What is the Titanium Market Size?

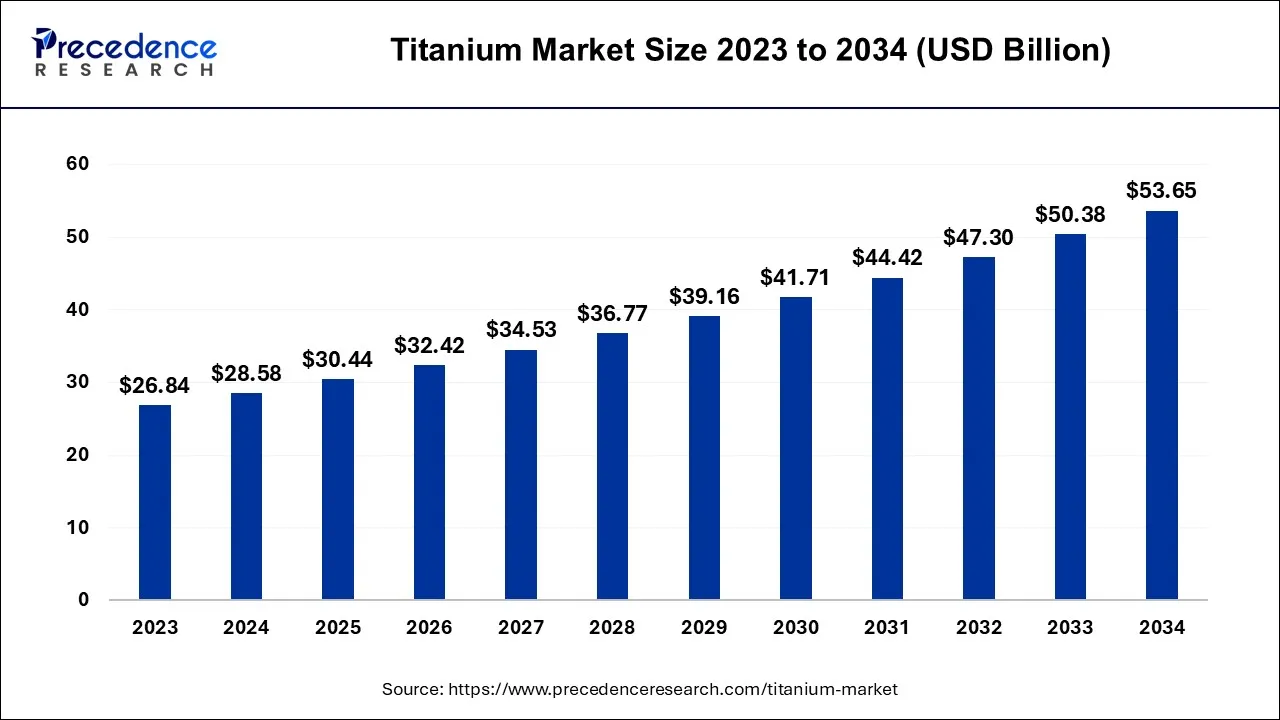

The global titanium market size was valued at USD 30.44 billion in 2025, and is projected to hit around USD 32.42 billion by 2026, and is anticipated to reach around USD 56.79 billion by 2035, expanding at a CAGR of 6.43% over the forecast period from 2026 to 2035.

Titanium Market Key Takeaways

- In terms of revenue, the market is valued at $30.44 billion in 2025.

- It is projected to reach $56.79billion by 2035.

- The market is expected to grow at a CAGR of 6.43% from 2026 to 2035.

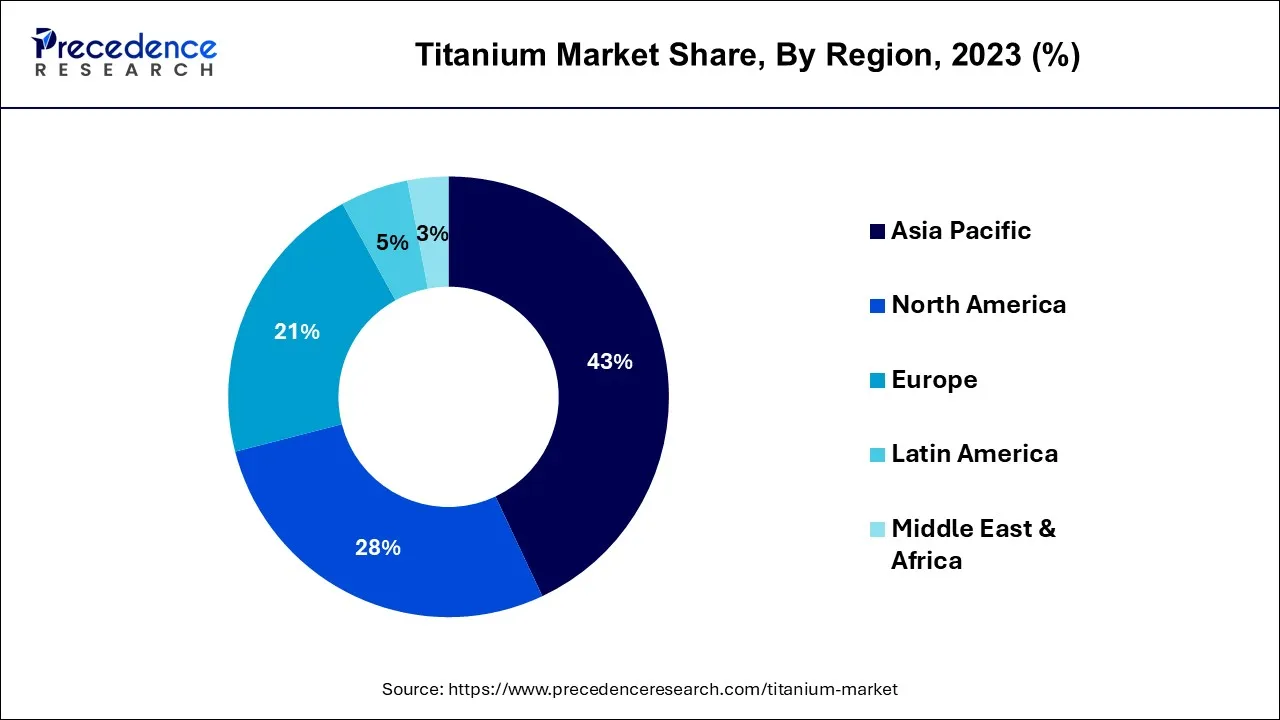

- Asia Pacific contributed more than 43% of revenue share in 2025.

- North America is estimated to expand the fastest CAGR between 2026 to 2035.

- By Microstructure, the alpha and near-alpha alloy segment has held the largest market share of 38% in 2025.

- By Microstructure, beta alloy segment is anticipated to grow at a remarkable CAGR of 7.8% between 2026 to 2035.

- By End-user Industry, the automotive and shipbuilding segment had the largest market share of 26% in 2025.

- By End-user Industry, the other end-user industries segment is expected to expand at the fastest CAGR over the projected period.

What is the Titanium?

The titanium market constitutes a global economic sector revolving around the extraction, processing, and dissemination of titanium, a prized metal celebrated for its remarkable strength-to-weight ratio, immunity to corrosion, and ability to withstand high temperatures. It enjoys extensive applications in aerospace, defense, medical implants, and various industrial domains.

The market's expansion primarily hinges on the surging demand in these fields, with the aerospace and aviation industries playing a pivotal role. Supply sources encompass the mining of titanium ores, chiefly ilmenite and rutile, followed by refining and the development of titanium alloys. Geopolitical factors, technological innovations, and end-user sectors collectively influence market dynamics, thereby affecting the price and availability of titanium.

How is AI contributing to the Titanium Industry?

Smarter additive production and alloy design are used to enhance titanium production with the aid of AI. Machine learning is used to analyze laser power, scan speed, and spacing to build dense, high-performance. Simulative models predict the behavior of alloys under extreme aerospace and defense conditions. Virtual testing lowers the physical testing and minimizes the time of qualification. Micro defects are found in milliseconds by AI-driven inspection.

Titanium Market Growth Factors

The titanium market experiences significant impetus from the escalating needs of the aerospace and aviation sectors. Titanium's extraordinary attributes, including its impressive strength-to-weight ratio and resistance to corrosion, position it as the material of choice for aircraft components. The relentless quest for lightweight, fuel-efficient aircraft is driving a surge in titanium usage in pivotal areas such as structural components, engines, and landing gear. The ever-expanding global travel industry fuels a continuous demand for advanced, long-lasting materials, consequently propelling the market's growth trajectory.

The defense sector serves as another potent catalyst for the titanium market. Titanium's robustness and resilience make it invaluable for the production of military vehicles, armor plating, naval vessels, and components for cutting-edge weaponry. In a geopolitical landscape marked by increasing complexity, countries are allocating significant resources to enhance their defense infrastructure, amplifying the requirement for titanium materials.

The remarkable biocompatibility and corrosion resistance of titanium renders it a preferred material for crafting a diverse array of medical implants, ranging from hip and knee replacements to dental prosthetics and surgical instruments. With the world's population steadily aging and medical technology continuously advancing, the demand for titanium within the healthcare sector is poised for substantial growth.

The corrosion resistance and tolerance for high temperatures exhibited by titanium render it indispensable in a multitude of industrial applications. It is integrally employed in the construction of chemical processing equipment, heat exchangers, and desalination facilities where durability and reliability are paramount. As various industries continue to expand, the demand for titanium-based solutions in these critical applications concurrently surges.

Elevated environmental consciousness is bringing sustainable practices to the forefront in a multitude of industries. The extended lifespan and recyclability of titanium align with the growing emphasis on sustainability. Corporations that incorporate titanium in their operations stand to benefit from the surging demand for eco-friendly choices as responsible environmental decisions ascend in priority.

Market Outlook

- Industry Growth Overview: Lightweight corrosion-resistant applications are reinforced in the aerospace, medical, and automotive applications.

- Sustainability Trends: Hydrogen reduction through closed-loop recyclability reduces the intensity of carbon production.

- Major investors: VSMPO, AVISMA, ATI Titanium Metals Corporation, Timet, Osaka Titanium Technologies, Toho Titanium, and Baoji Titanium Industry.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 56.79Billion |

| Market Size in 2025 | USD 30.44 Billion |

| Market Size in 2026 | USD 32.42 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.43% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Microstructure, End-user Industry and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Aerospace and aviation

The aerospace and aviation sector is a predominant force propelling the growth of the titanium market. Titanium's extraordinary combination of strength, lightweight properties, and exceptional resistance to corrosion is in high demand for aircraft manufacturing. With the aviation industry's unwavering pursuit of fuel efficiency, the use of titanium in aircraft components has become increasingly pivotal. Its application spans across structural elements, engines, landing gear, and more, contributing to lighter and more fuel-efficient aircraft, in line with global environmental and economic imperatives.

Furthermore, the expansion of the global travel industry fuels the continuous need for advanced, durable materials. Aircraft must withstand extreme conditions while ensuring passenger safety, and titanium excels in meeting these rigorous demands. With aerospace and aviation continually evolving to meet increased passenger demands and safety regulations, the titanium market is poised for sustained growth, as it remains an essential element in the ongoing advancements of aircraft design and performance.

- In October 2024, Kyhe Tech launched sustainable titanium alloy powders using innovative DH-S technology. By sourcing recycled titanium and minimizing energy-intensive processes, the company has reported having achieved significant reductions in greenhouse gas emissions and waste generation.

Restraint

Limited availability of high-quality ore

The restricted availability of premium-grade titanium ore is a substantial impediment to the burgeoning titanium market. Titanium primarily originates from ores like ilmenite and rutile, and the ore's quality significantly impacts the efficiency and economics of titanium extraction. Superior-quality ore boasts elevated titanium dioxide content and reduced impurities, streamlining the refining process and yielding a more desirable end product. However, sources of such superior ore are scarce and often scattered across different regions, giving rise to logistical complexities in securing a consistent supply chain.

The reliance on lower-quality ore necessitates intricate and energy-intensive refining procedures for impurity removal, resulting in escalated production expenses. Consequently, the cost of titanium products can soar, curtailing their competitiveness within the market. Though there are ongoing initiatives aimed at locating alternative sources or enhancing ore quality through technological advancements, the constrained availability of high-quality ore remains a notable constraint thwarting the expansion of the titanium market.

Opportunity

Alternative energy sources

The titanium market is being positively influenced by the rising prominence of alternative energy sources, including wind and solar power. Titanium's remarkable resistance to corrosion and its impressive strength-to-weight ratio make it a preferred material for pivotal components in renewable energy technologies. Wind turbines, specifically, reap the advantages of titanium in the production of lightweight, resilient, and corrosion-resistant parts like blades, fasteners, and gearboxes.

Titanium's extended lifespan ensures the dependability of these systems, translating into reduced maintenance expenses and minimal downtime, crucial factors in the realm of renewable energy. Additionally, titanium finds application in desalination plants, supporting sustainable water supply solutions in regions facing water scarcity. With the world's shift towards cleaner and more sustainable energy alternatives to combat climate change, the demand for titanium within the renewable energy sector is on an upward trajectory, presenting an encouraging avenue for market expansion and innovation.

- In March 2025, PIM Korea launched titanium production to boost IT, robotics, and autonomous driving. Starting this year, we plan to fully launch new businesses in information technology (IT), autonomous driving, and robotics based on our titanium production technology,” said the company.

Segment Insights

Microstructure Insights

According to the microstructure, the alpha and near-alpha alloy segment has held 43% revenue share in 2025. The alpha and near-alpha alloy segment holds a substantial growth in the titanium market due to its unique microstructure characteristics. These alloys consist primarily of the alpha phase, which imparts excellent strength, corrosion resistance, and high-temperature capabilities. Their microstructure allows for optimal performance in aerospace applications, where lightweight and durable materials are crucial.

Additionally, these alloys find use in critical industries such as medical implants and chemical processing, benefiting from their biocompatibility and resistance to corrosive environments. Their microstructural attributes make alpha and near-alpha alloys preferred choices, sustaining their significant share in the titanium market.

The beta alloy segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. The beta alloy segment holds significant growth in the titanium market due to its advantageous microstructure. Beta titanium alloys exhibit a balance of properties, offering high strength, good formability, and corrosion resistance. This microstructure allows for versatile applications across industries such as aerospace, automotive, and medical.

The ability to tailor the microstructure of beta alloys through heat treatment further enhances their performance characteristics. As a result, beta alloys are favored for critical components in aircraft, medical implants, and various engineering applications, making them a prominent and versatile choice in the titanium market.

End-user Industry Insights

Based on the end-user industry, the automotive and shipbuilding segment is anticipated to hold the largest market share of 38% in 2025. The dominance of the automotive and shipbuilding segments in the titanium market can be attributed to their distinctive demand for materials that combine strength, lightness, and resistance to corrosion. Titanium's exceptional attributes position it as the material of choice in these industries, enabling the reduction of vehicle weight for enhanced fuel efficiency in the automotive sector while simultaneously improving the longevity and robustness of marine vessels.

In the automotive realm, the stringent requirements of emission standards are met through the integration of titanium in exhaust systems and lightweight structural components. In shipbuilding, the deployment of titanium in critical elements like propellers ensures durability against corrosive seawater, ultimately lowering maintenance expenditures. These factors underscore titanium's predominant presence in these end-user sectors.

On the other hand, the others segment is projected to grow at the fastest rate over the projected period. The segment holds a significant share in the titanium market due to its diverse applications and versatility. This segment encompasses a wide range of industries, such as chemical processing, power generation, and automotive, which utilize titanium for its corrosion resistance, strength, and durability. Additionally, emerging applications in alternative energy, environmental technologies, and consumer goods further contribute to this segment's prominence. The adaptability of titanium to unique requirements in these various industries, combined with its potential for innovation, positions it as a major player in the overall titanium market.

Regional Insights

What is the Asia Pacific Titanium Market Size?

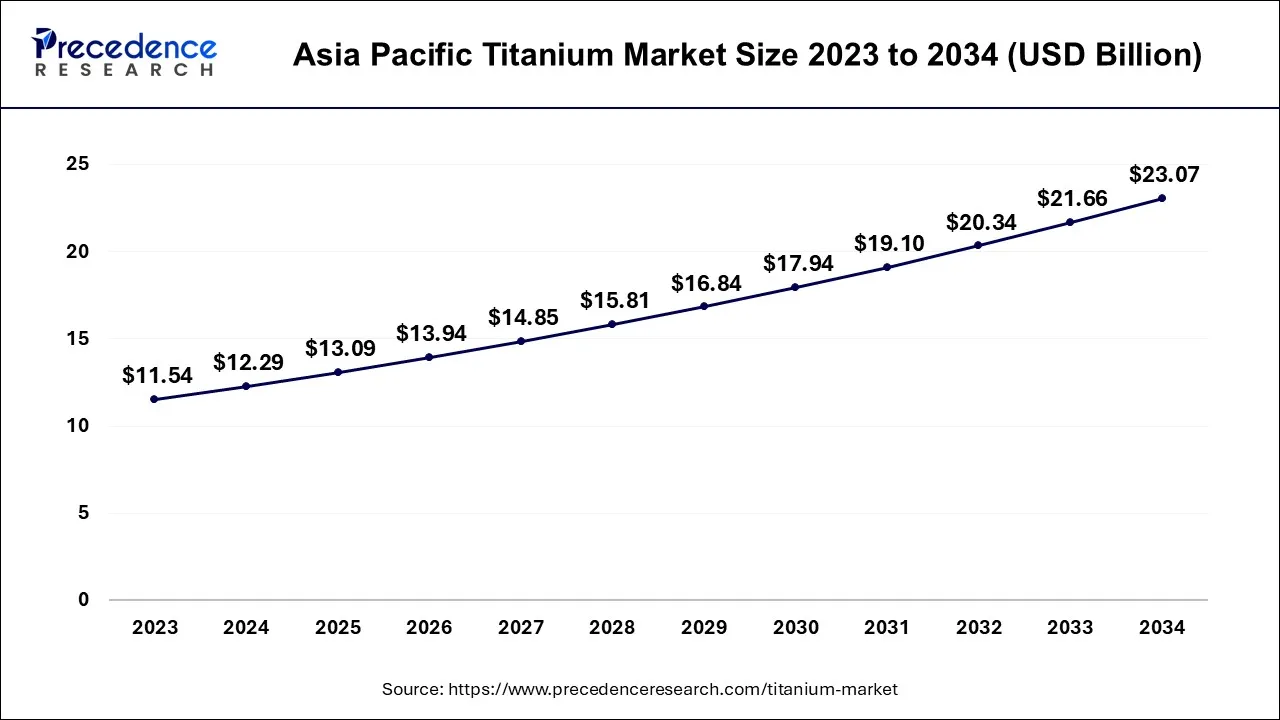

The Asia Pacific titanium market size is calculated at USD 13.09 billion in 2025 and is projected to be worth around USD 24.42 billion by 2035, poised to grow at a CAGR of 6.43% from 2026 to 2035.

Asia Pacific has held the largest revenue share of over 43% in 2025. Asia Pacific dominates the titanium market due to several factors. First, it is home to major titanium producers and consumers, with China leading in both production and demand. Additionally, the growing aerospace, automotive, and industrial sectors in countries like China and India have boosted titanium usage.

Moreover, Asia Pacific's expanding infrastructure projects and increasing focus on sustainable practices have driven titanium demand in construction and environmental applications. The region's economic growth, coupled with a burgeoning middle class, has further fueled demand for titanium in consumer goods, consolidating its significant share in the global market.

In November 2024, IREL (India) Limited, a Central Public Sector Undertaking (CPSU) under the Department of Atomic Energy (DAE), Government of India, and Ust-Kamenogorsk Titanium and Magnesium Plant JSC (UKTMP JSC) of Kazakhstan entered a partnership to form a joint venture, IREUK Titanium Limited. This venture aims to produce titanium slag in India.

North America is estimated to observe the fastest expansion. North America holds significant growth in the titanium market for several reasons. The region boasts a robust aerospace and defense sector, which is a major consumer of titanium due to its unique properties. Additionally, North America's advanced healthcare industry relies on titanium for medical implants, further increasing demand. The continent's well-established manufacturing infrastructure and technological advancements in titanium production contribute to its dominance. Furthermore, the focus on sustainability and eco-friendly practices aligns with titanium's recyclability, bolstering its use in various applications. These factors collectively position North America as a key player in the global titanium market.

Value Chain Analysis of the Titanium Market

- Feedstock Procurement: Ilmenite, rutile, and titanium slag used in the production of sponge pigment.

Key players: Rio Tinto Group, Iluka Resources Limited, Kenmare Resources plc - Chemical Synthesis and Processing: Making sponge pigment through the Kroll chloride process.

Key players: The Chemours Company, Venator Materials PLC, Kronos Worldwide Inc. - Compound Formulation and Blending: The blending of titanium, aluminum, and vanadium powders to be used in industrial aerospace.

Key players: Titanium Metals Corporation (TIMET), Howmet Structure Systems, Allegheny Technologies Incorporated - Quality Testing and Certification: Testing aerospace ASTM purity composition properties.

Key players: EAG Laboratories (Eurofins), 6NAPSE Group, RVS Quality Certifications - Titanium Packaging and Labelling: Accurate labeling and containment to avoid contamination, to prevent storage and transportation.

Key players: Swastik Interchem Private Limited, Neelgiri Chemicals, Salvia Cosmeceuticals

Titanium Market Companies

- VSMPO-AVISMA Corporation: Provides titanium sponge ingots, forgings, plates, and tubes that are integrated to provide high-strength mill products that are certified by global aerospace manufacturers.

- Allegheny Technologies Incorporated: Manufactures improved titanium alloys, powder metals, and complex forged parts backing aerospace defense and favored energy execution requests.

- Timet (formerly Titanium Metals Corporation): Offers vertically integrated services of supplying sponge to melted bars, sheets, and aircraft structural pipes.

Other Major Key Players

- Norsk Hydro ASA

- Toho Titanium Co., Ltd.

- BaoTi Group

- Tronox Limited

- Cristal

- Japan Aluminums Corporation

- Reading Alloys

- OSAKA Titanium Technologies Co., Ltd.

- RTI International Metals (acquired by Alcoa Corporation)

- JSC VSMPO-AVISMA (Verkhnaya Salda Metallurgical Production Association)

- Haynes International, Inc.

- Luxfer Group

Recent Developments

- In May 2025, Tekna received major orders for titanium MIM powder totaling CAD 5.2 million. These sales have historically been strong contributors to our cash flow, and it is reassuring to have multiple customers for this material now, signaling an increase in demand and potential for margin improvement,” said Luc Dionne, CEO of Tekna.

- In April 2025, IperionX, based in Charlotte, North Carolina, USA, announced that the Board of Directors of the Export-Import Bank of the United States has approved an equipment finance loan of USD 11 million. Subject to the completion and execution of definitive documentation, this loan will support the significant expansion of IperionX's advanced titanium manufacturing capabilities.

- In February 2023, Midhani, also known as Mishra Dhatu Nigam Limited, the defense public sector metallurgy unit, showcased its latest five nickel and titanium metal alloy products, which are high-strength, lightweight, anti-corrosive, and malleable, for use in strategic sectors of defense and aerospace, as well as various other civilian applications, during the ongoing ‘Aero-India 2023' show in Bengaluru.

- In July 2022,Perryman Company's ambitious expansion plans in Pennsylvania underscore the increasing demand for titanium in aerospace and medical applications. The installation of additional electron beam and vacuum arc remelt furnaces signifies the industry's response to the growing need for titanium, solidifying Perryman's position as a global leader in titanium melting.

- Aurubis AG's construction of a multi-metal recycling plant in Georgia, USA, in November 2021 is a significant step toward sustainable metal recycling. This facility, capable of processing various metal-bearing materials, including titanium cables, highlights the industry's commitment to environmental responsibility and its aim to strengthen its presence in the North American market by producing a substantial amount of blister titanium annually. These developments collectively demonstrate the titanium industry's efforts to adapt to evolving market demands and sustainability goals.

Segments Covered in the Report

By Microstructure

- Alpha and Near-alpha Alloy

- Alpha-beta Alloy

- Beta Alloy

By End-user Industry

- Aerospace

- Automotive and Shipbuilding

- Chemical

- Power and Desalination

- Other End-user Industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting