Smart Fleet Management Market Size and Forecast 2025 to 2034

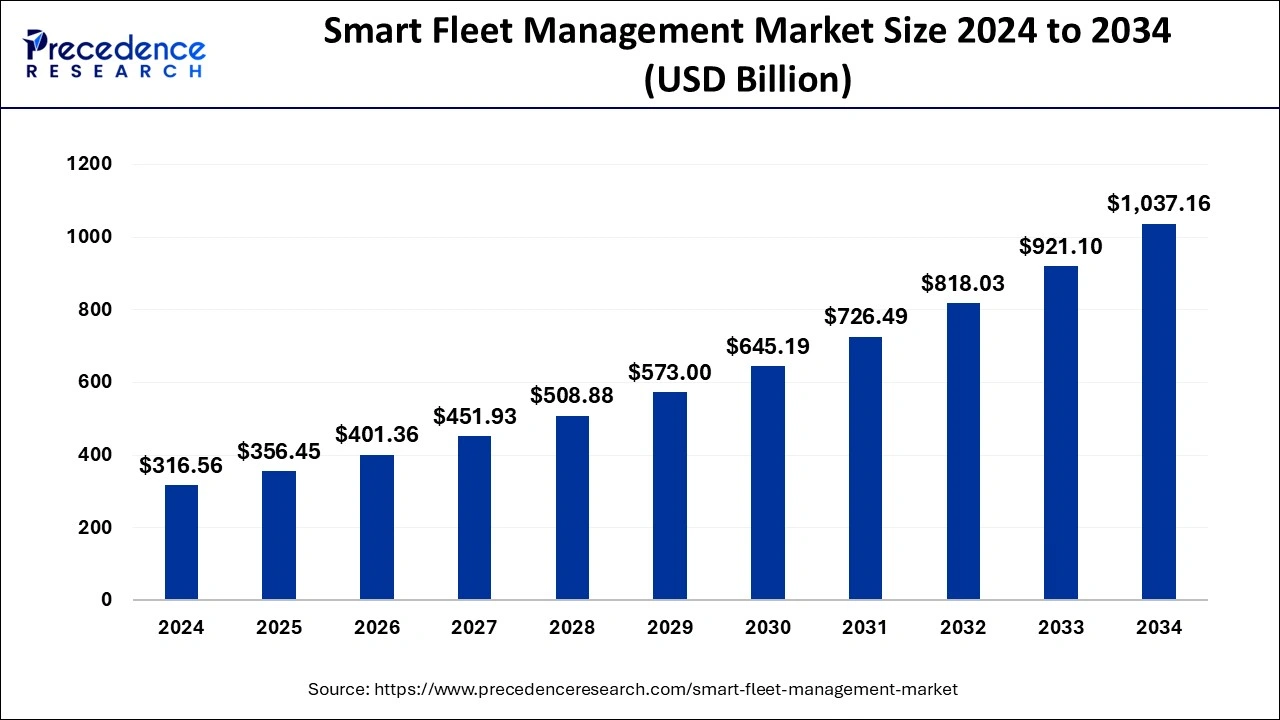

The global smart fleet management market size accounted for USD 316.56 billion in 2024 and is expected to be worth around USD 1,037.16 billion by 2034, at a CAGR of 12.6% from 2025 to 2034. The increasing demand for connected and enhance performance fleet management for improving driver performance, increased vehicle lifespan, and reduce overhead costs that collectively drives the growth of the market.

Smart Fleet Management Market Key Takeaways

- In terms of revenue, the smart fleet management market is valued at 356.45 billion in 2025.

- It is projected to reach 1,037.16billion by 2034.

- The market is expected to grow at a CAGR of 12.6% from 2025 to 2034.

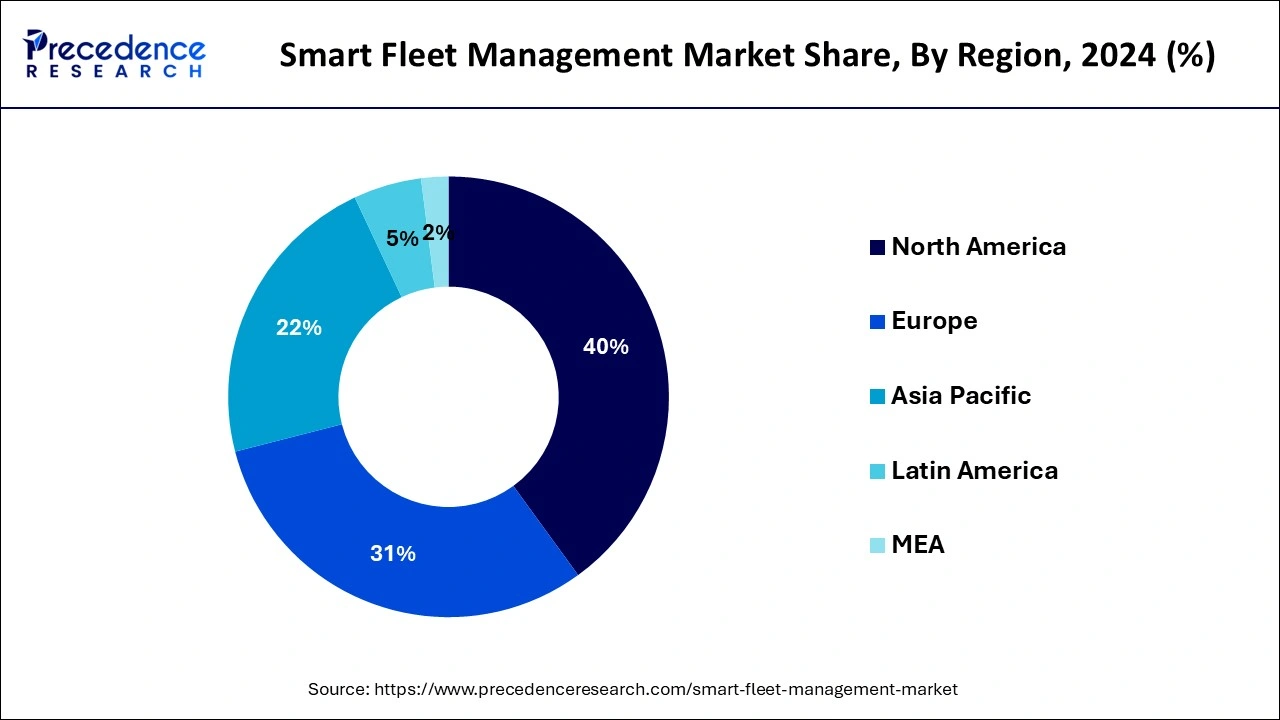

- Asia Pacific led the market with the biggest market share of 40% in 2024.

- By Transportation, the automotive segment registered the maximum market share in 2024.

- By Hardware, the Advanced Driver Assistance System (ADAS) segment is expected to grow at a notable CAGR during the forecast period.

How Can AI Impact Fleet Management?

The evaluation of artificial intelligence into the automotive industry is having the potential to revolutionize the landscape of fleet management. AI aims to streamline and improve operational efficiency with combining new standards and strategic foresights. AI helps in adapting the proactive approach to vehicle maintenance. AI predict and analyze the potential breakdown in the vehicle by predictive maintenance technologies which helps in mitigating the heavier cost of maintenance and unexpected failure of system.

- In May 2024, Motive, an AI-powered operations platform expands its unit in Mexico. Global businesses have access to Motive's integrated suite of fleet management, driver safety, equipment monitoring, and theft prevention solutions.

Asia Pacific Smart Fleet Management Market Size and Growth 2024 to 2034

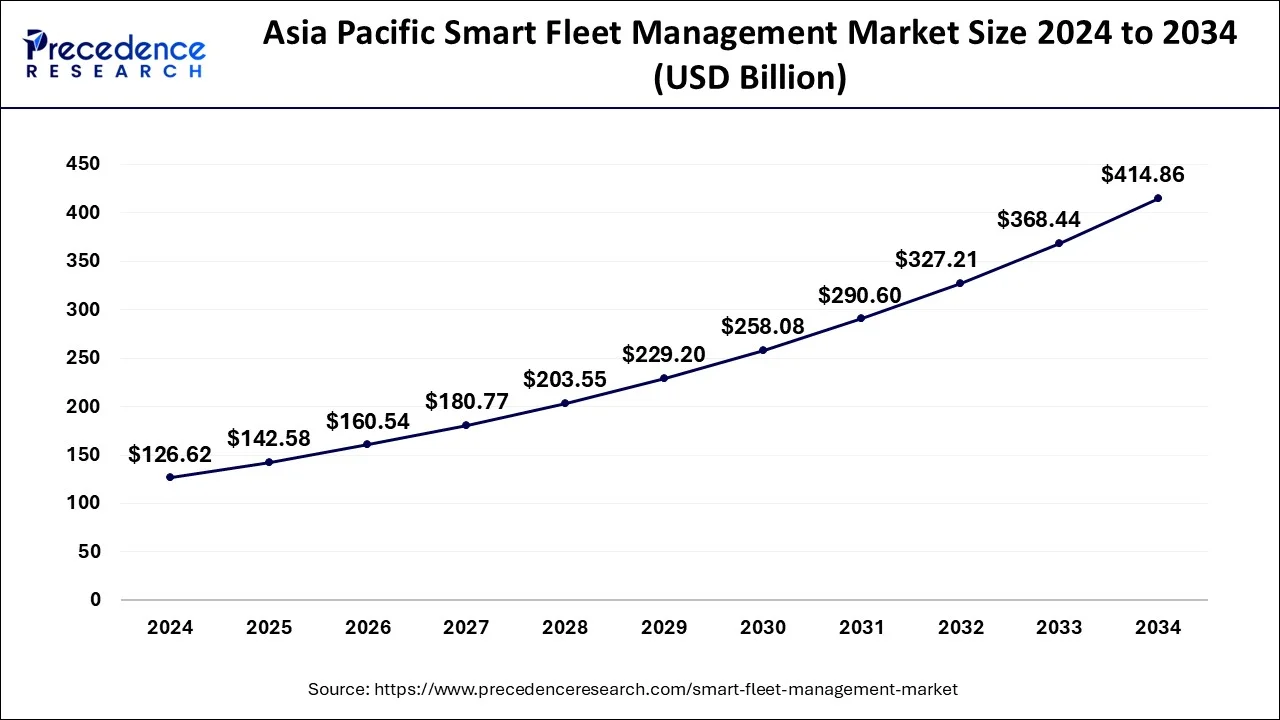

The Asia Pacific smart fleet management market size was estimated at USD 126.62 billion in 2024 and is predicted to be worth around USD 414.86 billion by 2034, at a CAGR of 12.8% from 2025 to 2034.

The Asia Pacific accounted for the largest market value share in the global smart fleet management market in the year 2024 and anticipated to register lucrative growth during the foreseen period. This is attributed to the increasing transportation facilities in the developing countries such as India, Japan, China, Singapore, Korea, and Malaysia. This is analyzed that with the rise in the adoption of connectivity solutions, the market for ADAS technology would grow prominently in the forthcoming period.

Furthermore, increasing number of accident cases across the region also significantly boost the requirement for vehicle safety features to curtail the number of deaths due to road accidents across the Asia Pacific. As per the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), the region accounted for nearly 62% of the total deaths occurred due to road accidents that is one of the leading causes of disability and death in the region. In the wake of same, the government of the various countries in the Asia Pacific has mandated the implementation of vehicle safety technology to curtail the number of increasing accidents and road fatalities.

The increasing demand for the efficient transportation system and the production and demand for the automotive industry from the countries like India, China, and Japan, owing to rising population and disposable income in people. Additionally, the demand for connected or advanced fleet management boosts the growth of the smart fleet management market.

- The annual production of automobile in India was 25.9 million vehicles in FY23. The total production of passenger vehicles two-wheelers, three-wheelers, and quadricycles was 27,73,039 units in September 2024.

- China's new energy vehicle (NEV) ownership is expanding continuously with 20.41 million at the end of 2023, as per the Ministry of Public Security.

- The new registration of NEVs was 7.43 million in 2023 with increase of 2.07 million compared to 2022.

North America is expecting a significant growth in the market during the forecast period. the rising demand for the automobile industry and the technological advancements in the automobile and fleet management in the countries like the United States and Canada is contributing in the growth of the smart fleet management market.

- As per the report by the Autos Drive America, there is a 4.9 million vehicles produced by the international automakers in the United States in 2023.

- There is a 1.6 million new light vehicles and over 160,000 medium and heavy trucks, exported by the United States in 2023 with additional export of automotive parts worth at $93.7 billion.

Europe expanded

Europe is expected to grow significantly in the smart fleet management market during the forecast period. The growing use of electric vehicles in Europe is increasing the demand for smart fleet management. At the same time, advancing infrastructure as well as digitalization also contribute to the same. This, in turn, is increasing the developments in smart fleet management, enhancing the collaboration between various companies. Furthermore, to support these developments, various investments, policies, as well as regulations are also being implemented by the government and regulatory bodies. Thus, this in turn promotes the market growth.

UK

The companies in the UK are focusing on the developments in smart fleet management to enhance their features. This is due to the growing use of electric vehicles. At the same time, with the use of various advanced technologies, different features of the smart fleet are being improved. This is further supported by the investments provided by the government.

Germany

The growing use of electric vehicles is increasing the demand for smart fleet management in Germany. At the same time, growing digitalization is enhancing the use of smart fleet as well. Furthermore, to improve safety, regulations are also being imposed by the regulatory bodies.

Smart Fleet Management Market Growth Factors

Need to enhance the vehicular safety and higher operational efficiency is one of the major factors to drive the growth of the market. Further, the integration of connected car technology in the vehicles has enhanced the fleet management operation. Initiatives taken by the government that aimed to create more secure and reliable transportation network plays an important role in the development of intelligent transport systems. Increasing road congestion, energy consumption, and carbon emission has significantly contributed towards the promotion of connected vehicles. Smart fleet management system helps the operator to obtain real-time information regarding fleet as well as saves cost and enhances the operational efficiency. Connected vehicles provide numerous advantages such as real-time tracking and monitoring.

However, lack of proper infrastructure for transfer of information in real time and to ensure seamless connectivity some of the prime factors that may restrict the market growth in the near future. Lack of adequate infrastructure especially in developing countries such as India and Mexico is a major challenge that hampers the growth of smart fleet management market. Moreover, rising concern for data breach and cyber-attack are the other prominent factors that equally diminish the growth prospect of the smart fleet management market.

Trends in the Smart Fleet Management Market

- The increasing adoption of electric vehicles in commercial fleets is one of the increasing trends, as governments are also encouraging the use of EVs instead of traditional IC-based engine vehicles with environmental protection regulations set by the governments of leading countries, like Europe. EVs are seen as a viable option, ideal for short-distance routes and in urban areas.

- Smart fleet management can leverage benefits from data analytics and predictive analytics due to various changes occurring in data collection and storage methods. Data can be collected from different sources, like sensors and telemetry, along with navigation systems. Many enterprises are leveraging this data to detect data patterns and trends with precision. By collecting this pattern, vehicle efficiency can be improved by optimizing routes and lowering fuel usage.

- Telemetry technology will continue to expand by offering precise tracking data about vehicles in real time, as fleets will be more connected in real time. It is expected to witness robust growth during the foreseeable period. With the help of connected fleets, data can be collected, such as information about location, movements, and behavior of drivers and route conditions.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 316.56 Billion |

| Market Size in 2025 | USD 356.45 Billion |

| Market Size by 2034 | USD 1,037.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Hardware, Transportation, Connectivity, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Transportation Insights

In 2024, automotive segment captured maximum market value share in the global smart fleet management market and projected to register the fastest growth over the forecast period. Numerous advantages offered by the connected vehicles such as remote diagnostics, fuel management, remote monitoring, route optimization, vehicle idle time, and predictive maintenance , contribute prominently towards the growth of the segment. These solutions enable the operators in the fleet management business to reduce business risk as well as to optimize their fleet operations. Such operational benefits along with government support & initiatives for road and vehicle safety are likely to propel the market growth for automotive segment.

Hardware Insights

In terms of hardware, the Advanced Driver Assistance System (ADAS) expected to demonstrate the fastest growth over the analysis period. Although, governments of various regions have issued mandatory laws for the adoption of vehicle safety equipment, autonomous car technology has encountered stupendous growth in the recent past and predicted to exhibit the same trend in the coming years. This serves as one of the prime factor for the growth of ADAS segment in smart fleet management market.

ADAS comprises of various components such as LiDAR, RADAR , sensors, and image processing units that enhance the safety and also helps to avoid collisions. They also provide adaptive features such as automated lighting, cruise control, GPS navigation, automated brakes, and compatibility with smart devices, all of which contribute towards enhancing the driving experience.

Smart Fleet Management Market Companies

- Continental AG

- Sierra Wireless

- Cisco Systems, Inc.

- Siemens AG

- IBM Corporation

- Tech Mahindra

- Robert Bosch GmbH

- Zonar Systems, Inc.

Latest Announcement by Industry Leaders

- In December 2024, Continental announced the sale of a leading provider of smart fleet management Zonar to GPS Trackit, a leading player in cloud-based GPS tracking and IoT fleet solutions. Continental Executive Board Member and head of Automotive Philipp von Hirschheydt said the decision to sell Zonar for enhancing and strengthening the fundamental strengths.

Recent Developments

- In June 2025, a collaboration between Vector Informatik GmbH and SMART/LAB Innovationsgesellschaft mbH was announced, where, for operators of semi-public charging infrastructure, a user-friendly, powerful, and future-ready solution will be delivered. Furthermore, this collaboration also offers a reliable foundation for efficient processes and seamless scalability of the charging infrastructure by merging load management systems, backend, and billing.

- In October 2024, a collaboration between Ooredoo Kuwait and OWS Automotive was announced, with a goal of advancing sustainable development and fostering progress. A Memorandum of Understanding was signed by this collaboration, where they will develop advanced defense innovative solutions and service applications in automotive Smart Fleet solutions.

- On 12 May 2025, the leading enterprise in GPS solutions, Trackhawk, introduced its innovatively redesigned website, incorporating the latest GPS solution- TrackHawk fleet. It is a platform designed particularly for fleet managers and business owners. This platform is designed in a way that will be beneficial for a seamless user experience with advanced technology.

- On May 23rd, 2025, global leading marketer ZF Group, based in Bengaluru, unveiled its largest fleet technology hub. This innovative facility marked a major milestone for enterprises' strategy to build a smart, scalable solution curated for global commercial fleet operators.

- In September 2024, Euler Motors launched the STORM EV two variants. The company introduces the India's first ADAS (Advanced Driver Assistance System) in a 4W Light Commercial Vehicle (LCV).

- In February 2024, Boston Dynamics introduces latest robotic fleet management platform, aiming to help businesses and maintain their robot ecosystem. The organization also updated its series of mobility to its robot dog, spot for offering ease in control.

- In September 2024, VERSES AI Inc., a cognitive computing company works on the development of next-gen intelligent systems, announced they joint the smart

- city project with an edge computing company ‘Analog' focusing on connecting places, people, and objects using mixed reality and smart sensor technology. The project is designed to simulate Abu Dhabi's taxi fleet management using the Genius platform.

Segments Covered in the Report

By Hardware

- Remote Diagnostics

- Tracking

- Optimization

- ADAS

By Transportation

- Rolling Stock

- Automotive

- Marine

By Connectivity

- Long Range Communication

- Short Range Communication

- Cloud

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting