Automotive Data Management Market Size and Forecast 2024 to 2034

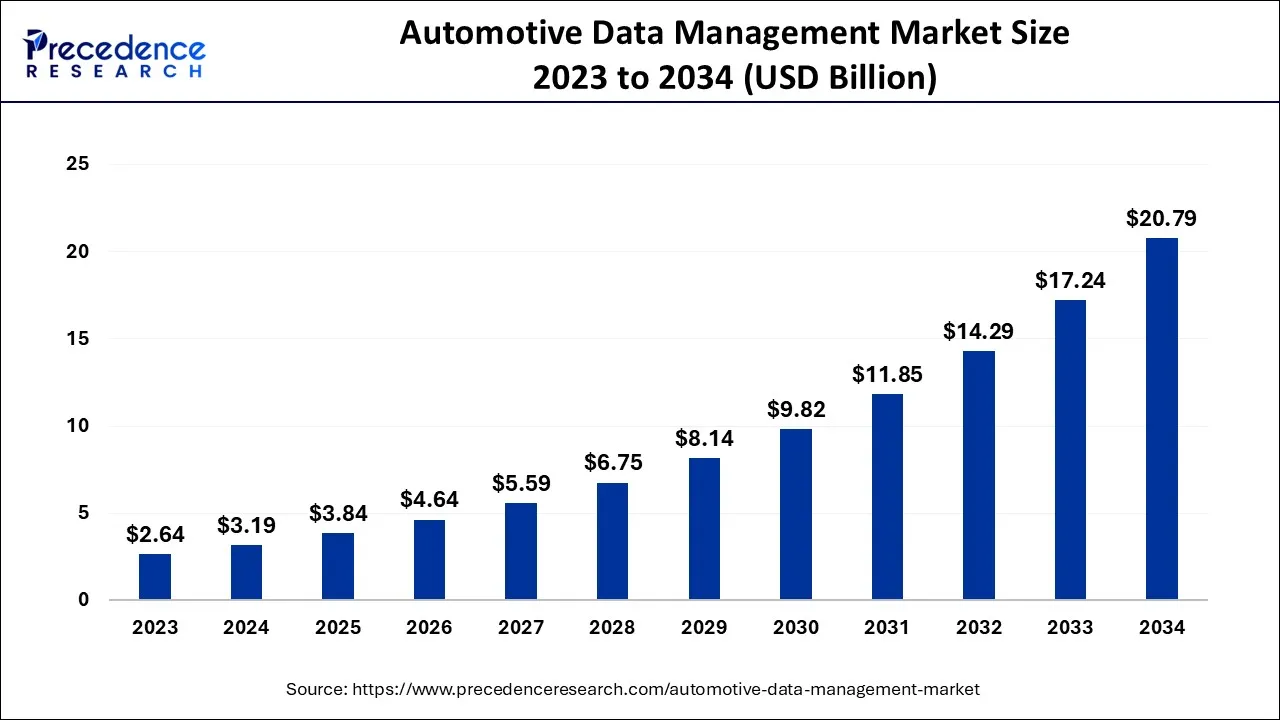

The global automotive data management market size was estimated at USD 3.19 billion in 2024 and is predicted to increase from USD 3.84 billion in 2025 to approximately USD 20.79 billion by 2034, expanding at a CAGR of 20.62% from 2025 to 2034. Automotive data management refers to collecting, storing, processing, and analyzing data generated by vehicles, drivers, and passengers. With the increasing use ofconnected cars, the volume of data generated by vehicles has increased significantly, creating a need for advanced data management solutions in the automotive industry.

Automotive Data Management Market Key Takeaways

- In terms of revenue, the global automotive data management market was valued at USD 3.19 billion in 2024.

- It is projected to reach USD 20.79 billion by 2034.

- The market is expected to grow at a CAGR of 20.62% from 2025 to 2034.

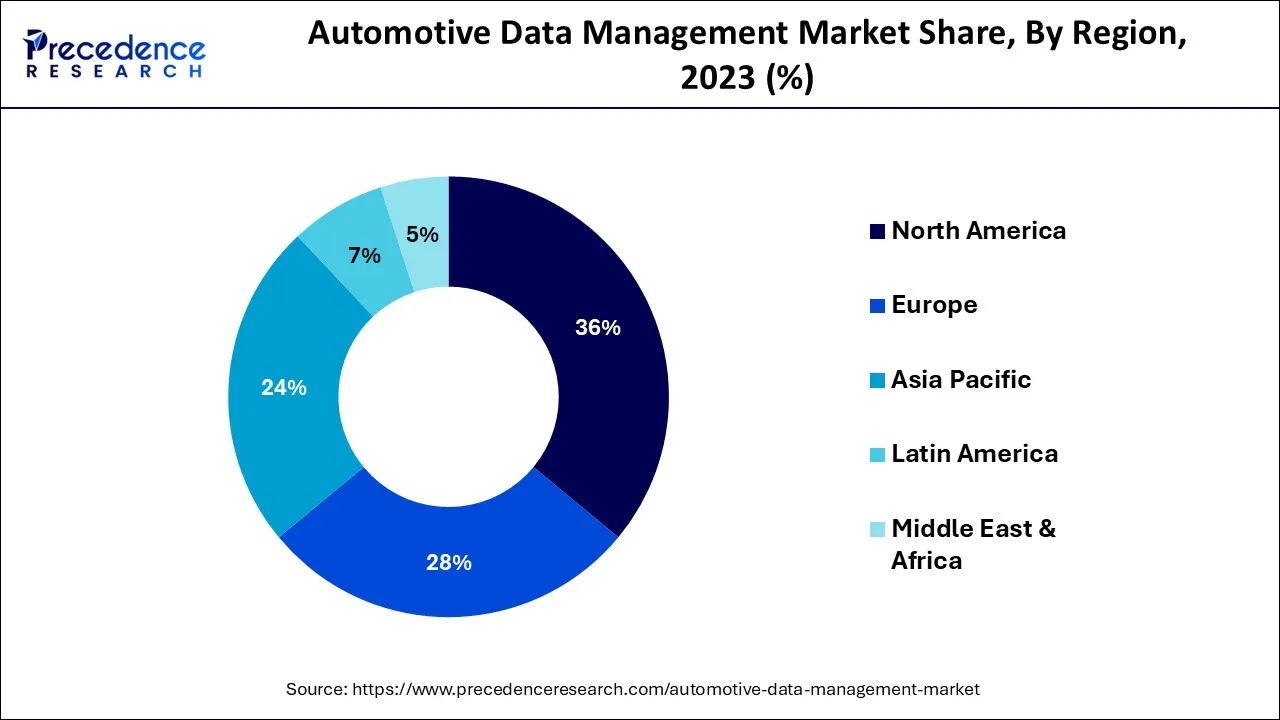

- North America dominated the global market with the largest market share of 36% in 2024.

- Europe is expected to expand at the fastest CAGR of 19.4% from 2025 to 2034.

- By component, the software segment dominated the market with a 64.70% share in 2024.

- By component, the services segment is expected to grow at the highest CAGR of 12.40% over the forecast period.

- By data type, the structured data segment dominated the market by holding a 52.30% share in 2024.

- By data type, the unstructured data segment is expected to grow at the highest CAGR of 13.10% over the forecast period.

- By vehicle type, the connected vehicles segment held a 57.60% market share in 2024.

- By vehicle type, the autonomous vehicles segment is expected to grow at the fastest CAGR of 15.30% during the projected period.

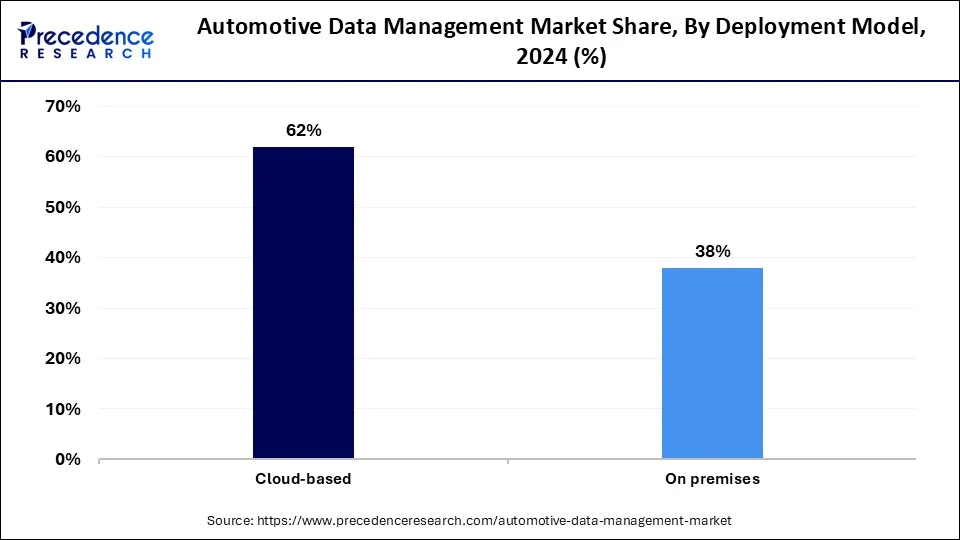

- By deployment model, the cloud-based segment dominated the market with 61.80% share and is expected to grow at the highest CAGR of 13.50% over the forecast period.

- By application, the predictive maintenance segment held a 20.40% market share in 2024.

- By application, the usage-based insurance (UBI) segment is expected to grow at the highest CAGR of 14.20% during the study period.

- By end user, the automotive OEMs segment dominated the market with a 41.90% share in 2024.

- By end user, the insurance companies' segment is expected to grow at the highest CAGR of 12.80% over the projected period.

U.S. Automotive Data Management Market Size and Growth 2025 to 2034

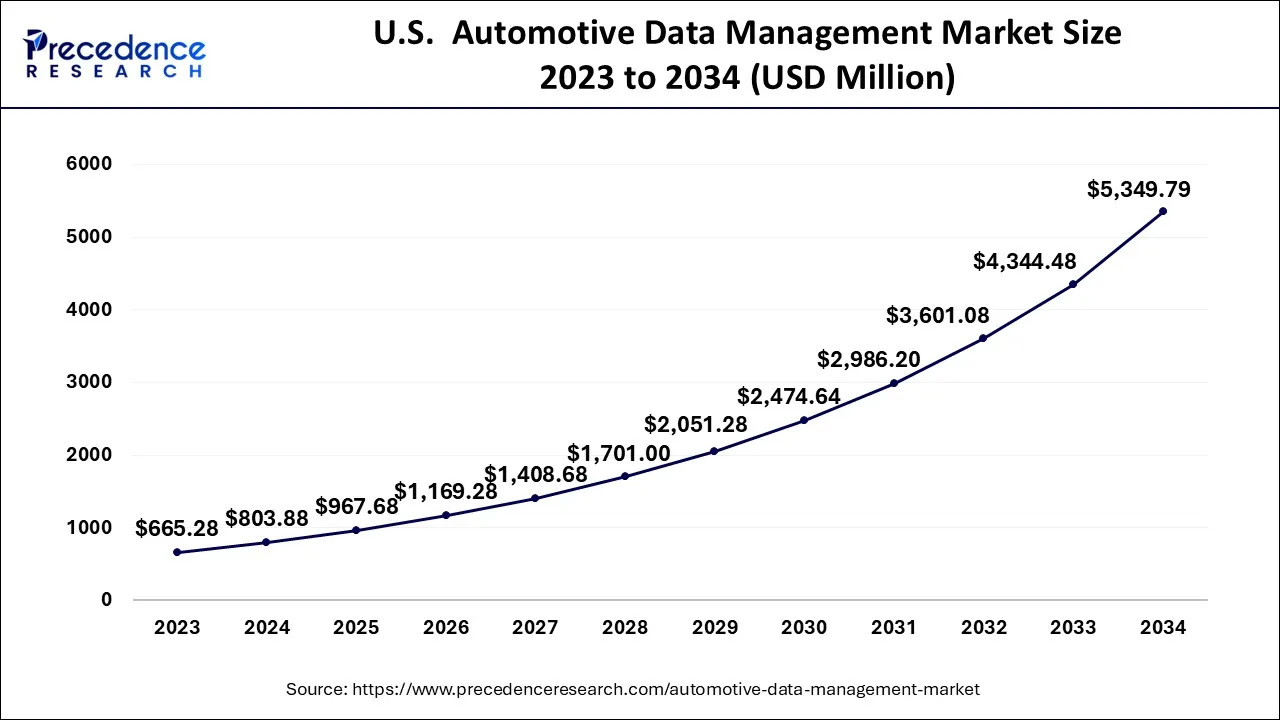

The U.S. automotive data management market size was exhibited at USD803.88 million in 2024 and is projected to be worth around USD 5,349.79 million by 2034, growing at a CAGR of 20.87% from 2025 to 2034.

North America dominated the market with a share of 36% in 2024,and it is expected that this region will continue to dominate during the projection period. The market in the region is being driven by elements like the existence of major market sellers, significant discretionary incomes, demand for new cars, and the high usage of advanced technologies in the area. Additionally, the increased testing and use of self-driving cars as a result of changes to traffic laws in the U.S. that permit them to communicate with one another on freeways and roads has increased demand for automotive data administration in the area.

Over the forecast time, Europe is expected to grow at the greatest rate of 19.4%.The development of the regional market is primarily attributable to improvements in the design of vehicle electronics, greater vehicle production, advances in vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, increasing linked vehicle sales, and the rise of significant OEMs. The market for linked cars is growing considerably thanks to Europe. Additionally, regional business actors are creating cutting-edge and ground-breaking vehicle data administration goods and services for customers.

Automotive Data Management Market Growth Factor

The growth of the market is driven by factors such as the increasing demand for connected cars, the growing focus on vehicle safety and security, and the rising adoption of advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT) in the automotive industry.

The global automotive data management market has experienced significant growth in recent years, driven by the increasing adoption of connected cars, the rising demand for real-time data analytics, and the need for efficient data management. The COVID-19 pandemic has also contributed to the growth of this market, as the shift towards remote work and online services has accelerated the need for digital transformation in the automotive industry.

The increasing demand for advanced analytics tools, such as artificial intelligence and machine learning, is expected to drive the growth of the automotive data management market further. These tools enable automakers to gather and analyze data from multiple sources, including vehicles, sensors, and customer interactions, to gain insights into customer behavior, preferences, and needs.

Moreover, the growing focus on data security and privacy in the automotive industry is expected to drive the adoption of data management solutions that offer advanced security features such as encryption, data access controls, and threat detection. These solutions help automakers comply with various data protection regulations, such as the General Data Protection Regulation (GDPR), and mitigate the risk of data breaches.

Cloud-based data management solutions are also expected to witness significant growth in the automotive industry, as they offer several benefits, such as scalability, cost-efficiency, and accessibility from anywhere. These solutions enable automakers to store and access data from anywhere, which is particularly important in a global industry like the automotive.

- As connected cars become more prevalent, so does the need for automotive data administration.

- As the market for automotive data management & cloud platforms grows, manufacturers are spending more and more in the creation of partially or completely autonomous vehicles as a result of increased rivalry in the autonomous mobility space.

- As automotive industry technologies have advanced, so has the demand for linked cars. This has also increased the need for data management systems to track user activity and evaluate and comprehend client requirements.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 20.79 Billion |

| Market Size in 2025 | USD 3.84Billion |

| Market Size in 2025 | USD 3.19 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 20.62% |

| Largest Market | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Data Type, Vehicle Type, Deployment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Key Market Drivers

Increasing demand for connected cars

One of the major factors propelling the worldwide market for automotive data management is the rising demand for linked vehicles. The performance, location, and use of connected vehicles produce enormous amounts of data. Automotive data management systems can assist manufacturers and other stakeholders in gathering, processing, and analyzing this data to enhance driver safety and vehicle performance.

Another important factor propelling the global car data management market is the rising popularity of electrified vehicles. Compared to conventional internal combustion engine vehicles, electric vehicles produce various kinds of data, such as battery charge level and energy usage. Automakers and other stakeholders can handle this data and improve vehicle performance with the aid of automotive data management tools. The market is expanding as a result of developments in the car industry like lightweight vehicles and electric mobility.

Key Market Challenges

Data privacy issues

One of the key industry inhibitors for the global vehicle data management market is data privacy issues. Concerns about the security and safety of private data, such as driver behavior and position information, are raised by the gathering, processing, and analysis of vehicle data. To prevent data leaks and cyberattacks that would impede the development of the Automotive data management market, automakers and other players must make sure they are in compliance with data protection laws and put in place effective data security measures.

Key Market Opportunities

Rising usage of cloud-based options and rising demand for data analytics

One of the major business possibilities for the global automotive data management market is the rising demand for data analytics. Automakers and other stakeholders can use automotive data management systems to evaluate massive quantities of vehicle data to spot trends and patterns, allowing data-driven decision-making and performance improvement of vehicles. Another significant business potential for the global automotive data management market is the growing use of cloud-based solutions. Businesses of all kinds prefer cloud-based solutions because they are more adaptable, expandable, and affordable than on-premises alternatives. By providing cloud-based solutions that allow for real-time data access and insights, automotive data management solutions can capitalize on this trend.

Component Insights

The software segment dominated the market with a 64.70% share in 2024. The big data analytics platforms deliver as the engine for transitioning driver, market data, and raw vehicle data into operational/actionable insights, providing advanced predictive maintenance, safety, and enhanced manufacturing and progress of autonomous driving systems. The development of this segment includes forming scalable platforms and examining various sourced data streams. The major development involves advancement in the analytics for AI-driven insight and real-time decision-making.

The services segment is expected to grow at the highest CAGR of 12.40% over the forecast period. The growth of the segment can be attributed to the rapid proliferation of autonomous, connected, and electric vehicles, along with the innovations in technologies. Also, automakers are using data to understand consumer preferences and provide data-driven, personalized services.

Data Type Insights

The structured data segment dominated the market by holding a 52.30% share in 2024. The structured data plays a crucial role by enabling machine-readable formats, delivering advanced analytics and effective operations working efficiently throughout the entire lifecycle, building robust manufacturing and customer experience. This segment is potentially leading with its new data sources, such as manufacturing IoT devices and connected car sensors.

The unstructured data segment is expected to grow at the highest CAGR of 13.10% over the forecast period. The growth of the segment can be credited to the growing complexity of vehicle functions and the ongoing demand to extract insights from various applications such as personalization, AI-driven driver assistance, and regulatory compliance.

Vehicle Type Insights

The connected vehicles segment held a 57.60% market share in 2024. Connected vehicles are strongly impacting automotive data management by creating a massive amount of real-time data to enhance personalized user experience and allow new services such as fleet optimization and predictive maintenance. The segment is prominently growing with its developmental efforts aiming to accelerate the vehicle-to-cloud (V2C) architectures and vehicle-to-everything (V2X). Additionally, adopting the technology in connected vehicles is a progressive step for this segment.

The autonomous vehicles segment is expected to grow at the fastest CAGR of 15.30% during the projected period. The autonomous vehicles are evolving for an advanced approach to this segment. By creating and demanding a huge amount of real-time sensor data for safety, decision making, and AI-driven navigation purposes, the development has paved the way to lead the way in the automotive data management sector.

Deployment Model Insights

The cloud-based segment dominated the market with a 61.80% share and is expected to grow at the highest CAGR of 13.50% over the forecast period. The adoption of cloud-based technology in the automotive data management company is a boon globally. The cloud-based systems enable organized, scalable storage and processing expertise for the vast amount of data created by autonomous and connected vehicles, providing real-time analytics. The development of the cloud-based system is improving the personalized driving experience and predictive maintenance.

Application/use case

The predictive maintenance segment held a 20.40% market share in 2024. The segment is evolving automotive data management by embedding ML, artificial intelligence, and IoT sensors and equipment data to avoid failure. This predictive maintenance application's approach improves vehicle safety, diminishes repair costs, and enhances manufacturing quality control by enabling active insights from large datasets.

The usage-based insurance (UBI) segment is expected to grow at the highest CAGR of 14.20% during the study period. The UBI is a slight shift to the behaviour-based and personalized pricing in auto insurance. By accelerating technology to win over individual risk, UBI can grant safe driving, decrease the number of accidents, and modify premiums to solo driving patterns. The segment is steadily evolving into automotive data management.

End user/ industry vertical

The automotive OEMs segment dominated the market with a 41.90% share in 2024. The automotive original equipment manufacturers (OEMs) are essential to the automotive data management ecosystem. The major shift for the traditional manufacturers is to elevate their position to stewards and developers of user data created by connected vehicles. The development of data analytics and infrastructure will fuel innovation in the software, services, and product design with the help of predictive maintenance, advancing the user experience and safety improvements.

The insurance companies' segment is expected to grow at the highest CAGR of 12.80% over the projected period. The insurance company uses automotive data, mostly collected through AI and telematics, to achieve a competitive edge via personalized policy pricing, effective fraud identification, and enhanced risk assessment. The segment is growing with vast applications in the insurance industry, and so the maintenance and quick accessibility to the data become crucial.

Automotive Data Management MarketCompanies

- Sibros Technologies Inc.

- Azuga

- Microsoft

- SAP SE

- IBM

- Amazon Web Services, Inc.

- Otonomo

- AGNIK LLC

- PROCON ANALYTICS

- Xevo

Recent Developments

ACTIA and Sibros Technologies Inc. signed a strategic collaboration agreement for the ACU6 telematics technology in March 2022. For OEM automakers in the motorbike, heavy-duty haulage, and light passenger sectors, this joint solution is anticipated to improve linked vehicle design and innovation.

Segments Covered in the Report

By Component

- Software

- Data Integration & ETL Tools

- Data Warehousing & Data Lake Solutions

- Big Data Analytics Platforms

- Machine Learning (ML) & Artificial Intelligence (AI) Platforms

- Business Intelligence (BI) & Visualization Tools

- Master Data Management (MDM) Solutions

- Product Information Management (PIM) Software

- Data Security Software

- Data Quality Software

- Services

- Consulting Services

- System Integration Services

- Managed Services

- Data Analytics and Visualization Services

- Support and Maintenance Services

By Data Type

- Structured Dat

- Unstructured Data

- Semi-structured Data

By Vehicle Type

- Autonomous Vehicles

- Connected Vehicles

- Non-Autonomous/Traditional Vehicles

By Deployment Model

- Cloud-based

- On premises

By Application/Use Case

- Predictive Maintenance

- Warranty Analytics

- Safety & Security Management

- Driver & User Behavior Analysis

- Dealer Performance Analysis

- Fleet Management

- Product Development & Design Improvement

- Supply Chain Optimization

- Sales & Marketing Optimization

- Usage-Based Insurance (UBI)

- Traffic Management

- Others (In-vehicle Infotainment, etc.)

By End-User/Industry Vertical

- Automotive OEMs (Original Equipment Manufacturers)

- Tier 1, 2, and 3 Suppliers

- Automotive Dealerships

- Fleet Owners & Operators

- Automotive Aftermarket Companies

- Insurance Companies

- Logistics & Transportation Companies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting