What is the Warehouse Automation Market Size?

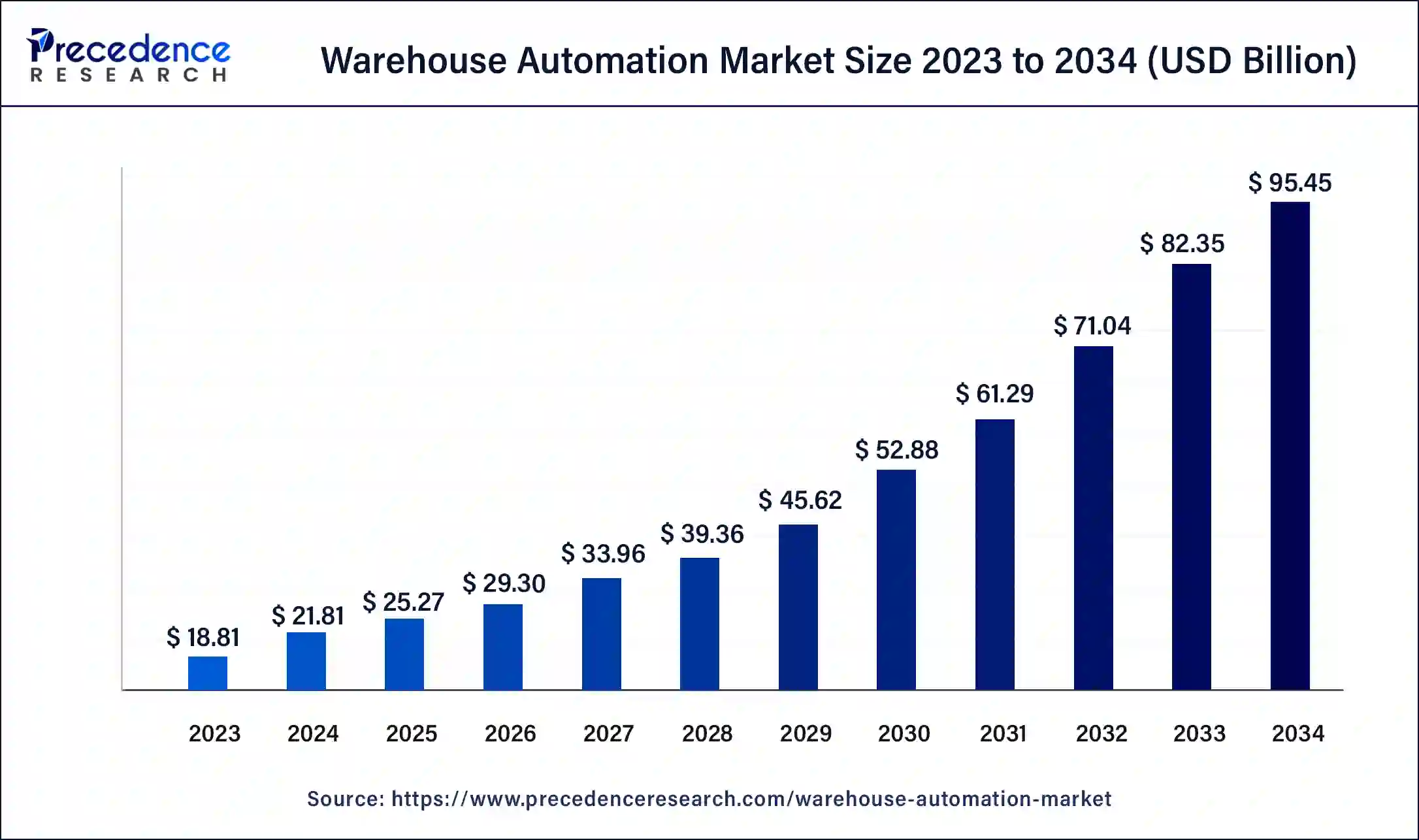

The global warehouse automation market size accounted for USD 25.27 billion in 2025and is predicted to increase from USD 29.30 billion in 2026 to approximately USD 107.36 billion by 2035, at a CAGR of 15.56% from 2026 to 2035. The North America warehouse automation market size reached USD 6.96 billion in 2025.

Warehouse Automation Market Key Takeaways

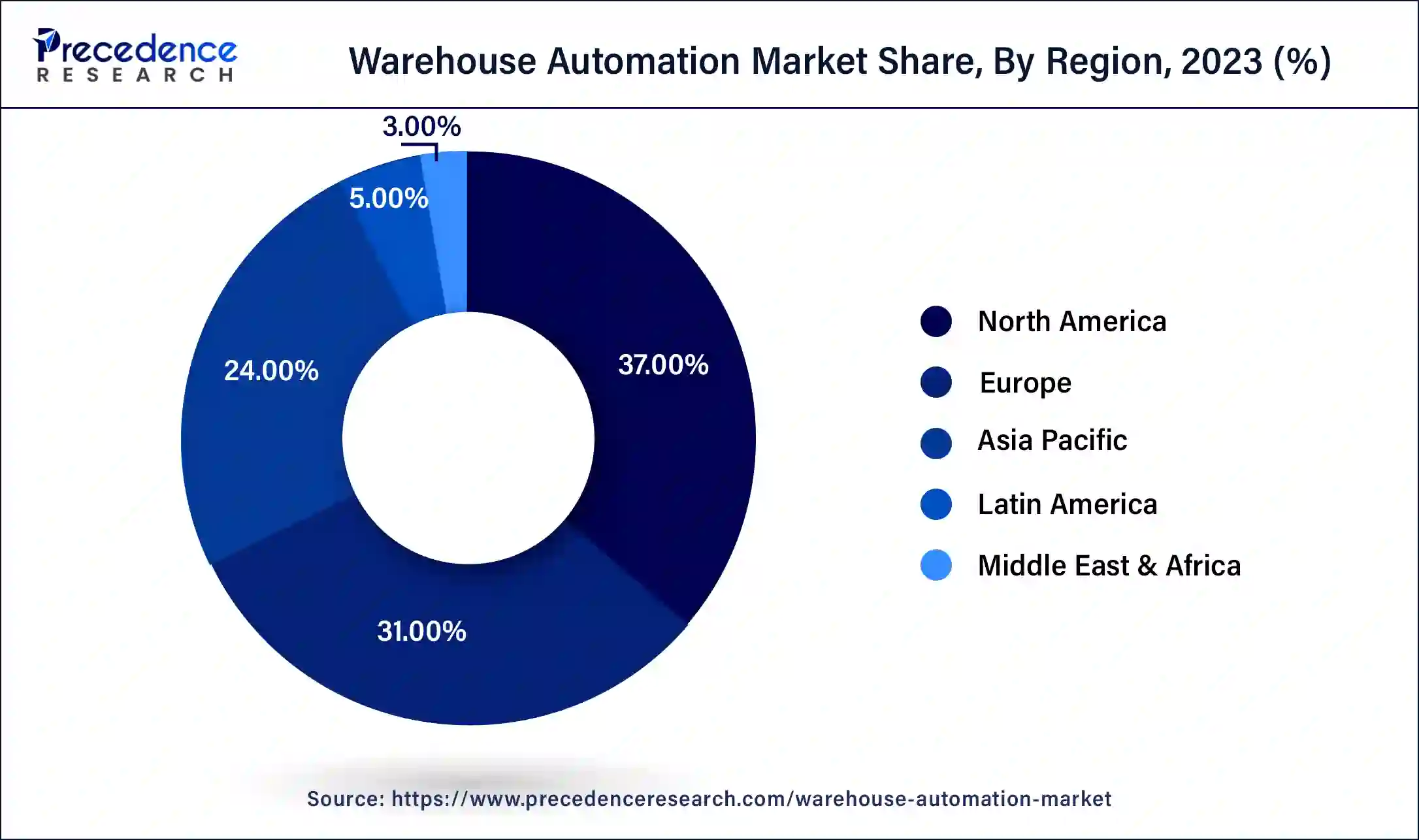

- North America led the global market with the highest market share of 37% in 2025.

- By type, the warehouse system segment shows notable growth in the warehouse automation market.

- By component, the hardware segment dominated the global market with 80% of revenue share in 2025.

- By technology, the automated storage and retrieval system segment dominated the global market.

- By application, the e-commerce segment shows significant growth.

- By end-user, the manufacturers segment shares the maximum CAGR during the projection period.

Strategic Overview of the Global Warehouse Automation Industry

Warehouse automation is a process of integrating robotics or other advanced mechanisms in warehouse operations, it involves the implementation of advanced technologies such as robotics, artificial intelligence (AI), machine learning, sensors, and software systems to streamline and improve efficiency in inventory management.

The demand for speedy delivery times and instantaneous stock control has emphasized the requirement for more efficient warehouse management practices in the rapidly evolving fashion industry. Warehouse automation systems are capable of inventory management, order fulfillment, material movement, storage, picking, packing and shipping processes for firms and businesses.

Production, manufacturing, and investment data:

- In April 2022, Amazon launched a $1 billion fund to invest in warehouse technologies that will raise delivery speed and further enhance the experience of the warehouse and logistics workforce.

- According to Kardex, up to 50,000 robotic warehouses will be produced by 2025.

- In 2022, Indian government launched National Logistics Policy to support the development of entire logistic system, the policy will work on enabling the nation's logistics system by making it technologically advanced.

Artificial Intelligence: The Next Growth Catalyst in Warehouse Automation

AI is significantly accelerating the warehouse automation industry by providing the intelligence needed to optimize complex operations. By integrating machine learning algorithms, AI enables more efficient route planning for autonomous mobile robots (AMRs) and improves the accuracy and speed of robotic picking systems. Furthermore, predictive analytics driven by AI helps warehouses forecast demand more accurately, allowing for better inventory management and minimizing stockouts.

Warehouse Automation Market Growth Factors

Automation technologies, such as robotic systems, conveyors, and automated storage and retrieval systems, can significantly increase the speed and accuracy of order fulfillment, inventory management, and material handling processes. This enhanced efficiency and productivity enable faster turnaround times, improved customer satisfaction, and the ability to handle larger order volumes. The rising demand for faster yet more efficient services at warehouses is propelling the growth of the market. Also, barcode scanning, RFID tagging, and computer vision enhance inventory accuracy and real-time tracking capabilities, reducing errors, minimizing stockouts, improving inventory visibility, and enabling efficient inventory management.

The growth of e-commerce has created a significant demand for efficient and streamlined warehouse operations. Warehouse automation enables faster order processing, accurate picking and sorting, and seamless integration with various sales channels, meeting the requirements of online retailers and improving customer satisfaction.

Market Outlook

- Market Growth Overview: The warehouse automation market is expected to grow significantly between 2025 and 2034, driven by the exponential growth in online shopping, rising wages pushing for automation to reduce reliance on human labor, and the need for increased throughput, accuracy, and reduced errors.

- Sustainability Trends: Sustainability trends involve energy efficiency, resource and waste reduction, and space and footprint optimization.

- Major Investors: Major investors in the market include Amazon, Toyota Industries Corp, KION Group, Honeywell, Hitachi, and Hyundai.

- Startup Economy: The startup economy is focused on rapid e-commerce expansion, a strong push for operational efficiency, and rising capital investment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.27 Billion |

| Market Size in 2026 | USD 29.30 Billion |

| Market Size by 2035 | USD 107.36 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 15.56% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Component, By Technology, By Application, and By End-Users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Surging application of IoT

The Internet of Things has a wide-ranging impact on human life and work; it allows machines to do more heavy lifting, take over monotonous tasks and make life more healthy, practical, and comfortable. The increasing application of IoT in everyday life has promoted the expansion of the market. IoT accelerates innovation by uncovering new opportunities and increases security by continuously monitoring digital and physical infrastructure, which enhances performance, improves efficacy, and reduces safety risks. IoT technologies can be deployed in a customer to increase satisfaction by restocking trending products promptly to avoid shortages. Adopting IoT technologies also reduces warehouse operational and labor costs as they can automate storage solutions, leading to better delivery of customer supply chain experiences.

Restraint

Mechanical challenges involved in warehouse automation

Automated systems require regular maintenance to ensure smooth operations and mechanical challenges include developing maintenance schedules, establishing preventive maintenance protocols, and training staff to perform routine checks and repairs. Maximizing uptime and minimizing downtime is critical for achieving optimal efficiency in warehouse automation. Ensuring the safety of workers and equipment is of utmost importance in warehouse automation.

Mechanical challenges arise in designing and implementing safety measures such as emergency stop systems, safety gates, protective barriers, and collision detection systems. Safeguarding against potential hazards and integrating safety protocols with automated systems require careful engineering and adherence to industry standards. Warehouse automation can significantly cause energy consumption. Overcoming mechanical challenges in reducing energy usage involves designing energy-efficient equipment, optimizing control systems, and implementing energy management strategies. Features like regenerative braking, motion sensors, and efficient power distribution systems can minimize energy consumption. Such elements turn into a hampering factor for the market.

Opportunities

Technological advancements

Big data and AI technologies enable the collection and analysis of vast amounts of data from various sources within the warehouse. This data can generate valuable insights and predictions about inventory levels, demand patterns, and operational efficiencies. By leveraging predictive analytics, warehouse managers can optimize inventory management, reduce stockouts, and improve overall warehouse performance.

Big data analytics combined with AI techniques enable intelligent inventory management in warehouses. AI algorithms can optimize inventory levels, reduce carrying costs, and minimize stockouts by analyzing historical data, demand patterns, and external factors like market trends. ML models can also help predict demand spikes or identify slow-moving items, enabling proactive decision-making and avoiding excess inventory.

AI and ML techniques can optimize warehouse operations, such as route planning, resource allocation, and order fulfillment. Advanced algorithms can calculate the most efficient routes for order picking, considering factors like item location, order priority, and traffic patterns within the warehouse, reducing travel time, improving order accuracy, and increasing productivity. The deployment of such advanced technologies for warehouse automation systems is observed to open a plethora of opportunities for market growth.

Segment Insights

Type Insights

The warehouse system segment shows a significant growth in the warehouse automation market. A warehouse system is a software application that controls and manages various warehouse operations. It provides functionalities such as inventory management, order fulfillment, picking optimization, and tracking of goods within the warehouse. The warehouse system is the central hub for integrating and coordinating different automation technologies and processes.

Component Insights

The hardware segment is commonly prescribed and dominates the warehouse automation market. Automation hardware enables faster, and more accurate execution of tasks compared to manual labor. Robots and conveyors can work continuously without fatigue, leading to increased throughput and reduced processing time.

The software segment shows attractive growth in the forecast period. Cloud computing offers scalability, flexibility, and accessibility to warehouse automation solutions. Cloud-based platforms allow real-time data sharing, remote monitoring, and integration with other business systems. Material handling equipment includes a wide range of automated machinery and devices for moving, storing, and managing inventory within a warehouse.

Technology Insights

The automated storage and retrieval systems segment dominates the application segment in the warehouse automation market during the predicted period. Automated storage and retrieval systems utilize advanced technologies such as robotics, conveyors, sensors, and software to automate various tasks involved in inventory management. For instance, Falcon Autotech, a global leader in intralogistics automation solutions, has launched NEO - an automated storage and retrieval system (ASRS). NEO is leveraging robotics, artificial intelligence, and advanced sensors to automate goods' storage and retrieval processes.

Autonomous mobile robots is the fastest-growing segment in the warehouse automation market throughout the forecast period. Autonomous mobile robots and automated guided vehicles are used in warehouses to pack, pick, sort, and route packages, optimize the picking process, and improve overall order fulfillment speed.

For instance, OTTO Motors, a leading provider of autonomous mobile robots (AMRs), announced their formal expansion into the European market at LogiMAT 2023. With over fourteen years of robotics experience and over 4 million production hours in mission-critical environments, OTTO Motors aims to solve labor and safety challenges with its established AMR fleet at manufacturing facilities and warehouses globally.

Application Insights

The e-commerce segment is commonly prescribed and dominates the warehouse automation market. E-commerce has led to a higher demand for efficient and fast order fulfillment. The growth of e-commerce is due to artificial intelligence (AI), machine learning (ML), software solutions, etc. The AI and ML algorithms are employed to analyze large volumes of data e-commerce operations generate. This data-driven approach helps optimize inventory forecasting, demand planning, and supply chain management.

The grocery segment shows attractive growth in the forecast period. The grocery and warehouse automation market are highly competitive, with numerous companies offering a range of solutions. The rise of e-commerce and online grocery shopping has increased the demand for efficient order fulfillment and delivery systems. The need to optimize inventory management and reduce waste has also driven the adoption of automation in the grocery and warehouse industry.

End-users Insights

The manufacturing segment is the fastest-growing segment in the warehouse automation market throughout the forecast period. Integration of various software systems, such as enterprise resource planning (ERP) and manufacturing execution systems (MES), enables seamless data flow and coordination across different stages of the manufacturing and warehouse processes. Automated conveyor systems allow the movement of goods and materials within manufacturing facilities and warehouses, improving efficiency and reducing manual labor.

The retailer's segment shows significant growth in the warehouse automation market during the projected period. The rise of online shopping has created a higher demand for efficient order fulfillment and delivery processes. Retailers are turning to automation warehouses to handle the increased volume of orders and improve order accuracy and speed. Many regions are facing labor shortages in the retail and warehousing sectors. Automation helps mitigate these challenges by reducing the reliance on manual labor, particularly for repetitive and physically demanding tasks.

Regional Insights

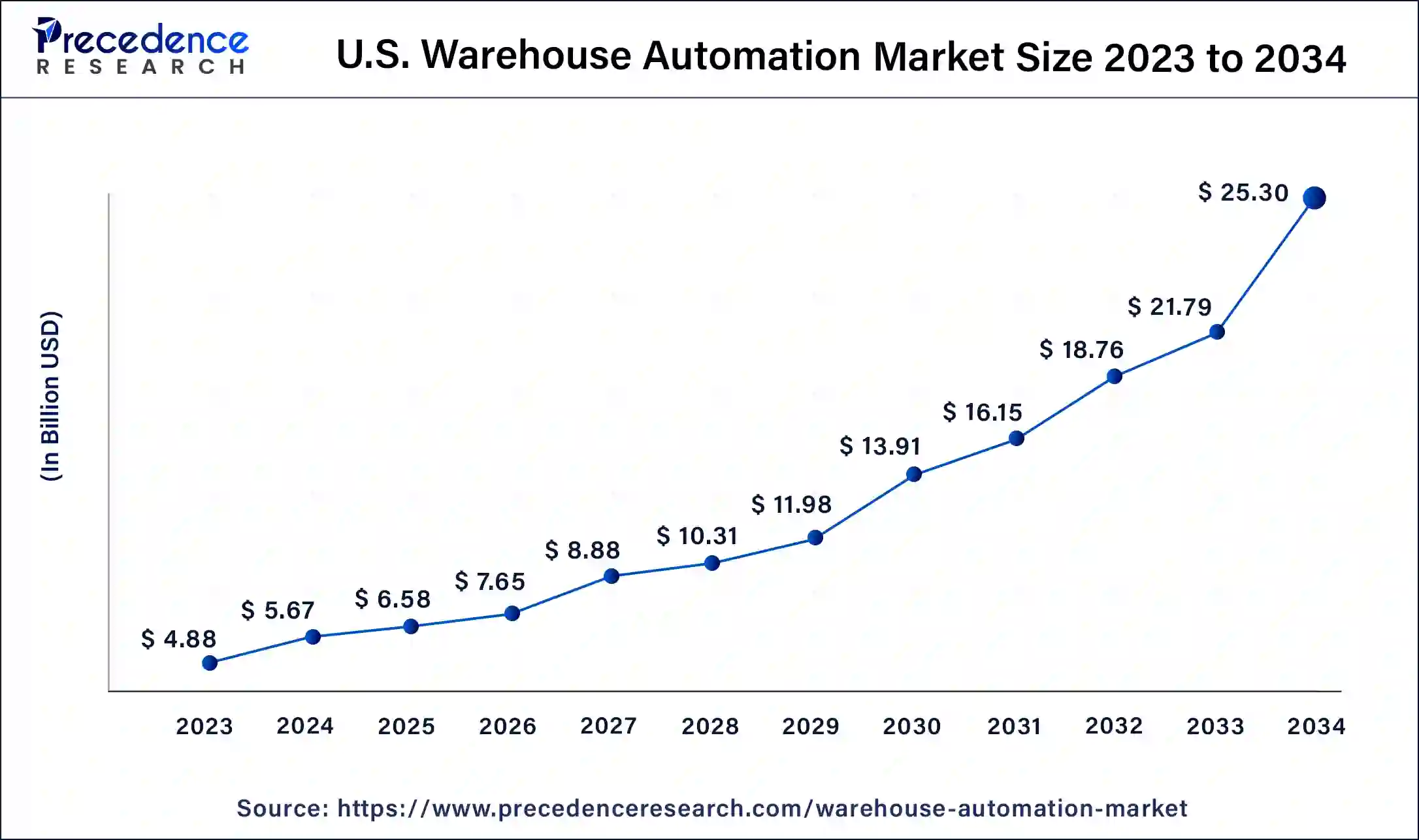

What is the U.S. Warehouse Automation Market Size?

The U.S. warehouse automation market size was estimated at USD 6.58 billion in 2025 and is predicted to be worth around USD 28.49 billion by 2035, at a CAGR of 15.78% from 2026 to 2035.

U.S. & Canada Warehouse Automation Market Trends

North America is dominating and expected to remain a significant marketplace throughout the predicted timeframe.This is attributed to advancements in technology such as artificial intelligence and machine learning, the requirement for improved efficiency & productivity, and the rise in the availability and affordability of automated systems across this region. The market's growth in North America, especially in the United States and Canada is driven by the adoption of warehouse automation and significant players in the market, such as the United States. E-commerce, automotive and manufacturing plants are major end-user industries in the region that have rapidly adopted the application of advanced warehouse management devices/tools. The growing robotics market along with substantial research and development activities is observed to promote the market's growth in North America.

Asia- Pacific shows lucrative growth in the warehouse automation market during the forecasted timeframe.Asia-Pacific is experiencing significant growth in e-commerce and retail sectors, leading to increased demand for efficient and cost-effective warehousing solutions. The rapid growth of e-commerce in countries such as China, Japan, and India stimulates the need for warehouse automation to handle the expanding volume of online orders. Several regional governments are promoting the adoption of advanced technologies in industries, including warehouse automation, through favorable policies and incentives.

For instance, Greater Noida- premised Falcon Autotech is among the pioneers in transforming the modern warehouse as one of the leading Indian warehouse automation firms with a global presence across sectors.

China Warehouse Automation Market Trends

China's growth in e-commerce, increasing wages, and fewer young workers for manual tasks push automation adoption, and companies seek optimized operations and lower logistics expenses. Leading logistics hubs such as Shanghai, Beijing, and Shenzhen are at the forefront, and government initiatives promoting digital logistics further support market growth, positioning China as a global leader in warehouse automation.

How Did Europe Notably Grow in the Warehouse Automation Market

Europe's intersection of surging e-commerce demands and persistent labor shortages has transformed automation from a luxury into a critical operational necessity for modern supply chains. By integrating AI-driven robotics and space-optimizing vertical storage, companies can achieve higher efficiency while simultaneously meeting stringent global sustainability goals.

Germany Warehouse Automation Market Trends

Germany's convergence of rapid e-commerce growth and critical labor shortages has solidified warehouse automation as an essential pillar for modern supply chain resilience. By leveraging Industry 4.0 digitalization, businesses can achieve the real-time visibility and operational speed necessary to meet evolving consumer expectations.

Warehouse Automation Market Companies

- Honeywell Intelligrated: Honeywell serves as a full-scale systems integrator, delivering enterprise-grade conveyor systems, robotic palletizers, and the cloud-native Momentum™ WES that orchestrates entire distribution centers.

- Aeologic Technologies: Aeologic specializes in custom, scalable automation for mid-sized businesses, particularly focusing on RFID-powered tracking and AI-driven inventory management systems.

- Kiva Systems (Amazon Robotics): Now operating as Amazon Robotics, this pioneer revolutionized the market with its goods-to-person (GTP) mobile robots that bring inventory directly to workers.

- GreyOrange: GreyOrange integrates AI with advanced robotics through its GreyMatter platform, which uses real-time data to optimize complex fulfillment workflows across entire supply chains.

- Swisslog: A member of the KUKA Group, Swisslog focuses on data-driven and energy-efficient automation, often integrating its SynQ software with systems like AutoStore to maximize storage density.

- Geek+: Geek+ is a global leader in AI-powered mobile robotics, offering versatile solutions for picking, sorting, and moving pallets that can be deployed rapidly.

- Jizhong Energy Storage: While primarily an energy technology firm, Jizhong contributes to the market by providing the critical battery and energy storage systems required to power 24/7 automated warehouse fleets.

Other Major Key Players

- Viastore Systems

- Kardex Remstar

- Interroll

Recent Developments

- In July 2025, Kardex SnapVac a semi-automated cleaning robot, was launched specifically for the AutoStore Red Line. The robot is engineered to remove dust from the grid without interrupting operations.

(Source: www.kardex.com) - In February 2025, Hai Robotics' HaiPick Climb retrofitting solution. This solution allows warehouses to use compact robots to store and retrieve totes up to 12 meters high in existing racking systems.

(Source: www.hairobotics.com/) - In April 2023,SVT Robotics declared a new SOFTBOT Platform Connector for Tecsys Inc. SVT, and Tecsys worked to develop and initiate the pre-built connector between the SVT's SOFTBOT Platform and Tecsys WMS, which will provide Tecsys Elite clients faster deployment and lower complexity without requiring custom code establishment often engaged in robotics deployments and multi-system automation.

- In January 2023, AutoStore proclaimed the North American release of Pio, a plug-and-play version of hailed AutoStore cube storage technology monitored for small and medium-sized businesses. Pio provides SMBs, such as sporting goods, crafts, cosmetics retailers, and apparel, to locate robotic automation for a relatively low investment, stimulating more businesses to access the world's best automation technology.

- In August 2022,Smart Robotics officially released its recent cobot - the Smart Fashion Picker. The cobot's ability to run and reliability constantly instructs a quicker return on investment – while answering the logistics labor chaos and enhancing warehouse employees' mental and physical health.

- In May 2022, Honeywell declared the Spring 2022 launch of new offerings and improvements to Honeywell Forge, the principal enterprise performance management software solution calculated to assist clients in accelerating the digital transformation of their operations, which covers Honeywell Forge Connected Warehouse, will assist organizations in simplifying processes and lower prices by allowing increased visibility to data and real-time insights, tailoring, and automation.

Segments Covered in the Report

By Type

- Basic Warehouse

- Warehouse System

- Mechanized Warehouse

- Advanced Warehouse

By Component

- Hardware

- Software

By Technology

- Automated Storage and Retrieval Systems (AS/RS)

- Automatic Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Voice Picking and Tasking

- Automated Sortation Systems

By Application

- E-commerce

- Grocery

- Apparel

- Food & beverage

- Pharmaceutical

- Automotive

By End-Users

- Retailers

- Manufacturers

- Distributors

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting