Big Data Analytics in Healthcare Market Size and Forecast 2025 to 2034

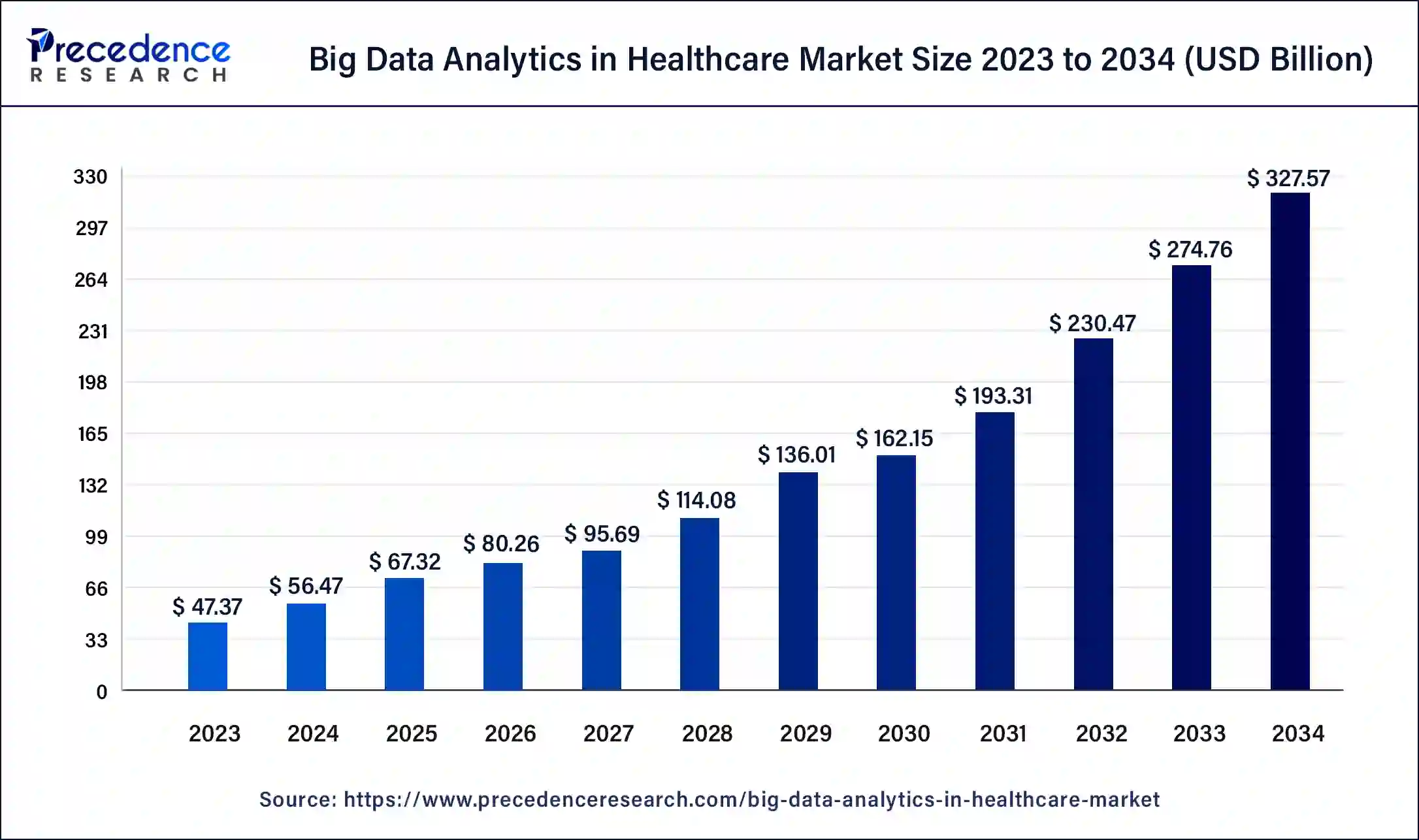

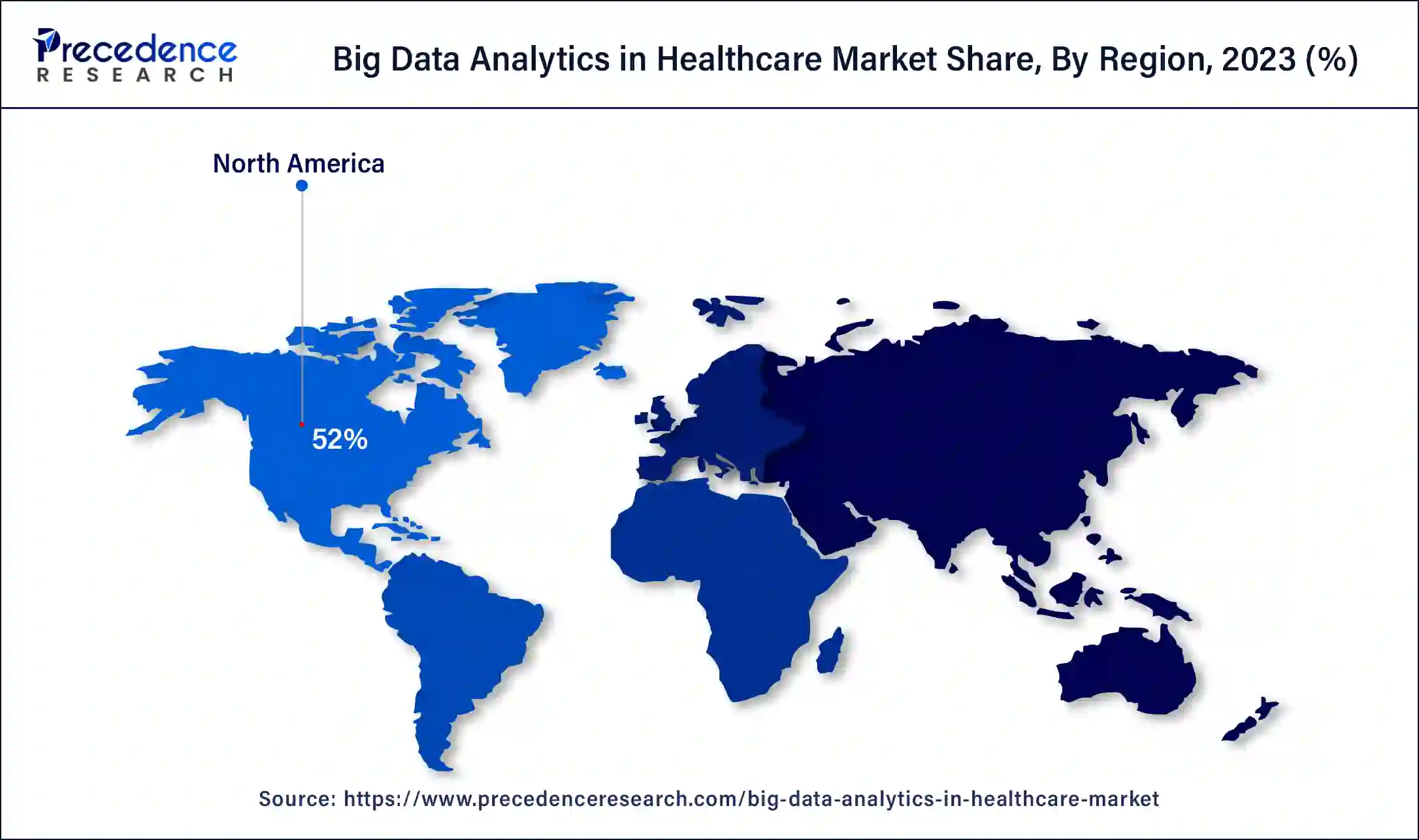

The global big data analytics in healthcare market size was valued at USD 56.47 billion in 2024, and is projected to fit around USD 67.32 billion by 2025, and is anticipated to reach around USD 327.57 billion by 2034, growing at a solid CAGR of 19.21% over the forecast period 2025 to 2034. The North America big data analytics in healthcare market size reached USD 24.63 billion in 2023. The big data analytics in healthcare market growth is attributed to the increasing demand for personalized medicine, advancements in artificial intelligence, the rise of telehealth services, and government initiatives promoting healthcare data analytics.

Big Data Analytics in Healthcare Market Key Takeaways

- In terms of revenue, the big data analytics in healthcare market is valued at $67.32 billion in 2025.

- It is projected to reach $327.57 billion by 2034.

- The big data analytics in healthcare market is expected to grow at a CAGR of 19.21% from 2025 to 2034.

- North America dominated the global big data analytics in healthcare market with the largest market share of 52% in 2024.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

- By spender, the healthcare payer segment held a dominant presence in the market in 2024.

- By spender, the healthcare provider segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By tool, the predictive analytics segment accounted for a considerable share of the market in 2024.

- By tool, the visual analytics segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By application, in 2024, the access clinical information segment led the global market.

- By application, the access operational information segment is projected to expand rapidly in the market in the coming years.

- By deployment, the on-premises segment held a significant share of the market in 2024.

- By deployment, the cloud segment is projected to grow at the fastest rate in the market in the future years.

Impact of Artificial Intelligence (AI) on the Big Data Analytics in Healthcare Market

AI plays an important role in the advanced improvement of the big data analytics in healthcare market through changing data management methods and diagnostics analytics. ITS tools improve the effectiveness of healthcare delivery through information analysis for predictions and tailored approaches to treatment. The implementation of artificial intelligence in the healthcare sector ensures that large medical data sets are analyzed faster, improving the overall decision-making processes and patient care. Furthermore, the development of applied AI technology is set to strongly favor even further proactive and data-oriented medical activities, overall healthcare improvements, and optimization of medical processes.

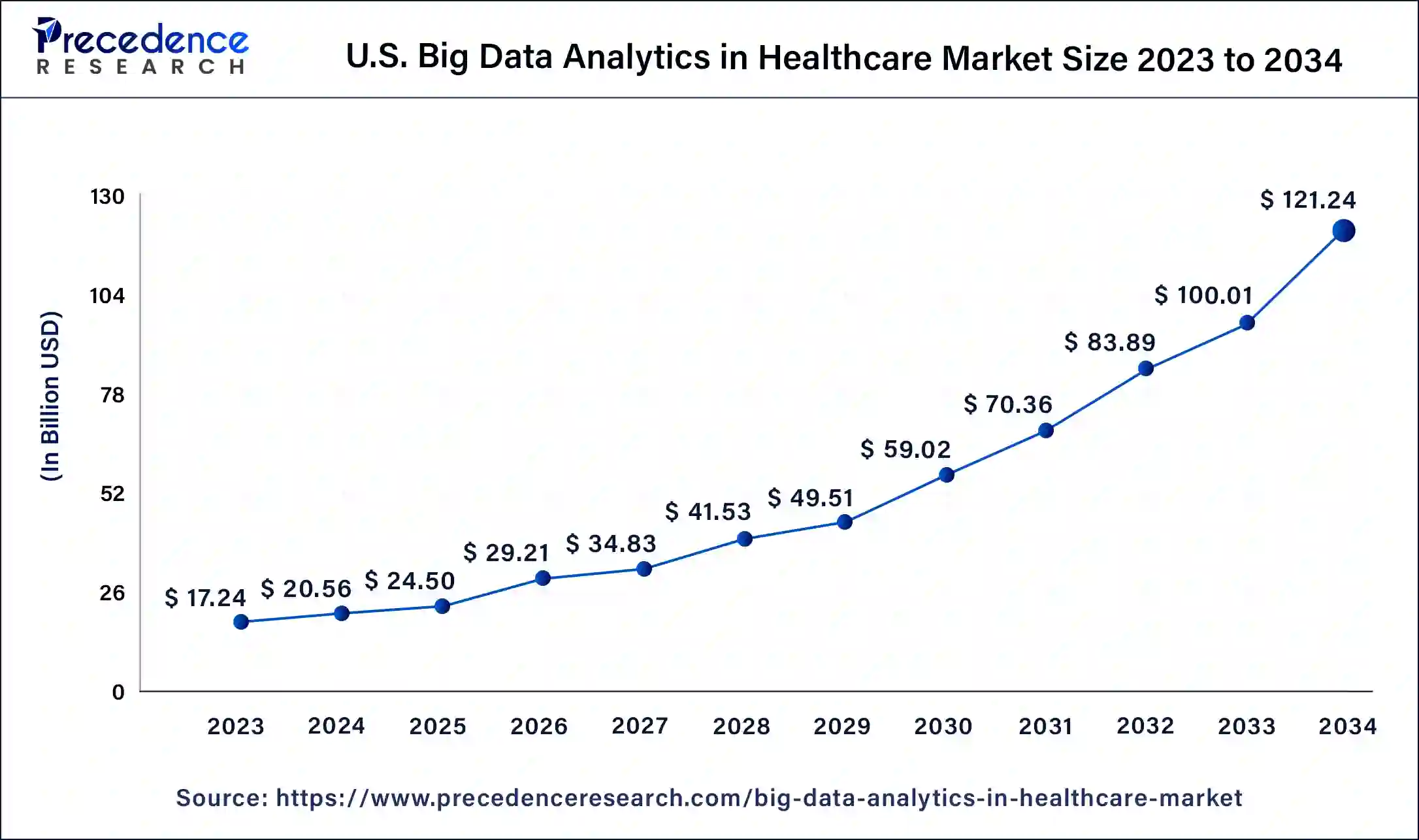

U.S. Big Data Analytics in Healthcare Market Size and Growth 2025 to 2034

The U.S. big data analytics in healthcare market size was exhibited at USD 20.56 billion in 2024 and is projected to be worth around USD 121.24 billion by 2034, poised to grow at a CAGR of 19.41% from 2025 to 2034.

North America dominated the global big data analytics in healthcare market in 2024 due to the technological adaption, strong healthcare framework, and major perspectives of big players. The U.S. healthcare industry, in particular, has embraced big data solutions to enhance patient care and organizational performance and gain compliance with legal frameworks, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act. These necessitate the requirement for analysis to extract knowledge from the masses of data that are being generated on patients.

- A report published by the U.S. National Institutes of Health (NIH) in 2021 drew attention to the fact that 88% of U.S. hospitals have already implemented electronic health records.

Asia Pacific is projected to host the fastest-growing big data analytics in healthcare market in the coming years, owing to the increasing interest in adopting digitization in the healthcare system and the increased use of big data analytics across developing countries, such as China, India, and Japan. This growth has been attributed to Government policies that seek to enhance the general healthcare system and adoption of technology within those systems. Moreover, the steadily rising middle-class population in the region means that the demand for sophisticated healthcare services continues to rise, thus increasing the potential for data analytics applications.

- According to Asia Development Bank (2022), healthcare costs in Asia Pacific are projected to increase by over 6% annually, opening up a massive potential in the growth sector of healthcare in the region.

Europe is expected to grow significantly in the big data analytics in healthcare market during the forecast period. The growing diseases and digitalization in Europe are increasing the use of big data analytics in healthcare. It helps in predicting the diseases, which in turn, minimizes the time to select the suitable treatment option. At the same time, various insights during decision-making are also provided, which increases their use. The data of the patient can be stored and analyzed effectively. Additionally, the healthcare sector in the UK, as well as Germany, is utilizing big data analytics to detect the disease, as well as to monitor the patient's recovery. Moreover, with the use of advanced technologies, their applications are being enhanced. Furthermore, the implementation of regulations maintains its safety and security. Thus, this is promoting the market growth.

Market Overview

The increasing use of the big data analytics in healthcare market is due to the rising use of personalized medicine. Healthcare big data analysis uses vast and complex patient and clinical data sets to identify potentially valuable patterns and relationships subsequently. This insight makes better decisions to gain clearer insights to increase patient satisfaction and offer delivery process improvement.

The inclusion of predictive analytics as an improvised element in healthcare systems is also expected to fuel the growth of the big data analytics in healthcare market. This technology is useful in forecasting disease outbreaks, determining a specific treatment regimen for individual patients, and handling big data from electronic health records (EHRs), wearable, and trials. The WHO has estimated that large-scale data utilization helps cut half of the costs of health-related expenses globally, not to mention the improvement of the quality of treatments.

Technological Advancement

Advancements in technology are playing a major role in reshaping Big Data Analytics in healthcare, and provide transformative ability in medical studies, diagnostics, patient care, and operational prowess. The innovation is the integration of artificial intelligence to analyse huge unstructured datasets, including medical records, diagnostic imaging, genetic information, and predict outcomes for patients.

Big Data analytics has also received a game-changer from the emergence of cloud computing. The integration of wearable devices and IoT (Internet of Things) sensors in the healthcare systems has made it possible to monitor patients' health on a 24/7 basis, thus gathering current data for predictive analysis, which can be used for improving preventive care and emergency care.

Key Factors Influencing Future Market Trends

- Increasing healthcare data volume: Exponential growth of healthcare data due to electronic health records (EHRs), wearable devices, and medical imaging is one of the major factors that determine the demand for Big Data analytics. Addressing the growing need for data-driven insights, medical facilities increasingly collect all data.

- Artificial intelligence adoption: AI-based algorithms are increasingly becoming an essential part of the analysis of complex healthcare data, the recognition of patterns, and forecasts for individual treatment. They refine diagnostic precision, optimize the use of resources, and help to make chronic diseases stay under control, which makes Big Data analytics in healthcare massively spread.

- Cost reduction and operational efficiency: Healthcare organizations are now adopting the technology to cut costs and increase efficiency in operations. Analytics can support in simplifying hospital management, improving supply chains, and treatment protocols, which lead to the reduction of operational costs without compromising the quality of care and service delivery for patients.

- Improved data security and privacy: As the use of healthcare data analytics continues to increase, ensuring data security and privacy has become an imperative. Progress in the field of cybersecurity technologies, as well as the increasing adoption of regulations (such as GDPR and HIPAA), is boosting consumer confidence and motivating healthcare organizations to embrace Big Data solutions.

Big Data Analytics in Healthcare Market Growth Factors

- Increasing data volume: The exponential growth of healthcare data from electronic health records, wearables, and other sources necessitates advanced analytics to derive meaningful insights.

- Rising demand for personalized medicine: The shift towards personalized healthcare drives the need for analytics that tailor treatments and interventions based on individual patient data.

- Focus on value-based care: The transition from volume-based to value-based care models emphasizes the importance of data analytics for improving patient outcomes and reducing costs.

- Technological advancements: Innovations in artificial intelligence and machine learning enhance the capabilities of analytics solutions, making them more effective and user-friendly.

- Regulatory compliance: The need to comply with healthcare regulations, such as HIPAA, pushes organizations to adopt analytics tools that ensure data security and privacy while optimizing operations.

- Growth of telehealth services: The expansion of telemedicine and remote patient monitoring generates significant data that requires analytics for effective management and decision-making.

- Government initiatives and funding: Increasing government support and funding for healthcare IT initiatives promote the adoption of data analytics solutions across various healthcare settings.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 327.57 Billion |

| Market Size in 2025 | USD 67.32 Billion |

| Market Size in 2024 | USD 56.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.21% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Spender, Tool, Application, Deployment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

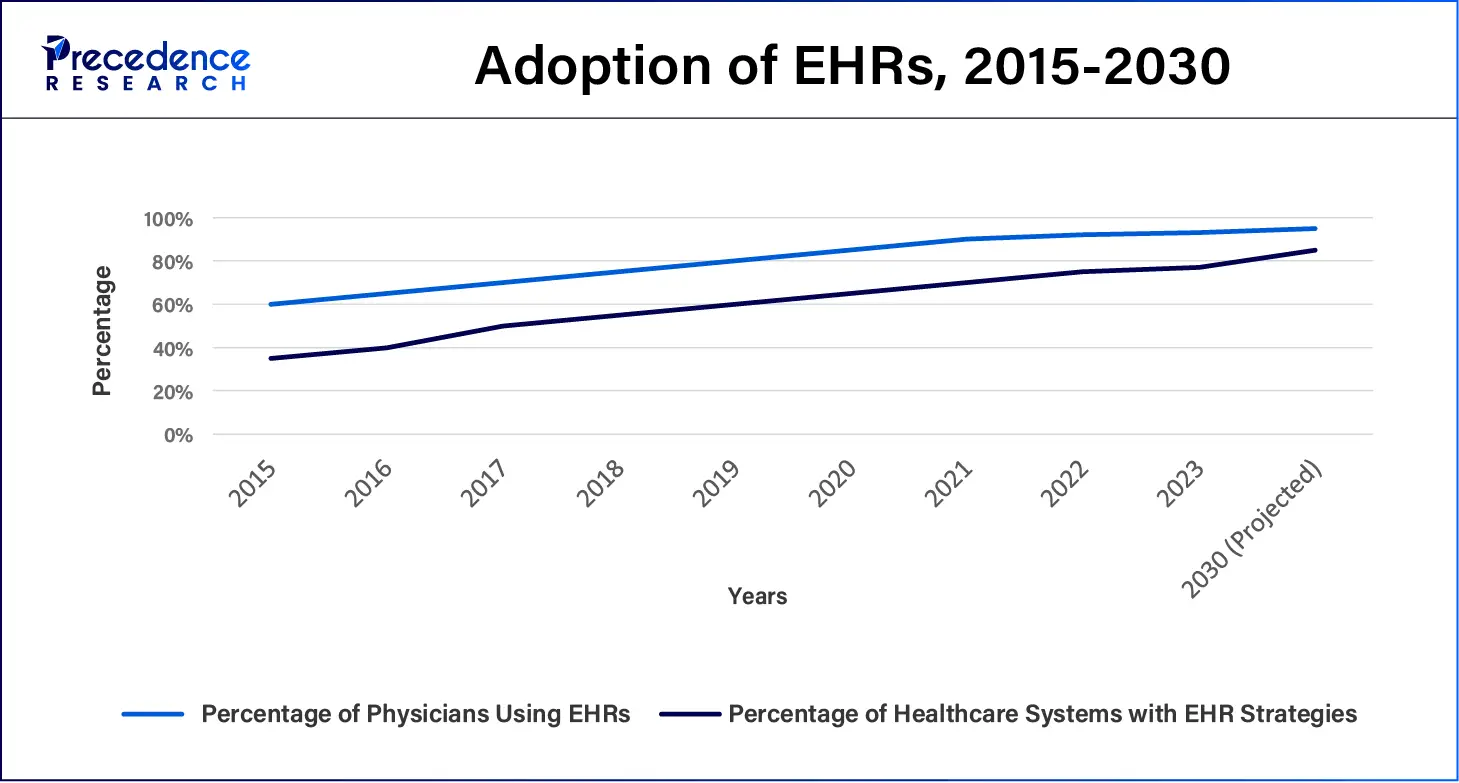

Increasing adoption of electronic health records

The growing implementation of electronic health records is anticipated to drive the demand for the big data analytics in healthcare market. EHRs generate significant volumes of patient information, which necessitates efficient means of enhancing therapeutic outcomes and enhancing practice operations. Furthermore, there is an increase in demand for data analytics in the context of healthcare.

- According to the survey by the Office of the National Coordinator for Health Information Technology (ONC), the U.S. has achieved an EHR adoption rate of 86% based on office-based practicing physicians in the year 2022.

- According to the World Health Organization, over 60% of healthcare facilities have embarked on an EHR solutions implementation plan courtesy of government push. Many CMSs also underline data analytics in enhancing EHR systems, with overall costs slashed by 20-30%.

| Year | Percentage of Physicians Using EHRs | Percentage of Healthcare Systems with EHR Strategies |

| 2015 | 60% | 35% |

| 2016 | 65% | 50% |

| 2017 | 70% | 55% |

| 2018 | 75% | 60% |

| 2019 | 80% | 65% |

| 2020 | 85% | 70% |

| 2021 | 90% | 75% |

| 2022 | 92% | 77% |

| 2023 | 93% | 75% |

| 2030 (Projected) | 95% | 77% |

Restraint

Data privacy concerns

Data privacy concerns are anticipated to hamper the growth of the big data analytics in healthcare market. Despite the importance of compliance, spending a high amount on it takes up resources from analytics necessary within healthcare organizations. Exposure to patients' information leads to expensive penalties, thus decreasing the number of organizations that use these complex analytics technologies.

- The Ponemon Institute published a report in 2022 that shows that the average cost of data breaches for the healthcare sector was USD 10.10 million.

- Based on a report from IBM Security, there is an alarming rise in data breaches in the healthcare industry, which jumped to 42% from 2019 to 2021.

| Year | Number of Healthcare Data Breaches | Average Cost of Breach (USD million) | Percentage Increase in Breaches (%) |

| 2018 | 365 | 7.91 | - |

| 2019 | 450 | 8.19 | 23% |

| 2020 | 500 | 9.23 | 11% |

| 2021 | 710 | 10.10 | 42% |

| 2022 | 750 | 10.20 | 5% |

Opportunity

Surging utilization of wearable devices

The soaring utilization of wearable health devices is expected to create immense opportunities for players competing in the big data analytics in healthcare market in the coming years. People are using fitness trackers and smartwatches to monitor heart rate, activity levels, and many other things. These devices produce a tremendous amount of data all the time.

In the big data analytics in healthcare market, interpreting information allows the healthcare workforce to inform and assure patient states, antecedent health status, risk prognosis, and customized early intervention. Additionally, the growth of interest in chronic diseases and the WHO admits that data from wearables improves patient follow-through treatment plans further propels the demand for AI technology in these healthcare devices.

- The IDC indicated that the market for wearable devices appeared to be worth USD 73 billion in 2018 and is expected to cross USD 100 billion by 2024 at a CAGR of 27.6%.

Spender Insights

The healthcare payer segment held a dominant presence in the big data analytics in healthcare market in 2024, due to the higher expectations on the efficiency of containing overall costs and enhancing patients' outcomes. Insurance companies and government programs primarily use analytics to evaluate risks, design optimal systems for claims management, and improve the identification of fraud. The expected transition to value-based care and payment systems also drives the demand for data analytical solutions for payers to assess the efficacy of treatments. This further links them to incentive compensations based on patient outcomes.

- In a report by Accenture, healthcare payers are predicted to spend more than USD 50 billion on analytics solutions by the year 2025.

The healthcare provider segment is expected to grow at the fastest rate in the big data analytics in healthcare market during the forecast period of 2024 to 2034, as hospitals and clinics are applying analytics tools to target clinicians' decision-making and patients' management. The increasing interest in personalized medicine and patient-centric care delivery models creates this growth since analytics make it possible to base treatments on patients' characteristics. Moreover, the implementation of artificial intelligence and machine learning in analytics improves expectancy as it helps providers to foretell patients' needs.

Tool Insights

The predictive analytics segment accounted for a considerable share of the big data analytics in healthcare market in 2024. This particular tool holds the ability to predict future occurrences using past data and statistics analysis tools to allow several healthcare providers to accurately prepare for future patient needs. The trend towards value-based reimbursement and population health has created a need for risk score calculations because organizations need to know who in the population is at risk and what steps to take. Furthermore, enhanced by the growing application of machine learning and artificial intelligence, predictive analytics augments the efficiency of existing healthcare strategies.

The visual analytics segment is anticipated to grow with the highest CAGR in the big data analytics in healthcare market during the studied years, owing to its ability to intelligently represent raw data. The large quantities of data produced by many healthcare organizations subsequently make the visualization of this information necessary for decision-making. Increasing health information technology, such as electronic health records and other digital health solutions, also explains this segment's expected growth. Additionally, the increased spending on visual analytical systems to improve care for patients and organizational performance contributes to fuelling the demand for AI technologies in this kind of tool.

Application Insights

The access clinical information segment led the global big data analytics in healthcare market. This application enables healthcare givers to always see the details of the patient's record, including the patient's history, laboratory results, and potential treatment options, as a means to enhance patient care and decision-making. The necessity of powerful clinical information systems based on personally contained and patient-orientated medicine development. Moreover, the use of multiple data inputs, such as EHR and wearables, helps providers create patient-clinician dossiers. Its capability to provide extensive access to clinical information enables early interventions, enhances the efficiency of the treatments rendered, and encourages the use of informed practices.

The access operational information segment is projected to expand rapidly in the big data analytics in healthcare market in the coming years. This application offers healthcare organizations information on their functioning within their ecosystems with special emphasis on the use of resources. The capacity and effectiveness of human resources and the management of their workflow processes. In the healthcare system, as the providers attempt to gain higher levels of clinical operational efficiency and lower costs, the necessity for analytics drives such improvements. Additionally, the current transition and more focus on value-based care operational analytics reflect the increased applications.

DeploymentInsights

The on-premises segment held a significant share of the big data analytics in healthcare market in 2024 due to standards, norms, and regulations such as HIPAA in the United States and GDPR in Europe. On-premises solutions ensure that institutions own the deployment of their data security, thus ideal for organizations dealing with very sensitive health information. Additionally, large hospitals and research institutions are becoming key advocates for patient data privacy, which further boosts the demand for advanced and secure AI data analytics technology.

- According to the European Commission (2020), about 9 out of 10 healthcare organizations in the European Union or the European Economic Area continue to run data analytics on-premises as they are more concerned about data ownership and/or data protection laws.

The cloud segment is projected to grow at the fastest rate in the big data analytics in healthcare market in the future years, owing to factors such as scalability, affordable price, and compatibility with other technologies intersecting healthcare. Cloud solutions provide real-time data processing, which means that healthcare practitioners process data from patients and analyze them using the Internet connection, even during the COVID-19 pandemic. Furthermore, the increasing demand by healthcare organizations desiring to optimize their operations and also lower costs relating to information technology.

- In the U.S., the University of Health and Human Services (HHS), in its report, discussed that there was a 50% rise in the telehealth service offering, and this has been attributed to the cloud infrastructure.

Big Data Analytics in Healthcare Market Companies

- Allscripts Healthcare Solutions

- Alteryx

- Cisco Systems Inc.

- Denodo Technologies Inc.

- IBM Corporation

- Infosys

- McKesson

- MedeAnalytics

- Microsoft Corp

- OptumHealth Care Solutions

- Oracle Corp

- SAP SE

- SAS Institute

- Swedish Health Services

- Verisk Analytics

- Zephyr Health

Recent Developments

- In July 2025, for infectious disease analytics, the STAgora™, which is a next-generation platform, was developed and launched by Seegene Inc., which is a global leader in molecular diagnostics (MDx) solutions. Moreover, to transform the way of world detects, responds, and tracks outbreaks is its main goal, where the diagnostic data is combined with advanced statistical modeling in this platform, which is designed as a real-time infectious disease intelligence system.

(Source:https://www.manilatimes.net)

- In June 2025, a powerful, full-stack analytics platform that is MapLab Enterprise, to change the operationalize and generation of healthcare insights of Healthcare and Life Sciences organizations, was launched by Komodo Health. Thus, with the use of MapLab Enterprise, the collaboration between data scientists to executives can be enhanced, as well as it can provide fast, confident decisions depending on unified healthcare insights, and amplify the time to insight.

(Source:https://www.businesswire.com)

- In February 2023, IBM announced the launch of enhanced AI-powered analytics tools within its Watson Health platform, designed to improve patient outcomes and operational efficiency for healthcare providers. The new features focus on analyzing clinical and operational data to identify trends and insights that support better decision-making.

- In March 2023, Google Cloud unveiled its Healthcare Data Engine, which enables healthcare organizations to integrate and analyze data from various sources seamlessly, enhancing data-driven decision-making. The platform supports interoperability by allowing providers to consolidate data from electronic health records, wearables, and other devices.

- In April 2023, Cerner announced the introduction of advanced predictive analytics capabilities in its electronic health record (EHR) systems, aimed at helping providers anticipate patient needs and improve care delivery. These capabilities enable healthcare professionals to analyze historical data and predict future patient outcomes, enhancing proactive care management.

Segments Covered in the Report

By Spender

- Healthcare Provider

- Healthcare Payer

By Tool

- Financial Analytics

- Data Warehouse Analytics

- CRM Analytics

- Production Reporting

- Visual Analytics

- Predictive Analytics

- Supply Chain Analytics

- Risk Management Analytics

- Test Analytics

- Others

By Application

- Access Clinical Information

- Access Transactional Data

- Access Operational Information

- Others

By Deployment

- On-premises

- Cloud-based

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content