Catalyst Market Size and Forecast 2025 to 2034

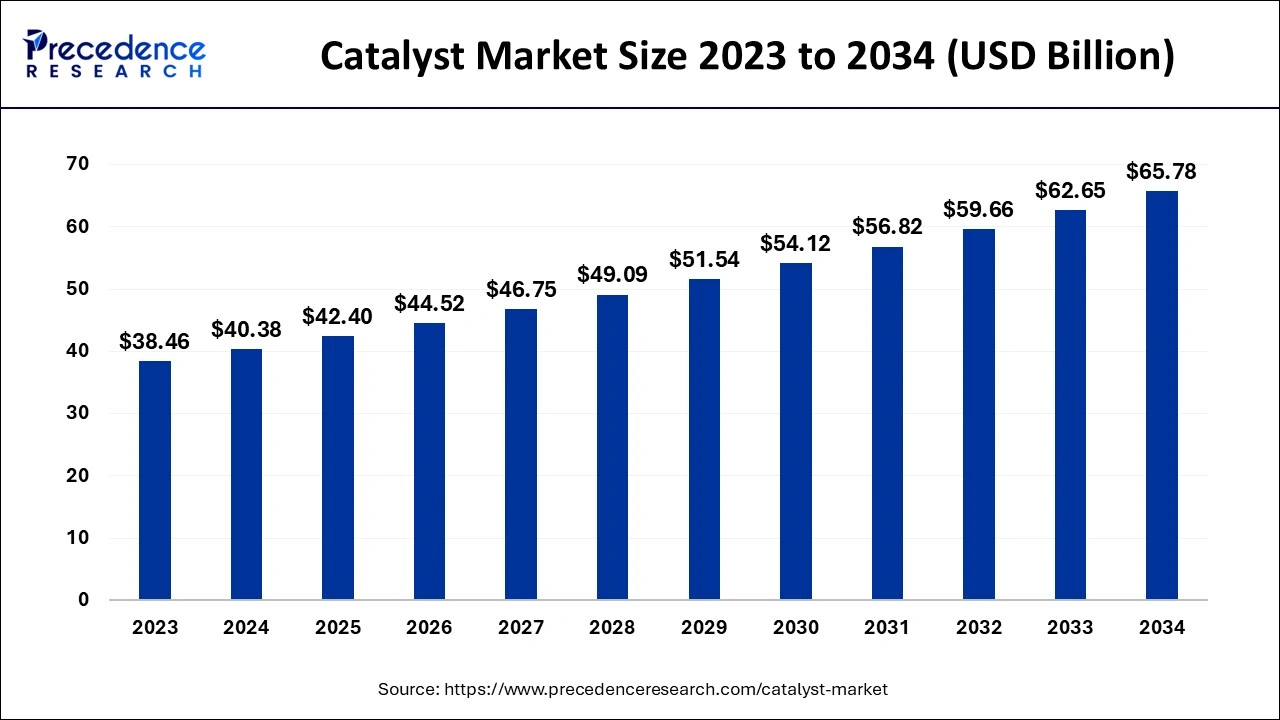

The global catalyst market size was estimated at USD 40.38 billion in 2024, and is anticipated to reach around USD 65.78 billion by 2034, expanding at a CAGR of 5% from 2025 to 2034.

Catalyst Market Key Takeaways

- In terms of revenue, the market is valued at $42.40 billion in 2025.

- It is projected to reach $42.4 billion by 2034.

- The market is expected to grow at a CAGR of 2% from 2025 to 2034.

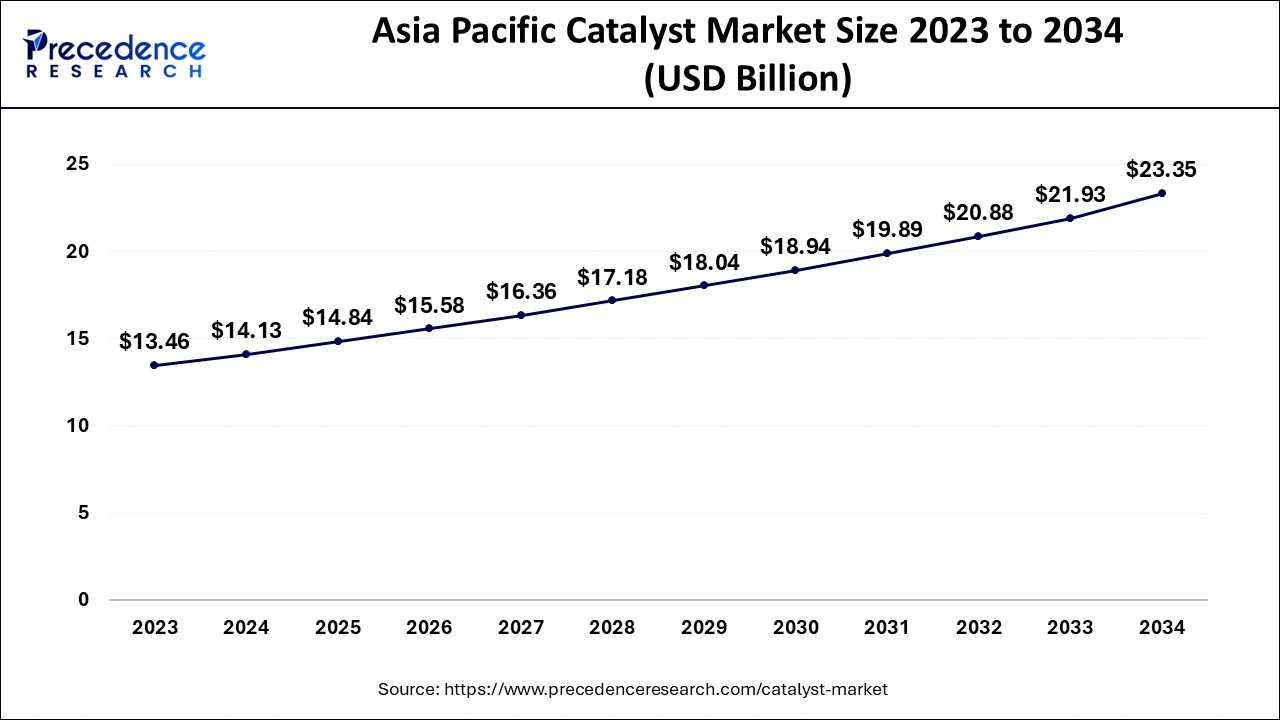

- The Asia-Pacific region is growing at a notable CAGR of 5% from 2025 to 2034.

- The enzyme type segment is registering a CAGR of 5.7% from 2025 to 2034.

- The regeneration process type segment is growing at a CAGR of 5.2% from 2025 to 2034.

- The environmental application segment is registering a CAGR of 5.8% from 2025 to 2034.

Asia Pacific Catalyst Market Size and Growth 2025 to 2034

The Asia Pacific catalyst market size is evaluated at USD 14.84 billion in 2025 and is predicted to be worth around USD 23.35 billion by 2034, rising at a CAGR of 5.14% from 2025 to 2034.

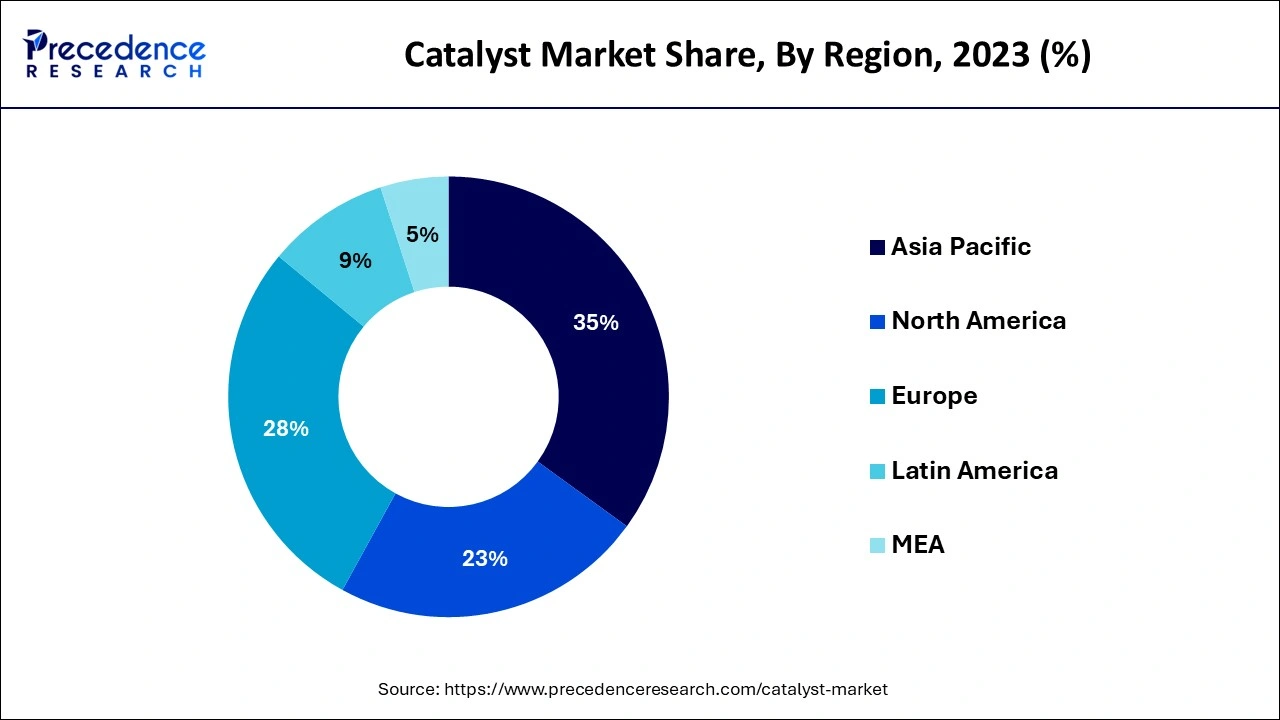

The Asia Pacific accounted for around 35% of the market share and dominated the global catalyst market in 2024. The Asia Pacific catalyst market is primarily driven by the chemicals, petrochemical, and automotive industries. China has a significant presence of polymer and chemical producing companies, which exponentially contributes to the growth of the Asia Pacific catalyst market. China has emerged as a manufacturing destination for the petrochemical and chemical products favored by the rising domestic demand and low costs of production. The favorable government policies pertaining to the FDIs and industrialization has significantly fostered the growth of the Asia Pacific catalyst market.

North America was the second-largest market in 2024. The evolving automobile mandates in North America has necessitated the environmental catalysts, which is significantly driving the growth of the North America catalyst market. The surging consumption of gasoline in the region is expected to boost the market growth in the forthcoming years. Gasoline is extensively used for converting the crude oil into light fractions like kerosene and diesel. The rising oil & gas and chemical sector in North America is further expected to drive the growth of the catalyst market.

The Middle East & Africa is estimated to be the most opportunistic market during the forecast period. This region accounted for around 5% of the global catalyst market in 2024. The oil & gas industry dominates in Saudi Arabia, Qatar, Kuwait, and Oman, which is expected to offer lucrative growth opportunities to the market players on account of petroleum refining. The surging domestic demand for the pharmaceuticals, packaging, construction, and automotive is expected to boost the growth of the chemicals industry and subsequently foster the growth of the catalyst market in Middle East & Africa.

Singapore Catalyst Market

The catalyst sector in Singapore is expanding, with the country being one of the Asia-Pacific centers in the refining of petroleum and the production of chemicals. This is due to the rising demand for catalysts in petroleum refining and other chemical synthesis, aided by the growing industry in petroleum refining, synthetic chemicals, and consumer base in Singapore.

The ability to influence environmental applications is increasing the need for catalysts, considering that Singapore has a strict policy of regulating emissions and green technologies. To reduce the impact on the environment, catalysts are more widely implemented in the emission control, waste treatment, and petrochemical sectors. Innovation in catalyst technologies through research and development funding by the government assists Singapore in sustaining a competitive advantage in this region.

Technology Advancement

Constant advances in technology result in a massive rise in the catalyst market as the main goal is to enhance efficiency and environmental sustainability in various industries. The efficient and selective catalysts being applied in automobile emissions control, catalysts that minimize harmful emissions and achieve regulatory requirements. In the refinery activities, the modern well-organized catalysts statistically improve the effectiveness of crude oil processing, improving the yield and reducing the amount of energy. All of these technological advances are key to streamlining industrial operations, but also to the limitation on the environmental footprint, and catalysts are one of the central components of modern manufacturing and environmental processes.

Catalyst Market Growth Factors

The demand for the catalysts is escalating owing to the surging applications in polymers and petrochemicals, petroleum refining, and chemical synthesis. Catalysts is used in various processes and helps in cost-saving, yield improvement, process optimization, and energy saving in the manufacturing sector. Moreover, there is a high demand for the environmental catalysts as it helps the manufacturers to meet the stringent regulatory mandates pertaining to carbon dioxide, NOx, and Sox emissions. The rising carbon emission and subsequent climate changes has forced the government to shift towards renewable energy sources and the rising government initiatives towards this direction is stimulating the manufacturers to shift towards alternative fuel. The rising adoption of alternative energy and fuel such as biodiesel and shale gas fuel is expected to boost the demand for the catalyst in the foreseeable future.

Furthermore, the manufacturers are seeking for value addition to their feedstock by manufacturing value-added chemicals such as polyolefins and methanol. This has significantly fostered the demand for the catalysts in the petrochemical and chemical applications. The industrial usage of chemicals is directed towards cost reduction and scarcity of the catalytic types based on rare metals via the metal reclaiming process development. The growing focus on adopting more cheaper and abundant base metal catalysts and avoid the use of rare metals in the metal reclaiming process is expected to spur the growth of the global catalyst market. The rising energy demand owing to the rapid industrialization and rapid urbanization of rural areas across the globe is significantly boosting the demand for the catalyst in oil refining and is expected to foster the market growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 |

USD 65.78 Billion |

| Market Size in 2025 |

USD 42.40 Billion |

| Market Size in 2024 |

USD 40.38 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Process, Raw Material, Application, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Product Insights

Based on the product, the heterogeneous catalyst segment dominated the global catalyst market and accounted for around 73% of the market share in 2024. To reduce the toxicity of the homogeneous catalysts, it is converted into the heterogeneous catalysts through solid supports. Sulfonated carbon materials, sulfated zirconia, sulfonated MOF materials, and sulfonated silica materials are some of the examples of heterogeneous catalysts. There are certain benefits associated with the heterogeneous catalysts such as easy separation of catalysts, ease of application, and cost-effectiveness that has significantly driven the growth of this segment in the global catalyst market. Moreover, the rising acceptance of the heterogeneous catalyst in the production of biodiesel is expected to accelerate the growth of the heterogeneous segment during the forecast period.

The homogeneous catalyst segment is expected to witness a strong growth rate during the forecast period. Hydrochloric acid, boric acid, phosphoric acid, and sulfuric acid are the most common types of homogeneous catalysts. The homogeneous catalysts are known to provide better performance in the industrial and raw material reactions as compared to that of its heterogeneous counterpart. However, the homogeneous process releases toxic wastes that may cause environmental hazards. Therefore, the demand for the eco-friendly alternative is increasing significantly and the availability of the eco-friendly ad bio-degradable homogeneous catalyst like methanesulfonic acid has helped to fulfill this demand.

Raw Material Insights

Depending on the raw material, the chemical compounds segment led the global catalyst market, accounting for a revenue share of 38.4% in 2024. Chemical compounds such as calcium carbonate, sulfuric acid, and hydrofluoric acid are extensively used as catalyst raw materials for numerous applications in polymer, chemical, and petrochemical industries around the globe.

Metals is the second largest segment in the global catalyst market. Metals act as key catalyst used for accelerating the breaking process and re-arranging the aromatics.

Zeolites are another prominent type of raw material used in the catalysts. It is used in catalyzing and absorbent applications due to their large surface area and porosity. Zeolites are known for accommodating a diversity of ions that is supported by the porosity of the zeolites. Zeolites are obtained naturally and can also be commercially produced from the crystallization reactions.

Application Insights

Depending on the application, the chemical synthesis segment accounted for a market share of around 27% and dominated the global catalyst market in 2024. It includes raw material chemistry and raw materials where the processes like converting ammonia to nitric acid, Contact, and Haber involves the use of catalysts. Hence, the growth of the chemical synthesis segment is directly linked with the growth of the chemical industry. The superior characteristics of the chemical synthesis like promotion of enantioselective processes has fostered the applications of chemical synthesis.

Catalyst Market Top Companies

- Albemarle Corporation

- BASF SE

- Evonik Industries AG

- LyondellBasell Industries Holdings B.V.

- Arkema

- W. R. Grace & Co.-Conn.

- Johnson Matthey Plc

- Axens SA

- Clariant International Ltd.

- ExxonMobil Corporation

- Umicore

Recent Developments

- In January 2023, Albemarle Corporation launched Ketjen specialist brand providing bespoke advanced catalyst solutions focused on petrochemical, refining, and specialty chemicals.

(Source: https://www.nasdaq.com) - In May 2023, Johnson Matthey (JM) and Hystar signed a three-year strategic supply agreement to support renewable hydrogen production using catalysts in the membrane electrode assemblies to facilitate electrolysis and produce renewable hydrogen.

(Source: https://matthey.com) - The market is moderately fragmented with the presence of several domestic and global market players. These market players are constantly engaged in various developmental activities like partnerships, mergers, acquisitions, and new product launches to gain competitive edge over others and gain market share. The rising investments by these market players in the research and development is expected open up new opportunities in the foreseeable future.

Segments Covered in the Report

By Product

- Heterogeneous Catalyst

- Homogeneous Catalyst

By Process

- Recycling

- Regeneration

- Rejuvenation

By Raw Material

- Chemical Compounds

- Acid

- Amines

- Peroxide

- Others

- Zeolites

- Linde Type A (LTA)

- Mobil Five

- Faujasite (FAU)

- Others

- Metals

- Base Metal

- Precious Metal

- Organic Material

- Enzymes

- Others

By Application

- Heterogeneous Catalyst

- Chemical synthesis

- Chemical catalysts

- Adsorbents

- Syngas production

- Others

- Petroleum refining

- FCC

- Alkylation

- Hydrotreating

- Catalytic Reforming

- Purification

- Bed grading

- Others

- Polymers and petrochemicals

- Ziegler Natta

- Reaction Initiator

- Chromium

- Urethane

- Solid Phosphorous Acid catalyst

- Others

- Environmental

- Light-duty vehicles

- Motorcycles

- Heavy-duty vehicles

- Others

- Chemical synthesis

- Homogeneous Catalyst

- Chemical synthesis

- Chemical catalysts

- Syngas production

- Adsorbents

- Others

- Petroleum refining

- FCC

- Hydrotreating

- Alkylation

- Bed grading

- Catalytic Reforming

- Purification

- Others

- Polymers and petrochemicals

- Ziegler Natta

- Chromium

- Reaction Initiator

- Urethane

- Solid Phosphorous Acid catalyst

- Others

- Environmental

- Light-duty vehicles

- Heavy-duty vehicles

- Motorcycles

- Others

- Chemical synthesis

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting