What is the Electronic Warfare Market Size?

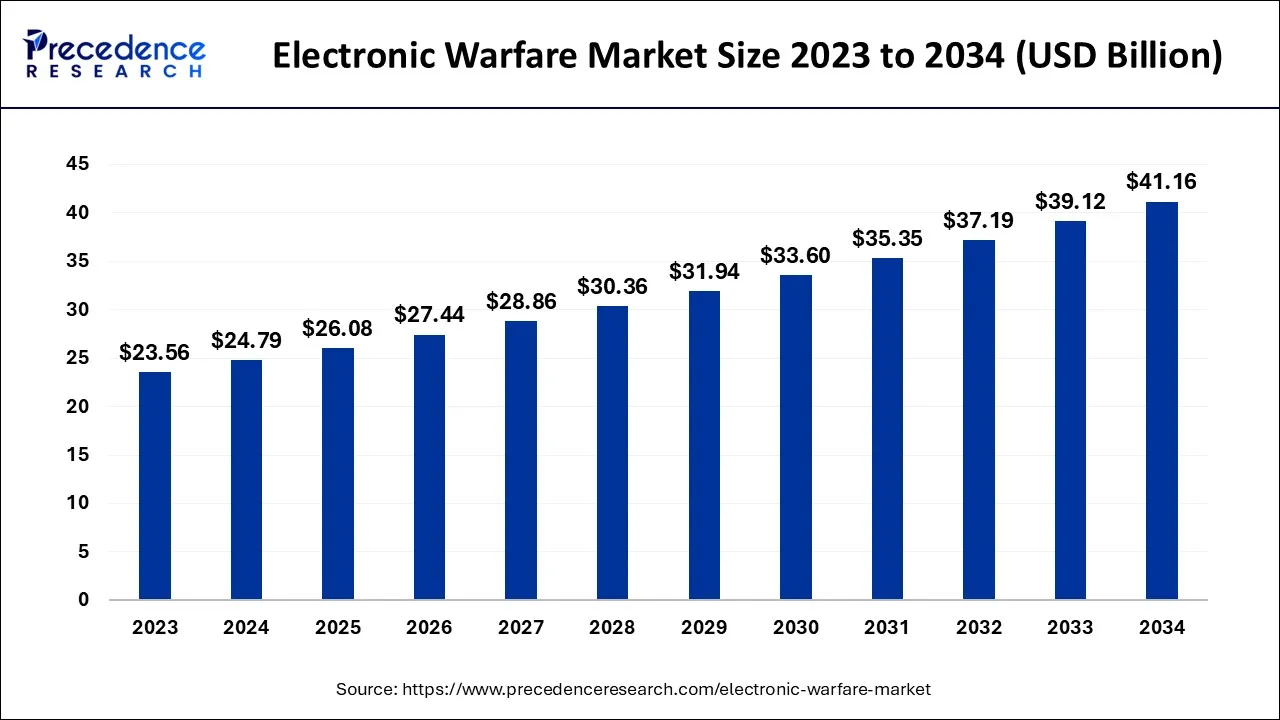

The global electronic warfare market is valued at USD 26.08 billion in 2025 andpredicted to increase from USD 27.44 billion in 2026 to approximately USD 41.16 billion by 2034, expanding at a CAGR of 5.20% over the forecast period from 2025 to 2034.

Electronic Warfare Market Key Takeaways

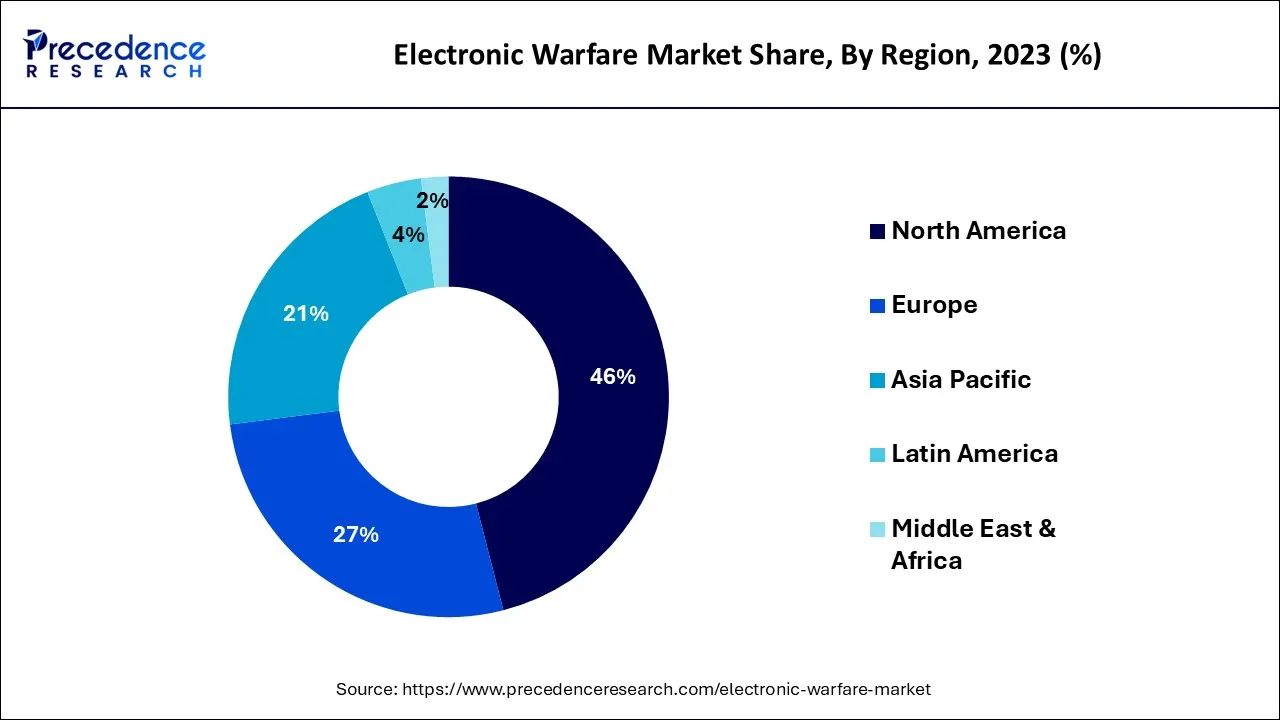

- North America contributed more than 46% of market share in 2024.

- Asia-Pacific region is expected to expand at the fastest CAGR between 2025 and 2034.

- By Domain, the electronic support segment captured the largest revenue share in 2024.

- By Equipment, the jammers segment accounted the largest market share in 2024.

- By Platform, the land-based generated the highest market share in 2024.

- By Platform, the air-based segment is predicted to grow at a remarkable CAGR from 2025 to 2034.

Market Overview

- The electronic warfare market consists of the deployment, development, and production of electronic warfare (EW) technologies and systems. It is used for the electromagnetic spectrum (EMS) of several military purposes, including radar detection and jamming, communication, electronic countermeasures, and electronic intelligence gathering. Moreover, electronic support measures systems intercept, analyze, and identify electromagnetic signals for intelligence gathering, threat detection, and situational awareness.

- The market comprises an extensive range of hardware, software, and services designed to safeguard and enhance the capabilities of military and defense organizations in the EMS domain.

Electronic Warfare Market Outlook

- Industry Growth Overview: Between 2024 and 2034, the electronic warfare market is expected to experience robust growth as global defense forces increase investments in spectrum control, signal intelligence, and countermeasure systems. Heightened geopolitical tensions in regions such as Eastern Europe, the South China Sea, and the Middle East are driving countries to modernize their electronic attack (EA) and electronic support (ES) capabilities. Additionally, the shift from hardware-centric to software-defined EW architectures is further fueling market development, offering greater flexibility and scalability for long-term adaptability.

- Technology Innovation: The landscape of electronic warfare is being reshaped by the integration of Artificial Intelligence (AI), machine learning (ML), and cyber-electromagnetic capabilities. Leading innovators such as BAE Systems, Raytheon Technologies, and L3Harris Technologies are pioneering AI-enhanced EW suites that deliver adaptive threat response, spectral dominance, and multi-domain interoperability. Similarly, Lockheed Martin is making significant investments in open-architecture software platforms designed to seamlessly integrate across air, space, and ground environments.

- Global Expansion: The electronic warfare industry is expanding worldwide, as defense contractors are enhancing production, forming new partnerships, and establishing maintenance hubs closer to key regional demand centers. Companies like Northrop Grumman, Thales Group, and Leonardo SpA have significantly expanded their manufacturing presence in Europe, supporting NATO-driven modernization efforts and participating in joint R&D programs through the European Defence Fund. Moreover, these multinational alliances are facilitating technology transfers and the development of localized workforce capabilities, strengthening resilience against global supply chain disruptions.

- Defense-Level Investments and Strategic Alliance: Global defense spending has reached record levels, with electronic warfare (EW) emerging as one of the most strategically prioritized domains. Through extensive modernization programs and collaborative R&D initiatives, organizations such as the U.S. Department of Defense, the European Defence Agency (EDA), and NATO Allied Command Transformation are placing a strong emphasis on cross-allied EW interoperability. Major prime contractors like BAE Systems, Lockheed Martin, and Raytheon Technologies are partnering with smaller firms to develop modular EW systems. This specialized approach allows vendors to rapidly deploy flexible, upgradable EW solutions capable of adapting to evolving signal threats.

- Emerging EW Ecosystem:The electronic warfare (EW) ecosystem is rapidly diversifying, driven by the rise of specialized startups and mid-tier defense innovators focused on agility, software-defined capabilities, and integration with unmanned platforms. Companies like Mercury Systems (U.S.), Hensoldt (Germany), and Cognitive Space (U.S.) are at the forefront, developing modular, AI-enabled EW systems for drones, satellites, and small defense platforms. A major emerging frontier is space-based EW, with funding from agencies like the U.S. Space Force and the European Space Agency (ESA) aimed at developing new orbital intelligence and denial capabilities.

Electronic Warfare Market Growth Factors

- The growth of the market for electronic warfare is driven by advancements in technology, evolving threats in the electronic domain, and the need for modern military forces to maintain a competitive edge in a rapidly changing operational environment. It includes both government defense agencies and private defense contractors as key players and is an integral part of modern defense and national security strategies.

- The ever-evolving threat landscape, characterized by the proliferation of advanced electronic systems and emerging technologies in potential adversary arsenals, fuels the demand for cutting-edge electronic warfare solutions. Geopolitical tensions and regional conflicts worldwide also play a pivotal role, prompting governments to allocate substantial budgets for defense and security, including investments in electronic warfare capabilities to safeguard national interests and maintain a strategic edge.

- Moreover, modernization programs are driving the replacement of aging electronic warfare systems with more sophisticated counterparts. These initiatives, coupled with technological advancements like software-defined radios and the integration of artificial intelligence and machine learning, encourage governments and private sector firms to invest in research and development, bolstering the market. The convergence of cyber warfare and electronic warfare capabilities further accentuates the importance of integrated solutions in the contemporary threat landscape, underpinning market growth.

- The increasing deployment of unmanned systems in military operations adds to the market's expansion, necessitating tailored electronic warfare solutions for these platforms. Furthermore, the dual-use nature of electronic warfare technologies opens civilian applications, thus expanding market potential. All-domain operations, which emphasize seamless electronic warfare integration across land, sea, air, space, and cyberspace, are reshaping military strategies and driving demand for comprehensive and interoperable electronic warfare solutions. Thus, the electronic warfare market's growth is fueled by the continuous evolution of technology and the changing nature of warfare, with a focus on electronic dominance and the protection of critical assets in an increasingly interconnected world.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 26.08 Billion |

| Market Size in 2026 | USD 27.44 Billion |

| Market Size by 2034 | USD 41.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Domain, Equipment, Platform, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Geopolitical tensions and conflicts

In an increasingly interconnected world, nations are grappling with heightened security concerns and the imperative to safeguard their interests, both regionally and globally. As rivalries intensify and uncertainties persist, governments are allocating substantial resources to bolster their defense capabilities, prominently including electronic warfare systems. These tensions necessitate a robust response to emerging threats, such as the proliferation of advanced electronic systems, radar networks, and communication technologies employed by potential adversaries.

The need for effective countermeasures to protect critical military infrastructure and maintain operational superiority is paramount. Consequently, defense agencies and armed forces are investing heavily in electronic warfare technologies that can detect, disrupt, and neutralize these threats, ensuring the protection of national sovereignty and security interests.

Furthermore, geopolitical tensions often prompt alliances and partnerships among nations seeking to enhance their collective defense capabilities. This collaboration fosters the exchange of electronic warfare expertise and technologies, stimulating research and development efforts and creating opportunities for international cooperation in the electronic warfare market. For instance, in August 2022, U.S. announced that Russia-Ukraine war is motivating the U.S. Army to get its own in-development jammers deployed as soon as possible. Thus, the electronic warfare market thrives in an environment where geopolitical tensions and conflicts underscore the critical importance of electronic dominance and the protection of sensitive electronic assets, propelling innovation and driving sustained growth in the industry.

Restraint

Technological complexity

These systems are designed to counteract advanced threats and ensure national security, their intricate nature can present several challenges that may hinder their widespread adoption and utilization. Cost associated with developing, manufacturing, and maintaining technologically complex electronic warfare systems one of the primary concerns in the electronic warfare market. The research, engineering, and integration efforts required can result in high procurement costs, straining the budgets of governments and defense agencies. This can lead to limited investments in these systems, potentially slowing down the growth of the electronic warfare market.

Moreover, the specialized training and expertise required to operate and maintain these complex systems can be a deterrent. Personnel must undergo rigorous and ongoing training to effectively utilize these technologies. This need for highly skilled individuals can create human resource challenges and increase the overall operational cost.

Integration complexities can also impact the demand for electronic warfare systems. The process of integrating diverse components and ensuring their interoperability can be time-consuming and error-prone, potentially delaying the deployment of critical systems. In addition, the vulnerability of complex electronic warfare systems to cyber-attacks raises security concerns. Ensuring the cyber security of these systems demands extra resources and measures, adding to the overall complexity. Thus, technologically advanced electronic warfare systems offer unparalleled capabilities, their complexity can limit demand due to cost constraints, training requirements, integration challenges, and cyber security vulnerabilities.

Opportunity

Increasing integration of cyber electronic warfare capabilities

As modern conflicts extend into the digital domain, the synergy between cyber and electronic warfare has become critical for military operations and national security. This convergence offers several compelling opportunities. Firstly, it enables more comprehensive and adaptive responses to threats. By combining cyber and electronic warfare capabilities, military forces can disrupt enemy communications, deceive their sensor networks, and simultaneously launch cyberattacks, creating a multifaceted assault that overwhelms adversaries. Furthermore digitalization of critical infrastructure continues, the need to protect it from cyber threats becomes paramount. This opens a significant market for electronic warfare systems designed to safeguard essential sectors such as power grids, telecommunications, and transportation networks.

Moreover, the integration of these capabilities fosters cross-disciplinary collaboration between electronic warfare and cyber security experts. This knowledge exchange drives innovation, leading to the development of cutting-edge technologies and tactics that can counter emerging threats effectively. The cyber and electronic warfare also accelerates the adoption of artificial intelligence and machine learning in these fields. These technologies improve real-time data analysis, enabling for quicker and more precise decision-making in complex electronic and cyber environments. Thus, the integration of cyber and electronic warfare capabilities not only enhances military capabilities but also unlocks a wealth of opportunities within the electronic warfare market.

Segment insights

Domain Insights

According to the domain, the electronic support segment held the highest revenue share in 2024 and is anticipated to expand at a significantly CAGR during the projected period. Electronic support measures involve the passive collection, analysis, and identification of electromagnetic signals for intelligence gathering and situational awareness. ESM systems are used to detect and locate enemy radar, communication networks, and other electronic emissions, providing critical information for decision-making.

Electronic support, protection and attack domains work together to provide comprehensive electronic warfare capabilities. Electronic attack seeks to disrupt or incapacitate enemy systems, electronic protection safeguards friendly systems, and electronic support measures gather intelligence and identify threats, allowing for informed responses. This segmentation helps defense organizations and manufacturers design and develop electronic warfare systems that can effectively fulfill their roles within the electromagnetic spectrum.

Equipment Insights

Based on the equipment jammers is anticipated to hold the largest market share in 2024 and projected to grow at the fastest rate over the projected period. Jammers are electronic warfare devices designed to disrupt, block, or deceive enemy communication systems, radar, or other electronic signals. They are used in electronic attack operations.

Each equipment serves specific roles in electronic warfare operations, allowing military forces to detect, manipulate, and protect against electronic threats while conducting both offensive and defensive electronic warfare missions.

Platform Insights

In 2024, the land-based had the highest market share on the basis of the platform. Land-based electronic warfare systems are positioned on the ground and used to protect military installations, defend borders, and support ground operations. They include ground-based radars, jamming equipment, and other electronic warfare capabilities deployed on land.

The air-based segment is anticipated to expand at the fastest rate over the projected period. Air-based electronic warfare systems are installed on aircraft, including fighter jets, reconnaissance planes, electronic warfare aircraft (such as the EA-18G Growler), and unmanned aerial vehicles (UAVs). These systems are essential for both offensive and defensive electronic warfare operations in the air domain.

Regional Insights

U.S. Electronic Warfare Market Size and Growth 2025 to 2034

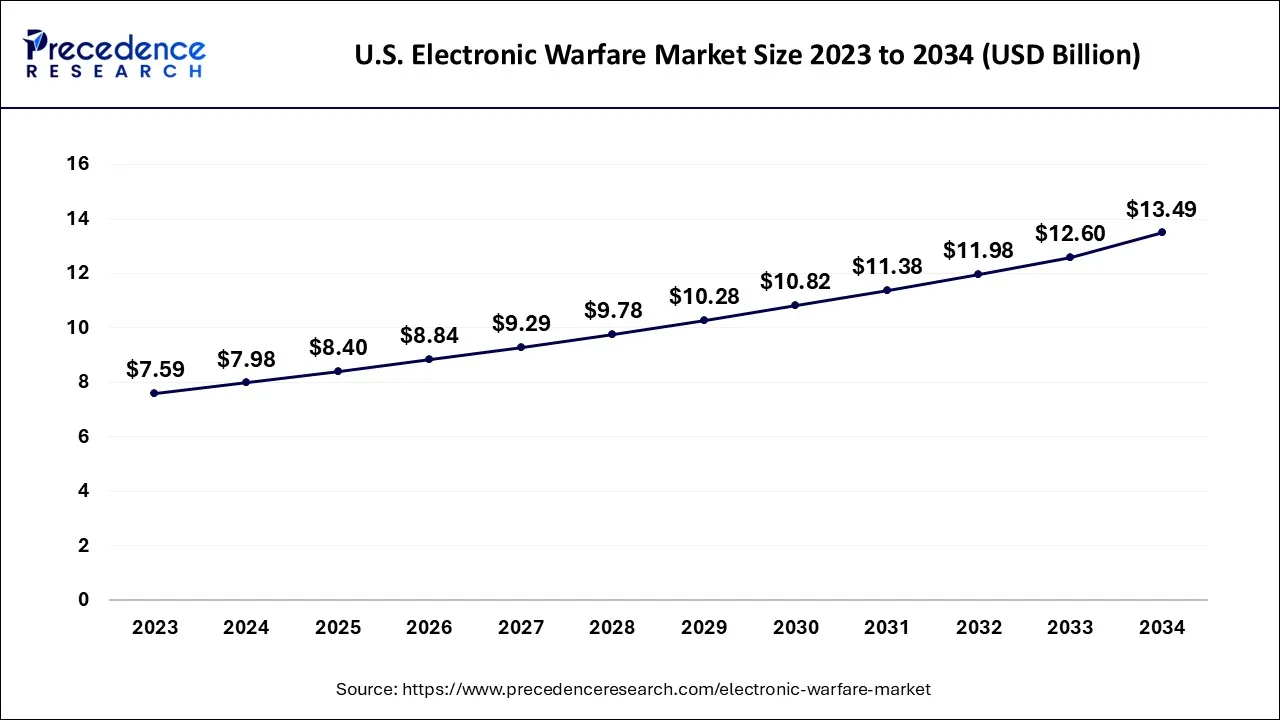

The U.S. electronic warfare market size accounted for USD 8.40 billion in 2025 and is projected to be worth around USD 13.49 billion by 2034, poised to grow at a CAGR of 5.39% from 2025 to 2034.

North America has held the largest revenue share in 2024.The region's growth is primarily due to greater funding in electronic warfare technologies by nations such as the United States in the region. The United States electronic warfare market provide a robust ecosystem for defense contractors, research institutions, and government agencies dedicated to advancing electronic warfare capabilities. North American companies, including industry giants such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, and BAE Systems, are renowned for their innovations in electronic warfare systems and technologies. Furthermore, U.S. government allocates substantial budgets to support the development and procurement of advanced electronic warfare solutions. For instance, in 2021, the U.S. government announced that it has allocated USD 3.17 billion for 45 electronic warfare programs across the military service departments and other platforms.

North America leads the electronic warfare market due to strong defense budgets, robust R&D investments, and the presence of major players like Lockheed Martin and Northrop Grumman. Growth is driven by the U.S. Department of Defense's continuous upgrades to electronic attack and protection systems for air, land, and sea forces.

U.S. Electronic Warfare Market Analysis

The U.S. continues to lead the market in North America. Increased budget allocations for EW technologies have been driven by the U.S. Department of Defense's procurement programs, with significant modernization efforts across military branches. Notably, initiatives like the Next Generation Jammer for the U.S. Navy and signal intelligence upgrades for the U.S. Air Force are boosting the demand for more advanced EW systems.

Key Growth Drivers

- Massive domestic electronic warefare demand in the U.S. and Canada

- Government-backed modernisation and expansion projects (e.g., FAA's NextGen initiative)

- Strong ecosystem of tech providers driving digital transformation

- An increase in government initatives

Why is the Electronic Warfare Market in Asia Pacific Growing at the Fastest Rate?

Asia-Pacific is estimated to observe the fastest expansion in the electronic warfare market. Growing demand for advanced electronic warfare capabilities, driven by geopolitical tensions, military modernization efforts, and evolving threat scenarios. Several countries in the Asia-Pacific region, including China, India, South Korea, and Japan, have been actively investing in electronic warfare research, development, and procurement to enhance their national security and strategic positioning. These investments encompass a wide range of electronic warfare systems, including electronic attack, electronic protection, and electronic support measures.

Asia Pacific is experiencing the fastest growth, fueled by rising geopolitical tensions and defense modernization programs in countries like China, India, and South Korea. Increased investment in indigenous EW capabilities and expanding military budgets are major drivers in the region.

China Electronic Warfare Market Analysis

China is a major contributor to the market in Asia Pacific due to the rapid deployment of naval, airborne, and unmanned systems integrating electronic warfare (EW) capabilities. Rising military spending is driving this growth, particularly in the South China Sea, where the expansion of naval and air forces is increasing the demand for advanced EW systems. China is significantly expanding its military budget, with a focus on modernizing its naval, air, and space-based defense systems. A substantial portion of this investment is directed toward enhancing EW capabilities, including advanced electronic attack (EA) and electronic support (ES) systems.

Key Growth Drivers

- Explosive growth in middle-class group

- Government investment in mega infrastructure

- Rise of budget carriers creating demand for efficient, low-cost airport services

Why is Europe Considered a Significantly Growing Area?

Due to Russia's weapon modernization, market share in Europe is projected to rise significantly over the projected period. European nations, including the United Kingdom, France, Germany, and Italy, have been active in developing and deploying advanced electronic warfare systems to safeguard their national interests and contribute to international security efforts. The market is driven by various factors, including the evolving threat landscape, regional security concerns, and investments in military modernization programs. European defense organizations and industry leaders are committed to enhancing their electronic warfare capabilities, focusing on electronic attack, electronic protection, and electronic support measures.

Germany Electronic Warfare Market Analysis

The market in Germany is being shaped by a combination of national modernization programs, industrial capabilities, and European collaborations. Germany's acquisition of combat helicopters and other military platforms has driven significant investment in EW systems, including advanced electronic countermeasures, signal intelligence, and night vision technologies. Germany actively participates in European Defence Agency (EDA) initiatives, promoting joint R&D, technology transfer, and common EW capability development across EU member states.

What Potentiates the Growth of the Latin America Electronic Warfare Market?

The electronic warfare market in Latin America is growing as many nations prioritize modernizing their defense infrastructure and enhancing their spectrum denial capabilities. Regional militaries are increasing investments in tactical EW systems to secure borders, conduct maritime patrols, and counter UAV threats. Additionally, the entry of international suppliers and strategic partnerships are further driving the growth of the market.

Brazil Electronic Warfare Market Analysis

Brazil is leading the Latin American electronic warfare market. The Brazilian Ministry of Defense has allocated funds for border security and counter-narcotics EW systems, focusing on enhancing surveillance, jamming, and signal monitoring capabilities. Strategic alliances between local defense companies and international contractors are fostering technology transfer and local production, strengthening Brazil's supply chain readiness.

What Opportunities Exist in the Middle East and Africa?

The Middle East and Africa (MEA) region presents significant opportunities for the electronic warfare market, driven by the modernization of armed forces, rising regional security threats, and investments in air and maritime defense systems. Gulf states are increasingly acquiring advanced EW technologies to counter drone swarms, missile threats, and communication disruptions. Additionally, the entry of global contractors into the region is strengthening local supply chains and driving the market.

Saudi Arabia Electronic Warfare Market Analysis

Saudi Arabia is leading the market for electronic warfare systems in the Middle East and Africa, driven by the country's strategic need to protect energy infrastructure, counter UAS threats, and secure maritime chokepoints. Major system integrators are attracted to defense offset programs and localization policies, which strengthen regional supply chains and foster local production capabilities.

Electronic Warfare Market – Value Chain Analysis

1. Raw Material Sourcing & Electronic Components

The foundation of EW systems lies in sourcing advanced electronic materials and components, including semiconductors, radar transceivers, high-frequency antennas, and signal processors. These components are critical for developing sensors, communication systems, and signal detection modules.

- Key Players: Analog Devices, Infineon Technologies, Broadcom Inc., Rohde & Schwarz.

2. Subsystem & Module Fabrication

Raw components are integrated into specialized subsystems such as radar warning receivers, electronic support measures (ESM), jammers, and electronic countermeasure (ECM) modules. This stage focuses on miniaturization, power optimization, and electromagnetic shielding.

- Key Players: Elbit Systems, L3Harris Technologies, BAE Systems, Thales Group.

3. System Integration & Platform Development

At this stage, EW subsystems are assembled into full-scale operational systems for aircraft, naval vessels, and land vehicles. System integration includes hardware-software synchronization, signal analysis algorithms, and cybersecurity reinforcement to ensure interoperability and stealth capabilities.

- Key Players: Northrop Grumman, Lockheed Martin, Raytheon Technologies, Leonardo SpA.

4. Testing, Calibration & Validation

Rigorous testing and field validation are conducted to assess signal accuracy, jamming strength, frequency range, and system resilience against hostile electronic attacks. This includes electromagnetic compatibility testing, simulation environments, and real-time battlefield trials.

- Key Players: Saab AB, BAE Systems, Raytheon Technologies, IAI.

5. Deployment & OEM Collaboration

Final systems are integrated into defense platforms and delivered to OEMs or military clients for operational use. This stage involves collaboration with defense ministries and aerospace contractors for fleet-wide deployment, maintenance, and software updates.

- Key Players: Boeing Defense, Airbus Defence and Space, General Dynamics, Thales Group.

6. Aftermarket Support & Upgrades

Post-deployment, continuous maintenance, software upgrades, and threat-adaptive reprogramming ensure long-term effectiveness against evolving electronic threats. This also includes lifecycle management, spare parts supply, and training programs for defense personnel.

- Key Players: L3Harris Technologies, Lockheed Martin, BAE Systems, Northrop Grumman.

Electronic Warfare Market Companies

- BAE Systems plc (UK): BAE Systems is a global defense technology leader offering advanced electronic warfare (EW) systems, threat detection solutions, and countermeasure suites for aircraft, naval vessels, and ground forces.

- Elbit Systems Ltd. (Israel): Elbit Systems delivers cutting-edge electronic warfare and signal intelligence solutions, including self-protection suites and electronic countermeasures for military aircraft and armored vehicles.

- General Dynamics Corporation (U.S.): General Dynamics provides mission-critical EW and cyber defense technologies integrated into communication, surveillance, and intelligence platforms for modern defense operations.

- Israel Aerospace Industries Ltd. (IAI) (Israel): IAI develops advanced electronic warfare systems for air, sea, and land applications, focusing on radar warning receivers, jamming systems, and electronic support measures.

- L3Harris Technologies Inc. (U.S.): L3Harris offers comprehensive EW solutions, including electronic attack, protection, and support systems, designed to enhance situational awareness and survivability in contested environments.

- Leonardo SpA (Italy): Leonardo is a leading European defense company specializing in radar, communications, and electronic warfare technologies for aircraft, naval platforms, and integrated defense systems.

- Lockheed Martin Corporation (U.S.): Lockheed Martin designs and integrates advanced EW systems and countermeasure technologies that enable real-time threat detection, spectrum dominance, and mission adaptability.

- Northrop Grumman Corporation (U.S.): Northrop Grumman is a major innovator in electronic warfare, providing cutting-edge systems for radar jamming, signal intelligence, and next-generation electronic attack capabilities.

- Raytheon Technologies Corporation (U.S.): Raytheon Technologies develops sophisticated EW and radar systems, delivering electronic support, attack, and protection technologies across air, land, and maritime domains.

- SAAB AB (Sweden): SAAB produces advanced self-protection and electronic countermeasure systems that enhance the survivability and operational efficiency of aircraft, ships, and ground vehicles.

- Thales Group (France): Thales designs and manufactures electronic warfare and sensor fusion solutions, integrating radar, communications intelligence, and jamming technologies for global defense and security forces.

This electronic warfare market is rapidly evolving with the integration of artificial intelligence, cognitive jamming, and advanced electronic countermeasures systems. Key innovations include software-defined radios, next-generation radar spoofing systems, and compact, modular EW solutions for unmanned platforms. Some of the technological advancements are as follows:

Technological recent advancements

- On July 2025, Nagpur University is launching innovative undergraduate degrees in drone technology and cyber science this academic year, featuring hands-on training in aerial robotics, GIS, cybersecurity, ethical hacking, and digital forensics. The a rising demand for skilled drone pilots and cybersecurity experts in both the government and private sectors. This has pushed industry-academia collaboration in tech hubs like Pune and Nagpur. Also, this has encouraged many government incentives under Skill India and the digital India Initiative.

(Source: https://timesofindia.indiatimes.com)

- In July 2025, a collaborative effort between the Motilal Nehru National Institute of Technology (MNNIT) and King George's Medical University (KGMU) led to the development of an innovative device designed to minimize the need for repetitive X-ray examinations after a bone fracture. This new technology aims to enhance patient care by reducing exposure to radiation while ensuring that healthcare providers can effectively monitor the healing process. The device is expected to play a crucial role in orthopedic practices, potentially improving recovery outcomes for patients while prioritizing their safety.

(Source: https://timesofindia.indiatimes.com)

Recent Developments

- On July 2025, MNNIT Prayagraj and KGMU Lucknow have co-developed a fiber-optic device that monitors bone healing through vibrations and pressure, eliminating the need for repetitive X-rays and benefiting vulnerable patients. A medical sensor that eliminates repetitive X-rays using optical feedback on bone healing. Focus on affordable, indigenous healthcare solutions for rural and semi-urban regions. Collaboration between top academic (MNNIT) and medical (KGMU) institutions. Rising incidence of road accidents and orthopaedic cases demanding non-invasive tech.

(Source: https://timesofindia.indiatimes.com)

- On July 2025, Lucknow's "Plantation-2025" campaign is embedding geo-tagging and protective technology like tree guards to digitally monitor sapling growth, improving transparency and long-term care. State-driven afforestation and climate resilience missions. Demand for transparency in environmental schemes. Use of GIS and digital mapping in public sector programs.

(Source:https://timesofindia.indiatimes.com)

- October 2022: India's Centum Electronics Ltd. Ltd. signed a memorandum of understanding (MoU) with and Israel's Rafael Advanced Systems to jointly develop an electronic warfare (EW) system for the Indian Coast Guard and the Indian Navy.

- February 2023:Israel Aerospace Industries signed a memorandum of understanding (MoU) with MBDA Germany for a cooperation agreement of electronic air defense and electronic warfare training for the German Armed Forces.

- August 2023: Australia's Alaris Antennas announced its partnership with Asension's role as a provider of electronic components and systems in the region.

Segments Covered in the Report

By Domain

- Electronic Attack

- Electronic Protection

- Electronic Support

By Equipment

- Jammer

- Antenna

- Radar Warning Receiver

- Directed Energy Weapon

- Anti-radiation Missile

- Counter Measure Dispenser System (CMDS)

- Directional Infrared Countermeasure (DIRCM)

- Self-protection EW Suite

- Others

By Platform

- Air-based

- Sea-based

- Land-based

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content