Smart Warehouse Market Size and Forecast 2025 to 2034

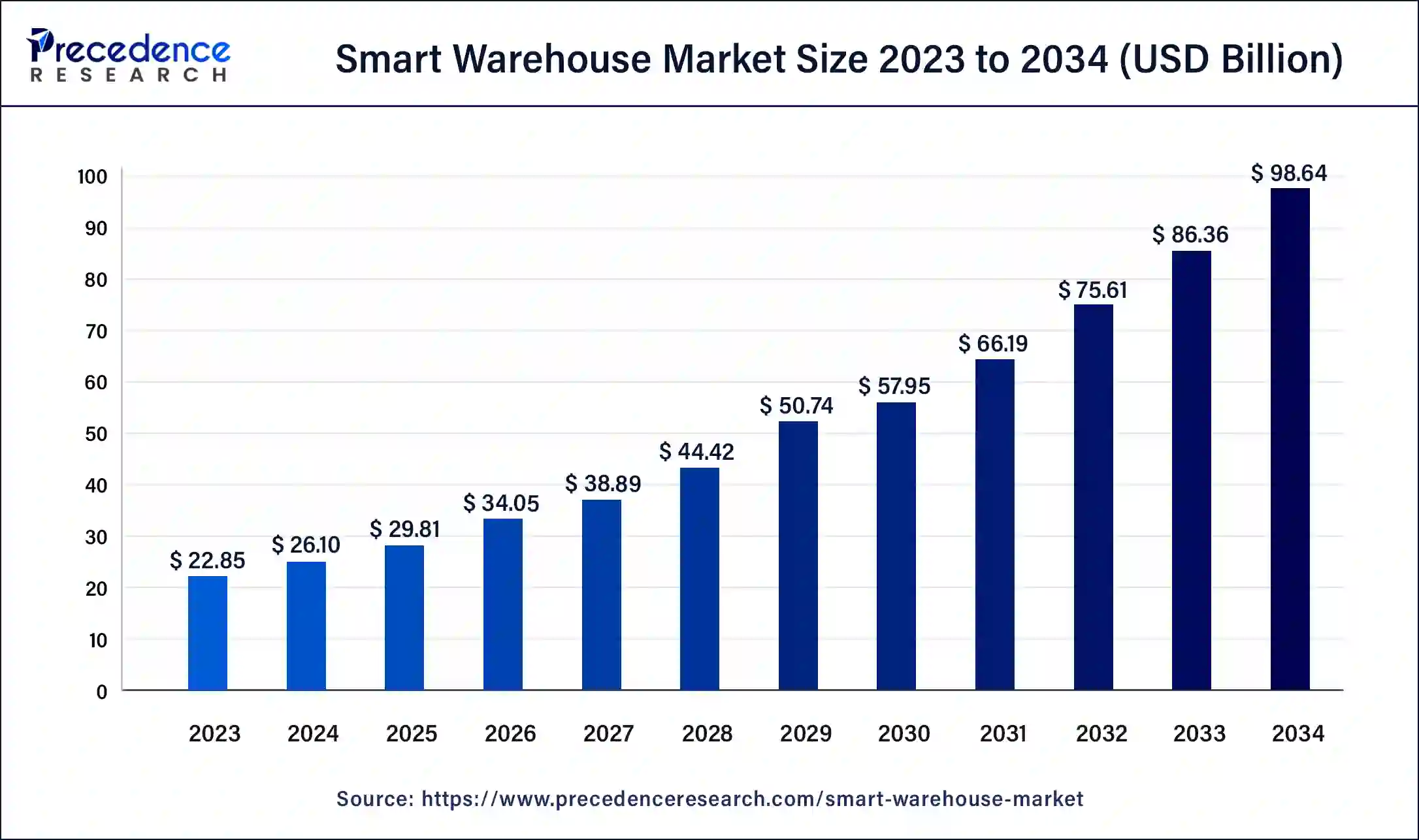

The global smart warehouse market size was valued at USD 26.10 billion in 2024 and is anticipated to reach around USD 98.64 billion by 2034, growing at a solid CAGR of 14.22% over the forecast period 2025 to 2034. The North America smart warehouse market size reached USD 7.31 billion in 2023. The rapid growth of e-commerce and the adoption of technological innovations in the Internet of Things, automation, and mobile robotics is driving growth in the smart warehouse market.

Smart Warehouse Market Key Takeaways

- In terms of revenue, the smart warehouse market is valued at $29.81 billion in 2025.

- It is projected to reach $98.64 billion by 2034.

- The smart warehouse market is expected to grow at a CAGR of 14.22% from 2025 to 2034.

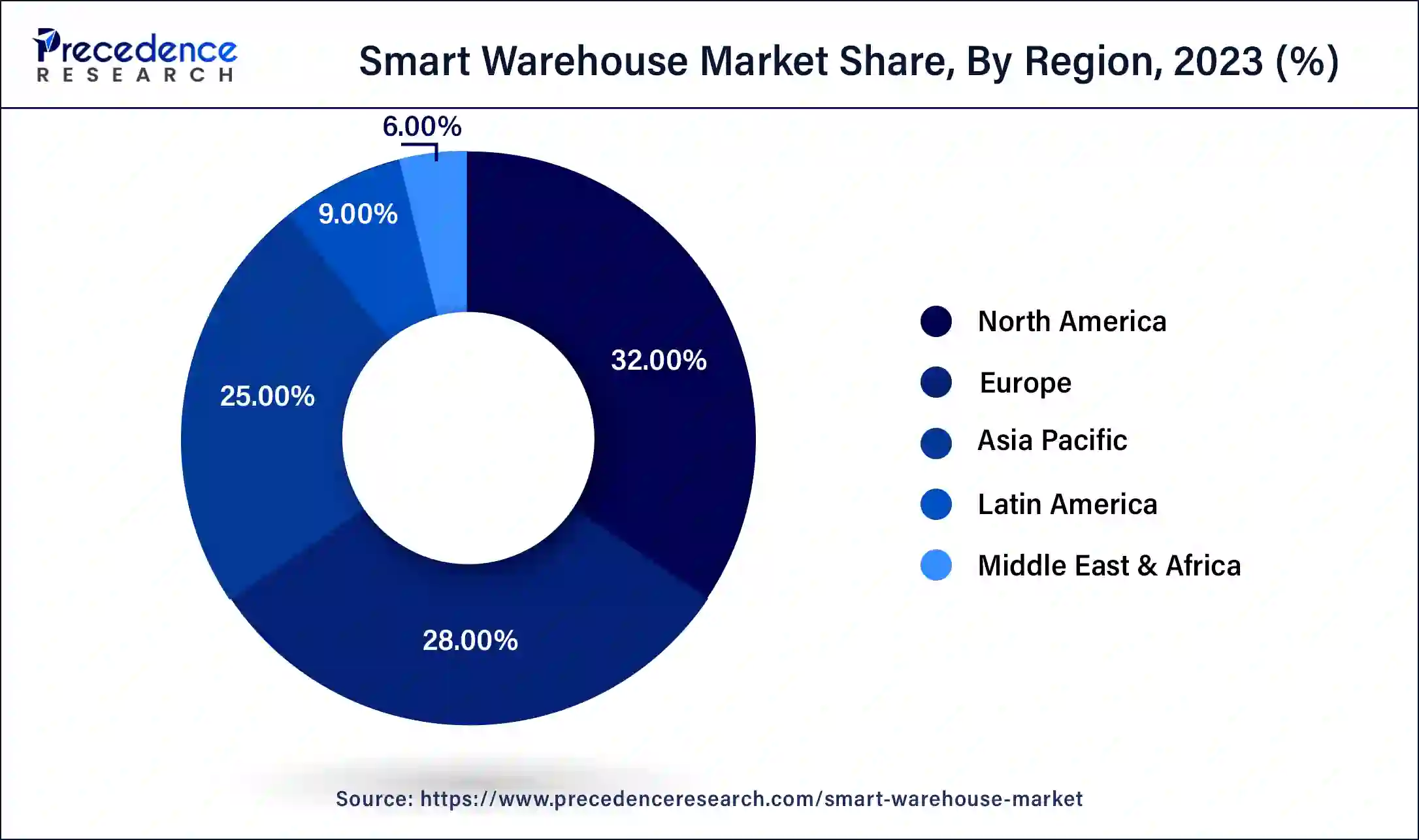

- North America dominated the smart warehouse market with the largest market share of 32% in 2024.

- Asia Pacific is expected to expand at a during the double digit CAGR of 15.22% forecast period.

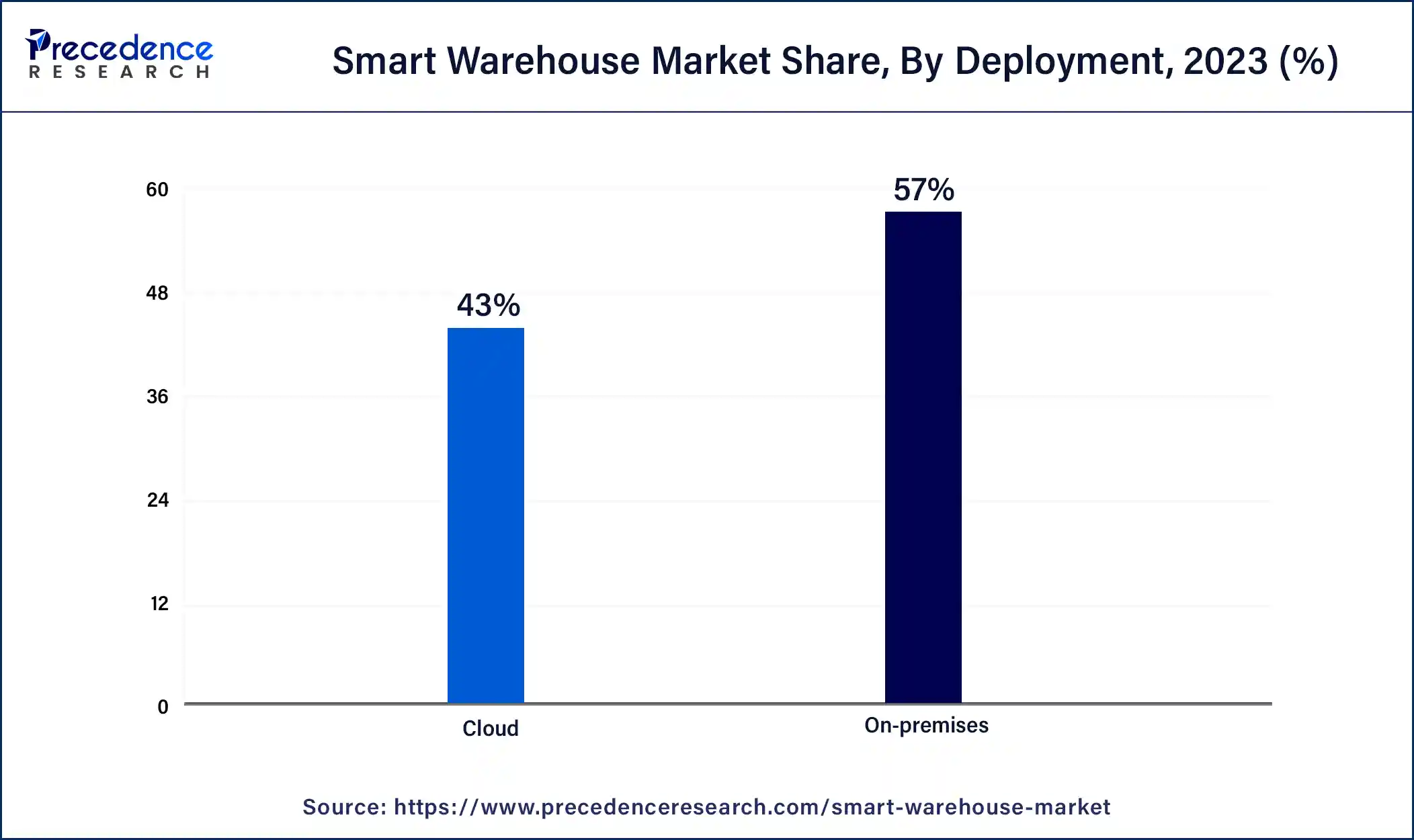

- By deployment, the on-premises segment has held the major market share of 57% in 2024.

- By deployment, the cloud storage segment is expected to grow at the significant CAGR of 15.42% during the forecast period.

- By technology, the robotics & automation segment accounted for the largest share of the market in 2024.

- By application, the order fulfillment segment contributed more than 35% of market share in 2024.

- By application, the inventory management segment is set to grow at the fastest CAGR of 14.92% over the forecast period.

- By size, the large warehouses segment accounted for the highest market share of 49% in 2024.

- By size, the medium warehouse segment is projected grow at a solid CAGR of 14.92% forecast period.

- By vertical outlook, the transportation & logistics segment dominated the market in 2024.

How is AI Revolutionizing the Smart Warehouse Industry?

Artificial intelligence is bringing major changes to several industries and is becoming a key component in the modern smart warehouse market. AI is used in several warehouse management processes, including in planning, where demand for products can be forecasted, allowing companies to meet demand without stockouts or oversupply. Artificial intelligence-powered machines are used in the automation of tasks such as arranging items on shelves. Cognitive automation can also help simplify billing and payment processes.

Integration of artificial intelligence into warehouse operations leads to the optimization of logistics, inventory management, and optimum storage. Autonomous mobile robots trained through machine learning move products across the facility without the need for human intervention. Robots also help take the burden of labor-intensive, repetitive tasks off human workers, allowing other tasks to be allocated to them. These factors contribute to the improvement of worker safety and are driving demand in the smart warehouse market.

- According to the 2024 MHI Annual Industry Report, 74% of all prominent supply chain companies are increasing technology investments, with 90% intending to spend over USD 1 million in 2024.

- In 2023, Amazon added a new robotics system called Sequoia, transporting batches of products to a sorting machine. The system uses robotic arms and computer vision to identify the inventory before sending it to employees for delivery. The robots deliver the products to workers at waist level, eliminating the need to access items kept on higher shelves.

U.S. Smart Warehouse Market Size and Growth 2025 to 2034

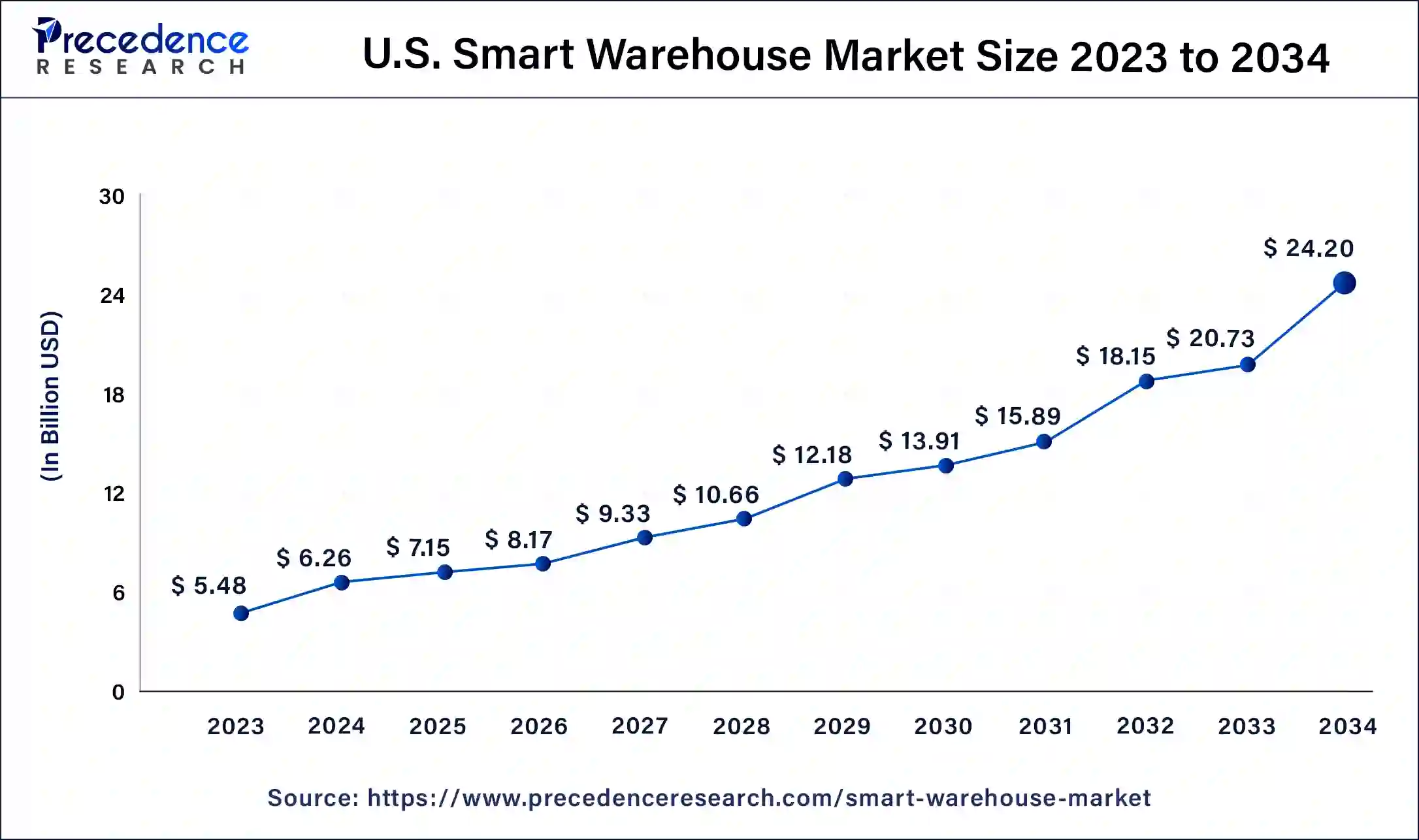

The U.S. smart warehouse market size was exhibited at USD 6.26 billion in 2024 and is projected to be worth around USD 24.20 billion by 2034, poised to grow at a CAGR of 14.48% from 2025 to 2034.

North America dominated the smart warehouse market in 2024. The region houses several major players in the market and is a major producer of smart warehousing technologies. Substantial investment in research and development in sensors, mobile networking, artificial intelligence, and machine learning in the region has led to several breakthroughs in artificial intelligence and automation tailored for the warehousing market. The robust technological infrastructure and a rise in e-commerce in the region have led to widespread automation in manufacturing and logistics. Companies are increasingly investing in automation to improve productivity and cut down on labor costs.

Asia Pacific is set to host the fastest-growing smart warehouse market during the forecast period. Emerging economies like China and India are seeing widespread adoption of smart warehousing technologies due to a rapid expansion of the e-commerce, automotive, and food and beverage sectors. Rapid industrialization is spurring demand for AI-powered automation and IoT devices to optimize material handling, transportation, and warehouse logistics.

- In March 2024, Telkomsel and Huawei inaugurated Indonesia's first 5G Smart Warehouse and 5G Innovation Centre in Bekasi Regency, West Java. This facility serves as an example of the potential of 5G technology in warehouse management and the logistics sector to support the country's digital revolution, Golden Indonesia Vision 2045.

Market Overview

A smart warehouse is a warehouse that uses technology and automation to optimize operations. Businesses use warehouses to store everything from raw materials to finished products ready for shipping. Smart warehouses are equipped with a variety of technologies, including automation software, robots, artificial intelligence, digital and RFID tags, and automated conveyor belts, which assist with administrative and inventory management issues, especially for large warehouses.

The substantial growth of e-commerce has led to massive demand for the smart warehouse market solutions for optimizing inventory and managing multi-channel distribution networks. Smart warehousing solutions help optimize warehouse management, reduce the required manual labor, and increase productivity through technologies such as integrated conveyor systems, sensors, scanners, and autonomous robots.

The smart warehouse market involves digital technology vulnerable to data breaches and cyber-attacks. The advent of augmented reality and virtual reality technology has the potential to transform warehousing activities like order allotment, material handling, and most processes in supply chain management. Augmented reality technology increases the efficiency of different data collection processes, using barcodes and other scanning systems to help workers find products easily and track deliveries better.

Smart Warehouse Market Growth Factors

- The increased efficiency and cost-effectiveness offered by artificial intelligence-powered smart warehousing solutions are driving growth in the smart warehouse market.

- Big data analytics and machine learning are helping improve decision-making for inventory management and supply chain optimization in the smart warehouse market, spurring demand.

- The emergence of multi-channel distribution networks is encouraging demand in the space as more companies look to tackle operational management issues and optimize productivity.

Key Factors Influencing Future Market Trends

- Automation and robotics adoption: Smart warehouses are incorporating more automation and the use of robots to facilitate the process of operations and elimination human errors. The picking, packing, and sorting activities are being changed with the use of autonomous mobile robots (AMRs), robotic arms, and automated guided vehicles (AGVs). Such a tendency not only increases the accuracy and speed but also helps to address the labor shortage.

- Cloud-based warehouse management systems (WMS):Cloud-based WMS solutions are increasingly being adopted because of their scalability and their ability to provide real-time visibility, and cost effectiveness. These systems make it possible for businesses to operate remotely; they can easily integrate with other enterprise solutions; they help share data across multiple locations.

- E-commerce and omnichannel retailing increase: Retailers are expected to deal with ever-more complicated fulfillment processes, from quick shipping to returns, as well as multi-channel visibility of the stock. Smart warehouses meet these needs through the provision of real-time inventory tracking, automated picking, and dynamic order processing so as to enable companies to deliver to consumers speed, efficiency, and convenience while shopping.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 98.64 Billion |

| Market Size in 2025 | USD 29.81 Billion |

| Market Size in 2024 | USD 26.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Technology, Application, Warehouse, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Integration of technology into warehouses allows for better decision-making

The smart warehouse market integrates tracking platforms, staff navigation, and scheduling into warehouse management. Warehouse asset tracking systems and IoT technology, including various tags and labels, help staff easily locate products and show them the shortest routes, reducing the time spent searching for items. Tracking systems also help businesses track the real performance of workers, assisting managers in optimizing staff workflow and conducting fleet management. Tracking systems use sensors and digital signatures to collect data, which can be used to solve operational challenges, perform predictive maintenance, and minimize unnecessary costs.

Restraint

Cost of implementation for smart technologies

The cost of adopting new technologies to transition to smart warehousing is high. The initial investment necessary to purchase and install smart technologies such as RFID tags, warehouse tracking and management systems, and robotics is steep. Businesses also need to hire professionals to maintain and operate new systems as well as train existing staff.

Although these investments provide significant returns in terms of productivity and cost-cutting, small and medium businesses working with tight budgets may be discouraged from employing these measures. Even larger players may need to find workarounds for AI technology that is still not sophisticated enough to do complex tasks. These factors contribute to challenges in the growth of the smart warehouse market.

- In 2024, Business Insider reported that Amazon's ‘Just Walk Out' technology, which was touted as allowing customers to skip traditional checkouts by automating item scanning and payment, relied on human workers. As many as 1,000 Indian employees were tasked with reviewing customer purchases from Amazon's ‘Just Walk Out' stores.

Opportunity

Implementation of low-latency networks and augmented reality

IoT devices require a strong internet connection and the use of advanced 5G networks. Focusing on the deployment of low-latency networks will improve connectivity and the speed at which these IoT devices operate. Integrating augmented reality with IoT devices has the potential to provide accurate real-time information and guide employees, improving inventory accuracy and minimizing errors. Adopting low-latency networks and augmented reality technology are huge opportunities for further growth in the smart warehouse market.

Component Insights

The hardware segment dominated the smart warehouse market in 2023. Increasing adoption of sensors, tags, and smart devices equipped with Bluetooth, wireless mesh, ultra-wideband communication, and similar technologies is the cornerstone for transitioning to smart warehouses. These devices help acquire real-time information and reduce errors and downtime, helping optimize supply chains from the ground up.

The software segment is expected to be the fastest-growing in the forecast period between 2024 and 2033. Warehousing management software such as Digital Twins helps recreate logistical processes and emulate various scenarios to optimize the throughput of a warehouse by improving decision-making processes, planning resources, and distributing workload efficiently without overworking the staff.

- In 2024, CEVA worked with Simul8 to implement the Digital Twin technology for a project in Größbeeren, resulting in an average saving of 200 working hours per week and a 2% increase in capacity across the facility.

Deployment Insights

The on-premises segment dominated the smart warehouse market in 2024. On-premise deployment of smart warehousing technologies helps businesses have better control over their operations. The on-premise deployment also helps the customization of the technology to meet the business's unique operational requirements. Businesses prefer on-premise deployment for better data security and management. Confidential corporate information is housed in a more secure environment. This is important for industries dealing with sensitive data, especially in the healthcare industry.

The cloud storage segment is expected to grow at the fastest rate in the smart warehouse market in the forecast period. As the cost of doing business grows, companies look to outsource the handling and management of data to third-party entities.

Technology Insights

The robotics & automation segment accounted for the largest share of the smart warehouse market in 2024. Robots assist with the transportation of materials and goods in warehouses and distribution centers, reducing labor costs and speeding up product placement, inventory, and loading. Mobile robots are especially useful in handling hazardous materials like corrosive chemicals, helping maintain worker safety. Technological innovations in IoT equipment help collect crucial data about warehouse operations, which can be analyzed to improve forecasting and inventory management.

- According to a 2024 study by Roland Berger, the implementation of mobile manipulator robots led to a cost reduction of between 20% to 40% and an improvement in productivity of between 25% and 70%.

Application Insights

The order fulfillment segment made up the largest share of the smart warehouse market in 2024. Implementation of smart warehousing technologies in order to fulfill this goal has led to better inventory management and overall operational efficiency, which ultimately leads to enhanced customer satisfaction. These AI-driven systems include real-time tracking and advanced analytics, leading to enhanced inventory visibility and ensuring a sufficient market supply of products.

- In 2023, ProgMressive Logistics and Langham Logistics partnered with Gather AI Inc. to use drones to scan and track items in their facilities. The drones have reportedly located approximately $1 million in inventory in customer warehouses that had been deemed lost by workers.

The inventory management segment is set to grow at the fastest rate in the smart warehouse market over the forecast period. Artificial intelligence is emerging as a powerful tool for optimizing inventory management through demand forecasting and streamlining logistics. Machine learning algorithms are now being trained to analyze historical data and identify patterns in demand fluctuation.

- In 2024, Lotlinx, a VIN-specific data company for dealership inventory management, launched Lotlinx Sentinel, an AI-powered tool that offers comprehensive, market, and competitive data (e.g., condition, body style, model) for each vehicle on a dealer's lot, enabling informed decision-making for inventory in the vehicle segment.

Size Insights

The large warehouses segment dominated the global smart warehouse market in 2024. Businesses operating large warehouses have a greater need and sufficient budgets to implement smart warehousing technologies. IoT devices and related AI are expensive, making small-scale businesses hesitant to adopt the technology.

The medium warehouse segment is expected grow at a rapid pace in the smart warehouse market over the forecast period between 2024 and 2033. Medium-size warehouses usually serve as supplementary support for large facilities, making them well-suited for integration into the smart technologies used in bigger warehouses.

Vertical Insights

The transportation & logistics segment dominated the smart warehouse market in 2024. The logistics sector has rapidly adopted smart warehousing technologies to improve operational efficiencies and cater to the robust e-commerce market.

- In 2024, Emiza set up a network of fulfillment centers to help e-retailers choose the most suitable courier partners for rapid dispatch and delivery in 14 major Indian cities, including Delhi, Mumbai, Kolkata, Chennai, Hyderabad, and Bengaluru, among others.

Smart Warehouse Market Companies

- Honeywell International Inc.

- Siemens

- Zebra Technologies Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- KION Group AG

- Cognex Corporation

- ABB Ltd.

- Tecsys, Inc.

- Manhattan Associates

- PSI Logistics

Recent Developments

- In April 2024, Huawei launched the UAE's 1st 5G smart warehouse for the country. This was part of a large effort to completely transform the logistics and warehouse space in the country by creating the capacity to process their data faster and better connect all aspects of the inventory tracking and operational processes.

- In March 2024, Telkomsel and Huawei launched Indonesia's first 5G smart warehouse and innovation center. The center was aimed at encouraging technological innovation in logistics by showing the potential of 5G technology to drive automation in warehouse management.

- In February 2024, CelcomDigi and ZTE partnered to develop some advanced technologies in smart manufacturing and smart warehousing. CelcomDigi's national aim to bolster operational efficiency and enable digital transformation across many sectors was facilitated by putting advanced technologies in the hands of manufacturers and importers.

- In June 2024, Chhattisgarh Medical Services Corporation Limited successfully implemented a GPS-based tracking system for medicine storage and delivery, enhancing supply chain efficiencies. The system supports tracking and monitoring of shipments in real-time from warehouses to healthcare providers.

- In April 2024, Amazon Australia announced the development of two new super-scale robotics-led centers, with the company investing $490 million into the project. The 685,000-square-foot warehouses will reportedly rely on robot workers to assist human workers and automate order fulfillment tasks.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Deployment

- Cloud

- On-premises

By Technology

- IoT

- Robotics and Automation

- AI & Analytics

- Networking & Communication

- AR & VR

- Others

By Application

- Inventory Management

- Order Fulfillment

- Asset Tracking

- Predictive Analytics

- Others

By Warehouse

- Small

- Medium

- Large

By Vertical

- Transportation & Logistics

- Retail & E-commerce

- Manufacturing

- Healthcare

- Energy and Utilities

- Automotive

- Food & Beverages

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting