle size distribution, others are more sensitive to the presence of chemical impurities.

In this paper, we explore the significance of distinct chemical impurities (Na2O, CaO, SiO2, and MgO) and their influence on the sintering profile and mechanical characteristics of alumina-based technical ceramic parts. Almatis, a member of the OYAK Group, is the industry's top producer of alumina and goods containing alumina. Almatis ensures local supply to a worldwide industry thanks to its extensive network of active plants and sales sites.

Specialty Alumina Market Growth Factors

Alumina has a favorable effect on both the glassmaking process and the qualities of the glass itself as a network stabilizer in glass structures. Alumina specifically increases mechanical strength, thermal shock resistance, and resistance to chemical assault. When compared to natural minerals, specialty aluminas made using the Bayer process have a number of advantages, including chemical consistency, particularly at the levels of Na2O and Fe2O3, low to very low levels of impurities (Fe2O3, Na2O, Sulphur, and Chlorine), consistent and uniform particle size and structure, and supply stability. When seeking high-quality glasses and when good natural raw materials are hard to come by, expensive, or unsuitable for new glass compositions, these features are very valuable.

The need for colloidal alumina as a raw material for electronic ceramics is rising along with the demand for high-performance electronic devices. Ceramic substrates for electronic parts like capacitors and semiconductors are made using colloidal alumina. In the chemical industry, colloidal alumina is frequently employed as a catalyst support material. The need for colloidal alumina as a catalyst support material is being driven by the expansion of the chemical sector, particularly in emerging economies. In addition, colloidal alumina is employed as a polishing agent in a number of fields, including optics, glass, and ceramics. The specialty alumina market is expanding as a result of the rising demand for high-quality polishing materials across a number of sectors, including aerospace, automotive, and medical.

Market Outlook

- Industry Growth Overview:

The specialty alumina market is experiencing significant growth, driven by growing demand in automotive, electronics, aerospace, medical care, and renewable energy. - Global Expansion:

The specialty alumina market is experiencing significant global expansion, driven by growing demand in automotive (EVs), electronics (semiconductors), aerospace, defense, and renewable energy fields. North America is dominant in the market due to increasing sustainability initiatives and technological developments. - Major investors:

Major investors are large, integrated metals and chemical corporations that produce and utilize specialty alumina in their own value chains, as well as their parent investment groups.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.45 Billion |

| Market Size in 2026 | USD 3.56 Billion |

| Market Size by 2035 | USD 4.64 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.01% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamic

Drivers

Growing aerospace & defense industry

Aluminum is perfect for making aircraft because it is both lightweight and durable. A third of the weight of steel is made up of aluminum, which makes it possible for aircraft to carry more cargo or use less fuel. Additionally, the great corrosion resistance of aluminum assures the safety of the airplane and its passengers. Aluminum is now a crucial component in the creation of aircraft. Although the composition of aluminum alloys has changed, aluminum's benefits have not changed. Aluminum enables engineers to create aircraft that are as light as possible, capable of hauling huge loads, consume the least amount of fuel, and are rust-free.

Aluminum is used in the fuselage, wing panels, rudder, exhaust pipes, door and floors, seats, engine turbines, and cockpit instrumentation of modern aircraft. 50% to 90% of all contemporary spacecraft are made of aluminum alloy. The International Space Station, the Space Shuttles, the Skylab space station, and the Apollo spacecraft all made substantial use of aluminum alloys.

Durability in high-stress settings, as well as resistance to temperature and pressure extremes, are other advantages that aluminum has for aircraft applications. The easy manufacture of smaller airplane parts is made possible by formability. Alloys of aluminum provide great electrical conductivity. Aluminum provides a more affordable option to other material types due to its lightweight characteristics. Less fuel usage and overall cost savings are advantages of lighter airplanes.

Restrain

Escalating environmental issues brought on by aluminum extraction

One of the biggest issues in urban life is air pollution. Emission removal technologies must be addressed because the industry is a major source of airborne pollutants. The manufacture of aluminum is a developing industry that necessitates planning and attention due to the hazardous pollutants it releases, including particulate matter, NOx, SO2, dioxins, mercury chloride, furans, and fluorine compounds. Large amounts of pollution are created in the aluminum electrolysis and alumina manufacturing units, which, in the best-case scenario, emit 1.07, 4.73, and 1.32 kg of sulfur dioxide, nitrogen dioxide, and particle pollutants for every tonne of finished aluminum produced.

Acidic precipitation, which makes catchments more acidic and increases the amount of aluminum in soil solutions and freshwaters, is the primary cause of aluminum's current environmental effects. Both the aquatic and terrestrial ecosystems are significantly impacted. By producing a loss of plasma and hemolymph ions and osmoregulatory failure in gill-breathing species like fish and invertebrates, aluminum acts as a hazardous agent in aquatic environments.

Opportunity

Increasing preference for aluminum extrusions over steel owing to superior performance

Among the most widely utilized metals in the manufacturing sector are steel and aluminum. Aluminum is a lightweight metal that weighs about one-third as little as copper or steel. But because of its excellent strength-to-weight ratio, aluminum extrusions are a good choice for the building sector. When appropriately alloyed or handled, aluminum can be up to 43 times stronger than steel and up to some steel grades.

Aluminum material has a maximum tensile strength of up to 90,000 psi (pounds per square inch) or even more. As a result, efforts are being made in the manufacturing sector to replace steel with aluminum. Due to the damaging impacts of plastics made with oil on the environment, the global manufacturing industry is progressively moving toward a non-plastic world. The most prevalent metal in the crust of the earth and one of the most well-known sustainable resources is aluminum.

Segment Insights

Product Insights

Standard Calcined Alumina has the major share in specialty alumina market. The increased popularity of electronic gadgets like cellphones, computers, and televisions is predicted to fuel the electronics industry's expansion. Electronic ceramics, which are utilized in many different electronic components, including capacitors and semiconductors, are made from colloidal alumina. Numerous industries, including aerospace, automotive, and medical, are predicted to see a surge in the demand for high-quality polishing materials.

Due to its superior polishing qualities, colloidal alumina is frequently utilized in various industries as a polishing medium. In the chemical industry, colloidal alumina is frequently employed as a catalyst support material.

The need for colloidal alumina as a catalyst support material is being driven by the expansion of the chemical sector, particularly in emerging economies. The expansion is furthered by the expanding building and construction sector. The development of the building and construction industry, which is the main consumer of steel, cement, glass, and ceramics, as well as other important calcined alumina application areas, is what drives the market for this product.

The density, particle size distribution, and purity of the material have an impact on the price and performance of calcined alumina. The demand for white fused alumina has increased significantly in recent years. This is because white fused alumina performs well and is becoming more popular in a range of applications.

Application Insights

In terms of applications, the ceramics sector held a sizable market share in 2023. Applications for advanced ceramics, technical ceramics, honeycomb ceramics, spark plugs, high voltage insulators, and wear parts are just a few of the many types of ceramics that are used in industry. Due to its strong mechanical, electrical, thermal, and chemical characteristics, including hardness, dielectric qualities, and a high melting point, calcined alumina is a frequently utilized raw material in practically every ceramic application.

Regional Insights

North America: Advanced manufacturing

North America dominates the market as a strong presence of foremost aerospace, semiconductor, automotive, and electronics organizations creates huge demand for specialized aluminas in components, catalysts, and energy storage. Major focus on technological developments, advancing novel grades, and exploring new manufacturing methods such as reactive additive manufacturing, which drives the growth of the market.

U.S. Specialty Alumina Market Trends

A sizeable portion of the global market is accounted for by the United States. Sales of alumina are relatively significant in the area and account for a sizable share of the market worldwide. People have started valuing colloidal alumina because it can potentially replace conventional refractory castable binders as a binding agent. Outlook for the Chinese specialty alumina market

Asia Pacific: Growing world's top manufacturers and exporters

Asia Pacific is the fastest-growing market due to the growing production of semiconductors, demand for industrial space, and data centers. Also, Artificial intelligence (AI) and machine learning are transforming chip design, enhancing productivity and lowering the expenses and time to market significantly, which drives the specialty alumina market.

China Specialty Alumina Market Trends

Given that China is the country that consumes the product the most globally, an increase in demand is anticipated there as well. The market is experiencing tremendous expansion as a result of the expanding demand for this commodity from massive aluminum smelters. Aluminum Corporation of China Ltd. (Chalaco) began construction on the second production line of the Huasheng, China-based alumina refinery in November 2020. The company will be able to produce more alumina due to the new production line, which will also help them gain more market share.

Europe: Advancement in next-generation vehicle design.

Europe is significantly growing in the market as alumina-driven materials are applied in a broad range of applications in developed manufacturing, aerospace, locomotive, industrial furnaces, and other areas. Europe is the foremost technical conference focused on the future of battery thermal engineering for next-generation production design, which contributes to the growth of the market.

The UK Specialty Alumina Market Trends

Novel UK feasibility study using Lucideon's Flash Sintering to produce beta-alumina for sodium batteries, lowering expenses and enhancing performance. The UK government actively helps the developed materials field via initiatives such as the National Materials Innovation Programme, whose goal is to accelerate the commercialization of cutting-edge innovations.

Value Chain Analysis - Specialty Alumina Market

- Raw Material:

The main raw material for specialty alumina is bauxite ore, a naturally occurring mineral rich in aluminum hydroxides (gibbsite, boehmite, diaspore).

Key Players: Norsk Hydro and Chalco - Clinical Trials:

Specialty alumina manufacturing includes refining bauxite ore through the Bayer process to get pure alumina powder, then further processing it through methods like calcination, fusion, or sintering to create high-purity, controlled-grain materials.

Key Players: Rio Tinto and Alcoa - Waste Management:

Waste management in the specialty alumina industry primarily involves the safe handling, storage, processing, and utilization or disposal of two major by-products: bauxite residue (red mud) and spent pot lining (SPL).

Key Players: Almatias and Hindalco

Specialty Alumina MarketCompanies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Almatis |

Germany |

Comprehensive product portfolio |

Hindalco Industries, the world's largest aluminium company by revenue and the metals flagship of the $28 billion Aditya Birla Group, has announced the acquisition of a 100 per cent equity stake in US-based AluChem Companies. |

|

Alteo |

France |

Strong Financial Position |

In March 2024, Alteo, the world leader in the production of specialty alumina, announced the completion of its fourth expansion project of grinding capacity in Korea. |

|

CHALCO |

China |

Strong government support |

In May 2025, Aluminum Corporation of China Limited (Chalco) successfully developed an alumina replacement product. |

|

Jingang |

China |

Affordability and cost-effectiveness |

Jingang New Materials Co., Ltd. has an annual production capacity of 200,000 metric tons of high-temperature α alumina powder and 150,000 metric tons of microcrystal and wear-resistant alumina ceramics. |

|

Sumitomo Chemical |

Japan |

Strong R&D and innovation |

In November 2025, Sumitomo Chemical reached an agreement to acquire a Taiwanese semiconductor process chemicals company. |

Other Major Key Players

- Hindalco

- Showa Denko

- Nippon Light Metal

- Nalco

- Nabaltec

- Shandong Aopeng

- Motim

- Huber Corporation

- ICA

- Silkem

Recent Development

- Gränges & Alcoa Partner for Low-Carbon Aluminum Production in June 2021. An agreement to collaborate on a project aimed at minimizing the environmental impact of the aluminum value chain was announced by the Swedish rolling aluminum company Gränges AB and also the American aluminum industry pioneer Alcoa Corp.

- In Apr 2021, Kaiser Aluminum Company stated that it had successfully acquired Alcoa Warrick LLC from Alcoa Corporation ("Alcoa") for a purchase cost of $670 million. This acquisition included all of the properties of the Warrick Rolling Mill.

Segment Covered in the Report

By Product Type

- Standard Calcined Alumina

- Tabular Alumina

- White Fused Alumina

- Medium Soda Calcined Alumina

- Low Soda Alumina

- Others

By Application

- Refractory Materials

- Ceramics

- Abrasives and Polishing

- Catalyst

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting