What is the Warehouse Management System Market Size?

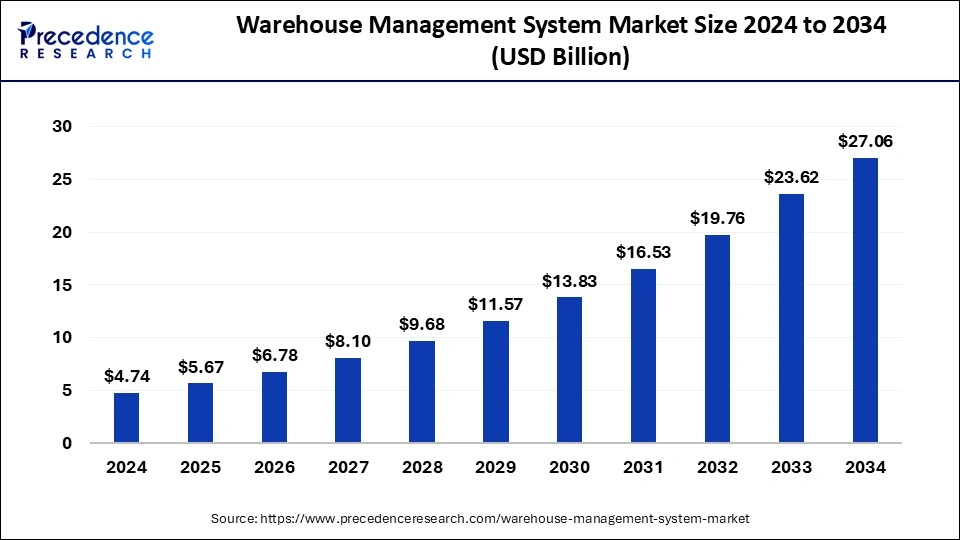

The global warehouse management system market size is accounted at USD 5.67 billion in 2025 and predicted to increase from USD 6.78 billion in 2026 to approximately USD 30.50 billion by 2035, expanding at a CAGR of 18.32% from 2025 to 2034. Growing economies across the globe have propelled various sectors, such as healthcare and manufacturing, which are the key drivers of the warehouse management system market.

Warehouse Management System Market Key Takeaways

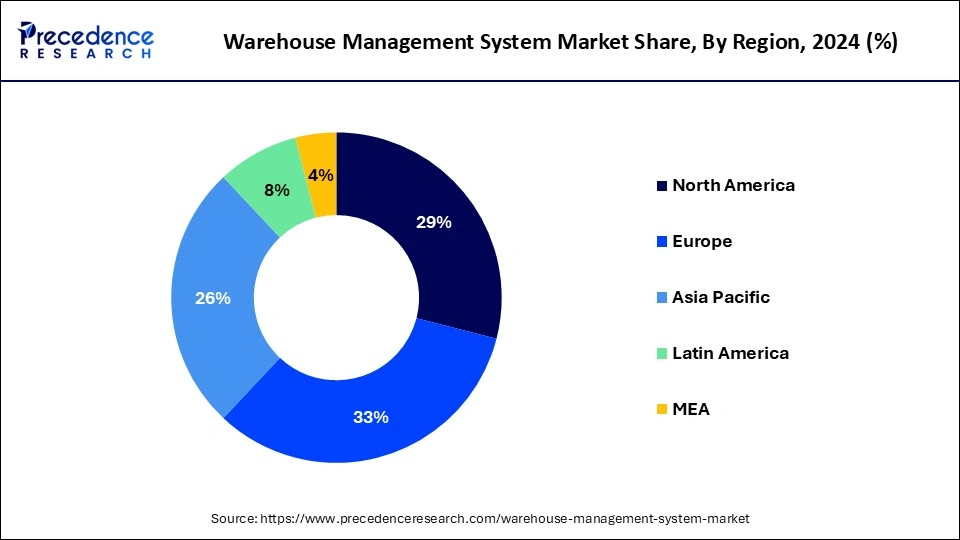

- Europe dominated the market with the largest revenue share of 33% in 2025.

- Asia Pacific is expected to host the fastest-growing market during the period studied.

- By component, the services segment has held a major revenue share of 82% in 2025.

- By component, the software segment is expected to show rapid growth in the market during the forecast period.

- By deployment, the cloud segment has contributed more than 54% of revenue share in 2025.

- By deployment, the on-premises segment is experiencing significant growth in the market.

- By function, in 2025, the systems integration & maintenance segment dominated the market.

- By function, the analytics & optimization segment is expected to grow at the fastest rate in the market during the studied period.

- By application, the manufacturing segment dominated the market in 2025.

- By application, the transportation & logistics segment is anticipated to grow at the fastest rate over the projected period.

What is a Warehouse Management System?

A warehouse management system (WMS) is a software application designed to oversee and manage warehouse operations. It provides comprehensive visibility into a company's entire inventory and handles supply chain fulfillment processes from the distribution center to the retail shelf. Functions of these systems include inventory control, workforce management, yard management, and dock management.

Implementing a WMS can minimize errors and accidents during product distribution. It enhances a company's ability to fulfill orders promptly and efficiently while tracking products within the warehouse. Additional benefits of an integrated warehouse management system are reduced fulfillment time, improved customer service, better space utilization, and lower labor costs.

Artificial Intelligence: The Next Growth Catalyst in Warehouse Management Systems

AI is revolutionizing the warehouse management system (WMS) industry by shifting operations from reactive, manual processes to proactive, automated, and data-driven intelligence. The integration of AI enables, among other things, smarter demand forecasting and dynamic slotting, which optimize inventory levels and dramatically increase order picking accuracy.

Furthermore, AI-powered computer vision and autonomous mobile robots (AMRs) are reducing labor-intensive tasks and enhancing safety, contributing to a projected surge in the AI-driven warehousing market.

What are the Growth Factors in the Warehouse Management System Market?

- Changing product manufacturers' supply chain models is expected to drive the warehouse management system market growth.

- The rising need for manufacturers to automate warehouse management processes can fuel market growth shortly.

- Customers' preference for cloud-based WMS services over on-premise solutions will likely expand the warehouse management system market further.

- Increasing trends in online purchasing can boost the warehouse management system marketin upcoming years.

Major Trends of the Warehouse Management System Market:

- AI-Orchestrated Operational Intelligence

Artificial Intelligence has evolved into a proactive operational engine, shifting from retrospective reporting to real-time, autonomous decision-making. - Strategic Integration of Collaborative Robotics (AMRs)

The industry is witnessing a massive deployment of Autonomous Mobile Robots and "cobots" that utilize dynamic navigation to work in tandem with human labor. Often procured through flexible Robotics-as-a-Service (RaaS) financial models, these systems mitigate chronic labor shortages and enhance precision in high-velocity picking and sorting environments. - Migration to Cloud-Native and SaaS Architectures

Traditional on-premise infrastructure is being rapidly replaced by subscription-based, cloud-native platforms to facilitate agility and minimize capital expenditure. - Holistic Visibility via Digital Twins and IoT

The convergence of IoT sensor networks and Digital Twin technology allows for the creation of high-fidelity virtual replicas of physical warehouse assets.

Warehouse Management System Market Outlook

- Industry Growth Overview: The period from 2025 to 2030 is anticipated to experience rapid market growth. Demand for real-time inventory visibility, automated processes, and multi-channel fulfillment will drive this growth. The expansion of e-commerce and an increase in warehouse modernization within Asia-Pacific and North America helped facilitate this growth phase.

- Sustainability Trends: The sustainability trend drove WMS adoption, with companies focusing on reducing waste, energy consumption, and optimizing transport routes. Vendors invested in cloud-based systems and AI-driven workflow automation to facilitate greener, low-carbon warehouse operations.

- Global Expansion: Leading providers expanded into Southeast Asia, Eastern Europe, and LATAM in response to the demand for digital supply chains, enhancing their local partnerships and bringing their regional data centers online to speed up deployments and address compliance issues, among other needs.

- Major Investors: Private equity and strategic investors increased their focus on WMS because of strong SaaS margins, a recurring revenue model, and increasing spending on automation.

- Startup Ecosystem: The WMS startup ecosystem grew significantly in the last year, especially around AI-based slotting, robotics integration, and predictive optimization. New entrants in the U.S. and India rapidly gained interest from VCs by offering scalable cloud-native platforms to fast-growing e-commerce brands.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 30.50 Billion |

| Market Size in 2025 | USD 5.67 Billion |

| Market Size in 2026 | USD 6.78 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 18.32% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment, Function, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing automation in distribution channels

In today's landscape, automation is a vital component across all industries. Distribution businesses globally are increasingly focusing on enhancing automation to reduce costs, improve throughput and efficiency within existing distribution routes, and address labor issues and other challenges. Automation is significantly transforming distribution channels and altering the sales process. With automation, tasks such as accessing data insights, managing inventory and sales processes, and understanding competitors have become more streamlined.

- In February 2024, Skechers U.S., a leading global footwear and apparel company, turned to Hai Robotics, a leading global provider of Automated Storage and Retrieval Systems. as they launched their new distribution center in Minato City, Tokyo, Japan. Using Hai's automated goods-to-person system, Skechers maximizes warehouse operational efficiency, fulfillment speed, and order accuracy.

Restraint

The high implementation cost of on-premises WMS

The high implementation cost of on-premises warehouse management systems is a significant factor hindering market growth. The expense of setting up on-premises WMS is substantially higher compared to other enterprise software—additionally, the salaries of IT personnel and the infrastructure costs associated with on-premises WMS present major challenges. In developing economies, the lack of reliable, high-quality Internet makes cloud-based WMS unreliable. These factors can impede the growth of the warehouse management system market.

Opportunity

E-commerce growth and supply chain management

The rise of e-commerce has increased the demand for the warehouse management system market as businesses strive to handle the surge in online sales. To keep pace with the need for rapid and precise order fulfillment, companies must manage their warehouses more efficiently. E-commerce has fundamentally transformed warehouse operations, emphasizing the necessity for swift and accurate order processing. Hence, there is a growing requirement for automation and optimization in warehouse activities. WMS solutions address this need by streamlining warehouse operations, automating inventory control, and improving order processing efficiency. This ultimately leads to quicker and more accurate order fulfillment.

- In June 2024, an article published by Arab News reported that The E-commerce and supply chain operations platform Omniful is aiming to significantly boost its presence in the Saudi market after a successful $5.85 million seed funding round. This includes enhancing the platform's capabilities, entering new strategic partnerships, and further tailoring the solutions to meet the specific needs of diverse markets

Component Insights

The services segment dominated the warehouse management system market in 2025 and is expected to grow at the fastest rate during the forecast period. The services segment encompasses consulting, system integration, and maintenance services. Third-party vendors can provide warehouse management as an outsourced service, which is offered by WMS providers. Vendors market their products either by providing them as a service, which allows clients to concentrate on their core business activities, or by selling the software directly to clients without additional services.

The software segment is expected to show rapid growth in the warehouse management system market during the forecast period. The expansion is mainly driven by the increasing adoption of WMS software by small and mid-sized enterprises (SMEs) globally. The software is hosted on a cloud-based system. Additionally, factors such as rising consumer disposable income and growing demand in the manufacturing and retail sectors are expected to propel the segment's growth.

- In March 2023, A pioneer in supply chain logistics, ArcBest, announced the release of Vaux, a cutting-edge collection of hardware and software that alters and modernizes the way freight is loaded, unloaded, and moved. Vaux provides total insight into freight movement inside warehousing facilities, on the dock, and across the road.

Deployment Insights

The cloud segment held the dominant share of the warehouse management system market in 2025 and is expected to grow at the fastest rate during the forecast period. Cloud-based technologies have fundamentally changed how organizations operate. Hosting WMS on the cloud offers companies savings on initial costs and greatly enhances warehouse efficiency. Moreover, warehousing allows firms to save on upfront expenditures and fuel productivity further.

The on-premises segment is experiencing significant growth in the warehouse management system market. On-premise solutions are characterized by large servers and high maintenance costs, which significantly increase a company's expenses. The initial and ongoing costs of maintaining an on-premise server are much higher compared to cloud-based technology. Also, implementing an on-premise WMS takes considerably longer than deploying a cloud-based solution.

Function Insights

The systems integration & maintenance segment dominated the warehouse management system market in 2025. WMS handles tasks such as receiving and storing goods, optimizing order picking and shipping, and suggesting inventory replenishment. One of its key features is automating the paper-based order-picking process. Factors like order type, warehouse layout, client requirements, and product movement can influence picking and material handling.

The analytics & optimization segment is expected to grow at the fastest rate in the warehouse management system market during the studies period. This is attributed to the rapid technological advancements and the growing demand for efficient storage solutions that have made warehouse operations more complex. Moreover, modern warehouse management requires increased transparency and information access throughout all processes. This enables the effective use of data to reduce costs, maximize revenue, and optimize workflows.

Application Insights

The manufacturing segment dominated the warehouse management system market in 2025. Manufacturing companies initially integrated ERP and WMS systems. To achieve full control over their supply chains, they are now also integrating logistics and transport management systems. Cloud-based technology is further improving the efficiency and performance ofsupply chain management in the manufacturing sector.

- In March 2024, Agility Robotics Brings Operational Visibility to Deployment of Digit Fleets with the Launch of Agility Arc. Company Introduces Cloud Automation Platform for Managing Bipedal Mobile Manipulation Robots in Logistics and Manufacturing Operations.

The transportation & logistics segment is anticipated to grow at the fastest rate in the warehouse management system market over the projected period. The growth is driven by the rising use of e-commerce platforms, along with increasing consumer disposable incomes, particularly in emerging markets like India and China. Logistics and supply chain firms are swiftly embracing WMS to enhance their operations and boost warehouse efficiency and productivity.

Regional Insights

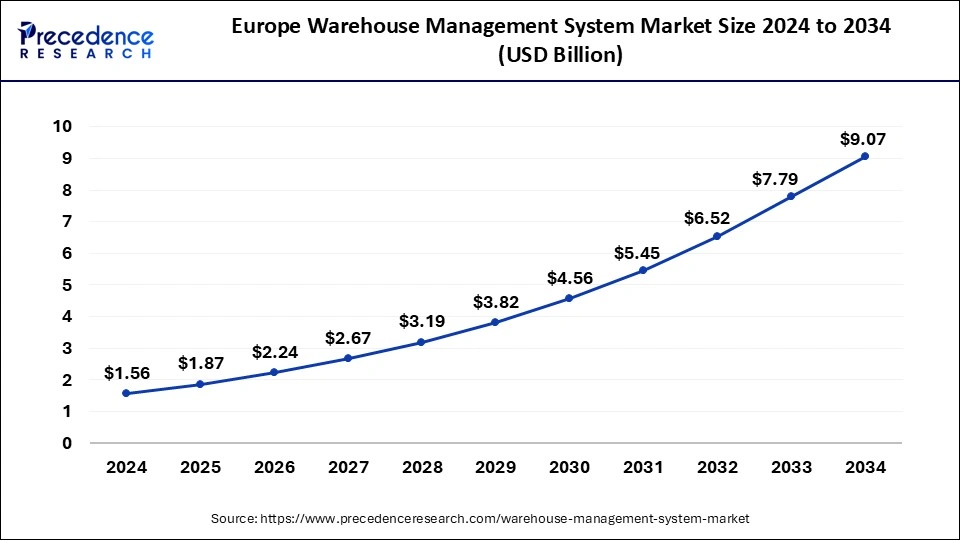

Europe Warehouse Management System Market Size and Growth 2026 to 2035

The Europe warehouse management system market size is valued at USD 1.87 billion in 2025 and is expected to be worth around USD 10.35 billion by 2035 with a CAGR of 18.66% from 2026 to 2035.

Europe dominated the warehouse management system market in 2025. The current expansion of the warehouse management system market in Europe is driven by the innovation in warehouse management systems and the increasing adoption of cloud-based solutions. The market is further fueled by the presence of extensive networks of third-party logistics (3PL) providers and large corporations providing global distribution and storage services alongside continued growth in the e-commerce industry.

Europe: Germany Warehouse Management System Market Trends

Germany's market is being driven by strong demand from e commerce and logistics players seeking greater efficiency and real time inventory visibility. Cloud based WMS solutions are increasingly adopted for their flexibility, scalability, and lower IT maintenance burden. Advanced technologies like AI, IoT, and predictive analytics are being integrated into WMS platforms to optimize labor, forecast inventory needs, and reduce errors.

- In December 2023, JD Logistics, the logistics arm of JD.com and a global leader in integrated supply chain and logistics solutions, announced the launch of its international express delivery service. With New Express Delivery Service to North America and Europe.

Asia Pacific is expected to host the fastest-growing warehouse management system market during the period studied. Various technological advancements, such as the utilization of connected devices and sensors to manage product quantities efficiently, have facilitated the adoption of WMS. As a result, the WMS market is projected to experience steady growth in the region throughout the forecast period.

- In July 2023, Cainiao Group, the logistics arm of Alibaba Group Holding Limited, announced the launch of its first warehouse, Cainiao Cikarang Logistics Park, in Jakarta, Indonesia, as part of its regional cHub expansion plan. The new Cainiao Cikarang Logistics Park is part of a regional warehouse network of Cainiao Hubs or cHubs in Southeast Asia and is the third warehouse in the network.

In the Asia Pacific warehouse management system market, China is expected to dominate with a significant revenue share. Increased demand from manufacturers for software that assists in order tracking, labeling, and quality control management is anticipated to be a crucial factor for market growth.

Why did North America grow steadily in the warehouse management system market?

North America was expected to grow steadily due to strong adoption of automation, robotics, and AI-driven warehouse solutions. The region's advanced retail and e-commerce sectors created a need for real-time inventory tracking. Companies invested heavily in cloud WMS to improve speed and address labor issues. Opportunities increased as more warehouses integrated autonomous mobile robots and data-driven optimization. Growth in pharmaceuticals, food supply chains, and large distribution centers continued to drive WMS demand.

U.S. Warehouse Management System Market Trends

The U.S. led the region because it had the largest network of warehouses, fulfillment centers, and retail distribution hubs. Companies heavily invested in automation, robotics, and AI-based WMS to manage high consumer demand. E-commerce giants pushed for rapid modernization, which forced smaller warehouses to upgrade their systems. The rise of same-day delivery and labor shortages drove the use of digital warehouse tools. The U.S. also saw strong investments in cold storage and logistics parks.

Why did the Latin American region grow significantly in the warehouse management system market?

Latin America was expected to grow significantly as companies began adopting digital systems to improve warehouse accuracy and lower costs. E-commerce expansion in the region urges businesses to modernize their warehouses. Opportunities increased as more local companies transitioned to cloud WMS for better tracking and quicker fulfillment. Investments in logistics hubs in Brazil, Mexico, and Chile supported strong regional growth. Improved internet access and increased cross-border trade further boosted demand for modern warehouse solutions.

Brazil Warehouse Management System Market Trends

Brazil led the Latin America region because of its large retail sector and growing number of fulfillment centers. Many companies upgraded cloud WMS to manage rising e-commerce orders. Investments in warehouse automation, robotics, and digital tracking improved efficiency. Brazil also became a key logistics center for the region, with strong demand from the food, beverage, and consumer goods industries. These factors made it the most active user of warehouse management technologies.

What made the Middle East and Africa experience notable growth in the warehouse management system market?

The Middle East and Africa experienced notable growth as companies modernized warehouses to support rising trade and expanding retail sectors. Investments in smart logistics parks, particularly in the UAE and Saudi Arabia, created strong opportunities for WMS providers. More businesses switched to cloud platforms to improve visibility and reduce delays. Increased import-export activity and the development of free-trade zones heightened the need for efficient warehouse systems across the region.

The UAE Warehouse Management System Market Trends

The UAE led the region due to its advanced logistics infrastructure and strong retail and re-export markets. Companies adopted modern WMS platforms to manage high trade volumes and fast delivery needs. Smart warehouses with automation and AI tools have become increasingly common. Government initiatives promoting digital transformation enhanced adoption. With expanding free zones and dynamic e-commerce activity, the UAE emerged as a major market for advanced warehouse management technologies.

Warehouse Management System Market Companies

- Epicor (Indago WMS): Epicor provides flexible, cloud-based WMS solutions that focus on improving inventory accuracy and labor productivity, particularly for small-to-mid-sized manufacturers and distributors.

- Körber AG (HighJump): Körber offers a highly adaptable, modular WMS platform, formerly HighJump, that supports everything from basic, manual processes to complex, fully automated distribution centers.

- Infor: Infor WMS delivers a tier-1, cloud-native solution designed for high-volume, multi-site distribution and 3PL providers, boasting 99.9% inventory accuracy.

- Made4net: Made4net provides highly configurable, "best-of-breed" WMS and 3PL solutions that focus on providing high ROI and rapid, cost-effective, Cloud-based deployments.

- Manhattan Associates: As a leading innovator in the WMS space, Manhattan Associates provides comprehensive, "best-in-class" solutions that leverage artificial intelligence for advanced slotting, order streaming, and real-time inventory management.

- Oracle (WMS Cloud): Oracle provides a robust, enterprise-grade cloud WMS that enables end-to-end visibility into inventory, order fulfillment, and distribution operations.

- PSI Logistics (PSIwms): PSI Logistics delivers a highly flexible and intelligent WMS (PSIwms) that optimizes warehouse processes through AI, self-learning algorithms, and seamless integration with automated warehouse technology.

Warehouse Management System Market Companies

- EPICOR

- Körber AG (HighJump)

- Infor

- Made4net

- Manhattan Associates

- Oracle

- PSI Logistics

- Reply

- SAP

- Softeon

- Synergy Ltd

- Tecsys

Recent Developments

- In February 2024, ArcBest introduces Vaux Smart Autonomy™, merging AMR forklifts with intelligent software for autonomous material handling in warehouses. The technology aims to enhance efficiency and safety while keeping humans in the loop.

- In January 2024, Versa Networks' Unified SASE gateways offer robust security measures and optimized network performance, benefiting Warehouse Management Systems (WMS). With scalability and simplified infrastructure, they enable seamless expansion and cost-efficiency in managing warehouse networks.

- In September 2022, Leading supply chain visibility company FourKites announced a USD 10M investment from Mitsui & Co., Ltd. to expand FourKites' offerings across the Asia-Pacific region. This investment encompasses the first phase in an ongoing strategic relationship between FourKites and Mitsui, which the two companies intend to formalize by the end of the year.

Segments Covered in the Report

By Component

- Software

- Services

By Deployment

- On-premise

- Cloud

By Function

- Labor Management System

- Analytics & Optimization

- Billing & Yard Management

- Systems Integration & Maintenance

- Consulting Services

By Application

- Transportation & logistics

- Retail

- Healthcare

- Manufacturing

- Food & beverage

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting