Polypropylene Catalyst Market Size and Forecast 2025 to 2034

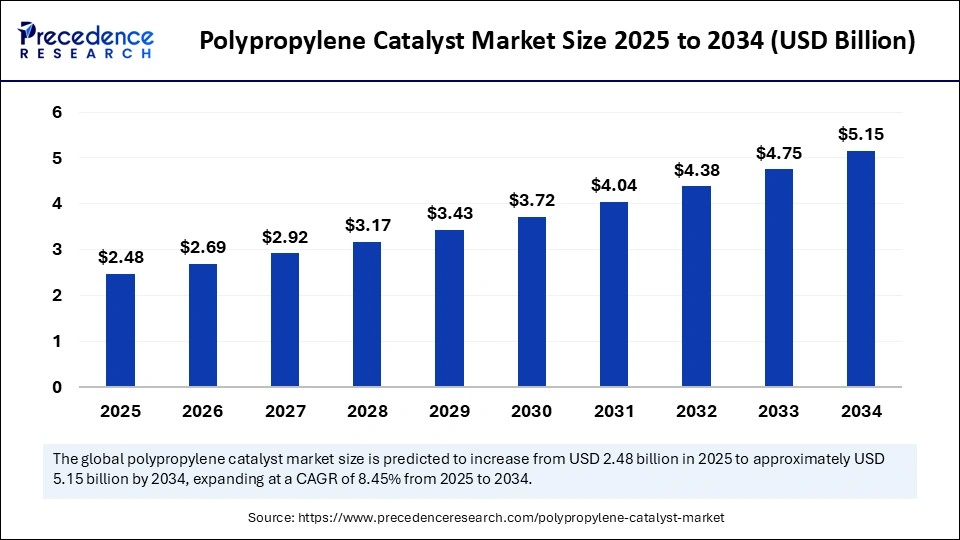

The global polypropylene catalyst market size accounted for USD 2.29 billion in 2024 and is predicted to increase from USD 2.48 billion in 2025 to approximately USD 5.15 billion by 2034, expanding at a CAGR of 8.45% from 2025 to 2034. The market is growing due to increasing demand for high-performance polypropylene in packaging, automotive, and construction applications, driven by its lightweight, durable, and cost-effective properties.

Polypropylene Catalyst Market Key Takeaways

- In terms of revenue, the global polypropylene catalyst market was valued at USD 2.29 billion in 2024.

- It is projected to reach USD 5.15 billion by 2034.

- The market is expected to grow at a CAGR of 8.45% from 2025 to 2034.

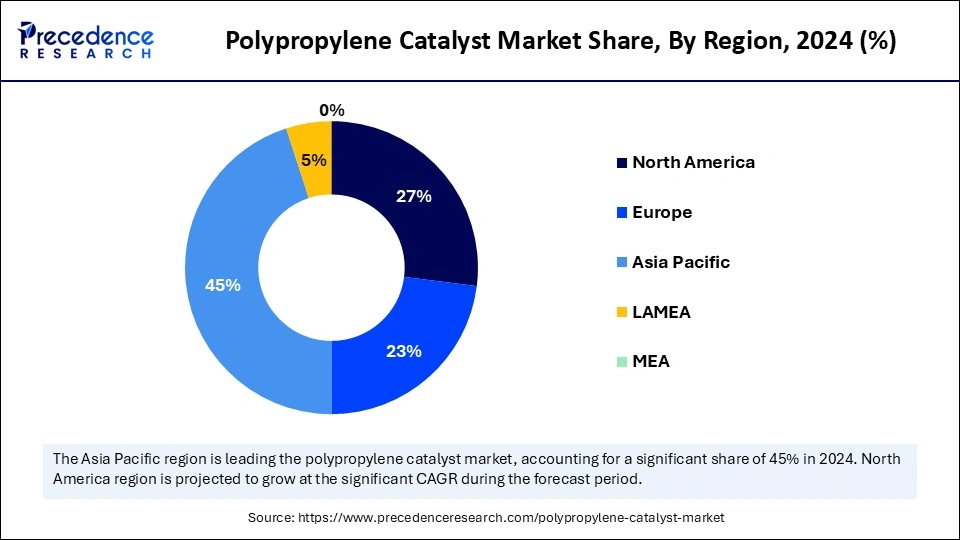

- Asia Pacific dominated the polypropylene catalyst market with the largest share of around 45% in 2024.

- North America is expected to grow at the fastest CAGR during the forecast period.

- By catalyst type, the Ziegler-Natta catalysts segment held the biggest market share of 60% in 2024.

- By catalyst type, the metallocene catalysts segment is expected to grow at the fastest CAGR during the forecast period.

- By manufacturing process, the bulk phase polymerization segment captured the highest market share of 55% in 2024.

- By manufacturing process, the gas phase polymerization segment is projected to grow at the fastest CAGR during the forecast period.

- By application, the injection molding segment held the largest share of 50% in 2024.

- By application, the film & sheet segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use industry, the packaging segment generated the major market share of 65% in 2024.

- By end-use industry, the automotive segment will expand rapidly in the coming years.

Impact of AI on the Polypropylene Catalyst Market

Since Artificial Intelligencefacilitates quicker research and development, increased process efficiency, and enhanced sustainability, it has a profoundly transformative effect on the polypropylene catalyst market. With AI-driven predictive modeling, digital simulations, and machine learning, manufacturers can now design catalysts with improved precision, customized properties, and faster commercialization timelines than in the past, when catalyst development involved lengthy cycles and expensive trial-and-error.

Artificial intelligence is essential in promoting environmentally friendly developments by assisting in the development of recyclable and energy-efficient catalysts that meet stringent legal requirements. To ensure consistent quality at an industrial scale, AI-powered digital twins and process optimization tools on the production side lower operational costs, increase yields, and minimize inconsistencies. In the quickly changing polypropylene catalyst market, artificial intelligence (AI) enables businesses to innovate more successfully, differentiate their products, and boost competitiveness by fusing scientific literature, regulatory data, and market demands.

Asia Pacific Polypropylene Catalyst Market Size and Growth 2025 to 2034

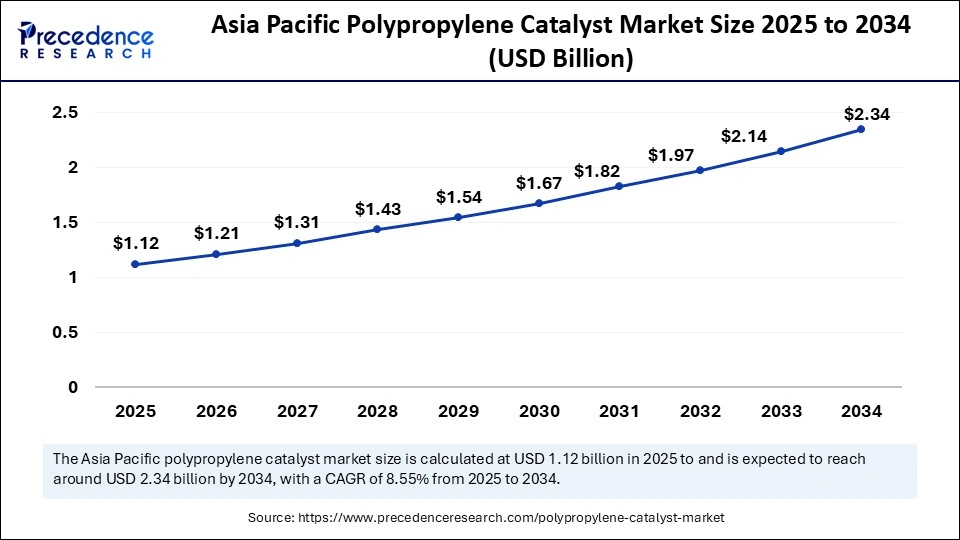

The Asia Pacific polypropylene catalyst market size was exhibited at USD 1.03 billion in 2024 and is projected to be worth around USD 2.34 billion by 2034, growing at a CAGR of 8.55% from 2025 to 2034.

Why did Asia Pacific dominate the polypropylene catalyst market in 2024?

Asia Pacific is dominating the polypropylene catalyst market, fueled by widespread industrialization, strong demand in industries like packaging and automotive, and strong manufacturing capacities. Its strong petrochemical infrastructure, stable economic climate, and rising consumption all contribute to its dominant position in the world market. To develop advanced catalysts and expand production facilities, the region is also seeing an increase in investments from both domestic and foreign players. Asia Pacific's position as the primary growth engine for the market is further reinforced by growing urbanization and consumer demand for plastics that are lightweight, strong, and reasonably priced.

North America

North America stands out as the fastest-growing region in the polypropylene catalyst market, propelled by technological innovation, advanced research and development, and a rising shift toward sustainability. The growing availability of feedstocks and increasing demand for high-performance polypropylene in sectors like healthcare, packaging, and transportation underpin this strong growth trajectory. Moreover, the region benefits from strong government support for innovation and energy-efficient production practices, which encourages manufacturers to adopt modern catalysts. With the rapid expansion of end-use industries and increasing focus on eco-friendly materials, North America is expected to record steady long-term growth in polypropylene catalyst adoption.

Why are Catalysts Important in Polypropylene Production?

Catalysts are crucial in polypropylene production because they have a direct impact on the polymerization process effectiveness and result. The strength, flexibility, and heat resistance of the polymer are determined by its molecular structure, tacticity, and crystallinity, all of which are under its control. Manufacturers can now precisely control the properties of polymers thanks to advanced catalysts like metallocene and Ziegler-Natta types, which enable them to produce polypropylene with properties for various applications. Catalysts also increase production efficiency by lowering energy consumption, boosting reaction rates, and minimizing waste, which makes the process more economical and environmentally friendly overall.

Polypropylene Catalyst Market Growth Factors

- Increasing demand for polypropylene across industries like packaging, automotive, construction, and healthcare.

- Advancements in catalyst technology, such as Ziegler-Natta and metallocene catalysts, have improved polymerization efficiency and product quality.

- Focus on sustainable production, with eco-friendly catalysts, reducing energy consumption, and environmental impact.

- Government regulations and incentives promote lightweight, durable, and recyclable plastics.

- R&D investments by key chemical manufacturers are leading to innovation and new catalyst development.

- Expansion of end-use applications for polypropylene, increasing overall polymer demand.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.15 Billion |

| Market Size in 2025 | USD 2.48 Billion |

| Market Size in 2024 | USD 2.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.45% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Catalyst Type, Manufacturing Process, End-Use Industry, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for polypropylene

It is a versatile, durable, and affordable polypropylene that finds extensive use in construction materials, healthcare products, automotive parts, and packaging. Growing demands for packaging in online retail, the consumer goods sector, and the automotive sector are all contributing to an increase in polypropylene consumption. Because of its lightweight nature, manufacturers are able to lower the overall weight of their products, which is crucial for applications in the automotive and aerospace industries. Production of polypropylene is becoming more and more necessary as industries grow, which in turn increases the need for effective catalysts. Additionally, polypropylene is a preferred material in many industries due to its chemical resistance and recyclability.

- On 29 October 2024, W.R.Grace & Co. announced expanded polypropylene operating capacity in India with Nayara Energy Limited. Nayara is also utilizing Grace's UNIPOL UNIPPAC process control software to operate the plant with optimal performance. (Source: https://grace.com)

Expansion of polypropylene applications

Applications of polypropylene are being extended beyond conventional sectors by new end-use industries and creative product designs. For instance, polypropylene is being used more in electronics, medical devices, and renewable energy industries. Catalyst consumption is increased in these applications due to the need for strong and lightweight materials. Because of its mechanical qualities and resistance to chemicals, polypropylene is also being driven by advancements in packaging and the expansion of e-commerce. This application diversity guarantees a steady need for catalysts in a variety of sectors.

Restraints

Fluctuating raw materials prices

A major source of feedstock for the production of polypropylene is natural gas and crude oil. The profitability of polypropylene and its catalyst market is impacted by unstable production costs caused by changes in global oil prices. Long-term planning is also challenging for manufacturers due to the volatility of raw material prices. Furthermore, OPEX+ policies, supply chain interruptions, and geopolitical tensions can all exacerbate price instability. New investments in catalyst technologies are deterred by this volatility.

Intense market competition

The supply of polypropylene catalyst is dominated by a small number of multinational corporations in this highly consolidated market. This hinders the growth of smaller businesses and causes fierce pricing competition. Differentiation also necessitates constant innovation, which puts additional strain on margins. Suppliers are compelled to lower prices due to the end-use industries' strong bargaining power. Consequently, despite rising demand, profit margins are squeezed.

Opportunities

Rising demand for lightweight materials in the automotive industry

Automotive manufacturers are increasingly using polypropylene because of its lightweight, long-lasting, and economical qualities in response to tighter emission regulations and fuel efficiency standards. There are significant prospects for catalysts that facilitate the production of high-performance polypropylene grades. Lightweight materials for battery casings, interiors, and exteriors will become increasingly important as electric vehicles grow in popularity. As a result, advanced catalysts designed for automotive applications have significant growth potential.

Sustainability and circular economy initiatives

Opportunities for the production of environmentally friendly polypropylene are being created by the global emphasis on recycling, lowering carbon footprints, and fostering a circular economy. Catalysts that facilitate increased use of recycled content or encourage chemical recycling are becoming more popular; manufacturers of catalysts who create greener solutions will gain new sources of income as regulations force businesses to adopt sustainable practices.

Catalyst Type Insights

Why did the Ziegler-Natta catalysts segment dominate the polypropylene catalyst market in 2024?

The Ziegler-Natta catalysts segment dominates the polypropylene catalyst market because of their widespread industrial adoption, proven manufacturing techniques, and affordability. Consistent polymerization is made possible by these catalysts, which makes them ideal for creating a variety of polypropylene grades with desired chemical and mechanical characteristics. Manufacturers continue to choose them for a variety of applications due to their adaptability in creating isotactic polypropylene and scalability in large-scale industrial processes.

The metallocene catalysts segment is emerging as the fastest-growing segment due to their ability to deliver superior product uniformity, precise molecular weight distribution, and enhanced transparency of polypropylene. Their advanced features allow for customization of polymer structures, catering to high-performance applications in packaging, automotive, and healthcare sectors. As industries demand materials with improved strength, clarity, and processability, the adoption of metallocene catalysts is expected to accelerate significantly in the coming years.

Manufacturing Process Insights

Why did the bulk phase polymerization segment dominate the polypropylene catalyst market in 2024?

The bulk phase polymerization segment dominated the market because of its scalability for large-scale production, high efficiency, and low energy requirements. This method minimizes the use of solvents and improves control over polymer properties, making it economical and environmentally beneficial. Its dominance is further reinforced by its ability to reliably produce premium polypropylene grades appropriate for consumer goods, textiles, and packaging.

The gas phase polymerization segment is witnessing the fastest growth as it offers greater flexibility, lower operational costs, and suitability for continuous large-scale production. The process allows for simplified plant design, reduced waste, and enhanced efficiency, making it highly attractive to manufacturers. With rising demand for specialty polypropylene grades and advancements in gas-phase reactor technologies, this method is rapidly gaining traction in the global market.

ApplicationInsights

Why did the injection molding segment dominate the polypropylene catalyst market in 2024?

The injection molding segment dominated the market because it is widely used to create components with intricate shapes and durability. In the consumer goods, electronics, automotive, and packaging sectors, where strength, rigidity, and accuracy are essential, it is widely used. The robust dominance of polypropylene in industrial applications is guaranteed by its capacity to provide reliable performance and cost-effectiveness.

The film & sheet segment is growing rapidly, fueled by the growing need for protective sheets, agricultural films, and flexible packaging. The use of polypropylene catalysts in this application improves the mechanical strength barrier qualities and film clarity, satisfying the changing needs of the food and packaging sectors. The market for this segment is predicted to grow rapidly due to growing consumer preferences for eco-friendly and lightweight packaging materials.

End Use Industry Insights

Why did the packaging segment dominate the polypropylene catalyst market in 2024?

The packaging segment dominates the polypropylene catalyst market as polypropylene is extensively used in food containers, bottles, caps, films, and other flexible packaging materials. Its lightweight nature, chemical resistance, and affordability make it the material of choice for large-scale packaging solutions. Growing e-commerce activities and the rising demand for safe, hygienic, and sustainable packaging further reinforce its dominance across the market.

The automotive segment is growing rapidly, driven by the growing demand for lightweight materials that lower emissions and improve fuel efficiency. Because of its exceptional durability and affordability, polypropylene finds extensive use in bumpers, under-the-hood applications, and automotive interiors. Globally, there is a growing need for advanced polypropylene grades in automotive applications due to the trend toward electric vehicles and sustainability.

Value Chain Analysis

- Feedstock Procurement

Reliable sourcing of titanium precursors, magnesium chloride, supports electron donors and co-catalysts such as trialkylaluminums is essential for the production of polypropylene catalysts. Specialized ligands and activators like MAO are also necessary for metallocene catalysts. While multi-supplier strategies lower the risk of shortages, securing high-purity inputs is crucial to preventing catalyst poisoning. This stage promotes sustainable supply chains, guarantees uniformity, and reduces procurement expenses.

Key Players : W. R. Grace & Co., Albemarle Corporation, Evonik Industries, LyondellBasell Industries N.V.

- Chemical Synthesis & processing

At this point, complex reactions involving titanium chlorides, donors, and supports for Ziegler–Natta systems or ligand–metal complexes for metallocenes are used to create catalyst formulations. The performance of polymers and reactor operability depend heavily on controlled morphology and particle homogeneity. Process enhancements aim to increase activity, decrease donor usage, and handle pyrophoric co-catalysts more safely. Plant efficiency and polymer quality are directly impacted by this step.

Key Players : Clariant AG, Mitsui Chemicals, Toho Titanium Co. Ltd., Sumitomo Chemical Co. Ltd.

- Regulatory Compliance & Safety Monitoring

Catalyst manufacturing and usage must align with stringent safety and environmental frameworks such as OSHA, Seveso, and ATEX. Compliance ensures safe handling of toxic chlorides and pyrophoric aluminums while meeting emission standards for solvents. Certification and stewardship programs help expand market adoption, especially in food-contact and medical-grade polypropylene applications.

Key Players: W. R. Grace & Co., Mitsui Chemicals, Albemarle Corporation, Clariant AG

Polypropylene Catalyst Market Companies

- LyondellBasell Industries

- W. R. Grace & Co.

- Clariant AG

- BASF SE

- Evonik Industries AG

- Mitsui Chemicals, Inc.

- China Petrochemical Corporation (Sinopec)

- Sumitomo Chemical Co., Ltd.

- Univation Technologies, LLC

- Japan Polypropylene Corporation

- TOHO Titanium Co., Ltd.

- INEOS Group

- SABIC

- Reliance Industries Limited

- Chevron Phillips Chemical Company

- ExxonMobil Chemical Company

- TotalEnergies

- LG Chem

- Formosa Plastics Corporation

- PetroChina Company Limited

Recent Developments

- On 19 August 2025, Vioneo launched the world's first industrial-scale, fossil-free polypropylene production complex in Antwerp, Belgium, utilizing Lummus's Novolen polypropylene technology powered by green methanol and renewable energy. The plant will be part of Vioneo's complex that, once complete, will be the world's first industrial-scale fossil-free plastics production complex. (Source: https://www.lummustechnology.com)

- On 7 July 2025, SIBUR announced initiated pilot testing of its first metallocene polypropylene catalyst, marking a major step toward indigenous catalyst production in Russia by 2027. Metallocene catalyst application allows precise control of polymer structure and characteristics - improving transparency, flexibility, impact strength, and thermal resistance. (Source: https://www.interfax.com)

Segments Covered in the Report

By Catalyst Type

- Ziegler-Natta Catalysts

- Conventional Ziegler-Natta

- Supported Ziegler-Natta

- Metallocene Catalysts

- Single-site Metallocene

- Chiral Metallocene

- Others

- Hybrid Catalysts

- Novel Proprietary Catalysts

By Manufacturing Process

- Bulk Phase Polymerization

- Loop Reactor

- Bulk Reactor

- Gas Phase Polymerization

- Fluidized Bed

- Slurry Bed

- Slurry Phase Polymerization

- Solution Polymerization

- Slurry Reactor

- Others

- Emerging Techniques

- Specialized Pilot Processes

By Application

- Injection Molding

- Automotive Components

- Consumer Goods

- Blow Molding

- Bottles & Containers

- Industrial Drums

- Film & Sheet

- Packaging Films

- Agricultural Films

- Fiber & Raffia

- Textiles

- Woven Products

- Others

- Medical Devices

- Miscellaneous Industrial Applications

By End-Use Industry

- Packaging

- Flexible Packaging

- Rigid Packaging

- Automotive

- Interior Components

- Under-the-Hood Components

- Building & Construction

- Pipes & Fittings

- Insulation Materials

- Electrical & Electronics

- Insulation

- Housings

- Healthcare

- Medical Devices

- Pharmaceutical Packaging

- Others

- Consumer Goods

- Industrial Products

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting