Automotive RADAR Market Size and Forecast 2025 to 2034

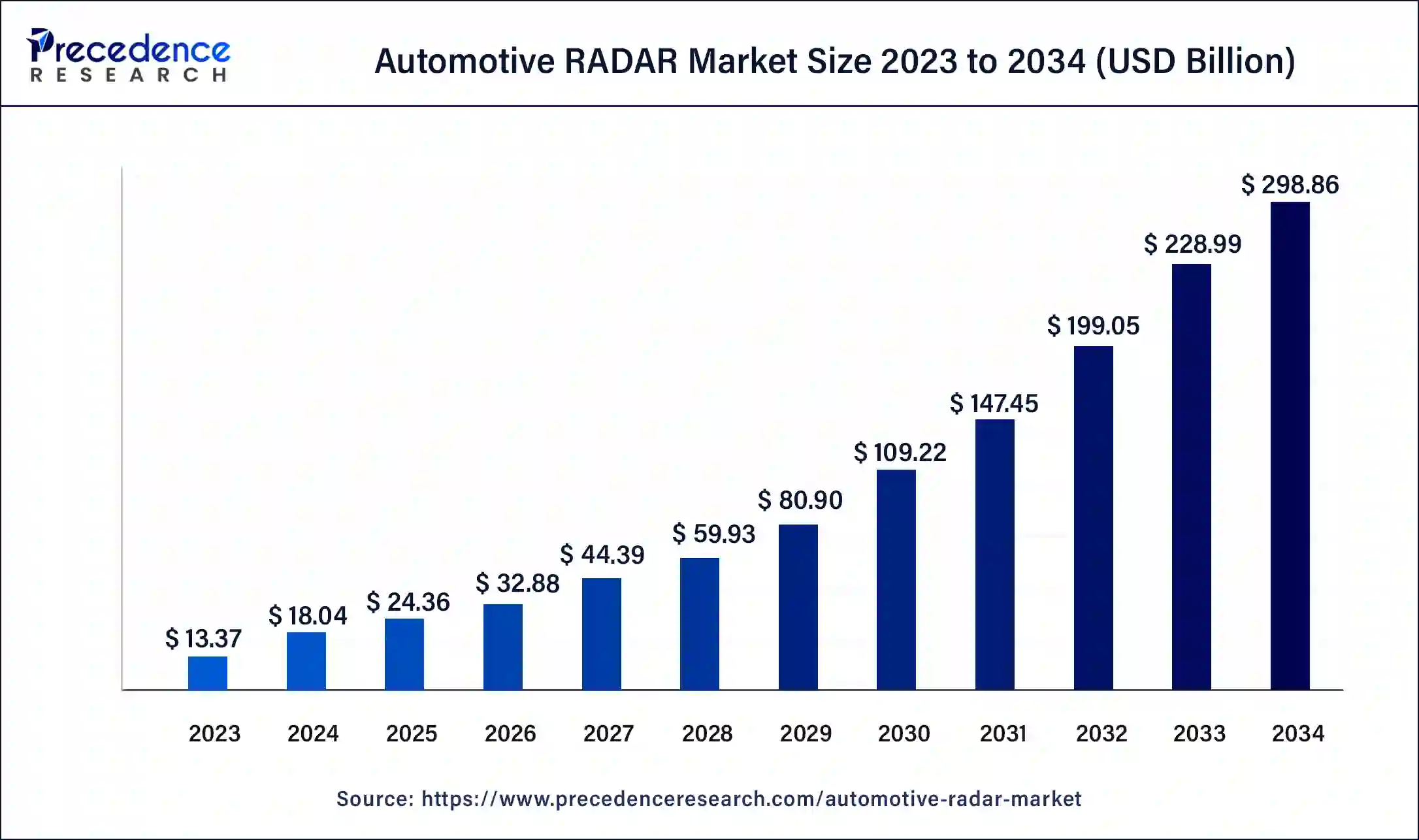

The global automotive RADAR market size was estimated at USD 7.68 billion in 2024 and is predicted to increase from USD 8.66 billion in 2025 to approximately USD 25.6 billion by 2034, expanding at a CAGR of 12.80% from 2025 to 2034.

Automotive RADAR Market Key Takeaways

- In terms of revenue, the market is valued at $8.66 billion in 2025.

- It is projected to reach $ 25.6 billion by 2034.

- The market is expected to grow at a CAGR of 12.80% from 2025 to 2034.

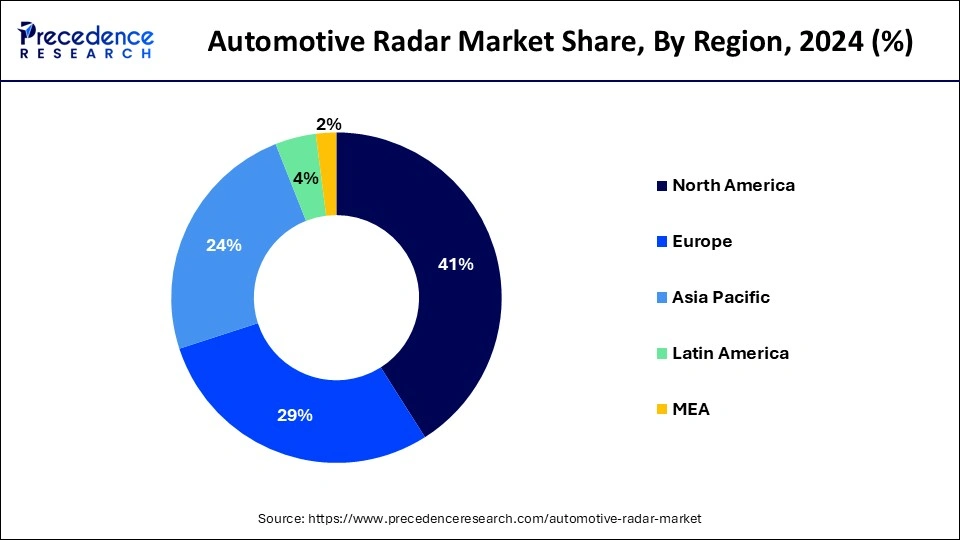

- Asia Pacific led the global market with the highest market share of 41% in 2024.

- Europe is predicted to expand at the fastest CAGR during the forecast period.

- By frequency, the 77 GHz segment held the biggest market share of 58.20% in 2024.

- By frequency, the 79 GHz segment is expanding at a significant CAGR of 15.30%from 2025 to 2034.

- By application, the adaptive cruise control (ACC) segment dominated the market with the largest share of 22.70% in 2024.

- By application, the imaging/4D radar segment is expected to grow at a significant CAGR of 17.90% from 2025 to 2034.

- By vehicle type, the passenger car segment led the market with a major market share of 71.50% in 2024.

- By vehicle type, the heavy commercial vehicles (HCV) segment is expected to grow at a significant CAGR of 13.10% over the projected period.

- By range, the long-range radar (LRR) segment led the market share of 43.60% in 2024.

- By range, the short-range radar (SRR) segment is expected to grow at a significant CAGR of 14.60% over the projected period.

- By technology, the frequency-modulated continuous wave (FMCW) radar segment led the market share of 48.90% in 2024.

- By technology, the AI-enabled and machine learning segment is expected to grow at a significant CAGR of 18.20% from 2025 to 2034.

- By component, the radar transceiver (Tx/Rx) segment dominated the market share of 31.40%in 2024.

- By component, the software and signal processing algorithms segment is expected to grow at a significant CAGR of 16.70% over the projected period.

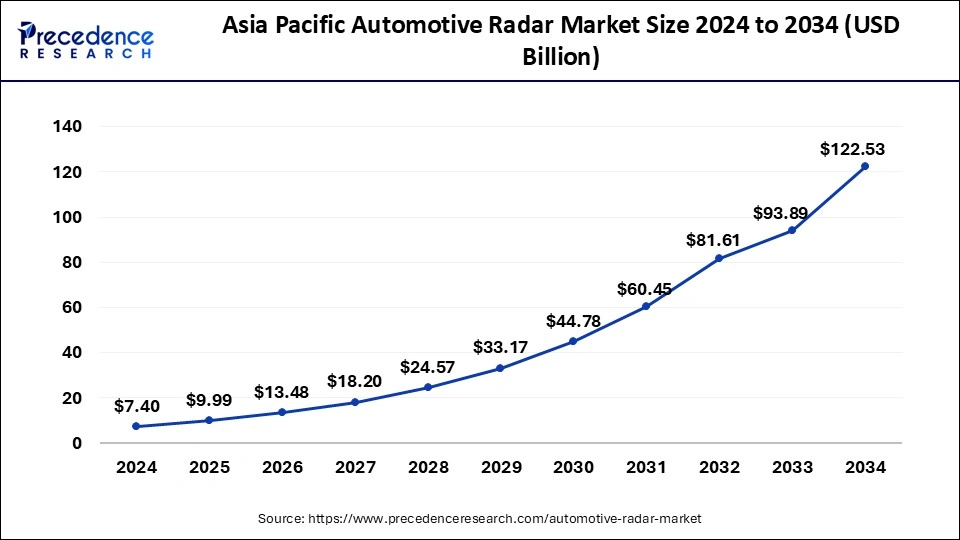

Asia Pacific Automotive RADAR Market Size and Growth 2025 To 2034

The Asia Pacific automotive RADAR market size was valued at USD 3.15 billion in 2024 and is expected to be worth around USD 10.62 billion by 2034, growing at a CAGR of 12.95% from 2025 to 2034.

In 2024, the Asia Pacific dominated the global automotive RADAR market and expected to flourish prominently in the coming years owing to increased purchasing power coupled with green revolution transforming the mobility in the region. China, India, South Korea, and Japan are some of the Asian countries that significantly adopt the smart mobility solution for enhancing vehicle safety and reducing pollution in the environment.

On the other hand, Europe exhibits lucrative growth over the forecast period. The significant growth of the region is mainly due to government initiatives taken in Germany, UK, and other European countries for green and smart mobility. The government in the region aimed to reduce the air pollution along with number of accident cases. For the same, incentives to the public for adoption of electric and smart mobility triggered the growth of electric and hybrid vehicles in the region. Presently, electric vehicles are the most prominent application of advanced vehicle safety solutions and devices.

According to the European Automobile Manufacturers' Association, Europe's electric vehicle (EV) market is thriving in 2025, marking a robust recovery. From January to April, over 2.2 million electrified vehicles were registered across the European Union, Switzerland, Norway, and Iceland. This figure encompasses battery-electric vehicles (BEVs), hybrid-electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs), reflecting a 20% surge compared to the same period in 2024.

BEV registrations alone soared by 26%, showing robust momentum in the shift to zero-emission driving. The United Kingdom mirrored this trend, with BEV, HEV, and PHEV registrations climbing 22.8% to 486,561 units from January to April.

Automotive RADAR Market Growth Factors

Factors such as rising demand for confortable driving along with incorporated safety features in the vehicle drive the market growth significantly. Increasing demand for vehicle safety features such as collision avoidance systems, parking assistance, traction control, lane departure warnings, tire pressure monitors, airbags, electronic stability control, and telematics is mainly due significant growth in number of accidents. For the same, governing bodies in some regions have imposed strict rules and regulations for the implementation of advanced safety features in the autonomous and semi-autonomous vehicles are projected to propel the market growth. For instance, National Highway Traffic Safety Administration (NHTSA) has imposed strict regulations on the vehicle safety such as air brake systems, and air bag deactivation. Similarly, European Union has regulated the use of short range radar in automotive application. As per the regulation the 79 GHz radio spectrum means the frequency range between 77 and 81 GHz.

However, high cost of devices and solutions installation restricts the growth of automotive RADAR as it increases the overall cost of the vehicle. Besides this, introduction to Advanced Driver Assistance System (ADAS) expected to propel the market growth during the forecast period. Technological advancements and innovation in ADAS are the prime factors that attracts large consumer base owing to the benefits offered by the system.

Automotive RADAR Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 25.6 Billion |

| Market Size in 2025 | USD 8.66 Billion |

| Market Size in 2024 | USD 7.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Frequency, Range, Vehicle Type, Application, Regional Outlook |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Frequency Insights

The 77 GHz segment led the automotive radar market in 2024. This is because of its superior range and resolution, which are essential for ADAS and autonomous driving. This frequency band allows for long-range object detection up to 250 meters, high accuracy, and the ability to distinguish multiple objects. The high transmit power of 77 GHz radar enables reliable long-range detection, critical for features like Adaptive Cruise Control (ACC), Forward Collision Warning (FCW), and Automatic Emergency Braking. It also offers better range, resolution, and accuracy compared to lower frequency bands like 24 GHz, improving detection and tracking of multiple objects, even when they are close together.

The 79 GHz segment is the fastest-growing part of the market during the forecast period. This is mainly due to its superior performance, regulatory support, and increasing demand for advanced driver-assistance systems and autonomous vehicles. This frequency offers wider bandwidths than other mmWave frequencies, leading to higher range resolution and accuracy. Innovations in radar design, such as digital beamforming and radar-on-chip solutions, are making these systems more compact, energy-efficient, and affordable, boosting their adoption across various vehicle segments. Moreover, regulatory bodies have allocated the 79 GHz band specifically for automotive radar, further accelerating its use.

Range Insights

The long-range radar (LRR) segment led the market in 2024 due to its vital role in enhancing vehicle safety and enabling advanced driver-assistance systems as well as autonomous driving features. LRRs offer superior detection capabilities at longer ranges compared to short-range and medium-range radars, facilitating features like adaptive cruise control, lane-keeping assist, and automatic emergency braking. These radars can detect objects at significantly greater distances, making them ideal for highway driving and other situations where long-range visibility is crucial. As a result, LRRs are key components in modern vehicles.

Meanwhile, the short-range radar (SRR) segment is experiencing rapid growth during this forecast period, driven by its essential role in enabling ADAS and autonomous driving features. This growth is further fueled by the increasing adoption of ADAS, stringent safety regulations, and the rise of electric and autonomous vehicles. Innovations in sensor design, signal processing, and the utilization of 77 GHz frequency are enhancing SRR performance and facilitating wider adoption. These vehicles depend heavily on advanced sensor suites, with SRR being a critical element for environmental awareness and vehicle control.

Technology Insights

The frequency-modulated continuous wave (FMCW) radar segment dominated the market in 2024, primarily because of its ability to deliver accurate range, velocity, and Doppler measurements using relatively simple hardware and low power requirements. Since FMCW radar requires minimal power, it is well-suited for integration into vehicles without significantly draining the battery. This makes it ideal for advanced driver-assistance systems (ADAS) such as adaptive cruise control and collision avoidance, which are increasingly becoming standard features in modern vehicles. Continuous advancements in this technology, including improvements in range resolution and sensitivity, further enhance its performance and reliability.

The AI-enabled and machine learning segment is experiencing the fastest growth in the market. This rapid expansion is largely attributed to its capacity to significantly improve radar perception capabilities, facilitating more accurate object detection, classification, and tracking. These advancements are crucial for both advanced driver-assistance systems and autonomous driving. AI-powered radar systems can effectively manage challenging scenarios, such as rain, snow, fog, and low-light conditions, which often hinder other types of sensors. This capability not only boosts system performance over time but also enhances functionality in diverse environments. The growth of this segment is also driven by the increasing demand for enhanced safety features and the need for robust, reliable sensing solutions in complex driving conditions.

Component Insights

The radar transceiver (Tx/Rx) segment remained dominant in the market in 2024, due to its essential role in supporting advanced driver-assistance systems and autonomous driving features. This dominance is further amplified by the rising demand for safety features such as adaptive cruise control, blind spot detection, and autonomous emergency braking, all of which rely on radar technology. The growing number of connected cars and electric vehicles (EVs) also fuels the need for radar systems, as they enhance vehicle perception and situational awareness. Several advancements, including the development of high-resolution imaging radar and 4D radar, strengthen the transceiver's importance in improving vehicle perception and awareness on the road.

The software and signal processing algorithms segment within automotive radar is experiencing rapid growth, driven by advancements in artificial intelligence, enhanced target tracking, and the need for more sophisticated processing techniques to tackle complex driving scenarios. Software and signal processing algorithms are essential for enabling advanced functionalities such as adaptive cruise control, automatic emergency braking, and lane-keeping assistance. These advancements support features like adaptive beamforming, anomaly detection, and improved target classification, thereby increasing the demand for more complex software solutions.

Application Insights

The adaptive cruise control (ACC) dominated the market in 2024. This is because of its important role in improving vehicle safety and comfort. Its ability to automatically adjust vehicle speed to maintain a safe distance, especially with advancements in radar technology, has made it a preferred choice for both manufacturers and consumers. This system relies heavily on radar, especially long-range radars, to accurately measure the distance to the vehicle ahead and adjust speed accordingly. Rising government regulations and increased consumer awareness are further promoting its widespread adoption.

The imaging/4D radar segment is rapidly growing, primarily because of its ability to provide a more detailed view of a vehicle's surroundings, supporting advanced driver-assistance and autonomous features. The higher resolution and increased data points from 4D radar improve object detection and classification, including distinguishing between pedestrians, vehicles, and obstacles, even in challenging weather conditions. This enables features like automatic emergency braking, adaptive cruise control, and lane-keeping assistance. The growth is driven by increasing safety demands, stricter regulations, and technological advancements, especially in sensor fusion.

Vehicle Type Insights

The passenger car segment dominated the market in 2024, largely due to the widespread adoption of Advanced Driver-Assistance Systems (ADAS) and safety features in these vehicles. Systems such as adaptive cruise control, blind-spot detection, and automatic emergency braking significantly rely on radar technology for enhanced safety and driver convenience. Regulatory mandates and growing consumer awareness are driving this trend. Continuous advancements in radar technology, such as improved range, accuracy, and miniaturization, have made it more feasible and cost-effective for widespread use in passenger cars.

The heavy commercial vehicles (HCV) segment is currently experiencing the fastest growth in the market. This growth is attributed to increased regulatory pressures for safety, the rise of ADAS, and the expanding e-commerce sector. Companies are integrating next-generation radar technologies, like 77 GHz long-range and corner radars, to enable features such as adaptive cruise control, blind-spot detection, and automatic emergency braking, particularly for long-haul and fleet applications. Lane departure warning systems are also becoming more common in HCVs, further boosting the demand for radar sensors.

Key Companies & Market Share Insights

The global automotive RADAR market has large number of international and regional players operating globally; however, some of the top players lead the market revenue in 2024. Increased focus of industry participants on developing high-performance RADAR systems for automotive application is changing the face of market competition. In addition, companies also invest significantly in the research & development sector to develop attractive solution and gain strategic benefits over the competitors. For instance, in October 2016, Robert Bosch introduced Tesla Model S self-driving prototype. It was the first self-driving car developed in Australia. The self-driving car comprises one stereo video camera, six laser sensors (LiDAR), six RADARs, and one high precision GPS.

Additionally, strategic initiatives by key market players to expand their presence the new product launches, partnerships, or collaborations aim to expand their presence and gain strategic benefits over competitors, driving the expansion of the automotive RADAR market. For instance, in December 2024, Radar startup Bitsensing Inc. formed a strategic partnership with NXP Semiconductors to offer radar for multiple sectors, including automotive, smart cities, healthcare, robotics, and others. The collaboration is intended to combine NXP radar chipsets with Bitsensing's radar sensors and software.

Automotive RADAR Market Companies

- Continental AG

- Autoliv Inc.

- DENSO Corporation

- Delphi Automotive Company

- NXP Semiconductors

- Texas Instruments

- Robert Bosch GmbH

- ZF Friedrichshafen

- Valeo

- Analog

Recent Developments

- In January 2025, Texas Instruments (TI) unveiled new integrated automotive chips to enable safer, more immersive driving experiences at any vehicle price point. TI's AWRL6844 60GHz mmWave radar sensor supports occupancy monitoring for seat belt reminder systems, child presence detection, and intrusion detection with a single chip running edge AI algorithm, enabling a safer driving environment.

- In March 2025, Indie Semiconductor, an automotive solutions innovator, announced a strategic collaboration with GlobalFoundries to develop its portfolio of high-performance radar systems-on-chip (SoC). These SoC's - manufactured on GF's 22FDX platform will target 77 GHz and 120 GHz radar applications for advanced driver assistance systems (ADAS) and adjacent industrial applications.

- In April 2025, HiRain Technologies, a leading provider of intelligent driving system to the Chinese automotive market, announced the launch of the LRR615, a production-intent long-range imaging radar system powered by the Arbe Robotics high-performance chipset. It is designed to deliver ultra-high resolution and reliability across all weather and lighting conditions.

Segments Covered in the Report

By Frequency

- 24 GHz

- 77 GHz

- 79GHz

- Others (e.g., 60 GHz, 94 GHz � experimental)

By Range

- Short-Range Radar (SRR) � up to 20 meters

- Medium-Range Radar (MRR) � 20 to 70 meters

- Long-Range Radar (LRR) � 70+ meters

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs

By Application

- Adaptive Cruise Control (ACC)

- Automatic Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Forward Collision Warning (FCW)

- Lane Departure Warning (LDW)

- Intelligent Parking Assistance

- Traffic Jam Assist

- Cross-Traffic Alert

- Imaging/4D Radar

- Highway Pilot / Autonomous Navigation Support

By Technology

- Frequency-Modulated Continuous Wave (FMCW) Radar

- Pulse Radar

- Digital Beamforming Radar

- Imaging Radar (4D Radar)

- AI-Enabled / Machine Learning Radar

By Component

- Radar Transceiver (Tx/Rx)

- Microcontroller Unit (MCU) / DSP

- Antenna

- Radar Sensor Module

- Software / Signal Processing Algorithms

- Power Management ICs

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting