What is the Fleet Management Market Size?

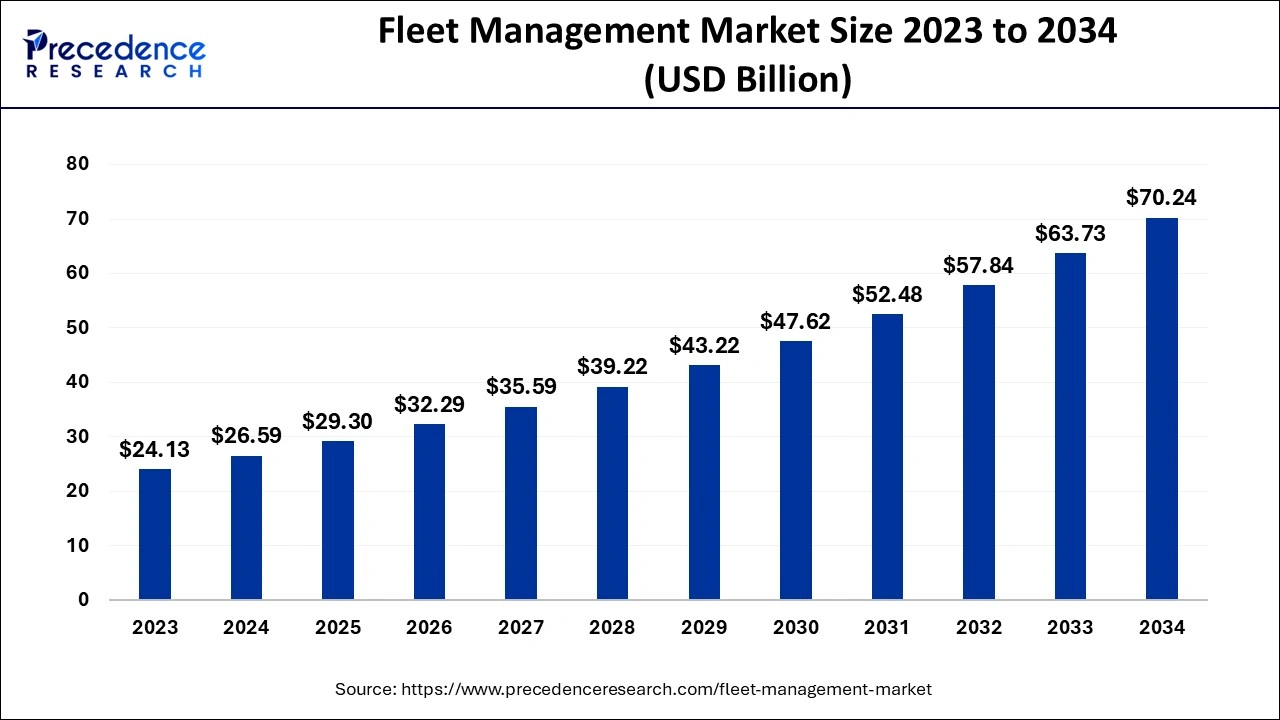

The global fleet management market size is accounted at USD 29.30 billion in 2025 and predicted to increase from USD 32.29 billion in 2026 to approximately USD 76.33 billion by 2035, expanding at a CAGR of 10.05% from 2026 to 2035

Market Highlights

- By vehicle type, the commercial vehicle segment dominated the market in 2025 with a revenue share of about 73.8%.

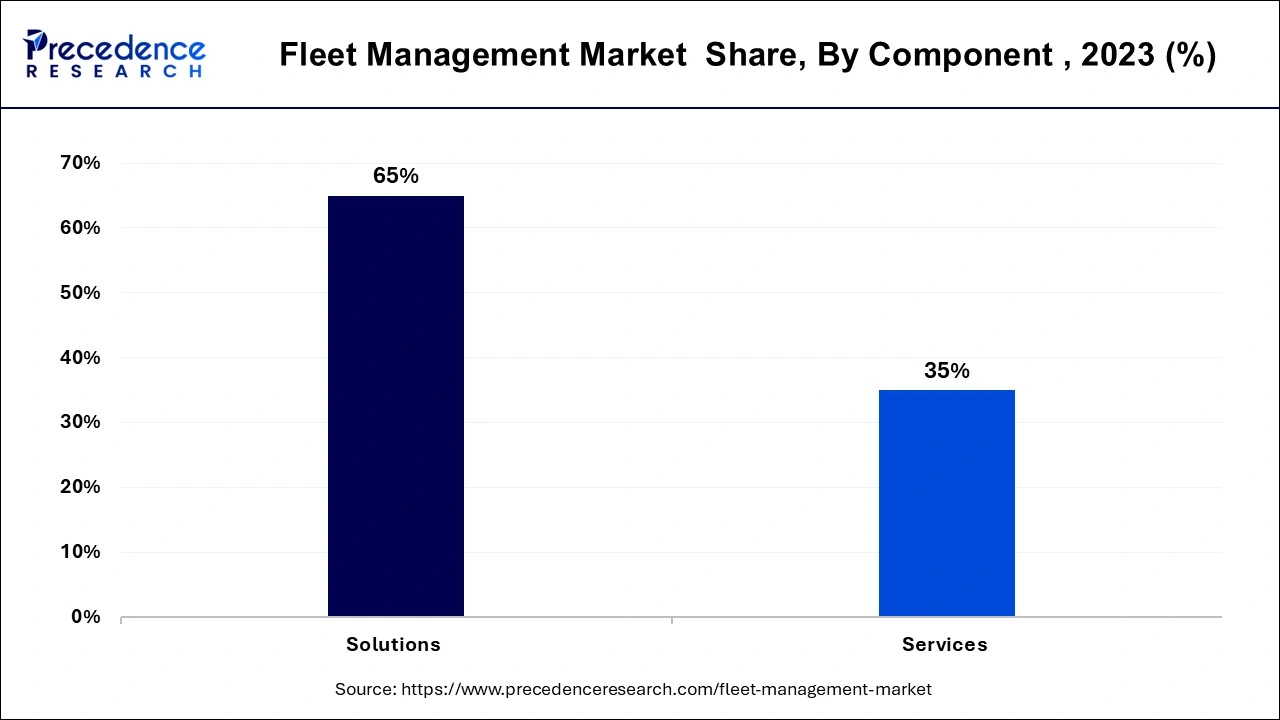

- By component, the solutions segment dominated the market in 2025 with a share of about 65% in terms of revenue.

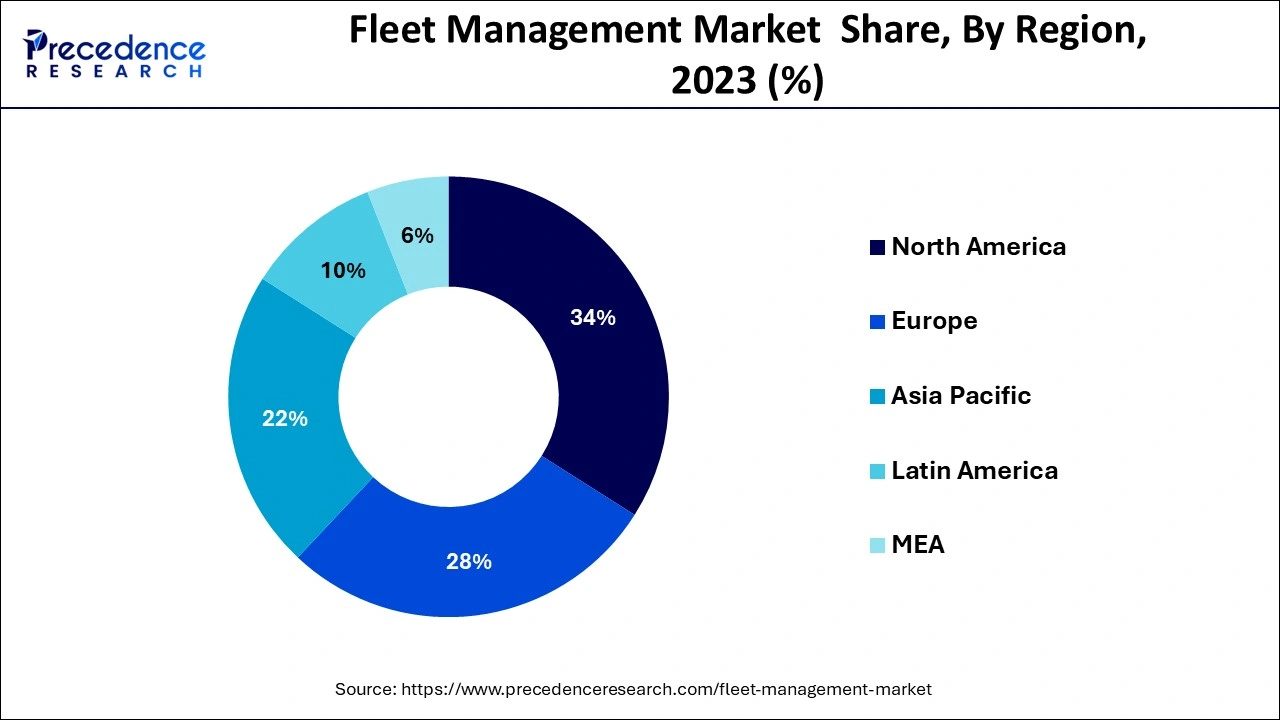

- North American region accounted for a share of about 34% in the past.

- Asia Pacific region is expected to grow at a CAGR of 12.3% over the forecast period 2026 to 2035

- By component, the solutions segment dominated the market with a 65.00% share in 2025.

- By component, the services segment is expected to grow at the highest CAGR of 11.00% over the forecast period.

- By Deployment Model, the on-premises segment held a 54.00% market share in 2025.

- By Deployment Model, the cloud-based (SaaS) segment is expected to grow at the highest CAGR of 14.00% over the forecast period.

- By vehicle type, the light commercial vehicles (LCVs) segment dominated the market with a 41.50% share in 2025.

- By vehicle type, the off highway & construction equipment segment is expected to grow at the highest CAGR of 12.30% during the projected period.

- By end user industry, the transportation & logistics segment held a 32.60% market share in 2025.

- By end user industry, the energy & utilities segment is expected to grow at the highest CAGR of 10.90% over the study period.

Market Overview

The large-scale management of the operations of commercial vehicles is known as fleet management. All the processes that are adopted by the fleet managers in order to make various decisions by monitoring the activities of the fleet Is known as fleet management. It includes the acquisition of the vehicles dispatch and the routing of the vehicle.

Fleet managers constantly focus on managing the fleet in a way that helps in reducing the consumption of fuel, it helps in controlling the costs, it helps in improving the productivity and ensures compliance. All of these are the functions of the fleet managers which help in maximizing the profitability of any business and focuses on maintaining the costs. By the way of management of fleet, the managers help in reducing any risk associated with the vehicles.

Financing of the vehicle and the management of the driver is also done by the fleet manager. The functions also include vehicle telematics which are associated with the commercial vehicles, aircrafts and watercrafts. Most of the fleet managers have adopted softwares which helps in improving the customer service and ensures better safety. It also helps in improving the profitability for the business and also increases the visibility.

Fleet Management Market Outlook

- Industry Growth Overview: The fleet management market is poised for robust growth between 2026 and 2035. This growth is driven by the escalating need for operational efficiency, stringent government regulations regarding vehicle emissions and safety, and the widespread adoption of cloud-based solutions and IoT devices.

- Sustainability Trends: Key trends include integrating Electric Vehicle fleet management solutions that monitor battery health and optimize charging schedules, and route optimization software to reduce mileage. The market is embracing data analytics to help fleets achieve ESG targets and comply with global climate initiatives.

- Major Investors: Significant investment is flowing into the fleet management space from strategic investors, venture capital firms, and private equity firms. Major players like Verizon Connect, Geotab, Trimble, and ZF are actively investing in R&D, strategic partnerships, and acquisitions to enhance their service offerings, particularly in AI-driven analytics and the integration of advanced driver-assistance systems (ADAS).

- Startup ecosystem: The startup ecosystem is evolving, with innovators targeting niche fields like AI-driven logistics optimization, specialized software for EV fleet management, and advanced sensor technology for cargo monitoring. New companies are gaining significant funding by offering scalable, software-as-a-service solutions.

Fleet Management Market Growth Factors

The major reasons which are helping in the growth of the market are the increase in concerns about the safety of the fleet and the regulations imposed by the government for the tracking as well as the maintenance of the vehicles. The government of various regions has adopted policies for the maintenance of the vehicles in order to prevent any accidents. There has also been an increase in the demand for competency in the operations of the vehicles. Increased use of the wireless technology has also helped in ensuring the growth of the market.

Fleet management market is expected to grow in the coming years as the businesses seek efficient operations through the use of various technologies that make the process of coordination and tracking of the vehicles better.

- The use of advanced technologies and the introduction of innovative systems and softwares will also help in the growth of the market in the coming years.

- The availability of applications that are cloud based and the systems that provide electronic information will also help in the growth of the market during the forecast period.

- Two-way communication between the vehicle and the driver through the use of softwares has also helped in the growth of the market in the recent years.

- One of the most significant components that will drive the market growth in the coming years is the availability of the software for fleet management which has helped in increasing the efficiency of various businesses by providing real time information in order to make good decisions.

Fleet Management Market Major Trends

- Fleet operators are beginning to leverage Artificial Intelligence (AI) powered operational intelligence rather than just using basic tracking to gain insights. As a result, fleet operators will now utilize AI to perform predictive maintenance, automate routing, and optimize real-time detection of risks that lead to lower downtime and operating costs.

- Fleet operators are now adopting edge computing within their vehicles instead of relying solely upon cloud processing, which enables fleet operators to make quicker decisions, minimize latency, and enables the analysis of data in areas that have limited connectivity.

- Modern technologies now offer advanced driver safety analytics, such as driver behaviour modelling, the ability to detect driver fatigue, and the use of real-time coaching tools. All of these technologies improve safety and decrease the cost of insurance, as well as the driver's overall compliance score.

- Many vendors are now providing open platforms that offer open application programming interfaces (APIs) so that third-party vendors can easily integrate with Enterprise Resource Planning (ERP) systems, fuel cards, tolling platforms, insurance systems, and human resources (HR) software to form a fully integrated digital fleet ecosystem.

Fleet Management Market Trade Analysis

- The rising volume of global trade is driving demand for more efficient fleets and better visibility to cargo in real time.

- With the push to comply with multiple governments' cross-border transportation regulations, companies will be adopting fleet management platforms equipped to meet compliance requirements.

- Telematics are being adopted by international logistics companies to help them combat the effects of fluctuating fuel costs, customs delays and develop acceptable routes, which will lead to a stronger demand for telematics solutions in emerging trade corridors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 29.30 Billion |

| Market Size in 2026 | USD 32.29 Billion |

| Market Size by 2035 | USD 76.33 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.05% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle, Component, Communication Technology, Deployment Type, Industry and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

What are the drivers of fleet management market?

- Growing need of public transport- the demand for the public transport has increased in the recent years in order to provide access as well as mobility for employment. Increased need for the medical facilities has created more demand for public transport. Public transport also provides opportunities for recreational purposes in various communities across the world due to which the demand for public transport is expected to grow in the coming years.

- Increase in the international trade- as the restrictions of the pandemic subsided international trade has grown. as international trade helps in better innovation and productivity in the country it is expected to grow in various regions across the world. The markets of various countries are exposed due to the policies that support international trade and it shall also create more demand for fleet management

- Increased use of the wireless technology - wireless technology is in great demand and it is expected to grow in the coming years as it helps in making various decisions associated with repairing, renting as well as selling of the vehicles many tools are available for fleet management. Satellite networks and cellular networks provide wireless transfer of data.

Market Challenges

- Growing cyberthreats- fleet managers have concerns about the security of data. Important information associated with the fleets which has mentions of the routes traversed and the personal details of the drivers can be exploited and used for any criminal activities and this is another major challenges that the industry faces.

- GPS connectivity issues- the increased use of the GPS navigation system needs connectivity but the connectivity can be hampered due to the existence of mountains, trees and huge buildings of various places. Having accurate signal becomes harder in such cases.

Market Opportunities

- Rapid urbanization- the growing trend of ride-hailing or shared mobility has increased in the urban areas there are many apps that help in sharing cars all of these will help in the growth of the market in the coming years. These unique mobility solutions are provided on the basis of the needs of an individual.

- Increased use of fleet management solutions- there has been a demand for the systems and solutions that help in managing the fleet. As the industry focuses on maximizing the productivity at minimum costs the use of software will be instrumental in the growth of the market

Segment Insights

Vehicle Insights

On the basis of the vehicle type, the commercial vehicle segment held highest revenue share in 2025. Various initiatives taken by the government which are favorable for international trade has been instrumental in the growth of the commercial vehicle segment in the recent years and it is expected to grow well in the coming years. For proper scheduling and tracking of the material that needs to be exchanged the market for commercial fleet is expected to grow well in the coming years. The use of the commercial vehicles in transportation and logistics will play an instrumental role in the growth of the segment. The increased use of the commercial vehicles in the manufacturing industries will also play an important role in the growth of the market in the coming years.

The light commercial vehicles (LCVs) segment dominated the market with a 41.50% share in 2025. Various initiatives taken by the government, which are favourable for international trade, has been instrumental in the growth of the light commercial vehicle segment in recent years, and it is expected to grow well in the coming years, for proper scheduling and tracking of the material that needs to be exchanged the market for commercial fleet is expected to grow well in the coming years. The use of light commercial vehicles in transportation and logistics will play an instrumental role in the growth of the segment.

The off highway & construction equipment segment is expected to grow at the highest CAGR of 12.30% during the projected period. The growth of the segment can be driven by growing demand for improved operational efficiency, along with technological advancements like IoT and telematics. Market players are using these systems to track the location and status of their equipment.

Component Insights

The solutions segment accounted highest revenue share in 2025. The market was valued at USD 12,614.34 million, and it will continue to grow well in the coming years.

Apart from solutions segment the services segment is also expected to grow well in the coming years due to a growing demand for it in various industries.

The solutions segment dominated the market with a 65.00% share in 2025. The dominance of the segment can be attributed to the growing adoption of cost and operational efficiency, along with the ongoing shift toward sustainable transportation methods. Also, solutions help fleets minimize fuel costs through optimized routing and monitoring, leading to further segment growth.

The services segment is expected to grow at the highest CAGR of 11.00% over the forecast period. The growth of the segment can be credited to the increasing demand for improved safety, cost reduction, and operational efficiency, coupled with the innovations in AI and big data analytics. The growing adoption of electric vehicles is creating new avenues for specialized fleet management services.

Communication Technology Insights

On the basis of the communication technology the cellular system segment is expected to have the largest market share in the coming years and this segment has dominated the market in the past with the highest share in terms of revenue.

Industry Insights

On the basis of the industry the transportation industry is expected to have the largest market share in the coming years and this segment has dominated the market in the past with the highest share in terms of revenue and it will continue to grow in the coming years.

Deployment Model Insights

The on-premises segment held a 54.00% market share in 2025. The dominance of the segment can be linked to the growing demand for improved data security and control with specific compliance requirements, especially in sectors with stringent data regulation. On-premises solutions enable market players to maintain complete control over their fleet data.

The cloud-based (SaaS) segment is expected to grow at the highest CAGR of 14.00% over the forecast period. The growth of the segment can be driven by the cost-effectiveness, flexibility, and scalability of cloud solutions. In addition, Cloud solutions cut the requirement for significant upfront infrastructure investments, which makes them a crucial choice for businesses of all sizes.

End-User Industry Insights

The transportation & logistics segment held a 32.60% market share in 2025. The dominance of the segment is owed to the growing capabilities of GPS and telematics, along with the ongoing expansion of the e-commerce sector. Furthermore, fleet management tools help manage, organise, and coordinate the complex operations of supply chains.

The energy & utilities segment is expected to grow at the highest CAGR of 10.90% over the study period. The growth of the segment is due to a surge in the adoption of EVs and the adoption of technologies like IoT, 5G, and advanced telematics. These systems help to enhance safety through driver monitoring and performance analysis.

Regional Analysis

U.S. Fleet Management Market Size and Growth 2026 to 2035

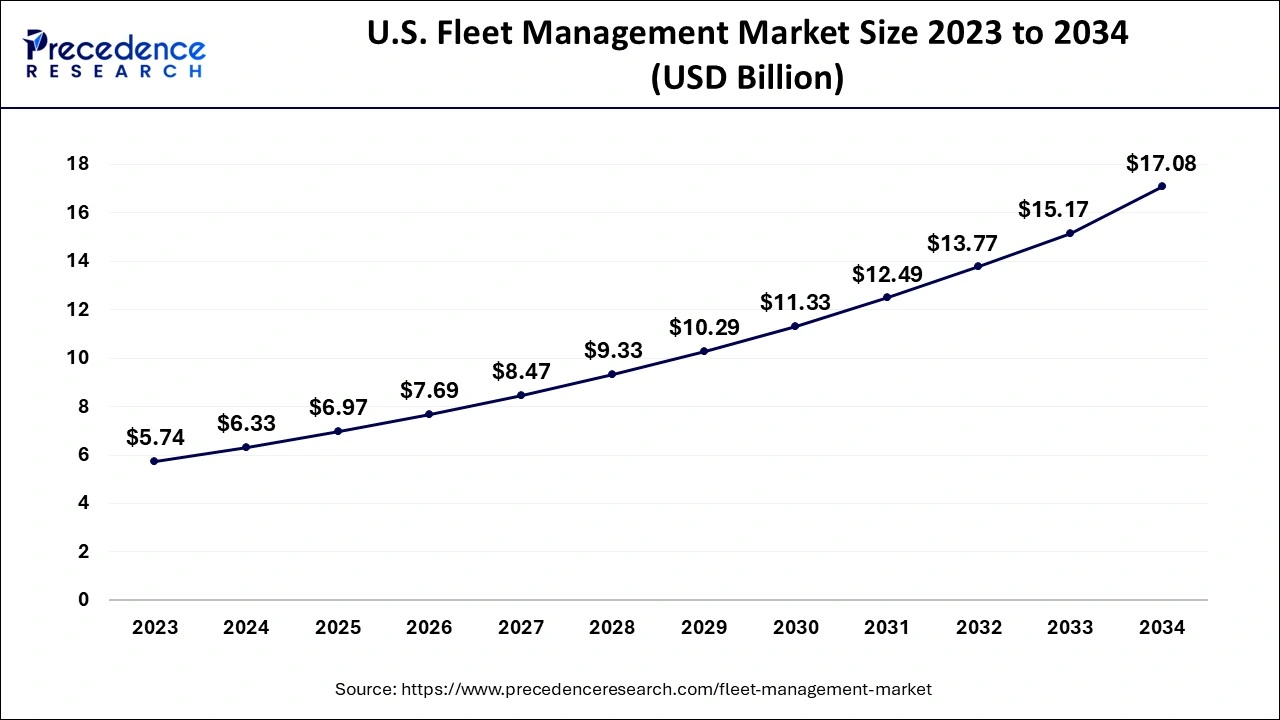

The U.S. fleet management market size is evaluated at USD 6.97 billion in 2025 and is predicted to be worth around USD 18.65 billion by 2035, rising at a CAGR of 10.34% from 2026 to 2035

North American region held highest revenue share in 2025. The government of this region has played an extremely significant role in increasing the market for fleet management in the recent years. The strict regulations and rules in the North American region have successfully reduced the amount of emissions that come through the use of vehicles. And in order to reduce the pollution caused by the vehicles the stringent regulations are compelling the industry to adhere to the policies. This region is expected to contribute well in the growth of the fleet management market during the forecast period.

- For instance, in April 2025, Siemens Mobility Services, a subsidiary of Siemens Corporation Supply Chain Management, launched Depot360 Home Charging Reimbursement in the U.S. which is a part of its Managed Services portfolio. The innovative solution uses vehicle telematics data and geofencing for accurate identification and measurement of home charging sessions allowing fleet operators to precisely reimburse drivers while significantly reducing operational costs and capital investments.

U.S. Fleet Management Market Trends

The U.S. fleet management market is mature and highly developed, driven by advanced technology adoption and a strong regulatory framework, including the ELD mandate. The market serves as a hub for innovation in AI-powered analytics and IoT solutions, fueled by the growth of e-commerce and the shift toward fleet electrification. Key players such as Verizon Connect and Samsara are leading the development of sophisticated software solutions that optimize operational efficiency, reduce costs, and enhance vehicle and driver safety.

What Makes Asia Pacific the Fastest-Growing Market?

Due to the presence of countries like China as well as India in Asia Pacific region this region is expected to show maximum growth in fleet management in the coming years. Increased international trade has also been instrumental in the growth of the market in the Asia Pacific region in the recent years. This region is expected to grow at the highest compound annual growth rate in the coming years owing to the favorable policies adopted by the government of various regions in order to support the trade. The demand for vehicles that cause less pollution has increased in the Asia Pacific region as though pollution in these countries is more due to the population explosion.

- For instance, in May 2025, state-run Indian Oil Corporation collaborated with TrucksUp, a logistics technology company for launching XTRAPOWER-Fleet Card which is a promising comprehensive fuel and fleet management solution for the logistics industry.

India Fleet Management Market Trends

India is a rapidly emerging and one of the fastest-growing fleet management markets, driven by the significant expansion of its logistics and e-commerce sectors. Government digitalization initiatives, such as the mandatory AIS-140 standard for commercial vehicles, promote the adoption of GPS and telematics technologies. Although the market faces challenges like high initial costs, it offers vast opportunities for developing cost-effective, AI-enabled solutions to enhance efficiency and safety.

What Potentiates the Growth of the Latin America Fleet Management Market?

The fleet management market in Latin America is experiencing strong growth, driven by the need for operational efficiency, cost reduction, and improved safety compliance. Adoption of advanced technologies, including IoT and telematics, is increasing, with smart fleet solutions offering significant potential to optimize fuel consumption and streamline maintenance schedules. Brazil and Mexico are leading this adoption, leveraging technology to address challenges such as urban congestion and diverse local regulatory requirements.

Brazil Fleet Management Market Trends

Brazil represents the largest fleet management market in Latin America, driven by its extensive industrial and commercial activities, a high volume of fleet vehicles, and the need for enhanced operational control. The market is supported by government interventions and regulations that mandate the use of digital monitoring systems and telematics to improve road safety and reduce emissions. Integration of advanced technologies, including AI and cloud-based platforms, is fueling market growth, with key players focusing on delivering innovative and efficient fleet solutions.

How Big is the Opportunity for the Fleet Management Market in the MEA?

The MEA offers immense opportunities for the expansion of the fleet management market, driven by digital transformation initiatives, expanding infrastructure, and the need to reduce operational costs. The UAE and Saudi Arabia are recognized as key markets in the region. Adoption of IoT and AI technologies for predictive maintenance, real-time tracking, and fuel optimization is a major focus, while government regulations promoting safety and operational efficiency further support market expansion.

Saudi Arabia Fleet Management Market

Saudi Arabia's fleet management market is growing rapidly, driven by efforts to diversify the economy and modernize the transportation and logistics sectors. The country's strategic location as a logistics hub, the expansion of e-commerce, and government regulations mandating GPS tracking and electronic logging devices (ELDs) to enhance safety and compliance are key growth drivers. The market's future is focused on full digitalization, automation, and sustainability, with emerging solutions expected to include EV battery monitoring, carbon tracking, and green routing.

How is the Opportunistic Rise of Europe in the Fleet Management Market?

Europe is expected to see significant growth in the fleet management market, driven by strict government regulations on vehicle maintenance, driver safety, and emissions standards. This market is well-developed and highly advanced technologically, with a strong emphasis on IoT, telematics, and cloud-based solutions for real-time tracking, route optimization, and monitoring driver behavior. The shift toward fleet electrification and the use of AI for predictive analytics and fuel efficiency are key factors fueling this growth.

Germany Fleet Management Market Trends

Germany holds a leading position in the European fleet management market, supported by its strong automotive industry, mature logistics sector, and clear regulatory frameworks. The market is a hub for innovation, emphasizing advanced telematics, AI-powered optimization, and the integration of electric vehicles into existing fleets. German companies utilize high-quality engineering to develop sophisticated fleet management solutions that focus on driver safety, compliance with strict German laws, and operational efficiency.

Value Chain Analysis

- Hardware Manufacturing & Telematics Supply

This stage involves creating telematics devices like GPS trackers and sensors.

Key Players: CalAmp Corp., Teltonika, Garmin. - Software Development & Data Platform (SaaS)

This stage focuses on developing cloud-based platforms and applications for fleet management.

Key Players: Samsara, Verizon Connect, Trimble, Geotab. - Integration, Distribution, and Sales

This stage involves the distribution of hardware and software to fleet operators, often through direct sales, resellers, and installation partners.

Key Players: Samsara, Verizon Connect. - Service Delivery and Implementation

This stage focuses on providing initial setup, training, and ongoing support for customers.

Key Players: Samsara, Geotab, Verizon Connect. - Data Analytics & Value Optimization

Fleet operators use the platform to analyze data and improve operations.

Key Players: End-users across industries like logistics, construction, and field services. - Aftermarket and Value-Added Services

Offering ongoing services such as regulatory updates and integration with insurance or fuel card providers.

Key Players: WEX Inc., FleetCor Technologies, Inc.

Top Companies in the Fleet Management Market and Their Offerings

- Trimble Transportation & Logistics: Integrated hardware/software for routing, scheduling, compliance, maintenance, and freight logistics.

- Fleetmatics Group PLC: Cloud-based GPS tracking, route optimization, and fuel management software for SMB fleets.

- TomTom N.V.U.S:High-quality maps, real-time traffic data, and navigation components for fleet tracking and optimization.

- AT&T Inc.:IoT connectivity platforms, network infrastructure, and related services for connected fleet management.

- I.D. Systems: Wireless asset management and tracking solutions for vehicles, trailers, containers, and yard management.

Other Key Players

- General Services Administration

- Fleetmatics Group PLC

- Telogis

- Freeway Fleet Systems

- IBM Corporation

- Navico

- Grupo Autofin de Monterrey

- Grab

- Scope Technologies

- Troncalnet

- FAMSA

- Ola Cabs

- MiTAC International Corporation

- Cisco Systems

- Uber Technologies

- Didi Chuxing

- DC Velocity

- European GNSS Agency (GSA)

Recent Developments

- In May 2025, Nawgati, a fuel aggregator startup, secured $2.5 million through its Pre-Series A funding round. The startup aims at using the new capital for scaling up its fleet management offerings to build congestion management and compliance monitoring systems for fuel stations and fleet operators.

- In April 2025, Stellantis' Data as a Service business unit, Mobilisights joined forces with Zubie for expanding its customer base. By leveraging Mobilisights Fleet Plus Data Pack providing access to embedded telematics data of millions of Stellantis N.V. vehicles in the United States, Zubie will use the data for enhancing fleet management and rental car operations with features like advanced predictive maintenance, monitoring of driver behavior, and vehicle health management insights.

- In April 2025, EVAI, an innovative company focused on advanced fleet data analytics and AI-powered solutions for fleet management, launched its new Dual Powertrain Platform Solution designed for addressing critical challenges encountered by fleet operators through integrated fleet management. The solution offers an all-inclusive, OEM agnostic approach to Total Cost of Ownership (TCO) management for both electric vehicles (EVs) and internal combustion engine (ICE) vehicles on a unified platform.

- In the year 2021 according to the agreement Inseego had to sell the Ctrack South African branch to the convergence partners, this firm is the investment management organization which focuses on the telecommunication industry, media and technology industries of Africa.

- For acquiring Donlen, Hertz global and Athene limited entered into a partnership in the year 2020

- In the year 2022 Ford pro intelligence was introduced by Ford pro which is a system for fleet management.

Segments covered in the report

By Component:

- Solutions (Software):

- Operations Management:

- Asset/Vehicle Tracking & Geo-fencing

- Routing & Scheduling Optimization (e.g., Multi-stop, Dynamic Routing, Last-mile Delivery Optimization)

- Dispatch Management (e.g., Job Assignment, Real-time Communication)

- Vehicle Maintenance & Diagnostics:

- Predictive Maintenance (AI/ML-driven)

- Preventive Maintenance Scheduling

- Fault Code Diagnostics & Alerting

- Tire Pressure Monitoring System (TPMS) Integration

- Fluid Level Monitoring (e.g., fuel, oil, DEF)

- Performance Management:

- Driver Management & Safety:

- Driver Behavior Monitoring (e.g., speeding, harsh braking, idling, distracted driving, fatigue detection)

- Driver Coaching & Gamification

- Electronic Logging Devices (ELD) Compliance

- Driver ID & Access Control

- Accident Reconstruction & Reporting

- Fuel Management:

- Fuel Consumption Monitoring & Reporting

- Fuel Card Integration & Transaction Tracking

- Fuel Efficiency Analysis & Optimization

- Idle Time Management

- Driver Management & Safety:

- Fleet Analytics & Reporting:

- Business Intelligence Dashboards

- Custom Report Generation

- Key Performance Indicator (KPI) Tracking

- Data Visualization

- Benchmarking

- Compliance & Risk Management:

- Hours of Service (HOS) Compliance

- Driver Vehicle Inspection Report (DVIR) Management

- Emissions Monitoring & Reporting

- Regulatory Compliance (e.g., FMCSA, ELD Mandates)

- Insurance & Claims Management

- Other Solutions:

- Payment Management

- Inventory Management (for parts, etc.)

- Vehicle Acquisition & Disposal Management

- Leasing & Rental Management

- Mobile Applications for Drivers & Managers

- Operations Management:

- Services:

- Professional Services:

- Consulting & Strategy Development

- Implementation & Integration (with ERP, CRM, TMS, etc.)

- Data Migration

- Customization

- Training & Onboarding

- Professional Services:

- Managed Services:

- Full-Service Fleet Management Outsourcing

- Data Monitoring & Analysis

- Technical Support & Helpdesk

- Hardware as a Service (HaaS)

- Support & Maintenance:

- Technical Support (24/7, multi-channel)

- Software Updates & Upgrades

- Troubleshooting & Bug Fixing

- Hardware:

- Telematics Devices:

- GPS Tracking Devices (Real-time, Passive)

- OBD-II Dongles

- J1939 Connectors (for heavy-duty vehicles)

- Embedded Telematics Systems (OEM-installed)

- Aftermarket Devices

- Safety & Monitoring Hardware:

- Dash Cameras (Single-lens, Multi-lens, AI-powered)

- Driver-facing Cameras

- Road-facing Cameras

- Advanced Driver-Assistance Systems (ADAS) Integrations (e.g., Lane Departure Warning, Forward Collision Warning)

- Blind Spot Monitoring Systems

- Sensors:

- Fuel Level Sensors

- Temperature Sensors (for reefer trucks)

- Tire Pressure Sensors

- Cargo Sensors

- Door Open/Close Sensors

- Connectivity Modules:

- Cellular Modems (4G LTE, 5G)

- Satellite Communication Devices

- Bluetooth Modules

- Wi-Fi Modules

- Other Hardware:

- Data Loggers

- RFID Readers

- Vehicle Gateways

- Telematics Devices:

By Deployment Model:

- Cloud-based (SaaS):

- Public Cloud

- Private Cloud

- On-Premises

- Hybrid

By Vehicle Type:

- Light Commercial Vehicles (LCVs):

- Vans

- Pickup Trucks

- Small Delivery Trucks

- Heavy Commercial Vehicles (HCVs):

- Heavy-duty Trucks (Class 8)

- Semi-trailers

- Dump Trucks

- Tankers

- Buses and Coaches:

- School Buses

- Public Transit Buses

- Tour Buses

- Trailers/Semi-Trailers:

- Dry Van Trailers

- Refrigerated Trailers (Reefers)

- Flatbed Trailers

- Specialized Trailers

- Off-highway & Construction Equipment:

- Excavators

- Bulldozers

- Loaders

- Cranes

- Agricultural Machinery (Tractors, Harvesters)

- Mining Vehicles

- Passenger Cars:

- Corporate Fleets

- Rental Cars

- Ride-sharing Vehicles

- Other Specialized Vehicles:

- Emergency Vehicles (Ambulances, Fire Trucks)

- Waste Management Vehicles

- Utility Vehicles

- Forklifts & Warehouse Equipment

By Fleet Size:

- Small Fleets: (e.g., 1-49 vehicles)

- Mid-sized Fleets: (e.g., 50-199 vehicles)

- Large Fleets: (e.g., 200-999 vehicles)

- Enterprise Fleets: (e.g., 1000+ vehicles)

By End-User Industry (Verticals):

- Transportation & Logistics:

- Freight & Shipping

- Courier & Express Delivery

- Third-Party Logistics (3PL)

- Public Transportation

- Construction & Mining:

- Heavy Civil Construction

- Building Construction

- Underground Mining

- Surface Mining

- Energy & Utilities:

- Oil & Gas (Upstream, Midstream, Downstream)

- Electric Utilities

- Water & Wastewater Utilities

- Telecommunications Utilities

- Manufacturing & Retail Distribution:

- Consumer Goods Distribution

- Automotive Manufacturing

- Industrial Manufacturing

- Wholesale & Retail Logistics

- Government & Public Safety:

- Municipal Fleets

- Police Departments

- Fire Departments

- Emergency Medical Services (EMS)

- Military Fleets

- Field Service Management:

- HVAC Services

- Plumbing Services

- Pest Control Services

- Landscaping Services

- Home Healthcare Services

- Food & Beverage:

- Food Distribution (Perishable, Non-perishable)

- Beverage Distribution

- Catering Services

- Rental & Leasing:

- Vehicle Rental Companies

- Equipment Rental Companies

- Fleet Leasing Providers

- Waste Management:

- Solid Waste Collection

- Recycling Services

- Hazardous Waste Management

- Healthcare & Pharmaceuticals:

- Medical Device Delivery

- Pharmaceutical Distribution

- Mobile Clinics

- Agriculture:

- Farm Equipment Fleets

- Produce Transportation

- Others:

- Education (School Bus Fleets)

- Hospitality (Hotel Shuttle Services)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content