Carbon Tetrafluoride Market Size and Forecast 2025 to 2034

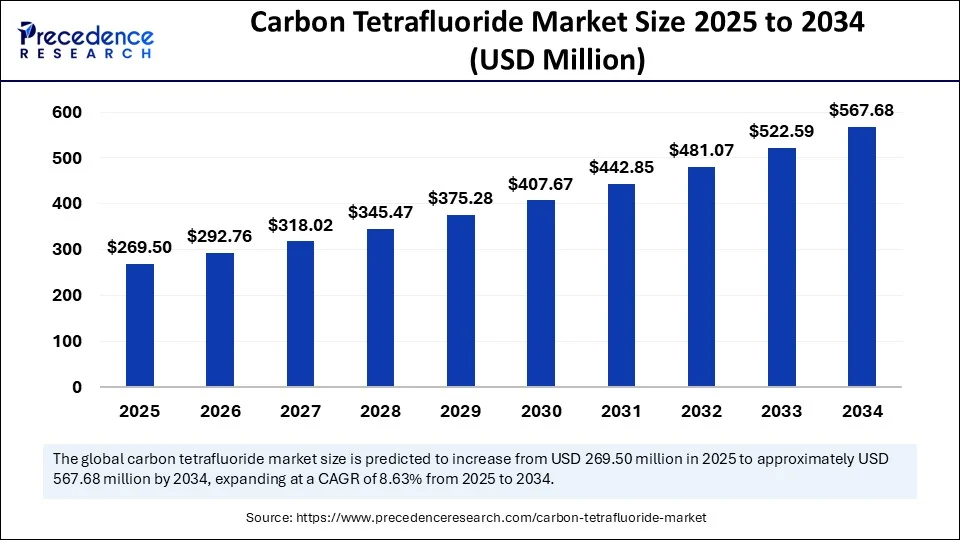

The global carbon tetrafluoride market size accounted for USD 248.09 million in 2024 and is predicted to increase from USD 269.50 million in 2025 to approximately USD 567.68 million by 2034, expanding at a CAGR of 8.63% from 2025 to 2034. The market is growing due to its increasing use in semiconductor manufacturing and plasma etching applications.

Carbon Tetrafluoride Market Key Takeaways

- In terms of revenue, the global disposable urine bags market was valued at USD 248.09 million in 2024.

- It is projected to reach USD 567.68 million by 2034.

- The market is expected to grow at a CAGR of 8.63% from 2025 to 2034.

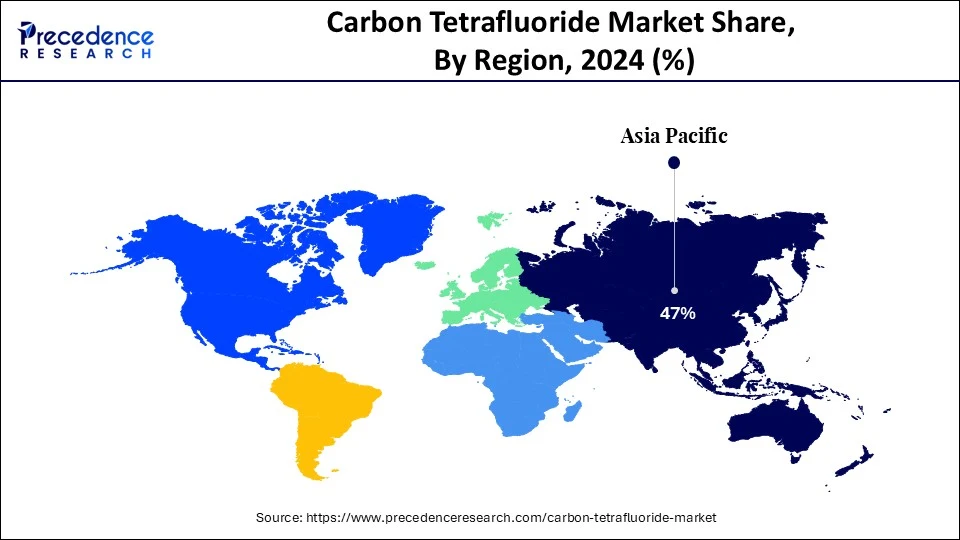

- Asia Pacific dominated the carbon tetrafluoride market, holding the largest market share of 47% in 2024.

- North America is expected to grow at the fastest rate during the forecast period.

- By grade, the electronic grade CFâ‚„ segment held the largest market share of 58% in 2024.

- By grade, the high-purity CFâ‚„ segment is expected to grow at the fastest rate during the forecast period.

- By production process, the fluorination of carbon compounds segment held the largest share of the market in 2024.

- By production process, the byproduct from aluminum smelting (electrolysis process) segment is likely to grow at the fastest rate between 2025 and 2034.

- By application, the semiconductors & microelectronics segment held the largest share of 61% in 2024.

- By application, the optical fiber manufacturing segment is projected to grow at the fastest rate in the carbon tetrafluoride market.

- By end user, the electronics & semiconductor manufacturing segment held the largest market share of 64% in 2024.

- By end user, the aerospace & defense segment is expected to expand at the highest CAGR in the coming years.

How is AI making chip-making faster and changing how carbon tetrafluoride is used?

By enabling faster, smarter, and more efficient semiconductor manufacturing processes, artificial intelligence (AI) is transforming the chip industry and directly influencing the use of carbon tetrafluoride. By carefully regulating carbon tetrafluoride flow rates and etching times, AI optimizes plasma etching in semiconductor fabs, cutting waste and increasing accuracy. In addition, it forecasts equipment failures, tracks gas consumption in real time, and facilitates carbon tetrafluoride recycling by determining when and how the gas can be safely recycled. AI also assists producers in assessing cheaper and more environmentally friendly alternatives to carbon tetrafluoride, improving process sustainability and efficiency.

Asia Pacific Carbon Tetrafluoride Market Size and Growth 2025 to 2034

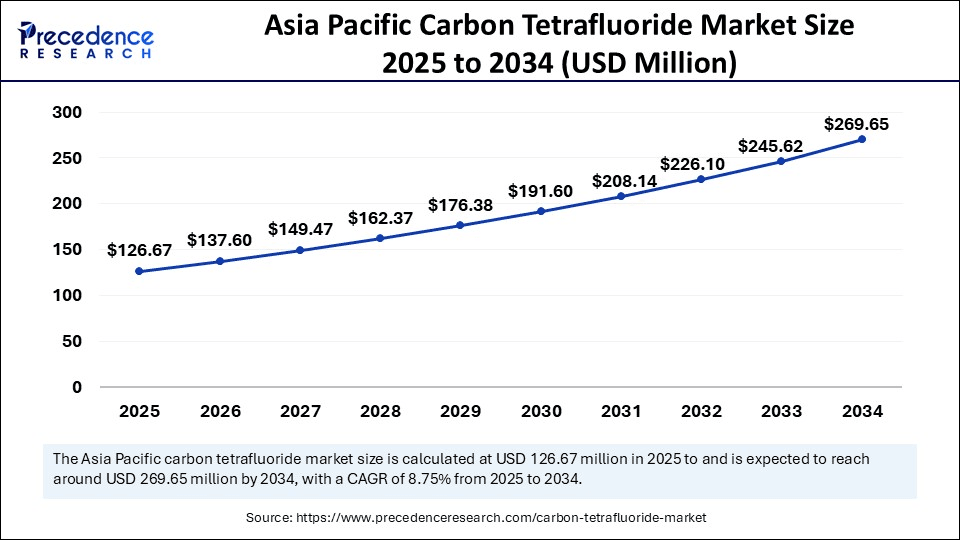

The Asia Pacific carbon tetrafluoride market size is evaluated at USD 126.67 million in 2025 and is projected to be worth around USD 269.65 million by 2034, growing at a CAGR of 8.75% from 2025 to 2034.

What made Asia Pacific the dominant region in the carbon tetrafluoride market in 2024?

Asia Pacific dominated the carbon tetrafluoride market by holding the largest share in 2024 due to the increased demand for specialty gases across a variety of industries. The region is known for large-scale semiconductor production and a strong manufacturing base. Because of the region's well-established electronics ecosystem, there is a steady need for high-purity carbon tetrafluoride for processes like etching, cleaning, and plasma. Its market dominance is further cemented by encouraging industrial policies and continuous development of fiber optic and electronics infrastructure. Additionally, the region's supply chain stability and product accessibility are improved by the presence of important gas suppliers and end-user manufacturers.

North America is expected to experience the fastest growth in the carbon tetrafluoride market, driven by the expansion of the aerospace and semiconductor manufacturing industries. There is strong support for electronics and defense industries, boosting the development of smart electronics and defense systems. This significantly creates the need for specialty gas. The use of carbon tetrafluoride is growing faster due to the increased demand for high-performance materials and precision manufacturing. Additionally, North America is being positioned as a major future hub for cleanroom-grade and ultra-pure process gases through strategic expansions and facility upgrades.

Market Overview

The carbon tetrafluoride (CFâ‚„) market refers to the global demand and supply of carbon tetrafluoride, a colourless, non-flammable gas primarily used in the semiconductor industry, plasma etching, refrigerant blends, and optical fiber manufacturing. It is also known as tetrafluoromethane and belongs to the perfluorocarbon (PFC) family.

Due to its high chemical and thermal stability, CFâ‚„ is used extensively in electronics-grade processes and reactive ion etching (RIE). However, its very high global warming potential (GWP) and long atmospheric life have led to growing environmental scrutiny, pushing innovation in gas recovery and emissions control technologies.

Carbon Tetrafluoride Market Growth Factors

- Rising demand in the semiconductor industry: Carbon tetrafluoride is widely used as a plasma etching gas in semiconductor fabrication, driven by growing consumption of electronics and advanced chips.

- Expansion of the electronics and display panel sector: The increasing production of flat panel displays and integrated circuits is fueling the demand for carbon tetrafluoride as a cleaning and etching agent.

- Growth in the solar photovoltaic industry: carbon tetrafluoride is used in the cleaning of plasma chambers and the etching of silicone wafers, contributing to its demand in solar panel manufacturing.

- Industrial applications in metallurgy: Its usage as a refrigerant and in metal production processes, including aluminum and magnesium, supports market growth.

- Environmental regulations promoting gas recycling: Increasing focus on reducing greenhouse gas emissions is leading to innovations in carbon tetrafluoride recovery and reuse, which is helping stabilize supply and demand.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 567.68 Million |

| Market Size in 2025 | USD 269.50 Million |

| Market Size in 2024 | USD 248.09 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.63% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Grade, Production Process, Application, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rising production of semiconductors and microelectronics

The rising production of semiconductors and microelectronics significantly drives the growth of the carbon tetrafluoride market. An important component of the etching procedure used to produce semiconductors is carbon tetrafluoride. With the increasing complexity, speed, and small size of electronic devices, manufacturers are increasingly dependent on accurate etching to produce microscopic circuit patterns. The growing use of wearable technology, smartphones, tablets, and smart appliances is driving global demand for semiconductors. Moreover, government incentives and private investments in chip fabrication facilities across Asia and North America are intensifying carbon tetrafluoride usage. As 5G and IoT technologies advance, it is anticipated that this trend will continue, leading to an increase in the frequency of fab expansions and upgrades.

Expansion of the metal smelting industry

Carbon tetrafluoride is a by-product of electrolysis in metal processing, specifically in the smelting of magnesium and aluminum. Degassing and refining are two examples of applications where it is purposefully used. The expansion of the construction, automotive, and aerospace industries has increased demand for lightweight metals, which has a direct impact on the production and consumption of carbon tetrafluoride. To recover and reuse carbon tetrafluoride, manufacturers are also implementing sophisticated emission control and capture systems, which improve process efficiency. One of the main secondary sources of carbon tetrafluoride and a factor in its availability and price stability is the integration of the metal industry.

Restraints

Environmental concerns and greenhouse gas emissions

Carbon tetrafluoride is a potent greenhouse gas that has an atmospheric lifetime of more than 50,000 years and a very high global warming potential (GWP). Environmental agencies around the world, including the U. S. are therefore paying more attention to emissions. The EU and EPA. Stricter control measures and emissions reporting requirements are being pushed for by regulatory bodies, especially in sectors like semiconductor manufacturing and aluminum smelting. Manufacturers now face higher compliance costs as a result. The effects of carbon tetrafluoride on the environment could deter people from using it or lead to a search for more environmentally friendly gases.

- In January 2025, ECHA announced updated carbon tetrafluoride risk guidelines under the REACH framework.

High cost of gas recovery and abatement systems

Gas recovery and abatement technologies must be installed by industries using carbon tetrafluoride to capture and neutralize emissions because of its detrimental environmental profile. These systems are costly and need specialized infrastructure, trained technicians, and continuous maintenance. The operational load and initial capital outlay can be substantial for smaller semiconductor fabrication facilities and manufacturing facilities. The use of carbon tetrafluoride may be further restricted in developing nations due to a lack of strong environmental infrastructure. These financial obstacles frequently prevent market expansion in areas with low and moderate incomes.

Opportunities

Advancements in gas recovery and recycling technologies

Advancements in gas recovery and recycling technologies create immense opportunities in the carbon tetrafluoride market. It is now feasible to capture, purify, and repurpose carbon tetrafluoride in industrial settings thanks to new gas abatement and recycling technologies. In addition to lessening the impact on the environment, this lowers user operating costs. Closed-loop systems are being used by businesses increasingly to improve gas efficiency and guarantee that emissions standards are met. These solutions are starting to stand out in crowded markets, which is driving demand for innovations with a sustainability focus. The pattern encourages expansion in the production of equipment related to carbon tetrafluoride usage as well as gas management services.

Emerging demand from electronics and flat panel display manufacturing

The demand for high-precision etching gases is being driven by the growth of smart devices, display panels, and consumer electronics. Its ability to etch delicate layers without creating defects makes carbon tetrafluoride essential to the production of thin-film transistor (TFT) displays and other screen technologies. As electronics get smaller and more aesthetically pleasing, producers are looking for process gases that provide cleanliness and consistency. Because of this, there is a constant need for carbon tetrafluoride in display fabrication procedures. The chance is to provide high-purity gas that is suited to changing technological needs.

Grade Insights

Why did the electronic grade CFâ‚„ segment dominate the carbon tetrafluoride market in 2024?

The electronic grade CFâ‚„ segment continues to dominate the carbon tetrafluoride market due to its superior purity and suitability for delicate processes like plasma processing and semiconductor etching. It is now become crucial for chipmakers aiming for accuracy and purity in demanding settings due to its extensive use in the creation of integrated circuits and flat panel displays. Electronic-grade carbon tetrafluoride and other ultra-clean gases are in greater demand due to the rising complexity of microelectronic devices. Furthermore, its relevance is highlighted by the emergence of advanced packaging technologies like system-on-chip and 3D ICs. To reduce device failure rates and meet stricter process windows, major foundries give priority to electronic-grade gases.

The high-purity CFâ‚„ segment is expected to grow at the fastest rate in the upcoming period, as industries beyond traditional semiconductor manufacturing, such as advanced optics, photovoltaics, and medical technologies, demand tighter process controls and higher gas purity. The shift toward nano-fabrication and the miniaturization of electronic components is also fueling this segment's growth, as high-purity variants enable more accurate, contamination-free processing at the molecular level. The growing global emphasis on defect-free production and improved yield in advanced manufacturing is pushing suppliers to enhance purification technologies.

Production Process Insights

What made fluorination of carbon compounds the dominant segment in the carbon tetrafluoride market in 2024?

Fluorination of carbon compounds remains the dominant method of carbon tetrafluoride production, offering better scalability, control, and purity in industrial synthesis. This process allows producers to meet the stringent quality requirements of high-tech industries, particularly the electronics sector, where even minute impurities can result in substantial performance issues or yield losses.

- In November 2024, TSMC's Taichung Zero Waste Manufacturing Center was inaugurated, which includes a fluoride recycling plant for recovering carbon tetrafluoride and other process gases, supporting circular usage and reducing pressures on primary supply chains.(Source: https://esg.tsmc.com)

The by-product from aluminium smelting (electrolysis process) segment is expected to expand at the fastest CAGR over the forecast period, as recovering and using carbon tetrafluoride from smelting operations is viewed as an economical and ecologically responsible strategy, as sustainability becomes a major concern. It provides two advantages: it reduces metallurgical waste and increases supply for the market for high-purity gas. Environmentally conscious manufacturers and regulators are showing interest in this circular economy model. Furthermore, this process is becoming more economically feasible due to technological developments in gas recovery systems.

Application Insights

Why did the semiconductor & microelectronics segment dominate the carbon tetrafluoride market in 2024?

The semiconductors & microelectronics segment dominated the market in 2024 because of the effectiveness of carbon tetrafluoride in dry etching procedures for MEMS devices, compound semiconductors, and silicon wafers. It is the preferred etchant for producing accurate patterns without causing harm to substrate materials, which aids in the creation of more intricate, quicker, and smaller chips that drive modern digital technologies. Reliable etching gases like carbon tetrafluoride are even more important now that the demand for logic and memory chips has increased due to the global AI and 5G boom. To maintain continuous operations, top chip manufacturers are negotiating long-term supply agreements for electronic-grade carbon tetrafluoride.

The optical fiber manufacturing segment is expected to grow at a significant rate in the coming years due to the rising demand for optical fiber cables, driven by the rapid expansion of telecom infrastructure. During fiber production, carbon tetrafluoride is used to clean and etch preforms, guaranteeing minimal signal loss and high optical clarity in fiber networks. Global data center expansions and 5G rollouts are driving up demand for faster and more dependable fiber optic connections. As a result, carbon tetrafluoride is being used more often in precision fiber fabrication and maintenance.

End User Insights

How does the electronics & semiconductor manufacturing segment dominate the carbon tetrafluoride market in 2024?

The electronics & semiconductor manufacturing segment dominated the market in 2024 due to the increased production of semiconductors and electronic devices, in which gas is necessary for etching and cleaning procedures. The industry uses carbon tetrafluoride to produce cutting-edge chips that are used in everything from computers and smartphones to electric vehicles and smart home appliances. The demand for reliable, high-performing etching gases has increased as node size has decreased and chip architectures have changed. Long-term capacity increases in the U.S. are responsible for this end-use segment's ongoing dominance.

The aerospace & defense segment is expected to expand at the highest CAGR over the projection period. This is mainly due to the critical applications of carbon tetrafluoride in semiconductor manufacturing, plasma etching, and insulation processes, all of which are essential to modern aerospace and defense systems. In the aerospace industry, carbon tetrafluoride supports the production of high-performance composite materials and intricate structural parts. As these sectors embrace innovation and miniaturization, the relevance of high-purity specialty gases is set to rise sharply. Moreover, advanced radar systems, satellite communications, and electronic warfare technologies require miniaturized, high-performance semiconductor components. CFâ‚„ is used extensively as a plasma etching gas in the fabrication of these microelectronics, where ultra-high purity and precision are essential.

Carbon Tetrafluoride Market Companies

- The Linde Group

- Mitsui Chemicals

- Kanto Denka Kogyo Co., Ltd.

- Air Products and Chemicals, Inc.

- SHOWA DENKO K.K.

- Solvay S.A.

- Honeywell International Inc.

- Praxair Technology, Inc. (Linde)

- Hyosung Chemical Corporation

- American Gas Products

- Messer Group

- Versum Materials (Merck Group)

Recent Development

- On 10 April 2025, China's Ministry of Ecology and Environment released a finalized work plan under which the national ETS will expand to cover cement, steel, and aluminum smelting, including carbon tetrafluoride emissions for aluminum producers.(Source: https://icapcarbonaction.com)

Segments Covered in the Report

By Grade

- Electronic Grade CFâ‚„

- Industrial Grade CFâ‚„

- Refrigerant Grade CFâ‚„

- High-Purity CFâ‚„ (Research/Analytical Grade)

By Production Process

- Fluorination of Carbon Compounds

- By-product from Aluminium Smelting (Electrolysis Process)

- Plasma Process Recovery Systems

By Application

- Semiconductors & Microelectronics

- Flat Panel Displays (FPDs)

- Optical Fiber Manufacturing

- Refrigerants

- Medical & Research

- Metal Production

- Leak Detection & Calibration Gases

By End-Use Industry

- Electronics & Semiconductor Manufacturing

- Telecommunications (Fiber Optics)

- Industrial Gas Supply & Specialty Gases

- Metallurgy & Metal Processing

- Aerospace & Defense

- Refrigeration & HVAC

- Research & Academic Institutions

By Distribution Channel

- Direct Supply

- Specialty Gas Distributors

- Online Industrial Gas Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting