Automated Truck Loading System Market Size and Forecast 2025 to 2034

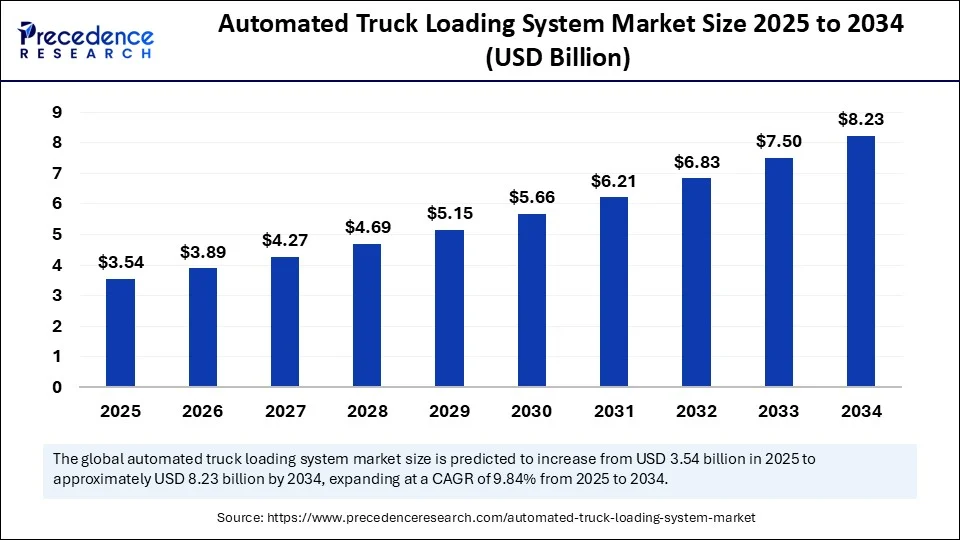

The global automated truck loading system market size accounted for USD 3.22 billion in 2024 and is predicted to increase from USD 3.54 billion in 2025 to approximately USD 8.23 billion by 2034, expanding at a CAGR of 9.84% from 2025 to 2034. This market is growing due to the rising need to optimize the efficiency of warehouse operations, reduce labor costs, and faster turnaround times in logistics operations.

Automated Truck Loading System Market Key Takeaways

- In terms of revenue, the global automated truck loading system market was valued at USD 3.22 billion in 2024.

- It is projected to reach USD 8.23 billion by 2034.

- The market is expected to grow at a CAGR of 9.84% from 2025 to 2034.

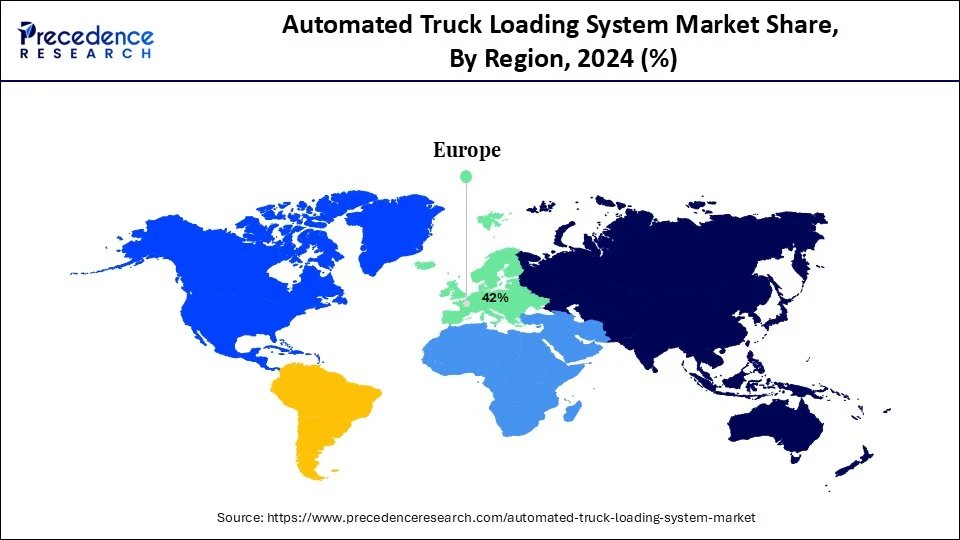

- Europe dominated the automated truck loading system market with the largest share of 42% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By system type, the chain conveyor system segment held the biggest market share in 2024.

- By system type, the AGV-based system segment is observed to grow at the fastest CAGR during the forecast period.

- By truck type, the standard trailer trucks segment led the market in 2024.

- By truck type, the refrigerated/cold chain trucks segment is expected to grow at the fastest CAGR in the upcoming period.

- By loading dock design, the flush docks segment captured the highest market share in 2024.

- By loading dock design, the enclosed docks segment is emerging as the fastest growing.

- By industry, the automotive segment held the largest share in 2024.

- By industry, the e-commerce & logistics segment is expected to grow at the fastest CAGR during the forecast period.

- By automation level, the semi-automated systems segment generated the highest market share in 2024.

- By automation level, the fully automated systems segment is expected to grow at the fastest CAGR during the forecast period.

- By component, the hardware segment accounted for significant market share in 2024.

- By component, the services segment is expected to grow at the fastest CAGR between 2025 and 2034.

How is artificial intelligence revolutionizing truck loading operations in logistics hubs?

Artificial intelligence is transforming truck loading operations by enabling smarter, faster, and more adaptive systems within logistics hubs. AI-driven automated truck loading systems (ATLS) can determine the best loading sequences based on cargo type, weight distribution, and delivery schedules. AI algorithms minimize errors and maximize space utilization. Automated truck loading systems powered by AI can optimize the loading process, reducing the time taken to load a truck. Additionally, AI systems, utilizing computer vision and sensors , enable robotic arms and conveyors to accurately identify, track, and handle a wide range of shapes, sizes, and fragile goods with precision. Automated truck loading systems can anticipate optimal configurations to minimize product damage and delays by utilizing machine learning models that learn from historical loading patterns.

AI also facilitates the coordination of real-time transportation management systems (TMS) and warehouse management systems (WMS) to optimize processes from dispatch to inventory. Logistics hubs become more effective, robust, and scalable when AI is utilized to enable self-optimizing loading docks, autonomous decision-making, and predictive maintenance alerts.

- In June 2025, Boston Dynamics deployed its AI-powered Stretch robots at DHL facilities to automate the unloading of trailers. The system doubled productivity compared to manual methods and is now being scaled across hundreds of sites.

(Source: https://www.wsj.com )

Europe Automated Truck Loading System Market Size and Growth 2025 to 2034

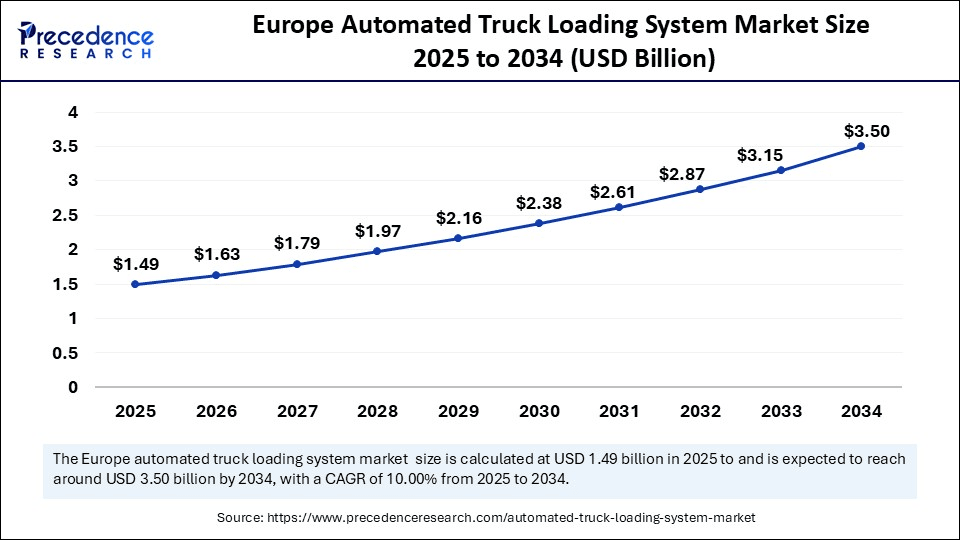

The Europe automated truck loading system market size is exhibited at USD 1.49 billion in 2025 and is projected to be worth around USD 3.50 billion by 2034, growing at a CAGR of 10.00% from 2025 to 2034.

What factors contribute to Europe's stronghold on the automated truck loading system market?

Europe dominated the automated truck loading system market while holding the largest share in 2024. This is mainly due to its early adoption of industrial automation , strong logistics infrastructure, and emphasis on workplace safety and efficiency. Businesses across various industries, including manufacturing, FMCG, and automotive, have extensively adopted partially and fully automated loading systems to meet stringent operational requirements. Furthermore, industries are moving toward automation to reduce reliance on manual labor and maintain competitiveness, due to stringent labor laws and rising wages. Europe's emphasis on smart warehousing and sustainability further solidifies its position as a leader in this market.

Asia Pacific is witnessing the fastest growth due to increasing investments in logistics automation, the rapid expansion of the e-commerce sector, and the rapid growth of warehousing. High-throughput operations are being prioritized by businesses to meet rapid delivery cycles, which is propelling the use of sophisticated truck loading systems. The emergence of expansive logistics parks and infrastructure modernization initiatives accelerates the trend toward automation. The need for intelligent and adaptable loading solutions continues to grow as local companies seek to reduce turnaround times and labor dependency.

Market Overview

The automated truck loading system (ATLS) market refers to the ecosystem of solutions, technologies, and equipment designed to automate the loading and unloading of goods from trucks and trailers in industrial, logistics, and distribution environments. These systems minimize manual intervention, enhance safety, increase throughput, and reduce turnaround time and labor costs. ATLS solutions can include conveyor systems, automated guided vehicles (AGVs), robotic arms, shuttle systems, and other integrated material handling technologies.

ATLS is primarily used in high-volume operations where speed, accuracy, and labor efficiency are essential, such as in manufacturing plants, warehouses, distribution centers, FMCG, automotive assembly, postal services, and cold chain logistics .

Automated Truck Loading System Market Growth Factors

- Rising Demand for Supply Chain Automation: Companies are increasingly adopting automation to streamline operations, reduce human error, and boost throughput in warehouse and distribution centers.

- Labor Shortages and Rising Labor Costs: With ongoing labor shortages in logistics and increasing wage pressures, businesses are turning to automated loading systems to maintain operational efficiency.

- Surge in E-commerce and Just-in-Time Deliveries: The growth of e-commerce and consumer expectations for faster deliveries are pushing logistics providers to automate loading for quicker truck turnaround times.

- Increased Focus on Workplace Safety: Automated systems help reduce workplace injuries related to manual loading, aligning with stricter occupational safety regulations and goals.

- High Return On Investment (ROI): Although initial costs are high, many companies experience a strong ROI through reduced labor costs, improved cycle times, and minimal product damage.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.23 Billion |

| Market Size in 2025 | USD 3.54 Billion |

| Market Size in 2024 | USD 3.22 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.84% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System Type, Truck Type, Loading Dock Design, Industry, Automation Level, Component, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Need for Faster Loading and Unloading Cycles

The two most important performance indicators in logistics hubs are speed and turnaround time. Automated truck loading systems (ATLS) enable fleets to operate more efficiently by significantly reducing vehicle dwell times. During periods of high shipping demand when throughput needs to be optimized, this becomes even more important. A full truck can be loaded in minutes rather than hours by businesses using robotic arms, conveyors, or shuttles in place of manual loading. Additionally, it expedites delivery scheduling and reduces truck waiting times.

Focus on Reducing Product Damage and Operational Errors

A strong focus on reducing product damage in warehouses drives the growth of the automated truck loading system market. Particularly for delicate or expensive items, manual loading often results in damaged packaging, dropped objects, or uneven weight distribution. Automated loading systems use weight counters, sensors, and AI algorithms to guarantee consistent and secure load handling. This accuracy decreases product loss, customer complaints, and expensive returns. Better adherence to traffic safety and cargo stability laws is also guaranteed. Consistently high handling quality helps businesses increase customer satisfaction and strengthen brand reliability.

Restraints

Complex Integration with Existing Infrastructure

Integrating automated systems into existing infrastructure can be very challenging, hampering the growth of the automated truck loading system market. The layout, ceiling height, and dock design of many older facilities are insufficient to support such systems. Complex IT support and lengthy testing cycles are necessary for integration with ERP software , transportation management systems (TMS), and warehouse management systems (WMS). Any mismatch in hardware and software could result in expensive reconfigurations or operational outages. This is a significant barrier, particularly for institutions attempting to modernize their infrastructure gradually. Moreover, these systems require substantial investments, creating barriers for SMEs.

Limited Flexibility for Irregular Loads or Mixed Cargo

Standard pallets, crates, or homogeneous product types are usually the best candidates for automated truck loading systems. Manual loading is still frequently chosen in operations involving mixed-size cargo, fragile goods, or irregularly shaped items. Programming complexity expenses and time are increased when automation is adjusted for such complexity. Certain industries, such as construction materials, automobiles, and furniture, have limitations when it comes to completely relying on automated solutions. This lowers the system's overall adoption rate and versatility in multipurpose logistics.

Opportunities

Expansion of Smart Warehousing and Digital Twins

Advanced automated truck loading systems (ATLS) have the potential to become commonplace as smart warehouses driven by AI, IoT, and real-time analytics grow in popularity. Before actual installation, businesses can plan to simulate and optimize automated loading systems using digital twins of logistics operations. Deployment is accelerated, and trial-and-error expenses are decreased. Wider market penetration and frequent system upgrades can result from ATLS's seamless integration into intelligent dock operations as more warehouses become networked and data-driven.

Growth of Cold Chain and Pharmaceutical Logistics

Pharmaceutical and cold chain logistics demand minimal human involvement, speed, and cleanliness. Since they guarantee the quick, sterile, and temperature-controlled handling of delicate cargo, automated truck loading systems are perfect for these industries. The need to develop ATLS, especially for refrigerated trailers and temperature-sensitive areas, is growing as demand for vaccine distribution, perishable foods, and biologics rises. This type of innovation enables businesses to tap into a highly regulated yet rapidly growing vertical.

System Type Insights

How does the chain conveyor system segment dominate the automated truck loading system market in 2024?

The chain conveyor system segment dominated the market with the largest revenue share in 2024, driven by its increased adoption, which is attributed to its simplicity and high efficiency in moving regular pallets and crates quickly. Chain conveyor systems are frequently utilized in warehouses that handle heavy-duty operations and a variety of cargo types. They are the most reliable option in the conventional manufacturing and logistics sectors due to their minimal maintenance needs and compatibility with fixed dock layouts. They are also the go-to option for extensive automation in industrial and automotive supply chains due to their long operational lifespan and demonstrated return on investment.

The AGV-based system segment is expected to grow at the fastest CAGR over the projection period, driven by the growing need for flexibility and adaptability to various load types. Automated guided vehicles (AGVs) based systems can be easily integrated with smart warehouse technologies. AGVs are ideal for tech-driven, scalable warehouses because they can navigate through confined spaces, reroute in real-time, and eliminate the need for fixed infrastructure. Their demand is also being accelerated by the growth of mobile robotics in e-commerce fulfillment centers.

Truck Type Insights

Why did the standard trailer trucks segment dominate the market in 2024?

The standard trailer trucks segment dominated the automated truck loading system market in 2024 because they are compatible with the majority of automated loading systems and are widely used in various industries. They serve as the foundation for freight transportation worldwide and complement traditional pallet-based loading and fixed dock configurations, facilitating the adoption of automation and increasing its scalability. These trucks' height, width, and floor level are frequently standardized, making lift and conveyor alignment easier. Their widespread use also influences system architecture, ensuring that the majority of ATLS models are constructed according to their requirements.

The refrigerated/ cold chain trucks segment is expected to grow at the highest CAGR in the upcoming period, driven by their high usage in the pharmaceutical, healthcare, and food & beverages industries. These trucks are ideal for transporting products that are sensitive to temperature, such as dairy products and medications. For these industries, quick, clean, and climate-controlled loading is necessary to avoid product spoilage. Because automation guarantees faster turnaround and minimizes exposure to ambient air, these trucks are particularly appealing for cold chain logistics in the food and healthcare sectors.

Loading Dock Design Insights

What made flush docks the dominant segment in the automated truck loading system market in 2024?

The flush docks segment maintained dominance in the market, holding the largest share in 2024, as they provide a level, straight interface between the truck and the building, making it simpler to align robotic loaders, lifts, and conveyors. This design, typical of warehouses, facilitates automated loading setup without requiring significant structural alterations. It reduces energy loss from open dock areas and facilitates effective loading from one side. Since flush docks are frequently already designed as logistics hubs, automation retrofits can be implemented with great success.

The enclosed docks segment is expected to expand at the fastest rate in the upcoming period due to their high adoption rate in sectors requiring high security, temperature control, or all-weather loading. These docks protect both workers and goods from external environmental conditions. With rising concerns over theft, spoilage, and worker comfort, companies are investing in enclosed docks to create climate-controlled, automated loading zones that support high-value or sensitive freight.

Industry Insights

Why did the automotive segment dominate the market in 2024?

The automotive industry segment dominated the automated truck loading system market in 2024, as this industry heavily relies on automation and careful planning. Automated systems are ideal for the standardized loading of large components or heavy pallets needed for vehicle parts and assemblies. Reducing loading times is also a top priority for automakers to preserve just-in-time production flows. Moreover, ATLS is a component of fully integrated logistics systems that OEMs and Tier 1 suppliers are investing in to ensure more efficient operations, cost control, and lower damage rates.

The e-commerce & logistics segment is likely to grow at the fastest CAGR in the foreseeable period, driven by the rising need for rapid order fulfillment, increasing shipping volumes, and the need for same-day deliveries. High-throughput facilities require loading systems that can operate continuously with minimal human intervention. The sectors' reliance on smart warehouses and robotics creates strong synergy with fully or semi-automated loading systems designed to support frequent truck dispatch cycles.

Automation level Insights

How does the semi-automated systems segment dominate the automated truck loading system market in 2024?

The semi-automated systems segment dominated the market in 2024, as they offer an affordable way to transition from manual to fully automated processes. For complex tasks, they retain human control while enabling partial automation, such as conveyor-fed loading, making them more accessible to medium-sized businesses with limited resources or space. These systems can frequently be retrofitted into existing docks and require fewer changes to the infrastructure. Stepwise adoption is made possible by their modular design, which reduces risk and boosts operational flexibility.

The fully automated systems segment is expected to grow rapidly in the market, as businesses seek end-to-end automation to support round-the-clock operations, enhance efficiency, and reduce labor costs. These systems combine software control, robotics, and artificial intelligence to automate everything from trailer loading to conveyor alignment. Newly built warehouses and smart logistics parks are prioritizing full automation as labor shortages worsen and the benefits of automation become more apparent.

Component Insights

What made hardware the dominant segment in the automated truck loading system market?

The hardware segment dominated the market in 2024, holding a major share, as the foundation of any automated truck loading system lies in physical components such as conveyors, lifts, sensors, and robotic loaders. Hardware solutions are necessary for both system operation and the actual movement of cargo. Even the most sophisticated software cannot deliver efficient loading performance without sturdy and dependable hardware. Investment in hardware is essential to system deployment due to its high durability and precise engineering.

The services segment is expected to grow at the fastest rate, driven by the rising demand for system integration, predictive maintenance, remote monitoring, and custom automation consulting. As systems become smarter and more interconnected, clients seek expert support for upkeep and to enhance productivity. Integrating automated truck loading systems in existing infrastructure is complex, requiring expertise to achieve seamless integration. As the adoption of automated systems increases, so does the need for installation, integration, and maintenance services.

Automated Truck Loading System Market Companies

- Joloda Hydraroll Ltd

- Actiw Oy

- Secon Components

- Beumer Group

- Scmidt

- GEBHARDT Fördertechnik GmbH

- Siemens AG

- Daifuku Co., Ltd.

- Dematic (KION Group)

- Cimcorp

- Bastian Solutions

- Murata Machinery

- Honeywell Intelligrated

- Kardex Group

- E&K Automation

- FlexLink (Coesia Group)

- Interroll Group

- VDL Systems

- KUKA AG

- SSI Schäfer

Recent Developments

- In December 2024, Slip Robotics introduced its Slip Boats, robotic systems designed for automated truck loading/unloading. Backed by a $28 million series B led by DCVC, they can reduce loading times to about 5minutes and have delivered major throughput and safety improvements for clients like Valeo, John Deere, and GE Appliances.(Source: https://www.sliprobotics.com )

- In March 2024, Mitsubishi Logisnext completed a demonstration and began operational deployment of automated guided forklifts to load trucks at Konoike Transport facilities. The system utilizes two AGFs to accommodate different truck types, thereby minimizing dwell time and replicating manual loading speed.(Source: https://www.jcnnewswire.com )

Segments Covered in the Report

By System Type

- Chain Conveyor System

- Slat Conveyor System

- Roller Track System

- Belt Conveyor System

- Skate Conveyor System

- Automated Guided Vehicles (AGVs) Based System

- Robotic Arm-Based System

- Others (e.g., telescopic belt loaders, modular lift systems)

By Truck Type

- Standard Trailer Trucks

- Refrigerated/Cold Chain Trucks

- Containerized Trucks

- Flatbed Trucks

- Special Purpose Trucks

By Loading Dock Design

- Flush Docks

- Enclosed Docks

- Open Docks

- Sawtooth Docks

By Industry

- Automotive

- FMCG & Retail

- E-commerce & Logistics

- Pharmaceuticals & Healthcare

- Food & Beverage

- Chemicals

- Postal & Courier

- Others (Textile, Electronics, Aerospace, etc.)

By Automation Level

- Semi-Automated Systems

- Fully Automated Systems

By Component

- Hardware

- Software

- Services (Installation, Maintenance, Integration)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting