Healthcare IT Services Market Size and Forecast 2025 to 2034

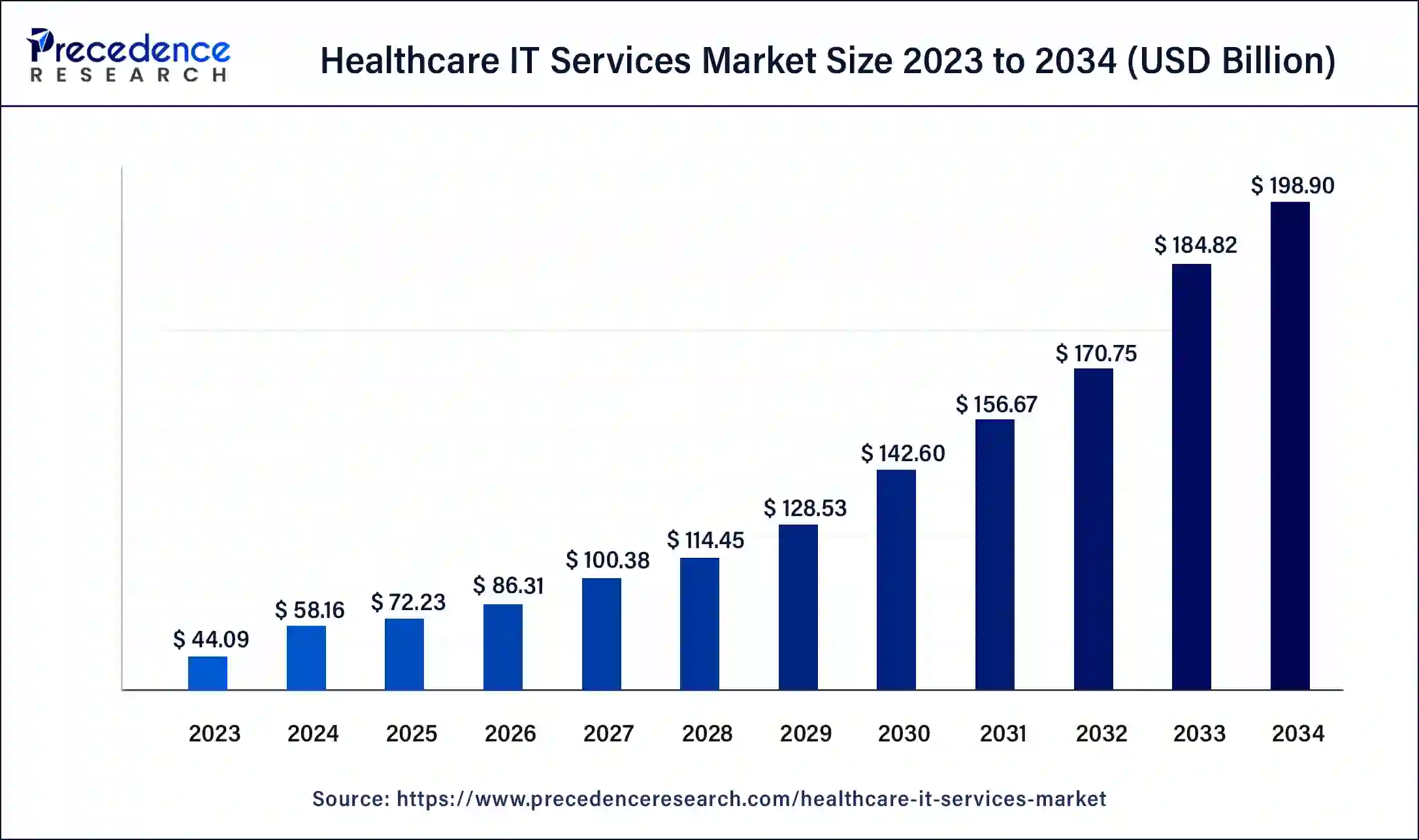

The global healthcare IT services market size was calculated at USD 58.16 billion in 2024 and is expected to reach around USD 198.90 billion by 2034, expanding at a CAGR of 13.08% from 2025 to 2034.

Healthcare IT Services Market Key Takeaways

- In terms of revenue, the healthcare IT services market is valued at USD 72.23 billion in 2025.

- It is projected to reach USD 198.90 billion by 2034.

- The healthcare IT services market is expected to grow at a CAGR of 13.08% from 2025 to 2034.

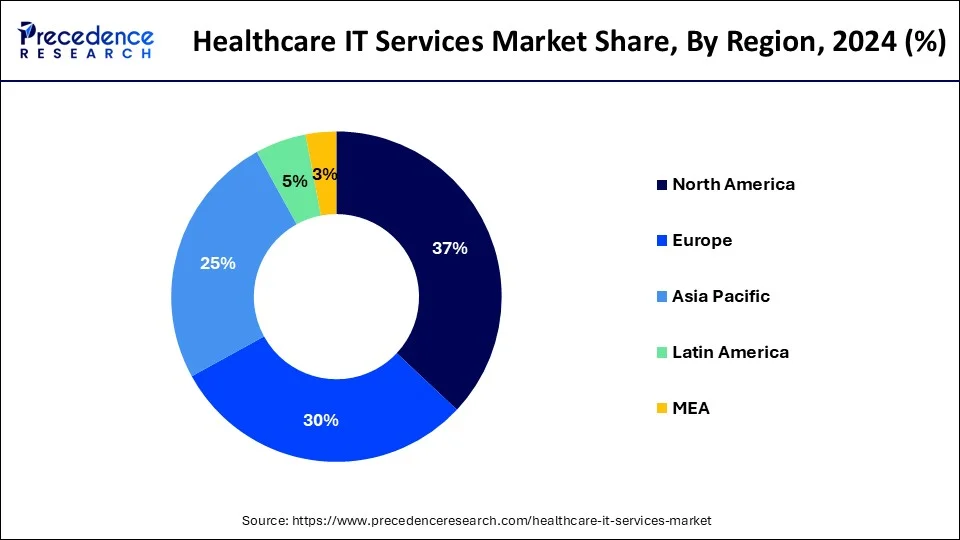

- North America led the market with the biggest market share of 36.4% in 2024.

- Asia Pacific is expected to witness the fastest rate of growth in the healthcare IT services market during the forecast period.

- By type, the medical imaging segment held the largest segment of the healthcare IT services market in 2024.

- By type, the managed services segment is expected to grow at a significant rate during the forecast period.

- By application, the healthcare analytics segment is expected to hold the dominating share of the market during the forecast period.

- By application, the fraud management segment is expected to grow at a notable rate.

U.S. Healthcare IT Services Market Size an Growth 2025 to 2033

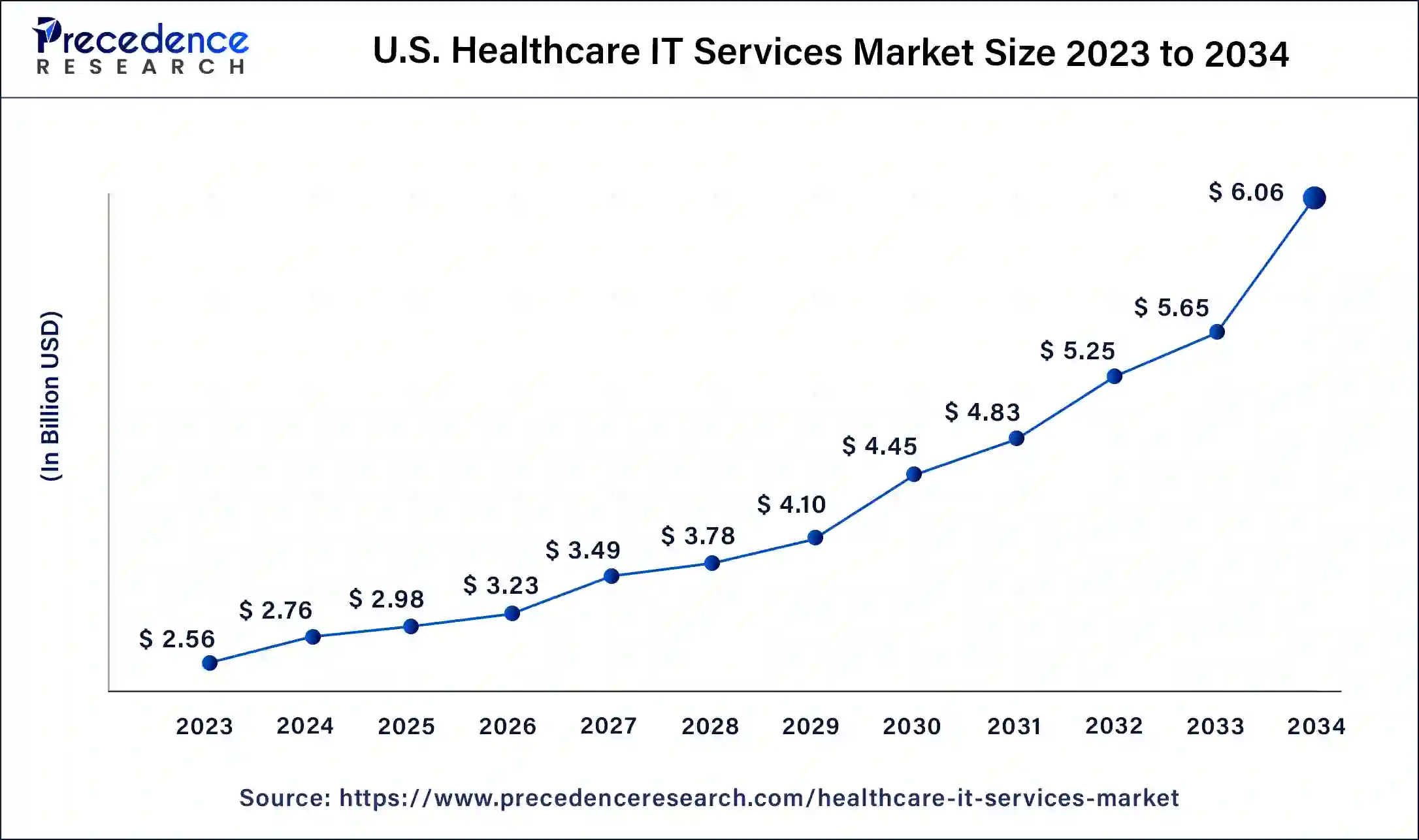

The U.S. healthcare IT services market size was valued at USD 15.06 billion in 2024 and is expected to reach USD 52.59 billion by 2033, growing at a CAGR of 13.32% from 2025 to 2033.

North America had the highest market share of 36.4% in 2024 and is maintain its dominant position between 2024 and 2033, in the healthcare IT services market due to robust technology infrastructure, widespread adoption of advanced healthcare technologies, and stringent regulatory frameworks promoting digitization.

- According to Health IT reports, by 2021, nearly 9 out of 10 physicians based in the U.S. had embraced EHR systems. This high adoption rate proves to be a pivotal factor contributing significantly to the growth of the market.

The region boasts a high concentration of key market players, extensive government initiatives for EHR implementation, and a strong focus on improving healthcare outcomes through IT integration. The mature healthcare system and substantial investments in healthcare IT contribute to North America's major market share, as the region continues to lead in the adoption of innovative solutions for enhanced patient care and operational efficiency.

The U.S. is a major player in the regional market, growth driven by increased adoption of cutting-edge technologies in healthcare, including IoT devices, AI integration, and cloud computing. Federal initiatives, like the Health Insurance Portability and Accountability Act (HIPAA), are shaping the implementation of strong IT systems for data protection in healthcare organizations. The country's surge in telehealth is fostering market expansion.

- In March 2025, Congress announced the extension of key telehealth flexibilities for another six months, along with the establishment of novel measures in America. Source: openloophealth.com

Asia-Pacific is poised for rapid growth in the healthcare IT services market due to increasing digitalization, expanding healthcare infrastructure, and a growing focus on improving patient care and data management. Rising awareness of the benefits of IT solutions, coupled with government initiatives promoting healthcare technology adoption, drives market expansion. Additionally, the region's large and diverse population presents significant opportunities for IT service providers to address the evolving healthcare needs, creating a favorable environment for the accelerated growth of healthcare IT services in the Asia-Pacific market.

- In March 2025, the Ministry of Health and Family Welfare (MoHFW) integrated Artificial Intelligence (AI) into public health services. The government demonstrated three premier institutions, including AIIMS Delhi, PGIMER Chandigarh, and AIIMS Rishikesh, as ‘Centres of Excellence for Artificial Intelligence' to enhance AI-powered solutions development and deployment to improve disease surveillance, diagnosis, and patient care. Source: ehealth.eletsonline.com

Meanwhile, Europe is growing at a notable rate in the healthcare IT services market due to increasing digitization initiatives in healthcare, government support for technological advancements, and the growing awareness of the benefits of IT solutions. The region is witnessing a surge in the adoption of electronic health records (EHR), telehealth services, and advanced analytics. Additionally, regulatory frameworks promoting interoperability and data security have created a favorable environment. The demand for healthcare IT services in Europe is further propelled by the need for improved patient outcomes, streamlined workflows, and efficient healthcare management systems.

Market Overview

Healthcare IT services encompass a broad spectrum of technology-driven solutions designed to enhance and optimize healthcare delivery. This multifaceted field integrates advanced technologies into various aspects of the healthcare sector to improve efficiency, patient care, and overall system performance. Key services within Healthcare IT include the implementation of electronic health records (EHR), which digitize patient information, streamlining data management and accessibility for healthcare providers. Additionally, the adoption of telehealth solutions facilitates remote healthcare delivery, enabling virtual consultations and monitoring.

Healthcare IT Services Market Data and Statistics

- In April 2021, Microsoft Corp. and Nuance Communications, Inc. entered into a binding contract, marking a significant step in Microsoft's commitment to offering specialized cloud solutions tailored to different industries, particularly in healthcare. This move is aimed at assisting customers and partners in navigating challenges and capitalizing on emerging opportunities within the healthcare sector.

- In November 2021, InsiteOne LLC launched its platform (V11) for broader use after a successful trial at Doylestown Health in the United States. This upgraded platform signifies a substantial technological advancement, facilitating the seamless integration of various tools into clinical workflows. It equips healthcare institutions with automation tools designed to optimize the utilization of their enterprise VNA imaging data.

Healthcare IT Services Market Growth Factors

- The ongoing transition to digital healthcare processes, encompassing electronic health records (EHR) and telehealth solutions, is spurring the demand for IT services to streamline operations and elevate patient care.

- As the healthcare landscape seeks seamless data exchange between systems and providers, there is a rising need for IT services that facilitate interoperability, ensuring a smooth integration of diverse healthcare technologies.

- With the surge in sensitive patient data, ensuring robust cybersecurity solutions has become paramount, making IT services crucial for safeguarding healthcare information.

- The swift adoption of telehealth services, particularly in response to global events, is driving the healthcare IT services market. Organizations are seeking technological support to optimize virtual healthcare delivery.

- Healthcare institutions are embracing IT services integrated with data analytics tools to extract valuable insights. This empowers informed decision-making, ultimately contributing to improved healthcare outcomes.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 198.90 Billion |

| Market Size in 2025 | USD 72.23 Billion |

| Market Size in 2024 | USD 58.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.08% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for electronic health records (EHR)

- In 2021, the Office of the National Coordinator for Health Information Technology reported that approximately 94% of hospitals in the United States adopted certified EHR technology.

The escalating demand for electronic health records (EHR) significantly propels the market demand for healthcare IT services. The adoption of EHR systems has become a pivotal strategy for healthcare providers aiming to enhance patient care, streamline workflows, and achieve regulatory compliance. EHRs facilitate comprehensive and centralized electronic health information, enabling healthcare professionals to access, manage, and share patient data efficiently. As the healthcare industry transitions from traditional paper-based records to digital platforms, the need for specialized IT services arises to ensure the seamless integration, implementation, and optimization of EHR systems.

The surge in EHR adoption is driven by the numerous benefits it offers, including improved clinical decision-making, increased patient engagement, and enhanced overall healthcare efficiency. healthcare IT services play a crucial role in supporting organizations through the complex process of EHR implementation, customization, and maintenance. This rising demand underscores the integral role of IT services in facilitating the successful integration of EHR systems, ultimately contributing to the modernization and advancement of healthcare practices.

Restraint

Integration issues and high implementation costs

Integration issues and high implementation costs act as substantial restraints on the market demand for healthcare IT services. Integration challenges arise from the complex nature of healthcare systems, with existing legacy systems often incompatible with modern IT solutions. This impedes the seamless flow of information and limits the efficiency gains expected from the adoption of integrated IT services.

Furthermore, the high implementation costs associated with healthcare IT services hinder widespread adoption. A study published in the Journal of Medical Internet Research (JMIR) indicates that cost considerations are a significant factor influencing healthcare organizations' decisions on IT adoption. The substantial financial investment required for implementing advanced IT solutions, such as electronic health records, poses a barrier for many healthcare providers, particularly smaller institutions with limited budgets, limiting the overall market demand for these services.

Opportunity

Renewable energy targets

The integration of Internet of Things (IoT) in healthcare and the emphasis on healthcare analytics are creating substantial opportunities for the healthcare IT services market. IoT devices, ranging from wearables to medical sensors, generate vast amounts of real-time patient data. This influx of data presents an opportunity for IT services to develop solutions that facilitate efficient data collection, analysis, and integration into healthcare systems. IoT enables remote patient monitoring, improves treatment adherence, and enhances overall patient care, driving the demand for IT services to manage and optimize these interconnected systems.

- A 2022 study by HIMSS Analytics revealed that 75% of healthcare organizations are using IoT solutions for patient monitoring.

Simultaneously, the rise of healthcare analytics provides an avenue for IT services to deliver advanced data-driven insights. Analytics solutions can interpret complex healthcare data, offering valuable information for clinical decision-making, operational efficiency, and predictive modeling. IT services assume a crucial role in creating and deploying analytics tools, empowering healthcare providers to extract actionable intelligence from their data. This contributes to enhanced patient outcomes and more efficient healthcare processes. As healthcare organizations increasingly grasp the significance of these technologies, the demand for specialized IT services is anticipated to surge in harmony with the evolving requirements of the healthcare industry.

Type Insights

The medical imaging segment dominated the healthcare IT services market in 2024; the segment is observed to continue the trend throughout the forecast period. In the healthcare IT services market, the medical imaging segment focuses on technology solutions that enhance the acquisition, storage, and distribution of medical images. This includes Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS). A prominent trend in this segment is the integration of Artificial Intelligence (AI) for image analysis, improving diagnostic accuracy and efficiency. Additionally, cloud-based medical imaging solutions are gaining traction, facilitating seamless access to images across healthcare networks, enhancing collaboration, and supporting remote diagnostics. The medical imaging segment continues to evolve, playing a crucial role in advancing diagnostic capabilities and patient care.

The managed services segment is expected to grow at a significant rate throughout the forecast period. In the healthcare IT services market, the managed services segment refers to the outsourcing of IT operations and responsibilities to third-party providers. Managed services encompass various functions, including network management, security, and system maintenance, allowing healthcare organizations to focus on core activities.

A notable trend in this segment involves the increasing adoption of managed services to ensure the seamless operation of healthcare IT systems. This trend is driven by the growing complexity of IT environments, emphasizing the need for specialized expertise and external support to optimize overall performance and cybersecurity in healthcare settings.

Application Insights

The healthcare analytics segment is observed to hold the dominating share of the healthcare IT services market during the forecast period. The healthcare analytics segment in the healthcare IT services market involves the utilization of data analysis tools to extract meaningful insights for improved decision-making in clinical, operational, and financial aspects of healthcare delivery. The trend in healthcare analytics is marked by a growing emphasis on real-time analytics, predictive modeling, and population health management. Healthcare providers are increasingly leveraging analytics solutions to enhance patient care, optimize resource allocation, and adapt to value-based care models, driving the demand for advanced healthcare IT services tailored to analytics applications.

The fraud management segment is expected to generate a notable revenue share in the market. Fraud management in the healthcare IT services market refers to the application of technology solutions to detect, prevent, and mitigate fraudulent activities within healthcare systems. As the industry digitizes, fraud management becomes crucial to safeguard sensitive patient data and financial transactions. Key trends include the integration of advanced analytics and artificial intelligence for real-time monitoring, anomaly detection, and pattern recognition, providing healthcare organizations with proactive tools to combat fraudulent activities and ensure the integrity and security of their systems.

Healthcare IT Services Market Companies

- Cerner Corporation

- Epic Systems Corporation

- McKesson Corporation

- Allscripts Healthcare Solutions, Inc.

- Athenahealth, Inc.

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- IBM Corporation

- Oracle Corporation

- Dell Technologies Inc.

- NextGen Healthcare

- Carestream Health

- eClinicalWorks

- CPSI (Computer Programs and Systems, Inc.)

Recent Developments

- In March 2025, the parent entity of insurance brokerage firm Policybazar, PB Fintech Ltd., announced its proposal of Rs 696 crore for PB Healthcare Services Private Limited, its subsidiary, for the next financial year for business growth, decided by the Board of Directors of PB Fintech Ltd. Source: moneycontrol.com

- In April 2025, a leader in offering digital cloud fax and interoperability solutions, Consensus Cloud Solutions, Inc., announced that its eFax, a cloud fax platform, was nominated for the G2's 2025 Best Software Awards. The platform has placed #12 in the Best Healthcare Software Products list. Source: markets.ft.com

- In February 2025, the India Digital Health Activator was launched by the World Economic Forum (WEF). The India Digital Health Activator is a novel effort in accelerating digital health choice, interoperability, and research through public-private collaboration. The World Economic Forum (WEF) announced the establishment of these initiatives in regional homes for testing and scaling the digital health solutions, along with the government's digital healthcare initiatives, at THIT 2025. Source: businesstoday.in

- In October 2023, Carestream Health collaborated with EXAMION, a German medical imaging solutions provider, aiming to bolster Carestream's product capabilities and expertise in the field of medical imaging solutions.

- In June 2022, Athena health expanded its mobile Electronic Health Record (EHR) voice capabilities, offering healthcare providers a voice assistant to enhance documentation accuracy, improve the patient experience, and save time.

- In March 2022, Constellation Software's N. Harris Computer Corporation finalized an agreement with Allscripts Healthcare to acquire its electronic health record business segments, including tools like Opal, Paragon, dbMotion, Sunrise, and TouchWorks.

- In March 2022, athenahealth and MedWise entered into a partnership, enabling MedWise to utilize athenaOne's medical coding solutions to enhance patient experience, reduce administrative burden, and improve financial performance.

Segments Covered in the Report

By Type

- Medical Imaging

- Consulting & Outsourcing

- Managed Services

- Order & Inventory Management

- Document Management

By Application

- Healthcare Analytics

- Patient Care Management

- Fraud Management

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting