What is Big Data Analytics Market Size?

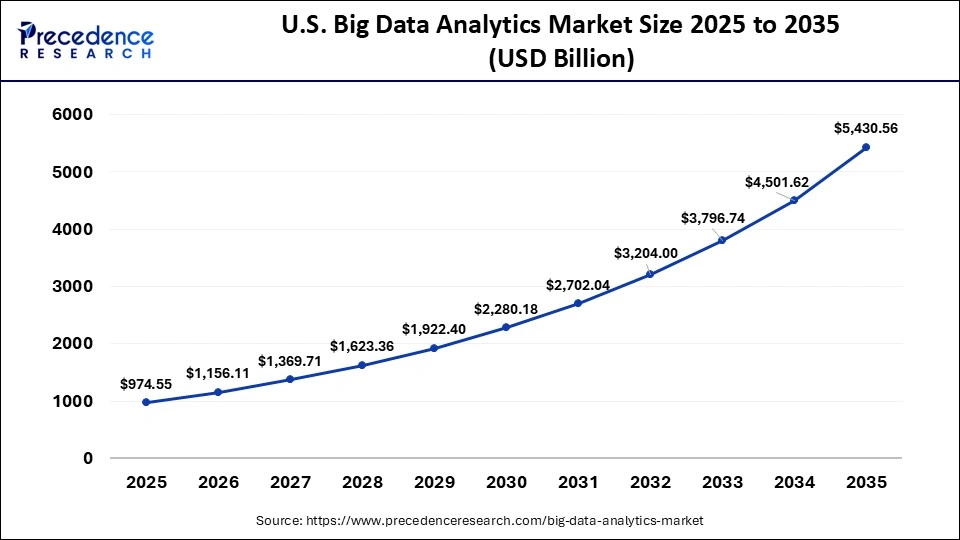

The global big data analytics market size was calculated at USD 495.18 billion in 2025 and is predicted to increase from USD 559.75 billion in 2026 to approximately USD 1,686.88 billion by 2035, expanding at a CAGR of 13.04% from 2026 to 2035. The market is experiencing robust growth because companies need faster and smarter insights from large amounts of data to improve decision-making, cut costs, and stay competitive.

Market Highlights

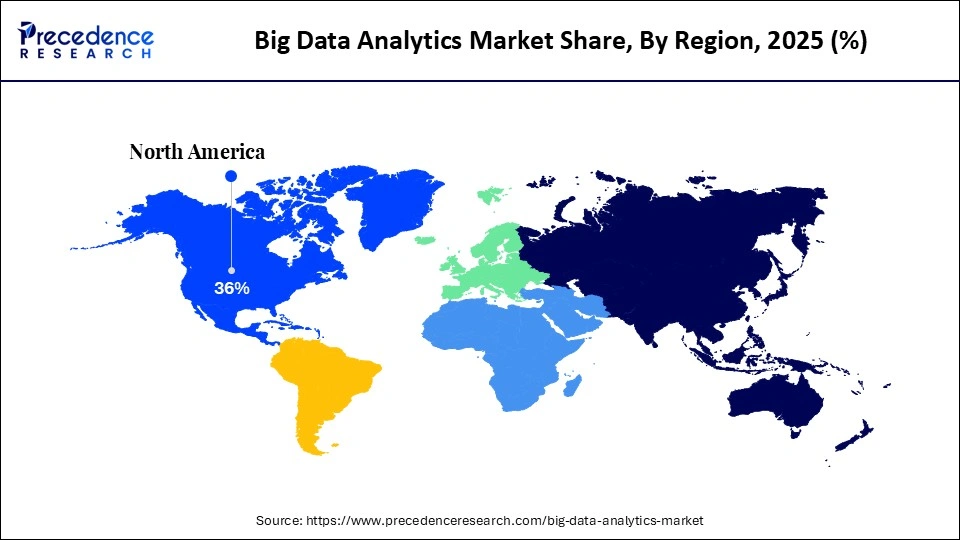

- North America dominated the big data analytics market in 2025.

- Asia-Pacific is expected to be the fastest-growing region between 2026 and 2035.

- By component, the software segment held a dominant position in the market with a share of approximately 46.2% in 2025.

- By component, the services segment is expected to grow at the fastest CAGR during the forecast period.

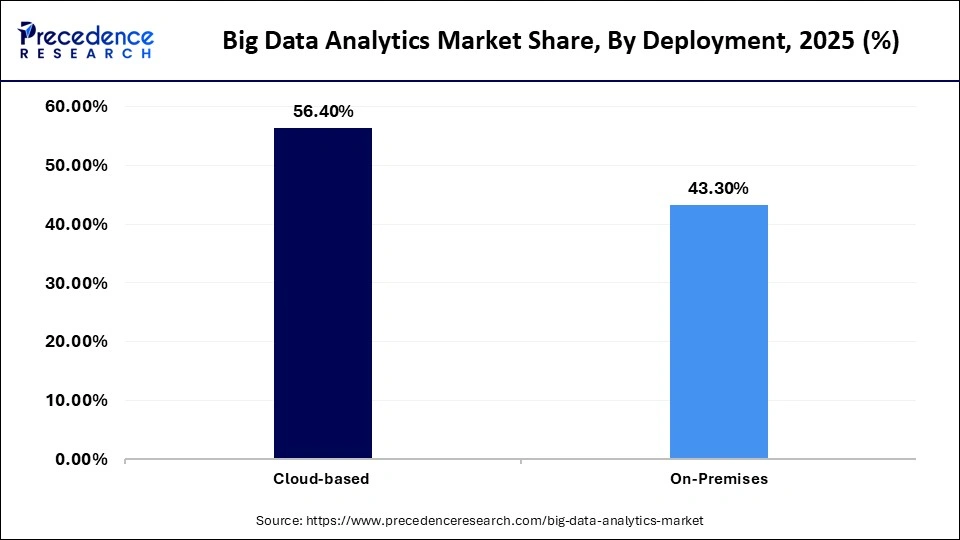

- By deployment, the cloud-based segment held a dominating revenue share of approximately 56.4% in the market in 2025, and is expected to sustain as a leader in the upcoming period.

- By application, the customer analytics segment led the global market with a share of approximately 32.1% in 2025.

- By application, the risk & credit analytics segment is expected to witness the fastest growth in the market over the forecast period.

- By vertical, the BFSI segment registered its dominance over the global market with a share of approximately 27.8% in 2025.

- By vertical, the healthcare & life sciences segment is expected to expand rapidly in the market in the coming years.

Market Overview

The global big data analytics market refers to advanced processes and technologies used to examine massive and varied datasets to uncover hidden patterns, correlations, and insights. Big data analytics can uncover trends, patterns, and correlations in large amounts of data, enabling analysts to make data-informed decisions. It can analyze data from various sources, including Internet of Things (IoT) sensors, social media, financial transactions, and smart devices. It is based on four main data analysis methods: descriptive, diagnostic, predictive, and prescriptive.

Big Data Analytics Market Trends

- AI-powered analytics is rising fast, as over 80% of companies now use artificial intelligence (AI) tools to quickly understand data, automate reports, and make faster business decisions with less manual effort.

- Real-time data analysis is growing rapidly, helping businesses track customer behaviour, detect fraud instantly, and manage supply chains better using live data from apps, devices, and sensors.

- Cloud-based analytics is coming to the default, with more than 70% of new analytics systems built on cloud platforms like AWS, Azure, and Google Cloud for flexibility, speed, and lower infrastructure costs.

- Predictive analytics adoption is increasing, allowing companies to forecast demand, reduce risks, and plan smarter strategies by learning patterns from historical and real-time data.

- Stronger focus on data security and privacy, driven by global regulations, pushing companies to invest in secure analytics platforms that protect sensitive business and customer information.

What is the Role of AI in the Big Data Analytics Market?

Artificial intelligence plays a key role in transforming the market by making data faster, smarter, and easier to use. It helps businesses automatically process huge volumes of data, identify patterns, and generate meaningful insights in real time. AI-powered tools improve forecasting, detect fraud, personalize customer experiences, and optimize operations across industries. By reducing manual work, AI allows teams to focus more on decision-making rather than data handling. It also improves accuracy by learning from past data and continuously refining results. As data volumes keep growing, AI ensures that organizations can turn complex information into clear, actionable insights, driving better performance, innovation, and long-term business growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 495.18 Billion |

| Market Size in 2026 | USD 559.75 Billion |

| Market Size by 2035 | USD 1,686.88 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component,Application, Deployment,Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

Why the Software Segment Dominated the Big Data Analytics Market?

The software segment led the global market with a share of approximately 46.2% in 2025 because organizations depend heavily on analytics platforms, visualization tools, and AI-based software to manage and interpret massive data volumes. These tools help businesses quickly convert raw data into clear insights for better decision-making. The growing use of cloud-based analytics, automation, and AI integration has further increased software adoption. Companies across industries prefer scalable and user-friendly software solutions to improve efficiency, reduce costs, and gain real-time business intelligence, making software the largest market contributor.

The services segment is expected to grow at the fastest CAGR of 31.5 % in the market between 2026 and 2035 due to the rising need for expert support in implementing and managing complex analytics systems. Many companies lack skilled data professionals, driving demand for consulting, integration, training, and managed services. Service providers help businesses customize analytics solutions, ensure smooth deployment, and maintain system performance. As data volumes and AI adoption increase, organizations rely more on specialized services to maximize returns from their analytics investments, improve data quality, and strengthen long-term digital transformation strategies.

Deployment Insights

How Cloud-based Segment Dominated the Big Data Analytics Market?

The cloud-based segment held a dominating revenue share of the market in 2025 and is expected to sustain as a leader in the upcoming period. It offers flexible, scalable, and cost-effective solutions for handling massive data volumes. Cloud platforms allow organizations to quickly store, process, and analyze data without heavy investment in physical infrastructure.

They also support real-time analytics, AI integration, and remote access, which are essential for modern digital operations. Businesses prefer cloud deployment for faster implementation, easy upgrades, and improved security. As companies across industries adopt digital transformation and data-driven strategies, demand for cloud-based analytics continues to rise, making it the leading and fastest-expanding deployment model globally.

Application Insights

Why Did the Customer Analytics Segment Dominate the Big Data Analytics Market?

The customer analytics segment accounted for a considerable revenue share of approximately 32.1% in the market in 2025 because businesses strongly focus on understanding customer behavior, preferences, and buying patterns. By analyzing customer data, companies can improve personalization, enhance user experience, increase customer loyalty, and boost sales. Industries such as retail, e-commerce, banking, and telecom heavily rely on customer analytics to design targeted marketing strategies and improve service delivery.

The risk & credit analytics segment is expected to grow with the highest CAGR in the market during the studied years, due to rising financial risks, digital payments, and increasing online transactions. Banks, fintech firms, and financial institutions use these tools to detect fraud, reduce defaults, and manage regulatory compliance. The rapid growth of digital lending, buy-now-pay-later services, and online banking has increased the need for real-time risk assessment. As financial security becomes critical, organizations are investing more in advanced risk and credit analytics, supporting strong growth across global financial markets.

Vertical Insights

Which Vertical Segment Dominated the Big Data Analytics Market?

The BFSI segment held a dominant position in the market with a share of approximately 27.8% in 2025, because banks, financial institutions, and insurance companies handle massive volumes of sensitive customer and transaction data every day. Analytics helps them detect fraud, assess credit risk, improve customer experience, and ensure regulatory compliance. With the rapid growth of digital payments, mobile banking, and online lending, financial institutions increasingly rely on advanced data analytics to improve security and operational efficiency. Personalized financial services, real-time fraud detection, and smarter risk management further strengthen the demand for analytics, making BFSI the leading industry.

The healthcare & life sciences segment is expected to witness the fastest growth in the market with a CAGR over the forecast period, due to the rising demand for data-driven clinical decisions, personalized medicine, and real-time patient monitoring. Hospitals and healthcare providers use analytics to improve diagnosis accuracy, predict disease trends, optimize treatment plans, and reduce operational costs.

The growing adoption of electronic health records, wearable health devices, and AI-based diagnostic tools has significantly increased healthcare data volumes. Additionally, pharmaceutical companies use big data analytics to accelerate drug discovery, clinical trials, and supply chain management, driving rapid growth across the global healthcare and life sciences sector.

Regional Insights

How Big is the North America Big Data Analytics Market Size?

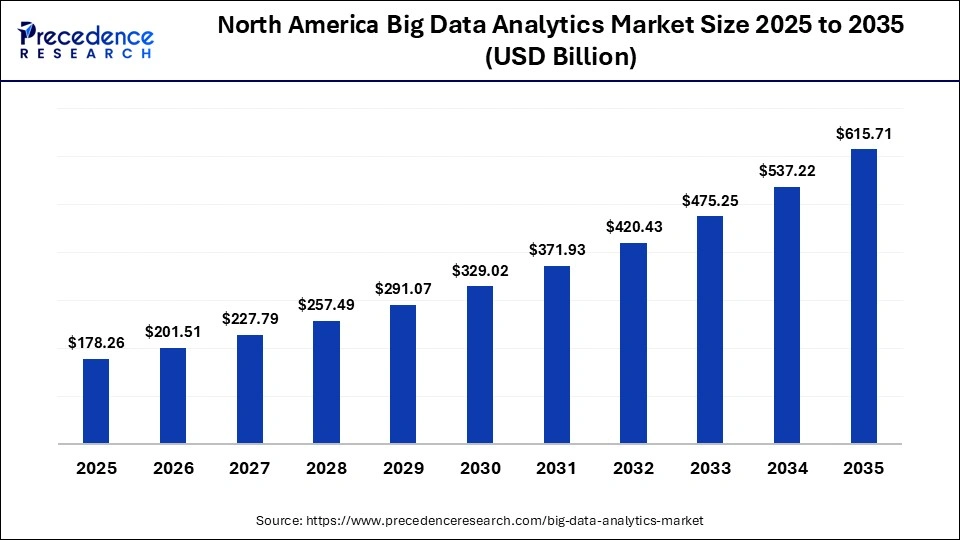

The North America big data analytics market size is estimated at USD 178.26 billion in 2025 and is projected to reach approximately USD 615.71 billion by 2035, with a 13.20% CAGR from 2026 to 2035.

Why North America Dominated the Big Data Analytics Market?

North America dominated the global market with a share of approximately 42.8% in 2025 due to its strong digital ecosystem, advanced IT infrastructure, and early adoption of emerging technologies. The region is home to major technology companies, cloud service providers, and AI innovators, which drives continuous innovation in analytics solutions. Enterprises across banking, healthcare, retail, and manufacturing actively invest in data platforms to improve efficiency, security, and customer experience. High cloud adoption, rising AI integration, and strong cybersecurity frameworks further support market expansion.

What is the Size of the U.S. Big Data Analytics Market?

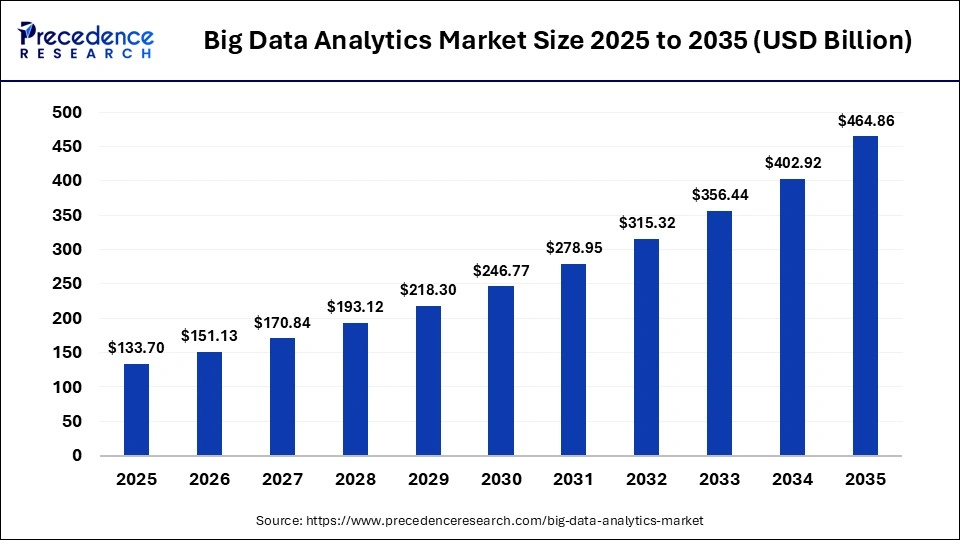

The U.S. big data analytics market size is calculated at USD 133.70 billion in 2025 and is expected to reach nearly USD 464.86 billion in 2035, accelerating at a strong CAGR of 13.27% between 2026 to 2035.

U.S. Market Analysis

The U.S. plays a central role in driving big data analytics growth due to its strong presence of global tech giants, startups, and research institutions. Businesses increasingly rely on analytics to optimize operations, personalize customer engagement, and enhance financial decision-making. Rapid adoption of cloud computing, AI, and automation has accelerated analytics deployment across enterprises of all sizes. Sectors such as BFSI, healthcare, retail, and e-commerce heavily depend on data-driven insights. Furthermore, strong investments in digital infrastructure, cybersecurity, and advanced analytics research continue to strengthen the U.S. position in the market.

How is Asia-Pacific Growing in the Big Data Analytics Market?

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period, due to rapid digitalization, rising internet usage, and expanding smartphone adoption. Countries such as China, India, Japan, and South Korea are witnessing strong growth in cloud services, e-commerce, digital payments, and smart manufacturing.

Governments across the region are investing heavily in smart city projects, digital governance, and technology advancements. Growing startup ecosystems and affordable cloud platforms are making analytics tools accessible to small and mid-sized businesses. These factors, combined with increasing data generation, are driving rapid adoption of analytics across diverse industry sectors.

China Big Data Analytics Market Trends

China is experiencing strong growth in the market due to large-scale digital transformation initiatives and heavy investments in AI and smart infrastructure. Rapid adoption of e-commerce, mobile payments, and smart manufacturing generates vast data volumes, creating high demand for analytics platforms. Government-led digital economy programs, industrial automation, and smart city development further support market growth. Enterprises increasingly use analytics to optimize supply chains, predict customer demand, and improve operational efficiency.

India Big Data Analytics Market Trends

India's market is growing rapidly due to strong government digitalization programs, expanding internet connectivity, and rising cloud adoption. Initiatives such as Digital India, smart cities, and fintech expansion are generating massive data streams. Businesses across banking, retail, healthcare, telecom, and e-commerce are increasingly adopting analytics to improve efficiency, reduce costs, and enhance customer engagement. The country's growing startup ecosystem and affordable technology solutions are making analytics accessible to SMEs. With a large, skilled workforce and increasing focus on AI-driven solutions, India is emerging as a key high-growth market for big data analytics.

Who are the major players in the global big data analytics market?

The major players in the big data analytics market include Microsoft Corporation, IBM Corporation, Amazon Web Services (AWS), Google Cloud, Oracle Corporation, SAP SE, Salesforce, Inc., Snowflake Inc., Databricks, Palantir Technologies, SAS Institute Inc., and Alteryx, Inc.

Recent Developments

- In September 2025, Databricks partnered with OpenAI in a $100 million deal to embed advanced AI models into its analytics platform, enabling over 20,000 enterprises to build scalable, real-time data applications, accelerating innovation and adoption across the global market. (Source:https://www.databricks.com)

- In September 2025, Egypt-based Entlaq launched “Arqam,” the country's first fully integrated data analytics platform, offering advanced visualization, analysis, and reporting tools to help enterprises and policymakers make faster, data-driven decisions and strengthen digital transformation efforts. (Source:https://techafricanews.com)

- In May 2025,Zepto launched Zepto Atom, a new consumer analytics platform that gives brands real-time, location-level data insights. It helps companies understand consumer demand better, improve product availability, set smarter prices, and plan more effective marketing strategies. (Source:https://www.financialexpress.com)

Segments Covered in the Report

By Component

- Software

- Services

- Hardware

By Deployment

- Cloud-based

- On-Premises

By Application

- Customer Analytics

- Risk & Credit Analytics

- Supply Chain, Marketing, and Workforce Analytics

By Vertical

- BFSI

- Healthcare & Life Sciences

- Retail, Manufacturing, and IT/Telecom

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting