Radar Sensors Market Size and Forecast 2025 to 2034

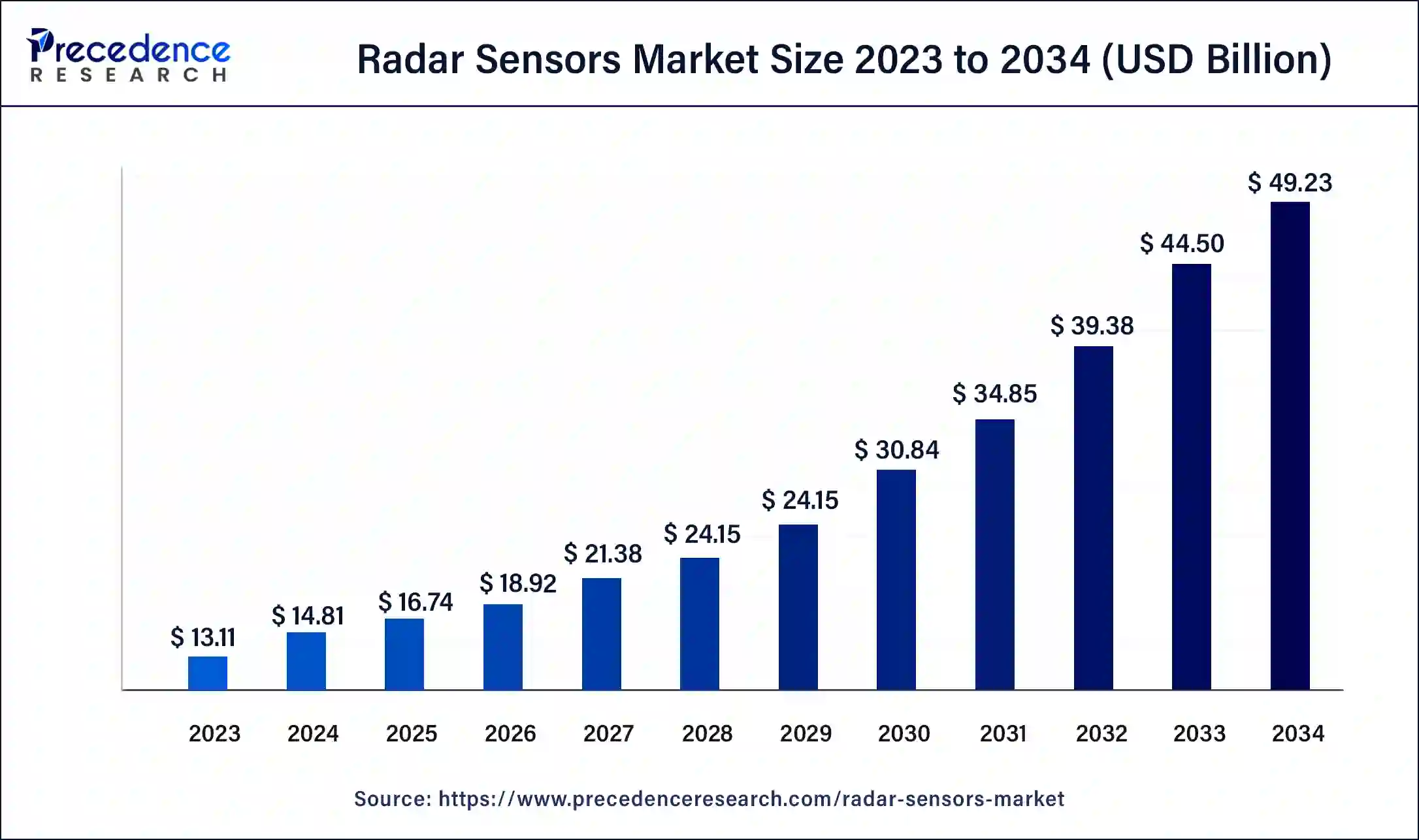

The global radar sensors market size accounted at USD 14.81 billion in 2024 and is predicted to reach around USD 49.23 billion by 2034, growing at a CAGR of 12.76% from 2025 to 2034.

Radar Sensors Market Key Takeaways

- The global radar sensors market was valued at USD 14.81 billion in 2024.

- It is projected to reach USD 49.23 billion by 2034.

- The radar sensors market is expected to grow at a CAGR of 12.76% from 2025 to 2034.

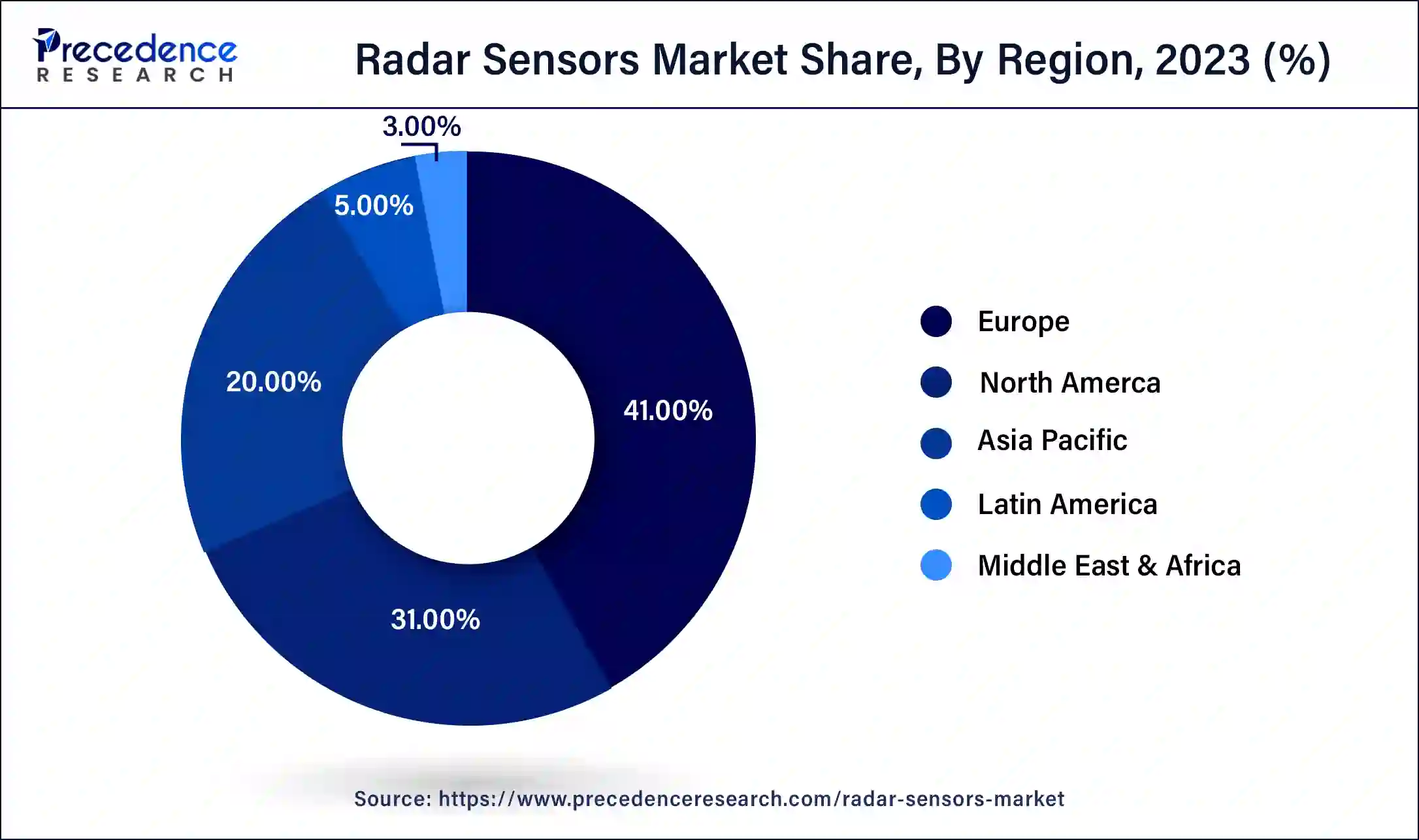

- Europe contributed more than 41% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

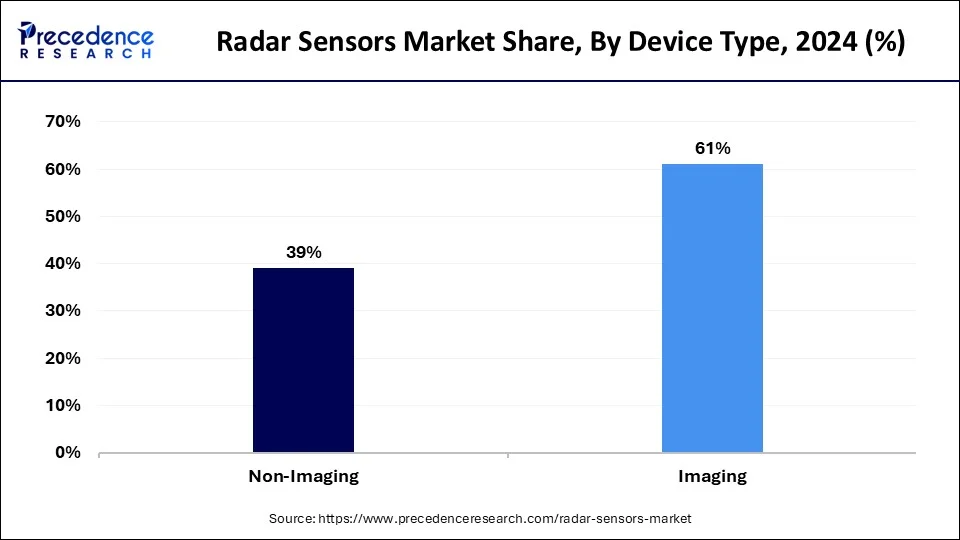

- By device type, the imaging segment has held the largest market share of 61% in 2024.

- By device type, the non-imaging segment is anticipated to grow at a remarkable CAGR of 15.2% between 2025 and 2034.

- By range, the medium range segment generated over 43% of revenue share in 2024.

- By range, the short range segment is expected to expand at the fastest CAGR over the projected period.

- By end user, the automotive segment generated over 31% of revenue share in 2024.

- By end user, the environment and weather monitoring segment is expected to expand at the fastest CAGR over the projected period.

Impact of AI on the Radar Sensors Market

The emergence of AI has redefined the capabilities of radar sensors. AI algorithms process vast amounts of data generated by radar sensors, which is crucial in applications such as weather monitoring and autonomous driving. AI has the ability to improve object detection, which is particularly important in defense and security applications to detect threats. Integrating AI algorithms in radar sensors automates data analysis and predicts maintenance whenever required, thereby reducing downtime and increasing reliability.

- In September 2024, Sumitomo Electric Industries, Ltd. introduced a sensor that can accurately detect and identify pedestrians and bicyclists approaching the road. By using its proprietary AI image processing technology, the sensor's detection range towards a pedestrian extends to five meters behind.

Europe Radar Sensors Market Size and Growth 2025 To 2034

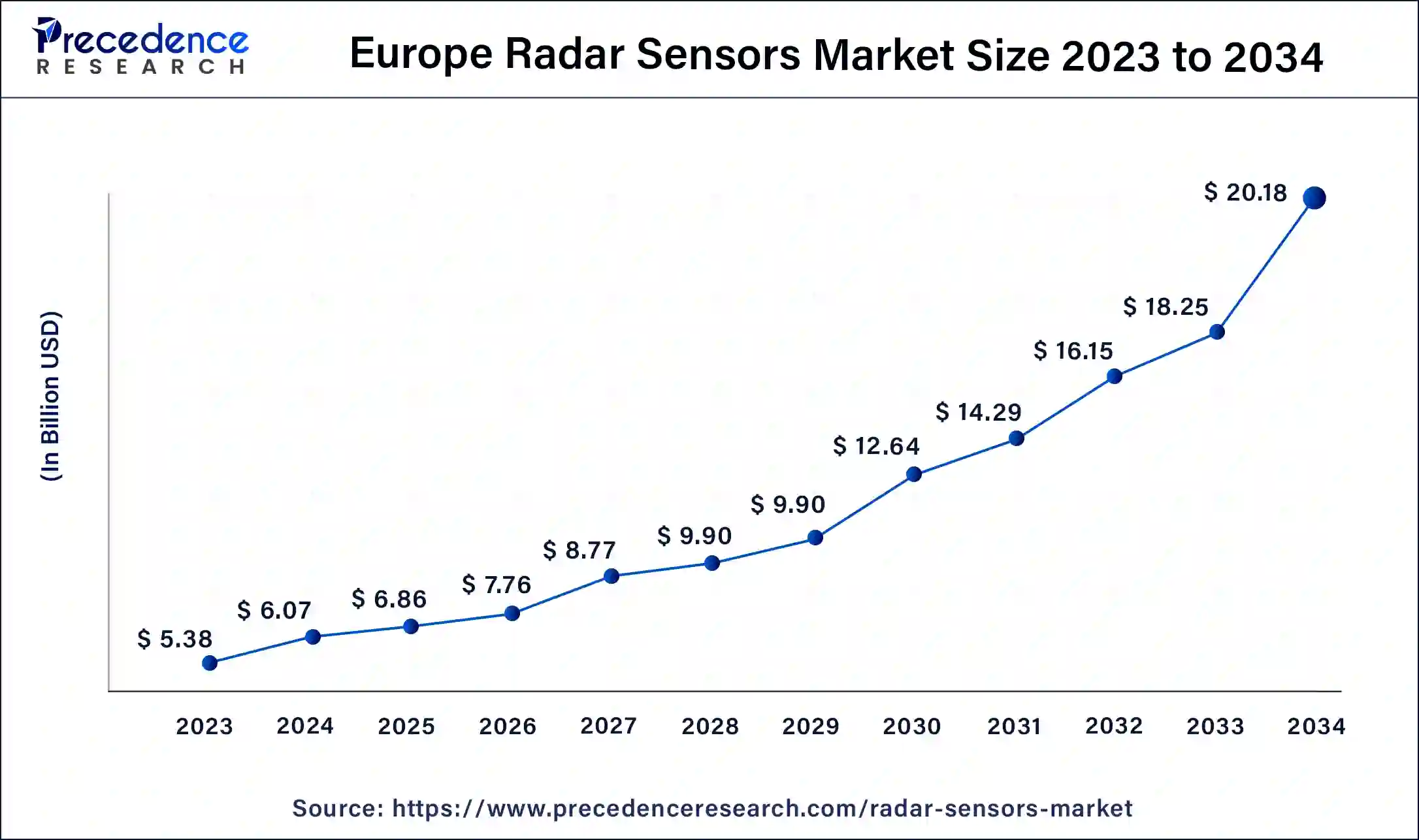

The Europe radar sensors market size was valued at USD 6.07 billion in 2024 and is expected to reach USD 20.18 billion by 2034, growing at a CAGR of 12.90% from 2025 to 2034.

Europe has held the largest revenue share of 41% in 2024. Europe holds a major share in the radar sensor market due to robust advancements in automotive safety regulations and the widespread adoption of radar sensors in the automotive industry. The region's commitment to promoting intelligent transportation systems and smart city initiatives has further fueled the demand for radar sensors. Additionally, Europe's focus on research and development, coupled with stringent safety standards, has propelled the integration of radar sensor technologies across various sectors, contributing to the region's significant market share in this dynamic and evolving industry.

Asia-Pacific is estimated to witness the highest growth. Asia-Pacific dominates the radar sensor market due to rapid industrialization, urbanization, and the surge in automotive production. The region's extensive deployment of radar sensors in vehicles for advanced driver assistance systems (ADAS) and the increasing adoption of smart technologies in sectors like infrastructure and agriculture contribute to its major market share. Moreover, government initiatives promoting smart city development and the robust expansion of the electronics industry in countries like China and Japan further propel the growth of radar sensor applications, solidifying Asia-Pacific's significant position in the market.

Market Overview

A radar sensor is a sophisticated technology used for detecting and locating objects by emitting radio waves and analyzing their reflections. Standing for "Radio Detection and Ranging," radar sensors play a pivotal role in applications such as aviation, automotive systems, weather monitoring, and military operations. In the automotive realm, these sensors are key components of advanced driver assistance systems (ADAS), enabling features like collision avoidance and adaptive cruise control. In aviation, radar sensors aid air traffic control, ensuring the safe navigation of aircraft. In military settings, radar sensors are employed for surveillance, tracking targets, and guiding missiles. Their flexibility and precision make radar sensors essential in diverse industries, improving safety, efficiency, and situational awareness across different operational scenarios.

The adoption of radar sensors is increasing in the automotive industry, contributing to market expansion. These sensors are essential for improving safety features like collision avoidance. Moreover, they play a key role in autonomous driving, allowing vehicles to monitor their surroundings and measure speed. Many industries are also demanding radar sensors for security purposes, as they help detect threats and enhance surveillance. The rising demand from the aerospace industry further drives the growth of the market. In the aerospace industry, radar sensors are increasingly used for navigation, weather monitoring, and mapping terrain.

Radar Sensors Market Growth Factors

- Increasing Demand in Automotive Sector: The rising adoption of radar sensors for applications such as collision avoidance and autonomous driving is driving significant growth in the automotive industry.

- Rising Emphasis on Safety and Security: Growing concerns about safety and security across various industries are fueling the demand for radar sensors, which play a vital role in threat detection and surveillance.

- Advancements in Technology: Ongoing technological developments, including improvements in signal processing and miniaturization, contribute to the enhanced performance and efficiency of radar sensors, fostering market growth.

- Expanding Applications in Aerospace: The aerospace sector is witnessing increased utilization of radar sensors for navigation, weather monitoring, and terrain mapping, amplifying market expansion.

- Surge in Smart Infrastructure Projects: Radar sensors are integral to smart city initiatives, promoting their adoption in applications such as traffic management, waste monitoring, and infrastructure development.

- Rise of Industry 4.0: The fourth industrial revolution is driving the integration of radar sensors into manufacturing processes, facilitating automation, predictive maintenance, and quality control.

- Growing Demand for Unmanned Systems: Radar sensors are essential components in unmanned aerial vehicles (UAVs), ground vehicles, and marine systems, contributing to the expansion of the radar sensor market.

- Emergence of 5G Technology: The deployment of 5G networks supports the increased connectivity and communication capabilities of radar sensors, fostering their integration into diverse industries.

- Expanding Defense Expenditure: Increased defense budgets worldwide are leading to the adoption of radar sensors for applications such as border surveillance, threat detection, and military reconnaissance.

- Rapid Urbanization: Urbanization trends are driving the need for radar sensors in urban planning, traffic management, and public safety applications, stimulating market growth.

- Growing E-commerce and Logistics: Radar sensors contribute to the efficiency of logistics and e-commerce operations through applications like inventory management, tracking, and automated warehouse systems.

- Environmental Monitoring Requirements: Radar sensors are increasingly employed for environmental monitoring, including weather forecasting, flood detection, and wildfire tracking, supporting their market expansion.

- Expansion of IoT Ecosystem: The proliferation of the Internet of Things (IoT) creates opportunities for radar sensors to be integrated into interconnected systems for smart homes, healthcare, and agriculture.

- Government Regulations and Standards: Stringent regulations related to vehicle safety, emissions, and industrial standards drive the adoption of radar sensors to meet compliance requirements.

- Growth in Precision Agriculture: Radar sensors play a vital role in precision agriculture by providing accurate data for crop monitoring, irrigation management, and yield optimization.

- Increasing Use in Robotics: Radar sensors are becoming integral to robotics for obstacle detection, navigation, and collaborative operations, contributing to the expansion of the market.

- Demand for Long-Range Detection: Applications requiring long-range detection capabilities, such as in the defense sector and maritime operations, are boosting the market for radar sensors.

- Texas Instruments' annual revenue in 2021 was $18.344 billion, which was a 26.85% increase from 2020. In 2020, the company's revenue was $14.461 billion, which was a 0.54% increase from 2019.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.76% |

| Market Size in 2024 | USD 14.81 Billion |

| Market Size in 2025 | USD 16.74 Billion |

| Market Size by 2034 | USD 49.23 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Device Type, By Range, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rise of autonomous vehicles and automotive safety regulations

The rise of autonomous vehicles and stringent automotive safety regulations has significantly propelled the demand for radar sensors in the automotive industry. Autonomous vehicles heavily rely on advanced sensor technologies for real-time detection and navigation, making radar sensors a crucial component in ensuring the safety and reliability of these self-driving systems. Radar sensors provide essential features such as adaptive cruise control, collision avoidance, and emergency braking, addressing the regulatory requirements for enhanced vehicle safety.

In response to increasing concerns about road safety, governments worldwide have implemented stringent safety standards, mandating the integration of radar sensors in modern vehicles. These regulations drive automakers to adopt radar sensor technologies to comply with safety mandates, contributing to a surge in market demand. The combination of autonomous vehicle trends and regulatory imperatives positions radar sensors as indispensable elements in the automotive landscape, fostering innovation and advancements in sensor technologies to meet the evolving demands of a safer and more automated driving experience.

Emergence of New Technologies

New technologies are improving radar sensors, making them more efficient and effective. Radar sensors are important in smart city projects, where they help manage traffic and monitor environmental conditions. The rollout of 5G networks enhances the connectivity of radar sensors, allowing them to be used in various industries. The rise of the Internet of Things (IoT) provides opportunities to connect radar sensors in smart homes, healthcare, and agriculture. These sensors also play a key role in robotics, helping them avoid obstacles, navigate, and work efficiently.

Restraint

Environmental interference and privacy concerns

Environmental interference and privacy concerns pose substantial constraints on the market demand for radar sensors. Adverse weather conditions, including heavy rain, snow, or fog, can disrupt radar signals, limiting the effectiveness of radar sensors in various applications. Industries relying on radar technology, such as autonomous vehicles and surveillance systems, face challenges in maintaining consistent performance under diverse weather conditions. This limitation hampers the widespread adoption of radar sensors, particularly in regions prone to challenging weather patterns. Privacy concerns also act as a significant restraint on radar sensor market demand.

In applications like smart cities and surveillance, where radar sensors are deployed for data collection and analysis, concerns about individual privacy and data security can lead to resistance from end-users and regulatory hurdles. Striking a balance between the benefits of radar sensor technology and addressing privacy apprehensions is crucial for fostering market acceptance and overcoming these constraints. As the industry works towards developing solutions that address both environmental challenges and privacy considerations, the market demand for radar sensors is expected to navigate these hurdles and advance.

Opportunity

Drone technology and 5G integration

Drone technology and 5G integration are creating significant opportunities for the radar sensor market. In the realm of drone technology, radar sensors play a pivotal role in collision avoidance, navigation, and surveillance applications. As drones become increasingly prevalent in industries such as agriculture, infrastructure inspection, and security, the demand for radar sensors is escalating. These sensors provide crucial data for safe and efficient drone operations, opening avenues for innovation and growth in the drone industry.

The integration of 5G networks offers a transformative opportunity for radar sensors by enhancing connectivity and communication capabilities. With the increased bandwidth and low-latency features of 5G, radar sensors can transmit and receive data more efficiently, enabling real-time decision-making in various applications. This integration benefits sectors such as autonomous vehicles, smart cities, and industrial automation, where radar sensors rely on seamless and rapid data exchange.

The synergy between radar sensors, drone technology, and 5G integration underscores a promising future for radar sensor applications, fostering advancements and expanding their role in diverse industries.

Device Type Insights

In 2024, the imaging segment held the highest market share of 61% on the basis of the type. In the radar sensor market, the imaging segment involves the use of radar technology to generate visual representations of the surrounding environment. Imaging radar sensors utilize advanced signal processing to create detailed maps, enhancing object recognition and tracking capabilities. A key trend in the imaging radar segment is the increasing demand for high-resolution and synthetic aperture radar (SAR) technologies. These trends cater to applications such as autonomous vehicles and surveillance systems, where precise imaging and mapping are essential for reliable decision-making and situational awareness.

The non-imaging segment is anticipated to witness the highest growth at a significant CAGR of 15.2% during the projected period. In the radar sensor market, the non-imaging segment refers to radar sensors that focus on detecting and analyzing the presence, speed, and direction of objects without generating visual images. This segment typically includes continuous wave radar and pulse radar technologies. A prominent trend in the non-imaging radar sensor market is the increasing adoption in applications such as industrial automation, traffic management, and drone navigation. Non-imaging radar sensors offer cost-effective solutions for precise object detection, making them pivotal in scenarios where image visualization is not a primary requirement.

Range Insights

According to the range, the medium range segment has held 43% of the market share in 2024. The medium-range segment in the radar sensor market typically refers to sensors with a detection range spanning from a few hundred meters to several kilometers. These radar sensors find extensive applications in automotive systems, traffic management, and industrial settings.

A key trend in this segment involves ongoing advancements to enhance the accuracy and resolution of medium-range radar sensors, improving their performance in applications like adaptive cruise control and collision avoidance systems. The demand for reliable and cost-effective medium-range radar solutions is growing, driven by the increasing integration of radar sensors in various safety and surveillance applications.

The short range segment is anticipated to witness highest growth over the projected period. In the radar sensor market, the short-range segment typically refers to sensors with a detection distance up to a few hundred meters. Short-range radar sensors find extensive applications in urban environments, parking assistance systems, and collision avoidance scenarios. A growing trend in this segment involves advancements in miniaturization and cost-effectiveness, making short-range radar sensors more accessible for integration into vehicles, smart city infrastructure, and consumer electronics. This trend is fostering the development of innovative applications, enhancing safety features, and driving the overall growth of the short-range radar sensor market.

End User Insights

According to the end user, the automotive segment has held 31% market share in 2024. In the radar sensor market's automotive segment, these sensors are integral components of Advanced Driver Assistance Systems (ADAS). They facilitate collision detection, adaptive cruise control, and parking assistance, contributing to enhanced vehicle safety. A prominent trend is the increasing integration of radar sensors in autonomous vehicles, aligning with the industry's progression toward self-driving technologies. As automakers continue to prioritize safety features and autonomous capabilities, the demand for radar sensors in the automotive sector is expected to experience sustained growth.

The environment and weather monitoring segment is anticipated to witness the highest growth over the projected period. The environment and weather monitoring segment in the radar sensor market focuses on utilizing radar technology to gather real-time data for environmental conditions. This includes applications in weather forecasting, flood detection, and wildfire tracking. Recent trends indicate an increasing demand for radar sensors in environmental monitoring due to their ability to operate in challenging weather conditions. The segment is witnessing growth as governments, research institutions, and industries seek accurate and timely information for climate-related decisions, emphasizing the importance of radar sensors in enhancing weather monitoring capabilities.

Radar Sensors Market Companies

- Texas Instruments

- Infineon Technologies

- NXP Semiconductors

- Analog Devices

- STMicroelectronics

- Bosch Sensortec

- Qualcomm Technologies

- Honeywell International Inc.

- Continental AG

- Denso Corporation

- Delphi Automotive (Aptiv)

- Hella KGaA Hueck & Co.

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

Recent Developments

- In September 2024, Bosch introduced six new radar-based assistance systems designed to enhance motorcycle safety and comfort.

- In December 2022, Continental, the technology company, extended exclusive support to the Indy Autonomous Challenge (IAC), a collaborative initiative involving public-private partnerships and academic institutions. The project aims to design, build, and showcase advanced automated vehicle software for fully autonomous racecars. Continental will supply the IAC with its ARS540 4D imaging radar sensors, integrated into the Dallara AV-21, recognized as the world's fastest autonomous racecar with highly automated driving capabilities.

- In February 2022,NXP Semiconductor reported a significant development by its partner, innovative micro, unveiling a 4D imaging radar sensor. This sensor utilizes NXP's flagship radar processor S32R45, combining four TEF8232 transceivers to deliver 192 virtual channels, achieving an impressive angular resolution of one degree at distances of up to 300 meters.

- In January 2022, DENSO, a prominent mobility supplier, announced the creation of the Global Safety Package. This active safety system enhances vehicle safety by providing high sensing capabilities of the surroundings. The package integrates a vision sensor and a millimeter-wave radar sensor, collectively improving the driver's control of the vehicle for enhanced safety.

Segments Covered in the Report

By Device Type

- Imaging

- Non imaging

By Range

- Short range

- Medium range

- Long range

By End User

- Automotive

- Aerospace and Defense

- Environment and Weather Monitoring

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting