What is the Air Freight Forwarding System Market Size?

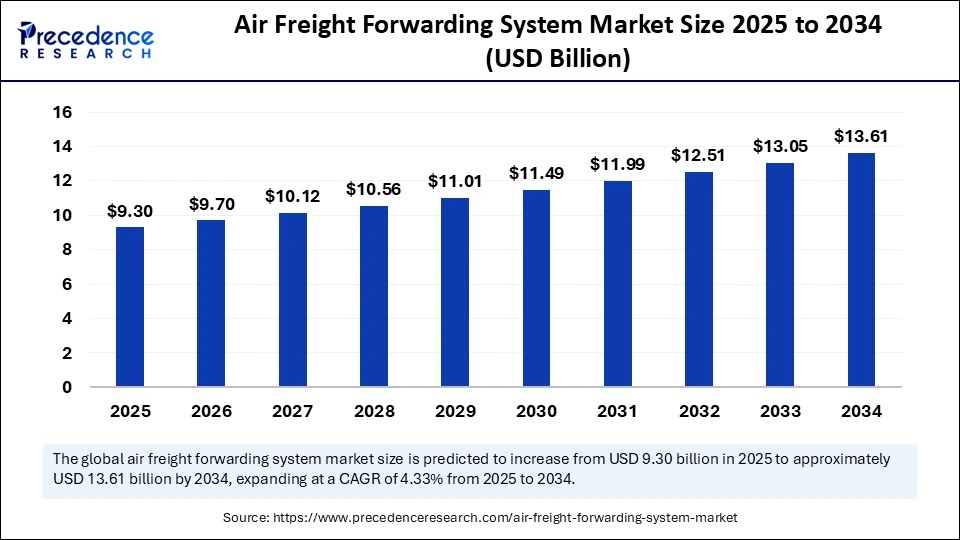

The global air freight forwarding system market size accounted for USD 9.30 billion in 2025 and is predicted to increase from USD 9.70 billion in 2026 to approximately USD 13.61 billion by 2034, expanding at a CAGR of 4.33% from 2025 to 2034. The market growth is attributed to the rising demand for faster, more efficient, and technology-driven global logistics solutions.

Market Highlights

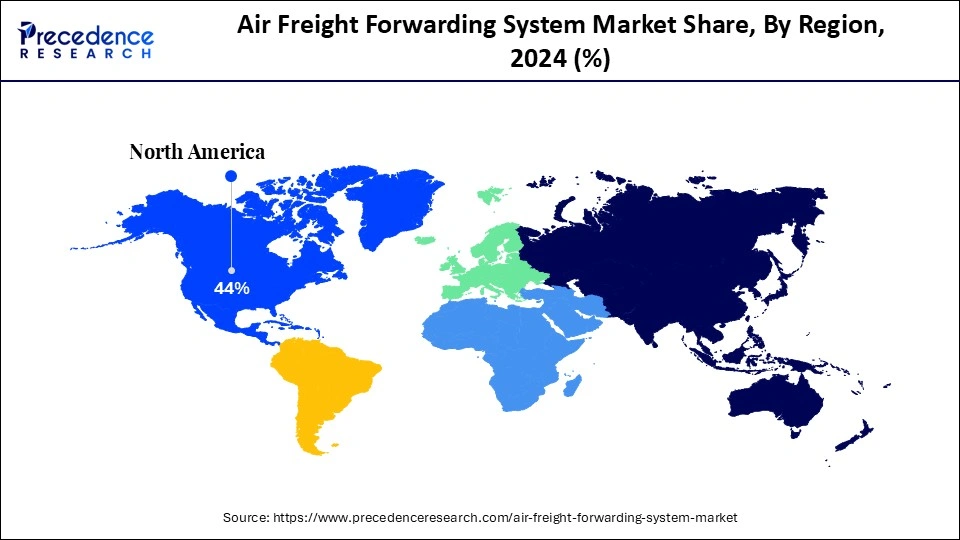

- The North America accounted for the largest market share of 44% in 2024.

- The Asia Pacific segment is expected to grow at the fastest rate from 2025 to 2034.

- By solution type, the freight management software segment contributed the highest market share of 38% in 2024.

- By solution type, the analytics & reporting platforms segment is growing at a notable CAGR between 2025 and 2034.

- By deployment, the cloud-based / SaaS segment held the major market share of 50% in 2024.

- By deployment, the on-premises segment is set to experience the fastest CAGR from 2025 to 2034.

- By service type, the transportation management segment generated the highest market share of 40% in 2024.

- By service type, the customs clearance & regulatory compliance segment growing at a solid CAGR from 2025 to 2034.

- By end user, the freight forwarding companies segment held the largest market share of 45% in 2025.

- By end user, the e-commerce companies segment is projected to expand rapidly between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 9.30 Billion

- Market Size in 2026: USD 9.70 Billion

- Forecasted Market Size by 2034: USD 13.61 Billion

- CAGR (2025-2034): 4.33%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are air freight forwarding systems?

The rapid development of e-commerce has been a significant contributor to the growth of the air freight forwarding system market. The International Air Transport Association (IATA) indicates that air cargo traffic is expected to grow by 5% by 2024, driven by the boom in online shopping and the need for fast and reliable delivery services. The advancement in logistics demands the implementation of progressive technologies to match the changing requirements.

The ARPA-I program of the U.S. Department of Transportation is another step to underline the role of AI in the transportation sphere, emphasizing the possibilities that the introduction of AI can lead to changes in logistics activities. Moreover, the World Bank also emphasizes the importance of digital technologies in the context of modernizing the freight transportation system, with a focus on promoting integration to increase efficiency and sustainability.

Impact of Artificial Intelligence on the Air Freight Forwarding System Market

Artificial intelligence (AI) is transforming the air freight forwarding system, as it significantly improves efficiency, accuracy, and decision-making in the logistics chain. Major freight forwarders utilize AI-based predictive analytics to forecast cargo demand and optimize efficient flight paths. Moreover, AI is catalyzing a revolution in the air freight forwarding sector, which is developing a more interconnected, efficient, and sustainable logistics ecosystem that meets the needs of contemporary global trade.

Sky-High Trade: Unveiling 2024's Air Freight Boom and E-Commerce Surge

- Global air cargo demand increased by 11.3% year-on-year in 2024, surpassing pre-pandemic levels and setting a new record by exceeding 2021's volumes.

- Asia-Pacific carriers experienced the strongest growth, with a 14.5% year-on-year increase in air cargo demand in 2024.

- European carriers observed an 11.2% year-on-year rise in air cargo demand in 2024, reflecting a stable recovery.

- African carriers held a 2.0% share of global air cargo traffic in 2024.

- In 2025, the rapid expansion of fast-fashion e-commerce retailers like Shein and Temu is significantly impacting the global air cargo industry by increasing demand for air-cargo space to expedite deliveries to consumers.

- Hong Kong International Airport saw a 6.8% increase in cargo volume in 2024, making it a central node for Asia-Pacific freight forwarding.

(Source: https://timesofindia.indiatimes.com)

(Source: https://www.iata.org)

(Source: https://africanpilot.africa)

Air Freight Forwarding System Market: Regulatory Landscape

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA) | Clean Air Act (CAA), SmartWay Program | Air emissions, fuel efficiency, environmental impact of freight operations | The EPA sets limits on air pollutants and promotes the use of cleaner diesel engines to improve community health. |

| European Union | European Union Aviation Safety Agency (EASA) | Regulation (EU) No 965/2012, Air Operations Regulation | Air operations, flight time limitations, aircrew requirements | EASA sets detailed rules for air operations, including flight time limitations and rest requirements for commercial air transport. |

| China | Ministry of Ecology and Environment (MEE) | Interim Regulations on the Management of Carbon Emissions Trading (trial), Hazardous Chemical Import/Export Regulations | Carbon emissions trading, hazardous chemical management | China has implemented a national carbon emissions trading scheme covering over 5.1 billion tonnes of COâ‚‚ emissions. |

| India | Ministry of Civil Aviation (MoCA) | Air Freight Station Policy Guidelines, Civil Aviation Requirements (CAR) | Air cargo operations, freight station management, service standards | MoCA has established uniform performance standards for major airports and regulates air freight station operations. |

| Japan | Ministry of Land, Infrastructure, Transport and Tourism (MLIT) | Civil Aeronautics Act, Dangerous Goods Regulations | Air transport safety, hazardous materials handling | MLIT enforces strict regulations on the transport of dangerous goods by air and conducts regular inspections to ensure safety. |

Air Freight Forwarding System Market Growth Factors

- Rising Adoption of AI-Driven Logistics Platforms: Growing demand for predictive analytics and automation is propelling efficiency in air freight forwarding.

- Boosting Cross-Border E-Commerce Expansion: Increasing global online trade is driving the need for advanced air cargo logistics solutions.

- Driving Investment in Cold Chain Logistics: Rising demand for temperature-sensitive shipments is boosting specialised air freight forwarding services.

- Growing Government Support for Trade Facilitation: Policies promoting faster customs clearance are propelling the adoption of integrated forwarding systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.30 Billion |

| Market Size in 2026 | USD 9.70 Billion |

| Market Size by 2034 | USD 13.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.33% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution Type, Deployment, Service Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Surge in Global Trade Volumes Transforming the Air Freight Forwarding System Market?

Increasing global trade volumes are expected to significantly boost the market in the years to come. The growing volume of global trade will lead to a significant demand for air freight forwarding services. In 2024, global trade reached a record of $ 33 trillion, with a growth rate of 3.7% compared to the previous year. This was primarily due to a 10% growth in services trade and a 2% growth in goods trade.

Such development is attributed to the rise of developing countries and the increasing importance of services in global trade. The advanced use of digitalization and automation in the logistics industry is expected to bring about changes in air freight forwarding. The digital economy has been active, and sales of business e-commerce have increased by almost 60% between 2016 and 2022, reaching $ 27 trillion. Furthermore, the growing adoption of digitalisation and automation in logistics is anticipated to accelerate the transformation in air freight forwarding systems demand.

Surge in Global Trade Volumes Reinforces Growth in the Air Freight Forwarding System Market

| Years | Evolution of Global Trades (Billion USD) |

| 2018 | 19,164 |

| 2019 | 18,685 |

| 2020 | 17,285 |

| 2021 | 21,830 |

| 2022 | 24,734 |

| 2023 | 23,571 |

| 2024 | 24,023 |

(Source: https://unctad.org)

Market Dynamics

Restraint

High Operational Costs Impacting Air Freight Forwarding System Market Stability

High operational costs are likely to hamper the market growth. Transportation costs, due to the unpredictability of fuel prices, are one of the significant impacts on freight costs and profitability. An increase in airport charges and handling fees puts pressure on forwarders and carriers. Furthermore, the hamper of geopolitical tensions and trade disruptions is likely to challenge market stability.

Opportunity

How Will Rapid Technological Innovation Reshape Efficiency in the Air Freight Forwarding System Market?

High technological innovation in logistics systems is anticipated to redefine operational efficiency in air freight forwarding, further creating immense opportunities for the air freight forwarding system market. Firms implement IoT-based sensors to track cargo and monitor its conditions in real-time. Fleet optimisation of load planning and route choice, and predictive maintenance are the insights produced by AI-based analytics.

It is estimated that more than 45 billion data points related to logistics are processed annually by cloud-based systems to streamline decision-making. The constant increase in technological progress compels industry players to modernize their infrastructure and invest in smart freight forwarding systems. Moreover, Emirates SkyCargo, DHL Global Forwarding, and Kuehne + Nagel are leaders in the UAE cargo market and invest heavily in AI-based automation, establishing a new standard in the industry. (Source: https://qodenext.com)

Segment Insights

Solution Type Insights

Which Solution Type Dominated the Air Freight Forwarding System Market in 2024 and Why?

The freight management software segment dominated the air freight forwarding systems market in 2024, accounting for an estimated 35-40% market share, due to the increasing complexity of global supply chains and the need for real-time shipment visibility. According to IATA, the volume of air cargo in the world has grown by 6.5% during the first half of 2024 as compared to the previous year. (Source: https://www.iata.org)

This highlights the need for efficient automated systems. The global trade organisation, WTO, noted a 12% increase in year-on-year cross-border e-commerce transactions in 2024, which puts additional pressure on logistics providers to implement sophisticated freight management tools. Furthermore, the growing demand for speed and transparency among consumers continues to drive the preference for freight management software within the industry.(Source:https://www.wto.org)

The analytics and reporting platform segment is expected to grow at the fastest rate in the air freight forwarding system market in the coming years, driven by the increasing demand for actionable insights and operational intelligence provided by analytics and reporting platforms.

- In 2024, the ITF reported that the number of data-driven logistics initiatives worldwide had increased by 15%, demonstrating a growing desire to adopt analytics. Additionally, the growth of regulatory complexity and transparency requirements puts analytics and reporting platforms on a massive growth in the logistics industry.(Source: https://www.itf-oecd.org)

Deployment Insights

Why Did Cloud-Based Deployment Lead the Air Freight Forwarding System Market in 2024?

The cloud-based/SaaS segment held the largest revenue share in the air freight forwarding systems market in 2024, accounting for 50% of the market share, due to the flexibility and scalability of cloud platforms, which enable logistics companies to dynamically allocate demands.

The SaaS model minimizes the investment requirement in IT systems, and therefore advanced systems are available to small and medium-sized enterprises. Furthermore, the major air cargo operators were using cloud-based freight management solutions to optimise their operations, fuelling the segment.

The on-premises segment is expected to grow at the fastest CAGR in the coming years, owing to an increase in concerns regarding data security and compliance with regulatory requirements.

These systems provide the ability to have full control over data storage and processing, enabling the highest level of compliance with the requirements of organisations such as IMO and IATA. Additionally, due to the rise of cyber threats worldwide, the secure, locally controlled deployment is likely to drive sustained growth in this segment.

Service Type Insights

What Made Transportation Management the Leading Service Type in the Air Freight Forwarding System Market in 2024?

The transportation management segment dominated the air freight forwarding systems market in 2024, holding a market share of approximately 40%, due to the increase in international trade volume and the need to track shipments accurately as demand for time-sensitive deliveries grows. Furthermore, transportation management provides core support for the current air freight operations, further facilitating segment growth.

The customs clearance & regulatory compliance segment is expected to grow at the fastest rate in the coming years, owing to the increased e-commerce and global trade expansion. The World Customs Organisation (WCO) highlighted in 2024 that a major cause of cross-border air cargo delays is caused by documentation and compliance problems, which led to a rush into the use of automated customs solutions.

These platforms facilitate the calculation of duties, the generalization of tariff codes, and the verification of compliance with requirements to accelerate operations at border checkpoints. Additionally, with the increase in geopolitical trade complexity, the demand for customs clearance and regulatory compliance solutions is expected to be fuelled in the coming years.

End User Insights

Why Were Freight Forwarding Companies the Dominant End Users in the Air Freight Forwarding System Market in 2024?

The freight forwarding companies segment held the largest revenue share in the air freight forwarding systems market in 2024, accounting for 45% of the market share, due to the growing need for integrated, technology-based logistics solutions that can control complex global supply chains. Furthermore, the changing regulatory framework is also expected to support the use of the advanced forwarding solutions.

The e-commerce companies segment is expected to grow at the fastest rate in the coming years, driven by skyrocketing demand for same-day and cross-border delivery. As stated by UNCTAD (2024), sales in e-businesses increased by 14% in 2023-2024, underscoring the need to offer freight forwarding services more efficiently and promptly.

Air express remains a popular choice for high-value and time-sensitive e-commerce shipments, which require advanced forwarding systems. Firms, such as Amazon Air and Alibaba, invested in custom forwarding platforms to enhance speed and tracking provisions. Furthermore, the growing global online shopping is expected to have a profound effect on the innovation and growth patterns in the air freight forwarding industry.

Regional Insights

U.S. Air Freight Forwarding System Market Size and Growth 2025 to 2034

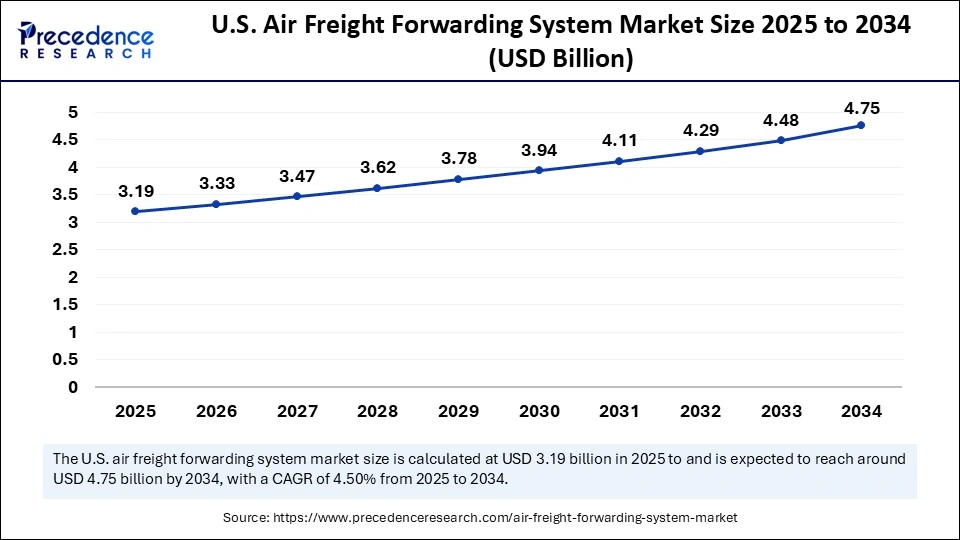

The U.S. air freight forwarding system market size was evaluated at USD 3.19 billion in 2025 and is projected to be worth around USD 4.75 billion by 2034, growing at a CAGR of 4.50% from 2025 to 2034.

Why Did North America Dominate the Air Freight Forwarding System Market in 2024?

North America led the air freight forwarding systems market, capturing the largest revenue share in 2024, due to a well-established manufacturing base and the need has a high speed for the transportation of goods, especially in the electronics, automotive, and pharmaceutical industries. The help of large hubs such as Memphis, Louisville, and Miami, which process millions of tonnes of cargo annually.

To the Federal Aviation Administration (FAA), air cargo traffic in North America increased by about 6.7% in 2024 over the previous year. Implementation of technologies, such as AI route optimisation and IoT-enabled cargo tracking, has made the processes more efficient. Moreover, FedEx, UPS Supply Chain Solutions, and DHL Global Forwarding, the top competitors, have increased capacity by building new air cargo facilities and expanding their fleets, thereby strengthening the dominance of North America.(Source: https://www.bts.gov)

The Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, driven by the development of trade flows and the rapid growth of e-commerce. According to Global Forwarding, in mid-2025, air cargo demand in the region increased by about 11% per annum, the fastest growth rate among worldwide regions. E-commerce growth in Southeast Asia has led to increased demand for air cargo, and cross-border shipments are projected to rise by 14% in 2024, according to UNCTAD. (Source: https://www.iata.org)

China has become a significant source of growth, and the volume of cross-border trade is expected to increase by over 5% in 2024. In response, major logistics companies such as Kuehne + Nagel, DHL,, and CEVA Logistics have also increased their air freight capacities in the region. Hong Kong International and Incheon International airports are undergoing significant upgrades to accommodate larger freight loads. Furthermore, advancements in technology and policy support make the Asia Pacific the most rapidly developing market in the global air freight forwarding systems landscape.(Source:https://www.china-briefing.com)

Top Vendors in the Air Freight Forwarding System Market & Their Offerings

- Kuehne + Nagel (Switzerland): Leading the global air freight sector with 1.89 million metric tons shipped in 2025, Kuehne + Nagel offers end-to-end logistics solutions, including air, sea, and overland transport, catering to industries such as automotive, pharmaceuticals, and electronics.

- DHL Supply Chain & Global Forwarding (Germany): A major player in the logistics industry, DHL provides comprehensive air freight services, leveraging its extensive global network to offer time-sensitive and temperature-controlled solutions across various sectors.

- DSV (Denmark): Ranked third globally, DSV specialises in air freight forwarding, offering tailored solutions to meet the diverse needs of industries such as automotive, healthcare, and technology.

- DB Schenker (Germany): With a strong presence in the air freight market, DB Schenker offers integrated logistics services, including air cargo, warehousing, and supply chain management, with a focus on industries such as automotive and pharmaceuticals.

- Sinotrans (China): A leading Chinese logistics provider, Sinotrans offers comprehensive air freight services, catering to industries such as electronics, automotive, and retail, with a focus on efficiency and cost-effectiveness.

- Nippon Express (Japan): A prominent Japanese logistics company, Nippon Express provides air freight forwarding services, specializing in sectors such as automotive, electronics, and healthcare, with a commitment to reliability and customer satisfaction.

- Expeditors International (USA): Recognized for its global reach, Expeditors provides air freight forwarding services, with a focus on industries such as technology, retail, and healthcare, emphasizing compliance and efficiency.

Other Air Freight Forwarding System Market Companies

- Panalpina (DHL)

- C.H. Robinson

- UPS Supply Chain Solutions

- FedEx Logistics

- Agility Logistics

- CEVA Logistics

- Geodis

- Hellmann Worldwide Logistics

- Bolloré Logistics

- Yusen Logistics

- Kerry Logistics

- Rhenus Logistics

- Toll Group

- Damco

Recent Developments

- In October 2025, Virgin Atlantic Cargo announced a strategic partnership with CargoAi, a leading digital platform in the airfreight sector. This collaboration marks a significant step forward in Virgin Atlantic Cargo's digital transformation strategy, underscoring its commitment to customer-centric innovation. The partnership will streamline the global freight booking experience, offering forwarders enhanced visibility, real-time pricing, and seamless access to capacity across the airline's extensive network.

- In September 2025, United Cargo deepened its digital footprint through a strategic alliance with CargoAi, aimed at strengthening digital connectivity across the airfreight industry. The integration makes United Cargo's domestic and international freight capacity directly accessible to more than 23,000 freight forwarders via the CargoAi platform. Customers can now obtain real-time rates, view bookable capacity, and utilise eBooking for both General Cargo and Express services, enhancing automation and visibility across key booking channels and leading TMS integrations.

- In October 2025, FedEx unveiled an expansion of its Intra-Asia air network, introducing two new routes to bolster capacity for freight forwarders within the region. The move strategically reallocates aircraft to meet rising intra-regional demand as trans-Pacific volumes face pressure from U.S. tariffs. This expansion reflects FedEx's proactive approach to adapting to global trade dynamics while strengthening its foothold in the fast-growing Asian freight market.

(Source: https://www.stattimes.com)

(Source: https://www.supplychain247.com)

(Source: https://www.unitedcargo.com)

(Source: https://phaata.com)

Segments Covered in the Report

By Solution Type

- Freight Management Software

- Cargo Tracking & Visibility Systems

- Warehouse & Inventory Management Solutions

- Documentation & Customs Compliance Tools

- Analytics & Reporting Platforms

- Others

By Deployment

- On-Premises

- Cloud-Based / SaaS

By Service Type

- Transportation Management

- Route Planning & Optimization

- Shipment Consolidation & Documentation

- Freight Cost Management

- Customs Clearance & Regulatory Compliance

- Others

By End User

- Airlines & Cargo Carriers

- Freight Forwarding Companies

- Logistics Service Providers

- Exporters / Importers

- E-commerce Companies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting