Alumina Market Size and Forecast 2025 to 2034

The global alumina market size is estimated at USD 46.83 billion in 2025 and is anticipated to reach around USD 70.8 billion by 2034, expanding at a CAGR of 4.70% from 2025 to 2034.

Market Highlights

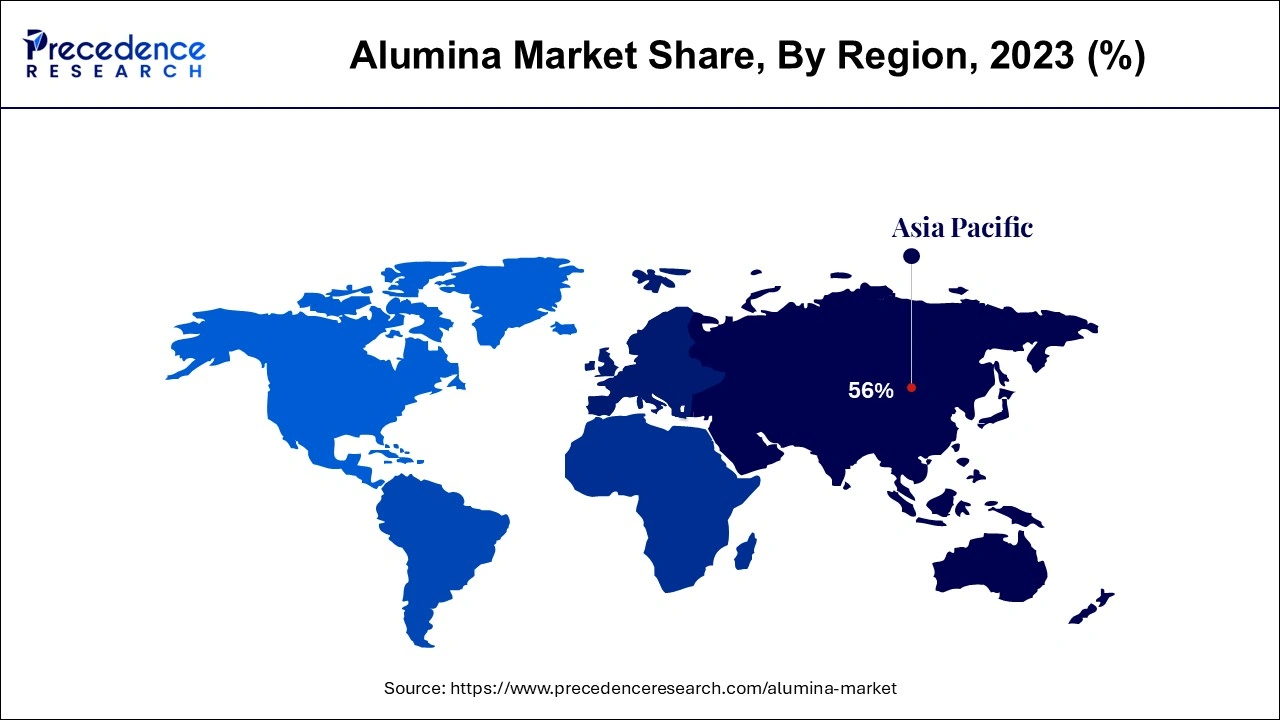

- Asia Pacific dominated alumina market in 2024.

- By grade, the smelting quality alumina sector segment dominated the market in 2024.

Market Size and Forecast

- Market Size in 2025: USD 46.83 Billion

- Market Size in 2026: USD 49.03 Billion

- Forecasted Market Size by 2034: USD 70.8 Billion

- CAGR (2025-2034): 4.70%

- Largest Market in 2024:Asia Pacific

What is alumina?

A white crystalline ingredient with the popular name "Alumina," aluminum oxide, is typically made from bauxite. It is extensively utilized in a variety of engineering disciplines, such as those involving anti-corrosion compounds, wear and abrasion-resistant components, and the computer industry. The quality attributes of alumina include great durability, brightness, minimal heat emission, and good stability at high temperatures. Alumina is now an expensive substance.

The automotive industry is continually being dominated by improved alumina components because of their superior performance and safety. Global automakers are changing their tastes by swapping out steel and iron elements with lightweight materials because lighter materials increase fuel efficiency. The market with alumina will increase significantly due to the rising need for lightweight body panels and improved load-bearing capabilities for light-duty commercial vehicles. In the nourishing term, the demand for premium alumina will be impacted by the rapidly expanding automotive sectors in emerging economies.

The consumer devices and building sectors actively create possibilities as a result of the modern standard of living. In recent years, alumina has been widely used for roof and wall cladding, incorporating frames, stairways, and panels. Wall cladding is frequently used in commercial buildings due to its affordability, usefulness, and attractive appearance.

Alumina Market Growth Factors

The rising demand from the automobile & building and construction sectors is one of the major reasons behind the expansion of the global alumina industry. The alumina market is anticipated to rise significantly over the projected period as a consequence of high rises in construction investment in industrialized and developing nations as an outcome of rapid urbanization & wealth creation. Furthermore, it is anticipated that throughout the projection period, demand for alumina would increase due to the growing need for lighter and rising components to increase automotive fuel efficiency and lower carbon footprint. Additionally, rising automotive production & sales are anticipated as a result of global economic growth, especially in developing nations, and rising per capita discretionary money. This is anticipated to further support the growth of the global alumina market throughout the forecast period.The change in the food and beverages sector toward packaged foods, particularly in developing economies like China, India, and Brazil, is also another factor anticipated to fuel the expansion of the global alumina market.

The rapid growth of packaged beverages and food goods in developing nations is predicted to increase the need for alumina in the packaging sector. Nevertheless, it is anticipated that the expansion of the alumina industry would be constrained over the forecast timeframe by severe competition from substitute materials like glass or plastic. Even though the fact that the requirement for alumina is anticipated to rise sharply due to rapid growth from the automobiles, building, and construction industries, the worldwide market is anticipated to face some difficulties due to varying raw material costs and the accessibility of substitute materials like glass as well as plastic materials. But because of its qualities including low weight, good strength, elasticity, good electrical and thermal conductance, resistance to corrosion, and permeability need for alumina are anticipated to rise throughout the projection timeframe.

Alumina Market Outlook:

- Industry Growth Overview: Between 2025 and 2030, an increase in demand for alumina is expected due to a rise in aluminum production, refractories, and developing applications in battery materials. The largest areas of growth will remain in the Asia-Pacific region, with benefits from industrialization and electrification efforts. In particular, China and India will account for the majority of growth.

- Sustainability Trends: Green manufacturing of alumina is garnering attention as companies pursue low-carbon calcination and recycling of aluminum waste. This activity coincides with tightening global emissions regimes and the introduction of ESG-driven industrial policies.

- Global Expansion: Major players are investing in expanding capacity in Asia, the Middle East, and Africa, so they can establish bauxite sources nearer to their plants and reduce the cost of logistics. For example, Rusal and Alcoa have announced new refining projects that target high-purity alumina markets.

- Key Investors: Strategic and financial investors are getting in on the action, drawn by the potential for energy-efficient production and increasing demand for EV batteries. Brookfield Asset Management and the Canada Pension Plan Investment Board - CPP Investment Board - are funding alumina refining and smelting projects.

- Startup Ecosystem: Companies enter the startup ecosystem with a focus on high-purity alumina, recycling, and related processes and technologies to create battery-grade materials. Companies such as Constellium Technologies and Alumina Innovations are creating visibility around solutions that are scalable and sustainable.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 46.83 Billion |

| Market Size in 2026 | USD 49.03 Billion |

| Market Size by 2034 | USD 70.8 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.70% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product,By Grade,By Application,By End User, and Region |

| Regions Covered | North America,Europe,Asia-Pacific,Latin America,Middle East & Africa |

Market Dynamics

Key Market Drivers

Growing alumina use in the medical & defense sectors

- By 2030, the worldwide alumina market is anticipated to rise due to rising alumina use in the defense and healthcare sectors. The advantages of alumina include its lightweight weight and high strength, which improve the efficacy of chest armor such as breastplates utilized by the military as well as armor for aircraft and vehicles. Additionally, it is widely used to create ballistics & bulletproof glass. Importantly, rising geopolitical tension around the world is predicted to increase government spending on defense and military operations, which is expected to fuel market growth over the projection period.

Demand for LED lighting is increasing

- Due to considerations including expanding LED lighting consumption and falling LED prices, HPA is becoming increasingly necessary. LED goods have a significant rate of adoption amongst end customers since they are dependable, sturdy, and long-lasting.

Increasing lithium-ion battery demand

- The worldwide economy will be stimulated by the multiplicative desire for lithium-ion batteries as a result of the increased use of electric cars and communal demand for mobile apps. High-purity alumina industry demand is projected to increase due to the growing need for lithium-ion batteries as a result of the increased use of electric cars.

Demand in the market is being boosted by increasing applications in smart devices

- Manufacturers of high-purity alumina are expected to benefit from the growing demand for smart gadgets like smartwatches, smartphones, and rising plasma TVs.

Key Market Challenges

- Residues are subject to strict environmental standards -The global demand for high-purity alumina is anticipated to increase as a result of government regulations about alumina manufacturing leftovers.

- Limited technological expertise knowledge -The entire market is expected to be constrained in the foreseeable term due to inadequate expertise in alumina manufacturing.

Key Market Opportunities

- New uses for high-grade alumina in healthcare and defense - It is predicted that the future market demand for highly pure alumina would be stimulated by the usage of production equipment in the healthcare profession.

- High demand from construction, manufacturing, and automobile industries - The worldwide market is anticipated to face some difficulties due to rapidly changing raw material costs and also the availability of other materials like glass and polymers. The requirement for aluminum alloys is expected to rise significantly due to rapid growth from the construction, automotive, and construction industry. But because of qualities like lightweight, high tensile strength, elasticity, good temperature & electricity conductance, resistance to corrosion, and impermeability, the demand for alumina is anticipated to rise throughout the projected period.

- Use of alumina in a wide range of industries -Alumina is perfect for such a packaging sector because it is proven to significantly extend the shelf life of liquids and food without affecting their flavor. As a result, the broad use of alumina in a wide range of industries is projected to accelerate segmental growth in the decades to come.

Segment Insights

Product Insights

The biggest demand in the alumina market was for commercial alumina. The rising usage of alumina in end-use sectors like transportation, building, packing, and durable goods is to blame for the growing demand for a metallurgy grade. Moreover, it is anticipated that the need for alumina for a variety of product compositions would be drawn by worldwide economic progress along with strong prosperity projections for these sectors, providing market expansion shortly.

Grade Insights

In 2024, the smelting quality alumina sector held over 86% of the market share, and growth is anticipated to be significant through 2034. The increasing demand for alumina from finished sectors is to blame for this sector's expansion. Throughout the course of the research period, the emergence of the automobile sector in emerging nations will increase demand for premium alumina for use in exterior and interior bodywork, engine parts, and other applications. Due to the steady demand for premium aluminum components from the Asian Region and Latin America areas as a result of the expanding applications in finished industries, aluminum manufacturing from alumina will gain a sizable share of the market over the decades and it will create much more USD 48 billion by the end of 2030.

The car industry's increased use of aluminum components for interior and exterior components will increase the market share for alumina. 80% of the weight of contemporary commercial aircraft is made up of aluminum. Additionally, the construction industry in emerging nations will grow quickly, which will increase demand for aluminum.

Application Insights

In the alumina industry, the market for oxide for ceramics is anticipated to rise at the highest CAGR. Calcined alumina is primarily used in the creation of advanced ceramics. Due to its simplicity in blending with the other batch preparations, ability to regulate and distribute particle size, excellent power insulation, high strength, dielectric loss continuous, and superior corrosion resistance, the substance is preferred as the material of selection for ceramic production. Additionally, alumina components are simple to work with and machine using a variety of chemical and physical techniques, expanding its potential utilization base.

Regional Insights

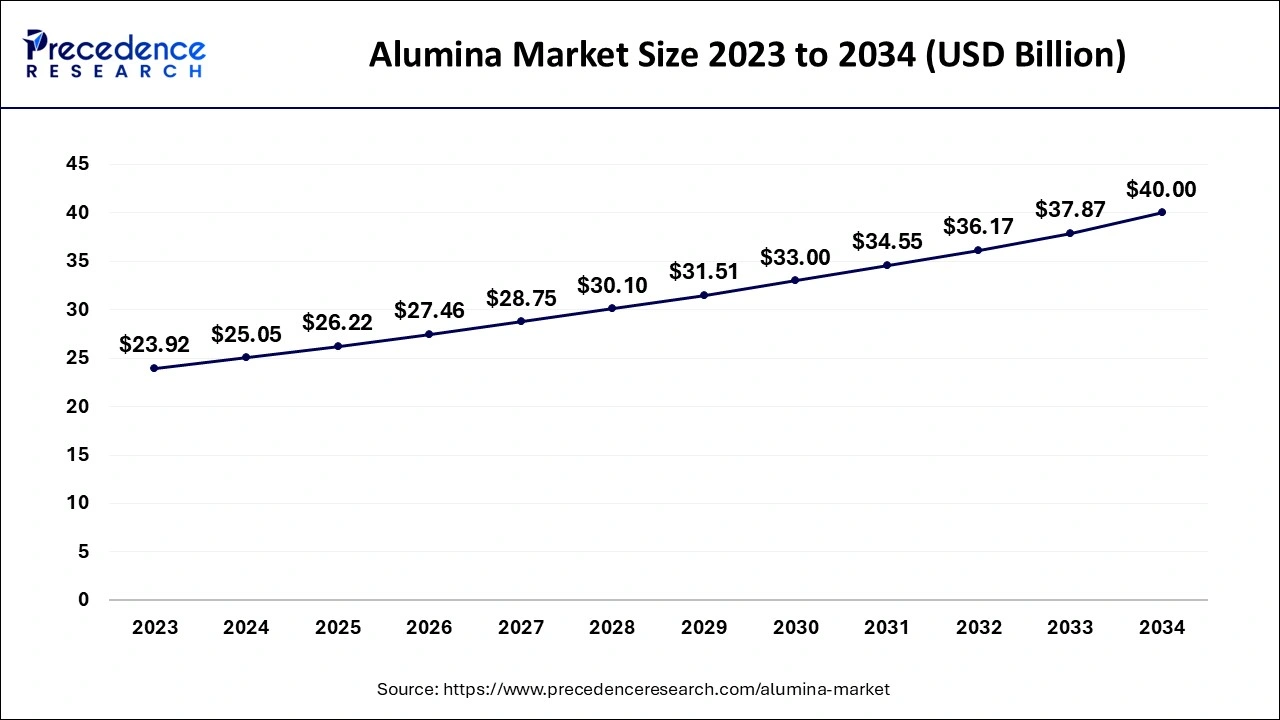

Asia Pacific Alumina Market Size and Growth 2025 to 2034

The Asia Pacific alumina market size is evaluated at USD 26.22 billion in 2025 and is predicted to be worth around USD 40.00 billion by 2034, rising at a CAGR of 4.79% from 2025 to 2034.

In 2024, the Asia-Pacific region had a primary market share of over 56%. China's domestic market makes a major contribution to the Asian Region and worldwide markets. China is known as the top producer and consumer of high-purity alumina, with more than 55percentage points of the market share by value and capacity. Furthermore, with over 15% of the Asian Region's highly pure alumina industry, Japan ranks as the second-largest market in the area. The important development factors influencing the highly pure alumina market in the Asia Pacific region are the presence of established businesses, the prevalence of emerging economies, the combined demand from the electronics and automotive sectors, and the growing preference for LED lighting.

Due to the region's expanding use of highly pure alumina within the semiconductor and electronics sectors, North American highly pure alumina maintained the second-largest market share of over 15% in 2024. Due to the ease with which raw materials can be obtained and the growing desire that enterprises have for them as a result of their superior features, the US is predicted to become the region's largest market.

North America is the fastest growing market for the alumina market with a significant CAGR during the forecast period, fueled by strong demand from sectors like automotive, aerospace, and electronics. Consumption and production are primarily led by the United States, which is seeing a rise in investments aimed at advancing research and development of innovative materials. Canada's focus on eco-friendly aluminum production, utilizing hydroelectric energy, further supports the region's growth trajectory. The increasing shift towards electric vehicles and renewable energy solutions heightens the need for high-purity alumina, vital for components in batteries and electronic devices. Ongoing infrastructure projects and advancements in technology establish North America as a key player in the global alumina market.

Latin America – The Resource-Driven Player

Latin America is expected to steadily grow in the alumina market due to abundant bauxite reserves and rising smelting capacity for aluminum. There were advantages in export markets, energy-efficient refining, and battery-grade alumina for electric vehicles. The region is also seeing a shift towards specialty and high-purity alumina variants used in advanced applications, and there is growing interest in reducing import dependency by expanding domestic refining and processing capabilities.

Brazil Alumina Market Trends

Brazil was the leader in the Latin American alumina market due to an abundance of bauxite reserves and alumina production. Moreover, investment in sustainable refining and export-oriented projects improved market growth and helped the country lead the region. Export volumes have shown notable increases in past periods, reflecting Brazil's potential to serve international markets. Rising demand for “green” aluminum and investment in low carbon refining methods are shaping the market's future direction.

Middle East & Africa – The Energy Advantage Zone

The Middle East & Africa region expanded in the alumina market through the development of aluminum smelting operations and access to inexpensive energy, as well as opportunities in high-purity alumina manufacture, the expansion of infrastructure, and environmentally friendly production in support of industrial growth. Strategic dynamics also include a strong import dependency and growing interest in downstream processing and refining to capture more value. Overall, the MEA alumina market is stable but not rapidly expanding, driven more by sustaining feeds

UAE Alumina Market Trends

The UAE was the leader in alumina production and refining projects. Major investments in high-quality alumina and downstream production of aluminum products also contributed to the growth of the market. While production from local refineries, such as Emirates Global Aluminum's Al Taweelah plant, remains significant, the region still relies heavily on imports to meet demand, creating supply and price dynamics that influence the market. Modest volume and value growth are expected in the coming years, supported by ongoing investments in refining capacity, recycling, and downstream integration.

Canada

Canada plays a vital part in North America's alumina sector, mostly through its aluminum production that is powered by hydroelectric energy, ensuring a minimal carbon footprint. Central Canada is a hub for alumina consumption due to various primary aluminum facilities. Investments in sustainable methods and cutting-edge technologies strengthen Canada's position in the market. The nation's strategic emphasis on green manufacturing and export-oriented policies improves its international competitiveness in alumina production.

Europe Market Trends

Europe is observed to grow at a considerable growth rate in the upcoming period, driven by the region's commitment to sustainable practices and technological progress. Nations such as Germany and France are channeling investments into high-purity alumina production to address the growing needs of the electronics, automotive, and renewable energy fields. Strict environmental regulations promote the use of lightweight, energy-efficient materials, boosting alumina consumption. Partnerships among industry stakeholders and research institutions encourage progress in refining technologies, improving product quality and ecological compliance. Europe's dedication to a circular economy and green technologies highlights its significant role in the global alumina arena.

France

France is positioning itself as an important contributor to Europe's alumina market, focusing on producing high-purity alumina for uses in electronics, LEDs, and lithium-ion batteries. The country's dedication to sustainable development and technological innovation drives capital into refining processes. Collaborations between French firms and research entities aim to boost product quality and ecological adherence, establishing France as a notable player in the growth of the European alumina sector.

Alumina Market Companies

- AnPhat Holdings

- Avantium

- BASF

- Biotec

- Braskem

- Futerro

- iome Bioplastics

- Kaneka Takasago

- LyondellBasell Industries Holdings B.V.

- Matrìca S.p.A.

- Mitsubishi Chemical Holding Corporation

- NatureWorks LLC

- Novamont S.p.A.

- Plantic Technologies (Australia).

- PTT MCC Biochem Co., Ltd. (Thailand)

- SABIC

- Solvay

- SUPLA (JIANGSU SUPLA BIOPLASTICS CO., LTD.)

- Taghleef Industries (U.A.E.)

- TEIJIN LIMITED

- Toray Industries, Inc. (Japan)

- Total Corbion (Netherlands),

- Toyota Tsusho Corporation

- Trinseo S.A.

Recent Developments

- In March 2025, Russian aluminum company Rusal reached an agreement to acquire a 26% stake in India's Pioneer Aluminium Industries Limited with intentions to increase its ownership to 50%. This strategy aims to secure alumina supplies following disruptions caused by Australia's export ban and operational stoppages in Ukraine, underscoring India's rising significance in the global alumina landscape.

- In January 2025, METLEN revealed a USD 333.76 million investment to improve its production capacities in bauxite, alumina, and gallium. This initiative is set to enhance annual alumina production and initiate industrial gallium manufacturing in Europe. Long-term contracts with Rio Tinto to supply bauxite and alumina offtake reinforce this strategic expansion.

- In September 2024, Indonesia launched a USD 941 million smelter-grade alumina refinery in West Kalimantan, managed by state-run companies Aneka Tambang and Inalum. The facility aims to decrease raw material exports and fulfill domestic aluminum needs, with plans to boost production capacity and build an aluminum plant for alumina processing.

- Gränges & Alcoa Partner for Low-Carbon Aluminum Production In June 2021. An agreement to collaborate on a project aimed at minimizing the environmental impact of the aluminum value chain was announced by the Swedish rolling aluminum company Gränges AB and also the American aluminum industry pioneer Alcoa Corp.

Segments Covered in the Report

By Product

- Metallurgical Grade

- Refractory Grade

- Grinding Grade

- Others

By Grade

- Chemical

- Smelter

- Calcined

- Ordinary soda

- Medium soda

- Low soda

- Tabular

- Reactive

- Fused

- Aluminum Trihydrate

By Application

- Aluminum Production

- Non-Aluminum Production

- Abrasives

- Ceramics

- Refractories

- Filtration

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content