What is Ilmenite Market Size?

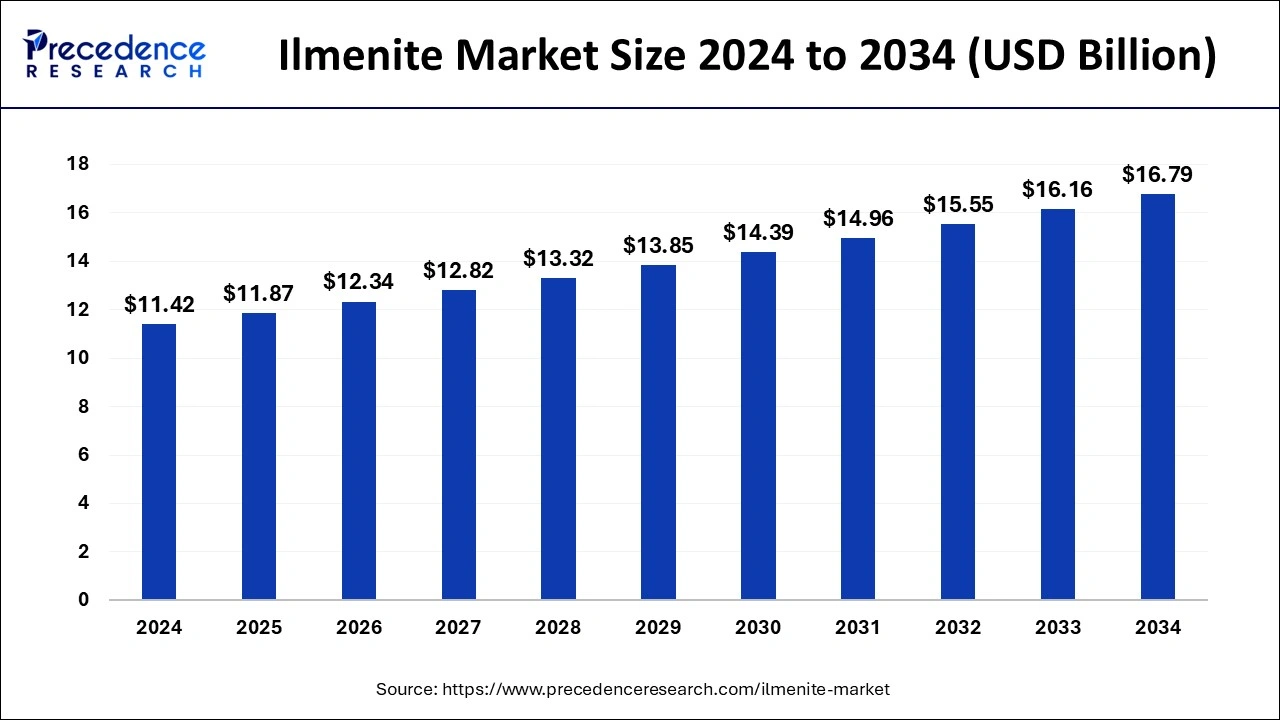

The global ilmenite market size is calculated at USD 11.87 billion in 2025 and is predicted to reach around USD 16.79 billion by 2034, expanding at a CAGR of 3.93% from 2025 to 2034. The ilmenite market growth is attributed to the increasing demand for ilmenite for titanium dioxide manufacturing.

Market Highlights

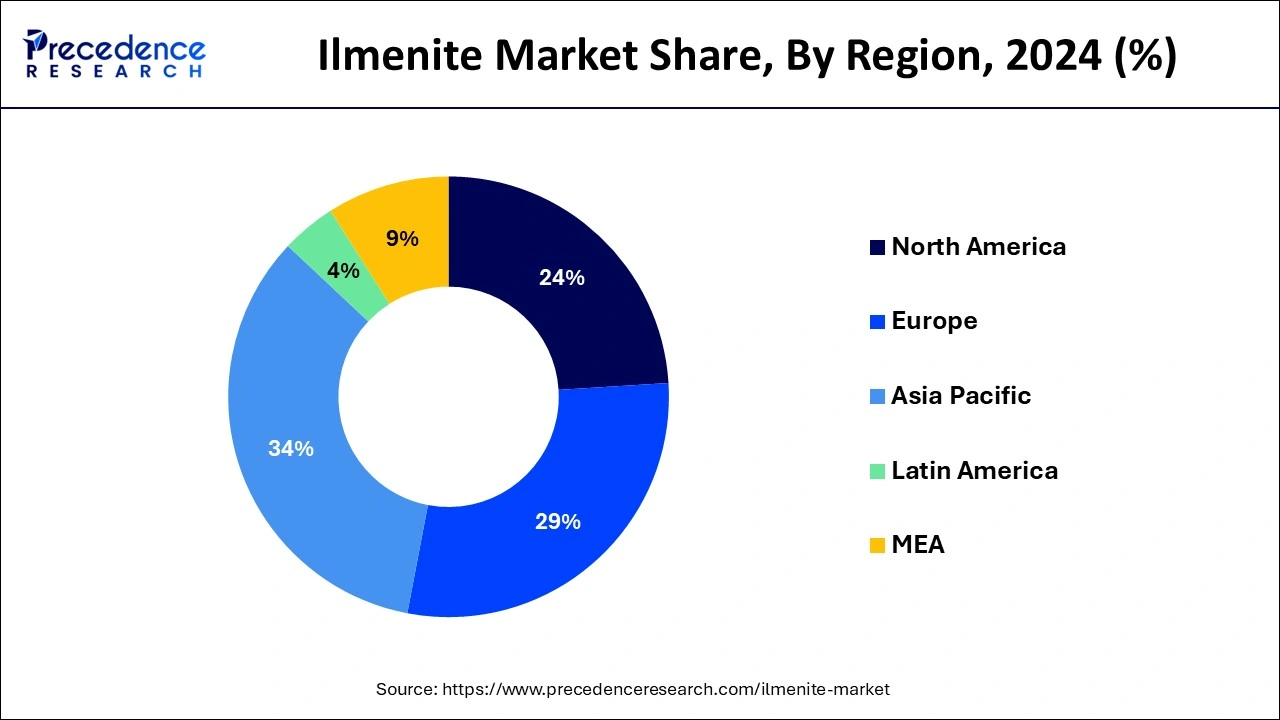

- Asia Pacific dominated the global ilmenite market with the largest market share of 34% in 2024.

- North America is projected to host the fastest-growing market in the coming years.

- By application, the titanium dioxide segment held a major market share of 90.23% in 2024.

- By application, the titanium metal segment is expected to grow at the fastest CAGR during the forecast period.

- By end-user, the paints and coatings segment accounted for the highest market share in 2024.

- By end-user, the plastic segment is anticipated to grow with the highest CAGR during the studied years.

Impact of Artificial Intelligence (AI) on the Ilmenite Market

Businesses utilize artificial intelligence analytical tools to determine that more attractive reserve that cuts expenses and impacts the environment less in the ilmenite market. Intelligent and complex formulas let miners perform predictive maintenance of equipment that is used in mines, hence enhancing effectiveness and longevity. AI also helps in improving market forecasts mainly through analyzing the trends in the real-time data and demands that the stakeholders need to make. Additionally, intelligent automation is effective in enhancing the organizational flow of production and increasing manufacturing quality.

What is ilmenite?

Ilmenite is the primary ore of titanium and the main source of titanium dioxide. It is a weakly magnetic solid that is black or steel-gray in color. Rising demand for titanium dioxide (TiO) in the paint, coating, plastic, and paper industries will facilitate the ilmenite market in the coming years. Due to its high light resistance and opaque nature, TiO is crucial to any application seeking to create high-quality, long-lasting, and eco-friendly products. Moreover, it's a key ingredient in industries such as automotive due to the increased need for superior coatings that provide a better appearance and long-lasting. Future innovations in methods for producing TiO?, including production methods that are efficient and environmentally friendly.

- A survey carried out by the U.S. Environmental Protection Agency (EPA) in 2024, it was found that due to the availability of low-VOC and environment-friendly paints and coatings containing the TiO

Ilmenite Market Growth Factors

- Increasing global demand for titanium dioxide as a key industrial pigment is expected to drive ilmenite consumption.

- Rising aerospace and defense sector investments are likely to boost demand for high-quality titanium alloys derived from ilmenite.

- The growing construction industry in emerging markets is anticipated to escalate the need for titanium-based products, spurring ilmenite demand.

- Advancements in ilmenite extraction and processing technologies are expected to increase efficiency and enhance supply.

- Expanding electric vehicle production is projected to fuel the demand for titanium components, thereby promoting the use of ilmenite.

- Increased focus on sustainable and eco-friendly materials in manufacturing is likely to drive the use of ilmenite in green technologies.

- The recovery of mining operations in key regions such as Ukraine and Australia is expected to boost ilmenite supply in the global ilmenite market.

Market Outlook

- Industry Growth Overview: The ilmenite market is increasing, driven by growing demand for titanium dioxide in plastics, paints, and paper, as well as the use of titanium in defense and aerospace. Increasing awareness and demand for sustainable and high-performance materials are driving the market.

- Global Expansion: The Ilmenite market is increasing worldwide, driven by the growing production of titanium metal is used in defense, aerospace, and medical such as artificial limbs, which use it for its high strength-to-weight ratio. Asia Pacific is dominated in the market due to increasing urbanization and the growing construction and automotive sectors.

- Major investors: Major investors and leading organizations in the ilmenite industry, which is significantly driven by demand for titanium dioxide and titanium metal, include multinational mining corporations and particular mineral sands producers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.87 Billion |

| Market Size in 2026 | USD 12.34 Billion |

| Market Size by 2034 | USD 16.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.93% |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for ilmenite-derived titanium dioxide in various sectors

Increasing demand for titanium dioxide is anticipated to drive the ilmenite market. Titanium dioxide serves as a critical pigment in industries such as paints, plastics, and paper due to its excellent opacity and whitening properties. The construction and automotive industry, especially in emerging markets, is growing fast and is the major driver that requires high-performance coatings and materials that actively use titanium dioxide. Moreover, the enhanced methods of producing titanium dioxide through new technologies increase the value of ilmenite as one of the inexpensive and environmentally efficient resources.

- According to the 2024 report by The Freedonia Group, new housing construction in India is projected to grow at an average rate of 4.1% per year, reaching 11.3 million units by 2028.

Restraint

Strict environmental regulations

Hamper environmental regulations and restrictions on mining activities are anticipated to challenge the growth of the ilmenite market. Governments around the world are employing strict measures to reduce the environmental cost of mining. These regulations prescribe operational requirements for land reclaim, waste disposal, and emission control standards that raise operational expenses for firms in mining. However, legal actions and social activism in the source regions slow or stop most mining activities. This type of supply environment destabilizes the chain for applications of ilmenite in downstream industries.

Opportunity

Increasing Investments

Growing investments in the aerospace and defense industries are expected to boost ilmenite consumption, thus creating immense opportunities for the players competing in the ilmenite market. These sectors increasingly rely on titanium-based alloys for manufacturing lightweight and durable components. The increased defense expenditure across the globe and the higher utility of titanium, derived from ilmenite, in manufacturing high-end equipment. Furthermore, the new generation players also continue to invest deeper into aerospace manufacturing, which only places even greater demand for pure raw materials, such as ilmenite, for the titanium parts required across airliners and in defense industries.

- According to the 2024 report by The International Institute for Strategic Studies, regional defense expenditure is expected to grow by 4.2% in real terms in 2024 as nations strive to overcome economic and fiscal challenges while maintaining increases in defense spending.

Segment Insights

Application Insights

The Titanium Dioxide (TiO2) segment held a dominant presence in the ilmenite market in 2024 due to its high light-scattering index, durability, and stability of color. TiO is a key raw material in developing paints, coatings, and varnishes for the construction, automotive, and consumer goods industries. Global demand for titanium dioxide in paints and coatings in 2024, a growing environmentally friendly trend, and low VOC solid formulations. The U.S. EPA 2024 report describes the green building standards with emphasis on products with reduced effects on the environment and the current trend towards sustainable paints with titanium dioxide.

The titanium metal segment is expected to grow at the fastest rate in the ilmenite market during the forecast period of 2025 to 2034. Titanium alloying is important to industries, including aerospace industries, for its strength-to-weight ratio, corrosion resistance, and very good elevated temperature service. Citing the U.S. Department report, Defense Budget, Elsevier stated that global defense budgets and advancement in the next generation of military technologies. The invention of new-age weapon systems and aerospace sectors are expected to boost the demand for titanium-based alloys in the forecast period. Furthermore, the growth in the civil aerospace sector is also creating demand for lightweight titanium material, hence boosting the demand for titanium metal.

- According to the 2024 report published by the International Civil Aviation Organization, the aviation sector is experiencing rapid growth and is expected to continue expanding. The latest estimates indicate that the demand for air transport increased at an average annual rate of 4.6% from 2012 to 2032.

End-Use Insights

The paints and coatings segment accounted for a considerable share of the ilmenite market in 2024 due to the growing need to use better quality coatings in many areas it is used in. Ilmenite is used in the production of titanium dioxide, which has been established as the ideal pigment for paints, as it is opaque, bright, and very hardwearing. Increased usage of protective coatings for buildings and infrastructure created demand for the ilmenite. Furthermore, the innovation in coatings, which are increasingly popular as environmentally friendly and low VOC, has led to the application of titanium dioxide coatings, as those coatings are more harmless and more sustainable.

- The U.S. Census Bureau has reported that the construction industry in the United States expanded by 5.2 % in 2023, elemental in the increasing need for high-performance coatings.

The plastic segment is anticipated to grow with the highest CAGR in the ilmenite market during the studied years, owing to the utilization of titanium oxide as a white color in various plastic products in the increasing. TiO helps to enhance the aesthetics and achieve a high level of opacity of the plastics used in various products, including packaging material, consumer products, and automotive industries. Global plastic consumption is on the rise for consumables, packaging, and many other uses, and therefore, the need to use titanium dioxide as a colorant for plastics is anticipated to grow.

- According to a report published by the UN Environment Programme, approximately one million plastic drinking bottles are purchased every minute globally, and around 500 billion single-use plastic bags are used worldwide each year.

Regional Insights

Asia Pacific Ilmenite Market Size and Growth 2025 to 2034

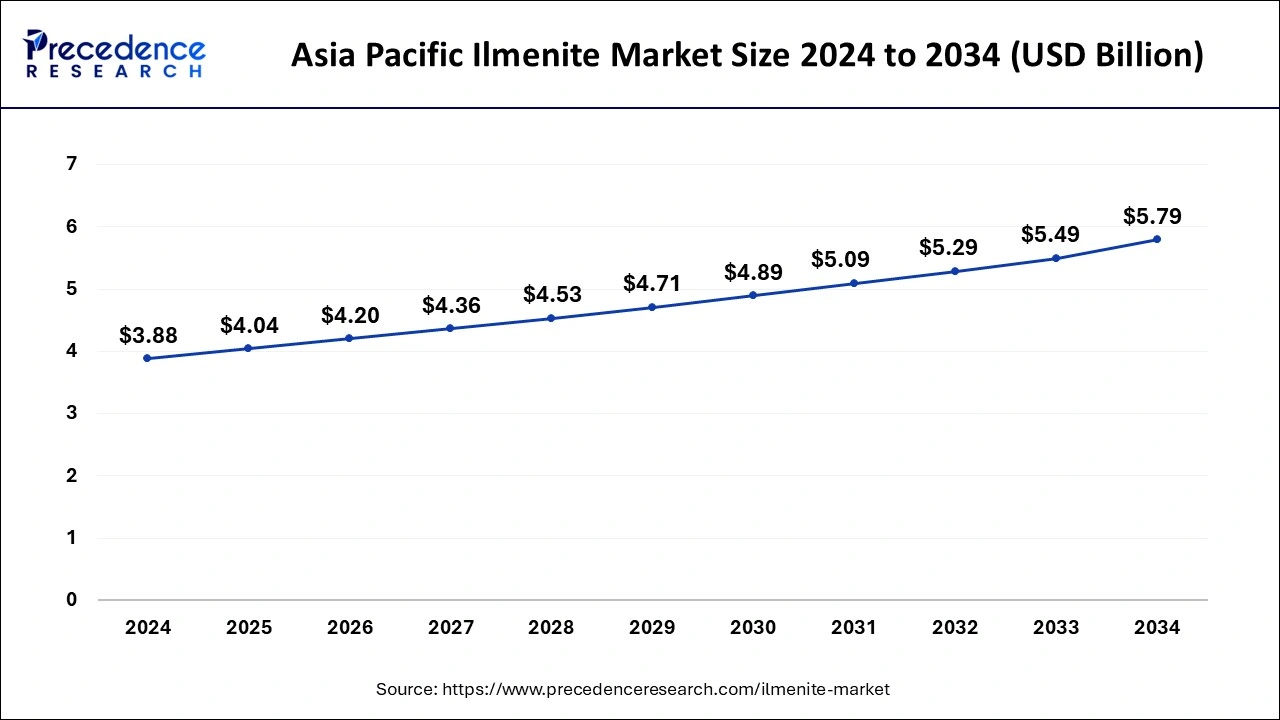

The Asia Pacific ilmenite market size is evaluated at USD 4.04 billion in 2025 and is projected to be worth around USD 5.79 billion by 2034, growing at a CAGR of 4.08% from 2025 to 2034.

Asia Pacific: Massive domestic demand

Asia Pacific dominated the global ilmenite market in 2024 due to its strong industrial dynamics and increased usage of titanium dioxide in numerous sectors. It pointed out that China is the largest producer and consumer of ilmenite across the world, with other leading countries, including India and Japan. Newly emerging construction and automotive industries in China, in addition to China's manufacturing giant capacity, have also fuelled the demand for titanium dioxide. Furthermore, aerospace and defense investments have also been seen in Asia Pacific due to increased budgets by India and Japan.

According to a report published by the International Trade Administration, civil aviation is one of the fastest-growing sectors in India. The country is projected to have over 500 million domestic and international air travelers by 2030 and has the potential to become the world's leading aviation market by 2047.

- As reported by China's National Bureau of Statistics the construction industry in the country rose by 5.8% in 2023, thus the demand for coatings and paints where TiO has an important value.

North America is projected to host the fastest-growing ilmenite market in the coming years, owing to the increasing consumption of titanium dioxide, mainly in the paint, coating, and aerospace industries. The U.S. continues to dominate consumption due to continued spending on construction activities, infrastructures, and aerospace industries. Moreover, the use of lightweight material for better fuel economy and performance in the automotive industry boosts the consumption of titanium alloys for several applications where ilmenite would be useful within the region.

India: Immense reserves

India has major deposits of heavy metals and significant minerals required for vital industries such as Li-Ion batteries, computing, and semiconductor technology. In India, the titanium-bearing ilmenite deposits are projected at around 375 – 400 million tonnes, which is around 21% of worldwide deposits.

North America: Presence of major industry players

U.S.: Advanced Technological Infrastructure

The U.S. possesses well-recognized manufacturing infrastructure and modern processing technologies that efficiently produce high-quality, high-purity titanium products. Technological advancements in mineral separation and refinement allow for economically viable extraction from different deposits.

Europe: Increasing government policies for energy saving

Europe is significantly growing in the market as this region is the highest distributor of wrought titanium products, largely consumed by its noteworthy aerospace companies, specifically in France and Germany. It has a well-developed production infrastructure and advanced technological abilities for the complex processing of titanium, which requires high capital and energy expenses.

UK: Strong public health initiatives

The UK is the hub of the headquarters of the Rio Tinto Group, one of the world's largest producers of titanium minerals. The UK is an important customer of ilmenite derivatives, specifically titanium dioxide pigment, which is used in high-value applications such as paints, plastics, coatings, cosmetics, and aerospace. The UK is an importer of ilmenite, and its strength lies in its progressive manufacturing and chemical companies that use ilmenite byproducts.

Ilmenite Market- Value Chain Analysis

- Raw Material Sourcing:

The ilmenite market sources its primary raw material from naturally occurring ilmenite mineral ore (FeTiO₃), which is obtained by large-scale mining operations

Key Players: Iluka Resources and Rio Tinto - Package Design and Prototyping:

Designing and enhancing the configuration and functioning parameters of reactors used for the lower of ilmenite with synthesis gas.

Key Players: Tronox - Recycling and Waste Management:

It focuses significantly on repurposing manufacturing by-products to lower environmental impact and conserve resources.

Key Players: Kenmare Resources plc and Chemours Company

Key Players in Ilmenite Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Yucheng Jinhe Industrial Co., Ltd. |

China |

Strong focus on sustainability |

It is mainly complicated in the production and distribution of different chemicals, including titanium dioxide (TiO2) |

|

V.V Mineral |

Chennai |

Integrated infrastructure |

Currently produces several grades of high-quality sulphate grade Ilmenite |

|

Rio Tinto |

London |

Strong financial position |

Rio Tinto's ilmenite operations include exploration at its Mutamba Project in Mozambique and production from its QMM mineral sands operation in Madagascar. |

|

PT Monokem Surya |

Indonesia |

High-quality chemical manufacturing technologies |

PT Monokem Surya is listed as an active supplier of zircon sand |

|

Kenmare Resources |

Ireland |

Low-cost production |

It provides modern services. |

Latest Announcements by Industry Leaders

- May 26, 2023 – Interfax Information Group

- Citing Management Board Member – Dimitry Kalandadze

- Announcement- Dimitry Kalandadze, a member of the management board of United Mining and Chemical Company (UMCC), stated, "We plan to resume mining and processing at Irshansky GOK and reach a production level of 18,000 tonnes of ilmenite concentrate per month by the end of this year. Currently, almost 54,000 tonnes of ilmenite concentrate are stored in storage. We must start selling these stocks to initiate the mining of new ore." He also emphasized, "Restoring product sales is crucial for gradually ramping up mining and processing. Increasing our resource base is a key factor in the successful privatization of UMCC by a Western investor. A Western strategic investor is essential for modernizing the sector and continuing its growth."

Recent Developments

- In November 2024, IREL (India) Limited and Kazakhstan's Ust-Kamenogorsk Titanium and Magnesium Plant (UKTMP JSC) entered into a joint venture to form IREUK Titanium Limited. This collaboration aims to produce titanium slag in India, enhancing the country's titanium value chain by upgrading low-grade ilmenite into high-grade titanium feedstock. The partnership is expected to generate employment opportunities in Odisha and contribute to India's foreign exchange earnings. It will also provide UKTMP JSC with a reliable supply of raw materials while strengthening the brand reputation of both companies in the titanium sector.

- In August 2024, IperionX Limited announced the successful development of low-carbon titanium mineral enrichment technologies. The company upgraded ilmenite from its Titan Project in Tennessee into a high-grade synthetic rutile product. This achievement enhances the ilmenite sector by producing high-quality titanium feedstocks, which are essential for manufacturing titanium metal and pigments. IperionX's innovation in upgrading ilmenite into synthetic rutile further strengthens its position in the global titanium industry.

Segments Covered in the Report

By Application

- Titanium Metal

- Titanium Dioxide

- Others

By End-use

- Cosmetics

- Paints and Coatings

- Paper and Pulp

- Plastics

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting